Abstract

This research work aims to study photovoltaic systems that generate energy for self-consumption using different traditional technologies, such as silicon, and emerging technologies, like nanowires and quantum. The photovoltaic system without batteries was implemented in a residential property in three different places, in Portugal. According to Portuguese Law, the sale of surplus energy to the grid is possible but the respective value for its selling is not defined. To evaluate the project viability, two different analyses are considered: with and without the sale of surplus energy to the grid. Results show that if there is no sale of excess energy produced to the grid, the project is not economically viable considering the four different technologies. Otherwise, using traditional technologies, the project is economically viable, presenting a payback time lower than 10 years. This shows that the introduction of nanostructures in solar cells is not yet a good solution in the application of solar systems namely with the current law. Furthermore, independently of the used technology, the current Portuguese law seems to difficult the investment return, which should not be the way to encourage the use of renewable sources.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

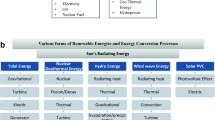

Since the 1970s, the concern with the environment has become a topic of special attention. Economic development, associated with the accelerated growth of industrialization and the increase of the world population, led into rising in the use of natural resources in an unlimited way, which proved to be unsustainable. Over the years, the growth of the \(\hbox {CO}_2\) concentration levels has been exponential, which contributed to the intensification of global warming. During the second decade of the XXI century, the annual global greenhouse gas emissions average reached its highest value and, consequently, the global average temperature was at its highest level ever [1]. In terms of global environmental points, it is, in fact, a significant alarming factor. So, the transition to a cleaner energy model is urgent to mitigate greenhouses gas emissions, and it can be done by using renewable energy sources [2]. This type of energy contributes to the economic development of each country, has a lower environmental impact and it’s a never-ending source, having another record-breaking year in 2020 with an increase of about 30%, in comparison with the previous year [3]. Also in 2020, solar energy reached its peak with an estimated total of 760 GW [3] and it is considered one of the most important renewable sources. It has huge power and if the Sun’s energy would be daily harvested through photovoltaic devices, the Earth’s energy needs would be ensured for one year [4, 5].

Photovoltaic effect was discovered in 1839 by Alexandre Edmond Becquerel, but only in 1954, a silicon semiconductor cell was developed by Bell Labs, whose efficiency was improved in the following years [6, 7]. Due to several factors, like different materials used and different techniques employed, solar cells have been grouped into several generations over the years [2]. More recently, nanotechnologies have demonstrated amazing results in new devices, and the third photovoltaic generation joins nanotechnologies with solar technologies, to have solar cells with higher efficiencies and, one day, with lower costs. The introduction of nanostructures in solar cells, like Quantum-Dots (QDs) and Nanowires (NWs) allows the control of the band gap due to their small size, providing flexibility in charge recombination and the radiation confinement [7].

In our daily life, traditional technologies, i.e, first and second’s generations solar cells are commonly used, but the emerging technologies that use nanostructures are not applied, by now, in particular, if we talk about buildings, that generate power for self-consumption, contributing to a more sustainable world. However, obviously, this represents an economic investment that most people are not willing to make. Therefore, the incorporation of photovoltaic systems in infrastructures, besides being good for the environment, and contributing to its sustainability, is, primarily, an economic investment and this is, in fact, where the decision to invest in systems that use renewable energy for self-consumption starts. For that reason, governments have also an important role, to encourage investments in renewable sources.

Photovoltaic technology

In the last decades, the development of the technologies behind solar cells has been remarkable, evolving into three technological generations of various semiconductor materials and different architectures [6, 8]. Besides that, the reduction in production costs combined with the reduction of operation and maintenance costs and, at the same time, efficiency increase is one of the priorities in the photovoltaic industry. This can be observed through the information provided by the National Renewable Energy Laboratory (NREL), where the evolution of different cells’ efficiency is presented in a chart [9].

The first generation photovoltaic cells (GI) concerns crystalline silicon structures (c-Si) that are widely used, so far, and have higher efficiency, if compared with the other technology generations. These types of cells are dominating the technology market, since silicon is abundant material on Earth and its manufacturing process is not toxic, presenting a study base for over 50 years in terms of longevity, performance, and reliability [10]. The second generation photovoltaic cells (GII) is based on thin-film technologies, like CIGS and CdTe solar cells. This photovoltaic generation is characterized by lower production costs, but its efficiency is not as high as GI’s [2, 6,7,8, 11]. Besides that, they are produced with toxic and rare materials, which is a disadvantage of this generation. With its evolution observed in NREL’s chart [9], as long as the costs still lower than the GI’s, its market share is expected to increase [7, 12]. GI and GII’s solar technologies are called traditional solar cells. They are known for not exceeding the Shockley-Queisser limit [11], so their absorption power is limited.

The third generation photovoltaic cells (GIII) cover solar technologies that are still emerging, using other materials. In addition, some of these cells enjoy their small dimensions to increase solar efficiencies, like Quantum-Dots (QDs) and Nanowires (NWs). These cells are capable of tuning the band gap energies with composition changes [2, 6,7,8, 11]. In NREL’s chart, it is noticeable that, in just 20 years, the efficiency of this technology has evolved significantly [9].

Crystalline silicon solar cells (c-Si)

Chapin et al. developed, in 1954, the first silicon solar cell, having demonstrated an efficiency of 6% [7, 13], and today this value is 26.1% [2]. The efficiency of this type quickly evolved, and this evolution was largely due to the development of the technology used in the development of transistors and, later, of integrated circuits [13]. In addition, the increase in efficiency was due to improvements in the manufacturing process, like adding surface texturing to the surfaces, which leads to a reflection reduction and adding an aluminum back surface to reduce rear surface recombination velocity [2].

In the 1970s, it was observed a growing interest in the use of renewable energy, especially photovoltaics, and the development of more reliable models. This coincided with a decrease in the production cost of c-Si cells [13, 14]. In 1983, a team at the University of New South Wales (UNSW) achieved an efficiency of 18% by combining a double-layer anti-reflective coating, thin contact lines, and an improved voltage through surface oxide passivation. In 1985, efficiency of 20% was achieved by adding surface texturing. In 2009, the efficiency was increased to 25% [9, 15], and a maximum efficiency of 26.95% is expected to be reached in 2024 [14].

CIGS solar cells

The manufacturing process of these solar cells is based on LASER scribing, but, to have lower production costs, a roll-to-roll process (R2R) is proposed, which has already been put into operation by Flisom company [2].

Kazmerski et al. developed the first CIGS solar cell, in 1976, with an efficiency of 4.5% [12], and four years later, Mickelsen and Chen produced a CdS/\(\hbox {CuInSe}_2\) heterojunction that led to increased efficiency to 5.7%, exhibiting a short-circuit current density of about \(31 \,\hbox {mA}/\hbox {cm}^2\). During the 1980s, Potter et al., by introducing Zn0 in conjunction with p-type \(\hbox {CuInSe}_2\) and CdS, obtained an efficiency of 11.2%, and, in 1990, Devany et al. replaced \(\hbox {CuInSe}_2\) with \(\hbox {CuInGaSe}_2\), which led to an increase in efficiency to 12.5%. At the end of the XX century, the best performance was 18.8%. In 2005, Contreras et al. reported a maximum efficiency of 19.5% due to improvements in the cell. Several laboratories and research centers have contributed to the increase in efficiency combined with low cost, with a maximum efficiency of 23.4% reported, in 2019, to the north american laboratory NREL by the Japanese company Solar Frontier [9, 12]. Over the years, a remarkable increase in efficiency has been recorded, coming significantly closer to silicon cells. Despite this high efficiency value, CIGS solar cells haven’t reached their best value, due to several loss mechanisms [16].

Nanowires solar cells (NWs)

NWs are 1D semiconductors nanoparticles, being characterized by transversal dimensions of a few nanometers and longitudinal dimensions of a few micrometers [17,18,19,20]. Due to their size, they work as optical antennas, allowing the concentration of the incident radiation [17, 18, 20,21,22,23].

The diameter of the nanostructures represents a big factor in the optimization of radiation absorption, leading to an oscillation of the current density. Hu et al. verified the highest short circuit current in a solar cell based on GaAs NWs with a diameter of 180 nm and a period of 350 nm [24]. The nanostructure length constitutes another important factor and it has been found that increasing it leads to optimized solar cells [24]. Guo et al. studied the diameter, length and filling ratio influence in a GaAs NWs. The optimized values were 180 nm, 2 µm and 0.5, respectively. With these values, an absorption that exceeds 90% in the visible region is achieved [21]. In 2013, it was registered higher efficiencies with matrixes of InP NWs (13.8%) and GaAs NWs (15.3%) [18, 20, 21, 23], and Hwang et al. observed an efficiency of 18.9% [21].

As far as the geometry of the NWs is concerned, axial and radial heterojunctions are pointed out and, in the literature, the axial p-i-n junctions exhibit higher energy conversion power [22, 25]. It is not clear why the axial is better than radial heterojunction, but it is pointed out as a possible reason the difficulty in producing the contacts in these junctions due to the fragility of each layer, which occurs because of their small thicknesses [21].

Quantum-dots solar cells (QDs)

QDs are semiconductors nanoparticles, ideally classified as being 0D. Due to their small size, the particles are capable to produce quantum confinement. This phenomenon allows discrete energy levels to exist. QDs have applications in several areas of electronics, like LEDs, laser diodes, and photovoltaic technology. In this last one, these nanoparticles can increase much more the solar cells’ record efficiency [26, 27].

In the literature, QDs, whose active layer is composed of PbS, are pointed out as the best developed solar cells, since the band gap can be tuned to infrared frequencies, which represents more than half of the solar spectrum, and are capable of absorbing most of the energy coming from the Sun [12, 27, 28].

Sablon et al. studied solar cells based on GaAs QDs and found an efficiency of 18-19%, which can be increased up to 24% under certain conditions [29], presenting a high advantage in its production, although it is more expensive than other semiconductor materials [7]. In the literature, under AM 1.5 at a temperature of 300 K, simulations of solar cells based on InSb/GaAs QDs verified efficiency of 16.19% when inserting 30 layers of QDs. It is found that, as the number of layers decreases, the conversion performance of the cell decreases as well. Similarly, for QDs of 10 nm diameter, the short-circuit current density for solar cells based on the nanoparticles reaches the value of 22.33 mA/\(\hbox {cm}^2\) [30]. Various types and different QDs based on different materials have been targeted in various simulations and incorporated into sensitized solar cells. Du et al. measured an efficiency of 11.66% and a current density of 25.18 mA/\(\hbox {cm}^2\) when using Zn-Cu-In-Se [8].

Financial indicators for project evaluation

To evaluate the economic viability, it is necessary to determine some financial indicators like the present value of future cash flows, which is done through the discount rate, DR, given by the Eq. 1, where \(T_1\), \(T_2\) and \(T_3\) are the inflation rate, risk-free rate of return and equity risk premium, respectively [2].

Assuming that the analysis will be done at constant cost values, the inflation rate will not be considered, and, from now on, the real discount rate, RDR, is given by Eq. 2, which is a function of the risk-free rate of return and equity risk premium [2]. In some European countries, RDR values vary around 2%, ranging from 5.16%, the value recorded in Germany, to 7.07%, the value recorded in Cyprus. In Portugal, the RDR value is 6.1% [31].

The Net Present Value (NPV) represents the difference between the present value of cash inflows and the present value of cash outflows up to date, over a time period, which is computed through Eq. 3 [2, 32]. In that equation, \(I_0\) is the initial investment, which is considered to be done in year 0 and \(R_t\) is the revenue in the year t.

If the NPV is positive, this means that the project is economically viable, covering the initial investment and generating a profit rate. In case the NPV is zero, it means the complete recovery of the initial investment. In this situation, the project’s viability is uncertain. If the NPV is negative, it means that the project is clearly not viable [2].

The Payback Period (PP) is the times it takes to recover the cost of an investment and can be computed through Eq. 4, where A is the last year with a negative cumulative cash flow, B is the absolute value of cumulative cash inflow at the end of year A, and C is the total cash flow during the year A+1. The smaller the PP, the better for the investor.

Methodology

Solar cells

A solar cell, like many other devices, uses electrical models in order to represent its behaviour. The simplest one is the 1M3P—one Model of three Parameters, whose equations are already well defined in the literature [2]. This can be called an ideal model due to no power losses being considered. 1M5P—one Model of five Parameters—is the most commonly used model. This model has two resistances to represent the several power losses that exist in a solar cell [2, 33].

Solar PV

Assuming that all cells of a solar PV are equal, having the same performance, it’s possible to create an association of z cells based on electricals models. Consider an association of \(m \times n\) solar cells.

Once again, using Kirchhoff’s circuit laws, the PV total current, voltage and power can be given by Eqs. 5, 6 and 7, respectively [2].

Residential property assessment

There are two parameters in the infrastructure that need to be assessed: the area available for the placement of solar panels and the amount of solar radiation in a given time interval, per square meter of surface. The Autodesk Revit 2022 ® programme was used for this purpose, through Insight Solar tool, running a custom study of cumulative isolation. Changing the residential property’s location, external conditions like temperature and irradiance change as well. For PVs’ performance, extreme external conditions may change a lot the energy conversion capacity, for better or worse. Therefore, the study of changing the property’s location was carried out to analyse the economic factors and the viability of the project depending on its location. External conditions data at each place were obtained through the PVGIS tool [34]. The data used corresponds to the latest data provided by the tool.

Load sizing

The monthly average consumption for the period under analysis is obtained by consulting the electricity bills provided by the owner of the residential property. From here, an algorithm that evaluates the consumption of the load was developed, throughout the day of each month. The minimum operating interval of each load was considered to be of 15 min. In addition, throughout each month, the load distribution all over the day varies similarly on two types of days, working and nonworking days. This means that each month is represented by only two significant days that repeat themselves x times during the month.

Photovoltaic system sizing

Consider a photovoltaic generator with Z panels, with M connected in series and N connected in parallel. Once again, Eqs. 5, 6 and 7 are valid, but now for the generator as follows:

Figure 1 shows the configuration scheme of the photovoltaic system. To size the system it’s important to size the inverter and the cables and protections to not have problems concerning the overcurrents and/or overheating.

Inverter

The correct inverter sizing has to fulfill the condition 11, where \(P_{MPP}^{\text {DC}}\) corresponds to the maximum DC power provided by the generator, in the worst conditions, i.e. for the minimum irradiance and maximum temperature [35].

The inverter is characterized by a maximum input voltage, \(V_{max}^{\text {inv}}\), a minimum input voltage, \(V_{min}^{\text {inv}}\) and a maximum input current, \(I_{max}^{\text {inv}}\). Since we have M panels connected in series and N panels connected in parallel, these variables have to fulfill the conditions 12, 13 and 14 [35]. Regarding the output variables, it’s important to verify the grid frequency and the grid voltage, which are 50 Hz and 230/400 V, in most countries.

DC sizing

-

1.

Row Cable

This cable will connect the M panels connected in series. The maximum cable current, \(I_z\), has to fulfil the condition 15.

$$\begin{aligned} I_z^{\text {Row Cable}} \ge 1.25 I_{sc}^{\text {panel}}(G_{min}, T_{max}) \end{aligned}$$(15)The maximum cable length and the cable cross section must be chosen taking into account that power losses, across each row, must be lower than 1%. The cable cross section must be chosen according to Eq. 15 and the maximum cable length is computed through Eq. 16.

$$\begin{aligned}{} & {} L_{max}^{\text {Row Cable}} \\{} & {} \quad = 0.01\times \frac{M \cdot V_{oc}^{\text {panel}}(G_{max},T_{min})\cdot N\cdot I_{n}^{\text {panel}}\cdot \sigma \cdot s}{2I_n^{\text {panel}^2}}\nonumber \end{aligned}$$(16) -

2.

Fuses

Fuses must be sized taking into account the nominal current of the series connection, to protect the row’s cable against overcurrents. Fuses’ rated current, \(I_n^{\text {fus}}\), has to be higher in 25% of the rated row current, and lower than the fuse’s breaking capacity, which cannot be higher in 15% of the maximum cable current. In practice, the condition 17 has to be verified.

$$\begin{aligned} 1.25I_n^{\text {panel}} \le I_z \le 1.15I_z\text {,} \end{aligned}$$(17) -

3.

Main DC Cable

This cable connects the N rows to the inverter. The maximum cable current, \(I_z\), has to verify the condition 18.

$$\begin{aligned} I_z^{\text {Main Cable}} \ge 1.25 I_{n}^{\text {panel}} \end{aligned}$$(18)As in the Row Cable, the power losses have to be lower than 1%. The cable cross section must be chosen according to Eq. 18 and the maximum cable length is computed through Eq. 19.

$$\begin{aligned} L_{max}^{\text {Main Cable}} = 0.01 \times \frac{M\cdot N \cdot P_{MPP}^{\text {panel}} \cdot \sigma }{2\left( N\cdot I_n^{\text {panel}}\right) ^2} \end{aligned}$$(19)

Financial indicators for project evaluation

The financial factors can be evaluated from two different perspectives: if the surplus is sold to the grid and, therefore, there is a benefit for the investor, and if there is no sale to the grid. In the first case, consider the selling price to the grid of the surplus energy to be the value of its purchase price. To get the parameters referred, the first step is to calculate the annual cash flows, whose parameters are shown in Table 1, in which the considered tariff is the simple one. Consider year 0 to be the year in which the initial investment is made and in which the photovoltaic installation is carried out, so there is no production in that year. The data presented in Table 2 correspond to the values used in the computation of the initial investment.

Knowing the full cost of each system, it’s possible to run a financial analysis, to obtain the NPV and PP. To achieve the best viability and the best generator in the first year, an optimisation algorithm was developed. The first constraint of this algorithm is the area occupied by the generator, which has to be lower than the available area. The second one is related to viability, which means that the generated power must be higher than the consumed power, in each time interval. The better the viability of the generator, the better the PV system will be able to cope with the load. The third and last constraint is the number of properties, with the same consumption, that the generator can cover, always bearing in mind that the goal is to achieve the best project viability. The optimisation algorithm was applied to all locations under study, for all technologies under analysis and also for the cases of selling or not the surplus to the grid.

Results and discussion

Solar cells

Consider four different types of solar cells, whose parameters, under STC conditions, are presented in Table 3. In what concerns the traditional technologies, c-Si and CIGS solar cells with higher efficiency registered by NREL [9] were analysed. It’s important to notice that these cells are laboratory-tested cells, so their parameters have ideal values due to the simulation conditions. Through a scientific method, the characteristics curves of the solar cells are shown in Fig. 2.

Solar PV

Consider four different types of solar panels, each one with z solar cells, whose parameters are presented in Table 4. Figure 3 shows the characteristics curves of the solar panels.

Residential property analysis

The simulation results are shown in Fig. 4. The colour coding shows that the part of the roof with the most Sun exposure is the one facing south. However, the existence of the window on the top floor of the property ends up causing some shadow and, in addition, the area available for the placement of solar panels decreases. Therefore, it was chosen for the east-facing roof, which corresponds to the second part of the roof with greater solar exposure. The available useful roof area is \(50.8068\,\hbox {m}^2\).

Load sizing

Electricity bills of 2021 show that the months with the highest and lowest consumption are January and August with 540 kWh and 313 kWh of consumption, respectively.

Considering 15 min as the minimum operation time of each load, the daily load profile on working and nonworking days in the months with the highest and the lowest consumption in 2021, are shown in Figs. 5 and 6. These profiles correspond to an average of the daily profile of consumption on each type of day per month, which leads to the monthly consumption that is presented in the electricity bills.

Photovoltaic system sizing

Consider three different locations in Portugal, as shown in Fig. 7. Santa Iria de Azoia is where the property is located but, to evaluate the photovoltaic system performance, two other locations will be analysed.

The atmospheric conditions for the three locations are shown from Figs. 8, 9 and 10.

The optimisation algorithm presents, as the best solution, the generators whose data are inserted in Table 5. For these generators, the characteristics of the inverters chosen must comply with the values shown in Table 6 and, to avoid electrical problems, the cables and protection devices shall correspond to the values shown in Table 7.

For these generators, it is possible to get the generation curves represented from Fig. 11, 12, 13, 14, 15, 16 and 18.

Financial indicators for project evaluation

The financial indicators were obtained using an analysis time period of 1000 years. Optimisation results obtained for the cases with and without the sale of the surplus to the grid are detailed from Tables 8, 9, 10 and 11. These tables show the first 5 years and the years when product warranties expire [42].

c-Si

Using c-Si technology, if the surplus energy produced was sold to the grid, the NPV value would be 19588.346 € in Santa Iria, 23145.022 € in Castro Verde and, in Vila Real, 15899.477 €, and it would take 4.434 years in Santa Iria, 3.968 in Castro Verde and 5.049 in Vila Real to recover the investment. Otherwise, the NPV value is − 25902.288 €, − 25926.163 € and − 26136.880 €, in Santa Iria, Castro Verde and Vila Real, respectively, and the investment would not be retrieved after 1000 years in the three locations.

CIGS

Using CIGS technology, if the surplus energy produced was sold to the grid, the NPV value would be 11811.527 € in Santa Iria, 15364.535 € in Castro Verde and, in Vila Real, 8124.153 €, and it would take 6.858 years in Santa Iria, 6.059 in Castro Verde and 7.955 in Vila Real to recover the investment. Otherwise, the NPV value is − 33167.066 €, − 33149.910 € and − 33408.105 €, in Santa Iria, Castro Verde and Vila Real, respectively, and the investment would not be retrieved after 1000 years in the three locations.

c-Si NWs

Using c-Si NWs technology, if the surplus energy produced was sold to the grid, the NPV value is -5353.050 € in Santa Iria, − 2891.284 € in Castro Verde and, in Vila Real, − 7890.932 €, and it would take 20.743 years in Santa Iria and 15.927 in Castro Verde to recover the investment. In Vila Real, the investment would not be retrieved. Otherwise, the NPV value is − 35521.71647 €, − 35414.6140 € and − 35521.71647 €, in Santa Iria, Castro Verde and Vila Real, respectively. In the three places, the investment would not be retrieved after 1000 years.

\(\hbox {CsPbI}_3\) QDs

Using \(\hbox {CsPbI}_3\) QDs technology, if the surplus energy produced was sold to the grid, the NPV value would be -9001.194 € in Santa Iria, -7033.547 € in Castro Verde and, in Vila Real, − 11029.577 €. Otherwise, the NPV value is − 30079.3752 €, − 29963.774 € and − 30510.232 €, in Santa Iria, Castro Verde and Vila Real, respectively. In the three locations, in both cases, the investment would not be recovered after 1000 years.

Discussion

One of the objectives of this work was to understand the financial impact on investors of installing renewable systems in infrastructures, using traditional and emerging technologies.

The operation and maintenance costs associated with photovoltaic installation constitute the largest burden of operational expenses for the investor. In 2007, the operation and maintenance costs were around 35 €/kW/year and, according to the latest data, it has decreased to around 17 €/kW/year in 2019 [37]. This shows the downward trend that this cost will have and, therefore, at the investment level, there will be a significant reduction at the economic level for the investor. Regarding PV costs, the value used for the nanoscale technologies for the financial analysis corresponds to a random value which, according to the literature, because they are still emerging technologies, their cost per Wp is higher than traditional technologies’. Furthermore, for the efficiency degradation rate of these technologies, the value corresponding to the GII technology was used to obtain results in the best situation. It is important to say that the algorithm is prepared for any change of parameters.

In what concerns the financial indicators, there are two topics to focus on for each technology under study: (i) the location where the study is carried out and (ii) the sale or not of the surplus energy produced to the grid. Table 12 presents a summary of the financial indicators to simplify its discussion.

When viability is zero this means that all the generation points are below the consumption points in each interval of time. Although the analysis time is a user defined variable, if the viability is null and the payback time has not yet occurred, then, from then on, there will no longer be a payback time, what means that the project will never have the investment paid, which, from an economic point of view, makes the installation of solar technology systems completely impossible. Analysing Table 12, it is possible to verify that if there is no sale of the surplus energy produced to the grid, there is no expected time for the investment to be recovered within the analysis time period. It takes about 650 years with c-Si technology, 440 with CIGS technology, 400 with c-Si NWs and about 380 with \(\hbox {CsPbI}_3\) QDs for all production points to be lower than the consumption points. If we think that a common disposable diaper takes 450 years to decompose, the number of years needed until viability is null is no longer just numbers.

Besides, the atmospheric conditions contribute to the increase or decrease of the payback time. In the residential property in Castro Verde, the number of years to cover the investment is lower than the other places’ payback time, which constitutes a higher benefit to the investor. In all three locations, if there is no sale of surplus energy to the grid, the NPV is negative, at around − 30 k€, so, naturally, the investor will not go ahead with the project. This implies a decrease in investment in renewables and the continued use of non-renewable energy, often fossil fuels, which contributes to a further increase in pollution and all that this implies. In the case of selling the surplus energy produced to the grid, in traditional technologies, the NPV is positive, demonstrating to the investor the project’s plausibility. In nanoscale technologies, the NPV is not positive and the payback time is higher than 15 years, which means that some of the warranties will be expired [42], what may lead to a new investment due to the equipment failure. It is possible to conclude that these types of technologies are not, yet, the best solution for solar energy applications.

The fact that there are no batteries and the system is on-grid leads to a loss of surplus energy produced. Through the generation and consumption curves presented in appendix 8, it can be seen that the production peaks occur, mostly, at times of low consumption on working days. To take advantage of this energy, commercial establishments near the residential property could use it, as they need more energy in the intervals of time when the residential property’s low consumption occurs, creating, this way, the concept of an energetically sustainable city. This solution ultimately promotes more efficient use and management of Earth resources, increasing energy production with lower associated greenhouse gas emissions.

Closing remarks

In this paper, different solar technologies integrated into a self-consumption power supply system are analysed. For each technology, both the photovoltaic system sizing and the financial viability are presented. Three locations in Portugal are under analysis and, besides that, the sale or not of the surplus energy to the grid is another point to focus on.

The technologies that are still emerging show not to be a good option by now in the application of solar systems, although they present characteristics that increase the production of energy. Over the last decades, the efficiency of these cells has evolved significantly. In the long term, with the decrease in their cost per Wp, can lead to them being a good solution in the application of renewable energy system projects.

The results of the financial analysis show that traditional technologies are the right choice for the implementation of photovoltaic systems. This shows a return time of the investment lower than 10 years, which means that any problem with the equipment would be assured by its warranty, with no need for a new investment. This is true only if the surplus energy produced is sold to the grid.

In Portugal, according to the law in force, the sale of the surplus energy produced to the grid is possible, but there is no defined value for it. According to this study, if companies define the price of selling the surplus energy as equal to 0 €, then the plausibility and viability of the project for the investor are practically null using traditional technologies and nanotechnology. This action is reason enough not to invest in renewable energy systems for self-consumption since it only translates into a huge endless investment. Obviously, this is something that has a negative impact at any time in the history of the world, but in the current global energy crisis, it becomes even more worrying.

In future work, a financial analysis of the system, considering a bi-hourly regime, will be done to evaluate the same financial indicators and, consequently, the project’s plausibility.

References

Intergovernmental Panel on Climate Change, The Evidence Is Clear: the Time for Action Is Now. We Can Halve Emissions by 2030. https://www.ipcc.ch/2022/04/04/ipcc-ar6-wgiii-pressrelease/

Lameirinhas, R., Torres, J.P., Cunha, J.: A photovoltaic technology review: history, fundamentals and applications. Energies 15, 1823 (2022). https://doi.org/10.3390/en15051823

REN: Best Research-Cell Efficiency Chart. https://www.ren21.net/wp-content/uploads/2019/05/GSR2021_Full_Report.pdf

Khaligh, A., Onar, O.C.: Energy harvesting: solar, wind, and ocean energy conversion systems. In: Energy, Power Electronics, and Machines. CRC Press (2017). https://books.google.pt/books?id=SkzRBQAAQBAJ

Khaligh, A., Onar, O.C.: 23—energy sources. In: Rashid, M.H. (ed.) Power Electronics Handbook (Fourth Edition), 4th edn., pp. 725–765. Butterworth-Heinemann, Oxford (2018). https://doi.org/10.1016/B978-0-12-811407-0.00025-8

Chapter 7 - high efficiency plants and building integrated renewable energy systems. In: Asdrubali, F., Desideri, U. (eds.) Handbook of Energy Efficiency in Buildings, pp. 441–595. Butterworth-Heinemann (2019). https://doi.org/10.1016/B978-0-12-812817-6.00040-1. https://www.sciencedirect.com/science/article/pii/B9780128128176000401

El Chaar, L., lamont, L.A., El Zein, N.: Review of photovoltaic technologies. Renew. Sustain. Energy Rev. 15(5), 2165–2175 (2011). https://doi.org/10.1016/j.rser.2011.01.004

Sahu, A., Garg, A., Dixit, A.: A review on quantum dot sensitized solar cells: past, present and future towards carrier multiplication with a possibility for higher efficiency. Solar Energy 203, 210–239 (2020). https://doi.org/10.1016/j.solener.2020.04.044

NREL: Best Research-Cell Efficiency Chart. https://www.nrel.gov/pv/cell-efficiency.html

Green, M.A.: Silicon photovoltaic modules: a brief history of the first 50 years. Progr. Photovolt.: Res. Appl. 13(5), 447–455 (2005)

Sinke, W.C.: Development of photovoltaic technologies for global impact. Renew. Energy 138, 911–914 (2019). https://doi.org/10.1016/j.renene.2019.02.030

Lee, T.D., Ebong, A.U.: A review of thin film solar cell technologies and challenges. Renew. Sustain. Energy Rev. 70, 1286–1297 (2017). https://doi.org/10.1016/j.rser.2016.12.028

Goetzberger, A., Hebling, C., Schock, H.-W.: Photovoltaic materials, history, status and outlook. Mater. Sci. Eng.: R: Reports 40(1), 1–46 (2003). https://doi.org/10.1016/S0927-796X(02)00092-X

Sopian, K., Cheow, S.L., Zaidi, S.H.: An overview of crystalline silicon solar cell technology: past, present, and future. AIP Conf. Proc. 1877(1), 020004 (2017). https://doi.org/10.1063/1.4999854

Wolfe, P.R.: Photovolt. Res. 47–76 (2018). https://doi.org/10.1002/9781119425618.ch4

Powalla, M., Paetel, S., Hariskos, D., Wuerz, R., Kessler, F., Lechner, P., Wischmann, W., Friedlmeier, T.M.: Advances in cost-efficient thin-film photovoltaics based on cu(in, ga)se2. Engineering 3(4), 445–451 (2017). https://doi.org/10.1016/J.ENG.2017.04.015

Nehra, M., Dilbaghi, N., Marrazza, G., Kaushik, A., Abolhassani, R., Mishra, Y.K., Kim, K.H., Kumar, S.: 1d semiconductor nanowires for energy conversion, harvesting and storage applications. Nano Energy 76, 104991 (2020). https://doi.org/10.1016/j.nanoen.2020.104991

Mokkapati, S., Jagadish, C.: Review on photonic properties of nanowires for photovoltaics invited. Opt. Express 24(15), 17345–17358 (2016). https://doi.org/10.1364/OE.24.017345

Borgström, M.T., Wallentin, J., Heurlin, M., Fält, S., Wickert, P., Leene, J., Magnusson, M.H., Deppert, K., Samuelson, L.: Nanowires with promise for photovoltaics. IEEE J. Sel. Top. Quantum Electron. 17(4), 1050–1061 (2011). https://doi.org/10.1109/JSTQE.2010.2073681

Spies, M., Monroy, E.: Nanowire photodetectors based on wurtzite semiconductor heterostructures. Semiconductor Sci. Technol. 34(5), 053002 (2019). https://doi.org/10.1088/1361-6641/ab0cb8

Zhang, Y., Liu, H.: Nanowires for high-efficiency, low-cost solar photovoltaics. Crystals (2019). https://doi.org/10.3390/cryst9020087

Goktas, N.I., Wilson, P., Ghukasyan, A., Wagner, D., McNamee, S., LaPierre, R.R.: Nanowires for energy: a review. Appl. Phys. Rev. 5(4), 041305 (2018). https://doi.org/10.1063/1.5054842

Li, Z., Tan, H.H., Jagadish, C., Fu, L.: Iii-v semiconductor single nanowire solar cells: a review. Adv. Mater. Technol. 3(9), 1800005 (2018). https://doi.org/10.1002/admt.201800005

LaPierre, R.R., Chia, A.C.E., Gibson, S.J., Haapamaki, C.M., Boulanger, J., Yee, R., Kuyanov, P., Zhang, J., Tajik, N., Jewell, N., Rahman, K.M.A.: Iii-v nanowire photovoltaics: Review of design for high efficiency. Physica Status Solidi (RRL) Rapid Research Letters 7(10), 815–830 (2013). https://doi.org/10.1002/pssr.201307109

Otnes, G., Borgström, M.T.: Towards high efficiency nanowire solar cells. Nano Today 12, 31–45 (2017). https://doi.org/10.1016/j.nantod.2016.10.007

Hong, N.H.: Chapter 1 - introduction to nanomaterials: Basic properties, synthesis, and characterization. In: Hong, N.H. (ed.) Nano-Sized Multifunctional Materials. Micro and Nano Technologies, pp. 1–19. Elsevier (2019). https://doi.org/10.1016/B978-0-12-813934-9.00001-3. https://www.sciencedirect.com/science/article/pii/B9780128139349000013

Sumanth Kumar, D., Jai Kumar, B., Mahesh, H.M.: Chapter 3 - quantum nanostructures (qds): An overview. In: Mohan Bhagyaraj, S., Oluwafemi, O.S., Kalarikkal, N., Thomas, S. (eds.) Synthesis of Inorganic Nanomaterials. Micro and Nano Technologies, pp. 59–88. Woodhead Publishing (2018). https://doi.org/10.1016/B978-0-08-101975-7.00003-8. https://www.sciencedirect.com/science/article/pii/B9780081019757000038

Tiwari, S., Carter, S., Scott, J.C.: Optical simulation of quantum dot thin film solar cells. In: Workshop on Recent Advances in Photonics (WRAP), pp. 1–2 (2013). https://doi.org/10.1109/WRAP.2013.6917711

Zhou, W., Coleman, J.J.: Semiconductor quantum dots. Curr Opin Solid State Mater Sci 20(6), 352–360 (2016). https://doi.org/10.1016/j.cossms.2016.06.006. (the COSSMS Twentieth Anniversary Issue)

Aissat, A., Benyettou, F., Aissat, A., Vilcot, J.P.: Insb/gaas quantum dot solar cell. In: 2016 International Renewable and Sustainable Energy Conference (IRSEC), pp. 1–4 (2016). https://doi.org/10.1109/IRSEC.2016.7984053

Lugo-Laguna, D., Arcos-Vargas, A., Nuñez-Hernandez, F.: A european assessment of the solar energy cost: key factors and optimal technology. Sustainability (2021). https://doi.org/10.3390/su13063238

dos Santos, Castilho C., Torres, J.P.N., Ferreira Fernandes, C.A., Marques Lameirinhas, R.A.: Study on the implementation of a solar photovoltaic system with self-consumption in an educational building. Energies (2021). https://doi.org/10.3390/en14082214

Khatibi, A., Razi Astaraei, F., Ahmadi, M.H.: Generation and combination of the solar cells: a current model review. Energy Sci. Eng. 7(2), 305–322 (2019). https://doi.org/10.1002/ese3.292

Huld, T., Müller, R., Gambardella, A.: A new solar radiation database for estimating pv performance in Europe and Africa. Solar Energy 86(6), 1803–1815 (2012). https://doi.org/10.1016/j.solener.2012.03.006

d. E. Mecânica, I.D.: Energia fotovoltaica - manual e guia técnico sobre tecnologias, projeto e instalacão. Portal Energia (2004). https://www.portal-energia.com/downloads/guia-tecnico-manual-energia-fotovoltaica.pdf. https://doi.org/10.1002/ese3.292

Jordan, D.C., Kurtz, S.R.: Photovoltaic degradation rates—an analytical review. Progr. Photovolt.: Res. Appl. 21(1), 12–29 (2013). https://doi.org/10.1002/pip.1182

Walker, H., Lockhart, E., Desai, J., Ardani, K., Klise, G., Lavrova, O., Tansy, T., Deot, J., Fox, B., Pochiraju, A.: Model of operation-and-maintenance costs for photovoltaic systems (2020). https://doi.org/10.2172/1659995

Haase, F., Hollemann, C., Schäfer, S., Merkle, A., Rienäcker, M., Krügener, J., Brendel, R., Peibst, R.: Laser contact openings for local poly-si-metal contacts enabling 26.1%-efficient polo-ibc solar cells. Solar Energy Mater. Solar Cells 186, 184–193 (2018). https://doi.org/10.1016/j.solmat.2018.06.020

Nakamura, M., Yamaguchi, K., Kimoto, Y., Yasaki, Y., Kato, T., Sugimoto, H.: Cd-free cu(in, ga) (se,s)<sub>2</sub> thin-film solar cell with record efficiency of 23.35%. IEEE J. Photovolt. 9(6), 1863–1867 (2019). https://doi.org/10.1109/JPHOTOV.2019.2937218

Hwang, I., Um, H.-D., Kim, B.-S., Wober, M., Seo, K.: Flexible crystalline silicon radial junction photovoltaics with vertically aligned tapered microwires. Energy Environ. Sci. 11, 641–647 (2018). https://doi.org/10.1039/C7EE03340K

Sanehira, E.M., Marshall, A.R., Christians, J.A., Harvey, S.P., Ciesielski, P.N., Wheeler, L.M., Schulz, P.A., Lin, L.Y., Beard, M.C., Luther, J.M.: Enhanced mobility cspbi 3 quantum dot arrays for record-efficiency, high-voltage photovoltaic cells. Sci. Adv. 3, 4204 (2017). https://doi.org/10.1126/sciadv.aao4204

Sangwongwanich, A., Yang, Y., Sera, D., Blaabjerg, F.: Lifetime evaluation of grid-connected pv inverters considering panel degradation rates and installation sites. IEEE Trans. Power Electron. 33(2), 1225–1236 (2018). https://doi.org/10.1109/TPEL.2017.2678169

Acknowledgements

This work was supported in part by FCT/MCTES through national funds and in part by cofounded EU funds under Project UIDB/50008/2020. Also, this work was supported by FCT under the research grant UI/BD/151091/2021.

Author information

Authors and Affiliations

Corresponding authors

Ethics declarations

Conflict of interest

The authors declare no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Pinho Correia Valério Bernardo, C., Marques Lameirinhas, R.A., Neto Torres, J.P. et al. Comparative analysis between traditional and emerging technologies: economic and viability evaluation in a real case scenario. Mater Renew Sustain Energy 12, 1–22 (2023). https://doi.org/10.1007/s40243-022-00223-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40243-022-00223-2