Abstract

It has been observed that credit period has become a major concern for most of the retailers, because not only it has direct influence on inventory and finance but also on the demand of an item. Unfortunately, the impact of credit period on demand has received very little attention in the literature, whereas in reality length of the credit period offered has positive impact on the demand rate. The impact of credit period on demand may be instant or delayed. The aim of this paper is to determine the retailer’s optimal replenishment and credit policy in EOQ model under two-levels of trade credit policy when demand is influenced by credit period. These types of demand functions are observed in many consumer durables. Results have been illustrated with the help of a numerical example. Computational results provide some interesting policy implications.

Similar content being viewed by others

References

Aggarwal SP, Jaggi CK (1995) Ordering policies of deteriorating item under permissible delay in payments. J Oper Res Soc 46:658–662

Chang HJ, Hung CH, Dye CY (2004) An inventory model with stock-dependent demand and time-value of money when credit period is provided. J Inf Optim Sci 25(2):237–254

Chang CT, Teng JT, Goyal SK (2008) Inventory lot-size models under trade credits: a review. Asia Pacific J Oper Res 25:89–112

Chang CT, Teng JT, Chern MS (2010) Optimal manufacturer’s replenishment policies for deteriorating items in a supply chain with upstream and down-stream trade credits. Int J Prod Econ 127:197–202

Chen LH, Kang FS (2010) Integrated inventory models considering the two-level trade credit policy and a price-negotiation scheme. Eur J Oper Res 205:47–58

Chung KH (1989) Inventory control and trade credit revisited. J Oper Res Soc 40:495–498

Goyal SK (1985) Economic ordering quantity under conditions of permissible delay in payments. J Oper Res Soc 36:335–343

Ho CH (2011) The optimal integrated inventory policy with price-and-credit-linked demand under two-level trade credit. Comput Ind Eng 60:117–126

Huang Y-F (2003) Optimal retailer’s ordering policies in the EOQ model under trade credit financing. J Oper Res Soc 54:1011–1015

Huang Y-F (2007) Optimal retailer’s replenishment decisions in the EPQ model under two levels of trade credit policy. Eur J Oper Res 176:1577–1591

Huang YF, Hsu KH (2008) An EOQ model under retailer partial trade credit policy in supply chain. Int J Prod Econ 112:655–664

Hwang H, Shinn SW (1997) Retailer’s pricing and lot sizing policy for exponentially deteriorating products under the condition of permissible delay in payments. Comput Oper Res 24:539–547

Jaggi CK, Kausar A (2009) Inventory decisions for deteriorating items under two-stage trade credit with credit period induced demand. Int J Appl Decis Sci 2(1):74–86

Jaggi CK, Khanna A (2009) The retailer’s procurement policy with credit-linked demand under inflationary conditions. Int J Procure Manag 2:163–179

Jaggi CK, Goyal SK, Goel SK (2008) Retailer’s optimal replenishment decisions with credit linked demand under permissible delay in payments. Eur J Oper Res 190:130–135

Jamal AMM, Sarkar BR, Wang S (2000) Optimal payment time for a retailer under permitted delay of payment by the wholesaler. Int J Prod Econ 66:59–66

Liao JJ (2008) An EOQ model with non-instantaneous receipt and exponentially deteriorating items under two-level trade credit policy. Int J Prod Econ 113:852–861

Teng JT (2002) On economic order quantity under conditions of permissible delay in payments. J Oper Res Soc 53:915–918

Teng JT, Chang CT (2009) Optimal manufacturer’s replenishment policies in the EPQ model under two-levels of trade credit policy. Eur J Oper Res 195:358–363

Teng JT, Chen J, Goyal SK (2009) A comprehensive note on: an inventory model under two levels of trade credit and limited storage space derived without derivatives. Appl Math Model 33:4388–4396

Thangam A, Uthayakumar R (2009) Two-echelon trade credit financing for perishable items in a supply chain when demand depends on both selling price and credit period. Comput Ind Eng 57:773–786

Thangam A, Uthayakumar R (2011) Twoechelon trade credit financing in a supply chain with perishable items and two different payment methods. Int J Oper Res 11:365–382

Tsao YC (2009) Retailer’s optimal ordering and discounting policies under advance sales discount and trade credits. Comput Ind Eng 56:208–215

Acknowledgment

The authors thank the anonymous referees for their valuable suggestions and comments, which helped in improving the paper. The first author would also like to acknowledge the financial support provided by University Grant Commission (Grant No. Dean (R/R&D/2011/423).

Author information

Authors and Affiliations

Corresponding author

Appendix: Concavity of π(T, N) with respect to N

Appendix: Concavity of π(T, N) with respect to N

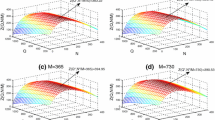

Here, for a fixed value of T, we have also shown the concavity of profit functions π 1(T, N), π 2(T, N) and π 3(T, N) with respect to N,

and

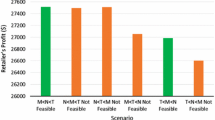

For fixed T, Eqs. (28) to (30) are ≤0 which implies that π 1(T, N), π 2(T, N) and π 3(T, N) are concave on N provided (i) N + 2 ≥ 1/r and (ii) CI p > PI e . Moreover, it has also been verified graphically (Fig. 5).

Rights and permissions

About this article

Cite this article

Jaggi, C.K., Kapur, P.K., Goyal, S.K. et al. Optimal replenishment and credit policy in EOQ model under two-levels of trade credit policy when demand is influenced by credit period. Int J Syst Assur Eng Manag 3, 352–359 (2012). https://doi.org/10.1007/s13198-012-0106-9

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13198-012-0106-9