Abstract

Optimal selection and allocation of suppliers are crucial decisions for an organization and it becomes more critical when the firm faces disruptive events. The recent outbreak of COVID-19 has led to massive supply disruptions in a supply chain. This paper aims to address the supplier selection and allocation problem of manufacturing firms under pandemic environment. In this study, a novel Mixed Integer Linear Programming (MILP) model integrated with grey optimal ranking of suppliers considering factors related to pandemic situation is proposed. The methodology is implemented in two subsequent stages. In the first stage, Grey Relational Analysis is adopted to determine the grey possibility scoring, and in the second stage, a supplier selection model is proposed to integrate the grey scoring to a MILP model to determine optimal allocation of suppliers. The paper presents a numerical study to demonstrate the proposed model and sensitivity analysis is conducted to deduce key managerial insights regarding the factors affecting the allocation under pandemic situation. Further, the illustration demonstrates how the proposed method integrates the expert ranking based approach and the cost minimization approach. The study is generic in nature and provides useful directions for practitioners involved in supplier selection in manufacturing organizations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In this increasingly uncertain and vulnerable world, over the past decade, humankind has witnessed several unpredictable disruptions. These disruptions include terrorist attacks, wars, natural disasters, attenuation of currencies and pandemics. Historical data indicates that over the past decade, the total number of natural and man-made disasters has risen dramatically, severely impacting human lives and global business supply chains (www.cred.be). Since December 2019, the global spread of the novel coronavirus, also known as the COVID-19 pandemic, has had a devastating impact on human lives. COVID-19 has not only resulted in the global tragedy for human life but also devastated the manufacturing sectors by completely disrupting the existing supply chain operations.

In order to compete under the growing competition in the global market, an organization must precisely coordinate with the supply chain partners (e.g., suppliers) and develop a robust yet dynamic supply chain model. Among several other key factors, the supplier selection and management has long been identified as a major strategic tool for improving a firm’s competence [6]. Supplier selection is a strategic process to select the right set of suppliers to ensure adequate quality supply of raw materials or components at any given time to ensure timely manufacturing of finished-good-products [16]. Therefore, a good supplier selection strategy must ensure optimal selection of suppliers considering several crucial factors like supplier’s delivery capacity, their quality level, environmental costs, delivery lead time, and various other cost parameters. For any significantly large organization, this problem is even more multifaceted due to a multi-period, multi-parts, and multi-source planning environment.

The background of the study is based on the observation made in a manufacturing industry producing heavy earth moving equipment located in the eastern part of India. The organization has to consider a lot of factors for the final material procurement strategy. Therefore, it is not always possible for the organization to place procurement orders to a single supplier, which is also applicable to many other manufacturing industries [50]. This can be due to unavailability or insufficient capacity of a supplier at that particular time. More to that, any unexpected disruption caused to the supplier will also cause supply issues for the organization. Hence, it is almost always better to pre-select a set of suppliers and then based upon their capacity, ability to handle risk and other factors, allocate orders in such a way that disruption is minimized. The organization requires spare part based on the manufacturing schedule and any delay in supply causes internal production and scheduling issues. Due to the effect of COVID-19 pandemic, like any other organization, the organization under study also faces severe disruptions in the procurement process. This is primarily because of the disturbances in the transportation network and difficulties in distributing items and human resources. To aid the issue, this study considers the case of such organizations that have a set of available suppliers and the final product which can be assembled by procuring spare parts from these suppliers. One way of dealing with this situation is to modify the supply selection strategy by ranking the suppliers based on expert rating to tackle the unprecedented scenarios where human judgement is crucial. However, the organization also wants to allocate the orders in such a way that the total cost and other variable factors are also minimized in a dynamic planning horizon. This is extremely important for the organization as fixating the supplier rank might incur very high procuring cost to the organization. Therefore, to make the both ends meet, it is important for the organization to develop a supplier selection framework that prioritizes the expert-judgements as well as minimize the associated costs through a quantitative technique.

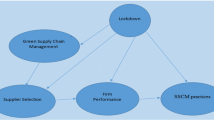

A supply chain primarily includes every stage from the supply of materials and the manufacture of the goods through to their distribution and sale [22]. As identified in the literature, there are six major preliminary decision processes involved in an organization, namely, (i) make or buy, (ii) supplier selection, (iii) contract negotiation, (iv) design collaboration, (v) procurement, and (vi) sourcing analysis. Among them, supplier selection is regarded as one of the most crucial decisions [56]. Supplier selection process of any firm directly affects the firms’ profitability, reliability, and overall cost performance. Therefore, the selection and evaluation of the suppliers are a significant decision-making process responsible for the success of any manufacturing firm [29]. However, as identified in the literature, most of the studies in supplier selection problems have been considered in a multi-objective, multicriteria, and organization-specific problem environment and are often particularly developed for a firms’ type, product type, and their complexity. Thus, specific practical considerations of general uncomplimentary situations, and flexible decision support mechanisms, which is also extremely important while developing supplier selection models, is often neglected in the literature. More to that, as the parameters-value of supplier cost and customer’s demand change, there is a need for inclusion of dynamicity into supplier selection decisions.

Since the COVID-19 pandemic started, researchers have been investigating various supply chain issues and mitigation strategies to enable the firms to fight back the unprecedented challenges imposed by the new normal. However, to the best of our knowledge, none of studies in the existing pool of literature have considered supplier selection strategy to be a major element for firms’ performance during pandemic outbreaks. Therefore, in this paper, we mathematically develop a novel supplier selection strategy incorporating the unique and unprecedented characteristics of a pandemic outbreak to aid an efficient supplier selection strategy. In the existing literature, the contribution of the paper is twofold. They are:

-

i.

We identified several factors that affect the supplier selection strategy during a pandemic and develop a novel Mixed Integer Linear Programming (MILP) model to derive a weightage-based flexible supplier selection strategy based on grey optimal ranking to determine the optimal best combination of suppliers, which has not been considered in earlier literature.

-

ii.

The study is designed keeping in mind the impact of pandemics on the industry to develop strategies for optimal allocation of resources to minimize the impact of such incidents and the overall cost simultaneously. Therefore, the study, by its design, is unique and contributes to the existing pool of supplier selection literature.

The remainder of the paper is as follows. In Sect. 2, we present the relevant review of literature. Section 3 presents the Methodology of Grey Relational Analysis (GRA) and the development of the mathematical model. Section 4 presents the numerical analysis, results and discussions. Section 5 concludes the study and demonstrates the limitations and future scopes.

2 Literature review

In a supply chain, sourcing is one of the most strategic aspects when a company attempts to reduce cost and improve competitiveness [60]. This is true especially in a manufacturing context, where the cost of parts represents the largest portion of the product cost [41]. In the past, many of the researchers who have studied the problem proposed a variety of approaches and techniques. One can refer to the work by Chai et al. [10] and Chai and Ngai [9] for a detailed overview of the recent developments in the field of supplier selection problem. From their study, it is evident that the supplier selection problem is multi-dimensional. This multi-dimensionality usually comes in the form of either multi-criteria, multiple supplier or multiple periods. The traditional approaches of tackling supplier selection problems are mostly confined by a single method-based approach (data envelopment analysis, MILP, max–min approach). However, more recently, integrated approaches are gaining popularity in the field of supplier selection. To name a few among the single-method based approach, as can be seen in the literature, Data Envelopment Analysis (DEA), MILP based models, analytic network process (ANP) and techniques of multi-criterion decision-making (MCDM) are the most widely used methods.

To discuss a few literatures in the single-method approach, Liu et al. [37] proposed DEA to evaluate supplier performance through a case study of an agricultural and construction equipment manufacturer. Talluri and Narasimhan [53] discussed the importance of incorporating multi-dimensional information into vendor evaluation and proposed a max–min productivity-based approach that derives vendor performance variability measures. In their work, these measures are utilized as a non-parametric statistical technique in identifying vendor groups for effective selection. An Action Research (AR) framework was proposed by Ross et al. [48], where they consider the supplier evaluation environment of a telecommunication company using DEA. Ng [43] developed a weighted linear optimization model through a transform technique that can be implemented with a spreadsheet package without an optimization solver. Joshi et al. [24] demonstrate an ANP with a mutual compatibility index to help the decision maker in the supplier selection processes. More recently, Ware et al. [56] developed a MINLP model to address problems in a multi-period, multi-parts, and multi-source problem. This type problem is known as Dynamic Supplier Selection Problem (DSSP). Unlike traditional supplier selection problems, the DSSP is multi-period and a single supplier might not satisfy the total demand of the organization. Liaqait et al. [35] have identified sustainable supplier selection and order allocation to be most crucial to sustainable supply chain management. Dobos and Vörösmarty [14] studied a green supplier selection problem and presented a DEA type supplier selection method where green factors served as the output variables. In addition to managerial and green criteria, the paper adds to the literature by studying the effect of inventory related costs. Li et al. [32] discussed the importance of environmental factors in a dynamic supplier selection and order allocation problem and proposed a two-stage mathematical model. The first stage of their model involves a primary selection of suppliers based on the best–worst method. In the second stage, a multi-objective mathematical model is formed to aid dynamic supplier selection and order allocation. Orji and Ojadi [44] examined the COVID-19 pandemic’s impact on supply chain sustainability, and indicated that economic criteria and pandemic response strategies (PRS) are key to sustainable supplier selection.

Compared to a single-method approach, an integrated approach is relatively scarce. However, an integrated method in supplier selection often comprises the advantage of flexibility for the practical applications. To discuss a few, one can see the seminal work of Xia and Wu [60] where they presented an integrated approach of analytical hierarchy process improved by a mixed integer programming to determine the number of suppliers and the order allocation. Lin et al. [36] developed a hybrid MCDM approach based on ANP for outsourcing vendor selection for a semiconductor company. Karsak and Dursun [27] proposed an integrated supplier selection methodology incorporating quality function deployment (QFD) and DEA. Bodaghi et al. [7] proposed an integrated weighted fuzzy multi-objective model for supplier selection and order scheduling. They developed a mathematical measure for evaluating the volume flexibility of suppliers and to allocate the order quantity. Ahmed and Mondal [1] address the supplier selection problem for a mining company under dynamic business environments by developing an integrated methodology of analytic hierarchy process (AHP) and MILP. Similar to this line, Yu et al. [62] develops a novel integrated supplier selection approach incorporating decision maker’s risk attitude using the artificial neural network (ANN), AHP and technique for order of preference by similarity to ideal solution (TOPSIS) methods. More recently, Beiki et al. [5] introduces a novel approach by integrating language entropy weight method (LEWM) and multi-objective programming for a sustainable supplier selection for an automobile industry. In their work, they critically study and emphasize the importance of environmental concerns in a supply chain, due to the recent increase of government policies and people’s environmental awareness.

In recent times. GRA has received significant attention from researchers to improve the precision of decision-making [47]. To discuss a few recent studies on GRA, Rajesh and Ravi [46] developed a grey-DEMATEL based model for analyzing the drivers of risks in electronic supply chains. Mahmoudi et al. [38] developed a conceptual model for selecting the best supplier based on a sustainability framework by employing grey theory to consider multiple ranks for criteria and alternatives. Rajesh [47] developed a grey programming model for optimizing profits or an indeterminate product mix problem of a case electronics manufacturing industry. Results from their work endorse the flexibility of grey programming in uncertain decision-making environments. Du et al. [15] discussed a novel grey multi-criteria three-way decisions model based on grey incidence analysis and TOPSIS. More recently, Asgharnezhad and Darestani [2] developed a green supplier selection model based on GRA for the polyethylene industry. In the first stage of their work, they identified the criteria that influence supplier selection in the polyethylene industry, and, in the second stage, suppliers are selected in a green supply chain using multi-criteria decision-making. A similar study was also conducted by Ghosh et al. [18], where they developed a GRA based strategic sourcing framework in which supplier organizations are prioritized and ranked based on their green supply chain performance. Through a case study in a food manufacturing company, Leong et al. [31] identified seven criteria for a resilient supplier selection framework and determined the importance of these criteria by GRA. A spherical fuzzy GRA based model for emergency supplies supplier selection was proposed by Zhang et al. [64], which can be regarded as a classic multiple attribute group decision making (MAGDM) problem. These researches show that the grey numbers have the flexibility to deal with uncertain and indeterminate situations, and therefore, can effectively aid complex decision-making problems.

From the literature, it is also observed that most of the researchers have clearly stated the relative benefits of an integrated method over a single method in terms of flexibility. The immense importance of environmental and quality factors has also been identified in the context of supplier selection problems. To the best of our knowledge, no other study in the literature considered the supplier selection strategy to be a major element under pandemic outbreaks. To bridge this gap in literature, we develop a MILP model based on grey optimal ranking to aid supplier selection and order allocation. In our study, the developed model considers the unique characteristics of a pandemic and also prioritizes the environmental factor and quality standards to ensure practical implications. Therefore, it can be outlined that according to the best awareness of the authors, no other study in the existing literature develops such a model to consider the unique characteristics of a pandemic in the supplier selection.

3 Problem background and methodology

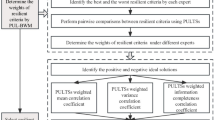

In this study we consider a business organization operating under pandemic situation. The organization has to develop a supplier selection mechanism considering several factors that might influence the supplier performance in a pandemic. The organization has to minimize the total procurement cost of multiple parts from multiple suppliers. As these associated costs often randomly, fixating a supplier ranking is not appropriate for the organization. This is due to the fact that fixation of a supplier order might lead to a very high cost in some ordering period, due to a heavy increase in cost of a particular supplier. From literature, it is evident that under these highly situation specific environments (E.g., pandemic and lockdown protocols), an expert opinion based MCDM technique can be a useful decision-making tool. However, for multi-product environments, researchers also suggest that for identifying the right set of suppliers to deliver the optimal quantity for individual products at a minimum cost, a discrete optimization is more preferred [28]. To address such conflict, in this paper, we initially develop a MCDM based approach to determine the supplier score. Later, implying these scores as individual weights of the suppliers, we develop a MILP based model to determine the appropriate supplier allocation to minimize the total cost. We discuss the methodology of developing this supplier selection strategy in the following sections.

3.1 Determination of the supplier scoring

In order to determine the initial supplier scoring, we have adopted the GRA methodology. GRA was first proposed by Deng [13] and is a very effective method to solve MCDM problems. The primary reason for adopting GRA in this study is due to its ability to incorporate both quantitative as well as qualitative factors [33, 61]. Also, due to the ability to work well under partial information availability [39], GRA perfectly fits our discussed supplier selection problem. In Fig. 1, we present a flowchart for the adopted methodology. For an organization, we have identified a set of four alternative suppliers over a panel discussion consisting of five distinguished industrial experts (Table 11). The methodology for GRA is explained as follows.

3.1.1 Defining the criteria and sub-criteria

Based on the existing literature and discussion with industrial experts, we develop the following criteria for the problem. The details of the selection of criteria are explained in Table 1. The major factors considered in this study are as follows.

-

i.

Cost—The cost incurred by the supplier in providing its items to the manufacturer. It is the most commonly used criteria to evaluate supplier performance.

-

ii.

Quality—The quality of the product that supplier provides to the manufacturer. It is also a very important factor for assessing the supplier.

-

iii.

Delivery—It refers to the performance of the supplier with respect to the delivery of the items by the supplier.

-

iv.

Internal Performance—It refers to the performance capability of the supplier.

-

v.

Pandemic factors—These are novel factors that hold utmost importance and need to be considered in assessing supplier performance during a pandemic like COVID-19.

3.1.2 Calculation of the weight matrix of the attributes

In order to identify the alternative suppliers, we form a set of alternative suppliers \(S = \left\{ {1,2,3 \ldots m} \right\}\). An expert committee consisting several key executives from various organization is formed, given by \(K = \left\{ {1,2,3 \ldots k} \right\}\). The set of factors are given as \(N = \left\{ {1,2,3 \ldots j} \right\}\). Each expert provides a linguistic assessment conveying the importance of the sub-criteria in evaluating supplier’s performance in the given scenario (Tables 12 and 13). The linguistic values are converted into grey values by the following scale in Table 2.

Here, \(\otimes W\) refers to the grey value of weight of attributes where

All grey numbers consist of a lower and an upper value and are represented as shown in Eq. (1). Let the weight assigned to \(j^{th}\) attribute by \(k^{th}\) expert be represented as \(\left\{ {W_{j}^{1} , W_{j}^{2} ,W_{j}^{3} , \ldots , W_{j}^{k} } \right\}\). Also let the grey values associated with the weights be represented as \(\left\{ { \otimes W_{j}^{1} , \otimes W_{j}^{2} , \otimes W_{j}^{3} , \ldots , \otimes W_{j}^{k} } \right\}\).

The average attribute weight for the attribute \(j\) is given in Eq. (2). Thereafter, based on the responses of the experts, the final weight matrix calculated is shown in Table 3.

3.1.3 Calculation of the grey decision matrix

Each of the experts provide responses to the performance of supplier \(m\) with respect to attribute \(j\) in linguistic terms (Table 13). The linguistic value is converted to grey value by the following scale as shown in Table 4.

Let \(G_{mj}^{k}\) represent the linguistic value of performance of supplier \(m\) for attribute \(j\) as rated by expert \(k\) and \(\otimes G_{mj}\) be the corresponding grey value.

The average rating is calculated as:

Now, let \(D\) represent the grey decision matrix in Eq. (5). Based upon the responses of the experts, the grey decision matrix is then calculated as shown in Table 5.

3.1.4 Calculation of the normalized grey decision matrix

The grey decision matrix is normalized so as to bring the grey values in the range of [0,1]. The grey value of normalized matrix is represented as \(\otimes {\varvec{G}}_{{{\varvec{mj}}}}^{\user2{*}}\). The normalization is carried out by performing the following calculation as shown in Eq. (6). The normalized matrix can be represented as \({\varvec{D}}^{\user2{*}}\). The normalized matrix based on the Decision matrix in the problem is given in Table 6.

3.1.5 Calculation of the weighted normalized grey decision matrix

The weighted normalized grey decision matrix is obtained by multiplying the normalized grey decision matrix with the weight matrix. The grey values in the weighted normalized matrix are represented as follows.

The weighted normalised Grey Decision matrix is further denoted as \(D^{**}\), as shown in Eq. (11). Based on the previous calculation the weighted normalised Grey Decision Matrix obtained is given in Table 7.

3.1.6 Establishing the ideal reference set of supplier alternatives

The ideal reference value is established for each possible attribute that is used for evaluating the supplier. It is the maximum value of the weighted normalised decision matrix for each attribute across the different suppliers. The value can be obtained using Eq. (12) and is represented as \(S^{\max }\).

Or,

In this case, the value of ideal reference set is:

3.1.7 Calculating the grey possibility value for each supplier

This step involves calculating the Grey Possibility Value for each Supplier \(m\) against the ideal reference set \(S^{\max }\). This value is represented as \(P\left( {S_{m} \le S^{\max } } \right) \forall m \in M\).

Equation (14) depicts the possibility of the performance of the supplier for each attribute. Therefore, grey possibility value indicates how far or close it is to the ideal reference set. In an ideal scenario, the lesser the possibility value, the better is the performance and hence the ranking of the supplier. The possibility that a grey number is less than or equal to another grey number can be estimated as by Eqs. (15)–(18). From the different values calculated from the data, the derived possibility values are given in Table 8.

Now,

Putting the values, we get

In the next section, we present a mathematical model that integrates the grey scoring to a MILP based cost optimization model to determine the final allocation for the suppliers. The novelty of the mathematical model lies in integrating the grey possibility score as a relative weight to the suppliers in the cost minimization model, so that an appropriate balance is maintained between the total cost incurred and risk minimization.

3.2 Development of the grey possibility score based mathematical model

In this section, we develop a MILP based mathematical model for the optimal allocation of the order quantity towards each supplier. Following are the assumptions and notations for the mathematical model.

3.2.1 Assumptions

-

i.

Demand is deterministic and known over a planning horizon.

-

ii.

The total capacity available with all the suppliers combined are sufficient to meet the demand.

-

iii.

Associated costs and capacity of suppliers are known.

-

iv.

Lead time is deterministic and known.

3.2.2 Notations

\(S\) | \(Set of suppliers; 1, 2, . . . , m\) |

\(P\) | \(Set of products; 1, 2, . . . , n\) |

Q mn | Number of product n supplied by supplier m for a given time period |

Y m | Binary variable for assignment of supplier |

R mn | Binary variable for condition with respect to Quality |

Z mn | Binary variable for condition with respect to Emission level |

P mn | Wholesale price offered by supplier m for supplying product n |

A m | Transportation cost incurred by supplier m for delivery of products (independent of product type) |

C mn | Capacity of supplier m for product n |

D n | Demand for product n |

PQ mn | Unit Penalty cost for non-conformance to quality of product n by supplier m |

PT mn | Unit delay cost to supplier m for product n for providing product beyond delivery time |

DLT mn | Delay lead time for product n by supplier m |

X mn | Quality level of product n for supplier m |

XA mn | Quality level set by the Organization |

E mn | Emission level of the supplier m for product n |

EA mn | Emission level as prescribed by the organization |

W m | Grey possibility value |

3.2.3 Mathematical model

Subject to,

The objective function given in Eq. (19) minimizes of the total selling price of the product by the suppliers, the setup cost of preparing the products, the penalty cost for non-conformance to quality by the suppliers and the penalty cost for not providing the products on time by the supplier by considering the relative weightage derived from the GRA. Equation (20) takes into account the capacity constraint for each supplier and product. Equation (21) ensures that the sum of the quantities assigned to each supplier for a particular product should be greater than or equal to the demand of the product. Equation (22) is for binary constraint satisfaction. It makes sure that if any of the suppliers provide any product, the setup cost of that supplier would be included in the objective function. Equation (23) is with respect to the quality level assurance for allocation of quantity to the suppliers. It ensures that there would be no allocation to the supplier for a particular product if its quality level is less than what is prescribed by the organization. Equation (24) is a fixed charge constraint imposing the binary restrictions. Equation (25) is with respect to Pollution and CO2 emission acceptance for allocation of quantity to the suppliers. It ensures that there would be no allocation to the supplier for a particular product if its emission level is more than the industrial standard. Equations (26)–(30) imposes the necessary binary and non-negativity conditions.

4 Numerical analysis and discussions

The proposed model is programmed in LINGO 12 on an Intel Core-i5 processor with 8 GB RAM and Windows 7 Professional edition. In the numerical analysis, the organization is manufacturing a final product based on three primary products supplied by a pool of suppliers. These suppliers’ information is previously available with the manufacturer and ranking has been done through GRA analysis as demonstrated in Sect. 3.1.

The associated data and the solved allocation are being presented in Tables 9 and 10 respectively. It is observed from the results that from the pool of suppliers, the organization selects three suppliers. It is interesting to notice that despite having the best ranking, unlike the traditional approach, supplier 1 has not been used at its full capacity. It is also observed, that despite having a comparatively better cost propositions, supplier 3 has not even been selected for any of the products. This is primarily due to the less weightage assigned towards supplier 3 through the GRA. It is also evident that supplier 4 was assigned maximum quantity despite having a relatively lower score, as compared to supplier 1, due to a relatively better cost proposition. Therefore, we can conclude that the proposed approach is beneficial when the organization wants to strike a balance between the risk minimization based on expert opinion during pandemic and total incurred cost. In the next section, through a detailed sensitivity analysis, we demonstrate how the changes in cost parameters are affecting the quantity allocation.

4.1 Effect of change in product price on order allocation

In order to analyze the effect of change in product price on order allocation, we conduct sensitivity analysis individually for all the suppliers, by changing the cost of one supplier and fixing the cost of other suppliers. The results are presented in Fig. 2. In Fig. 2a, we see the effect of change in the price of supplier 1, when other suppliers remain constant. The results show that for supplier 1, allocation changes to a good degree on reduction of cost. However, for an increase in price, the allocation tends to shift towards other suppliers. It is observed that for an increase of 30% cost, despite having the best GRA score, the allocation quantity for supplier 1 becomes 0.

In Fig. 2b, we see a further steep dependency between the price and allocation for supplier 2. From numerical analysis, it is observed that even for a 4% increase in price, the allocation for supplier 2 becomes drastically zero the quantity is allocated to supplier 1. This demonstrates the sensitivity of the model as well as the importance of the right pricing for suppliers under such a competitive environment. Similarly, on decreasing the pricing by as low as 10%, supplier 2 can acquire a near-full capacity allocation.

In Fig. 2c, we see that due to a low GRA score, supplier 3 does not acquire any order in the base level. The results show that to overturn the low GRA score and an allocation to occur, supplier 3 pricing needs to be reduced as low as 40%. Further, in Fig. 2d, we see that due to a good GRA score and cost proposition, supplier 4 is allocated to the present full capacity. We observe that up to an increase of 7% in cost, there is no change in allocation.

4.2 Effect of change in lead time on order allocation

Figure 3 demonstrates the impact of lead time on supplier allocation. In Fig. 3a, for supplier 1, it is observed that a decrease in lead time improves the order allocation drastically and near-full capacity allocation can be observed. In Fig. 3b, c, for supplier 2 and supplier 3 respectively, it is seen that a reduction in lead time does not affect order allocation significantly. In Fig. 3d, as supplier 4 operates in full-capacity-allocation, a decrease in lead time does not impact the order quantity. However, an increase in lead time will reduce the allocation for supplier 4.

4.3 Effect of change in supplier capacity on order allocation

From Fig. 4a–c, it is observed that an increase in capacity does not lead to quantity allocation, as these suppliers were not being allocated at their full capacity. However, for supplier 4, for all three products, it is observed that an increase in capacity can lead to a substantial improvement in allocation due to better cost proposition and relatively good GRA score.

4.4 Effect of change in quality level of supplier on order allocation

Further, to demonstrate the impact of change in the quality level on order allocation, we draw respective changes in Fig. 4. It is to be noted that for a drop in quality level below the organization standard, the allocation towards that supplier will become zero due to the nature of the formulation. From Fig. 5a, it is seen that an increase in respective quality level does not lead to a different order allocation for supplier 1. However, as indicated, if the quality level drops to a value lower than the standard set by the organization, the assigned quantity becomes zero. For supplier 2, as observed from Fig. 5b, an increase in quality level leads to an improvement in order allocation. However, similar to supplier 1, a decrease in leads to no allocation. Figure 5c, d shows the changes in order allocation for supplier 3 and 4, respectively. Similar to the previous instances, also for these suppliers, an increase in quality level does not lead to a change in order allocation.

Further to these factors, it is also observed that a change in other factors does not influence the distribution of quantity allocation significantly. This is mostly due to the fact that these factors are mostly product independent, and thus having low influence on the total order allocation.

4.5 Theoretical implications of the study

Sourcing is one of the most critical strategic aspects to reduce costs and improve competitiveness. In today’s world, supplier selection has been identified as a major strategic tool for improving a firm’s competence. However, for large organizations, this is extremely challenging due to a multiperiod, multi-parts, and multi-source planning environment. Due to the effect of the COVID-19 pandemic, organizations faced severe disruptions in the procurement process. This disruption was caused primarily due to disturbances in the transportation network and difficulties in distributing items and human resources. The findings of this research add important insights to the existing literature on supplier selection framework under disruption. There are very few papers in the literature on supply chain management that have considered supplier selection strategy to be a major element under pandemic outbreaks. To bridge this gap, our model considers and prioritizes the unique characteristics of a pandemic, which have not been previously considered in the literature. In this study, we develop a grey optimal ranking based mathematical model to aid supplier selection and order allocation. Further, the work also provides a conceptual framework and mathematical model to optimize supplier selection considering cost and quality standards to ensure practical implications.

4.6 Practical implications of the study

The sensitivity analyses show that the proposed approach strikes a balance between the qualitative based order quantity allocation by the traditional expert opinion-based methodology and the cost-centric optimization-based methodology. Therefore, by adopting this methodology, any organization can benefit from the relative advantages of both approaches. More to that, as this study includes the unique features of supplier selection under pandemic, organizations operating in similar environments would be greatly benefited. Further, from the computational results, a detailed analysis can be made from the suppliers’ perspective. For instance, from the numerical example, it was identified that a slight change in pricing will lead to a substantial reduction in quantity allocation for supplier 2. Also, despite a poor GRA score due to operational inefficiencies in a pandemic, a reduction of 10% on pricing would allow some allocation to supplier 3. Further, we demonstrate that supplier 4 can be most benefited by increasing its operational capacity, due to a balanced cost proposition and GRA score. Therefore, the findings highlight a list of criteria that managers can consider during their strategy development so that they can stay ahead in the increasingly competitive market.

5 Conclusions and scopes of future work

The paper proposes a mathematical model based on grey optimal ranking in the context of a pandemic breakout for supplier selection problem. In this study, we develop a mathematical model integrated with GRA to determine the optimal quantity allocation for suppliers. In the first phase of the problem, we use GRA methodology to obtain grey optimal ranking for suppliers considering the unique complexities that arise during a pandemic outbreak. In the second phase of the problem, we develop a mathematical model to determine optimal allocation based on the grey weightage obtained in the first stage. To solve and analyze the model, we have used the Lingo 14 optimization tool to generate optimal solutions in very low-runtime.

The outcome of the model demonstrates that the proposed approach can be successfully adopted to strike a balance between the risk minimization based on expert opinion during a pandemic and minimization of total incurred cost in the process. In our test instance, we see that supplier 1, supplier 4 and supplier 2 have the best GRA ranking. However, supplier 3 and 4 have better cost propositions. Through numerical analysis, we show that despite having a good cost proposition, supplier 3 was not allocated any quantity. Maximum quantity was allocated to supplier 4, despite being second in the GRA ranking, and relatively lesser quantity was allocated to supplier 1, despite having the highest rank. Further, through sensitivity analysis, we study the impact of change in various supplier parameters on order allocation. The results show that the product price has the dominant impact on the allocation model, followed by delivery lead time and supplier capacity. It is also found that the product independent parameters also have the least impact on the model.

The present study can be extended in several directions. For instance, uncertainty in the supplier capacity, delivery quantity and lead time has not been considered in the present study. The study can also be extended in a multi-period setting to analyze further insights. Further, a partial information theory model can also be adopted to develop a game-theoretic strategy between the organization and the suppliers. The proposed model can also be applied in the real-world to develop a case study. Despite the limitations, we strongly believe that this study provides food for thought and encouragement for practitioners.

Data availability

The data of this research are generated randomly and are available upon request.

References

Ahmad, M.T., Mondal, S.: Dynamic supplier selection approach for mining equipment company. J. Model. Manag. 14(1), 77–105 (2019)

Asgharnezhad, A., Darestani, S.A.: A green supplier selection framework in polyethylene industry. Manag. Res. Rev. (2022). https://doi.org/10.1108/MRR-01-2021-0010

Asamoah, D., Annan, J., Nyarko, S.: AHP approach for supplier evaluation and selection in a pharmaceutical manufacturing firm in Ghana. Int. J. Bus. Manag. 7(10), 49–62 (2012)

Azizi, M., Modarres, M.: A decision model to select facial tissue raw material: a case from Iran. OR Insight 23(4), 207–232 (2010)

Beiki, H., Mohammad Seyedhosseini, S., Ponkratov, V.V., Olegovna Zekiy, A., Ivanov, S.A.: Addressing a sustainable supplier selection and order allocation problem by an integrated approach: a case of automobile manufacturing. J. Ind. Prod. Eng. (2021). https://doi.org/10.1080/21681015.2021.1877202

Ben-Ammar, O., Bettayeb, B., Dolgui, A.: Optimization of multi-period supply planning under stochastic lead times and a dynamic demand. Int. J. Prod. Econ. 218, 106–117 (2019)

Bodaghi, G., Jolai, F., Rabbani, M.: An integrated weighted fuzzy multi-objective model for supplier selection and order scheduling in a supply chain. Int. J. Prod. Res. 56(10), 3590–3614 (2018)

Çebi, F., Bayraktar, D.: An integrated approach for supplier selection. Logist. Inf. Manag. 16(6), 395–400 (2003)

Chai, J., Ngai, E.W.: Decision-making techniques in supplier selection: recent accomplishments and what lies ahead. Expert Syst. Appl. 140, 112903 (2020)

Chai, J., Liu, J.N., Ngai, E.W.: Application of decision-making techniques in supplier selection: a systematic review of literature. Expert Syst. Appl. 40(10), 3872–3885 (2013)

Cheraghi, S.H., Dadashzadeh, M., Subramanian, M.: Critical success factors for supplier selection: an update. J. Appl. Bus. Res. (JABR) (2004). https://doi.org/10.19030/jabr.v20i2.2209

Choi, T.Y., Hartley, J.L.: An exploration of supplier selection practices across the supply chain. J. Oper. Manag. 14(4), 333–343 (1996)

Deng, J.L.: Introduction to grey system theory. J. Grey Syst. 1(1), 1–24 (1989)

Dobos, I., Vörösmarty, G.: Inventory-related costs in green supplier selection problems with data envelopment analysis (DEA). Int. J. Prod. Econ. 209, 374–380 (2019)

Du, J., Liu, S., Liu, Y.: A novel grey multi-criteria three-way decisions model and its application. Comput. Ind. Eng. 158, 107405 (2021)

Flankegård, F., Granlund, A., Johansson, G.: Supplier involvement in product development: challenges and mitigating mechanisms from a supplier perspective. J. Eng. Technol. Manag. 60, 101628 (2021)

Florez-Lopez, R.: Strategic supplier selection in the added-value perspective: a CI approach. Inf. Sci. 177(5), 1169–1179 (2007)

Ghosh, S., Mandal, M.C., Ray, A.: Strategic sourcing model for green supply chain management: an insight into automobile manufacturing units in India. Benchmarking Int. J. (2021). https://doi.org/10.1108/BIJ-06-2021-0333

Gonzalez, M.E., Quesada, G., Monge, C.A.M.: Determining the importance of the supplier selection process in manufacturing: a case study. Int. J. Phys. Distrib. Logist. Manag. 34(6), 492–504 (2004)

Gunasekaran, A., Patel, C., Tirtiroglu, E.: Performance measures and metrics in a supply chain environment. Int. J. Oper. Prod. Manag. 21(2), 71–87 (2001)

Humphreys, P.K., Wong, Y.K., Chan, F.T.S.: Integrating environmental criteria into the supplier selection process. J. Mater. Process. Technol. 138(1–3), 349–356 (2003)

Ivanov, D., Pavlov, A., Sokolov, B.: Optimal distribution (re) planning in a centralized multi-stage supply network under conditions of the ripple effect and structure dynamics. Eur. J. Oper. Res. 237(2), 758–770 (2014)

Jayaraman, V., Srivastava, R., Benton, W.C.: Supplier selection and order quantity allocation: a comprehensive model. J. Supply Chain Manag. 35(1), 50–58 (1999)

Joshi, K., Singh, K.N., Kumar, S.: Two-sided supplier-manufacturer selection in BTO supply chain. J. Model. Manag. 7(3), 257–273 (2012)

Kannan, D., Khodaverdi, R., Olfat, L., Jafarian, A., Diabat, A.: Integrated fuzzy multi criteria decision making method and multi-objective programming approach for supplier selection and order allocation in a green supply chain. J. Clean. Prod. 47, 355–367 (2013)

Kar, A.K., Pani, A.K.: Exploring the importance of different supplier selection criteria. Manag. Res. Rev. 37(1), 89–105 (2014)

Karsak, E.E., Dursun, M.: An integrated supplier selection methodology incorporating QFD and DEA with imprecise data. Expert Syst. Appl. 41(16), 6995–7004 (2014)

Klinmalee, S., Naenna, T., Woarawichai, C.: Application of a genetic algorithm for multi-item inventory lot-sizing with supplier selection under quantity discount and lead time. Int. J. Oper. Res. 38(3), 403–421 (2020)

Koul, S., Verma, R.: Dynamic vendor selection based on fuzzy AHP. J. Manuf. Technol. Manag. 22(8), 963–971 (2011)

Kuo, R.J., Lee, L.Y., Hu, T.L.: Developing a supplier selection system through integrating fuzzy AHP and fuzzy DEA: a case study on an auto lighting system company in Taiwan. Prod. Plan. Control 21(5), 468–484 (2010)

Leong, W.Y., Wong, K.Y., Wong, W.P.: A new integrated multi-criteria decision-making model for resilient supplier selection. Appl. Syst. Innov. 5(1), 8 (2022)

Li, F., Wu, C.H., Zhou, L., Xu, G., Liu, Y., Tsai, S.B.: A model integrating environmental concerns and supply risks for dynamic sustainable supplier selection and order allocation. Soft. Comput. 25(1), 535–549 (2021)

Li, X., Wang, Z., Zhang, L., Zou, C., Dorrell, D.D.: State-of-health estimation for Li-ion batteries by combing the incremental capacity analysis method with grey relational analysis. J. Power Sour. 410, 106–114 (2019)

Li, Z., Wong, W.K., Kwong, C.K.: An integrated model of material supplier selection and order allocation using fuzzy extended AHP and multiobjective programming. Math. Probl. Eng. 42(21), 7951–7959 (2013)

Liaqait, R.A., Warsi, S.S., Zahid, T., Ghafoor, U., Ahmad, M.S., Selvaraj, J.: A decision framework for solar PV panels supply chain in context of sustainable supplier selection and order allocation. Sustainability 13(23), 13216 (2021)

Lin, Y.T., Lin, C.L., Yu, H.C., Tzeng, G.H.: A novel hybrid MCDM approach for outsourcing vendor selection: a case study for a semiconductor company in Taiwan. Expert Syst. Appl. 37(7), 4796–4804 (2010)

Liu, J., Ding, F.Y., Lall, V.: Using data envelopment analysis to compare suppliers for supplier selection and performance improvement. Supply Chain Manag. Int. J. 5(3), 143–150 (2000)

Mahmoudi, A., Deng, X., Javed, S.A., Zhang, N.: Sustainable supplier selection in megaprojects: grey ordinal priority approach. Bus. Strategy Environ. 30(1), 318–339 (2021)

Malekpoor, H., Chalvatzis, K., Mishra, N., Mehlawat, M.K., Zafirakis, D., Song, M.: Integrated grey relational analysis and multi objective grey linear programming for sustainable electricity generation planning. Ann. Oper. Res. 269(1), 475–503 (2018)

Mathiyazhagan, K., Sudhakar, S., Bhalotia, A.: Modeling the criteria for selection of suppliers towards green aspect: a case in Indian automobile industry. Opsearch 55(1), 65–84 (2018)

Mendoza, A., Ventura, J.A.: A serial inventory system with supplier selection and order quantity allocation. Eur. J. Oper. Res. 207(3), 1304–1315 (2010)

Nayak, J.K., Sinha, G., Guin, K.K.: Impact of supplier management on a firm’s performance. Decision 38(1), 77–90 (2011)

Ng, W.L.: An efficient and simple model for multiple criteria supplier selection problem. Eur. J. Oper. Res. 186(3), 1059–1067 (2008)

Orji, I.J., Ojadi, F.: Investigating the COVID-19 pandemic’s impact on sustainable supplier selection in the Nigerian Manufacturing Sector. Comput. Ind. Eng. 160, 107588 (2021)

Paksoy, T., Özceylan, E., Weber, G.W.: Profit oriented supply chain network optimization. CEJOR 21(2), 455–478 (2013)

Rajesh, R., Ravi, V.: Analyzing drivers of risks in electronic supply chains: a grey–DEMATEL approach. Int. J. Adv. Manuf. Technol. 92(1), 1127–1145 (2017)

Rajesh, R.: Group decision-making and grey programming approaches to optimal product mix in manufacturing supply chains. Neural Comput. Appl. 32(7), 2635–2649 (2020)

Ross, A., Buffa, F.P., Dröge, C., Carrington, D.: Supplier evaluation in a dyadic relationship: an action research approach. J. Bus. Logist. 27(2), 75–101 (2006)

Sarkar, A., Mohapatra, P.K.: Evaluation of supplier capability and performance: a method for supply base reduction. J. Purch. Supply Manag. 12(3), 148–163 (2006)

Sharma, M.J., Yu, S.J.: Selecting critical suppliers for supplier development to improve supply management. Opsearch 50(1), 42–59 (2013)

Songhori, M.J., Tavana, M., Azadeh, A., Khakbaz, M.H.: A supplier selection and order allocation model with multiple transportation alternatives. Int. J. Adv. Manuf. Technol. 52(4), 365–376 (2011)

Stanley, L.L., Wisner, J.D.: Service quality along the supply chain: implications for purchasing. J. Oper. Manag. 19(3), 287–306 (2001)

Talluri, S., Narasimhan, R.: Vendor evaluation with performance variability: a max–min approach. Eur. J. Oper. Res. 146(3), 543–552 (2003)

Thakkar, J., Kanda, A., Deshmukh, S.G.: Supply chain issues in Indian manufacturing SMEs: insights from six case studies. J. Manuf. Technol. Manag. 23(5), 634–664 (2012)

Thanaraksakul, W., Phruksaphanrat, B.: Supplier evaluation framework based on balanced scorecard with integrated corporate social responsibility perspective. In: Proceedings of the International MultiConference of Engineers and Computer Scientists, vol. 2, pp. 18–20. (2009, March)

Ware, N.R., Singh, S.P., Banwet, D.K.: A mixed-integer non-linear program to model dynamic supplier selection problem. Expert Syst. Appl. 41(2), 671–678 (2014)

Watt, D.J., Kayis, B., Willey, K.: The relative importance of tender evaluation and contractor selection criteria. Int. J. Project Manag. 28(1), 51–60 (2010)

Weber, C.A., Ellram, L.M.: Supplier selection using multi-objective programming: a decision support system approach. Int. J. Phys. Distrib. Logist. Manag. 23(2), 3–14 (1993)

Wilson, E.J.: The relative importance of supplier selection criteria: a review and update. Int. J. Purch. Mater. Manag. 30(2), 34–41 (1994)

Xia, W., Wu, Z.: Supplier selection with multiple criteria in volume discount environments. Omega 35(5), 494–504 (2007)

Yang, C.C., Chen, B.S.: Supplier selection using combined analytical hierarchy process and grey relational analysis. J. Manuf. Technol. Manag. 17(7), 926–941 (2006)

Yu, C., Zou, Z., Shao, Y., Zhang, F.: An integrated supplier selection approach incorporating decision maker’s risk attitude using ANN, AHP and TOPSIS methods. Kybernetes 49(9), 2263–2284 (2019)

Yu, J.R., Tsai, C.C.: A decision framework for supplier rating and purchase allocation: a case in the semiconductor industry. Comput. Ind. Eng. 55(3), 634–646 (2008)

Zhang, H., Wei, G., Chen, X.: SF-GRA method based on cumulative prospect theory for multiple attribute group decision making and its application to emergency supplies supplier selection. Eng. Appl. Artif. Intell. 110, 104679 (2022)

Acknowledgements

The authors would like to thank the Editor-in-Chief and the anonymous reviewers for their valuable comments in improving the quality of the article.

Funding

This research received no specific grant from any funding agency in the public, commercial, or not-for profit sectors.

Author information

Authors and Affiliations

Contributions

The authors of this paper contributed equally to the outline and development of the paper.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Chakraborty, S., Jain, A. & Sarmah, S.P. An integrated mathematical model based on grey optimal ranking for supplier selection considering pandemic situation. OPSEARCH 59, 1613–1648 (2022). https://doi.org/10.1007/s12597-022-00601-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12597-022-00601-4