Abstract

In recent years, industry loss warranties (ILWs) have become increasingly popular in the reinsurance market. The defining feature of ILW contracts is their dependence on an industry loss index. The use of an index reduces moral hazard and generally results in lower prices compared to traditional, purely indemnity-based reinsurance contracts. However, use of the index also introduces basis risk since the industry loss and the reinsured company’s loss are usually not fully correlated. The aim of this paper is to simultaneously examine basis risk and pricing of an indemnity-based industry loss warranty contract, which is done by comparing actuarial and financial pricing approaches for different measures of basis risk. Our numerical results show that modification of the contract parameters to reduce basis risk can either raise or lower prices, depending on the specific parameter choice. For instance, basis risk can be reduced by decreasing the industry loss trigger, which implies higher prices, or by increasing the reinsured company attachment, thus inducing lower prices.

Similar content being viewed by others

Notes

An overview and discussion of different pricing approaches is presented in Embrechts (1998).

An overview of ILW contracts is provided in SwissRe (2006).

Embrechts (1998) points out parallels between the determination of the certainty equivalent in actuarial mathematics and in financial valuation.

For an overview, see Goovaerts et al. (1984).

References

Andreadakis, M., Waters, H.R.: The effect of reinsurance on the degree of risk associated with an insurer’s portfolio. ASTIN Bull. 11(2), 119–135 (1980)

Björk, T.: Arbitrage Theory in Continuous Time. Oxford University Press, New York (2004)

Bühlmann, H.: Premium calculation from top down. ASTIN Bull. 15(2), 89–101 (1985)

Bühlmann, H.: Mathematical Methods in Risk Theory. Springer, Berlin (1996)

Burnecki, K., Kukla, G., Weron, R.: Property insurance loss distributions. Phys. A, Stat. Mech. Appl. 287(1–2), 269–278 (2000)

Cao, X., Thomas, B.: Index hedge performance: bootstrap study of hurricane Fran. Discussion papers on securitization of risk. Casualty Actuarial Society (1999)

Cummins, J.D.: Asset pricing models and insurance ratemaking. ASTIN Bull. 20(2), 125–166 (1990a)

Cummins, J.D.: Multi-period discounted cash flow rate-making models in property-liability insurance. J. Risk Insur. 57(1), 79–109 (1990b)

Cummins, J.D., Lalonde, D., Phillips, R.D.: The basis risk of catastrophic-loss index securities. J. Financ. Econ. 71(1), 77–111 (2004)

Cummins, J.D., Weiss, M.A.: Convergence of insurance and financial markets: hybrid and securitized risk-transfer solutions. J. Risk Insur. 76(3), 493–545 (2009)

D’Arcy, S., Doherty, N.: The Financial Theory of Pricing Property-Liability Insurance Contracts. S.S. Huebner Foundation, Philadelphia (1988)

Doherty, N.A., Garven, J.R.: Price regulation in property-liability insurance: a contingent-claims approach. Journal of Finance 41(5), 1031–1050 (1986)

Doherty, N.A., Richter, A.: Moral hazard, basis risk, and gap insurance. J. Risk Insur. 69(1), 9–24 (2002)

Embrechts, P.: Actuarial versus financial pricing of insurance. Surv. Math. Ind. 5(1), 6–22 (1998)

Fairley, W.B.: Investment income and profit margins in property-liability insurance: theory and empirical results. Bell J. Econ. 10(1), 192–210 (1979)

Federal Reserve (2007) Federal Reserve Statistical Release H.15. Download (18.04.2007): http://www.federalreserve.gov/releases/h15/Current/h15.txt

Gatzert, N., Schmeiser, H.: The influence of corporate taxes on pricing and capital structure in property-liability insurance. Insur. Math. Econ. 42(1), 50–58 (2008)

Glasserman, P.: Monte Carlo Methods in Financial Engineering. Springer, New York (2004)

Goovaerts, M.J., de Vylder, F., Haezendonck, J.: Insurance Premiums. Elsevier, Amsterdam (1984)

Gründl, H., Schmeiser, H.: Pricing double-trigger reinsurance contracts: financial versus actuarial approach. J. Risk Insur 69(4), 449–468 (2002)

Guy Carpenter: U.S. Reinsurance Renewals at January 1, 2006: Divergent Paths After Record Storms. Available at: www.guycarp.com (2006)

Harrington, S., Niehaus, G.: Basis risk with PCS catastrophe insurance derivative contracts. J. Risk Insur. 66(1), 49–82 (1999)

Hartwig, R.P.: Overview of Florida hurricane insurance market economics. Presentation given to the Florida Joint Select Committee on Hurricane Insurance, Tallahassee, FL, January 19, 2005 (2005)

Hill, R.D.: Profit regulation in property liability insurance. Bell J. Econ. 10(1), 172–191 (1979)

Hilti, N., Saunders, M., Lloyd-Hughes, B.: Forecasting stronger profits. Global Reinsurance 6–7 July/August 2004

Ishaq, A.: Reinsuring for catastrophes through industry loss warranties—a practical approach. Working Paper, CAS Reinsurance Forum Spring (2005)

Kreps, R.: Investment-equivalent reinsurance pricing. Proc. Casualty Actuar. Soc. LXXXV(162), 101–131 (1998)

Lee, J.-P., Yu, M.-T.: Pricing default-risky CAT bonds with moral hazard and basis risk. J. Risk Insur. 69(1), 25–44 (2002)

Lee, J.-P., Yu, M.-T.: Valuation of catastrophe reinsurance with catastrophe bonds. Insur. Math. Econ. 41(2), 264–278 (2007)

Meyers, G.G., Kollar, J.J.: Catastrophe risk securitization: insurer and investor perspectives. Casualty Actuarial Society discussion paper, Program May 1999, Casualty Actuarial Society, Arlington, VA (1999)

Pratt, J.W.: Risk aversion in the small and in the large. Econometrica 32(1/2), 122–136 (1964)

SwissRe: Securitization—new opportunities for insurers and investors. Sigma 07/2006. Zürich: Swiss Reinsurance Company (2006)

SwissRe: The role of indices in transferring insurance risks to the capital markets. Sigma 04/2009. Zürich: Swiss Reinsurance Company (2009)

U.S. Department of Labor: Consumer price index—all urban consumers. Download (17.4.2007): http://www.bls.gov/cpi/ (2007)

Wharton Risk Center: Managing large-scale risks in the new era of catastrophes. Report on phase 1 of the study. The Wharton School, Philadelphia (2007)

Zeng, L.: On the basis risk of industry loss warranties. J. Risk Finance 1(4), 27–32 (2000)

Zeng, L.: Hedging catastrophe risk using index-based reinsurance instruments. Casualty Actuarial Society Forum, Spring, pp. 245–268 (2003)

Zeng, L.: Enhancing reinsurance efficiency using index-based instruments. J. Risk Finance 6(1), 6–16 (2005)

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

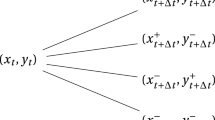

For the stochastic process as given in (2), one obtains

where N(a,b) denotes a normally distributed random variable with expected value a=ln (S 0)+μ−0.5σ 2 and standard deviation b=σ S , leading to a lognormal distribution for S 1. Given the expected value

and the standard deviation

σ S and S 0 can be obtained by transforming these equations. Using

and

the standard deviation of the stochastic process σ S and the initial nominal value S 0 are given by

A derivation of I 0 and σ I for the industry loss distribution I 1 can be done analogously.

Rights and permissions

About this article

Cite this article

Gatzert, N., Schmeiser, H. & Toplek, D. An analysis of pricing and basis risk for industry loss warranties. ZVersWiss 100, 517–537 (2011). https://doi.org/10.1007/s12297-011-0152-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12297-011-0152-4