Abstract

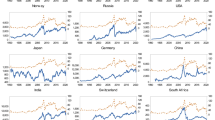

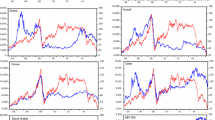

This paper examines the symmetric and asymmetric effects of oil price changes on stock prices using the linear and non-linear Autoregressive Distributed Lag (ARDL) approach to cointegration and error-correction modeling. For the country-level analysis, monthly data from Brazil, Canada, Chile, Japan, S. Korea, Malaysia, Mexico, the U.K., and the U.S. have been considered. The results show that oil price changes have asymmetric effects on stock prices mostly in the short run. To dig deeper into the asymmetric relationship between oil and stock prices, I disaggregate data at the sectoral level by focusing on eleven U.S. sectoral stock indices to investigate the performance of different sectors. This helps solve the problem of aggregation bias that is associated with country-level data. The findings show that changes in oil price have significant asymmetric effects in nine out of the eleven sectors in the short run. In most of these sectors, the short run asymmetric relationship translates into the long run.

Similar content being viewed by others

Notes

A detailed description on the data period and data source is provided in Appendix 1.

Pesaran et al. (2001, p. 291) write “our approach is quiet general in the sense that we can use a flexible choice for the dynamic lag structure in... as well as allowing for short-run feedbacks.”.

See Bahmani-Oskooee and Tanku (2008) for more on this method.

A similar model is explained by Bahmani-Oskooee and Saha (2016b) for the relationship between stock prices and exchange rates.

The critical value comes from Pesaran et al. (2001, Table CI, Case III, p. 300).

The critical value comes from Pesaran et al. (2001, Table CII, Case III, p. 303).

At least one of the coefficients associated with the lags is positive.

Among the short-run coefficient estimates, only the ones associated with oil price are reported for brevity. The short run estimates of the remaining variables are available upon request. But the normalized long-run estimates for all the variables and the diagnostic statistics for all the sectors have been reported.

At least one of the coefficients associated with the lags is significant at the 10% level.

The coefficient for POS is positive except for one lag.

References

Alsalman Z (2016) Oil price uncertainty and the U.S. stock market analysis based on a GARCH-in-mean VAR model. Energy Econ 59:251–260

Alsalman Z, Herrera AM (2015) Oil price shocks and the U.S. stock market: Do sign and size matter? Energy J 36(3):171–188

Apergis N, Miller S (2006) Consumption asymmetry and the stock market: empirical evidence. Econ Lett 93:337–342

Badeeb RA, Lean HH (2018) Asymmetric impact of oil price on Islamic sectoral stocks. Energy Econ 71:128–139

Bahmani-Oskooee M, Bahmani S (2015) Nonlinear ARDL approach and the demand for money in Iran. Econ Bull 35:381–391

Bahmani-Oskooee M, Saha S (2016a) Do exchange rate changes have symmetric or asymmetric effects on stock prices? Glob Financ J 31:57–72

Bahmani-Oskooee M, Saha S (2016b) Asymmetry cointegration between the value of the dollar and sectoral stock indices in the U.S. Int Rev Econ Financ 46:78–86

Bahmani-Oskooee M, Sohrabian A (1992) Stock prices and the effective exchange rate of the dollar. Appl Econ 24:459–464

Bahmani-Oskooee M, Tanku A (2008) The black market exchange rate vs. the official rate in testing PPP: which rate fosters the adjustment process. Econ Lett 99:40–43

Basher SA, Sadorsky P (2006) Oil price risk and emerging stock markets. Glob Financ J 17:224–251

Bastianin A, Conti F, Manera M (2016) The impacts of oil price shocks on stock market volatility: evidence from the G7 countries. Energy Policy 98:160–169

Boonyanam N (2014) Relationship of stock price and monetary variables of Asian small open emerging economy: Evidence from Thailand. Int J Financ Res 5(1):52–63

Chen NF, Roll R, Ross SA (1986) Economic forces and the stock market. J Bus 59(3):383–403

Cong RG, Wei YM, Jiao JL, Fan Y (2008) Relationships between oil price shocks and stock market: An empirical analysis from china. Energy Policy 36:3544–3553

Degiannakis S, Filis G, Floros C (2013) Oil and stock price returns: evidence from European industrial sector indices in a time-varying environment. J Int Finan Markets Inst Money 1(26):175–191

Delatte A-L, Lopez-Villavicencio A (2012) Asymmetry exchange rate pass-through: evidence from major countries. J Macroecon 34:833–844

Driesprong G, Jacobsen B, Maat B (2007) Striking oil: Another puzzle? EFA 2005 Moscow Meetings Paper, Available at SSRN: https://ssrn.com/abstract=460500 or https://doi.org/10.2139/ssrn.460500

Eita JH (2012) Modelling macroeconomic determinants of stock market prices: evidence from Namibia. J Appl Bus Res 28(5):871–884

Fama EF (1981) Stock returns, real activity, inflation and money. Am Econ Rev 71(4):545–565

Hamilton JD (1983) Oil and the macroeconomy since World War II. J Polit Econ 91(2):228–248

Huang RD, Masulis RW, Stoll HR (1996) Energy shocks and financial markets. J Futur Mark 16(1):1–36

Jones CM, Kaul G (1996) Oil and the stock markets. J Financ 51(2):463–491

Kang W, Ratti RA, Yoon KH (2015) The impact of oil price shocks on the stock market return and volatility relationship. J Int Finan Markets Inst Money 34:41–54

Kilian L, Park C (2009) The impact of oil price shocks on the U.S. stock market. Int Econ Rev 50(4):1267–1287

Mishra S (2015) An econometric investigation of long and short run relationship among crude oil price, exchange rate and stock price in India: An ARDL-UECM Approach. J Manag 12(2):1–20

Mohanty SK, Nandha M, Turkistani AQ, Alaitani MY (2011) Oil price movements and stock market returns: evidence from Gulf Cooperation Council (GCC) countries. Glob Financ J 22:42–55

Mukherjee TK, Naka A (1995) Dynamic relations between macroeconomic variables and the Japanese stock market: An application of a vector error correction model. J Financ Res 18:223–237

Narayan PK, Narayan S (2010) Modelling the impact of oil prices on Vietnam’s stock prices. Appl Energy 87:356–361

Nejad MK, Jahantigh F, Rahbari H (2016) The long run relationship between oil price risk and Tehran stock exchange returns in presence of structural breaks. Proc Econ Financ 36:201–209

Park J, Ratti RA (2008) Oil price shocks and stock markets in the U.S. and 13 European countries. Energy Econ 30:2587–2608

Pesaran MH, Shin Y, Smith RJ (2001) Bounds Testing Approaches to the analysis of level relationships. J Appl Econom 16:289–326

Sadorsky P (1999) Oil price shocks and stock market activity. Energy Econ 21:449–469

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In: Sickels R, Horrace W (eds) Festschrift in honor of Peter Schmidt Econometric methods and applications. Springer, pp 281–314

Tian GG, Ma S (2010) The relationship between stock returns and the foreign exchange rate: the ARDL approach. J Asia Pacific Econ 15(4):490–508

Verheyen F (2013) Interest rate pass-through in the EMU-New evidence using nonlinear ARDL framework. Econ Bull 33:729–739

Acknowledgements

I express my deepest gratitude and thankfulness to my summer research interns: Patrick Carper ’21, Wabash College, who helped me with the initial literature review, and the initial regression results for the country-level analysis, and to Nieshaal Thambipillay ’22, Wabash College, who helped me with data cleaning and the initial regression results for the sectoral-level analysis. I also sincerely thank the anonymous reviewers for their valuable comments and suggestions. Any remaining errors, however, are mine.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix 1

Appendix 1

1.1 Data definitions and sources

1.1.1 The data come from the following sources

-

a.

Yahoo Finance.

-

b.

Bank for International Settlements (BIS).

-

c.

International Financial Statistics (IFS) database of International Monetary Fund (IMF).

-

d.

Federal Reserve Bank of St. Louis (FRED) Database.

1.1.2 Variables

SPi = Country-level or the U.S. Sectoral Stock Price Indices. Data come from source a.

OPi = Spot Crude Oil Price, West Texas Intermediate (WTI), Dollars per Barrel. Data come from source d.

EX = Nominal Effective Exchange Rate of the U.S. Data come from source b.

IPI = Industrial Production Index, base year = 2010. Data come from source c.

CPI = Consumer Price Index of the U.S., base year = 2010. Data come from source c.

MS = Nominal Money Supply (M2 for Malaysia and M3 for the rest of the countries), source d.

1.1.3 Data period and stock price indices for the country-level analysis

Country | Data Period | Stock Price Index Name |

|---|---|---|

Brazil | 1994 – 2019 | IBOVESPA |

Canada | 1986 – 2019 | S&P/TSX Composite Index |

Chile | 1997 – 2019 | IPSA Santiago de Chile |

Japan | 1994 – 2019 | Nikkei 225 |

S. Korea | 1997 – 2019 | KOSPI Composite Index |

Malaysia | 2000 – 2019 | FTSE Bursa Malaysia KLCI |

Mexico | 1994 – 2019 | IPC |

U.K | 1986– 2019 | FTSE 100 |

U.S | 1986 – 2019 | S&P 500 |

1.1.4 Data period and stock price indices for the sectoral-level analysis

Index | Description | Data period |

|---|---|---|

Dow Jones Industrial Average | Comprises of 30 large publicly owned companies | 1986: M1–2020:M5 |

Dow Jones Transportation Average | Tracks stock prices of twenty transportation corporations | 1992: M1–2020:M5 |

Dow Jones Utility Average | Tracks the performance of 15 prominent utility companies | 1986: M1–2020:M5 |

NASDAQ Bank | Includes banks providing financial services such as retail banking, loans, and money transmissions | 1990: M11–2020:M5 |

NASDAQ Biotechnology | Includes biotechnology and pharmaceutical equities | 1993: M11–2020:M5 |

NASDAQ Computer | Includes companies from the computer industry | 1995: M8–2020:M5 |

NASDAQ Industrial | Includes around 950 companies | 1990: M11–2020:M5 |

NASDAQ Insurance | Includes around 46 insurance companies | 1990: M11–2020:M5 |

NASDAQ Telecommunications | Includes around 118 telecom companies | 1996: M6–2020:M5 |

NASDAQ Transportation | Tracks around 50 transportation companies | 1990: M11–2020:M5 |

PHLX Semiconductors | Tracks 30 companies involved in manufacturing and sale of semiconductors | 1994: M8–2020:M5 |

Table 1

1.1.5 Tables for the country-level (aggregate-level) analysis:

Notes:

-

i.

Numbers inside the parentheses are the absolute values of the t-ratios. *, ** indicate coefficient estimates are significant at the 10% and 5% level respectively.

-

ii.

The upper bound critical value of the F-test for cointegration when k = 5 is 3.35 (3.79) at the 10% (5%) level of significance. These values come from Pesaran et al. (2001, Table CI, Case III, p. 300). “k” denotes the no. of exogenous variables. Shin et al. (2014) recommend considering POS and NEG (the two partial sum variables) as one variable. Thus, the critical values of the F test are same for both the linear and non-linear models.

-

iii.

The critical value of the t-test for significance of ECMt-1 is -3.86 (-4.19) at the 10% (5%) level when k = 5, and, is − 4.04 ( − 4.38) at the 10% (5%) level when k = 6. These values come from Pesaran et al. (2001, Table CII, Case III, p. 303).

-

iv.

LM is the Lagrange Multiplier statistic to test for autocorrelation and RESET is Ramsey’s test for misspecification. They are distributed as χ2 with one degree of freedom individually. The critical value is 2.70 (3.84) at the 10% (5%) level. The WALD statistic is also distributed as χ2 with one degree of freedom.

Tables 2, 3, 4, 5, 6, 7, 8, 9, 10

II. Full-Information Estimates of the Non-Linear Model (4)

Panel A: Short Run | ||||||||

|---|---|---|---|---|---|---|---|---|

Variables | Lags | |||||||

0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

Δ lnSPt | − 0.10 (1.61) | 0.00 (0.08) | 0.07 (1.19) | 0.14 (2.45)** | − 0.07 (1.20) | − 0.10 (1.82)* | ||

Δ POSt | 0.14 (3.61)** | |||||||

Δ NEGt | 0.20 (2.11)** | − 0.13 (1.30) | − 0.16 (1.60) | − 0.16 (1.70)* | ||||

Δ lnEXt | 0.72 (5.26)** | |||||||

Δ lnIPIt | 0.14 (0.88) | |||||||

Δ lnCPIt | 0.07 (0.05) | 1.39 (0.77) | − 3.7(2.02)** | − 3.22 (1.77)* | − 1.35 (0.75) | 0.51 (0.29) | − 0.15 (0.09) | − 5.01(3.38)** |

Δ lnMSt | 1.47 (2.45)** | |||||||

Panel B: Long Run | ||||||

|---|---|---|---|---|---|---|

POS | NEG | ln EX | ln IPI | ln CPI | ln MS | Constant |

0.52 (5.61)** | − 0.27 (2.28)** | 1.03 (2.86)** | 0.68 (1.41) | − 0.26 (0.16) | − 2.16 (3.40)** | 68.07 (4.00)** |

Panel C: Diagnostics | |||||||

|---|---|---|---|---|---|---|---|

F | ECM t-1 | LM | RESET | R bar Squared | CUSUM (CUSUM2) | Wald-Short | Wald-Long |

5.76** | − 0.16(6.41)** | 0.10 | 4.92 | 0.25 | S (S) | 2.39 | 9.75** |

II. Full-Information Estimates of the Non-Linear Model (4)

Panel A: Short Run | ||||||||

|---|---|---|---|---|---|---|---|---|

Variables | Lags | |||||||

0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

Δ lnSPt | ||||||||

Δ POSt | 0.01 (0.57) | |||||||

Δ NEGt | 0.00 (0.04) | |||||||

Δ lnEXt | 0.69 (4.69)** | 0.25 (1.69)* | ||||||

Δ lnIPIt | 0.28 (1.23) | 0.50 (2.22)** | ||||||

Δ lnCPIt | 0.63 (1.00) | − 0.02 (0.03) | − 0.75(1.24) | − 0.71 (1.17) | − 1.55(2.57)** | − 1.16 (1.92)* | ||

Δ lnMSt | 0.38 (0.79) | 0.86 (1.81)* | ||||||

Panel B: Long Run | ||||||

|---|---|---|---|---|---|---|

POS | NEG | ln EX | ln IPI | ln CPI | ln MS | Constant |

0.12 (0.59) | − 0.01 (0.04) | 0.30 (0.36) | 1.10 (1.37) | 0.97 (0.58) | − 0.53 (0.47) | 12.10 (0.45) |

Panel C: Diagnostics | |||||||

|---|---|---|---|---|---|---|---|

F | ECM t-1 | LM | RESET | R bar Squared | CUSUM (CUSUM2) | Wald-Short | Wald-Long |

1.87 | − 0.06 (3.64) | 0.68 | 13.25 | 0.12 | S (S) | 0.02 | 0.55 |

II. Full-Information Estimates of the Non-Linear Model (4)

Panel A: Short Run | ||||||||

|---|---|---|---|---|---|---|---|---|

Variables | Lags | |||||||

0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

Δ lnSPt | 0.05 (0.77) | 0.02 (0.29) | − 0.07 (1.04) | 0.16 (2.54)** | ||||

Δ POSt | 0.07 (4.52)** | |||||||

Δ NEGt | 0.08 (1.53) | |||||||

Δ lnEXt | − 0.00 (0.03) | 0.05 (0.37) | − 0.22 (1.50) | − 0.15 (1.01) | − 0.35(2.44)** | − 0.04 (0.25) | − 0.20 (1.42) | − 0.39(2.79)** |

Δ lnIPIt | 0.09 (1.34) | |||||||

Δ lnCPIt | − 0.04 (0.16) | |||||||

Δ lnMSt | − 0.29(3.91)** | |||||||

Panel B: Long Run | ||||||

|---|---|---|---|---|---|---|

POS | NEG | ln EX | ln IPI | ln CPI | ln MS | Constant |

0.52 (5.61)** | − 0.27 (2.28)** | 1.03 (2.86)** | 0.68 (1.41) | − 0.26 (0.16) | − 2.16 (3.40)** | 68.07 (4.00)** |

Panel C: Diagnostics | |||||||

|---|---|---|---|---|---|---|---|

F | ECM t-1 | LM | RESET | R bar Squared | CUSUM (CUSUM2) | Wald-Short | Wald-Long |

5.72 ** | − 0.14 (6.37)** | 0.61 | 0.43 | 0.18 | S (S) | 0.01 | 25.38** |

II. Full-Information Estimates of the Non-Linear Model (4)

Panel A: Short Run | ||||||||

|---|---|---|---|---|---|---|---|---|

Variables | Lags | |||||||

0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

Δ lnSPt | ||||||||

Δ POSt | 0.15 (2.09)** | |||||||

Δ NEGt | − 0.02 (1.40) | |||||||

Δ lnEXt | − 0.79(6.10)** | |||||||

Δ lnIPIt | 0.57 (3.40)** | |||||||

Δ lnCPIt | 0.32 (0.80) | |||||||

Δ lnMSt | − 0.12 (0.85) | |||||||

Panel B: Long Run | ||||||

|---|---|---|---|---|---|---|

POS | NEG | ln EX | ln IPI | ln CPI | ln MS | Constant |

− 0.36 (1.09) | − 0.61 (1.31) | − 0.16 (0.15) | 0.98 (0.51) | 8.37 (0.96) | − 3.17 (0.91) | 75.85 (0.64) |

Panel C: Diagnostics | |||||||

|---|---|---|---|---|---|---|---|

F | ECM t-1 | LM | RESET | R bar Squared | CUSUM (CUSUM2) | Wald-Short | Wald-Long |

1.40 | − 0.04 (3.10) | 0.00 | 1.79 | 0.17 | S (S) | 0.29 | 1.71 |

II. Full-Information Estimates of the Non-Linear Model (4)

Panel A: Short Run | ||||||||

|---|---|---|---|---|---|---|---|---|

Variables | Lags | |||||||

0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

Δ lnSPt | 0.08 (1.22) | 0.02 (0.39) | 0.16 (2.76)** | − 0.02 (0.44) | 0.10(1.96)** | |||

Δ POSt | 0.17 (1.66)* | 0.03 (0.36) | − 0.07 (0.77) | 0.19 (2.17)** | 0.12 (1.36) | − 0.20(2.27)** | ||

Δ NEGt | 0.23 (2.71)** | − 0.18(2.00)** | ||||||

Δ lnEXt | 0.83 (4.07)** | − 0.96(4.37)** | − 0.43(1.86)* | |||||

Δ lnIPIt | 0.44 (2.16)** | 0.38 (1.85)* | 0.25 (1.34) | |||||

Δ lnCPIt | 0.36 (0.29) | − 5.37(4.53)** | − 0.73 (0.59) | − 1.54 (1.27) | − 2.96(2.62)** | − 0.09 (0.08) | − 2.87(2.62)** | |

Δ lnMSt | − 0.29 (1.39) | |||||||

Panel B: Long Run | ||||||

|---|---|---|---|---|---|---|

POS | NEG | ln EX | ln IPI | ln CPI | ln MS | Constant |

0.30 (1.24) | 0.07 (0.39) | 0.82 (1.85)* | − 0.06 (0.10) | 5.35 (1.54) | − 2.05 (1.32) | 50.37 (1.17) |

Panel C: Diagnostics | |||||||

|---|---|---|---|---|---|---|---|

F | ECM t-1 | LM | RESET | R bar Squared | CUSUM (CUSUM2) | Wald-Short | Wald-Long |

4.13** | − 0.14 (5.42)** | 0.45 | 0.06 | 0.38 | S (S) | 0.35 | 0.31 |

II. Full-Information Estimates of the Non-Linear Model (4)

Panel A: Short Run | ||||||||

|---|---|---|---|---|---|---|---|---|

Variables | Lags | |||||||

0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

Δ lnSPt | ||||||||

Δ POSt | − 0.06(2.23)** | |||||||

Δ NEGt | 0.15 (2.89)** | 0.06 (1.05) | 0.06 (1.00) | 0.17 (3.28)** | 0.06(1.18) | 0.10 (2.03)** | ||

Δ lnEXt | 0.39 (1.74)* | − 0.35 (1.67)* | − 0.18 (0.84) | − 0.39 (1.76)* | ||||

Δ lnIPIt | 0.10 (1.54) | |||||||

Δ lnCPIt | − 1.75(2.70)** | 0.02 (0.03) | − 1.16 (1.55) | − 0.39 (0.45) | − 2.34(3.12)** | |||

Δ lnMSt | 0.21 (0.78) | 0.58 (2.29)** | ||||||

Panel B: Long Run | ||||||

|---|---|---|---|---|---|---|

POS | NEG | ln EX | ln IPI | ln CPI | ln MS | Constant |

− 0.43 (2.10)** | − 0.27 (2.32)** | 0.89 (1.37) | − 0.10 (0.18) | − 1.64 (0.72) | 1.81 (3.27)** | − 12.80 (1.14) |

Panel C: Diagnostics | |||||||

|---|---|---|---|---|---|---|---|

F | ECM t-1 | LM | RESET | R bar Squared | CUSUM (CUSUM2) | Wald-Short | Wald-Long |

2.71 | − 0.14 (4.39)** | 0.09 | 2.62 | 0.30 | S (S) | 15.85** | 0.55 |

II. Full-Information Estimates of the Non-Linear Model (4)

Panel A: Short Run | ||||||||

|---|---|---|---|---|---|---|---|---|

Variables | Lags | |||||||

0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

Δ lnSPt | − 0.12 (1.89)* | |||||||

Δ POSt | 0.15 (1.71)* | |||||||

Δ NEGt | 0.04 (1.97)** | |||||||

Δ lnEXt | 0.39 (2.99)** | 0.33 (2.50)** | − 0.19 (1.53) | |||||

Δ lnIPIt | 0.65 (1.85)* | 0.70 (2.10)** | 0.04 (0.12) | − 0.65(2.00)** | ||||

Δ lnCPIt | 1.38 (1.40) | − 2.81(2.55)** | 2.09(2.34)** | |||||

Δ lnMSt | 0.05 (0.17) | 0.51 (1.74)* | − 0.67(2.26)** | − 0.47 (1.56) | ||||

Panel B: Long Run | ||||||

|---|---|---|---|---|---|---|

POS | NEG | ln EX | ln IPI | ln CPI | ln MS | Constant |

0.58 (2.55)** | 0.80 (1.63) | − 2.65 (1.11) | 0.55 (0.19) | − 1.53 (0.57) | 1.06 (0.55) | − 3.32 (0.10) |

Panel C: Diagnostics | |||||||

|---|---|---|---|---|---|---|---|

F | ECM t-1 | LM | RESET | R bar Squared | CUSUM (CUSUM2) | Wald-Short | Wald-Long |

1.00 | − 0.03 (2.32) | 0.08 | 2.17 | 0.15 | S (U) | 0.67 | 2.57 |

II. Full-Information Estimates of the Non-Linear Model (4)

Variables | Lags | |||||||

|---|---|---|---|---|---|---|---|---|

0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

Δ lnSPt | ||||||||

Δ POSt | − 0.01 (1.38) | |||||||

Δ NEGt | − 0.01 (1.19) | |||||||

Δ lnEXt | − 0.33(2.34)** | 0.20 (1.42) | − 0.12 (0.89) | 0.37 (2.65)** | ||||

Δ lnIPIt | 0.58 (2.36)** | 0.47 (1.82)* | 0.48 (1.86)* | |||||

Δ lnCPIt | − 0.34 (0.51) | − 0.87 (1.37) | 0.69 (1.07) | − 1.25 (1.94)* | − 0.72 (1.12) | − 1.43(2.21)** | ||

Δ lnMSt | − 0.28 (1.25) |

Panel B: Long Run | ||||||

|---|---|---|---|---|---|---|

POS | NEG | ln EX | ln IPI | ln CPI | ln MS | Constant |

-0.29 (1.34) | − 0.19 (1.13) | − 0.25 (0.33) | − 0.11 (0.08) | − 0.54 (0.26) | 1.15 (1.56) | − 19.37 (1.28) |

Panel C: Diagnostics | |||||||

|---|---|---|---|---|---|---|---|

F | ECM t-1 | LM | RESET | R bar Squared | CUSUM (CUSUM2) | Wald-Short | Wald-Long |

2.82 | − 0.05 (4.46)** | 0.20 | 0.75 | 0.08 | S (S) | 0.38 | 1.18 |

II. Full-Information Estimates of the Non-Linear Model (4)

Panel A: Short Run | ||||||||

|---|---|---|---|---|---|---|---|---|

Variables | Lags | |||||||

0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

Δ lnSPt | ||||||||

Δ POSt | − 0.03 (1.85)* | |||||||

Δ NEGt | − 0.01 (0.13) | 0.08 (1.64)* | 0.08 (1.78)* | |||||

Δ lnEXt | − 0.37(2.28)** | 0.28 (1.76)* | ||||||

Δ lnIPIt | − 0.85(2.20)** | 0.52 (1.35) | 0.72 (1.87)* | |||||

Δ lnCPIt | − 0.17 (1.33) | |||||||

Δ lnMSt | -0.05 (0.62) | |||||||

Panel B: Long Run | ||||||

|---|---|---|---|---|---|---|

POS | NEG | ln EX | ln IPI | ln CPI | ln MS | Constant |

− 0.58 (1.62) | − 1.08 (2.47)** | − 2.35 (1.52) | 3.48 (2.80)** | − 3.82 (1.13) | − 1.02 (0.60) | 46.62 (0.81) |

Panel C: Diagnostics | |||||||

|---|---|---|---|---|---|---|---|

F | ECM t-1 | LM | RESET | R bar Squared | CUSUM (CUSUM2) | Wald-Short | Wald-Long |

2.56 | − (0.04) 4.25 * | 0.81 | 10.19 | 0.09 | S (S) | 3.38* | 1.52 |

1.1.6 Tables for the sectoral-level analysis

Notes:

-

i.

Numbers inside the parentheses are the absolute values of the t-ratios. *, ** indicate coefficient estimates are significant at the 10% and 5% level respectively.

-

ii.

The upper bound critical value of the F-test for cointegration when k = 5 is 3.35 (3.79) at the 10% (5%) level of significance. These values come from Pesaran et al. (2001, Table CI, Case III, p. 300). “k” denotes the no. of exogenous variables. Shin et al. (2014) recommend considering POS and NEG (the two partial sum variables) as one variable. Thus, the critical values of the F test are same for both the linear and non-linear models.

-

iii.

The critical value of the t-test for significance of ECMt-1 is − 3.86 ( − 4.19) at the 10% (5%) level when k = 5, and, is − 4.04 ( − 4.38) at the 10% (5%) level when k = 6. These values come from Pesaran et al. (2001, Table CII, Case III, p. 303).

-

iv.

LM is the Lagrange Multiplier statistic to test for autocorrelation and RESET is Ramsey’s test for misspecification. They are distributed as χ2 with one degree of freedom individually. The critical value is 2.70 (3.84) at the 10% (5%) level. The WALD statistic is also distributed as χ2 with one degree of freedom.

II. Long-Run Coefficient Estimates of the Linear ARDL Model (2)

U.S. sectoral indices | Long-run coefficient estimates | |||||

|---|---|---|---|---|---|---|

ln OP | ln EX | ln IPI | ln CPI | ln MS | Constant | |

Dow Jones Industrial Average | − 0.53(2.51)** | − 0.96 (1.02) | 2.21 (2.81)** | 0.88 (0.69) | 0.61 (1.45) | − 16.22(2.29)** |

Dow Jones Transportation Average | − 0.30 (1.24) | − 1.78 (1.75)* | 2.13 (1.82)* | − 3.08 (0.69) | 2.03 (1.51) | − 38.12 (1.74)* |

Dow Jones Utility Average | − 0.32 (1.27) | − 2.02 (1.54) | 2.69 (2.00)** | − 3.69 (1.84)* | 1.84(2.95)** | − 33.49(3.18)** |

NASDAQ Bank | 0.08 (0.15) | 2.22 (0.86) | 0.30 (0.08) | 0.41 (0.05) | 0.28 (0.12) | − 14.32 (0.36) |

NASDAQ Biotechnology | 0.66 (0.78) | − 4.87 (0.88) | 6.50 (1.39) | − 42.71 (1.51) | 14.73(1.69)* | − 245.24(1.93)* |

NASDAQ Computer | − 2.20 (1.62) | − 10.54(1.68)* | 3.13 (0.84) | − 22.97 (1.05) | 10.13 (1.39) | − 144.84 (1.40) |

NASDAQ Industrial | − 0.83(2.98)** | − 3.77(2.77)** | 4.05 (2.99)** | − 8.95(2.19)** | 4.31 (3.39)** | − 77.09(3.74)** |

NASDAQ Insurance | − 0.28(3.53)** | − 0.57 (1.66)* | 1.85 (4.66)** | 1.50 (1.25) | 0.68 (1.87)* | − 23.66(3.82)** |

NASDAQ Telecommunications | − 5.45 (1.40) | − 37.59 (1.35) | 13.67 (1.32) | − 86.34 (1.12) | 29.75 (1.14) | − 348.81 (1.06) |

NASDAQ Transportation | − 0.13 (0.65) | − 1.51 (1.74)* | 2.93 (2.88)** | − 6.24 (1.92)* | 2.97 (3.00)** | − 58.02(3.48)** |

PHLX Semiconductors | − 0.04 (0.06) | − 3.34 (1.17) | 4.77 (1.72)* | − 35.42(2.13)** | 12.52(2.30)** | − 210.3(2.51)** |

III. Diagnostics of the Linear ARDL Model (2)

U.S. sectoral indices | Statistical diagnostics | |||||

|---|---|---|---|---|---|---|

F | ECM t-1 | LM | RESET | R bar squared | CUSUM (CUSUM2) | |

Dow Jones Industrial Average | 2.70 | − 0.06 (4.05)* | 0.14 | 10.30 | 0.08 | S(S) |

Dow Jones Transportation Average | 2.17 | − 0.06 (4.05)* | 0.11 | 0.14 | 0.08 | S(S) |

Dow Jones Utility Average | 2.28 | − 0.04 (3.70) | 0.02 | 4.22 | 0.08 | S(S) |

NASDAQ Bank | 2.80 | − 0.03 (4.11)* | 0.01 | 40.93 | 0.09 | S(S) |

NASDAQ Biotechnology | 2.35 | − 0.03 (3.76) | 0.20 | 3.74 | 0.12 | S(S) |

NASDAQ Computer | 3.36 | − 0.03(4.47)** | 0.31 | 7.61 | 0.10 | S(S) |

NASDAQ Industrial | 2.61 | − 0.06 (3.98)** | 0.99 | 6.94 | 0.12 | S(S) |

NASDAQ Insurance | 3.74* | − 0.13 (4.77)** | 0.38 | 10.65 | 0.11 | S(S) |

NASDAQ Telecommunications | 7.60** | − 0.02 (6.80)** | 0.02 | 3.13 | 0.19 | S(S) |

NASDAQ Transportation | 3.00 | − 0.07 (4.26)** | 0.49 | 6.15 | 0.08 | S(S) |

PHLX Semiconductors | 3.46* | − 0.05 (4.55)** | 0.001 | 3.11 | 0.07 | S(S) |

II. Short-Run Coefficient Estimates of NEG for the Non-Linear ARDL Model (5)

U.S. sectoral indices | Short-run coefficient estimates | ||||

|---|---|---|---|---|---|

∆ NEGt | ∆ NEGt-1 | ∆ NEGt-2 | ∆ NEGt-3 | ∆ NEGt-4 | |

Dow Jones Industrial Average | 0.13 (2.83)** | ||||

Dow Jones Transportation Average | − 0.04 (1.92)* | ||||

Dow Jones Utility Average | − 0.02(1.99)** | ||||

NASDAQ Bank | 0.23 (4.00)** | 0.11 (1.90)* | |||

NASDAQ Biotechnology | 0.02 (0.67) | ||||

NASDAQ Computer | 0.15 (2.00)** | ||||

NASDAQ Industrial | 0.12 (1.96)** | 0.01 (0.22) | 0.05 (0.68) | 0.17 (2.46)** | − 0.12 (1.80)* |

NASDAQ Insurance | 0.08 (1.70)* | 0.08 (1.67)* | |||

NASDAQ Telecommunications | 0.10 (1.27) | ||||

NASDAQ Transportation | − 0.01 (0.48) | ||||

PHLX Semiconductors | 0.14 (1.47) | ||||

III. Long-Run Coefficient Estimates of the Non-Linear ARDL Model (5)

U.S. sectoral indices | Long-run coefficient estimates | ||||||

|---|---|---|---|---|---|---|---|

POS | NEG | ln EX | ln IPI | ln CPI | ln MS | Constant | |

Dow Jones Industrial Average | − 0.25 (1.02) | − 0.75(2.77)** | − 1.34 (1.31) | 3.24(3.62)** | − 2.97 (1.24) | − 1.63 (1.24) | 58.68 (1.33) |

Dow Jones Transportation Average | − 0.16 (0.48) | − 0.42(2.01)** | − 2.01(2.28)** | 3.19(2.45)** | − 5.60 (1.04) | 0.98 (0.67) | − 1.67 (0.04) |

Dow Jones Utility Average | 0.11 (0.36) | − 0.45 (1.57) | − 1.98 (1.55) | 3.30(2.2)** | − 7.27(2.08)** | − 0.86 (0.49) | 53.97 (0.93) |

NASDAQ Bank | − 0.35 ( − 0.43) | − 0.22 ( − 0.41) | 1.05 (0.47) | 1.40 (0.43) | − 0.12 (0.01) | 1.41 (0.36) | − 43.41 (0.36) |

NASDAQ Biotechnology | 2.62 (1.23) | 0.73 (0.68) | − 9.71 (1.04) | 14.24 (1.39) | − 89.76 (1.38) | 16.29(1.37) | − 100.3(0.53) |

NASDAQ Computer | − 0.80 (0.66) | − 2.07 (1.87)* | − 10.1(1.86)* | 6.81 (1.95)* | − 39.31 (1.83)* | 6.10 (0.86) | 16.54 (0.11) |

NASDAQ Industrial | − 0.28 (0.80) | − 1.07(3.94)** | − 3.98(3.35)** | 5.7(4.07)** | − 16.14(3.1)** | 1.17 (0.74) | 34.02 (0.67) |

NASDAQ Insurance | − 0.31(2.3)** | − 0.27(3.19)** | − 0.61 (1.75)* | 1.89(4.1)** | 1.78 (1.05) | 0.86 (1.38) | − 30.87 (1.58) |

NASDAQ Telecommunications | − 2.68 (1.11) | − 4.33 (1.84)* | − 26.29(1.69)* | 13.9(1.86)* | − 73.09 (1.50) | 13.48(0.86) | − 7.50 (0.03) |

NASDAQ Transportation | 0.19 (0.51) | − 0.11 (0.49) | − 1.54 (1.60) | 3.62(2.7)** | − 9.96 (1.86)* | 2.00 (1.23) | − 17.85 (0.35) |

PHLX Semiconductors | 1.05 (1.73)* | − 0.44 (0.90) | − 2.21 (1.36) | 7.65(3.8)** | − 38.3(3.47)** | 2.91 (0.87) | 60.79 (0.75) |

IV. Diagnostics of the Non-Linear ARDL Model (5)

U.S. sectoral indices | Statistical diagnostics | |||||||

|---|---|---|---|---|---|---|---|---|

F | ECM t-1 | LM | RESET | R bar squared | CUSUM (CUSUM2) | Wald-short | Wald-long | |

Dow Jones Industrial Average | 2.82 | − 0.06(4.47)** | 0.56 | 10.43 | 0.09 | S(S) | 2.63 | 2.96* |

Dow Jones Transportation Average | 2.98 | − 0.08(4.59)** | 0.04 | 0.11 | 0.95 | S(S) | 9.71** | 0.64 |

Dow Jones Utility Average | 2.39 | − 0.04 (4.12)* | 0.04 | 5.03 | 0.08 | S(S) | 0.79 | 2.24 |

NASDAQ Bank | 2.43 | − 0.03 (4.15)* | 0.08 | 30.18 | 0.09 | S(S) | 4.75** | 0.06 |

NASDAQ Biotechnology | 3.27 | − 0.02(4.57)** | 0.02 | 10.88 | 0.10 | S(S) | 0.10 | 0.72 |

NASDAQ Computer | 3.32 | − 0.03(4.80)** | 0.29 | 8.74 | 0.10 | S(S) | 0.03 | 1.36 |

NASDAQ Industrial | 4.00** | − 0.07(5.32)** | 1.63 | 4.40 | 0.12 | S(S) | 1.75 | 3.72* |

NASDAQ Insurance | 2.97 | − 0.13(4.59)** | 1.07 | 7.90 | 0.12 | S(S) | 1.61 | 0.08 |

NASDAQ Telecommunications | 6.54** | − 0.02(6.82)** | 0.00 | 3.38 | 0.19 | S(S) | 0.01 | 0.93 |

NASDAQ Transportation | 2.19 | − 0.07 (3.92) | 0.11 | 4.74 | 0.09 | S(S) | 0.25 | 0.86 |

PHLX Semiconductors | 4.04** | − 0.08(5.35)** | 0.001 | 0.89 | 0.09 | S(S) | 0.01 | 7.97** |

Rights and permissions

About this article

Cite this article

Saha, S. Asymmetric Impact of Oil Price Changes on Stock Prices: Evidence from Country and Sectoral Level Data. J Econ Finan 46, 237–282 (2022). https://doi.org/10.1007/s12197-021-09559-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-021-09559-3