Abstract

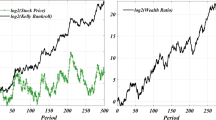

We introduce a microscopic model of interacting financial agents, where each agent is characterized by two portfolios; money invested in bonds and money invested in stocks. Furthermore, each agent is faced with an optimization problem in order to determine the optimal asset allocation. Thus, we consider a differential game since all agents aim to invest optimal and we introduce the concept of Nash equilibrium solutions to ensure the existence of a solution. Especially, we denote an agent who solves this Nash equilibrium exactly a rational agent. As next step we use model predictive control to approximate the control problem. This enables us to derive a precise mathematical characterization of the degree of rationality of a financial agent. This is a novel concept in portfolio optimization and can be regarded as a general approach. In a second step we consider the case of a fully myopic agent, where we can solve the optimal investment decision of investors explicitly. We select the running cost to be the expected missed revenue of an agent which are determined by a combination of a fundamentalist and chartist strategy. Then we derive the mean field limit of the microscopic model in order to obtain a macroscopic portfolio model. The novelty in comparison to existent macroeconomic models in literature is that our model is derived from microeconomic dynamics. The resulting portfolio model is a three dimensional ODE system which enables us to derive analytical results. The conducted simulations reveal that the model shares many dynamical properties with existing models in literature. Thus, our model is able to replicate the most prominent features of financial markets, namely booms and crashes. In the case of random fundamental prices the model is even able to reproduce fat tails in logarithmic stock price return data. Mathematically, the model can be regarded as the moment model of the recently introduced mesoscopic kinetic portfolio model (Trimborn et al. in Portfolio optimization and model predictive con trol: a kinetic approach, arXiv:1711.03291, 2017).

Similar content being viewed by others

References

Albi, G., Pareschi, L., Zanella, M.: Boltzmann-type control of opinion consensus through leaders. Philos. Trans. R. Soc. Lond. A: Math., Phys. Eng. Sci. 372(2028), 20140138 (2014)

Anand, K., Kirman, A., Marsili, M.: Epidemics of rules, information aggregation failure and market crashes. https://halshs.archives-ouvertes.fr/halshs-00545144 (2010)

Beja, A., Goldman, M.B.: On the dynamic behavior of prices in disequilibrium. J. Financ. 35(2), 235–248 (1980)

Bertsimas, D., Pachamanova, D.: Robust multiperiod portfolio management in the presence of transaction costs. Comput. Oper. Res. 35(1), 3–17 (2008)

Breeden, D.T., Litzenberger, R.H.: Prices of state-contingent claims implicit in option prices. J. Bus. 51, 621–651 (1978)

Bressan, A.: Noncooperative differential games. Milan J. Math. 79(2), 357–427 (2011)

Brock, W.A., Hommes, C.H.: A rational route to randomness. Econom. J. Econom. Soc. 65, 1059–1095 (1997)

Brock, W.A., Hommes, C.H.: Heterogeneous beliefs and routes to chaos in a simple asset pricing model. J. Econ. Dyn. Control 22(8), 1235–1274 (1998)

Brown, D.J., Lewis, L.M.: Myopic economic agents. Econom. J. Econom. Soc. 49, 359–368 (1981)

Camacho, E.F., Alba, C.B.: Model Predictive Control. Springer, Berlin (2013)

Chiarella, C.: The dynamics of speculative behaviour. Ann. Oper. Res. 37(1), 101–123 (1992)

Chiarella, C., He, X.-Z.: Heterogeneous beliefs, risk and learning in a simple asset pricing model. Comput. Econ. 19(1), 95–132 (2002)

Conlisk, J.: Why bounded rationality? J. Econ. Lit. 34(2), 669–700 (1996)

Cont, R., Bouchaud, J.-P.: Herd behavior and aggregate fluctuations in financial markets. Macroecon. Dyn. 4(02), 170–196 (2000)

Day, R.H., Huang, W.: Bulls, bears and market sheep. J. Econ. Behav. Organ. 14(3), 299–329 (1990)

Duffie, D., Zame, W.: The consumption-based capital asset pricing model. Econom. J. Econom. Soc. 57, 1279–1297 (1989)

Egenter, E., Lux, T., Stauffer, D.: Finite-size effects in monte carlo simulations of two stock market models. Phys. A: Stat. Mech. Appl. 268(1), 250–256 (1999)

Fama, E.F.: The behavior of stock-market prices. J. Bus. 38(1), 34–105 (1965)

Franke, R., Westerhoff, F.: Structural stochastic volatility in asset pricing dynamics: estimation and model contest. J. Econ. Dyn. Control 36(8), 1193–1211 (2012)

Golse, F.: On the dynamics of large particle systems in the mean field limit. Macroscopic and Large Scale Phenomena: Coarse Graining. Mean Field Limits and Ergodicity, pp. 1–144. Springer, Cham (2016)

Gros, D.: The effectiveness of capital controls: implications for monetary autonomy in the presence of incomplete market separation. Staff Pap. 34(4), 621–642 (1987)

Grüne, L., Pannek, J., Seehafer, M., Worthmann, K.: Analysis of unconstrained nonlinear mpc schemes with time varying control horizon. SIAM J. Control Optim. 48(8), 4938–4962 (2010)

Grune, L., Rantzer, A.: On the infinite horizon performance of receding horizon controllers. IEEE Trans. Autom. Control 53(9), 2100–2111 (2008)

Hommes, C.H.: Modeling the stylized facts in finance through simple nonlinear adaptive systems. Proc. Natl. Acad. Sci. 99(suppl 3), 7221–7228 (2002)

Hommes, C.H.: Heterogeneous agent models in economics and finance. Handb. Comput. Econ. 2, 1109–1186 (2006)

Jensen, M.C., Black, F., Scholes, M.S.: The capital asset pricing model: some empirical tests. In: M. C. Jensen (ed.) Studies in the Theory of Capital Markets, Praeger Publishers inc. (1972)

Kahneman, D.: Maps of bounded rationality: psychology for behavioral economics. Am. Econ. Rev. 93(5), 1449–1475 (2003)

Kahneman, D., Tversky, A.: Prospect theory: an analysis of decision under risk. Econom. J. Econom. Soc. 47, 263–291 (1979)

Kirk, D.E.: Optimal Control Theory: An Introduction. Springer, Berlin (1970)

Kirman, A.: The crisis in economic theory. Rivista Italiana Degli Economisti 16(1), 9–36 (2011)

Lehmann, B.N.: Fads, martingales, and market efficiency. Q. J. Econ. 105(1), 1–28 (1990)

Levy, M., Levy, H., Solomon, S.: A microscopic model of the stock market: cycles, booms, and crashes. Econ. Lett. 45(1), 103–111 (1994)

Lintner, J.: Security prices, risk, and maximal gains from diversification. J. Financ. 20(4), 587–615 (1965)

Lo, A.W.: The adaptive markets hypothesis: market efficiency from an evolutionary perspective. J Portf Manag 30th Anniv. 30(5), 15–29 (2004)

Lux, T.: Herd behaviour, bubbles and crashes. Econ. J. 105, 881–896 (1995)

Lux, T. et al: Stochastic behavioral asset pricing models and the stylized facts. Technical report, Economics working paper/Christian-Albrechts-Universität Kiel, Department of Economics, (2008)

Lux, T., Marchesi, M.: Scaling and criticality in a stochastic multi-agent model of a financial market. Nature 397(6719), 498–500 (1999)

Malkiel, B.G.: The efficient market hypothesis and its critics. J. Econ. Perspect. 17(1), 59–82 (2003)

Mantel, R.R., et al.: On the characterization of aggregate excess demand. J. Econ. Theory 7(3), 348–353 (1974)

Markowitz, H.: Portfolio selection. J. Financ. 7(1), 77–91 (1952)

Merton, R.C.: Lifetime portfolio selection under uncertainty: the continuous-time case. Rev. Econ. Stat. 51, 247–257 (1969)

Merton, R.C.: Optimum consumption and portfolio rules in a continuous-time model. In: Stochastic Optimization Models in Finance, pp. 621–661. Elsevier, Amsterdam (1975)

Michalska, H., Mayne, D.Q.: Receding horizon control of nonlinear systems. In: Proceedings of the 28th IEEE Conference on Decision and Control, 1989, pp. 107–108. IEEE, (1989)

Mitchell, J.E., Braun, S.: Rebalancing an investment portfolio in the presence of convex transaction costs, including market impact costs. Optim. Methods Softw. 28(3), 523–542 (2013)

Mossin, J.: Equilibrium in a capital asset market. Econom.: J. Econom. Soc. 34, 768–783 (1966)

Niehans, J.: The international allocation of savings with quadratic transaction (or risk) costs. J. Int. Money Financ. 11(3), 222–234 (1992)

Odean, T.: Volume, volatility, price, and profit when all traders are above average. J. Financ. 53(6), 1887–1934 (1998)

Ross, S.A.: The arbitrage theory of capital asset pricing. In: Handbook of the Fundamentals of Financial Decision Making: Part I, pp. 11–30. World Scientific, Singapore (2013)

Rubinstein, M.: The valuation of uncertain income streams and the pricing of options. Bell J. Econ. 7, 407–425 (1976)

Sharpe, W.F.: Capital asset prices: a theory of market equilibrium under conditions of risk. J. Financ. 19(3), 425–442 (1964)

Shiller, R.J.: From efficient markets theory to behavioral finance. J. Econ. Perspect. 17(1), 83–104 (2003)

Simon, H.A.: A behavioral model of rational choice. Q. J. Econ. 69, 99–118 (1955)

Sonnenschein, H.: Market excess demand functions. Econom.: J. Econom. Soc. 40, 549–563 (1972)

Sontag, E.D.: Mathematical Control Theory: Deterministic Finite Dimensional Systems, vol. 6. Springer, Berlin (2013)

Stanley, H.E.: Phase Transitions and Critical Phenomena. Clarendon Press, Oxford (1971)

Treynor, J.L.: Market value, time, and risk. (1961)

Trimborn, T., Otte, P., Cramer, S., Beikirch, M., Pabich, E., Frank, M.: Sabcemm- a simulator for agent-based computational economic market models. arXiv preprint arXiv:1801.01811, (2018)

Trimborn, T., Pareschi, L., Frank, M.: Portfolio optimization and model predictive control: a kinetic approach. arXiv preprint arXiv:1711.03291, (2017)

Walras, L.: Études d’économie politique appliquée:(Théorie de la production de la richesse sociale). In: Rouge, F. (ed.), Paris (1898)

Zhou, W.-X., Sornette, D.: Self-organizing ising model of financial markets. Eur. Phys. J. B 55(2), 175–181 (2007)

Acknowledgements

Torsten Trimborn gratefully acknowledges funding by the Hans-Böckler-Stiftung.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

Derivation of myopic investment strategy In this setting the parameter p of the approximation scheme is set to one. The Lagrangian becomes:

Notice that the quantities \((x_j^*,y_j^*,u_j^*),\ j=1,...,i-1,i+1,...,N\) are assumed to be optimal because we consider Nash equilibrium solutions. Thus, \((x_j^*,y_j^*,u_j^*),\ j=1,...,i-1,i+1,...,N\) only enter as parameters in the ith Lagrangian \(L_i\). The optimality conditions can be immediately derived from the Lagrangian and read:

Thus, we get:

For an introduction to optimal control theory and the derivation of optimality conditions we refer to [29, 54]. We can rewrite the maximum condition

Thus, in order to obtain the optimal strategy \(u_i^*\) we need to solve the adjoint equations. In fact we apply a backward Euler discretization on the time interval \([{\bar{t}}, {\bar{t}}+\Delta t]\) in order to compute the costates \(\lambda _{x_i}({\bar{t}}),\lambda _{y_i}({\bar{t}}), \lambda _{S}({\bar{t}}) \) explicitly.

The backward Euler discretization of the general ODE

is given by

for a positive small time step \(\Delta t>0\). When we apply this numerical scheme on the adjoint equations, we obtain:

By assumption \(\lambda _{x_i}({\bar{t}}+\Delta t)=\lambda _{y_i}({\bar{t}}+\Delta t)=\lambda _{S}({\bar{t}}+\Delta t)=0\) holds and thus the previously discretized adjoint equations reduce to

Then we insert the costates in the maximum condition (9) in order to obtain the optimal investment strategy \(u_N^*\).

Appendix B

Qualitative analysis The proof of Proposition 1 reads:

Proof

We show local Lipschitz continuity. Then existence and uniqueness directly follows by the Picard–Lindelöf theorem. We can rewrite the stock price equation into an explicit ODE system:

Thus, we may denote the right hand side of the explicit ODE system by \(F(z),\ z:=(X,Y,S)^T \in [0,\infty )\times [0,\infty )\times (0,\infty )\). Notice that the excess demand ED does no longer depend on \({\dot{S}}\), since we can insert the right hand side of the stock price equation (10). Local Lipschitz continuity is obvious except for the potential singularity in \(S^*=\frac{\chi \ \omega \ s^f+(1-\chi )\ D}{r+\chi \ \omega }\), since \(K(S^*)=0\) holds. Thus, we show Lipschitz continuity on \(U=U_X\times U_Y\times U_S, \ U_X:= [X_0-\epsilon , X_0+\epsilon ],\ U_Y:= [Y_0-\epsilon , Y_0+\epsilon ],\ U_S:= [S^*-\epsilon , S^*+\epsilon ],\ \epsilon >0 \) with \(z_0:= (X_0, Y_0, S^*)\), where \(X_0,Y_0\in [0,\infty )\) are arbitrary but fixed. First we discuss the excess demand ED:

As next step we discuss each component of \(F=(F_1,F_2,F_3)^T\) separately. For the stock price evolution we obtain:

For the portfolio dynamics we get:

Hence, we conclude that

holds on U with Lipschitz constant \(L:= C (C_1+C_2+C_3+ C_4 +r)\), where the additionally constant C is due to the equivalence of norms. \(\square \)

The proof of Proposition 2 is given by:

Proof

We set \(r=D=0\) and derive the explicit ODE system. Thus, for a continuous differentiable Lyapunov functional we can compute the Lie derivative. We define the Lyapunov functional as follows: \(\psi : \mathbb {R}^3 \rightarrow \mathbb {R},\ (x,y,S)^T\mapsto -(s^f-S)\ (x+y-(s^f-s))\). We immediately obtain

and can conclude the asymptotic stability of \(S_{\infty }\). \(\square \)

Proposition 3

In special cases, we can compute solutions of the stock price equation. We assume constant weights \(\chi \) and assume that the utility function is described by the identity.

-

Fundamentalists alone (\(\chi =1\)): The stock price equation reads

$$\begin{aligned} {\dot{S}} ={\left\{ \begin{array}{ll} \kappa \ (\omega \ s^f- (\omega +r)\ S)\ Y,\quad \frac{\omega s^f}{\omega +r}>S,\\ \kappa \ (\omega \ s^f-(\omega +r)\ S)\ X,\quad \frac{\omega s^f}{\omega +r}<S . \end{array}\right. } \end{aligned}$$This equation seems reasonable, so the investor shifts his capital into stocks if he expects a positive stock return, and vice versa. The solution is given by

$$\begin{aligned} S(t)= {\left\{ \begin{array}{ll} (1-\exp \{- \kappa \ (\omega +r)\ \int \limits _0^t Y(\tau )\ d\tau )\})\ \frac{\omega \ s^f}{\omega +r} +S(0) \ \exp \{- \kappa \ (\omega +r)\ \int \limits _0^tY(\tau )\ d\tau \},\\ \quad \text {for}\ \frac{s^f}{\omega +r}>S,\\ (1-\exp \{- \kappa \ (\omega +r)\ \int \limits _0^t X(\tau )\ d\tau )\})\ \frac{\omega \ s^f}{\omega +r} +S(0) \ \exp \{- \kappa \ (\omega +r)\ \int \limits _0^tX(\tau )\ d\tau \},\\ \quad \text {for}\ \frac{s^f}{\omega +r}<S. \end{array}\right. } \end{aligned}$$Hence, the price is driven exponentially fast to the steady state \(S_{\infty }=\frac{\omega \ s^f}{\omega +r}\).

-

Chartists alone (\(\chi = 0\)): We get

$$\begin{aligned} {\dot{S}} = {\left\{ \begin{array}{ll} \frac{\kappa \ D\ Y}{1-\kappa \ Y}- \frac{r\ \kappa Y}{1-\kappa Y}\ S,\quad \text {for}\ D>S,\\ \frac{\kappa \ D\ X}{1-\kappa \ X}- \frac{r\ \kappa X}{1-\kappa X}\ S,\quad \text {for}\ D<S. \end{array}\right. } \end{aligned}$$The solution is given by

$$\begin{aligned} S(t)= {\left\{ \begin{array}{ll} \left( 1-\exp \left\{ -r \ \kappa \ \int \limits _0^t \frac{Y(\tau )}{1-\kappa Y(\tau )}\ d\tau \right\} \right) \ \frac{D}{r}+S(0)\ \exp \left\{ -r \ \kappa \ \int \limits _0^t \frac{Y(\tau )}{1-\kappa Y(\tau )}\ d\tau \right\} ,\\ \quad \text {for}\ \kappa \ D\ Y +D\ (1-\kappa \ Y)>S,\\ \left( 1+ \exp \left\{ -r \ \kappa \ \int \limits _0^t \frac{X(\tau )}{1-\kappa \ X(\tau )}\ d\tau \right\} \right) \ \frac{D}{r}+S(0)\ \exp \left\{ -r \ \kappa \ \int \limits _0^t \frac{X(\tau )}{1-\kappa \ X(\tau )}\ d\tau \right\} ,\\ \quad \text {for}\ \kappa \ D\ X+D\ (1-\kappa \ Y)<S. \end{array}\right. } \end{aligned}$$ -

Chartists and fundamentalists with a constant weight \(\chi \in (0,1)\): The corresponding stock price equation reads

$$\begin{aligned} {\dot{S}} = {\left\{ \begin{array}{ll} \kappa \ (\chi \omega s^f+(1-\chi )\ D-(r+\chi \omega )\ S)\ \frac{Y}{1+(1-\chi )\kappa \ Y},\quad K(S)>0,\\ \kappa \ (\chi \omega s^f+(1-\chi )\ D-(r+\chi \omega )\ S)\ \frac{X}{1+(1-\chi )\kappa \ X},\quad K(S)<0. \end{array}\right. } \end{aligned}$$The solution is given by

$$\begin{aligned} S(t)= {\left\{ \begin{array}{ll} (1-\exp \{- \kappa \ (\chi \omega +r)\ \int \limits _0^t \frac{Y(\tau )}{1+\kappa (1-\chi ) Y(\tau )}\ d\tau )\})\ \frac{\chi \omega \ s^f+(1-\chi )\ D}{\chi \omega +r} \\ \quad +S(0) \ \exp \{- \kappa \ (\chi \omega +r)\ \int \limits _0^t\frac{Y(\tau )}{1+\kappa (1-\chi ) Y(\tau )}\ d\tau \},\quad \text {for}\ K(S)>0,\\ (1-\exp \{- \kappa \ (\chi \omega +r)\ \int \limits _0^t \frac{X(\tau )}{1+\kappa (1-\chi ) X(\tau )}\ d\tau )\})\ \frac{\chi \omega \ s^f+(1-\chi )\ D}{\chi \omega +r} \\ \quad +S(0) \ \exp \{- \kappa \ (\chi \omega +r)\ \int \limits _0^t\frac{X(\tau )}{1+\kappa (1-\chi ) X(\tau )}\ d\tau \},\quad \text {for}\ K(S)<0. \end{array}\right. } \end{aligned}$$

Proposition 4

For the wealth evolution, we consider the stock and bond portfolio separately.

-

In the stock portfolio, the wealth evolution is given by

$$\begin{aligned} {\dot{X}} = {\left\{ \begin{array}{ll} (\kappa \ K(S)\ Y+ \frac{D}{S})\ X + K(S)\ Y,&{}\quad \text {for}\ K(S)>0,\\ (\kappa \ K(S)\ X +\frac{D}{S})\ X+ K(S)\ X,&{}\quad \text {for}\ K(S)<0. \end{array}\right. } \end{aligned}$$The solution is given by

$$\begin{aligned} X(t) = {\left\{ \begin{array}{ll} X(0)\exp \left\{ \int \limits _0^t\kappa \ K(S) Y\ + \frac{D}{S}\ d\tau \right\} +\left( 1 - \exp \left\{ -\int \limits _0^t\kappa \ K(S) Y\ d\tau \right\} \right) \frac{1}{\kappa },\\ \quad \text {for}\ K(S)>0,\\ \frac{X(0)\ \exp \left\{ \int \limits _0^t K(s)+\frac{D}{S}\ d\tau \right\} }{ 1+\kappa \int \limits _0^t K(S)\ \exp \left\{ \int \limits _0^{\zeta } K(S)+\frac{D}{S}\ d\zeta \right\} \ d\tau },\quad \text {for}\ K(S)<0. \end{array}\right. } \end{aligned}$$ -

The bond portfolio is given by

$$\begin{aligned} {\dot{Y}} = {\left\{ \begin{array}{ll} r \ Y - K(S)\ Y,\quad &{}\text {for}\ K(S)>0,\\ r\ Y - K(S)\ X,\quad &{}\text {for}\ K(S)<0, \end{array}\right. } \end{aligned}$$with the solution

$$\begin{aligned} Y(t) = {\left\{ \begin{array}{ll} Y(0)\ \exp \left\{ \int \limits _0^t (r-K(S))\ d\tau \right\} ,&{}\quad \text {for}\ K(S)>0,\\ \exp \left\{ r\ t \right\} \left( Y(0)- \int \limits _0^t K(S)\ X \exp \left\{ -r \ \tau \right\} \ d\tau \right) ,&{}\quad \text {for}\ K(S)<0. \end{array}\right. } \end{aligned}$$

Appendix C

Parameters of simulation If not indicated differently the parameters are set to:

Rights and permissions

About this article

Cite this article

Trimborn, T. A macroscopic portfolio model: from rational agents to bounded rationality. Math Finan Econ 13, 491–518 (2019). https://doi.org/10.1007/s11579-019-00235-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11579-019-00235-z