Abstract

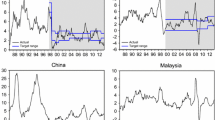

We conduct laboratory experiments with human subjects to test the rationale of adopting a band versus point inflation targeting regime. Within the standard New Keynesian model, we evaluate the macroeconomic performances of both regimes according to the strength of shocks affecting the economy. We find that when the economy faces small uncorrelated shocks, the level of inflation as well as its volatility are significantly lower in a band targeting regime, while the output gap and interest rate levels and volatility are significantly lower in a point targeting regime with tolerance bands. However, when the economy faces large uncorrelated shocks, choosing the suitable inflation targeting regime is irrelevant because both regimes lead to comparable performances. These findings stand in contrast to those of the literature and question the relevance of clarifying a mid-point target within the bands, especially in emerging market economies more inclined to large and frequent shocks.

Similar content being viewed by others

Notes

For instance, the Governor of the Reserve Bank of New Zealand is subject to resignation as soon as actual inflation deviates from the band target without convincing explanations.

In the same vein, Meyer (2002) and Mishkin (2008) argue that a point target is more appropriate in that it provides a more precise anchor for inflation expectations of agents, and a more specific target to be achieved by monetary authorities. When a country chooses to target a band for inflation, the implications in terms of costs when inflation deviates from the band will arise, and in the absence of any explicit focal point within the band, questions arise about where the monetary authorities would like inflation to be stabilized. When the movements of actual inflation within the band do not matter for the monetary authorities, the latter become too flexible and this entails a high variability of inflation, which can be detrimental. In addition, a band target can undermine the credibility of the central bank, once actual inflation deviates from the band.

See Hommes (2011) for an overview on LtFE.

Note that the choice of this simplified model is in line with the experimental macro literature, as e.g. Pfajfar and Zakelj (2014) and Cornand and M’baye (2016). However, it is worth mentioning that the non-microfounded NK model presented in Eqs. (1)–(3) uses average expectations instead of aggregated expectations as in e.g. Gali (2009). Kurz (2012) shows that these two do not necessarily coincide even in a linearized model, which implies that monetary policy and aggregate fluctuations might be altered.

In contrast to Kryvtsov and Petersen (2013) or Arifovic and Petersen (2015), we ask for inflation expectations only (and not for output gap expectations). As that of Pfajfar and Zakelj (2013, 2014) and Assenza et al. (2013), our set-up presents the drawback to be less exhaustive in this respect but has the advantage to ask subjects for an easier task.

Both survey papers (e.g. Pesaran and Weale 2006; Andolfatto et al. 2008; Lanne et al. 2009; Coibion and Gorodnichenko 2015) and the LtFE literature (e.g. Hommes et al. 2005; Assenza et al. 2013; Pfajfar and Zakelj 2014; Petersen 2014) show that subjects’ inflation expectations fail to be captured by rational expectations, but instead are well described by simple strategies, such as naive expectations.

Our experimental framework is close to Pfajfar and Zakelj (2013, 2014) and Assenza et al. (2013), as we use the same model and the results come from agents’ inflation expectations. However, our study differs from theirs in at least two respects. First, while these papers focus on the interplay between agents’ inflation expectations formation process and monetary policy, our analysis focuses more precisely on the role of the announced point and band inflation target on agents’ inflation expectations and on macroeconomic outcomes. Second, the reaction function of the central bank is also different: Pfajfar and Zakelj (2013, 2014) and Assenza et al. (2013) assume that the central bank only cares about inflation stabilization, while we more realistically assume that the central bank additionally takes into account (but with less weight) output gap stabilization.

The same Taylor rule (Eq. 3) was used both in simulations and in the experiment. In the experiment, both treatments (band and point) were equivalent except that the announcement was different: announcing a point target with margin error of ±1% or an explicit band (between 4 and 6% of inflation). As we wanted to analyze the pure communication effect of announcing a band or a point target, we strictly refer to this equation in each treatment. Moreover, in an uncertain environment, the central bank, which announces a band target, knows the numerical mid-point of the band it wishes to reach but does not clearly announce it to the public. As emphasized by Demertzis and Viegi (2009), every central bank has in practice a numerical inflation target that it wishes to reach irrespective of whether it announces it clearly to the public or not. Hence, the standard Taylor rule is convenient for both treatments.

The program was written using z-Tree (Fischbacher 2007).

“Appendix 5” provides a translation from French to English of instructions. “Appendix 6” shows some examples of the screens.

Note that initialization to a value that is below the target (which stands in contrast to the implementation of IT in various countries, especially emerging economies, when inflation was above the subsequent target) may impact the results of the experiment. As will become clear in Sect. 4, especially in the small uncorrelated shock environment, the realized inflation is always below the target.

This rule represents only one example. One could do the same exercise with a rule including the target and adaptive or trend-extrapolative inflation expectations.

Simulations with lower values of q yield very similar trends.

The latter rule is extreme in the sense that it does not account for the announcement of the band target. It therefore simply provides an idea on the direction of outcomes in comparison to a situation where the point target is communicated.

The steady state is \({\bar{y}}=0.1\), \({\bar{\pi }}=4.8\), \({\bar{i}}=4.8\), which are close to target values.

This section partly relies on individual expectation formation as described in “Appendix 7” to explain macroeconomic results.

Non-parametric tests are usually used to deal with experimental data as the size of samples is generally very small. We use two non-parametric tests in our analysis: the Mann–Whitney–Wilcoxon procedure which is used to test whether two samples come from the same population against an alternative hypothesis, especially that a particular population tends to have larger values than the other, and the Siegel–Tukey’s test which is used to assess whether there is a difference in terms of variances between series. The null hypothesis is that there is no difference between series of interest.

“Appendix 4” provides figures showing the evolution of inflation and average inflation expectations for each session of each treatment.

Note that realized inflation is always below the target, which may be due to the fact that initialization was below the target.

To control for the convenience of using non-parametric tests in our analysis, we perform the Jarque–Bera (JB) test for normality of our macroeconomic series. All draws exhibit non-normal distributions (JB p value \(=0.000\)) except for the output gap series of both band and point targeting in the large shocks environment. However, we obtain the same conclusion as for the Mann–Whitney–Wilcoxon test when applying the mean t test pairwise comparison on these output gap series (p value of the t test \(=0.9963\) and p value of the MWW \(=0.9958\)). We also median-adjust our data in order to check for the robustness of the Siegel–Tukey’s test conclusion: our results are unaffected.

See also “Appendix 2” for the descriptive statistics of all treatments.

By contrast, this observation is, for instance, well captured in the standard heuristic switching model proposed by Brock and Hommes (1998).

The descriptive statistics provided in “Appendix 2” go in the same direction.

In this respect, our study complements the analysis of Orphanides and Williams (2007) who propose a model that accounts for economic agents’ imperfect understanding of the macroeconomic landscape and estimate it. They highlight that monetary policy rules which perform well when agents form rational expectations may not be appropriate when agents rely on adaptive learning. In the context of imperfections in expectation formation, they show that central bank communication, and in particular the announcement of an explicit quantitative inflation target, can improve macroeconomic performance. In contrast to Orphanides and Williams, focusing on a situation of large uncorrelated shocks, in which the anchoring effect of inflation expectations is strong in comparison to a situation of small uncorrelated shocks (Sect. 4.1), we do not find a significant impact of the announcement of an explicit inflation target.

We drop the first 10 periods of the experiment out of our regression samples. Indeed, as in Assenza et al. (2013), we assume that subjects need to have first a learning step before completely forming their forecasting rules.

References

Andolfatto D, Hendryand S, Moran K (2008) Are inflation expectations rational? J Monet Econ 55:406–422

Arifovic J, Petersen L (2015) Stabilizing expectations at the zero lower bound: experimental evidence. Technical report. Available at SSRN 2735651

Assenza T, Heemeijer P, Hommes C, Massaro D (2013) Individual expectations and aggregate macro behavior. Technical report, Tinbergen Institute Discussion Papers 13-016/II

Barro R, Gordon D (1983) A positive theory of monetary policy in a natural rate model. J Polit Econ 91:589–610

Bernanke B, Laubach T, Mishkin F, Posen, A (1999) Inflation targeting: lessons from the international experience. Technical report, Princeton University Press

Bomfin A, Rudebusch G (2000) Opportunistic and deliberate disinflation under imperfect credibility. J Money Credit Bank 32:707–721

Brock W, Hommes C (1998) Heterogeneous beliefs and routes to chaos in a simple asset pricing model. J Econ Dyn Control 22(8):1235–1274

Calvo G, Mishkin F (2003) The mirage of exchange rate regimes for emerging market countries. J Econ Perspect 17(4):99–118

Clarida R, Gali J, Gertler M (2000) Monetary policy rules and macroeconomic stability: evidence and some theory. Q J Econ 115(1):147–180

Coibion O, Gorodnichenko Y (2015) Information rigidity and the expectations formation process: a simple framework and new facts. Am Econ Rev 105:2644–2678

Cornand C, M’baye CK (2016) Does inflation targeting matter? an experimental investigation. Macroecon Dyn. doi:10.1017/S1365100516000250

Demertzis M, Viegi N (2009) Inflation targeting: a framework for communication. BE J Macroecon 9:1–32

Fischbacher U (2007) z-tree: Zurich toolbox for ready-made economic experiments. Exp Econ 10(2):171–178

Fraga A, Goldfajn I, Minella A (2003) Inflation targeting in emerging market economies. Technical report, NBER Working Paper No. 10019

Gali J (2009) Monetary policy, inflation, and the business cycle: an introduction to the new keynesian framework. Princeton University Press, Princeton

Hammond G (2012) State of the art of inflation targeting, chapter in: handbooks. Number 29. Centre for Central Banking Studies, Bank of England

Heenan G, Peter M, Roger S (2006) Implementing inflation targeting: institutional arrangements, target design, and communications. Technical report, IMF Working Paper/06/278

Hommes C (2011) The heterogeneous expectations hypothesis: some evidence from the lab. J Econ Dyn Control 35(1):1–24

Hommes C, Sonnemans J, Tuinstra J, Velden HVD (2005) Coordination of expectations in asset pricing experiments. Rev Financ Stud 18(3):955–980

Kryvtsov O, Petersen L (2013) Expectations and monetary policy: experimental evidence. Technical report, Department of Economics, Simon Fraser University, Discussion Papers series dp13-09

Kurz M (2012) A new keynesian model with diverse beliefs. Technical report. Available at SSRN 1938821

Lanne M, Luoma A, Luoto J (2009) A nave sticky information model of households inflation expectations. J Econ Dyn Control 33:1332–1344

Levin A, Natalucci F, Piger J (2004) The macroeconomic effects of inflation targeting. Fed Reserve Bank St. Louis Rev 86(4):51–80

Lin S, Ye H (2009) Does inflation targeting make a difference in developing countries? J Dev Econ 89:118–123

Meyer L (2002) Inflation targets and inflation targeting. N Am J Econ Finance 13:147–162

Mishkin F (2008) Whither federal reserve communications. Technical report, Remarks at the Peterson Institute for International Economics, Washington DC

Mishkin F, Westelius N (2008) Inflation band targeting and optimal inflation contracts. J Money Credit Bank 40(4):557–582

Mokhtarzadeh F, Petersen L (2016) Central bank communication and expectations. Technical report, Working Paper Department of Economics, Simon Fraser University

Orphanides A, Williams JC (2007) Inflation targeting under imperfect knowledge, volume Vol. XI, chapter. In: Mishkin F, Schmidt-Hebbel K (eds) Monetary policy under inflation targeting. Banco central de Chile, Santiago

Pesaran H, Weale M (2006) Survey expectations. In: Elliott G, Granger C, Timmermann A (eds) Handbook of economic forecasting, chap 14, vol 1. Elsevier, North Holland, pp 715–776

Petersen L (2014) Forecast error information and heterogeneous expectations in learning-to-forecast macroeconomic experiments. Expe Macroecon 17:109–137

Pfajfar D, Zakelj B (2013) Inflation expectations and monetary policy design: evidence from the laboratory. Technical report, Tilburg University

Pfajfar D, Zakelj B (2014) Experimental evidence on inflation expectation formation. J Econ Dyn Control 44:147–168

Roger S (2009) Inflation targeting at 20: achievements and challenges. Technical report, IMF working paper 09/236, International Monetary Fund

Roger S Stone M (2005) On target? The international experience with achieving inflation targets. Technical report, IMF working paper No. 05/163, International Monetary Fund

Author information

Authors and Affiliations

Corresponding author

Additional information

We are thankful to the ANR-DFG joint Grant for financial support (ANR-12-FRAL-0013-01 StabEX). This research was performed within the framework of the LABEX CORTEX (ANR-11-IDEX-007) operated by the French National Research Agency (ANR).

Appendices

Appendix 1: Theoretical predictions: descriptive statistics

Small shocks | Large shocks | |||

|---|---|---|---|---|

Point IT | No communication | Point IT | No communication | |

Mean | ||||

Inflation | 4.80 | 4.31 | 4.89 | 4.62 |

Output | 0.11 | 0.40 | 0.11 | 0.28 |

Interest rate | 4.80 | 4.22 | 4.93 | 4.60 |

Variance | ||||

Inflation | 0.51 | 1.28 | 0.66 | 1.22 |

Output | 0.03 | 0.29 | 0.34 | 0.35 |

Interest rate | 0.59 | 1.81 | 0.75 | 1.83 |

Appendix 2: Experiment: descriptive statistics

1.1 Band IT

Stat. by session (S) | BT with low variance of shocks | BT with high variance of shocks | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

S1 | S2 | S3 | S4 | Avg | S1 | S2 | S3 | S4 | Avg | |

Inflation expectations | ||||||||||

Mean | 4.57 | 4.52 | 4.74 | 4.61 | 4.61 | 4.96 | 5.06 | 4.93 | 5.17 | 5.03 |

Median | 4.60 | 4.58 | 4.77 | 4.65 | 4.66 | 4.96 | 5.05 | 4.97 | 5.24 | 5.06 |

SD | 0.12 | 0.17 | 0.21 | 0.16 | 0.15 | 0.42 | 0.26 | 0.21 | 0.33 | 0.25 |

Inflation | ||||||||||

Mean | 4.58 | 4.54 | 4.72 | 4.62 | 4.62 | 4.96 | 5.06 | 4.94 | 5.15 | 5.03 |

Median | 4.60 | 4.60 | 4.80 | 4.70 | 4.65 | 5 | 5.10 | 5 | 5.20 | 5.09 |

SD | 0.18 | 0.20 | 0.23 | 0.20 | 0.18 | 0.51 | 0.43 | 0.41 | 0.45 | 0.42 |

Output gap | ||||||||||

Mean | 0.29 | 0.29 | 0.17 | 0.24 | 0.25 | \(-\)0.03 | \(-\)0.09 | \(-\)0.01 | \(-\)0.14 | \(-\)0.07 |

Median | 0.35 | 0.35 | 0.20 | 0.30 | 0.30 | \(-\)0.05 | \(-\)0.10 | \(-\)0.05 | \(-\)0.20 | \(-\)0.13 |

SD | 0.29 | 0.30 | 0.28 | 0.29 | 0.29 | 0.52 | 0.47 | 0.48 | 0.51 | 0.49 |

Interest rate | ||||||||||

Mean | 4.55 | 4.48 | 4.69 | 4.57 | 4.57 | 4.96 | 5.06 | 4.93 | 5.17 | 5.03 |

Median | 4.60 | 4.60 | 4.80 | 4.70 | 4.65 | 5 | 5.20 | 5 | 5.30 | 5.14 |

SD | 0.38 | 0.41 | 0.44 | 0.42 | 0.40 | 0.74 | 0.67 | 0.63 | 0.66 | 0.63 |

1.2 Point IT

Stat. by session (S) | PT with low variance of shocks | PT with high variance of shocks | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

S1 | S2 | S3 | S4 | Avg | S1 | S2 | S3 | S4 | Avg | |

Inflation expectations | ||||||||||

Mean | 4.83 | 4.31 | 5.05 | 4.89 | 4.77 | 4.95 | 5.18 | 4.89 | 5.09 | 5.03 |

Median | 4.84 | 4.52 | 5 | 4.92 | 4.81 | 5.03 | 5.16 | 4.93 | 5.09 | 5.07 |

SD | 0.16 | 0.43 | 0.23 | 0.17 | 0.14 | 0.28 | 0.51 | 0.24 | 0.24 | 0.25 |

Inflation | ||||||||||

Mean | 4.80 | 4.37 | 4.99 | 4.85 | 4.75 | 4.97 | 5.16 | 4.91 | 5.08 | 5.03 |

Median | 4.80 | 4.50 | 5 | 4.90 | 4.78 | 5 | 5.15 | 5 | 5.10 | 5.04 |

SD | 0.19 | 0.39 | 0.25 | 0.22 | 0.19 | 0.44 | 0.64 | 0.42 | 0.43 | 0.45 |

Output gap | ||||||||||

Mean | 0.15 | 0.39 | 0.02 | 0.14 | 0.17 | \(-\)0.03 | \(-\)0.16 | \(-\)0.01 | \(-\)0.09 | \(-\)0.07 |

Median | 0.20 | 0.40 | 0.10 | 0.20 | 0.23 | \(-\)0.10 | \(-\)0.15 | \(-\)0.05 | \(-\)0.10 | \(-\)0.10 |

SD | 0.29 | 0.35 | 0.29 | 0.27 | 0.28 | 0.49 | 0.56 | 0.50 | 0.47 | 0.49 |

Interest rate | ||||||||||

Mean | 4.80 | 4.27 | 4.99 | 4.86 | 4.73 | 4.96 | 5.19 | 4.89 | 5.09 | 5.03 |

Median | 4.90 | 4.50 | 5 | 4.95 | 4.83 | 5.10 | 5.25 | 5 | 5.20 | 5.16 |

SD | 0.39 | 0.59 | 0.44 | 0.43 | 0.39 | 0.68 | 0.92 | 0.65 | 0.67 | 0.68 |

Appendix 3: Statistical tests results

In the following tables, p values are reported in brackets. ***, ** and * respectively indicate significance at 1, 5 and 10% conventional levels.

1.1 Pairwise comparison: band versus point IT with low variance of shocks

Macro. outcomes | Mann–Whitney–Wilcoxon test | Siegel–Tukey test |

|---|---|---|

Statistical equality betw. tr.? | Statistical equality betw. tr.? | |

Inflation | No*** (0.0001) | No* (0.0566) |

Output gap | No*** (0.0010) | No* (0.0879) |

Interest rate | No*** (0.0001) | No** (0.0118) |

1.2 Pairwise comparison: band versus point IT with high variance of shocks

Macro. outcomes | Mann–Whitney–Wilcoxon test | Siegel–Tukey test |

|---|---|---|

Statistical equality betw. tr.? | Statistical equality betw. tr.? | |

Inflation | Yes (0.8583) | Yes (0.6785) |

Output gap | Yes (0.9958) | Yes (0.7709) |

Interest rate | Yes (0.8914) | Yes (0.5868) |

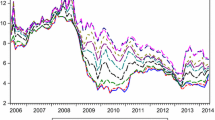

Appendix 4: Inflation and inflation expectations series across sessions by treatment

Appendix 5: Instructions

We present a translation from French to English of the instructions for inflation point targeting treatments. Instructions for other treatments are available from the authors upon request.

General information

Thank you for your participation to this economic experiment in which you can earn money. Your earnings will depend on both your actions and those of the other participants and will be paid in cash at the end of the experiment. From now until the end of the experiment, you are not allowed to communicate with each other. If you have any question, please raise your hand and we will come to you.

You are a group of 6 participants. The rules are the same for all participants. The experiment consists of 60 periods. Your role is to predict future values of a given economic variable. Your earnings will depend on the accuracy of your predictions. At each of the 60 periods, the economy will be characterized by the following variables: the inflation rate, the output gap, the interest rate, and the inflation target of the central bank.

Information about economic variables

To better understand the economic variables that you will use to make your decisions, we explain these variables as follows.

Inflation is defined as the generalized rise in prices in the economy. Inflation will depend in each period on agents’ average inflation forecasts in the economy (that is, both your forecast and the forecasts of the 5 other participants), on the output gap, as well as on a random shock affecting the economy.

The output gap describes the gap between the current output and the potential output (that is, the level of output the economy can achieve by using the maximum of its productive capacity). If the output gap is positive, the economy is producing beyond its potential level. Conversely, if the output gap is negative, the economy is producing below its potential level. The output gap also depends in each period on the agents’ average inflation forecasts (your prediction and the predictions of the 5 other participants), the lagged output gap, the interest rate as well as a random shock affecting the economy.

The interest rate is defined as the price of borrowing money for a period, and is set by the central bank of the economy. The interest rate mainly depends on inflation (and therefore indirectly on inflation forecasts), the output gap and the inflation target of the central bank.

The inflation target is clearly announced to all participants by the central bank in the form of a numerical target of 5% with a tolerance interval of ±1% around the target. The announcement of the inflation target reflects the central bank’s determination to guide current inflation towards its numerical target. So the central bank commits to reach its inflation target of 5%. However, given the various random shocks affecting the economy, the central bank allows itself a margin error of ±1% around its target. The inflation target then corresponds to a commitment of the central bank which has to ensure (via the interest rate) that inflation in the economy will converge towards this target.

The central bank has two goals: one primary, and the other secondary.

The primary goal the most important is for the central bank to stabilize inflation that is, to make as quickly as possible actual inflation converge towards its numerical target of 5%. The central bank uses the interest rate to stabilize inflation. Positive and significant deviations of actual inflation from the target (that is, actual inflation is not equal to the numerical target of 5%, and is above the upper band of the tolerance interval of 6%), force the central bank to increase the interest rate in order to lead actual inflation towards its target. By contrast, when the central bank notes that inflation is too low compared to its inflation target (that is, actual inflation is not equal to the numerical target of 5%, and is below the lower band of the tolerance interval of 4%) and penalizes the economic activity, it reduces the interest rate.

The secondary goal consists for the central bank in stabilizing the output gap that is, the gap between the current and potential output of the economy, by also using the interest rate. When the output gap is positive, the central bank tends to increase the interest rate, and when it is negative, the central bank tends to reduce the interest rate.

All these variables can be relevant for your inflation forecasts, but it is up to you to use them in your convenience to decide on your inflation expectations. The actual values of the different variables largely depend on your inflation forecasts and those of the others, but also on random shocks affecting the economy.

At the beginning of the experiment and before entering your inflation forecast for the first period in the computer, you observe on the screen initial values of the main economic variables (inflation, output gap and interest rate) at period 0. As stated earlier, the central bank implements an inflation targeting strategy by announcing to all participants its numerical target of 5% with tolerance interval of ±1%. By this announcement, the central bank commits to lead actual inflation towards its inflation target within a maximum of two periods. So you observe the central bank’s target within its tolerance interval. This target remains unchanged throughout the duration of the experiment. Based on these variables, you have to forecast inflation for the next period.

Once you have made your decision, a period ends and a new period starts where you observe the past and actual values of inflation, the output gap, the interest rate, and your inflation forecast made in the previous period. However, you do not observe the expectations of other participants in your group (you just indirectly observe them through actual inflation). All you observe in terms of expectations is your own time series forecasts. As time goes on, you get a large number of observations that allows you to evaluate the accuracy of your forecasts compared to actual values of inflation, as well as the inflation target of the central bank.

Information about your role in the economy

Throughout the 60 periods of the experiment, your role as an agent of the economy is simple. You have to forecast the actual value of future inflation. In other words, you have to predict in each period, the inflation that will prevail in the next period based on all information available to you when making your decision. You must then enter in the computer your inflation forecast. Suppose that on your computer screen, you observe at period 2, actual inflation. This observed inflation is not based on the forecasts that you and the other participants of your group have made at period 2, but the predictions you made in the previous period that is, those made in period 1 for period 2.

By choosing your inflation forecast, you seek to maximize your earnings. Your gain in each period depends on the accuracy of your inflation forecast relative to actual (realized) inflation. More specifically, your gain is given by:

where \(f=\mid \text {Inflation}-\text {Your forecast}\mid \). ‘Inflation’ indicates actual inflation, ‘Your forecast’ defines your inflation forecast made at previous period for the next, f indicates in absolute value your forecasting error, and finally ‘ECU’ indicates the Experimental Currency Unit. The profit function above means that you get money every time your forecasting error is less than 3%. The smaller your forecasting error, the higher your payoff. For instance if f \(=\) 0, you receive the maximum payoff of 120 units \((160/(1+0)-40)\). If your forecasting error is of 1.5%, you receive 24 units \((160/(1+1.5)-40)\). Otherwise if your forecasting error is of 3% or higher, then you receive 0 unit \((160/ (1+3) - 40)\). You can only choose your inflation forecasts within the interval [3, 16]. You can only choose whole numbers or numbers with one decimal digit (for instance, 5, 8.5, 4.6, etc). In addition, when making your decisions, you have to enter only numbers without the “%” symbol.

Once you have entered your decision in the computer, click on the ‘Submit’ button. Once all participants have done the same, the period ends and the profit for this period is written on the computer screen. Then, the next period starts. Once all the 60 periods are completed, the experiment ends. At each of the 60 periods of the experiment, at the top of each screen and on a graph, you can observe the entire history of economic variables as well as your earnings. You can then check at each period if your inflation forecast made in the previous period corresponds to actual inflation, and also whether it corresponds or converges towards the inflation target of the central bank. You will get informed about your gains period by period, and at the end of the experiment, your earnings will be added and will be paid in cash converted at the exchange rate of €1 \(=\) 520 ECU. Note that you do not get money in the first period of the experiment because you will not have made any forecast for this period 1. So your potential gains start at period 2 of the experiment, because you will have made forecasts at period 1 for this period 2.

Questionnaire

At the beginning of the experiment, we ask you to fill out a questionnaire to make sure that you understand instructions. When all participants have correctly answered the questionnaire, the experiment will begin. At the end of the experiment, we ask you to complete a personal questionnaire on the computer. All requested information will remain strictly confidential and is used for the sole purpose of research.

If you have any questions, please ask them now!

Thank you for your participation!

Appendix 6: Examples of screens

We provide examples of screens (first screen: band IT; second screen: point IT).

Appendix 7: Formation of individual inflation expectations

Agents’ expectations influence macroeconomic outcomes. Following the LtFE literature that emphasizes expectation heterogeneity, we study the formation of individual inflation expectations owing to the collected times series data for all subjects. This allows us to evaluate the impact of point versus band IT regimes on subjects’ expectation formation process.

Following Pfajfar and Zakelj (2013, 2014), Assenza et al. (2013), and Cornand and M’baye (2016), we consider the main expectations formation models supported in the literature in order to find the best fit of each subject’s expectation series. We assume that subjects behave like econometricians and select both the given rule and its parameters to forecast inflation. We do not include exogenous shocks in the given expectation models, because they were not directly observable in the experiment.Footnote 28 The methodology we apply here is the following: for each subject of each session (each including 4 treatments), we estimate the coefficient(s) of interest of the given expectation model by performing the OLS techniques. Then and conditional on the significance of the estimated parameter(s), we compute for each treatment the percentage of subjects using such and such forecasting rule. Table 2 below presents the conclusions of our regressions.

1.1 Prediction models

Naive expectations model

where \(\pi _{t+1/t}^{i}\) denotes subject i’s (where i \(=\) 1, 2, \(\ldots \), 96) inflation expectation made at time t for \(t+1\), \(\pi _{t-1}\) represents the past period inflation rate, and \(\alpha _{0}\) and \(\alpha _{1}\) are the estimating parameters. This forecasting rule implies that agents form their expectations for the next period conditional on the past period inflation rate.

AR(1) expectations model

where \(\pi _{t+1/t}^{i}\) denotes subject i’s inflation expectation made at time t for \(t+1\), \(\pi _{t/t-1}^{i}\) represents its past period forecast, and \(\beta _{0}\) and \(\beta _{1}\) are the estimating parameters. Following this forecasting rule, agents form their next period expectations by only taking into account their former inflation forecasts.

Trend extrapolation model

where \(\gamma _{0}\) and \(\gamma _{1}\) are the estimating parameters. In this case, agents form their inflation expectations based on past inflation and on the trend of past inflation.

Adaptive expectations model

where \(\eta \ge 0\) is the constant gain parameter. Agents revise their expectations based on the observed errors.

1.2 Econometric results

Table 2 presents for each treatment the percentage of subjects using the given expectations model.

The relevance of subjects’ forecasting rule depends on the considered treatment. We find that Treatment 1 (band targeting with small shocks) is the one which has the highest proportion (87.5%) of subjects that use the naive expectations model (M1) to forecast inflation, while Treatment 2 (point targeting with small shocks) is associated with the lowest proportion (66.67%) of subjects that use this forecasting rule to form their expectations. We also explore whether the behavior of individual inflation expectations among treatments is consistent with the AR(1) model. We find that most subjects do not really use this forecasting rule to predict inflation. Finally, we find that both trend extrapolation (M3) and adaptive expectations (M4) prediction rules play an important role in the dynamics of inflation expectations formation as all subjects in each treatment use on average these models to forecast inflation. Treatments 2 and 3 are associated with the highest proportion (87.5%) of subjects using M3, while Treatments 1, 2 and 4 are associated with the highest proportion of subjects using adaptive learning rule to predict inflation. These results are consistent with those of Assenza et al. (2013), Pfajfar and Zakelj (2014), and Cornand and M’baye (2016) who find that subjects most use M3 and M4 to form their expectations. Moreover, we find that for the trend extrapolation model, the significant coefficient \(\gamma _{1}\) is below 0 for a large proportion of subjects in all treatments, which suggests that on average and in all treatments, subjects using this rule expect that the upward (downward) movements in inflation in the current period will be followed by the downward (upward) movements in the next period.Footnote 29

We finally look for the prediction model that best explains the formation of average inflation expectations within each treatment. To do so, for each session of each treatment, we consider average inflation expectations and look at all prediction models to select the one that yields the highest adjusted \(R^{2}\). After doing so, we select the most relevant forecasting rule for a whole treatment. We find that the trend extrapolation rule appears to be the forecasting model which best explains the formation of average inflation expectations in all treatments.

Rights and permissions

About this article

Cite this article

Cornand, C., M’baye, C.K. Band or point inflation targeting? An experimental approach. J Econ Interact Coord 13, 283–309 (2018). https://doi.org/10.1007/s11403-016-0183-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11403-016-0183-y

Keywords

- Band inflation target

- Point inflation target

- Inflation expectations

- Monetary policy

- New Keynesian model

- Macroeconomic shocks

- Laboratory experiments