Abstract

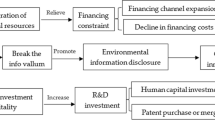

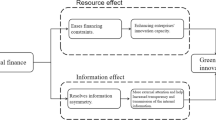

The digital finance created by technological empowerment has a significant impact on the inventive behavior of micro-enterprises. This paper uses a correlation analysis that combines the fixed effect model (FE) and the panel threshold model (PTM) to evaluate the impact of digital financing on the quantity and quality of innovation in green technology. In addition, its process is dissected in this work with respect to resource limitations and financial expenditures. The empirical evidence demonstrates that the use of digital financing considerably increases both the rate and quality of innovation in environmentally friendly technologies. Further, the effect of user engagement on green innovation is dynamically overlaid and accumulates over time, as opposed to the coverage of digital finance and digital services. In terms of ownership, growth cycle, and company size, digital finance may assist remedy the misallocation of financial resources and further drive inclusive green innovation. Based on the examination of underlying mechanisms, it is clear that digital finance may play a significant role in fostering innovation in environmentally friendly technologies by easing financial limitations and decreasing associated costs. Depending on the context, “quantitative change before qualitative change” describes the dynamic development process of green innovation fueled by digital finance. This paper proposes that the combination of technological innovation and digital financial services should focus on establishing an inclusive digital financial service system, fostering diverse financial forms, and enhancing the market environment for digital financial services.

Similar content being viewed by others

Data Availability

Not applicable.

References

Chen S, Chen D (2018) Smog pollution, government governance and high-quality economic development. Econ Res 53:20–34.

Chen XX, Chen BF (2022) Research on the spatial correlation between financial agglomeration and industrial green innovation efficiency. Indust Technol Econ 41(08):77–82. https://doi.org/10.3969/j.issn.1004-910x.2022.08.010

Chen Z, Zhang Y, Wang H, Ouyang X, Xie Y (2022) Can green credit policy promote low-carbon technology innovation? J Clean Prod 359:132061

Chen LX, Yang J (2022) Does the allocation of corporate financial assets inhibit green technological innovation?. Financial Development Research (07):15–23. https://doi.org/10.19647/j.cnki.37-1462/F.2022.07.002

Cheng QW, Lu SY (2022) Economic policy uncertainty, environmental control and green innovation. East China Economic Management 36(11):44–53. 10.19629/J. CNKI.34–1014/F.24011.201001010005

Du J, Sun Y (2021) The nonlinear impact of fiscal decentralization on carbon emissions: from the perspective of biased technological progress. Environ Sci Pollut Res 28:29890–29899

Du M, Hou Y, Zhou Q, Ren S (2022) Going green in China: how does digital finance affect environmental pollution? Mechanism discussion and empirical test. Environ Sci Pollut Res 29(60):89996–90010

Durai T, Stella G (2019) Digital finance and its impact on financial inclusion. J Emerg Technol Innov Res 6(1):122–127

Fang H, Huo Q, Hatim K (2023) Can digital services trade liberalization improve the quality of green innovation of enterprises? Evid China Sustain 15(8):6674

Feng S, Chong Y, Li G, Zhang S (2022a) Digital finance and innovation inequality: evidence from green technological innovation in China. Environ Sci Pollut Res 29(58):87884–87900

Feng S, Zhang R, Li G (2022b) Environmental decentralization, digital finance and green technology innovation. Struct Chang Econ Dyn 61:70–83

Fu L, Yi Y, Wu T, Cheng R, Zhang Z (2023) Do carbon emission trading scheme policies induce green technology innovation? New evidence from provincial green patents in China. Environ Sci Pollut Res 30(5):13342–13358

Gomber P, Kauffman RJ, Parker C, Weber BW (2018) On the fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. J Manag Inf Syst 35(1):220–265. https://doi.org/10.1080/07421222.2018.1440766

Gong M, You Z, Wang L, Cheng J (2020) Environmental regulation, trade comparative advantage, and the manufacturing industry’s green transformation and upgrading. Int J Environ Res Public Health 17(8):2823

Gu HF, Gao SW (2022) Research on the impact of digital financial development on green innovation of enterprises. Statistics and Information Forum:1–17. http://KNS.cnki.net/kcms/detail/61.1421.c.20220930.1146.014.html

Guo J (2019) The influence of environmental regulation on green technology innovation-China evidence of “Porter effect.” Finance and Trade Econ 40(03):147–160. https://doi.org/10.3969/J.ISSN.1002-8102.2019.03

Guo F, Wang J, Wang F, Kong T, Zhang XUN, Cheng ZJEQ (2020) Measuring the development of digital inclusive finance in China: index compilation and spatial characteristics. China Econ Q 19(4):1401–1418. https://doi.org/10.13821/j.cnki.cece

Haider H (2018) Innovative financial technologies to support livelihoods and economic outcomes, K4D Helpdesk Report. Brighton, UK: Institute of Development Studies. https://opendocs.ids.ac.uk/opendocs/handle/20.500.12413/13942

Hao J, He F (2022) Corporate social responsibility (CSR) performance and green innovation: evidence from China. Financ Res Lett 48:102889

Hu Y, Dai X, Zhao L (2022) Digital finance, environmental regulation, and green technology innovation: an Empirical Study of 278 Cities in China. Sustainability 14(14):8652

Huang YP (2018) Can China’s digital finance continue to lead? Tsinghua Financial Review (11):35–36. https://doi.org/10.19409/j.cnki.thf-review.2018.11.007

Jiakui C, Abbas J, Najam H, Liu J, Abbas J (2023) Green technological innovation, green finance, and financial development and their role in green total factor productivity: Empirical insights from China. J Clean Prod 382:135131

Jin H, Yu LH, Xu YB (2022) Green industrial policy and green technological innovation in manufacturing. China Popul Res Environ 32(06):136–146. https://doi.org/10.12062/cpre.20220429

Lee I, Shin YJ (2018) Fintech: Ecosystem, business models, investment decisions, and challenges. Bus Horiz 61(1):35–46. https://doi.org/10.1016/j.bushor.2017.09.003

Lee CC, Li X, Yu CH, Zhao J (2021) Does fintech innovation improve bank efficiency? Evidence from China’s banking industry. Int Rev Econ Financ 74:468–483

Li WJ (2016) Zheng MN (2016) Substantive innovation or strategic innovation? —the impact of macro-industrial policies on micro-enterprise innovation. Econ Res 51(04):60–73

Li Z, Wang J (2022) The dynamic impact of digital economy on carbon emission reduction: evidence city-level empirical data in China. J Clean Prod 351:131570

Li HL, Zhu XH, Chen JY, Jiang FT (2019) Environmental regulations, environmental governance efficiency and the green transformation of China’s iron and steel enterprises. Ecol Econ 165:106397

Li X, Shao X, Chang T, Albu LL (2022) Does digital finance promote the green innovation of China’s listed companies? Energy Economics 114:106254. https://doi.org/10.1016/j.eneco.2022.106254

Lin B, Ma R (2022) How does digital finance influence green technology innovation in China? Evidence from the financing constraints perspective. J Environ Manage 320:115833

Ling S, Han G, An D, Hunter WC, Li H (2020) The impact of green credit policy on technological innovation of firms in pollution-intensive industries: evidence from China. Sustainability 12(11):4493

Liu Z (2019) Building a modern economic system: basic framework, key issues, and theoretical innovation. China Political Economy 2(1):73–84

Liu BL (2022) Sun PB (2022) How does the national financial reform pilot area affect the carbon productivity? Economics Trends 09:71–90

Liu Y, Chen L (2022) The impact of digital finance on green innovation: resource effect and information effect. Environ Sci Pollut Res 29(57):86771–86795

Liu ML, Huang Xu, Sun J (2022) The influence mechanism of digital finance on green development. China Popul Res Environ 32(06):113–122

Lv C, Shao C, Lee CC (2021) Green technology innovation and financial development: do environmental regulation and innovation output matter? Energy Economics 98:105237. https://doi.org/10.1016/j.eneco.2021.105237

Ma J, Hu Q, Shen W, Wei X (2021) Does the low-carbon city pilot policy promote green technology innovation? Based on green patent data of Chinese A-share listed companies. Int J Environ Res Public Health 18(7):3695. https://doi.org/10.3390/ijerph18073695

Meng F, Zhang W (2022) Digital finance and regional green innovation: evidence from Chinese cities. Environ Sci Pollut Res 29(59):89498–89521

Norden L, Buston CS, Wagner W (2014) Financial innovation and bank behavior: evidence from credit markets. J Econ Dyn Control 43:130–145. https://doi.org/10.1016/j.jedc.2014.01.015

Ozili PK (2018) Impact of digital finance on financial inclusion and stability. Borsa Istanbul Rev 18(4):329–340

Qi S, Lin S, Cui J (2018) Can environmental rights trading market induce green innovation?—evidence based on green patent data of listed companies in China. Econ Res 53:129–143

Qiao B, Zhao GT, Shen SH (2022) Can digital inclusive finance promote green innovation of enterprises. South Financ 1:14–27

Shao W, Yin Y, Bai X, Taghizadeh-Hesary F (2021) Analysis of the upgrading effect of the industrial structure of environmental regulation: evidence from 113 cities in China. Front Environ Sci 9:692478. https://doi.org/10.3389/fenvs.2021.692478

Shao S, Zhang K, Dou JM (2019) Energy saving and emission reduction effect of economic agglomeration: theory and China’s experience. Management World. 35(01):36–60+226. https://doi.org/10.19744/j.cnki.11-1235/f.26.

Shofawati A (2019) The role of digital finance to strengthen financial inclusion and the growth of SME in Indonesia. KnE Soc Sci 389–407

Siping J, Wendai L, Liu M, Xiangjun Y, Hongjuan Y, Yongming C, Haiyun C, Hayat T, Alsaedi A, Ahmad B (2019) Decoupling environmental pressures from economic growth based on emissions monetization: case in Yunnan, China. J Clean Prod 208:1563–1576

Sun H, Edziah BK, Sun C, Kporsu AK (2019) Institutional quality, green innovation and energy efficiency. Energy Policy 135:111002

Tan GKS (2022) The ‘fintech revolution’ is here! The disruptive impact of fintech on retail financial practices. Finance and Society 8(2):129–148

Tan CC, Wang Z, Zhou P (2022) Financial technology “empowerment” and green innovation of enterprises-based on the perspective of credit allocation and supervision. Financial Research:1–18. https://doi.org/10.16538/j.cnki.jfe.20519.101.100000000005

Tang S (2019) The 70-year historical track, practical logic and basic strategy of the new China financial reform-promoting the financial supply-side reform in the new era and building a modern financial system of a powerful country. Research on Financial Economics 34(06):3–16

Tang X, Ding S, Gao X, Zhao T (2022) Can digital finance help increase the value of strategic emerging enterprises? Sustain Cities Soc 81:103829

Tang S, Wu XC, Zhu J (2020) Digital finance and technological innovation of enterprises-structural characteristics, mechanism identification and effect difference under financial supervision. Management World 36(05):52–66+9. https://doi.org/10.19744/j.cnki.11-11

Tian C, Xiao LM (2021) Will green credit promote technological innovation in heavy polluting enterprises? A quasi-natural experiment based on the green credit guidelines. Chin J Environ Manag 13:90–97. https://doi.org/10.16868/j.cnki.1674-6252.2021.06.090

Wang FZ, Jiang T (2015) The impact of environmental regulation on green technology innovation in resource-based industries-from the perspective of industry heterogeneity. Research on Financial Issues 08:17–23. https://doi.org/10.3969/j.issn.1000-176x.2015.08

Wang YZ, Luo NS, Liu WB (2019) What kind of leverage ratio is conducive to enterprise innovation. China Indust. Econ 372:138–155. https://doi.org/10.19581/j.cnki.ciejournal.2019.03.018

Wang YL, Zhou YL (2022) Green financial development and enterprise innovation. Financial Res:1–15. https://doi.org/10.16538/J.CNKI.jfe.20615.101.100010000005

Xia S, You D, Tang Z, Yang B (2021) Analysis of the spatial effect of fiscal decentralization and environmental decentralization on carbon emissions under the pressure of officials’ promotion. Energies 14(7):1878

Xiao HJ, Yang Z, Ling HC (2022) Does CSR have green innovation effect. Economics Trends 08:117–132

Yu D, Yang L (2021) Research on the impact of digital finance on enterprise green innovation: from the perspective of regional heterogeneity. J Credit Reference 39(10):72–79

Yuan G, Ye Q, Sun Y (2021) Financial innovation, information screening and industries’ green innovation—industry-level evidence from the OECD. Technol Forecast Soc Chang 171:120998

Zhang X, Wan G, Zhang J, He Z (2019) Digital economy, inclusive finance and inclusive growth. Econ Res 54(08):71–86

Zhang L, Saydaliev HB, Ma X (2022a) Does green finance investment and technological innovation improve renewable energy efficiency and sustainable development goals. Renewable Energy 193:991–1000

Zhang S, Wu Z, He Y, Hao Y (2022b) How does the green credit policy affect the technological innovation of enterprises? Evid China Energy Econ 113:106236

Zhang KZ, Wang J, Cui XY (2011) Fiscal decentralization and environmental pollution: the perspective of carbon emission. China Industrial Economy (10):65–75. https://doi.org/10.19581/j.cnki.ciejournal.2011.10.007

Zhao X, Ding X, Li L (2021) Research on environmental regulation, technological innovation and green transformation of manufacturing industry in the Yangtze River Economic Belt. Sustainability 13(18):10005

Zhu Y, Sun Z, Zhang S, Wang X (2021) Economic policy uncertainty, environmental regulation, and green innovation—an empirical study based on Chinese high-tech enterprises. Int J Environ Res Public Health 18(18):9503

Author information

Authors and Affiliations

Contributions

YC: conceptualization, investigation, methodology, formal analysis, visualization, and writing the original whole paper.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Cai, Y. Green innovations and environmentally friendly technologies: examining the role of digital finance on green technology innovation. Environ Sci Pollut Res 30, 124078–124092 (2023). https://doi.org/10.1007/s11356-023-31094-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-31094-3