Abstract

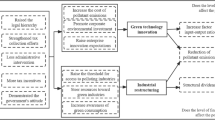

Environmental tax policy plays an important role in promoting economic efficiency, but it is unclear whether the taxation is well-designed and effective. The differentiated environmental tax and fee policy in China has come a long way in the past 20 years, along with the aim of high-quality economic development that focuses on the harmony of environment and productivity, so it is necessary to evaluate the effectiveness of the differentiated environmental tax and fee policy. This paper constructs a pollution and environmental tax model based on the new economic geography framework to simulate the effect of environmental tax and technological innovation in the eastern and western region on pollution, output, and productivity. Using China’s provincial panel data from 2005 to 2020 with difference-in-difference method, empirical evidence shows that differentiated environmental tax and fee adjustments generally boost industrial high-quality development by the industrial sulfur dioxide emission deduction and green total factor productivity improvement. When the adjustment is more differentiated between treatment and control, the effect is greater and more significant. Additionally, high environmental tax standard in high SO2 emission provinces significantly contributes to high-quality development. Progressive adjustments in 2007, 2014, and 2018 lead to heterogeneous policy effect. Technological innovation plays a mediating effect between differentiated environmental tax and high-quality economic development. The results above provide theoretical analysis and empirical study of China’s differentiated environmental taxes and high-quality economic development for policy making.

Similar content being viewed by others

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

Notes

The data is calculated from the Annual Report on Environment Statistics and Annual Report of Ecology and Environment Statistics.

The meaning of environmental taxes varies across countries. The environmental tax system levied in China in 2018 contains consumption tax, resource tax, vehicle and vessel tax, farmland tax, construction tax, and sewage charge (environmental tax), which is called “quasi-environmental tax” (Liu & An, 2018). Environmental taxes in the USA include energy (e.g., fuel tax), environment (e.g., ozone depletion tax), transportation (e.g., motor vehicle tax), and pollution (e.g., waste disposal tax), and in Germany include energy (e.g., electricity tax), pollution (e.g., wastewater pollution tax), and transportation (e.g., aviation tax).

Before 2005, China implemented a low and relatively uniform sewage charge standard. For instance, in 2003, cities such as Hangzhou, Changchun, and Zhengzhou levied sewage charge higher than 0.2 RMB per pollution equivalent for SO2, but differentiated charges within the whole nation have not been implemented.

The ranking of provinces along the x axis is firstly increasingly sorted by the environmental tax standards, then further increasingly sorted by the average industrial SO2 emission as environmental tax is equal across provinces.

In other words, a manufacture needs to transport \(\tau\) unit of industrial goods to supply one unit of industrial goods to the other region.

For convenience, the western variables are labeled with superscript asterisk and the overall variables are labeled with superscript \(w\). To avoid comparative advantage, let \(L/{L}^{*}=K/{K}^{*}\).

Obviously, \(\frac{d\gamma }{dt}<0\) and \(\frac{d{\gamma }^{*}}{d{t}^{*}}<0\), i.e., in the case that the environmental taxes stimulate technological innovation, the higher the environmental tax rate is, the lower the emission intensity would be.

\(\mu\) is the consumption share of industrial product \((0<\mu <1)\); \(1-\mu\) is the consumption share of agricultural product.

\(\sigma (\sigma >1)\) is the elasticity of substitution between any two industrial goods.

Among the function, \(\pi\) and \({\pi }^{*}\) denotes capital revenue, \(x\) and \({x}^{*}\) is the output, respectively, and \(\alpha\) is marginal labor input.

For convenience, let \(\Delta =n+{n}^{*}\phi\), \({\Delta }^{*}=n\phi +{n}^{*}\).

The eastern demand for industrial goods produced in the western region is \({c}_{2}^{*}=\mu {\text{y}}{P}_{M}^{\sigma -1}{({p}_{2}^{*})}^{-\sigma }\). The western demand for industrial goods produced in the eastern region is \({c}_{1}^{*}=\mu {\text{y}}^{*}{\left({P}_{M}^{*}\right)}^{\sigma -1}{\left({p}_{1}^{*}\right)}^{-\sigma }\).

Actually, the values of \({\gamma }_{0}\) and \({\gamma }_{0}^{*}\) can be arbitrary. The values chosen in this paper attempt to reach a maximum bearable SO2 emission level for the economy.

For convenience, the sewage charges and environmental taxes are jointly referred to as environmental protection taxes and fees.

Before 2005, China implemented a low and relatively uniform sewage charges standard. For instance, in 2003, cities such as Hangzhou, Changchun and Zhengzhou levied sewage charge higher than 0.2 RMB per pollution equivalent for SO2, but differentiated charges within the whole nation haven’t been implemented.

The gross industrial output \(\mathrm{lnind}\) represents the expected output; the industrial SO2 emission \({\mathrm{lnso}}_{2}\) represents the non-expected output; the input variables are annual average workers employed by industrial companies above the scale (\(\mathrm{lnlabor}\)), capital stock (\(\mathrm{ln}K\)), and total regional energy consumption (\(\mathrm{lnenergy}\)). Capital stock is obtained by fixed asset investment of the whole society with perpetual inventory method, and the initial capital stock is obtained by dividing the social fixed asset investment in the initial period by annual average growth rate of the study period, and the depreciation rate is 9.6% (Zhang et al. 2004).

We assume that local government determines environmental tax standard based on the past industrial SO2 pollution, so the average SO2 emissions are calculated by provinces from 2016 to 2018.

References

Acemoglu D, Aghion P, Bursztyn L et al (2012) The environment and directed technical change. Am Econ Rev 102(1):131–166

Aldy JE (2017) Frameworks for evaluating policy approaches to address the competitiveness concerns of mitigating greenhouse gas emissions. Natl Tax J 70(2):395–420. https://doi.org/10.17310/ntj.2017.2.06

Autor DH (2003) Outsourcing at will: the contribution of unjust dismissal doctrine to the growth of employment outsourcing. J Law Econ 21(1):1–42

Aydin Celil, Ömer E (2018) Reducing CO2 emissions in the EU member states: do environmental taxes work? J Environ Plan Manag 61(13):2396–2420. https://doi.org/10.1080/09640568.2017.1395731

Cai X, Lu Y, Wu M, Yu L (2016) Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China. J Dev Econ 123(1):73–85

Chen S, Zhang J, Liu C (2021) Environmental regulation, financing constraints and corporate pollution reduction: evidence from emission fees standard adjustment. Financ Res 09:51–71 (in Chinese)

Chen Li, Fang Y, Song C (2023) Corporate green innovation behavior and investment efficiency: evidence from China. Appl Econ 5:1–15. https://doi.org/10.1080/00036846.2023.2210828

Chiroleu-Assouline M, Mouez F (2014) From regressive pollution taxes to progressive environmental tax reforms. Eur Econ Rev 69:126–42. https://doi.org/10.1016/j.euroecorev.2013.12.006

Christiansen V, Smith S (2015) Emissions taxes and abatement regulation under uncertainty. Environ Resour Econ 60(1):17–35. https://doi.org/10.1007/s10640-013-9755-7

Dixit AK, Stiglitz JE (1977) Monopolistic competition and optimum product diversity. Am Econ Rev 67(3):297–308. http://www.jstor.org/stable/1831401. Accessed 23 June 2023

Du Jun, Liu X, Zhou Y (2014) State advances and private retreats? — evidence of aggregate productivity decomposition in China. China Econ Rev 31(12):459–74. https://doi.org/10.1016/j.chieco.2014.03.002

Fan H, Zivin J, Kou K et al (2019) Going green in China: firms’ responses to stricter environmental regulations. NBER Working Paper, Cambridge, MA. https://doi.org/10.3386/w26540

Forslid R, Ottaviano G (2003) An analytically solvable core-periphery model. J Econ Geogr 3(3):229–240

Gao P, Yuan F, Hu H, Liu X (2020) Motivation, mechanism and governance in high-quality development. Econ Res 55(04):4–19 (in Chinese)

Gibson M (2019) Regulation-induced pollution substitution. Rev Econ Stat 101(5):827–840

Gong M, Ning Z (2023) Drivers of China’s high-quality development: the role of intangible factors. Econ Model 124:106294. https://doi.org/10.1016/j.econmod.2023.106294

Guo J, Huang R (2022) A carbon tax or a subsidy? Policy choice when a green firm competes with a high carbon emitter. Environ Sci Pollut Res 29(9):12845–52. https://doi.org/10.1007/s11356-020-12324-4

Huang S, Lin H, Zhou Y et al (2022) The influence of the policy of replacing environmental protection fees with taxes on enterprise green innovation—evidence from China’s heavily polluting industries. Sustainability 1411:6850. https://doi.org/10.3390/su14116850

Jaimes R (2022) Does idiosyncratic risk matter for climate policy? Environ Dev Econ 11:1–15. https://doi.org/10.1017/S1355770X22000328

Johnstone N, Managi S, Rodriguez M et al (2017) Environmental policy design, innovation and efficiency gains in electricity generation. Energy Econ 63:106–115

Karmaker SC et al (2021) The role of environmental taxes on technological innovation. Energy 232(10):121052. https://doi.org/10.1016/j.energy.2021.121052

Kemp R, Pontoglio S (2011) The innovation effects of environmental policy instruments: a typical case of the blind menand the elephant. Ecol Econ 72:28–36

Leeuwen G, Mohnen P (2017) Revisiting the Porter hypothesis: an empirical analysis of green innovation for the Netherlands. Econ Innov New Technol 26(12):63–77

León-Ledesma MA et al (2010) Identifying the elasticity of substitution with biased technical change. Am Econ Rev 100(4): 1330–57. https://doi.org/10.1257/aer.100.4.1330

Li D, Shang C (2022) When does environmental innovation crowd out process innovation? A dynamic analysis. Manag Decis Econ 43(6):2275–2283. https://doi.org/10.1002/mde.3524

Lin C, Kong F (2016) Technological innovation, imitation innovation and technology introduction and industrial structure transformation and upgrading—a study based on dynamic spatial Durbin model. Macroecon Res 05:106–118 (in Chinese)

Luppi B et al (2012) The rise and fall of the polluter-pays principle in developing countries. Int Rev Law Econ 32(1):135–144. https://doi.org/10.1016/j.irle.2011.10.002

Ma C, Zhou Y (2015) Complementary environmental taxes, technological progress and SO2 governance: an analysis based on the new economic geography. Nankai Econ Res 02:118–135 (in Chinese)

Maung M, Wilson C, Tang X (2016) Political connections and industrial pollution: evidence based on state ownership and environmental levies in China. J Bus Ethics 138(4):649–659

Nie P-Y, Chan W, Yang Y-C (2017) Comparison of energy efficiency subsidies under market power. Energy Policy 110(11):144–49. https://doi.org/10.1016/j.enpol.2017.07.053

Pang A, Shaw D (2011) Optimal emission tax with pre-existing distortions. Environ Econ Policy Stud 13(2):79–88

Patuelli R, Nijkamp P, Pels E (2005) Environmental tax reform and the double dividend: a meta-analytical performance assessment. Ecol Econ 55(4):564–583

Pearce D (1991) The role of carbon taxes in adjusting to global warming. Econ J 101(407):938–948

Pigou AC (1933) The economics of welfare. Econ J 43(170):329. https://doi.org/10.2307/2224491

Porter ME, Van der Linde C (1995) Toward a new conception of the environment-competitiveness relationship. J Econ Perspect 9(4):97–118

Schwartz J, Repetto R (2000) Nonseparable utility and the double dividend debate: reconsidering the tax interaction effect. Environ Resour Econ 15:149–157

Spinesi L (2022) The environmental tax: effects on inequality and growth. Environ Resour Econ 82(3):529–572. https://doi.org/10.1007/s10640-022-00662-5

Tang W, Yang X (2023) Is environmental tax legislation effective for pollution abatement in emerging economies? Evidence from China. Front Environ Sci 10(1):1113383. https://doi.org/10.3389/fenvs.2022.1113383

Wang H, Cai L, Zeng Wei (2011) Research on the evolutionary game of environmental pollution in system dynamics model. J Exp Theor Artif Intell 23(1):39–50. https://doi.org/10.1080/0952813X.2010.506300

Ye J, An H (2017) Can the introduction of environmental protection tax effectively decrease air pollution. China Ind Econ 05:54–74 (in Chinese)

Zhai X, An Y (2020) Analyzing influencing factors of green transformation in China’s manufacturing industry under environmental regulation: a structural equation model. J Clean Prod 251(4):119760. https://doi.org/10.1016/j.jclepro.2019.119760

Zhang J, Wu G, Zhang J (2004) Provincial capital stock estimation in China: 1952–2000. Econ Res 10:35–44 (in Chinese)

Zhang N, Choi Y (2014) A note on the evolution of directional distance function and its development in energy and environmental studies 1997–2013. Renew Sustain Energy Rev 33:50–59

Zhang Q, Song Y, Li M, Zheng B (2020) Anthropogenic emissions of SO2, NOX, and NH3 in China. In Atmospheric reactive nitrogen in China 13–40. Singapore: Springer Singapore. https://doi.org/10.1007/978-981-13-8514-8_2

Zhang Z et al (2021) Why sulfur dioxide emissions decline significantly from coal-fired power plants in China? Evidence from the desulfurated electricity pricing premium program. Energy Policy 148:111996. https://doi.org/10.1016/j.enpol.2020.111996

Zhang Y, Song Y, Zou H (2020) Transformation of pollution control and green development: evidence from China’s chemical industry. J Environ Manage 275(11):111246. https://doi.org/10.1016/j.jenvman.2020.111246

Zhou Y, Huang J (2022) Environmental regulation, technological innovation and high-quality development of industrial economy—an analysis of dynamic spatial SAR model based on Chinese prefecture-level cities. Soft Sci 36(11):38–48 (in Chinese)

Zhu N, Bu Y, Jin M, Mbroh N (2020) Green financial behavior and green development strategy of Chinese power companies in the context of carbon tax. J Clean Prod 245:118908. https://doi.org/10.1016/j.jclepro.2019.118908

Funding

This work was supported by the National Social Science Foundation of China (No. 16BJY060).

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Yaxiong Zhou: methodology, validation, software, funding acquisition, writing—original draft preparation. Wenxin Yang: conceptualization, investigation, writing—review and editing.

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent to participate

I am free to contact any of the people involved in the research to seek further clarification and information.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Zhou, Y., Yang, W. Differentiated environmental taxes and high-quality economic development in China: theory and evidence. Environ Sci Pollut Res 30, 114222–114238 (2023). https://doi.org/10.1007/s11356-023-30168-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-30168-6