Abstract

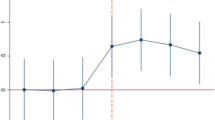

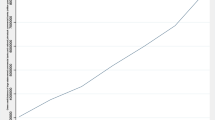

“green” + “innovation” has become a new concept of development. The integration of the two can bring win-win for the environment and economy. This paper selects the annual data of 14309 A-share companies in Shanghai and Shenzhen Stock Exchange from 2012 to 2020 as the research sample. And it uses the two-way fixed effect model to empirically test the impact of green finance on enterprise innovation performance. The study found that the development of green finance can promote the improvement of enterprise innovation performance. The analysis of influence mechanism shows that the development of green finance can reduce the financing constraints of enterprises, and then improve the innovation performance of enterprises; the development of green finance can increase the R&D investment of enterprises, and then improve the innovation performance of enterprises; green finance development can increase corporate investment in environmental protection, which in turn can improve corporate innovation performance. The results of heterogeneity test analysis show that compared with the western region, private enterprises, small and medium-sized enterprises, and high energy consumption and high pollution enterprises, the development of green finance in the central and eastern regions, state-owned enterprises, large enterprises, and non double high enterprises has more obvious role in promoting enterprise innovation performance. Therefore, the government should issue relevant policies and actively promote green finance policies that can help improve environmental and economic issues.

Similar content being viewed by others

Data availability

The datasets used and/or analysed during the current study are available from the corresponding author on reasonable request.

References

Abidemi C, Iweriebor S (2018) Does access to finance enhance SME innovation and productivity in Nigeria? Evidence from the World Bank Enterprise Survey. Afr Dev Rev 30(4):449–461

An GJ, Zi WS (2020) Exploring green finance for sustainable development in the free trade zone. Public Finance Rev 5:117–129

Ba SS, Wu LL, Xiong PH (2022) Government grants, R&D investment and firm innovation performance. Stat Decis 38(5):166–169. https://doi.org/10.13546/j.cnki.tjyjc.2022.05.032.C

Chen GJ, Ding SJ, Zhao XQ, Jiang XY (2021) China’s green financial policy, financing cost and green transformation of enterprises -- based on the perspective of the central bank’s collateral policy. J Financ Res 12:75–95

Chen J, Zheng HQ (2020) Financing constraints, customer bargaining power and corporate social responsibility. Account Res 8:50–63

Chen R, Zhang J (2022) Is bank competition conducive to enterprise innovation. Macroeconomics 9:120–140. https://doi.org/10.16304/j.cnki.11-3952/f.2022.09.012

Chen ZG, Gong YF (2022) The influence of green finance on enterprise performance and its mechanism analysis. Economic and Management Review 38(05):72–85. https://doi.org/10.13962/j.cnki.37-1486/f.2022.05.006.D

Chen ZT, Meng FR, Zhang RQ (2022) Government funding, innovation human resource mismatch and regional innovation performance: a test based on threshold effects. Science & Technological Progress and Policy, pp 1–10 http://kns.cnki.net/kcms/detail/42.1224.g3.20220517.1515.016.html

Chu DY, Liu WL (2021) Government innovation subsidies, corporate culture and innovation performance. Econ Manag 43(2):71–87. https://doi.org/10.19616/j.cnki.bmj.2021.2.005

Dai XF, Siddik AB, Tian HW (2022) Corporate social responsibility, green finance and environmental performance: does green innovation matter? Sustainability 14(20):13607

Ding N, Ren YN, Zuo Y (2020) Green credit policy pays for itself or pays for itself? --analysis of PSM-DID~1 cost efficiency based on a resource allocation perspective. J Financ Res 4:112–130.F

Fang JG, Lin FL (2019) A study on the relationship between green finance and sustainable economic development - an empirical analysis based on inter-provincial panel data of 30 provinces in China. Journal of China University of Petroleum (Edition of Social Sciences) 35(1):14–20. https://doi.org/10.13216/j.cnki.upcjess.2019.01.0003

Fee CE, Hadlock CJ, Pierce JR (2009) Investment, financing constraints, and internal capital markets: evidence from the advertising expenditures of multinational firms. Rev Financ Stud 22(6):2361–2392

Gui HF, Wang XY (2018) Financing constraints, ultimate control structure and environmental protection investment -- based on the empirical data of listed companies in heavy pollution industries in Shanghai and Shenzhen stock exchanges. South China Finance 10:15–24. https://doi.org/10.3969/j.issn.1007-9041.2018.10.005

Gu LL, Wang HY (2020) Social trust, financing constraints and business innovation. Economist 11:39–50

Hall BH, Lerner J (2010) The financing of R&D and innovation. Handbook of the economics of innovation 610–319

Hao J, Suo LL, Sui YT (2020) The influence mechanism of resources on enterprise innovation performance: an empirical study in East China coastal cities. J Coast Res 107(sp1):372–376

Hou XH, Wang B (2020) Research on the development of green finance in the context of financial supply-side structural reform. Seeking Truth 47(05):13–20

Kang W, Wu YX (2022) Green finance, internal mechanism of financing constraint and anti financing constraint effect. Inquiry into Economic Issues 6:124–133

Kuang XW, Shi ZY, He EL (2010) Design and evaluation of a financing constraint index for Chinese listed companies. Journal of Shanxi University of Finance and Economics 32(05):110–117

Li H, Liu Q (2021a) Analysis of the impact of fiscal policy on the innovation performance of new energy vehicle companies-an empirical analysis based on panel data of listed companies. IOP Conference Series: Earth and Environmental Science 787(1)

Li R, Liu LQ (2021b) Green finance and corporate green innovation. Wuhan University J (Philosophy & Social Sciences) 74(06):126–140. https://doi.org/10.14086/j.cnki.wujss.2021.06.012

Li J, Zhang JL, Dong XF (2022) How the digital economy affects the innovation ability of enterprises: internal mechanism and empirical evidence. Economic Management 44(8):5–22. https://doi.org/10.19616/j.cnki.bmj.2022.08.001

Liu ML, Huang X, Sun J (2022) Impact mechanism of digital finance on green development. China Popul Resour Environ 32(06):113–122

Liu Q, Wang WN, Chen HY (2020) Research on the impact of the implementation of green credit guidelines on the innovation performance of heavy pollution enterprises. Science Research Management 41(11):100–112. https://doi.org/10.19571/j.cnki.1000-2995.2020.11.010

Liu YY, Huang ZY, Liu XX (2021) Environmental regulation, executive compensation incentives and corporate environmental investment - evidence from the implementation of the Environmental Protection Act 2015. Account Res 5:175–192

Li ZH, Gao X (2021) Makers’ relationship network, knowledge acquisition and innovation performance: an empirical analysis from China. Technol Soc 66:101684

Ljubicic F (2016) The importance of organizational structure and corporate culture in open innovation performance. Eur J Bus Manag 8(11)

Lou RP, Zhang H, Mai SS (2021) Digital investment and innovation performance in manufacturing firms: the mediating role of human capital. Humanities & Social Sciences Journal of Hainan University:1–13[2022-05-24. https://doi.org/10.15886/j.cnki.hnus.20211229.001

Ma J (2016) The development and prospects of green finance in China. Comp Econ Soc Syst 6:25–32

Ma J, An GJ, Liu JL (2020) Building a financial services system that supports green technology innovation. Financial Theory & Practice 5:1–8

Mann W (2018) Creditor rights and innovation: evidence from patent collateral. J Financ Econ 130(1):25–47

Nguyen H, Onofrei G, Akbari M, McClelland R (2022) Enhancing quality and innovation performance: the role of supplier communication and knowledge development. Total Qual Manag Bus Excell 33(3-4):410–433

Ning JH, Wang M (2021) Can green bonds relieve companies of “short and long term investment”? --empirical evidence from The Bond Market. Securities Market Herald 9:48–59

Ning W, She JH (2014) An empirical study on the dynamic relationship between green finance and macroeconomic growth. Seeker 08:62–66

Niu HP, Zhang XY, Zhang PD (2020) Institutional change and effect evaluation of China’s green financial policy: a case study of green credit. Bus Rev 32(8):3–12. https://doi.org/10.14120/j.cnki.cn11-5057/f.2020.08.001

Pagell M, Wiengarten F, Fynes B (2013) Institutional effects and the decision to make environmental investments. Int J Prod Res 51(2):427–446

Peng H, He ZC, Zhang XL (2022) The impact of entrepreneurship and craftsmanship on firms’ innovation performance. China Soft Science 3:112–123

Qiao PH, Long Y, Xu WB (2022) A study on the mechanism of managerial mental toughness on the innovation performance of firms. Foreign Economics & Management:1–18[2022-06-23. https://doi.org/10.16538/j.cnki.fem.20211203.106

Ronaldo R, Suryanto T (2022) Green finance and sustainability development goals in Indonesian Fund Village. Resour Policy 78

Salazar J (1998) Environmental finance: linking two world

Shi DM, Shi XY (2022) Green finance and quality economic development: mechanisms, characteristics and empirical studies. Stat Res 39(1):31–48. https://doi.org/10.19343/j.cnki.11-1302/c.2022.01.003

Su DW, Lian LL (2018) Does green credit affect the investment and financing behaviour of heavy polluters? J Financ Res 12:123–137

Sun Y, Meng Y (2021) Green financial policy and green technology innovation - evidence from the green finance reform and innovation pilot zone. Fujian Tribune 11:126–138

Tan WH, Shu YY (2020) New financial development and industrial green transformation: an empirical analysis based on the system GMM model. Econ Geogr 40(11):149–157. https://doi.org/10.15957/j.cnki.jjdl.2020.11.017

Wang LP, Xu JH, Li C (2021) Mechanisms and stages in the evolution of the role of green financial policies in promoting corporate innovation. Soft Science 35(12):81–87

Wang X, Wang Y (2021) Green credit policy for green innovation study. Manage World 37(6):173–188+11. https://doi.org/10.19744/j.cnki.11-1235/f.2021.0085

Wang R, Ye L (2022) A study on the path of fintech to enhance corporate innovation performance - a chain mediating effect model. Journal of Technical Economics & Management 2:58–62

Wang Y, Pan DY, Zhang X (2016) A study on the contribution of green finance to China’s economic development. Comp Econ Soc Syst 6:33–42

Wang X, Zhang Q, Hou JX (2022) Research on the impact of R&D investment and government subsidies on corporate innovation performance. Statistics & Information Forum 37(02):108–116

Wang YL, Zhou YH (2022) Green finance development and enterprise innovation. J Financ Econ:1–15[2022-11-03. https://doi.org/10.16538/j.cnki.jfe.20220615.101

Wen K, Li CH, Xu XS (2022a) A study on the relationship between corporate internationalization and innovation performance - based on panel data of Chinese manufacturing listed companies from 2010 to 2020. Bus Econ 6:66–79[2022-06-23. https://doi.org/10.13529/j.cnki.enterprise.economy06.007

Wen SY, Lin ZF, Liu XL (2022b) Green finance and economic growth quality: construction and empirical testing of a general equilibrium model with resource and environmental constraints. Chinese Journal of Management Science 30(03):55–65

Wen ZL, Zhang L, Hou JT, Liu HY (2004) The intermediate effects test procedure and its application. Acta Psychologica Sinica 5:614–620

Wu H, Chen J (2022) How internationalisation affects innovation performance: a mediating model of regulation. Sdudies in Science of. Science:1–13. https://doi.org/10.16192/j.cnki.1003-2053.20220524.003

Wu XM, Wu SQ (2020) Government subsidies and corporate innovation performance- based on the empirical analysis of the new energy automobile industry. E3S Web Conf 214:01006. https://doi.org/10.1051/E3SCONF/202021401006

Xie QX (2021) Environmental regulation, green financial development and corporate technological innovation. Science Research Manageent 42(06):65–72. https://doi.org/10.19571/j.cnki.1000-2995.2021.06.009

Xie TT, Liu JH (2019) How does green credit affect the growth of China’s green economy? China Popul Resour Environ 29(09):83–90

Xu NN, Guo JH (2022) How government R&D funding affects Smes’ innovation performance. Studies in Science of Science 1–16. https://doi.org/10.16192/j.cnki.1003-2053.20210908.002

Xue J, Zhu D (2021) Can green credit policies improve debt financing for listed companies? Econ Surv 38(1):152–160. https://doi.org/10.15931/j.cnki.1006-1096.20201126.001

Xu YY (2023) Environmental protection investment, technological innovation, and financial performance of enterprises: an empirical analysis based on listed companies in the Yangtze River Economic Belt. The Chinese Certified Public Accountant 287(4):35–40. https://doi.org/10.16292/j.cnki.issn1009-6345.2023.04.005

Yang G, Li YR, Jiang XY (2020) Research on the impacts of green finance towards the high-quality development of China’s economy—mechanisms and empirical analysis. Theor Econ Lett 10(06):1338

Yang Y, Cui W, He J, Tsai SB (2022, 2022) An empirical analysis of the correlation between listed companies’ financial shared services and corporate innovation performance: based on the empirical data of A-share listed companies. Math Probl Eng. https://doi.org/10.1155/2022/8037582

Yin HY, Li C (2022) Has intelligent manufacturing empowered enterprises to innovate--quasi natural experiment based on China’s intelligent manufacturing pilot project. J Financ Res 10:98–116

Yu CH, Wu X, Zhang D, Chen S, Zhao J (2021) Demand for green finance: resolving financing constraints on green innovation in China. Energy Policy 153(1):112255

Yu Z, Cao YL (2021) Do green credit policies affect the quality of surpluses of heavy polluters? Securities Market Herald 5:26–36

Zhang YM, Zhang F, Li YX (2017) Accounting robustness, financing constraints and investment efficiency. Account Res 9:35–40+96

Zhang PD (2018) The exploration and development of green finance. Social Sciences in Chinese Higher Education Institution 1, 43–50+157

Zhang LL, Xiao LM, Gao JF (2018) Measurement and comparison of the level and efficiency of green financial development in China - based on micro data of 1040 public companies. Forum on. Sci Technol China 9:100–112+120

Zhang S, Chen C (2022) The impact of innovation climate on innovation performance - the mediating role of knowledge absorption capacity. Science Research Manageent 43(06):113–120. https://doi.org/10.19571/j.cnki.1000-2995.2022.06.012

Zhang Y, Li BW, Feng XL (2022a) Has fintech improved corporate innovation performance? --an empirical analysis based on data from Chinese A-share listed companies. Reform of Economic System 1:172–179

Zhang GF, Zhang YM (2022) CEO political affiliation and innovation performance: facilitator or inhibitor? --mediating effects based on financial performance. Communication of Finance and Accounting 10:48–53. https://doi.org/10.16144/j.cnki.issn1002-8072.2022.10.003

Zhang XC, Zhu ST, Li SH (2022b) A study on the scientific and technological innovation performance of universities under the dual influence of innovation policy and research structure. Science & Technological Progress and Policy:1–9 2022-06-23]. http://kns.cnki.net/kcms/detail/42.1224.g3.20220527.1605.006.html

Zhao N (2021) Does green credit promote regional green technology innovation? --based on regional green patent data. Econ Issues 6:33–39. https://doi.org/10.16011/j.cnki.jjwt.2021.06.005

Zhao T, Fang H (2019) An empirical study of OFDI and innovation efficiency in China. The Journal of Quantitative & Technical Economics 36(10):58–76. https://doi.org/10.13653/j.cnki.jqte.2019.10.004

Zhu XD, Huang YY, Zhu SJ, Huang HF (2021a) Technological innovation in polluting industries in China under the influence of green finance and its spatial differences. Geogr Sci 41(05):777–787. https://doi.org/10.13249/j.cnki.sgs.2021.05.005

Zhu XD, Zhou XY, Zhu SJ, Huang HF (2021b) Green finance and its influencing factors in Chinese cities - the case of green bonds. J Nat Resour 36(12):3247–3260

Funding

This work was supported by a grant of Shandong federation of social science (2022-JRZZ-06); Shandong Provincial Association for Science of Arts & Culture (QN201844); the Natural Science Foundation of Hebei Province(G2020208002); and Humanities and Social Science Research Project of Hebei Education Department (SQ2021138, SQ201106); Social Science Development Research Project of Hebei Province in 2021(20210501002); Hebei Social Science Foundation Youth Project(HB21MZ005).

Author information

Authors and Affiliations

Contributions

Conceptualization, Chao Liu and Congcong Dai; methodology, Congcong Dai; software, Congcong Dai; validation, Congcong Dai; formal analysis, Congcong Dai; investigation, Shuai Chen; resources, Chao Liu and Shuai Chen; data curation, Congcong Dai; writing—original draft preparation, Chao Liu and Congcong Dai; writing—review and editing, Shuai Chen; visualisation, Shuai Chen and Junjing Zhong; supervision, Shuai Chen and Junjing Zhong; project administration, Chao Liu; funding acquisition, Shuai Chen. All authors have read and agreed to the published version of the manuscript.

Corresponding author

Ethics declarations

Ethical approval

This article does not involve ethical issues.

Consent to participate

The authors of this article agree to participate in the preparation and publication of this article.

Consent for publication

This article is approved for publication.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Liu, C., Dai, C., Chen, S. et al. How does green finance affect the innovation performance of enterprises? Evidence from China. Environ Sci Pollut Res 30, 84516–84536 (2023). https://doi.org/10.1007/s11356-023-28063-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-28063-1