Abstract

We assess the reliability and validity of estimates of the Value per Statistical Life (VSL) from contingent valuation by administering the same contingent valuation (CV) questionnaire on samples drawn from the population of the Czech Republic five years apart. We use a novel approach in eliciting the WTP for cancer mortality risk reduction, in that we present respondents with two probabilities—that of getting cancer, and that of surviving it. We find that the cancer VSL is somewhat different across the two samples, but this difference is completely explained by income and cancer dread. The WTP is proportional to the size of the cancer mortality risk reduction, and increases with income and with cancer dread. The income elasticity of the VSL is 0.5 to 0.7, and is thus in line with the findings in Masterman and Viscusi (2018). Our estimates of the VSL (approximately €3–4 mill. May 2019 PPP euro) are close to Viscusi and Masterman’s prediction (2017) based on compensating wage studies, less than the estimates from compensating wage studies conducted in the Czech Republic, and similar to estimates from other stated preference studies in the Czech Republic. We conclude that the CV questionnaire and administration procedures produce reliable and stable results, and that construct and criterion validity are likewise good. We interpret these findings as providing support for an approach that expresses very small mortality risks and risk reductions as the product of two probabilities.

Similar content being viewed by others

Notes

This has prompted reliance on expert assessment (Roman et al. 2012).

Bishop and Boyle (2017) liken reliability to the notion of variability of the measure of value, and to the darts clustered together on a bull’s eye target: They may be clustered together near the center (unbiased measure of value), or far from it, in which case the results are biased, but stable (Atker et al. 2007).

Test-retest studies have been done in a variety of settings to learn about preference formation (Brown et al. 2008), the temporal stability of the WTP to protect natural resources where non-use values are likely to play an important role (Carson et al. 1997), the consistency of individual preferences for public health plans (Schwappach & Strasmann 2006), whether specific attributes of health care plans are valued similarly when they are bundled with different health plan packages (Telser et al. 2008), and even to see whether individuals are capable of assessing their own health (Crossley & Kennedy 2002).

See Appendix 1 for the more general case where the utility of income when dead is different from zero.

Implicit in this functional form are the usual assumptions that U(y) > V(y), and that U′(y) > V′(y).

This is easy to see as the cancer VSL is U(y)/U′(y), times a positive term that contains p, q, and h, but does not contain income. The first derivative of the VSL with respect to income is thus proportional to \( \frac{{\left[{U}^{\prime }(y)\right]}^2-U(y){U}^{\prime \prime }(y)}{{\left[{U}^{\prime }(y)\right]}^2} \), which is positive as long as the utility function is concave (and hence U′′ is negative).

This approach is thus in contrast with that used in Viscusi et al. (2014), who presented respondents with the unconditional probability of getting cancer and dying from it in a study that focuses on arsenic in the drinking water supply. Viscusi et al. focus on a specific type of cancer (bladder cancer), whereas we did not specify the type of cancer to the respondents at all. One major reason why we decided to keep the type of cancer unspecified is because we felt this approach better catered to the need to transfer our results to various types of regulated substances and pollutants.

Our approach is somewhat different from that in Smith and Desvousges (1987), where respondents are faced with a two-stage lottery. In the first-stage lottery, respondents face the probability of being exposed to a hazardous waste site. In the second stage, they face the risk of developing cancer and dying.

The most natural interpretation of our elicitation process is that it is a series of “yes”/“no,” “single-bounded” dichotomous choice contingent valuation questions. The responses are thus driven by a latent, and unobserved, WTP. Alternatively, our elicitation process may be thought of as discrete choice questions with only two alternatives, one of which is the status quo, and where the levels of some of the attributes do not change across the alternatives.

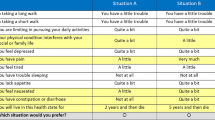

We remind the reader that the quality-of-life impacts of cancer and the level of pain that would be experienced by the respondents are the same across the status quo and the risk-abating alternative, but vary from one choice question to the next, and across respondents.

Speeders were defined as any respondent who completed the survey in less than 48% of the median length of interview, following the recommendation by Survey Sampling International (SSI 2013; Mitchell 2014) or Keusch (2013). A total of 53 and 59 respondents were classified as speeders in the 2019 and 2014 surveys, respectively.

The probability quiz asked the respondent which of two people, person A and person B, was more likely to become ill with a certain illness, if A’s chances were 5 in 1000, and B’s 10 in 1000. These chances were depicted side by side using a grid of squares, with 5 and 10 squares, respectively, colored blue, and the remainder in the grid white.

Unsurprisingly, the people who failed the probability quiz are, in both waves, less highly educated and less wealthy than those who passed the probability quiz. In the 2014 study people that did not have a high school diploma accounted for 68.8% of those who failed the probability quiz, people with a high school diploma 25.8%, and people with a college degree 4.2%. In the final sample (which is comprised of respondents that did pass the probability quiz) these shares were 50.7%, 31.1%, and 15.4% (see Table 2). Income was lower among those who failed the quiz: The average monthly household income is 24,313 CZK among those who failed the quiz in the 2014 study and over 28,000 CZK in the final sample (nominal 2014 CZK). As to the 2019 wave, the evidence is similar. Specifically, among the respondents who failed the quiz, 36.5% did not finish high school, 48.9% have a high school diploma, and 10.9% have a college degree. The shares in the final sample (which is comprised of people that passed the probability quiz) are 17.3%, 46.6%, and 34.4%, respectively. The average monthly household income was 36,325 CZK among those who failed the probability quiz in the 2019 study, and 46,017 CZK among those who passed it (nominal 2019 CZK). It seems reasonable to conjecture that the higher education level in the 2019 wave may have contributed to the lower quiz failure rate in the 2019 wave, compared to the 2014 wave.

It is likely that those respondents who failed the probability quiz were simply not paying full attention to the questions, rather than exhibiting a failure of the non-satiation assumption of preferences (San Miguel et al. 2005). Ozdemir et al. (2010) investigate how individual characteristics of the respondent (gender, income, education and age) affect subject performance in stability, transitivity, and monotonicity tests via their effect on cognitive ability or effort in solving difficult tasks.

We use micro data collected in compliance with the European Union’s directives and implementing regulations—Statistics on Income and Living Conditions (EU-SILC)—for the Czech Republic for 2015 and 2018 to compute an estimate of the average household income of the target population (persons aged 45–60) in the Czech Republic. The CZ-SILC survey is regularly conducted by the Czech Statistical Office, using random two-stage sampling in each region. CZ-SILC records family and dwelling characteristics, earnings, and income for each family member. The 2015 CZ-SILC reports earnings and income for 2014, and the 2018 CZ-SILC for 2017. Although the full CZ-SILC contains 7914 and 8634 households, respectively, we consider only those households with household head or partner aged between 45 and 60 at the time of the survey. This results in 2560 and 2686 households, respectively. Our estimates are weighted using the population weights supplied by Czech Statistical Office (CSO 2019).

The WTP for two risk reductions would be 436.65 and 742.462019 PPS euro, respectively.

Alternate calculations are possible: For instance, one can calculate the WTP for a specified risk reduction, and obtain an estimate of the VSL as the WTP divided by Δmortrisk. We display the results from this alternate procedure in Fig. 4 in Appendix 3.

We remind the reader that this figure is obtained as the coefficient on log income in the random effects probit, 0.5008, divided by the negative of the coefficient on log cost, namely 0.6762.

Education does not seem to affect the WTP. The coefficients on education dummies are individually and jointly statistically insignificant, whether or not the model already controls for income (results available from the authors).

We compute this income elasticity as ln(1.41)/ln(1.5656), where 1.5656 is the ratio of the average household income in the 2019 sample to the average household income in the 2014 sample. This calculation follows from the simple expression \( {VSL}_{2019}={VSL}_{2014}\cdotp {\left(\frac{INC_{2019}}{INC_{2014}}\right)}^{\theta } \), where θ is a cross-country income elasticity of the VSL.

Again, the educational attainment of the respondents is not significantly associated with the WTP.

Imposing this restriction may be a bit, but not much, of a stretch for the 2014 survey data, but is perfectly acceptable for the 2019 data.

In other words, for each education level, we retain only the respondents whose income falls in the common support for that education level for the 2014 and 2019 samples. By common support, we mean that we keep only respondents with income greater than max{min income in 2014 sample, min income in 2019 sample} and less than min{max income 2014 sample, max income 2019 sample}, where these conditions are applied for each education level.

This decision blurs the distinction between convergent validity and criterion validity (Bishop and Boyle 2017). Convergent validity means comparing the results from one non-market valuation method (in this case, contingent valuation) with those from other non-market valuation methods (compensating wage studies, housing price hedonics) applied to the same good.

Alberini and Šcasný (2018) show that the VSL is equal to the VSCC divided by the conditional mortality risk.

References

Adamowicz, W., Dupont, D., Krupnick, A., & Zhang, J. (2011). Valuation of cancer and microbial disease risk reductions in municipal drinking water: An analysis of risk context using multiple valuation methods. Journal of Environmental Economics and Management, 61(2), 213–226.

Alberini, A. (2019). Revealed v. stated preferences: What have we learned about valuation and behaviors? Review of Environmental Economics and Policy, 13(2), 283–298.

Alberini, A., & Šcasný, M. (2011). Context and the VSL: Evidence from a stated preference study in Italy and the Czech Republic. Environmental and Resource Economics, 49(4), 511–538.

Alberini, A., & Šcasný, M. (2013). Does the cause of death matter? The effect of dread, controllability, exposure and latency on the VSL. Ecological Economics, 94, 143–155.

Alberini, A., & Ščasný, M. (2018). The benefits of avoiding cancer (or dying from cancer): Evidence from a four-country study. Journal of Health Economics, 57, 249–262.

Alberini, A., Ščasný, M., Braun Kohlova, M., & Melichar, J. (2006). The value of a statistical life in the Czech Republic: Evidence from a contingent valuation study. In B. Menne & K. Ebi (Eds.), Climate change adaptation strategies for Europe. Springer.

Ancker, J. S., Senathirajah, Y., Kukafka, R., & Starren, J. (2006). Design features of graphs in health risk communication: A systematic review. Journal of the American Medical Information Association, 13(6), 608–618.

Andersson, H. (2005). The value of safety as revealed in the Swedish car market: An application of the hedonic pricing approach. Journal of Risk and Uncertainty, 30(3), 211–239.

Atker, S., Brouwer, R., Chowdury, S., & Aziz, S. (2007). Testing reliability and construct validity of inkind WTP responses in contingent valuation. PREM working paper 07/07, available at https://pdfs.semanticscholar.org/991c/decad698fe8c0f3c4a357dee3afddd85d684.pdf.

Bishop, R. C., & Boyle, K. J. (2019). Reliability and validity in nonmarket valuation. Environmental and Resource Economics, 72(2), 559–582.

Brown, T. C., Kingsley, D., Peterson, G. L., Flores, N. E., Clarke, A., & Birjulin, A. (2008). Reliability of individual valuations of public and private goods: Choice consistency, response time, and preference refinement. Journal of Public Economics, 92(7), 1595–1606.

Bryan, S., & Jowett, S. (2010). Hypothetical versus real preferences: Results from an opportunistic field experiment. Health Economics, 19(12), 1502–1509.

Cameron, T. A., & DeShazo, J. R. (2013). Demand for health risk reductions. Journal of Environmental Economics and Management, 65(1), 87–109.

Carmines, E. G., & Zeller, R. A. (1979). Reliability and validity assessment. Sage Publications.

Carson, R. T., Hanemann, W. M., Kopp, R. J., Krosnick, J. A., Mitchell, R. C., Presser, S., Ruud, P. A., Smith, V. K., Conaway, M., & Martin, K. (1997). Temporal reliability of estimates from contingent valuation. Land Economics, 73(2), 151–153.

Cook, J., Whittington, D., Canh, D. G., Johnson, F. R., & Nyamete, A. (2007). Reliability of stated preferences for cholera and typhoid vaccines with time to think in hue, Vietnam. Economic Inquiry, 45(1), 100–114.

Corso, P. S., Hammitt, J. K., & Graham, J. D. (2001). Valuing mortality risk reductions: Using visual aids to improve validity of contingent valuation. Journal of Risk and Uncertainty, 23(2), 165–184.

Costa, D. L., & Kahn, M. E. (2004). Changes in the value of life, 1940–1980. Journal of Risk and Uncertainty, 29(2), 159–180.

Crossley, T. F., & Kennedy, S. (2002). The reliability of self-assessed health status. Journal of Health Economics 21(4), 643–658.

CSO. (2019). European Union statistics on income and living conditions (EU-SILC), Statistical Office of the Czech Republic, https://www.czso.cz/csu/czso/household-income-and-living-conditions-wqg6poffyz (last accessed November 1, 2019).

Davis, L. W. (2004). The effect of health risk on housing value: Evidence from a cancer cluster. American Economic Review, 94(5), 1693–1704.

Eeckhoudt, L., & Hammitt, J. K. (2001). Background risks and the value of a statistical life. Journal of Risk and Uncertainty, 23(3), 261–279.

Etchegaray, J.M, & Fischer, W. (2006). Survey research: Be careful where you step…. Quality and Safety in Health Care 15(3), 154–155.

Gayer, T., Hamilton, J. T., & Viscusi, W. K. (2000). Private values of risk tradeoffs at superfund sites: Housing market evidence on learning about risks. Review of Economics and Statistics, 82(3), 439–451.

Gayer, T., Hamilton, J. T., & Viscusi, W. K. (2002). The market value of reducing cancer risk: Hedonic housing prices with changing information. Southern Economic Journal, 69(2), 266–289.

Hammitt, J. K., & Graham, J. D. (1999). Willingness to pay for health protection: Inadequate sensitivity to probability? Journal of Risk and Uncertainty, 18(1), 33–62.

Hammitt, J. K., & Liu, J. T. (2004). Effects of disease type and latency on the value of mortality risk. Journal of Risk and Uncertainty, 28(1), 73–95.

Hammitt, J. K., & Haninger, K. (2010). Valuing fatal risks to children and adults: Effects of disease, latency, and risk aversion. Journal of Risk and Uncertainty, 40(1), 57–83.

Hammitt, J. K., Geng, F., Guo, X., & Nielsen, C. P. (2019). Valuing mortality risks in China: Comparing stated-preference estimates from 2005 and 2016. Journal of Risk and Uncertainty, 58(2-3), 167–186.

Hammitt, J. K., & Robinson, L. (2011). The income elasticity of the value per statistical life: Transferring estimates between high and low income populations. Journal of Benefit-Cost Analysis, 2(1), 1–29.

Iacus, S. M., King, G., & Porro, G. (2012). Causal inference without balance checking: Coarsened exact matching. Political Analysis, 20(1), 1–24.

Jenkins, R., Owens, N., & Wiggins, L. B. (2008). Valuing reduced risks to children: The case of bicycle safety helmets. Contemporary Economic Policy, 19(4).

Kanya, L., Sanghera, S., Lewin, A., & Fox-Rushby, J. (2019). The criterion validity of willingness to pay methods: A systematic review and meta-analysis of the evidence. Social Science and Medicine, 232, 238–261.

Keusch, F. (2013). The role of topic interest and topic salience in online panel web surveys. The Market Research Society, 55(1), 59–80.

Kniesner, T. J., Viscusi, W. K., Woock, C., & Ziliak, J. P. (2012). The value of a statistical life: Evidence from panel data. The Review of Economics and Statistics, 94(1), 74–87.

Krupnick, A. (2007). Mortality-risk valuation and age: Stated preference evidence. Review of Environmental Economics and Policy, 1(2), 261–282.

Liu, J. T., Hammitt, J. K., & Liou, J. L. (1997). Estimated hedonic wage function and value of life in developing country. Economic Letters, 57(3), 353–358.

Loomis, J. B. (1989). Test-retest reliability of the contingent valuation method: A comparison of general population and visitor responses. American Journal of Agricultural Economics, 71(1), 76–84.

Masterman, C. J., & Viscusi, W. K. (2018). The income elasticity of global values of a statistical life: Stated preference evidence. Journal of Benefit Cost Analysis, 9(3), 407–434.

Melichar, J., Ščasný, M,. & Urban, J. (2010). Hodnocení smrtelných rizik na trhu práce: Studie hédonické mzdy pro Českou republiku. (The valuation of risks in the labour market: Hedonic wage study in Czech Republic). Politická ekonomie, 5.

Mitchell, N. (2014). The changing landscape of technology and its effect on online survey data collection – White paper. Survey Sampling International, June 2014. Retrieved from http://docplayer.net/21618373-White-paper-the-changing-landscape-of-technology-and-its-effect-on-online-survey-data-collection-by-nicole-mitchell-knowledge-specialist-june-2014.html.

OECD. (2012). Mortality risk valuation in environment, health and transport policies. OECD Publishing. https://doi.org/10.1787/9789264130807-en.

Olofsson, S., Gerdtham, U. G., Hultkrantz, L., & Persson, U. (2019). Dread and risk elimination premium for the value of a statistical life. Risk Analysis, 39(11), 2391–2407.

Ozdemir, S., Mohamed, A. F., Johnson, F. R., & Hauber, A. B. (2010). Who pays attention in stated-choice surveys? Health Economics, 19(1), 111–118.

Rakotanarivo, O. S., Schaafsma, M., & Hockley, N. (2016). A systematic review of the reliability and validity of discrete choice experiments in valuing non-market environmental goods. Journal of Environmental Management, 183, 98–109.

Rheinberger, C. M., Hammitt, J. K., & Herrera-Araujo, D. (2016). The value of disease prevention vs. treatment. Journal of Health Economics, 50, 247–255.

Roman, H. A., Hammitt, J. K., Walsh, T. L., & Stieb, D. M. (2012). Expert elicitation of the value per statistical life in an air pollution context. Risk Analysis, 32(12), 2133–2151.

San Miguel, F., Ryan, M., & Amaya-Amaya, M. (2005). ‘Irrational’ stated preferences: A quantitative and qualitative investigation. Health Economics, 14(3), 307–322.

Ščasný, M., & Urban, J. (2008). Application of the hedonic wage model: Value of statistical life derived from employee’s choice in the Czech labor market. In M. Ščasný, B. Kohlová, Markéta, et al. (Eds.), Modelling of Consumer Behaviour and Wealth Distribution (pp. 125–145). Matfyzpress, ISBN: 978-80-7378-039-5.

Schwappach, D. L. B., & Strasmann, T. J. (2006). Quick and dirty numbers? The reliability of a stated-preference technique for the measurement of preferences for resource allocation. Journal of Health Economics, 25(3), 432–448.

Smith, V. K., & Desvousges, W. H. (1987). An empirical analysis of the economic value of risk changes. Journal of Political Economy, 95(1), 89–114.

Sullivan, G. M. (2011). A primer on the validity of assessment instruments. Journal of Graduate Medical Education, 3(2), 119–120.

Survey Sampling International. (2013). Speeding (SSI POV). Retrieved from http://www.surveysampling.com/ssi-media/Corporate/POVs-2012/Speeding_POV.

Telser, H., Becker, K., & Zweifel, P. (2008). Validity and reliability of willingness-to-pay estimates: Evidence from two overlapping discrete-choice experiments. Working paper 0412, University of Zurich, Socioeconomic Institute, 1, 4, 283, 298.

Sunstein, C. R. (2014). Valuing life. Humanizing the regulatory state. University of Chicago Press.

US Department of Transportation. (2016). 2016 revised value of a statistical life guidance. Washington, D.C. Available at https://www.transportation.gov/sites/dot.gov/files/docs/2016%20Revised%20Value%20of%20a%20Statistical%20Life%20Guidance.pdf (last accessed 22 December 2018).

US Environmental Protection Agency. (2000). Guidelines for preparing economic analyses. Available at https://www.epa.gov/environmental-economics/guidelines-preparing-economic-analysis-2000.

US Environmental Protection Agency. (2010). Guidelines for preparing economic analyses. Available at https://www.epa.gov/environmental-economics/guidelines-preparing-economic-analyses.

Viscusi, W. K. (2013). Using data from the Census Of Fatal Occupational Injuries to estimate the “value of a statistical life.” Monthly Labor Review, October. Available at https://www.bls.gov/opub/mlr/2013/article/using-data-from-the-census-of-fatal-occupational-injuries-to-estimate-the.htm. Accessed 8 Aug 2018.

Viscusi, W. K., Huber, J., & Bell, J. (2014). Assessing whether there is a cancer premium for the value of a statistical life. Health Economics, 23(4), 384–396.

Viscusi, W. K., & Masterman, C. J. (2017). Income elasticities and global values of a statistical life. Journal of Benefit Cost Analysis, 8(2), 226–250.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This research received support from the H2020-MSCA-RISE project GEMCLIME-2020, GA no. 681228, and the European Chemicals Agency under contract ECHA/2018/558—Willingness to Pay for Non-fatal Cancer. The opinions reported in this paper are solely those of the authors and do not necessarily reflect the official policy and opinions of the European Chemicals Agency. We thank Christoph Rheinberger, the participants in the 21st International Conference on Environmental Economics, Policy and International Environmental Relations, held in Prague in November 2019, and the participants in sessions at the 2020 AERE and 2020 EAERE annual meetings, held in June 2020, for their helpful comments.

Appendices

APPENDIX 1: Derivation of cancer and non-cancer VSL, and VSCC

The expected utility of the individual is:

where θ is the chance of dying from any cause other than cancer, p is the chance of getting cancer, and q is the chance of dying from cancer, if one gets cancer. The unconditional cancer mortality risk is thus m = p·q.

We define the non-cancer VSL as the WTP for a marginal reduction in θ, the cancer VSL as the WTP for a marginal reduction in m, and the Value per Statistical Case of Cancer (VSCC) as the WTP for a marginal reduction in the risk of getting cancer p. It is also possible to obtain the WTP for a marginal improvement in the conditional chance of surviving cancer, namely q.

We first derive expressions for these metrics assuming that the utility of income when dead is always zero (i.e., W(y) = G(y) = 0). Under this simplifying assumption, it is straightforward to show that the non-cancer VSL is

where the numerator is the expected utility when alive, and the denominator is the marginal expected utility of income when alive, further multiplied by the chance of being alive (in the sense of not dying from cancer).

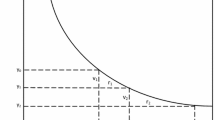

We arrive at the cancer VSL by replacing p in Eq. (9) with m/q, taking the total differential of the expected utility with respect to m and y, and setting that equal to zero:

The VSCC is.

In other words, the cancer VSL is equal to the VSCC, divided by q. The WTP for an improvement in conditional survival is \( \frac{dy}{dq}=\frac{pV(y)}{\left(1-p\right){U}^{\prime }(y)+p\left(1-q\right){V}^{\prime }(y)} \).

If we further assume that V(y) = (1-h)U(y), where h (0 ≤ h ≤ 1) is the reduction in utility with respect to the healthy state, expressions (10) and (11) further simplify to

respectively.

Expressions (13) and (14) show that the baseline odds of getting cancer, the chance of dying from it, and the loss of utility h when in the sick state enter in both the numerator and the denominator of the expression for the cancer VSL (Alberini & Ščasný 2018), but do not affect the non-cancer VSL, which depends exclusively on the utility in the healthy state and the chance of dying from all causes other than cancer.

The above expressions for the cancer and non-cancer VSLs change somewhat when one allows the utility of income when dead to be different from zero. Assume for the sake of simplicity that W(y) = G(y) at all values of y, i.e., the utility from leaving a bequest does not depend on the cause of the death. Under this assumption, Eq. (9) becomes

The non-cancer VSL is now

The numerator in the second term in the right-hand side of (16) is the utility differential between being alive and dead from non-cancer causes, while the denominator is the expected marginal utility of income.

The cancer VSL and the VSCC are now

showing once again that the cancer VSL is equal to the VSCC divided by q.

If we assume that V(y) = (1-h)U(y) and W(y) = (1-λ)U(y), with λ > h, then (16), (17) and (18) are simplified to

Compared to the simpler expected utility presented in Section 2 of this paper, this broader model results in p, q, h, λ and θ entering in the expressions for the cancer and non-cancer VSLs, and the VSCC.

APPENDIX 2. Wording of the Dread Question

C1. In the table below we list illnesses, health problems or situations that can be hazardous to one’s health or even fatal.

Which of these situations are those that you dread the most for the physical, psychological and social suffering they bring? Try to rate each of them on a scale from 1 to 5, where 1=low dread and 5=high dread.

Please keep in mind that for “dread” we do not mean how likely this situation is. Instead, we want you to think of how much this situation scares you for the physical, psychological and social suffering it may bring.

Programmer: Keep the order, but rotate the start at random, for ex. 1 to 8, then 2..8 followed by 1, etc.

Aspect or consequences | Low dread | High dread | |||

|---|---|---|---|---|---|

Dying in a car or road traffic accident. | 1 | 2 | 3 | 4 | 5 |

Dying in a domestic accident. | 1 | 2 | 3 | 4 | 5 |

Surgery on an emergency basis. | 1 | 2 | 3 | 4 | 5 |

Developing chronic respiratory illnesses (asthma, chronic bronchitis, emphysema). | 1 | 2 | 3 | 4 | 5 |

Getting cancer. | 1 | 2 | 3 | 4 | 5 |

Becoming paralyzed. | 1 | 2 | 3 | 4 | 5 |

Having a heart attack. | 1 | 2 | 3 | 4 | 5 |

Developing an illness that makes me completely dependent on being taken care of by someone else. | 1 | 2 | 3 | 4 | 5 |

APPENDIX 3: Alternative Calculation of the VSL for different risk reductions levels from the 2014 wave

The VSL is calculated as median WTP for a specified cancer mortality risk reduction as per the model in Table 6, col. (A), divided by the mortality risk reduction

Rights and permissions

About this article

Cite this article

Alberini, A., Ščasný, M. On the validity of the estimates of the VSL from contingent valuation: Evidence from the Czech Republic. J Risk Uncertain 62, 55–87 (2021). https://doi.org/10.1007/s11166-021-09347-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-021-09347-8