Abstract

Companies undertaking initial public offerings (IPOs) in Greece were obliged to include next-year profit forecast in their prospectuses, until the regulation changed in 2001 to voluntary forecasting. Drawing evidence from IPOs issued in the period 1993–2015, this is the first study to investigate the effect of disclosure regime on management earnings forecasts and IPO long-term performance. The findings show mainly positive forecast errors (forecasts are lower than actual earnings) and higher long-term returns during the mandatory period, suggesting that the mandatory disclosure requirement causes issuers to systematically bias profit forecasts downwards as they opt for the safety of accounting conservatism. The mandatory disclosure requirement artificially improves IPO share performance. Overall, our results show that mandatory disclosure of earnings forecasts can impede capital market efficiency once it goes beyond historical financial information to involve compulsory projections of future performance.

Similar content being viewed by others

1 Introduction

An initial public offering (IPO) brings a firm’s shares to the public for the first time and it anticipates mass participation during the subscription period. Public interest is highly dependent on evaluation of available information from the newly issued prospectus, since this information is often the first window on the firm’s past and its projected future performance. Few investors have the luxury of time to read the entirety of this official document, whereas others prefer to focus on key points disclosed in the prospectus. One figure that attracts special attention is the management earnings forecast.Footnote 1 Investors assess the accuracy of earnings forecasts, as they can serve as a performance indicator for the newly listed firm.

Accuracy in future earnings forecasts is difficult to achieve, as there are many unpredictable events that can take place between the forecast day and the day of the official announcement of actual earnings. Such events can include market instability, unforeseen political events, exchange rate fluctuations, liquidity problems, and misunderstanding of market trends. Despite efforts by senior management of many newly listed IPOs to provide accurate earnings forecasts, few firms succeed. Many firms end up with a large difference between forecast earnings and actual results. This forecast error is dualistic in nature. It can be optimistic if the earnings forecast in the prospectus is higher than the actual earnings presented in the first company annual report, or pessimistic if the earnings forecast appears to be less than actual earnings. The nature of the difference between actual and forecast earnings may lead to entirely different implications in the long term.

Motivated by the importance of earnings forecasts and their tendency to signal future performance, the aim of this study is to assess the usefulness of management earnings forecast disclosure to investors. Previous literature concentrates on the impact of various accounting decisions on long-term returns (Mitchell and Stafford 2000; Yi 2001; Liao et al. 2015). For example, the literature on public equity offerings focuses on the effect of discretionary accruals on the long-term performance of these offerings (Teoh et al. 1998a). In a related study, Chou et al. (2010) show how earnings management practices affect private placements of equity. Profit forecasts may include unwarranted optimism when managers exercise their discretion in an abusive way (Jaggi et al. 2006). Additional research draws a link between earnings forecast direction (i.e., positive or negative compared to actual earnings) and a number of post-IPO dimensions, such as firm organization and changes in competitive strategy of the firm (e.g., Bhabra and Pettway 2003).

This paper builds on the management earnings forecast literature in that it analyzes the effect that an exogenous change in IPO disclosure environment can have on the reliability of available information and investor behavior. Motivated by heavy market reliance on initial forecasts during IPOs (Dechow et al. 2000), we investigate the use of this mechanism, which is supposed to cause less friction in an IPO and to facilitate efficient allocation of capital. Basic questions that this paper addresses include: Does a flexible disclosure status brought about by regulatory change (mandatory to voluntary) contribute to increased forecast accuracy? Can earnings forecasts provided in IPO prospectuses constitute an important determinant of future market performance? Do investors penalize inaccurate forecasts by IPO firms with strong negative returns?

This paper differs from the existing literature on the effect of earnings forecasts on IPO performance in several ways. First, it focuses on management errors by contrasting forecast earnings in the prospectus with actual earnings as reported in the first annual report. The difference between the two figures constitutes forecast error; this is the central focus of this study. Previous studies do not explore this error, but compare earnings published before going public with earnings presented in annual reports up to three years after going public. However, the magnitude and sign of management forecast errors constitute valuable information. If the initial forecast is optimistic, realized earnings will come as a disappointment to investors and the market will correct earlier overvaluations (hence, lower long-run performance). Inversely, pessimistic forecasts should pave the way for higher future returns.

Second, this study analyzes management earnings forecasts under two different regulatory regimes (mandatory and voluntary) within the same market (Greece). This gives us the opportunity to conduct an experiment with direct comparison between two samples, one in which management is required to provide earnings forecasts in the prospectus (mandatory disclosure), and a second in which management has the choice of providing earnings forecasts (voluntary disclosure). The results shed light on which disclosure mechanism better serves the interests of investors, and will assist regulators in formulating decisions that are aligned with well-functioning capital markets.

The empirical evidence indicates the mandatory disclosure of earnings forecasts is associated with the production of inaccurate management earnings forecast. Moreover, the three-year returns (starting with the end of the first day of trading) become significantly more negative in the voluntary period compared to the mandatory disclosure period. By and large, IPOs that do not disclose earnings forecasts experience considerably inferior long-term returns.Footnote 2 Moreover, IPO firms with high positive forecast errors (i.e., actual profits exceeding forecast profits) are associated with lower returns. In sum, the evidence shows considerable accounting conservatism during the mandatory period as a form of insurance on the issuer side.

Overall, the findings have important policy implications, since this is, to the best of our knowledge, the first study to analyze the effect of the transition to a voluntary disclosure regime on earnings forecast accuracy and long-term performance. This regime change provides an opportunity for policymakers to observe the reaction of the market and for researchers to explore whether firms signal their own quality through earnings forecasts. In addition, the findings have major implications on how financial markets create managerial incentives to reduce forecast errors and to avoid costs associated with potential legal actions by shareholders when reported earnings diverge considerably from earnings forecasts (e.g., Skinner 1994; Frankel et al. 1995; Teoh et al. 1998b; Frankel et al. 2002; Baginski et al. 2002; Karamanou and Vafeas 2005; Jaggi et al. 2006; Shen et al. 2014).

The remainder of this paper proceeds as follows. Section 2 presents a literature review and develops the research hypotheses. Section 3 presents an overview of the institutional background. Section 4 describes the data and presents the methodology. Section 5 presents the descriptive statistics and interprets the empirical results. We test the robustness of our results in Sect. 6. Finally, Sect. 7 sets forth our conclusions.

2 Literature review

2.1 Theoretical framework

Numerous studies examine post-issue market performance of IPOs (e.g., Ritter 1991; Chen et al. 2000; Dimovski and Brooks 2004). Gajewski and Gresse (2006), in their survey of European IPO markets, report significant underperformance of newly listed firms at the three-year horizon in all countries, except Greece and Portugal. Thomadakis et al. (2012) confirm earlier results by reporting that the Greek case differs from international evidence. The authors reveal that long-term outperformance continues for a long period after listing. The unique case of Greek IPOs represents an interesting setting to explore post-issue performance in more depth and in light of management earnings forecasts.

Theories such as window-dressing, market timing,Footnote 3 market optimism,Footnote 4 price support,Footnote 5 and investor sentiment explain long-term underperformance of firms going public. Some of these theories, like window-dressing and investor sentiment, may explain both IPO long-run underperformance and management earnings forecasts. According to Teoh et al. (1998a), the window-dressing theory supports the view that managers are ready to manipulate reported earnings around IPOs to give the stock market a false signal on the future profitability of the candidate firm, thus reducing the cost of capital. These authors observe that the more earnings management there is around IPOs, the more stock price performance decreases after three years.Footnote 6 Investor sentiment theories focus on the impact of “irrational” or “sentiment” investors on stock prices. In the case of IPOs, this potential impact appears strong because IPO firms are more likely to suffer from information opacity, and hence are more difficult to value (Ljungqvist 2007). Ljungqvist et al. (2006) model an IPO firm’s response to the presence of sentiment investors. These authors assume that some sentiment investors are optimistic on the future prospects of the IPO firm. The objective of the issuer is to capture a bigger portion of the “surplus” attributable to the presence of sentiment investors, resulting in offer price maximization relative to the intrinsic value of the stock. Nevertheless, regulatory restrictions provide a low level of flexibility to issuers.

2.2 The literature on management earnings forecasts and long-run performance

Management earnings forecasts have received much research attention, because under specific circumstances, this information can signal the direction of long-term performance of IPOs. There are a number of studies that shed light on inefficiencies in the IPO market. For instance, Hughes (1986) and Guo (2005) highlight the importance of the information asymmetry between investors and the issuer of an IPO.Footnote 7 Li and McConomy (2004) show that retained ownership and management earnings forecasts are credible, value-relevant signals. However, in contrast to the Greek IPO market, forecasts in Canada never became compulsory. Jelic et al. (2001) are the first to explore the link between management forecast errors and long-term performance of IPOs. Their results suggest positive and statistically significant long-term returns up to three years after listing, which contradicts the consensus in the IPO literature for significant, negative long-term performance. Further, their evidence shows a negative association between upward bias in management earnings forecasts and IPO performance in the first 12 months following the IPO. Hensler et al. (1997) and Jain and Kini (2000) explain the usefulness of IPO prospectus data to potential investors. Their results indicate that prospectus information remains useful in the aftermarket over the short window of one year, although the value of this information declines rapidly with time. While the prospectus clues that were considered by these researchers comprise a variety of firm- and IPO-specific features, management projections and forward-looking information are discarded.

From a different point of view, Bhabra and Pettway (2003) argue that the reason for the lack of underperformance in the first year post-IPO is the price support provided by underwriters in the immediate aftermarket, leaving no room for behavioral interpretations. Jaggi et al. (2006) show that mandatory disclosure of earnings forecasts in Taiwanese IPOs results in more optimistic forecasts than pessimistic forecasts, especially for firms expecting better performance in the forecast year compared to the previous year. Overall, the findings from Malaysia (Jelic et al. 1998) and Singapore (Firth et al. 1995) suggest that managers tend to be pessimistic forecasters, whereas findings from Canada (Pedwell et al. 1994), New Zealand (Mak 1989; Firth and Smith 1992), and Australia (Lee et al. 1993; Firth et al. 2012) suggest that managers tend to overestimate future earnings in their forecasts. Evidence for Hong Kong is inconclusive. Selva et al. (1994) report optimistic forecasts, while Chan et al. (1996) report that management forecasts are conservative and pessimistic.

More recently, Gong et al. (2009) find a positive association between management earnings forecasts and long-term performance for US IPO firms, which is stronger for firms operating in a more uncertain business environment. These authors identify the length of the firm’s operating cycle, the volatility of turnover growth, and operating cash flow as the causes of uncertainty. These findings motivate us to study Greek IPO firms, which operate in an uncertain business environment, and to consider the transition from a mandatory to a voluntary disclosure regime. The regulatory change that took place early in the 2000s provides the unique setting we need to examine the link between management earnings forecasts and long-term performance of IPO firms.

2.3 Hypothesis development

Greece was the first country in the world to change its mandatory IPO forecasting regime to a voluntary one.Footnote 8 These two disclosure regimes embody entirely different philosophies and follow distinct principles, which affect the behavior of management during the IPO decision-making process. The overall Greek framework offers a unique opportunity to explore earnings forecasts prior to and after the regulatory change.

Prior literature documents a mandatory disclosure environment for earnings forecasts in Singapore, Malaysia, and New Zealand, and a voluntary one in other Commonwealth countries (Firth and Smith 1992; Firth et al. 1995; Hartnett and Romcke 2000; Chen et al. 2001; Li and McConomy 2004; Jelic 2011). The results on earnings forecasts reveal low levels of error in countries with voluntary disclosure (Australia: 34.49 %, Hong Kong: 12.79 %, UK: 11 %) compared with countries with mandatory earnings forecasts (Malaysia: 54.1 % and New Zealand: 111 %). This initial observation provides a first indication that moving from a mandatory disclosure environment to a voluntary one improves the accuracy of earnings forecasts.

Hutton et al. (2003) document that good-news forecasts are informative only when accompanied with verifiable forward-looking information that improves their credibility, whereas bad-news earnings forecasts are always informative. Ηuang et al. (2014) examine the efficacy of a forecast regulation in China and report that voluntary forecasts are timelier and more precise than mandatory forecasts, suggesting that voluntary forecasts are of higher quality than mandatory forecasts. In the same vein, Horton et al. (2013) report that the quality of the information environment, proxied by forecast accuracy, significantly increased following mandatory adoption of International Financial Reporting Standards.

In addition to this important international evidence in support of a voluntary regime, the environment of acute uncertainty characterizing an IPO incentivizes managers to act in ways that insulate them from any negative implications (e.g., reputational damage or litigation costs) in the post-IPO period. Consequently, if all issuers are required to disclose a forecast, then the average forecast is likely to be pessimistic, reflecting the general conservatism in estimates. On the basis of these arguments, we propose the following hypothesis:

H 1

Regulatory change from mandatory to voluntary earnings forecasts increases the accuracy of IPO earnings forecasts.

Degeorge and Zeckhauser (1993) argue that companies prefer to go public after unusually high earnings performance. They contend that superior earnings reduce the risk faced by investors and secure wide participation (see, also, Brav and Gompers 1997). Clearly, however, not all issuers are capable of deferring an IPO until their accounting bottom line is deemed satisfactory. For example, smaller firms or those belonging to technology industries condition their profitability on the proceeds to be raised so that positive earnings follow a successful listing and not the other way around. Forecasts of next-year profits could be important in these situations. Degeorge and Derrien (2001a) examine earnings forecasts published in IPO prospectuses and report that forecast error is the main driver of IPO stock price performance, as it embodies investor expectations at the time of the IPO. Gounopoulos et al. (2015) document that IPO firms with accurate forecasts experience lower levels of underpricing than those that are unable to provide accurate earnings forecasts. However, forecasts can hardly represent a global response to the problem of ex-ante uncertainty, given that the forecast horizon is confined to the next year’s profits. In fact, in the eyes of investors, IPO firms are likely to remain question marks until a sequence of future reporting periods. Consequently, resolution of such uncertainty should more apparently be reflected in long-term rather than first-day or other short-term returns.

Our focus during the post-issue period is also on firms that include a forecast in their prospectus and fail to meet earnings expectations. Such firms, by intentionally inflating their earnings forecasts, may obtain a higher share price on the IPO date. If there were no subsequent costs to managers of such firms, more firms would prefer to issue optimistic earnings forecasts. However, taking into account the risk of subsequent legal actions, the incentives for accounting conservatism through production of pessimistic forecasts are substantial. In addition, IPO firms that do not meet earnings expectations pay a price in the form of significantly lower post-issue performance than forecasters that meet their earnings forecasts (Jog and McConomy 2003). This line of reasoning leads to the following testable hypothesis:

H 2

IPO firms that provide accurate earnings forecasts exhibit significantly higher post-issue long-term performance.

3 Institutional background

3.1 Regulatory switch

By 2000, Greece appeared to be on track to qualify for the first eurozone enlargement and join the pioneer 11 Member States, which had already replaced their national currencies with the euro. Key to Greece’s candidacy has been the work of the Hellenic Capital Market Commission to identify possibilities for convergence with the institutional and regulatory framework of Greece’s eurozone partners. In Greece’s market for new equities, a great deal of friction resulted from a regulation forcing issuers to forecast profitability and disclose estimates in the IPO prospectus. This requirement caused much discontent among prospective IPO issuers, due to its significant compliance costs as well as a dearth of operational experience, which often resulted in highly precarious projections.

The subsequent switch to a voluntary disclosure environment came as a long-anticipated remedy to the above concerns. Given the limited depth of the Athens Stock Exchange (ASE) in terms of member companies and trading volumes, this regulatory flexibility was implemented to foster participation by eliminating some of the listing barriers. It was also intended to convey in an unambiguous manner the political will to implement structural reforms in the interest of market efficiency and harmonization.

In line with the economic and political objectives, the transition from mandatory to voluntary disclosure of management earnings forecasts marked a stepping stone toward the adoption of the more comprehensive International Accounting Standards (IAS). IAS assesses regulations on the basis of three criteria: first, that it fulfills the essential requirements imposed by the directives of the Council of the European Union (i.e., implementation of the regulation is conducive to a fair and accurate representation of a firm’s financial standing and performance); second, that, in the spirit of the 17 July 2000 Council decisions, it advances the European public interest; and third, that it adheres to quality standards that considers financial statement information both relevant and functional to end users. Maintenance of the status quo, that is, systematic production of biased earnings forecasts under a mandatory regime, would plausibly alienate the Greek capital market from IAS philosophy and principles. This was a discrepancy that Greek authorities were quick to understand.

3.2 Development of the IPO market in Greece

The IPO market in Greece experienced three historical periods of major development. The first is the period 1925–1926 with 9 IPOs, the second includes 1972–1974 with 32 IPOs, and the third is the period 1993–2001 with 243 IPOs. Each of these periods has unique characteristics and is associated with growth in the Greek economy. Specifically, Thomadakis et al. (2016) show that from 1924 to 1940, the ASE experienced a boom and an unprecedented record of new listings. In total, 71 companies were admitted to trading in that period,Footnote 9 as a result of the increasing public spending (including foreign aid) on refugee assistance from Asia Minor, which created high domestic demand for food, clothing, and housing. The pace of growth picked up; 1924–1928 was a distinct period of rapid economic development in Modern Greek history. Inflation was also high, but was, on the whole, much lower than in the preceding decade, averaging an annual rate of 13 % in the period 1924–1927.

The second IPO wave was a direct result of the development of the Greek economy during the 1972–1974 period. This was an era of GDP growth at an average annual rate of 6.2 % in an environment of monetary stability, while maintaining improved national production, employment, and exports, whose composition shifted to manufacturing, brought major increases in financial saving, and low inflation. This period of prosperity was interrupted by the first energy crisis and the simultaneous political (and geopolitical) crisis of Cyprus in 1974.

The third period is the most prominent and played a critical role in the rapid growth of the IPO market in Greece. In particular, 1997 was a very significant year, a landmark in the history of the Greek economy and in the history of the ASE. In the 1997–1999 period, the ASE witnessed its greatest phase of growth. Overall, the period 1993–2001 was characterized by readjustment of macroeconomic indicators, with the main goal being maintenance of the inflation rate lower than 3 % and reduction of the fiscal deficit. By the end of 2000, the Greek economy had transformed into a “modern” economy, with an updated structure and strong dynamism. Healthy conditions were present in the economy in the 1997–1999 period, as economic growth, monetary stability, investment in infrastructure, growth in exports, and reform of the business sector motivated many companies to seek higher growth rates through IPOs. As a result, a record 31.68 billion euros was raised through new public offerings during this period.

4 Data and methodology

4.1 Sample

The study sample covers the period January 1993 to December 2015 and consists of 303 Greek IPOs. Companies that operate as closed-end funds are excluded from the sample, because they are subject to different regulations and present unique characteristics. A strong effort was made to collect data for all remaining firms listed on the ASE. Toward that end, a variety of sources were used to gather the needed information, including Compustat, Datastream, and Thomson Financial Securities Data Corporation (SDC). To be included in the sample, a firm must have a prospectus with required financial statements of at least one year prior to going public, data on earnings forecasts, and stock prices for at least 36 months (or 756 trading days) following the IPO.

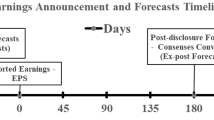

Forecast earnings for one year after going public are manually retrieved from the IPO prospectuses and crosschecked with the official statistical “Bulletin of the ASE.” Actual earnings for years t + 1, t + 2, and t + 3 are collected from the respective annual reports and crosschecked with data provided by the Capital Market Commission.Footnote 10 Market returns and stock prices are collected from Datastream, while ASEGI (ASE General Index) is retrieved from the ASE database. Necessary adjustments are made for dividends and stock splits. Financial data are derived from published financial statements at the end of fiscal year t − 1. Other variables used in the analysis are hand-collected from IPO prospectuses.

4.2 Methodology

The forecast error measure is the difference between actual and predicted earnings for a given period. It can be calculated with the error sign (forecast error) or without (absolute forecast error). Jaggi (1997), Cheng and Firth (2000), and Chen et al. (2001), among others, consider that the signed FE captures the bias in the forecast, as it indicates whether the manager has been optimistic or pessimistic in forecasting. Prior literature addresses this issue and partially explains why earnings forecasts are generally over-optimistic. A positive value for the signed forecast error implies that, on average, IPO firms have a pessimistic bias, while a negative value for the signed forecast error represents an optimistic bias.

Management forecast error for an IPO firm is calculated as

where FE it is forecast error for company i at date t, AP it stands for actual profit, and FP it is forecast profit.

Average forecast error using the signed FE measure does not give credible information on the average size of the error, since positive and negative errors cancel each other out. The absolute forecast error (AFE) is, therefore, a more appropriate measure of the accuracy of forecasts. AFE represents the magnitude of the error, while average FE (inclusive of sign) measures the bias in forecasts. AFE provides an indication of how close forecasts are to actual profits in absolute terms. AFE is measured as follows:

where AFE is absolute forecast error.

We consider the cumulative abnormal returns (CAR) from the end of the first day of trading until the earlier of the stock’s delisting date or its third anniversary as a measure of the long-run performance. The measure follows the method of Ritter (1991). We use the general market index to adjust stock returns on a monthly basis. Monthly market-adjusted returns are calculated as monthly raw returns on a stock over the monthly market return for the corresponding period. The market-adjusted return for stock i in event month t is given as

The average adjusted return on a portfolio of n stocks for event month t is the equally-weighted arithmetic average of the market-adjusted returns:

The cumulative market-adjusted aftermarket return (CAR) from event month q to event month s is the sum of the average market-adjusted returns over this period:

Abnormal returns depend on the benchmark used. To calculate the abnormal return we use the Fama and French (1993) model. Fama and French (1993)Footnote 11 show that when the standard three-factor model (without the momentum factor) is estimated in randomly chosen sample firms with small size and low book-to-market ratio, the null hypothesis of zero abnormal performance is over-rejected. The majority of our sample consists of small and growth firms, thus this potential problem can be particularly severe. Mitchell and Stafford (2000) also raise the possibility that the intercept under the null hypothesis may be biased under the standard calendar-time approach. We examine the performance of these monthly portfolios by calculating the subsequent excess return and running the following calendar-time regression. Under this model, abnormal returns are calculated using the Fama and French (1993) three-factor model as follows:

where R pt is the calendar-time portfolio return, R ft is the one-month Treasury-bill yield during month t, R mt is the value-weighted market index return, SMB t is the difference in returns of value-weighted portfolios of small firms and large firms during month t, HML t is the return differential of value-weighted portfolios of high and low book-to-market firms in month t, β, γ, and δ are regression parameters specific to the portfolio, and ε pt is the error term. We construct the SMB and HML factors as in Fama and French (1993).

4.3 Control variables

There is some evidence on factors affecting the quality of earnings forecasts; however there is thus far no study that associates this observed accuracy with the long-term performance of IPO firms. Addressing this gap, we identify a number of IPO- and firm-specific variables that can plausibly offer incremental explanatory power to the reliability of managerial predictions.

Size: Size, commonly proxied by market capitalization, has been extensively used as a determinant of the quality of management earnings forecasts and firm long-run performance.Footnote 12 In terms of earnings forecast, it has been argued that large companies are able to use the best expertise and modern, sophisticated forecasting techniques to attain more accuracy (e.g., Eddy and Seifert 1992; Firth and Smith 1992; Mak 1994). Some authors also argue that large companies may even have greater control over their market settings and they might have gained comparative economies of scale, making them less susceptible to economic fluctuations (e.g., Firth et al. 1995). Taken together, these arguments converge in the direction of enhanced accuracy for larger corporate issuers.

Age: The operating history of a firm prior to going public plays a significant role in its long-run stock price performance and in the accuracy of its forecasts. Firm age has been suggested as a proxy for the risk level of the IPO firm (Ritter 1984; Carter et al. 1998; Goergen et al. 2007). Firms with a long history are shown to provide more detailed management earnings forecast disclosure and more accurate forecasts about their future performance, as they are likely to have better control over their operations and a better feeling for the market environment (e.g., Firth and Smith 1992; Cazavan-Jeny and Jeanjean 2007). This is expected to affect their future performance and to offer better returns to their long-term investors. Age is measured as the number of years starting from the year of establishment until the year of going public.

Timelag: Time lag is the number of days from prospectus registration to listing date. In many countries, time lag is short; however, it generally ranges from 5 to 70 days. During this period, changes in market conditions may affect the price performance of IPO firms, as well as aftermarket returns. Many studies (e.g., Lee et al. 1993; Firth et al. 1995; Jelic et al. 1998; Hartnett and Romcke 2000; Lonkani and Firth 2005) support the notion that the length of the forecasting period influences the degree of forecast accuracy. Forecasts with a shorter time horizon are expected to be more accurate and to have better long-term performance, while those with longer time horizons are associated with greater uncertainty and less satisfactory returns in the long term (Jaggi 1997).

Privatization: Megginson et al. (2000) examine long-run aftermarket performance for a 36-country sample of 264 privatization IPOs for the period 1981–1997 and show a positive performance irrespective of the considered period (one, three, and five years). Brav and Gompers (1997) show empirically decreasing long-term underperformance of privatized IPO firms. It is expected that these firms are publicly recognizable and that any government, as the principal shareholder, would like to see a successful issue and, at the same time, secure positive feedback from the markets and the media. Because of the expected high public participation, management makes an effort to provide an accurate earnings forecast, which enhances the reputation of the firm and helps secure good long-term returns. We include in the model a dummy variable, Privatization, which is set to 1 if the firm is a privatized entity, and zero otherwise.

Oversubscription: The degree of forecast accuracy is likely to decrease with the level of oversubscription. It is expected that uninformed investors create high demand for highly underpriced, low-quality IPOs associated with high forecast error. These IPOs become part of the speculative attitude by well-informed investors in the aftermarket and experience amplified flipping activity. This behavior is well explained by the speculative bubble hypothesis, which is an alternative approach toward explaining the post-listing return behavior of IPO firms. When investors do not behave rationally, they may over- or under-react to information about IPO prospects and they may temporarily over- or undervalue the price of the initial offerings. As a result, investor demand will be high in the short-run, leading to poor long-term performance.

Underwriter reputation Footnote 13: Most theoretical studies regarding long-term performance of IPOs and the role of underwriters’ during the going-public period concentrate on asymmetric information and its effect on stock price performance. Baron (1982) and Dimovski et al. (2011) argue that asymmetric information exists between the well-informed underwriters and the less-informed issuers; therefore, underwriters are able to price new issues below the market equilibrium to reduce the probability that they will absorb losses due to unsold shares. Chen and Firth (1999) report a positive relation between underwriter reputation and accuracy of earnings forecasts. Ghikas et al. (2008) find that underwriters align their interests with those of the pre-IPO stockholders, affecting the quality of the earnings forecast by not incorporating adverse information provided by auditing of qualified reports. Overall, the aim of reputable underwriters is to maintain their reputation by associating themselves with more accurate disclosure information and better long-term returns to their loyal customers and retail investors.

Market conditions (Hot/Cold): This study uses a dummy variable to account for market conditions. This dummy variable takes the value of 1 for IPO firms that are listed during a hot period, and zero for those listed during a cold period. The “hot period” and “cold period” classifications are based on the intensity of IPO listing activity. The rationale underlying this control variable is that if an earnings forecast takes place during a hot period (i.e., periods with large numbers of listings on the ASE) and the actual earnings appear in the cold period, then the results can be lower than expected (optimistic forecast), leading to a high forecast error. Conversely, if an earnings forecast occurs during a cold period and the actual earnings are announced during a hot period, then the actual earnings can be much higher than expected (pessimistic forecast), leading to a high forecast error. Thomadakis et al. (2012) show a strong relation between cold IPO periods and long-term performance. These authors point out that some IPOs are issued in hot markets, when long-term expectations are low and the general level of the stock market is decreasing, while other issues take place during cold periods, when long-term return projections are promising.

Given ownership: The monitoring of managerial actions, such as management earnings forecasts, depends to a large extent on firm ownership structure. The literature indicates that a high (low) percentage of retained (given) ownership signals high firm quality (e.g., Li and McConomy 2004).Footnote 14 Managements of such IPO firms believe in the strength and potential of their companies and have strong motivation to provide accurate earnings forecasts. Accuracy is appreciated by long-term investors and encourages them to keep their position in the firm, supporting its investment plans. This creates better conditions for good long-term returns. The evidence from Hansen and Torregrosa (1992) indicates a direct relationship between the proportion of shares retained by owners and long-term performance of IPO firms. Jain and Kini (1994) argue that long-run underperformance can be partly explained by low managerial incentives following an IPO.

4.4 Description of the model

AFE and FE vary across companies. We construct cross-sectional models to explain these variations and regress AFE and FE on macroeconomic and firm-specific factors as follows:

Negative signs are expected on size (Size), age (Age), privatized firms (Privatization), level of oversubscription (Oversubscription), and underwriter quality (Underwriter); plausibly, these factors as proxies of an issuer’s quality and perceived prestige result in the production of more accurate forecasts. Positive signs with AFE are expected for those factors that are likely to instill greater uncertainty in IPO investors, such as length of the listing period (TimeLag), market conditions (HotCold), given ownership (Ownership), and industrial classification (Industry).

Further, we test for long-term performance using the following model:

5 Empirical results on profit forecasts

5.1 Descriptive statistics

Panel A of Table 1 provides an annualized listing of the 303 Greek IPOs that have been listed on the ASE since 1993. It also classifies earnings forecasts into mandatory and voluntary disclosure. Among the 83 IPOs listed during the voluntary disclosure period, 22 did not include earnings forecasts in their prospectuses. Overall, the sample of IPOs listed under the voluntary disclosure environment is relatively small, as the Greek debt crisis of 2009 to 2015 has affected the number of new listings. It is noteworthy that there have been no IPOs in Greece in the last five years of the study period. The last time the ASE experienced three consecutive years without an IPO was in the 1980s.

Panel B of Table 1 reports average values for market capitalization, firm age, oversubscription, and given ownership for each year in the sample period. Further, it partitions the sample based on whether earnings forecasts are optimistic or pessimistic. The optimistic (pessimistic) group includes firms with high (low) forecasts compared to the actual earnings realized after the IPO. The optimistic sample typically comprises larger firms (mean market capitalization is € 62.06 million versus € 26.05 million for the pessimistic sample). The optimistic (pessimistic) group is also associated with a more (less) appeal to IPO investors, evidenced by an average subscription multiple of 110.50 (79.80). In contrast, firm age and the given ownership fail to generate statistically significant differences between the two groups. Table 2 provides the distribution of IPOs per industry with a further breakdown by disclosure period (mandatory versus voluntary). The main industries represented in the sample are finance, insurance and real estate (25.41 %) and mining and construction (19.80 %). The chemical and health industries each account only for 2.64 % of sample IPOs.

The summary statistics for absolute forecast errors, forecast errors, and adjusted returns for one, two, and three years after going public are shown in Table 3. Means, medians, and standard deviations are broken down by mandatory and voluntary periods. The mean (median) forecast error for the total sample is 3.66 % (−0.38 %). The positive sign reveals that, on average, forecasts are less than the actual profits, leading to pessimistic forecasts. When breaking down forecast error by mandatory and voluntary disclosure regime, the results reveal a positive mean of 8.65 % for firms listed during the mandatory period and a negative mean of −9.58 % for firms listed during the voluntary period. This tells us that firms are more conservative when compelled to provide forecasts in their prospectuses, and therefore, actual profits are typically higher than forecast. Once the disclosure environment turns voluntary, Greek IPO firms behave differently and the forecast error sign changes, indicating more optimistic forecasts than the actual earnings. This lends support to the argument that earnings forecasts during mandatory (voluntary) periods are generally pessimistic (optimistic).

Long-term performance of Greek IPOs varies depending on the disclosure environment. IPOs in the mandatory regime period with pessimistic forecasts present positive long-term returns, with an average of 16.34 % after three years (ER3Y1D). When the disclosure regime changes to voluntary and the forecasts turn optimistic, the average three-year long-term return becomes negative, −34.68 %. This result indicates that investors reward a pessimistic earnings forecast approach by management, as they prefer to see better actual earnings than forecast one year after the IPO.

Long-term returns from the end of the first month of trading are negative for all IPOs. More specifically, firms going public under a mandatory disclosure environment experience negative returns one (ER1Y1M), two (ER2Y1M), and three (ER3Y1M) years after going public of −16.41, −27.64, and −8.88 %, respectively. Those firms that voluntarily provide earnings forecasts show negative returns of −10.09, −31.79, and −32.53 % over the same periods. IPOs in the mandatory regime period provide better long-term returns compared to those in the voluntary regime period two and three years after going public. The difference in long-term returns is statistically significant at conventional levels.

In summary, Table 3 indicates that long-term returns during the mandatory regime outperform those during the voluntary regime two (three) years after the IPO. The rationale underlying this result is that actual earnings tend to be better than the forecasts in the mandatory regime (hence good news, better returns), but lower than the forecasts in the voluntary regime (hence bad news, worse returns).

Table 4 (Panel A) shows the frequency distribution of forecast errors. Forecast errors are, on average, mainly positive (negative) during the mandatory (voluntary) period, meaning that forecasts for most firms are lower (higher) than actual results. It appears that most Greek firms providing mandatory (voluntary) forecast earnings have been underestimating (overestimating) their forecast profits and are generally more (less) conservative during the mandatory (voluntary) disclosure period. The mean AFE for Greek companies is 40.32, 36.83, and 39.72 % for mandatory, voluntary, and combined samples, respectively. The majority of IPOs in the mandatory and voluntary samples experience an AFE of less than 25 % (92 IPOs listed under the mandatory regime and 30 IPOs listed under the voluntary regime). Since the regulation changed, allowing IPO firms to provide an earnings forecast only when they feel confident to do so, 30 out of 61 IPOs (49.18 %) announced AFE lower than 25 %, which constitutes preliminary evidence in support of improved forecast accuracy.

Panel B of Table 4 analyzes long-term performance based on year of issuance and disclosure of earnings forecasts (mandatory versus voluntary). There is clear evidence that IPO firms that mandatorily disclose earnings forecasts experience much better long-term returns than others. More specifically, the IPOs that mandatorily provide earnings forecasts have an average return three years after the IPO of −8.88 % compared to −32.53 % for firms that voluntarily provide earnings forecasts. Similar results are found using alternative long-term performance measures over two and three years following the IPO (ER2Y1D, ER3Y1D, and ER2Y1M). Individual-year cases are sometimes surprising. For instance, newly listed firms in the hot period of 1999 enjoyed good long-term returns of 22.98, 4.19, and 10.09 %, one, two, and three years after going public, respectively. Further, IPO firms with voluntary earnings disclosure do not seem to be good long-term investments, because of the severe negative long-term returns. For instance, IPO firms listed in 2002 present a positive one-year return, 1.36 %, but extremely large second- and third-year negative returns of −46.42 and −92.04 %, respectively.

Table 5 presents the frequency distribution of the forecast errors in relation to long-term performance. IPOs with low forecast errors (0 < FE ≤ 0.1) during the mandatory period are rewarded with positive long-term returns (12.86, 38.93, and 30.15 %, for the first, second, and third year after listing, respectively), while newly listed firms with forecast error above 80 % (FE > 0.8) have strongly negative returns (−13.54, −35.38, and −69.81 %, for the first, second, and third year after listing, respectively). Similarly, IPOs with AFE below 10 % (0 < AFE ≤ 0.1) offer positive long-term returns of 42.33, 36.38, and 25.22 % depending on the horizon, while those with inaccurate forecasts (AFE ≥ 1.00) have negative returns of −38.53, −15.92, and −42.55 % depending on the horizon.

These results do not qualitatively change when we examine the voluntary sample. Only IPOs with low forecast error (0 < FE ≤ 0.1) offer positive three-year long-term returns (16.14 %). New issues with AFE lower than 10 % offer marginally positive returns to their investors (0.67 %). As expected, when management is unable to offer accurate absolute forecasts (AFE ≥ 0.8), the returns are, on average, strongly negative for two and three years after the IPO, suggesting that investors punish IPOs that do not provide accurate earnings forecasts in their prospectuses during the voluntary period. The 22 IPOs that chose to avoid announcing management earnings forecasts experienced severe negative long-term returns of −20.38, −40.20, and −50.35 % one, two, and three years after going public, respectively.

In summary, the findings shown in Table 5 indicate that post-IPO long-run performance (in particular the last column of Table 5) is highest for IPOs during the mandatory period (16.34 %), followed by IPOs during the voluntary period with voluntary management forecasts (−34.68 %), and is lowest for IPOs during the voluntary period without management forecasts (−50.35 %). Such differences in long-run performance may be at least partially attributable to market sentiment rather than a poorer quality of IPOs during the voluntary period, or other confounding factors. Consequently, it is a mistaken strategy to ignore the prevailing disclosure regime when analyzing IPO performance.

Table 6 reports pairwise correlations for all explanatory variables. The correlation coefficients are low, suggesting that multicollinearity is unlikely to be a problem.

5.2 Regression analysis

Table 7 reports results from regressing absolute forecast error and forecast error on disclosure regime (mandatory versus voluntary), along with a number of control variables suggested by the literature. These regressions are in the spirit of prior literature and are estimated using ordinary least squares with robust standard errors to control for heteroskedasticity. The adjusted R-squared are similar to existing studies.

Columns 1 and 2 use the full sample of 281 IPO firms that provide a forecast during the mandatory (220 IPO firms) and the voluntary (61 IPO firms) regime periods. They shed light on the effect of disclosure regime on AFE and FE. Consistent with H1, mandatory disclosure of earnings forecasts is associated with production of inaccurate management earnings forecasts. The coefficient on the Mandatory dummy is positive and statistically significant (at the 5 % level) when using AFE as the dependent variable. Our conclusions are reinforced when FE is the dependent variable. The coefficient on Mandatory is positive and statistically significant at the 1 % level, providing evidence that management earnings forecasts of IPOs issued during the mandatory period are lower than actual earnings, and suggesting that managers under-forecast earnings when they are mandated to provide earnings forecasts. This result is in line with the argument that managers provide less optimistic forecasts during the mandatory period as a form of insurance against possible criticism and legal action against the company in the post-IPO period.

As a robustness check, we use a matched-sample approach to ensure that our results are not driven by firm characteristics that may affect the choice to go public during the mandatory regime period. More specifically, for each of the 61 IPOs in the voluntary regime period, we assign the closest-neighbor from the 220 IPOs available in the mandatory regime period. In columns 3 and 4, firm size and industry are used as matching criteria, whereas in columns 5 and 6, matching is performed using firm age and industry at the time of IPO. The empirical results show that the coefficient on Mandatory remains positive and statistically significant irrespective of the matching criteria. Mandatory disclosure of earnings forecasts in IPO prospectuses is associated with greater forecast error (AFE and FE). Managers seem to underestimate profits more when the disclosure regime is mandatory than when it is voluntary.

Turning to the other determinants of forecast accuracy, we report, for the full sample, a positive effect of firm size on AFE. Contrary to our expectation, AFEs increase with firm size. This is not the first study to document a similar result. Lonkani and Firth (2005) generate similar evidence for their sample of Thai IPOs. The absolute forecast errors seem to increase with the period that separates publication of the prospectus and the first listing day (TimeLag). The longer this time interval is, the greater the likelihood of erroneous estimates due to possible changes in the underlying assumptions. The coefficient on the HotCold dummy is negative and statistically significant at the 1 % level. This result stands in sharp contrast to the notion that management forecast accuracy becomes a lesser concern in hot markets. The percentage of given ownership inversely relates to AFE, suggesting that managers of firms with large retained ownership are more careful in their forecasts. It is noteworthy that firm age and underwriter reputation do not seem to affect the quality of management earnings forecasts.

Table 8 shows the determinants of long-term performance by disclosure period (mandatory and voluntary). This table explores the explanatory factors (other than forecast accuracy) of IPO long-term returns under the two disclosure regimes. To capture possible time trends, we use first-, second-, and third-year returns as dependent variables. Further, to reduce the effect of any aberration in the early trading period (such as investment banker price support), we measure returns beginning from the first day of trading (ER1Y1D, ER2Y1D, and ER3Y1D) and from the first month of trading (ER1Y1M, ER2Y1M, and ER3Y1M). The results obtained from the mandatory sample show that large firms realize negative returns up to one year post-IPO (−0.118) and a positive return over a two-year period (0.145). During voluntary regime forecasts, the results are consistently positive and statistically significant irrespective of the measure of long-term returns. Firm age is negatively associated with long-term returns under the voluntary period. The coefficient sign is consistent with the intuition that longer operational experience reduces risk, and this, in turn, limits realized returns.

The privatization dummy exhibits a positive sign, indicating the presence of higher risk underpinning the long-run viability of firms that have existed only under state control and, following an IPO, are expected to compete in a market-driven business environment. In addition, high oversubscription during the book building period is a signal for good long-term returns. The mandatory period (exclusively) illustrates this. The negative association with first-year returns becomes a positive and statistically significant relation (at least at the 5 % level) for the returns of subsequent years. The finding that reputable underwriters barely give rise to a discernible pattern of performance is surprising, albeit the same under both regimes. The limited Greek IPO market and the even more limited number of local underwrites may explain this result. As expected, IPOs listed during a cold period are associated with better returns over a three-year period, highlighting the significance of market conditions during the public offering period. In contrast to the mandatory sample, a high percentage of given ownership is rewarded with good investor returns over the voluntary period. Finally, we document no statistically significant evidence for TimeLag and Industry.

Table 9 explores how the prevailing disclosure regime (captured by the Mandatory dummy variable) affects the long-term performance of IPOs using the cumulative abnormal returns of the Fama and French (1993) three-factor model as dependent variables. The results confirm that IPOs in the mandatory period realize superior returns rather than in the voluntary period (mainly columns 3 and 6). The fact that statistical significance is obtained only for coefficients in the regressions with two-year, and especially three-year returns shows that time accentuates the positive relation. This finding is consistent with the rationale that management earnings forecasts can be a strong tool in the hands of investors and can help them make future investment decisions. In particular, with a greater number of subsequent accounting periods to report earnings that consistently and sizably outperform the expectations (initial forecast in the IPO prospectus), the euphoric sentiment of investors reflects the upward trend of long-term returns. In parallel, the extent of conservatism that, on average, surrounds profit forecasts is fully revealed. This finding is mainly significant two, and in particular, three years after IPO.

Focusing on marginal effects constitutes an alternative way to shed light on the association with long-term performance. To this end, Columns 7 and 8 augment the baseline specification with AFE and its interaction with the Mandatory dummy. The resulting coefficients on the new terms convey important intuition on market investors’ perceptions of forecast accuracy. In particular, focusing on the ER3Y1D regression, we find a negative sign for the interaction term and a slightly positive coefficient for AFE. Taken together, the effect of AFE on ER3Y1D, given a mandatory period, is negative (0.003 − 0.014 = −0.011). That is, forecast accuracy is rewarded by means of higher long-term returns, which is consistent with H2. This suggests that issuers should always disseminate reliable information regardless of the prevailing regulatory regime. In addition, conservative forecasts should not be used as a tool for attaining higher market valuations, since the market is shown to be able to identify and penalize speculative behavior. Consistent with this relation, Columns 9 and 10 report qualitatively similar results when we substitute AFE for FE.

As for control variables, the results reveal a positive relation between firm size and long-term performance. The coefficient for firm age is negative only when returns are calculated from the end of the first month of trading and only for one year. This indicates that investors in companies with short operational history before listing enjoy better one-year returns. The privatization variable has the expected sign; the positive coefficient indicates that privatized firms experience superior one-year returns. Thus, investors should take advantage of and participate in privatized company issues. The coefficient on market condition (HotCold) shows that firms going public during hot periods offer better returns up to the one-year period, whereas those going public during cold periods provide better returns to investors after two and three listing years.

.

6 Additional robustness checks

6.1 A propensity score matching approach

Although our findings lend support to more pronounced IPO underperformance under voluntary disclosure, one cannot rule out the possibility that the effect is partially distorted by endogeneity. In particular, it is possible that the mandatory and voluntary periods feature distinct firm- or market-level characteristics that affect the aftermarket performance. We address this concern using a propensity score matching (PSM) technique. Through inclusion of possible confounding characteristics (Size, Age, Privatization, Oversubscription, Underwriter, HotCold, Ownership, and TimeLag), PSM matches observations from two samples in a simultaneous procedure. Therefore, framing the mandatory (voluntary) regime as the treatment (control) group, the observed difference in means captures the effect that is exclusively due to treatment. We apply four distinct PSM approaches: (i) nearest neighbor, (ii) radius, (iii) Kernel and (iv) stratification for returns calculated from the first day as well as the end of the first month. Table 10 summarizes the results.

The nearest-neighbor matching method (Panel A) assigns each voluntary disclosure IPO firms a mandatory counterpart based on propensity score proximity. The results on the matched sample show that long-term returns considerably deteriorate in the voluntary period compared to the mandatory period. Moreover, the long-term underperformance during the voluntary period is lower the longer the interval over which returns are measured. The long-term performance difference is largest for a three-year period and has the highest statistical significance (ER3Y1D: 82.76, t-statistic 3.94; ER3Y1M: 48.74, t-statistic 4.83). The radius (Panel B), Kernel matching method (Panel C), and stratification matching method (Panel D) provide results consistent with the nearest-neighbor matching method. The statistical significance appears troublesome only for ER1Y1M and ER2Y1M, while ER1Y1D and ER2Y1D are statistically significant at conventional levels. The evidence on three-year returns is invariably robust.Footnote 15

6.2 Management earnings forecasts during the voluntary period

The main conclusion of this study is that mandatory disclosure of earnings forecasts in IPO prospectuses is associated with better long-term returns. We attribute this association to the fear of managers failing to meet their forecast expectations. However, our reporting conservatism argument may be questionable if aftermarket performance depends on the management decision of whether or not to issue earnings forecasts for IPO firms listed during the voluntary period. To test the robustness of our results to this source of bias, we regress long-term returns on the Voluntary Forecast dummy, which takes 1 for IPO firms providing an earnings forecast during 2001–2015 and zero otherwise, along with control variables. The empirical results in Table 11 show that the coefficient on Voluntary Forecast dummy is not statistically significant irrespective of the measure of long-term performance. This result is consistent with the argument that the decision to issue voluntary earnings forecasts in IPO prospectuses is not related to long-term performance, suggesting that this issue is not serious in our case.Footnote 16

7 Conclusion

Greek IPOs were required to disclose next-year profit forecast in their prospectuses until the regulation changed in 2001 to make it voluntary. This study uses all Greek IPOs issued during 1993–2015 to investigate the effect of disclosure regime on management earnings forecasts and IPO long-term performance. The empirical results indicate that IPO aftermarket performance (excluding the first day of trading) significantly deteriorates in the voluntary period, suggesting that investors during the voluntary regime punish firms that provide inaccurate earnings forecasts in their prospectuses. In addition, the post-IPO long-run performance is highest for IPOs during the mandatory period, followed by IPOs with voluntary management forecasts and those without management forecasts. These differences in long-run performance do not seem to be due to poorer quality of IPOs in the voluntary period, but to decreased management earnings forecast accuracy during during the mandatory disclosure regime. The evidence is consistent with the systematic production of pessimistic forecasts during the mandatory period, which is mainly driven by accounting conservatism and lawsuit avoidance.

IPO firms that provide inaccurate forecasts in the mandatory regime exhibit poorer long-term performance. Therefore, setting initial expectations at a low level so as to exceed them effortlessly over the subsequent reporting periods is clearly a shortsighted strategy. Each IPO issuer should make efforts to produce accurate earnings forecasts. Firms with low forecast errors during the mandatory period offer higher long-term returns, suggesting that management efforts to provide accurate forecasts is rewarded by shareholders.

A closer look at AFE shows positive long-term returns for firms with low errors during the mandatory period, while long-term returns turn negative when errors are high. Similar results are found for the voluntary period, where only firms presenting low AFE are associated with positive long-term returns over a three-year period. It appears that investors are one step ahead of regulators and penalize, with strong negative returns, firms that are unable to provide reliable earnings forecasts.

In summary, we find positive forecast errors and higher long-term performance during the mandatory period, suggesting that the mandatory disclosure requirement causes IPO firms to systematically bias profit forecasts downwards. The mandatory disclosure requirement, hence, artificially improves long-term IPO share performance. Moreover, we find that IPO long-term performance decreases with management earnings forecast error during the mandatory period.

Notes

International evidence covering management earnings forecasts around IPOs includes Lee et al. (1993) and Hartnett and Romcke (2000) for Australia; Li and McConomy (2004) for Canada; Chen and Firth (1999), Firth et al. (2008), Tan et al (2015) for China; Cormier and Martinez (2006) for France; Gounopoulos et al. (2015) for Greece; Jaggi (1997), Cheng and Firth (2000), and Chen et al. (2001) for Hong Kong; Jelic et al. (2001) for Malaysia; Firth and Smith (1992) for New Zealand; Firth et al. (1995) for Singapore; Jaggi (2006) for Taiwan; Firth and Lonkani (2005) for Thailand; Jelic (2011) for the UK; and Drobetz et al. (2015) for the maritime industry.

We follow Ritter (1984), who considers cold periods as those with low average initial return.

According to the market timing hypothesis, managers choose a window of opportunity to launch an IPO. This window is identified as a function of the firm’s performance and market conditions. Generally, managers prefer to take their firms public when they have performed well, and probably the IPO date is conditional on the firm’s cycle of activity and operational performance. Further, the window of opportunity for an IPO may be determined by market conditions. In a bullish market, the number of IPOs tends to increase, because the placement of stocks is easier, the risk of failure of an IPO is lower, and securities are priced higher.

Market optimism theory states that active “buy and sell trades” in the aftermarket during the first day of trading, so-called “flipping activity” is a good indication of future stock price performance. The theory suggests that there are periods when investors are particularly confident about firms’ future projects and profits, and that managers are induced to make offerings in these periods.

The price support hypothesis indicates that underwriters stabilize stock prices during a short period of time after the IPO so as to avoid failure of the issue. Prices are artificially supported at a high level in the short-run, but at the end of the stabilization period, performance decreases.

This hypothesis assumes that investors are not able to correctly estimate firm value at the time of the offering. After a three-year period, investors would be able to identify the accounting adjustments and would reallocate their portfolios.

Hughes (1986) highlights that, to avoid market failure, the issuer should make a disclosure about firm value that can be verified by the investment bank.

The regulatory switch from mandatory to voluntary management earnings forecasts was motivated by its expected contribution to the efficient and cost-effective functioning of the capital markets. Protection of investors and maintenance of confidence in the Greek financial market were also important issues. This regulatory change was also intended to reinforce the freedom of movement of capital within the Greek market and to help small family companies to go public. The change involved the forecast for the next year-end.

Among the 71 listings, the most prominent were banking firms, with 15 listings, textiles with 12, construction with 8, and chemicals and food, each with 7 listings.

t corresponds to the year of IPO.

Fama and French (1996) find that many market “anomalies” can be explained by taking into account size and book-to-market effects through the use of a three factor benchmark.

Underwriters in the Greek stock market are either large banks (e.g., the National Bank of Greece, EFG Eurobank, Alpha Bank, and Piraeus Bank) or major securities firms.

Li and McConomy (2004) show that earnings forecast and retained ownership decisions are jointly determined by managers after controlling for other factors that affect each decision independently. These authors document a substitution effect between these two decisions.

We use this PSM matched sample to rerun our regressions in Table 7. The coefficient on Mandatory dummy remains positive and statistically significant, suggesting that management earnings forecasts during IPOs issued during the mandatory period are lower than actual earnings. In other words, managers under-forecast earnings when they are constrained to provide earnings forecasts. The empirical results remain qualitatively similar when we rerun regressions in Table 9 using the PSM matched sample. In particular, the coefficient on Mandatory dummy remains positive and statistically significant, suggestion that firms that went public during the mandatory period realize superior returns compared to those floated in the voluntary period. These results are not tabulated, for the sake of brevity, but are available from the authors upon request.

The results remain qualitatively similar when we use the fitted values of ‘Voluntary Forecast’ from a probit model that determine the decision of managers to disclose earnings forecasts or not during the voluntary period. These results are not reported in the paper, for the sake of brevity, but are available from the authors.

References

Baginski S, Hassell J, Kimbrough M (2002) The effect of legal environment on voluntary disclosure: evidence from management earnings forecasts issued in U.S. and Canadian markets. Acc Rev 77:25–50

Baron D (1982) A model of the demand for investment banking advising and distribution services for new issues. J Financ 37:955–976

Bhabra H, Pettway R (2003) IPO prospectus information and subsequent performance. Financ Rev 38:369–397

Boehme R, Colak G (2012) Primary market characteristics and secondary market frictions of stocks. J Financ Mark 15:286–327

Brav A, Gompers P (1997) Myth or reality? The long run underperformance of initial public offerings: evidence from venture and non venture capital backed companies. J Financ 32:1791–1821

Carter B, Dark F, Singh R (1998) Underwriter reputation, initial returns, and the long run performance of IPO stocks. J Financ 53:285–311

Cazavan-Jeny A, Jeanjean T (2007) Levels of voluntary disclosure in IPO prospectuses: an empirical analysis. Rev Acc Financ 6:131–149

Chan A, Cora S, Millie T, Wong D, Chan R (1996) Possible factors of the accuracy of prospectus earnings forecasts in Hong Kong. Int J Acc 31:381–398

Chen G, Firth M (1999) The accuracy of profit forecasts and their roles and associations with IPO firm valuations. J Int Financ Manag Acc 10:202–226

Chen G, Firth M, Kim J-B (2000) The post-issue market performance of initial public offerings in China’s new stock markets. Rev Quant Financ Acc 14:319–339

Chen G, Firth M, Krishnan G (2001) Earnings forecast errors in IPO prospectuses and their associations with initial stock returns. J Multinatl Financ Manag 11:225–240

Cheng T, Firth M (2000) An empirical analysis of the bias and rationality of profit forecasts published in new issue prospectuses. J Bus Financ Acc 27:423–446

Chou D-W, Gombola M, Liu F-Y (2010) Earnings management and long-run stock performance following private equity placements. Rev Quant Financ Acc 34:225–245

Cormier D, Martinez I (2006) The association between management earnings forecasts, earnings management, and stock market valuation: evidence from French IPOs. Int J Acc 41:209–236

Dechow PM, Hutton A, Sloan R (2000) The relation between analysts’ forecasts of long-term earnings growth and stock price performance following equity offerings. Contemp Acc Res 17:1–32

DeGeorge F, Derrien F (2001a) IPO performance and earnings expectations: some French evidence. Working paper, HEC Paris

DeGeorge F, Zeckhauser R (1993) The reverse lbo decision and firm performance: theory and evidence. J Financ 48:1323–1348

Deng Q, Zhou Z-G (2016) The pricing of the first day opening price returns for ChiNext IPOs. Rev Quant Financ Acc. doi:10.1007/s11156-015-0500-x

Dimovski W, Brooks R (2004) Initial public offerings in australia 1994 to 1999, recent evidence of underpricing and underperformance. Rev Quant Financ Acc 22:179–198

Dimovski W, Philavanh S, Brooks R (2011) Underwriter reputation and underpricing: evidence from the Australian IPO market. Rev Quant Financ Acc 37:409–426

Drobetz W, Gounopoulos D, Merika A, Merikas A (2015) Determinants of management earnings forecasts: the case of global shipping IPOs. European Financial Management (forthcoming)

Eddy A, Seifert B (1992) An examination of hypothesis concerning earning forecasts errors. Quart J Bus Econ 31:22–37

Fama E, French K (1993) Common risk factors in the returns on bonds and stocks. J Financ Econ 33:3–56

Fama E, French K (1996) Multifactor explanations of asset pricing anomalies. J Financ 51:55–84

Firth M, Smith A (1992) The accuracy of profits forecasts in initial public offerings prospectuses. Acc Bus Res 22:239–247

Firth M, Kwok B, Liau-Tan C, Yeo G (1995) Accuracy of profit forecasts in IPO prospectus. Acc Bus Rev 2:55–83

Firth M, Li Y, Wang SS (2008) Valuing IPOs using price-earnings multiples disclosed by IPO firms in an emerging capital market. Rev Pac Basin Financ Mark Polic 11:429–463

Firth M, Gounopoulos D, Pulm J (2012) IFRS adoption and management earnings forecasts of Australian IPOs. In: European accounting association conference

Frankel R, McNichols M, Wilson GP (1995) Discretionary disclosure and external financing. Acc Rev 70:135–150

Frankel RM, Johnson MF, Nelson KK (2002) The relation between auditor’s fees for nonaudit services and earnings management. Acc Rev 77:71–115

Gajewski JF, Gresse C (2006) A survey of the European IPO market. ECMI paper

Ghikas D, Papadaki A, Siougle G, Sougiannis T (2008) The relevance of quantifiable audit qualifications in the valuation of IPOs. Rev Acc Stud 13:512–550

Goergen M, Khurshed A, Mudambi R (2007) The long run performance of IPOs: can it be predicted. Manag Financ 33:401–419

Gong G, Li L, Xie H (2009) The association between management earnings forecast errors and accruals. Acc Rev 84:497–530

Gounopoulos D, Kraft A, Skinner F (2015) Voluntary versus. Mandatory earnings management in IPOs. Newcastle University Working Paper

Guo R (2005) Information collection and IPO underpricing. Rev Quant Financ Acc 25:5–19

Hansen R, Torregrosa P (1992) Underwriter compensation and corporate monitoring. J Financ 47:1537–1555

Hartnett N, Romcke J (2000) The predictability of management forecast error: a study of Australian IPO disclosure. Multinatl Financ J 4:101–132

Hensler D, Ruherford R, Springer T (1997) The survival of initial public offerings in the aftermarket. J Financ Res 20:93–110

Horton J, Serafeim G, Serafeim I (2013) Does mandatory IFRS adoption improve the information environment. Contemp Acc Res 30:388–423

Hughes P (1986) Signalling by direct disclosure under asymmetric information. J Acc Econ 8:199–242

Hussein MM, Zhou ZG (2014) The initial return and its conditional return volatility: evidence from the Chinese IPO market. Rev Pac Basin Financ Mark Polic 17:1–32

Hutton A, Miller G, Skinner D (2003) The role of supplementary statements with management earnings forecast. J Acc Res 41:867–890

Jaggi B (1997) Accuracy of forecast information disclosed in the IPO prospectuses of Hong Kong companies. Int J Acc 32:301–319

Jaggi B, Chin C, Lin W, Lee P (2006) Earnings forecast disclosure regulation and earnings management: evidence from Taiwan IPO firms. Rev Quant Financ Acc 26:275–299

Jain B, Kini O (1994) The post-issue operating performance of IPO firms. J Financ 49:1699–1726

Jain B, Kini O (2000) Does the presence of venture capitalists improve the survival profile of IPO firms? J Bus Financ Acc 27:1139–1183

Jelic R (2011) Management forecasts and IPO performance. University of Sussex Working Paper

Jelic R, Saadouni B, Briston R (1998) The accuracy of earnings forecast in IPO prospectuses on the Kuala Lumpur stock exchange 1984–1995. Acc Bus Res 29:57–72

Jelic R, Saadouni B, Briston R (2001) Performance of Malaysian IPOs: underwriters reputation and earnings forecast. Pac-Bas Financ J 9:457–486

Jog V, McConomy B (2003) Voluntary disclosures of management earnings forecast in ipos and the impact on underpricing and post-issue return performance. J Bus Financ Acc 30:125–167

Karamanou I, Vafeas N (2005) The association between corporate boards, audit committees, and management earnings forecasts: an empirical analysis. J Acc Res 43:453–486

Lee I, Taylor N, Yee C, Yee M (1993) Prospectus forecast earning: evidence and explanations. Austr Acc Rev 3:21–32

Li Y, McConomy B (2004) Simultaneous signaling in IPOs via management earnings forecasts and retained ownership: an empirical analysis of the substitution effect. J Acc Audit Financ 19:1–28

Liao T-L, Huang C-J, Liu H-C (2015) Earnings management during lockup in explaining IPO operating underperformance. Rev Pac Basin Financ Mark Polic 18:1–21

Ljungqvist A (2007) IPO underpricing. In: Eckbo B (ed) Handbook of corporate finance: empirical corporate finance. Elsevier, Amsterdam

Ljungqvist A, Nanda V, Singh R (2006) Hot markets, investor sentiment, and IPO pricing. J Bus 79:1667–1702

Lonkani R, Firth M (2005) The accuracy of IPO earnings forecasts in Thailand and their relationships with stock market valuation. Acc Bus Res 35:269–286

Mak Y (1989) The determinants of accuracy of management earning forecast: a New Zealand study. Int J Acc 24:267–280

Mak Y (1994) The voluntary review of earnings forecasts disclosed in IPO prospectuses. J Acc Public Polic 13:141–158

McGuinness PB (2016) Post-IPO performance and its association with subscription cascades and issuers’ strategic-political importance. Rev Quant Financ Acc 46:291–333

Megginson W, Nash R, Netter J, Schwartz A (2000) The long-run return to investors in share issue privatizations. Financ Manag 29:67–77

Mitchell ML, Stafford E (2000) Managerial decisions and long-run stock price performance. J Bus 73:287–320

Pedwell K, Warsame H, Neu D (1994) The accuracy of Canadian and New Zealand earnings forecasts: a comparison of voluntary versus compulsory disclosures. J Int Acc Audit Tax 3:221–236

Ritter J (1984) The hot issue market of 1980. J Bus 57:215–240

Ritter J (1991) The long performance of initial public offerings. J Financ 46:3–28

Selva M, Ma A, Wa J (1994) The reliability of prospectus-based profit forecasts in Hong Kong. Working paper, Hong Kong City University

Shen Z, Coakley J, Instefjord N (2014) Earnings management and IPO anomalies in China. Rev Quant Financ Acc 42:69–93

Skinner K (1994) Why firms voluntarily disclose bad news. J Acc Res 32:38–60

Tan Q, Dimovski W, Fang V (2015) The underpricing of infrastructure IPOs: evidence from China. Rev Pac Basin Financ Mark Polic 18:1–31

Teoh S, Welch I, Wong T (1998a) Earnings management and the long-run market performance of initial public offerings. J Financ 53:1935–1974

Teoh S, Welch I, Wong T (1998b) Earnings management and the underperformance of seasoned equity offerings. J Financ Econ 50:63–99

Thomadakis S, Gounopoulos D, Nounis C (2012) Long term performance of greek IPOs. Eur Financ Manag 17:117–141

Thomadakis S, Gounopoulos D, Nounis C, Riginos M (2016) Innovation and upheaval: early growth in the Greek Capital Market listing and IPOs from 1880 to World War II in the Athens Stock Exchange. Econ Hist Rev (forthcoming)

Thomadakis S, Gounopoulos D, Nounis C, Merikas A (2016) Collateral regulation and IPO specific rebelarization: the case or price limits in the Athens stock exchange. Eur Financ Manag 22:1–32

Wu C (2014) Underpricing of homecoming A-share IPOs by Chinese firms already listed abroad. Rev Quant Financ Acc 43:627–649

Yi J-H (2001) Pre-offering earnings and the long-run performance of IPOs. Int Rev Financ Anal 10:53–67

Yung C, Colak G, Wang W (2008) Cycles in the IPO market. J Financ Econ 89:192–208

Acknowledgments