Abstract

It is increasingly recognized that race interacts in important ways with taxation, including taxation of the family. In this paper, we quantify the racial disparity in the magnitude of the “marriage penalty” or “marriage bonus” in the Earned Income Tax Credit (EITC) using individual micro-level data from the Current Population Survey from 1992 to 2019. We find that low-income Black households experience on average a 22 percent larger EITC marriage penalty than low-income white households, even when their family income levels are largely the same. We also suggest ways to mitigate these racial disparities.

Similar content being viewed by others

Explore related subjects

Discover the latest articles and news from researchers in related subjects, suggested using machine learning.Avoid common mistakes on your manuscript.

1 Introduction

The Earned Income Tax Credit (EITC) has lifted millions of American families out of poverty since its introduction in 1975 (Center on Budget and Policy Priorities, 2023). The EITC is designed to supplement the incomes of lower-income families, all while providing incentives for individuals to work, and the program has often been heralded as a policy success along multiple dimensions for the working poor and their families.Footnote 1

However, the structure of the EITC has features that can penalize marriage via an EITC “marriage penalty” for some couples, as their total credit when married may be lower than the combined credit if filing separately as singles (Bastian, 2017). Although not all EITC couples face such a marriage penalty and some couples even receive an EITC “marriage bonus” (or a total credit that is greater when married than when single), the existence of an EITC marriage penalty may disincentivize family formation and stability, which has also been shown to play a key role in determining health and various measures of well-being, particularly in children (Gruber, 2004; Harknett, 2009; Ribar, 2015; Braga et al., 2020). Indeed, the Congressional Research Service (2022) wrote that as far back as 2001 the Joint Committee on Taxation identified the EITC as one of the main primary causes of the marriage penalty for low-income taxpayers.

As discussed in more detail later, EITC benefits are based on an income scale that is initially increasing, then flat, then decreasing, so whether a couple experiences an EITC marriage penalty or an EITC marriage bonus depends on their family income, their family size, and the division of couples’ earnings among their members. Families in which the two spouses have similar incomes are more likely to experience an EITC marriage penalty than couples with highly unequal earnings. For example, using the benefits structure for the tax year 2018, a childless couple in the increasing portion of the EITC in which each partner earns $5190 ($10,380 total) would receive an estimated $529 earned income tax credit. This same couple, if unmarried, would receive a $794 earned income tax credit, resulting in an EITC marriage penalty of $265. On the other hand, a childless couple comprised of one partner earning $13,840 and the other partner earning $0 would receive an earned income tax credit that is almost $400 more if married than if unmarried, thereby receiving an EITC marriage bonus. In addition to earnings differentials, the level of income also matters. In general, couples with earnings in the flat portion of the EITC sehedule are most susceptible to experiencing an EITC marriage penalty, while those in the decreasing portion are most likely to experience an EITC marriage bonus.

Importantly, because family income, family size, and the division of a couples’ earnings among its members typically differ by race, there can be significant differences in the EITC marriage penalty and EITC marriage bonus across race. Indeed, racial differences in family income, family size, and family income splits can generate significant racial differences in individual income tax liabilities more generally, as argued in pathbreaking work by Brown (1997, 1999, 2007, 2009, 2022). The tax code in the United States is written in a race-blind manner, and the Internal Revenue Service (IRS) resists even collecting race information on tax returns. Even so, the individual income tax – and by extension the EITC – can generate disparate tax treatments by race, largely due to household and labor market decisions that differ by race, as demonstrated by recent work by Alm et al., (2023), Holtzblatt et al., (2024), and Costello et al., (2024).Footnote 2

However, the analyses by Alm et al., (2023), Holtzblatt et al., (2024), and Costello et al., (2024) consider disparate treatments by race in the overall individual income tax liability, rather than the disparate treatments associated specifically and directly with the EITC. Given the central role of the EITC as the main federal government instrument for redistribution to lower-income households, any potential disparate treatment of Black versus white households is especially important – and especially troubling. Black families earn less on average than white families, and thus they are more likely to be affected by the features embedded in the EITC. If the EITC is a major source of marriage penalties among low-income couples, as argued by the Joint Committee on Taxation (2022), then any racial differences in the EITC marriage penalty/bonus can be potentially more prominent and more relevant within the EITC structure. A full reckoning of the magnitude and evolution of any racial differences in the EITC marriage penalty/bonus therefore requires detailed estimations based on household-level data through time.

This is what we do in this paper. We use detailed individual-level data from the Current Population Survey (CPS) over the extended period of 1992 to 2019, corresponding to tax years 1991 to 2018. These data have the crucial advantage of allowing us to identify the race of the individual or household (Black versus white). Although tax records would better capture the actual household take-up of EITC, administrative records lack the essential and required feature of information on race.Footnote 3 We use these data to estimate the EITC marriage penalty/bonus over time for EITC-eligible couples (including cohabiting couples) who are currently married (or cohabiting), assuming no behavioral responses of the couples. We are therefore able to quantify the actual magnitude by race of the EITC marriage penalty/bonus through time, along with the differential impact of the policy changes that have been adopted in an effort to make the EITC more marriage neutral. To our knowledge, we are the first to study the evolution of the EITC marriage penalty/bonus arising from the many structural features of the EITC across time and race.

We find that, while a similar percent of EITC eligible Black and white households experience a penalty (slightly above 50 percent in the latest year in our sample), the size of the penalty is consistently larger for Black households. Indeed, we find that Black households experience a higher EITC marriage penalty (or a lower EITC marriage bonus) than white households for nearly all time periods. Black married households experience an averaged EITC marriage penalty ranging from approximately $937 at its highest in 1998, to $214 at its lowest in 2014, compared to an averaged penalty for white married households ranging between $700 in 1997 and $184 in 2014. (For comparison, the estimated average EITC benefit received by these same Black households in our sample is $1098 in 1998 and $1558 in 2014, and for white households the estimated average EITC benefit is $1018 in 1997 and $1611 in 2014; that is, if filing separately, the credit for Black married couples would have been on average 85 percent higher in 1998 and 18 percent higher in 2014, while for white couples it would have been 68 percent higher in 1997 and 11.4 percent higher in 2014). Although the EITC marriage penalties have decreased for both Black and white households over time and the differences have also narrowed over time, there is still a significant gap between Black and white households. Further, for cohabitating couples, we find an estimated averaged EITC marriage penalty that is lower on average for both Black and white households relative to estimates of married households. Overall, we estimate that low-income Black households experience on average a 22 percent larger EITC marriage penalty than low-income white households, even when their family income levels are largely the same. While changes to the EITC structure have helped reduce the averaged EITC marriage penalty/bonus over time, the magnitude of the racial differences persists.

2 The structure and the evolution of the earned income tax credit

Since its inception in 1975, the EITC has been amended via tax changes six times, as summarized in Congressional Research Service (2022). These changes include the Tax Reform of 1986 (TRA86), the Omnibus Reconciliation Act of 1990 (OBRA90), the Omnibus Reconciliation Act of 1993 (OBRA93), the Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA), the Economic Growth and Tax Relief Reconciliation Act (EGTRRA) of 2001, and the American Recovery and Reinvestment Act (ARRA) of 2009. Of these six reforms, four have a relevant impact on our analysis while two (TRA86 and PRWORA) resulted in changes whose effects do not appear in our sample period (TRA86) or that do not have any noticeable impacts on our findings (PRWORA).Footnote 4

Originally, the EITC provided the same credit regardless of family size if the family included at least one qualifying dependent. In 1990, however, OBRA90 had a significant impact because it modified the formula so that eligible families with two or more children received a larger credit than families with one child, increasing the eligible maximum credit to $1197 for families with one child and $1235 for families with two or more children. In 1993, OBRA93 legislation further increased the credit for larger families, with a maximum credit of $2038 for eligible families with one eligible child and a maximum credit of $2528 for eligible families with two or more children. This legislation also allowed childless individuals to be eligible for a credit, with a maximum credit of $306. Note that expanding the EITC credit to childless individuals has important implications for an EITC marriage penalty/bonus. After this expansion, if a couple decides to file separately, the individual claiming children can receive the credit, and the partner without dependents can also be eligible for the EITC, increasing the overall credit received, if unmarried. While these changes are race-blind, differences in childbearing across races can potentially create systematic differences, with one group being disproportionally affected, as we demonstrate later.

Concerns about a potential increase in the marriage penalty and its possible effects on affect marital decisions resulted in modifications embedded in the EGTRRA and the ARRA.Footnote 5, Footnote 6 EGTRRA in 2001 increased the phase-out income for married couples relative to unmarried individuals. This “marriage penalty relief” specified a $1000 higher phase-out level for married couples in 2002, which increased each year until reaching a $3000 higher phase-out income level in 2008–2010. ARRA in 2009 extended this EITC “marriage penalty relief” to a $5000 higher phase-out income level. This legislation also created a maximum credit for eligible families with three or more children that was larger than the maximum credit for those with less than three children. Previously, an eligible family with three or more children would receive a maximum credit of $5028 compared to a maximum credit of $5657 after the legislation.

All of these changes, some of which were specifically aimed at reducing the EITC marriage penalty, invoke the importance of not only studying race differentials at one point in time but also analyzing the evolution of such differentials over time because such changes may have affected Black and white households differently. The next sections discuss our methods for this analysis, followed by the results of our analysis.

3 Estimating the earned income tax credit marriage penalty/bonus

Estimating the EITC marriage penalty/bonus requires computing the combined earned income tax credit that couples are eligible to receive assuming they are unmarried compared to the credit that they would receive assuming they are married. If the couple receives a lower tax credit when married, then they are classified as having a marriage penalty; likewise, if a couple receives a larger tax credit when married, then they are classified as having a marriage bonus. To make these calculations, we employ data from the Current Population Survey (CPS) obtained through the Minnesota Population Center (Flood et al., 2023).

We use a representative sample of low-income married households eligible for the EITC from the CPS data, which includes information on marital status, race, working status, number of children, and annual earnings for the members of these households.Footnote 7 We gather information on wage, business, and farm income for eligible individuals in the sample to account for all sources of earnings that could potentially affect the magnitude of the tax credit for either an individual (when single) or the family (when married).

We designate households as EITC-eligible either if the couple qualifies for the EITC if married or if either partner would qualify for EITC if unmarried. This allows us to capture any marriage penalty that is embedded in the EITC even if a married couple would only qualify for the EITC if unmarried. Any analysis that only considers households currently receiving EITC may underestimate the scope of the marriage penalty because it is excluding couples for whom being married makes them ineligible for an EITC benefit that they would receive if unmarried. Additionally, only households with positive earnings are categorized as EITC-eligible.

After restricting the sample to EITC-eligible couples, our sample includes 220,495 married households over the 1992 to 2019 calendar years.Footnote 8 Because the information collected by the CPS for any given year relates to the previous year’s earnings, we then use the tax codes for, say, 1991 to estimate the tax liabilities for 1992 CPS data, which means that our various marriage tax/bonus calculations relate to the 1991 to 2018 period. We follow Feenberg & Coutts (1993) by inputting our individual micro-level data into the National Bureau of Economic Research (NBER) TAXSIM model to estimate the tax liability and the EITC for each household (or individual when assumed to be filing separately), using the relevant CPS year’s income and other relevant information, along with the previous year’s tax code.Footnote 9 Note that the use of TAXSIM implicitly assumes 100 percent take-up of EITC if eligible.Footnote 10 For all taxing units, TAXSIM automatically computes their EITC eligibility and credit amount.

We calculate the EITC marriage penalty/bonus for eligible married couples in our sample in three steps, following standard practice (Eissa & Hoynes, 2000; Alm & Leguizamón, 2015; Alm et al., 2014, 2023). First, for each of these married couples in our sample, we calculate the joint EITC. Second, to calculate the total EITC each would receive if they were unmarried, we estimate each spouse’s EITC as if each was single – i.e. as if they were still the same household but they were cohabiting instead of being married – and we add these two individual EITCs to get their combined EITC in this hypothetical “divorce”. Third, we calculate the difference in EITC for the married couple when filing jointly versus the combined EITC when filing separately and cohabiting. A couple faces an EITC marriage penalty if this difference is negative (or a lower total credit if married) and an EITC marriage bonus if this difference is positive. To generate aggregate average estimates for each year, we use household weights in the CPS. For comparability across time, all dollar values are adjusted for inflation and expressed in constant 2020 dollars using the Bureau of Labor Statistics CPI index.

As pointed out by Alm et al., (2023), the race classification of households, although available in the CPS, is not straightforward. The Census has changed over time how individuals self-report race. At the beginning of the sample period, individuals might have identified themselves with one race. However, starting in the late 1990s people were able to report more than one race. When we add this complexity to the fact that we need to classify couples (e.g., two partners) into a race category, we are forced to make several assumptions.

We follow Alm et al., (2023) by creating different classifications of race. The most restrictive classification, and the one used in the results reported here because it is the most straightforward, is where partners report one race and it is the same race for both (either Black or white); we call this the Strict Definition of race. We check the robustness of the results using a Loose Definition. In this classification, a couple is categorized as Black: if both partners self-identify as Black; if at least “75 percent of the couple” chooses to self-identify as Black (e.g., one spouse self-identifies as Black and one spouse self-identifies as at least “50 percent Black”, meaning that the spouse identifies two races, one of which is Black); if each partner self-identifies as mixed race with at least “50 percent Black”; or if one partner chooses to self-identify as Black and one chooses to self-identify as a different race. The Loose Definition of white couples is slightly narrower, where a couple is classified in this group if at least 75 percent of the couple self-identifies as white, following the same criteria above.Footnote 11 For brevity, we only report the results for the Strict Definition of race because the overall results under the other classification yield the same conclusions; see Appendix A for more details on these racial classifications.Footnote 12

Determining the allocation of dependents when the couple is assumed to be cohabiting, instead of married, must be done with care. Indeed, as noted by Michelmore & Pilkauskas (2022), children in lower-income families are more likely to reside in complex family living situations, which also introduces complexity in tax filing. We address these issues in several ways.

In households with only one earner, we assume that an individual files as head of household if the individual claims eligible dependents but is single otherwise. We also assume that both individuals in couples without any eligible dependents file as single individuals. The allocation of children is more complicated. Children can be split between the two parents; they can instead be claimed entirely by one of the two partners, typically the mother. Even so, since the simulated divorce is merely hypothetical and for tax purposes only, we allocate dependents to a partner by assuming that couples minimize their total tax liabilities.Footnote 13 Consequently, when children belong to both partners, they are allocated to the higher-earning partner. Any child who belongs to only one partner is allocated to the biological parent regardless of earnings. Although there are relatively few cases in which we need to make this distinction, this procedure not only helps us get a more realistic estimate but also helps us ameliorate concerns about potential differences between Black and white couples along this dimension. We include children as dependents if they are 19 or younger and those 24 or younger if they are in college full-time. We also categorize adult children as dependents if they receive disability benefits.Footnote 14

Although the number is relatively small in our sample, there are some multigenerational households. In some cases, we observe households with multiple subfamilies, and in other cases we observe children living either with their grandparents or with a single parent in the grandparents’ house. Again, these cases are a small part of the sample. However, because there is some possibility that there are differences across races along these dimensions, we carefully identify all these scenarios to ensure that we use the appropriate family units. For instance, when there are multiple families, we separate all of them and assume that each files their taxes separately, despite living in the same household. Identifying these subfamilies is relatively straightforward because the CPS assigns each person in the household a number. In doing so, the CPS also provides the parents’ person numbers within the household, as well as the person number for spouses. Using this information, we are able to identify independent subfamilies. If children live at their married grandparents’ home with their corresponding adult single parent, we keep the grandparents but drop the others because such a subfamily does not constitute a married couple. In the very few instances in which the single parent is a minor, we assume that the married grandparents claim him/her as a dependent, along with the grandchild. Lastly, if children live with their married grandparents and the biological parent is not present in the household, we assign them as dependents of the grandparents. Similar to Eissa & Hoynes (2000), Alm & Leguizamón (2015), and Alm et al., (2014, 2023), we assume that there are no labor supply responses to couples being married or unmarried.

4 Results

4.1 Racial differences in the EITC marriage penalty/bonus

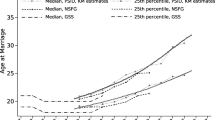

In Fig. 1 we depict the averaged EITC by filing status and race. When unmarried and hypothetically cohabiting, couples receive a larger credit than if married for all periods in our sample, confirming that the EITC tends to create a marriage penalty and that it can be an important factor in the individual income tax marriage penalty/bonus among low-to-middle-income households.

Estimated marriage penalties/bonus in the EITC benefits by race. Notes: For the calculations, we use a sample of EITC-eligible married couples from the Current Population Survey from 1992 to 2019. For each couple, we use the NBER TAXSIM simulator to estimate the EITC benefits under each scenario, where unmarried refers to a hypothetical scenario in which the couple cohabitates and each spouse files a separate tax return. Because information in the CPS relates to the previous year’s earnings, we use 1991 to 2018 as the filing tax years. In panel (a), the estimates represent the EITC benefits averaged across racial groups in each scenario, where “unmarried” refers to the couple’s total benefit when each partner files separately (e.g. as head of household or single). In panel (b), a negative value suggests that the combined EITC when filing separately is greater than the EITC received if filing jointly (an EITC marriage penalty), and a positive value suggests the opposite (an EITC marriage bonus). Couples with a penalty or bonus that is less than or equal to $10 are given a value of zero and assumed to face marriage neutrality with respect to the ETIC benefits. In panel (c), the solid line is estimated by subtracting the averaged EITC penalty/bonus for white couples from the averaged ETIC penalty/bonus for Black couples (black line – gray line in panel (b)), while the dotted lines are the 90 percent confidence intervals. A negative value would suggest that, when averaged across all families in the sample, Black couples are estimated to experience either a higher EITC marriage penalty or a lower EITC marriage bonus relative to white couples. The estimates are all expressed in 2020 dollars, using the Bureau of Labor Statistics Consumer Price Index, and represent averages across groups. Source: Authors’ calculations

Much of the racial difference in the EITC marriage penalty/bonus comes from differences in the total credit amount that could be received if filing separately as cohabiting households. Under their current marital status (i.e. married), Black and white households in our sample of EITC-eligible households receive on average a similar level of the EITC. Importantly, however, Black households receive a larger credit than white households when assumed to be cohabiting, creating a larger averaged EITC marriage penalty for Black households. Later, we examine the characteristics of the sample along with changes in the law to explore the possible explanations for the racial differences in the estimated averaged EITC when assumed to be cohabiting.

We quantify the magnitude of the averaged EITC marriage penalty/bonus for each group, and we provide these averages in Fig. 1, panel (b). Since the EITC is a credit, the sign of the averaged EITC marriage penalty/bonus takes the opposite interpretation than when we consider the averaged marriage penalty/bonus of the total individual income tax liability. A negative value implies that this couple would receive less EITC if married than unmarried (e.g., an EITC marriage penalty), while a positive value implies this couple would receive more EITC if married (an EITC marriage bonus).

Table 1 provides the exact numerical estimates of the averaged EITC marriage penalty/bonus for Black and white households, conditional on receiving a penalty or a bonus. At the beginning of our sample, 65 percent of eligible Black households experienced an EITC marriage penalty versus only 60 percent of white households. Among households with an estimated penalty in 1991, Black households faced an averaged $888 penalty while white households experienced an averaged penalty of $779. The percentage of eligible households experiencing an estimated penalty rose until the 2001 reform, then steadily decreased. For our last sample tax year (2018), 52 percent of Black households and 55 percent of white households experienced a penalty. Although the racial differences in the percent of households experiencing an estimated penalty were small or non-existent for much of the years in our sample, Black households experienced much higher conditional averaged penalties (approximately 22% higher in the last sampled year). The conditional averaged bonus received by eligible households yields a fluctuating racial difference, with Black households experiencing a higher averaged EITC bonus than white households in some years and a lower averaged EITC bonus in other years (approximately 20% lower in the last sampled year).

The proportion of households who experience a bonus has increased significantly over time while households experiencing neither a penalty nor bonus have declined from approximately 30 percent of EITC-eligible households to approximately 9 percent. This trend may help explain previous findings that EITC expansions are associated with higher marriage rates on net (Bastian, 2017), even while some couples experience a disincentive to marry.

Panel (c) of Fig. 1 illustrates the differences between the averaged EITC marriage penalty/bonus across races. Although Fig. 3 shows only the 90 percent confidence intervals, the differences are also statistically significant at the 5 percent level for most periods. This suggests that qualifying Black households incur a larger marriage penalty on average from the EITC. The fact that the EITC increases the averaged marriage penalty experienced by lower-and-middle-income households, in particular by Black households, may offset other efforts to encourage marriage among lower-income individuals.

Given that the EITC is race-blind, the main reasons for finding a racial difference are systematic differences in labor/earnings and family composition of Black and white households along with the ways that these differences interact with changes in the EITC structure. More specifically, a differential in the observed penalty/bonus may be caused by differences in the number of qualifying dependents, the presence of a one-earner household, and the within-couple earning ratios. Racial differences along these characteristics drive our observed differential. Indeed, our estimates there suggest that this observed racial differential, similar to the estimated differential for the overall individual income tax, is mainly driven by differences in the within-couple earnings division.Footnote 15

However, the EITC marriage penalty/bonus is commingled in complicated ways with the overall individual income tax marriage penalty/bonus, and it is essential to disentangle these interactions; that is, the extent to which estimated racial differentials generated by the EITC contribute to the racial differentials generated by the overall individual income tax has important policy implications. If the marriage penalty/bonus from the EITC alone is the primary driver of the estimated marriage penalty/bonus for low-and-moderate-income families in the overall individual income tax, then any policy reform that targets individual income tax racial inequities among low-income families must consider the structure of the EITC and its interactions with the individual income tax. We discuss these issues next by separating the overall individual income tax marriage penalty/bonus from the EITC marriage penalty/bonus.

4.2 The EITC contribution to the marriage penalty/bonus in the federal individual income tax

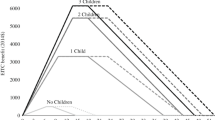

Using a similar procedure, we estimate the marriage penalty/bonus in the overall federal individual income tax for EITC-eligible couples with and without the EITC, separated by race. In Fig. 2, we observe a consistent pattern: the overall income tax marriage penalty/bonus appears to be greater for Black households than for white households. However, when we extract the EITC component from the overall income tax marriage penalty/bonus in Fig. 2, panel (b), the magnitudes decrease, and the difference between Black and white households also diminishes. Note that, since these estimates come from estimates of the overall individual income tax liabilities rather than simply the EITC amounts, a positive value indicates an implied averaged individual income tax marriage penalty (i.e. tax liabilities are lower when filing jointly).

Black-white household difference in averaged individual income tax marriage penalty for EITC-eligible households. Notes: For the calculations, we use a sample of EITC-eligible married couples from the Current Population Survey from 1992 to 2019. For each couple, we use the NBER TAXSIM simulator to estimate the EITC benefits under each scenario, where unmarried refers to a hypothetical scenario in which the couple cohabitates and each spouse files a separate tax return. Because information in the CPS relates to the previous year’s earnings, we use 1991 to 2018 as the filing tax years. The solid line in the bottom panels is estimated by subtracting the averaged individual income tax penalty/bonus for white couples from the averaged individual income tax penalty/bonus for Black couples (black line – gray line in the upper panels), while the dotted lines are the 90 percent confidence intervals. a corresponds to the estimates of the penalty and differences when the EITC is accounted for (left). b corresponds to the estimates in the absence of EITC (right). The estimates are all expressed in 2020 dollars, using the Bureau of Labor Statistics Consumer Price Index, and represent averages across groups. A negative value would suggest that, when averaged across all families in the sample, Black couples are estimated to experience either a lower individual income tax marriage penalty or a higher individual income tax marriage bonus, relative to white couples. Source: Authors’ calculations

Further, even though the estimated averaged individual income tax marriage penalties remain statistically different between Black and white EITC-eligible households for most of the 1990s and the first part of the 2000s, the magnitudes of these racial differences are much smaller when we remove the EITC from the overall income tax calculations. Moreover, extracting the EITC component makes some of the statistical differences observed after 2007 so small that they become statistically indistinguishable from zero.

These estimations suggest that the EITC, and the EITC marriage penalties it creates, also exacerbates the racial differences in the marriage penalty/bonus prevalent in the overall federal individual income tax. Although policymakers have not undertaken reform of the EITC with a goal of reducing the racial differences in the estimated EITC marriage penalty/bonus, efforts have been made to reduce the EITC marriage penalty for all families.

All of these figures suggest that previous changes to the structure of the EITC have clearly affected racial differences. While the existence of systematic racial disparities in the EITC marriage penalty/bonus at any point in time are solely explained by differences in households’ conditions, including a couple’s earnings, the distribution of those earnings across spouses, and the number of dependents, the changes over time can be attributed both to changes in households’ conditions and to changes in the EITC structure. Although any changes to the EITC structure are applied uniformly to all households regardless of race, the changes could affect Black households differently than white households, even if there were no changes to the households’ conditions over time. In the next sections we examine the effects of structural changes in the EITC on the EITC marriage penalty/bonus.

4.3 Inclusion of cohabitating couples

Our analysis relies on data from married couples only, raising a potential concern about the effect of excluding single individuals from consideration. Only 40 percent of EITC-eligible households are married and it is possible that the decision to marry or not may be influenced by the presence of a marriage penalty. To consider whether racial differences in the hypothetical estimated EITC marriage penalty/bonus of single individuals exist, we “marry” cohabitating couples in our sample. Marrying all single individuals would require assignment of hypothetical spouses, so we limit inclusion of single individuals to those who are currently cohabiting but are not legally married.Footnote 16 The number of cohabitating couples in the sample is significantly smaller than the number of married couples (33,512 couples relative to 220,495 married couples).

When filing as single, children are allocated to the biological parent if only one of the partners is the biological parent. If both of the cohabitating partners are the biological parent, we allocate the dependents to the highest earner, similar as the treatment of married couples when filing single. Unlike married couples whom we need to “separate” for tax purposes, “marrying” cohabitating couples is more straightforward. All deductions claimed individually are now claimed together, and all dependents are claimed by the couple jointly. The estimated EITC marriage penalty is computed the same way as for married couples, with a negative value implying this household would experience a lower credit if married (an EITC marriage penalty, or a cohabiting bonus in this case) and a positive value implying an EITC marriage bonus.

Figure 3 illustrates that the averaged estimated EITC marriage penalty for white married couples is slightly higher than that of their cohabiting counterarts (a higher negative value), especially in the second half of the sample period. This also seems to be the case for Black couples, although the differences appear smaller and more variable across time. This implies that, if cohabiting couples were to marry, their averaged penalty would be lower than the averaged penalty of married couples, alleviating some of the concerns that cohabiting couples may be cohabiting due to significantly higher potential EITC marriage penalties. As with our other calculations, this assumes that there is no labor market behavioral response to marriage for these couples.

Averaged EITC marriage penalty/bonus by marital status and race. Notes: For the calculations, we use a sample of EITC-eligible married couples from the Current Population Survey from 1992 to 2019. For each couple, we use the NBER TAXSIM simulator to estimate the EITC benefits under each scenario, where for married (cohabiting) people, unmarried (married) refers to a hypothetical scenario in which the couple cohabitates (marries) and they adjust filing status accordingly. Because information in the CPS relates to the previous year’s earnings, we use 1991 to 2018 as the filing tax years. a shows the average penalty for white couples, while b for Black couples. The estimates are all expressed in 2020 dollars, using the Bureau of Labor Statistics Consumer Price Index, and represent averages across groups. A negative value suggests that the combined EITC when filing separately is greater than the EITC received if filing jointly (an EITC marriage penalty), and a positive value suggests the opposite (an EITC marriage bonus). Couples with a penalty or bonus that is less than or equal to $10 are given a value of zero and assumed to face marriage neutrality with respect to the ETIC benefits. Source: Authors’ calculations

When we consider the subsample of cohabitating couples only, Fig. 4, we observe an averaged EITC marriage penalty for white and Black households. Although the differences are neither statistically nor economically significant, panel (b) in Fig. 4 demonstrates that Black cohabitating households also tend to experience a larger averaged EITC marriage penalty than white households, albeit smaller than that of their married counterparts.

Black-white household difference in averaged EITC penalty/bonus among cohabiting couples. Notes: For the calculations, we use a sample of EITC-eligible cohabiting couples from the Current Population Survey from 1995 to 2019. Prior to 1995, we could not identify cohabiting couples in the CPS sample. For each couple, we use the NBER TAXSIM simulator to estimate the EITC benefits under each scenario, where unmarried refers to their current cohabiting scenario in which the couple files a separate tax return, and married assumes they are filing jointly. Because information in the CPS relates to the previous year’s earnings, we use 1994 to 2018 as the filing tax years. In panel (b), the solid line is estimated by subtracting the averaged EITC penalty/bonus for white couples from the averaged penalty/bonus for black couples (black line – gray panel (a)), while the dotted lines are the 90 percent confidence intervals. The estimates are all expressed in 2020 dollars, using the Bureau of Labor Statistics Consumer Price Index, and represent averages across groups. A negative value would suggest that, when averaged across all families in the sample, Black couples are estimated to experience either a higher marriage penalty or a lower bonus, relative to white couples. Source: Authors’ calculations

Overalll, the inclusion of cohabitating couples into the whole sample results in estimated racial differences in averaged penalties that are virtually unchanged from our estimations with married couples only (Fig. 5).Footnote 17 While this result still does not capture the experience of all EITC recipients, it provides further evidence that, at least among those who are married or in a committed cohabiting relationship, we find on average racial disparities in the EITC treatment of marriage. The reminder of our analysis restricts the sample to married couples only.

Difference between black and white couples’ averaged EITC penalty/bonus: married and cohabiting couples. Notes: For the calculations, we use a sample of EITC-eligible married and cohabiting couples from the Current Population Survey from 1992 to 2019. For each couple, we use the NBER TAXSIM simulator to estimate the EITC benefits under each scenario, where unmarried refers to filing separately, while married refers to filing jointly. Because information in the CPS relates to the previous year’s earnings, we use 1991 to 2018 as the filing tax years. The solid line is estimated by subtracting the average estimated penalty/bonus for white couples from the average estimated penalty/bonus for black couples while the dotted lines are the 90 percent confidence intervals. The estimates are all expressed in 2020 dollars, using the Bureau of Labor Statistics Consumer Price Index, and represent averages across groups. A negative value suggests that, when averaged across all families in the sample, Black couples are estimated to experience either a higher averaged EITC marriage penalty or a lower averaged EITC marriage bonus, relative to white couples. Source: Authors’ calculations

4.4 Impact of changes to the EITC structure and family characteristics on the EITC marriage penalty/bonus

As previously mentioned, there were two important changes to the EITC at the beginning of the 1990s. The Omnibus Budget Reconciliation Act of 1990 (OBRA90) adjusted the EITC formula for family size. Before 1990, benefits/credits would not increase if families had more than one qualifying child; after 1990, benefits increased with family size. Further, in the 1993 OBRA93, Congress not only increased the maximum credits, but it also allowed childless households to qualify for credits. The increase in maximum credits was phased in, thus slowly changing benefits over time. Because there are racial differences in the number of dependents among EITC-eligible couples, these reforms likely had differential impacts across races, even if the relative number of children between white and Black households remained the same over time.

To isolate the impact of policy changes, we estimate the EITC benefits for each year but using the sample of couples from our first CPS year (1992) only. This allows us to see what would have been the evolution of the EITC marriage penalty/bonus across time if the differences in household composition between the two groups were constant at the 1992 levels, while at the same time minimizing any concerns that households may be simultaneously responding to changes in the EITC structure by changing their family decisions. These results are shown in Fig. 6.Footnote 18

Averaged EITC marriage penalty/bonus by race holding household composition constant (1992 CPS). Notes: For the calculations, we use a sample of EITC-eligible married couples from the Current Population Survey from 1992 to 2019. For each couple, we use the NBER TAXSIM simulator to estimate the EITC benefits under each scenario, where unmarried refers to a hypothetical scenario in which the couple cohabitates and each spouse files a separate tax return. Because information in the CPS relates to the previous year’s earnings, we use 1991 to 2018 as the filing tax years. In panel (a), the estimates represent the EITC benefits averaged across racial groups in each scenario, where “unmarried” refers to the couple’s total benefit when each partner files separately (e.g. as head of household or single). In panel (b), a negative value suggests that the combined EITC when filing separately is greater than the EITC received if filing jointly (an EITC marriage penalty), and a positive value suggests the opposite (an EITC marriage bonus). Couples with a penalty or bonus that is less than or equal to $10 are given a value of zero and assumed to face marriage neutrality with respect to the ETIC benefits. In panel (c), the solid line is estimated by subtracting the averaged EITC penalty/bonus for white couples from the averaged ETIC penalty/bonus for Black couples (black line – gray line in panel (b)), while the dotted lines are the 90 percent confidence intervals. A negative value would suggest that, when averaged across all families in the sample, Black couples are estimated to experience either a higher EITC marriage penalty or a lower EITC marriage bonus relative to white couples. The estimates are all expressed in 2020 dollars, using the Bureau of Labor Statistics Consumer Price Index, and represent averages across groups. Source: Authors’ calculations

As Fig. 6 shows, there still exists a statistical difference between the averaged EITC marriage penalty/bonus experienced by both groups throughout the sample period. If the labor and family conditions of Black and white low-and-middle-income households in 1992 had prevailed through 2019, Black households would still have experienced a larger EITC marriage penalty than white households. This suggests that the Black households’ labor conditions and their number of dependents in 1992 constitute a family structure that yields a higher EITC marriage penalty both in 1992 and throughout time.

However, Fig. 6 also shows that the two reforms of the 1990s have had significant effects on the size of the racial gap. After the mid-1990s, even though some other changes to the EITC structure occurred, those changes had little impact on the racial gap, with the magnitude of the racial difference becoming fairly stable between $200 and $250, in 2020 dollars. This is not to say that the reforms in the 2000s did not affect the averaged EITC marriage penalty/bonus, as shown in panel (b) of Fig. 6. Indeed, since the late 1990s, the size of the EITC marriage penalty has decreased proportionately for both groups. Interestingly, while the expansion of the maximum credit to families with 2 or more dependents in the early 1990s was intended to decrease the EITC marriage penalty, our calculations suggest that it may have had the opposite effect. Moreover, this effect may have affected Black couples more than white ones, as evidenced by the faster increases in the total family credits if the couple had not married.

Many of the changes passed in the various tax reforms over time were aimed at addressing the issues that arise from counting families of different sizes as equals. Two families that earn the same income but have a different number of dependents may not have the same purchasing power, and thus they may have different abilities to pay taxes. Consequently, depending on households’ characteristics, any changes to the law can have disparate impacts on different households. Some of the determinants of the EITC marriage penalty/bonus have varied over time for both groups. In some cases, either there are no average differences between Black and white households or these differences have diminished over time. In other cases, those differences have increased, and, in some cases, they have remained constant. A discussion of the differences in these factors through time can be found in Appendix B.

A pooled simple linear regression across all years of data formalizes how these many different factors correlate with the EITC marriage penalty/bonus, controlling for the other determinants. These regression results are presented in Table 2. Black couples are more likely to face an EITC marriage penalty (column 1). However, when we control for the number of dependents, the income ratio, and the presence of only one earner in the couple, we observe that being a Black household is no longer correlated with the probability of facing an EITC marriage penalty (column 2).Footnote 19 The higher the number of dependents, the less likely it is that a couple will receive a penalty. One-earner couples are also significantly less likely to face a penalty, while couples in which the relative earnings of both spouses are close are significantly more likely to face a penalty.

As for the magnitude of the EITC marriage penalty/bonus (columns 3 and 4), Black couples face a statistically significantly higher penalty. Even so, when we control for the other factors (column 4), the size of the effect is significantly reduced.Footnote 20 Having more dependents and a more similar income ratio is associated with a higher penalty, while having a single earner is associated with a higher bonus. Note also that the opposing results obtained for the impact of the number of dependents on the probability of a penalty versus the size of the penalty/bonus may be because the EITC does not increase the maximum credit once a couple has more than three children.

Accordingly, we now explore the changes to the laws within the context of family size, one of the determinants of the racial differences that we have documented.

There were four changes to the structure of the EITC that have affected the EITC marriage penalty/bonus. Three of them (OBRA90, OBRA93, EGTRRA) relate to changes to the number of dependents, and one (ARRA) relates to changes in the total income eligibility threshold for married couples. Since there are racial differences between Black and white households along these two dimensions (e.g., dependents, income), we examine here the differential impact of those changes on the EITC marriage penalty/bonus by, again, holding the sample constant at its 2019 composition while allowing the tax code to vary.

Figure 7 shows that these tax code changes had important overall impacts on both Black and white households, even while maintaining racial differences. As expected, the changes in OBRA90 (when the law started differentiating between couples with one child versus couples with two or more children) created a smaller penalty for those with more than one dependent. Shortly after, in 1993 Congress allowed childless individuals and couples to qualify for the EITC via OBRA93.Footnote 21 One of the biggest impacts of this change was the increase in the potential EITC benefits if couples decided to cohabitate. Since we assume that in most cases, if cohabiting, one of the spouses claims all dependents, the 1993 change allowed the other spouse to also receive an EITC credit, even though that person did not claim any dependents. This increased the total combined EITC credits for unmarried couples with children, making it costlier to marry and file jointly.

Averaged EITC marriage penalty/bonus by dependent category holding household composition constant (1992 CPS). Notes: For the calculations we use a sample of EITC-eligible married couples from the Current Population Survey from 1992 to 2019. For each couple, we use the NBER TAXSIM simulator to estimate the EITC benefits under each scenario, where unmarried refers to a hypothetical scenario in which the couple cohabitates and each spouse files a separate tax return. Because information in the CPS relates to the previous year’s earnings, we use 1991 to 2018 as the filing tax years. The estimates are all expressed in 2020 dollars, using the Bureau of Labor Statistics Consumer Price Index, and represent averages across groups. A negative value suggests that the combined EITC when filing separately is greater than the EITC received if filing jointly (an EITC marriage penalty), and a positive value suggests the opposite (an EITC marriage bonus). Couples with a penalty or bonus that is less than or equal to $10 are given a value of zero and assumed to face marriage neutrality with respect to the ETIC benefits. Source: Authors’ calculations

However, the changes had a bigger impact on the averaged EITC marriage penalty for Black couples. By 1998, the estimated EITC marriage penalty for Black households with one child was $210 more than the estimate for 1993, while white households with one child saw a smaller increase of $170 during the same time. Among households with two children, the increase for Black households was $629 while the increase for white households was $508. The largest disparate impact was observed for households with three or more children, with Black households experiencing an increase of $689, and white households experiencing an increase of $375. Consequently, the racial gap increased by $40, $120, and $314 between households with one, two, and three or more children, respectively.

In EGTRRA of 2001, Congress attempted to reduce the EITC marriage penalty by increasing the maximum qualifying income levels for married couples, phasing in this change over several years. Figure 7 indicates that this change largely worked. The EITC marriage penalty decreased further when in 2009 Congress increased the maximum income for which married couples became ineligible to receive the credit. In addition, ARRA (2009) differentiated between couples with two children only and those with three or more children. The EITC marriage penalties for couples with two versus couples with three or more children were very similar up until that point, especially for Black households, although there was a slight difference among white couples, which may be explained by differences in income levels and income ratios. As Fig. 6 suggested, although these two reforms affected the overall size of the EITC marriage penalty/bonus, their effects on the difference between Black and white households were minimal compared to the impact of the two reforms in the 1990s.

Interestingly, although the differentiation between families with two children and families with three or more children in ARRA of 2009 should have decreased the EITC marriage penalty for bigger families, it only did so for white couples. In fact, the change in the law actually increased the EITC marriage penalty slightly for Black households with more children, due to differences in income and income ratios by race. When comparing Black and white households, the size of the EITC marriage penalty is always higher for Black households, except for couples without children. This means that, using the racial differences in household characteristics in 2019, the only group for which the EITC marriage penalty would have been consistently lower for Black households over time is the childless group. All other groups would still face on average a larger EITC marriage penalty than the EITC marriage penalty for white households.

Evidently, changes to the law regarding family size had important impacts that tended to further disfavor Black households. However, as we have emphasized, differences in income ratios are a key determinant in the racial differences observed. Income ratios can also vary by income level. Note that Alm et al., (2023) did not find any racial differences in the individual income tax marriage penalty/bonus among lowest-income couples. Since the EITC is the main source of the individual income tax marriage penalties for lower income households, we explore in the next section whether racial differences in the EITC marriage penalty are also less evident among the lowest-income couples.

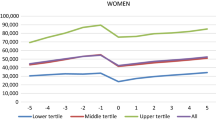

4.5 Differences in the EITC marriage penalty/bonus across income levels

A couple’s total income is a major determinant of whether households fall in the phase-in, flat, or phase-out parts of the EITC schedules, both when unmarried and when married. To gain an understanding of where along the income distribution the averaged EITC marriage penalty differential is more pronounced, we examine the heterogeneity in the results by splitting the sample into households earning $0–$40,000 and those earning $40,000–$85,000 (Fig. 8). The EITC marriage penalties are much larger for those earning between $40,000 and $85,000 than for those earning $0–$40,000. In fact, among those in the lower income bracket, both Black and white households are estimated to experience an averaged EITC marriage penalty until the mid-2000s, which then flips to an averaged EITC marriage bonus.

Averaged EITC marriage penalty/bonus by income group and race. Notes: For the calculations, we use a sample of EITC-eligible married couples from the Current Population Survey from 1992 to 2019. For each couple, we use the NBER TAXSIM simulator to estimate the EITC benefits under each scenario, where unmarried refers to a hypothetical scenario in which the couple cohabitates and each spouse files a separate tax return. Because information in the CPS relates to the previous year’s earnings, we use 1991 to 2018 as the filing tax years. The estimates are all expressed in 2020 dollars, using the Bureau of Labor Statistics Consumer Price Index, and represent averages across groups. A negative value suggests that the combined EITC when filing separately is greater than the EITC received if filing jointly (an EITC marriage penalty), and a positive value suggests the opposite (an ETIC marriage bonus). Couples with a penalty or bonus that is less than or equal to $10 are given a value of zero and assumed to face marriage neutrality with respect to the ETIC benefits. Source: Authors’ calculations

More importantly, however, Fig. 8 showes that among households earning $0–$40,000, there was a slightly higher averaged EITC marriage penalty for Black households until the mid-2000s, although any observed differential is statistically insignificant. The racial difference is more pronounced and statistically significant among households earning $40,000–$85,000, or those households that are more likely to be in the phase-out portion of the EITC. Among these households, Black households experience an averaged EITC marriage penalty higher than that for white households for all periods in our sample.

When we keep the sample constant at its 1992 CPS composition to see the impact of changes to the EITC structure by income (Fig. 9), we now see racial differences among couples in the low-income bracket.Footnote 22 However, once again, we see much larger racial differences in the moderate-income group, still driving the overall averages. For the lower-income group, the changes in 2001 and 2009 have overall converted the EITC marriage penalty into an EITC marriage bonus, for both Black and white households. The 1990s changes, on the other hand, were more important for those in the moderate-income group. Naturally, changes in the way the EITC accounts for the number of dependents along with changes in the maximum income eligibility are both more likely to affect the higher income group, and these changes have largely reduced the EITC marriage penalty but without having much impact on racial disparities.Footnote 23

Averaged EITC marriage penalty/bonus by income holding household composition constant (1992 CPS). Notes: For the calculations, we use a sample of EITC-eligible married couples from the Current Population Survey from 1992 to 2019. For each couple, we use the NBER TAXSIM simulator to estimate the EITC benefits under each scenario, where unmarried refers to a hypothetical scenario in which the couple cohabitates and each spouse files a separate tax return. Because information in the CPS relates to the previous year’s earnings, we use 1991 to 2018 as the filing tax years. a shows the averaged penalty for couples with annual incomes up to $40,000 while b for couples with incomes above $40,000. The estimates are all expressed in 2020 dollars, using the Bureau of Labor Statistics Consumer Price Index, and represent averages across groups. A negative value suggests that the combined EITC when filing separately is greater than the EITC received if filing jointly (an EITC marriage penalty), and a positive value suggests the opposite (an EITC marriage bonus). Couples with a penalty or bonus that is less than or equal to $10 are given a value of zero and assumed to face marriage neutrality with respect to the ETIC benefits. Source: Authors’ calculations

5 Conclusions

The disparate treatment of individuals and families by race has finally emerged as a fundamental tax policy issue. In this paper, we have found that Black households face larger marriage penalties through the EITC than white households. A major reason for this disparate treatment by race is the smaller spousal earnings differential among Black households relative to white households, especially in the moderate-income bracket where couples are more likely to be subject to the phase-out portion of the credit. Importantly, the racial differences in the marriage penalties in the EITC alone are the primary source of the racial differences in the marriage penalties in the overall individual income tax found by Alm et al., (2023) for moderate-income couples.

These findings have important implications. While the EITC helps millions of lower-income families increase their annual earnings, encourages work, and helps working families overcome poverty, our results suggest that the EITC also creates financial incentives to not marry (or even to conceal marital status) and that such incentives are stronger for lower-income Black families.

What could be done to reduce these disparate treatments by race? Although there have been policy reforms that have restructured the EITC to reduce the EITC marriage penalty, permitting childless individuals to claim the EITC remains an important factor in the creation of such penalties, especially for Black households. Even though the spousal earnings ratios of Black households without children are lower than the ratios for white households without children, thus creating a greater penalty for white couples in this group, this is not the case for families with two or more dependents. Since the childless provision increases the overall credit for parents who could file separately under “cohabitation,” and so increases the EITC marriage penalty, the marriage of those with high income ratios and/or a high number of dependents is likely to be penalized, with Black households more likely to be affected. Indeed, the biggest racial difference in spousal earnings ratios is among couples with three or more children (0.300 for Black households and 0.216 for white households).

Amending the childless provision could help reduce the EITC marriage penalty and thus also reduce the disparate racial differences that we document. However, this change could also have effects that might accentuate other racial disparities. Although outside the scope and time period of this paper, there were temporary changes to the childless provision in 2021, in part to help poor individuals during the COVID-19 pandemic, and these changes may have affected both couples without children and also of course the EITC marriage penalties estimated here. Due to the temporary nature of those changes and also to the fact that the pandemic may have altered the relative economic conditions of Black and white households either temporarily or permanently, we leave the examination of those changes to future research. Investigating the economic and structural changes during the COVID-19 pandemic can shed some light on the impact of such changes.

However, the permanent eliminatinon of marriage penalties/bonuses and their impact across races requires more fundamental changes to our tax system. As emphasized by Steuerle (2006), a marriage penalty/bonus will exist throughout the tax/transfer system as long as tax/transfer rates vary with income and taxes/transfers depend on joint household income. Changing the “unit of taxation” in the individual income tax from the family to the individual would be the first step to promoting marriage neutrality within the U.S. tax system. Spain took this step in the 1980s, citing as the main motivation that taxing the family conflicts with constitutional individual rights and discriminates against those who choose to marry.Footnote 24 Although it is important to address the far larger presence of racial disparities throughout our society, the elimination of marriage penalties and bonuses would be a useful first step toward this broader goal.

Data availability

No datasets were generated or analysed during the current study.

Notes

For example, the children in families who have an increased exposure to the EITC have improved childhood outcomes (Dahl & Lochner, 2012; Hoynes, Miller, and Simon, 2015), and they are more likely to graduate from high school, attend college, be employed, and enjoy higher incomes than children with lower exposure (Maxfield (2015); Bastian & Michelmore, 2018). Among women, increased exposure to the EITC in childhood is also associated with delayed marriage and childbearing in early adulthood (Michelmore & Lopoo, 2021). Unlike other cash transfers, the EITC reduces the disincentives to work that typically accompany other programs and in fact it generates strong incentives to work. Indeed, early estimates found evidence of lower family labor supply among married couples (Eissa & Hoynes, 2004) but an overall increase in employment and income (Grogger, 2003; Bastian & Jones, 2021), particularly among single mothers (Meyer & Rosenbaum, 2001). More recently, Bastian (2020) estimates that the EITC program increased the employment of eligible mothers by 6 percent since 1975, an effect that is most pronounced for mothers with children under the age of 3 (Michelmore & Pilkauskas, 2021), and Bastian & Jones (2021) estimate that the EITC net cost is approximately 17 percent of its budgetary cost. Also, Schanzenbach & Strain (2020) find that the EITC produces strong incentives to work at the extensive margin. However, recent work by Kleven (2024) has called into question whether the observed employment effects are due to the EITC rather than other economic conditions.

Government estimates for different racial groups based on tax records use statistical techniques to predict race, which have been shown to be subject to substantial misclassification. See Derby et al., (2023) for the analysis of one such methodology, called “Bayesian Improved First Name and Surname Geocoding (BIFSG)”.

TRA86 increased the credit available and allowed for greater changes due to inflation, affecting eligible families proportionally, but was enacted in 1986. PRWORA required a Social Security number of all eligible family members to receive the EITC, and it had no relevant effects on the marriage penalty/bonus.

Even aside from the equity concerns arising from disparate effects of the EITC on marriage penalties or bonuses, there are additional concerns that these marriage penalties and bonuses may have significant effects on family formation and marriage rates. Previous research on the effects of EITC on marriage has so far yielded mixed findings. Eissa & Hoynes (1999) found that a lower EITC benefit if married results in a lower marriage rate while Ellwood (2000) and Dickert-Conlin & Houser (2002) found that the EITC did not affect marriage rates. More recently, Isaac (2020) finds that the expansion of the EITC generated an increase in divorce among some women but had no effect on marriage. The potential impact of the EITC on marriage is demonstrated by Michelmore (2018), who simulated a marriage market for a sample of single women eligible for EITC and predicted spousal net earnings. She estimates that these women would lose approximately half of their averaged EITC benefits if they were to marry and that these potential losses would lead to a one percentage point decline in the likelihood of marriage for low-income women. Michelmore (2018) also considered the differential effects by race, and she finds that, similar to white women, Black women do not appear to be more likely to marry in the presence of a marriage bonus but that they are predicted to be twice as likely to cohabitate in the presence of a marriage penalty. See also Friedberg & Isaac (2024), who find that marriage decisions of same-sex couples are affected by the tax consequences of marriage.

Although single individuals are also affected by the potential of a marriage penalty or bonus, including singles in the sample requires a different set of assumptions about their taste for marriage. While those assumptions may not need to be as strong for cohabiting couples, who are observable in the CPS sample, many of the previous estimates of marriage penalties in the literature rely on samples of married individuals, who have already shown a preference for marriage. Indeed, while the full incidence across races may also require the inclusion of single and unmarried individuals, limiting the sample to married individuals allows us to estimate racial differences across individuals who are actually experiencing an EITC marriage penalty or bonus.

We consider households with a combined income of less than $85,000 (in 2020 dollars). Any couple in this income range estimated to not receive a credit – both married and unmarried – is dropped, leaving us with the total of 220,409 couples.

We rely on the Stata code generously provided by James Ziliak to estimate individual and family tax liabilities using CPS data, published on the NBER TAXSIM’s website. We are also grateful to Daniel Feenberg of the NBER for his help with the TAXSIM calculations.

Our analysis relies on averaged estimated EITC benefits, and these may not be equal to averaged realized EITC benefits. Jones and Ziliak (2022) find that discrepencies between estimated benefits using CPS data and estimated benefits using administrative data occur for several reasons, especially the presenece both of non-filers for those who are eligible and of errors in the amount of EITC benefits awarded.

Since couples in which “50 percent of the couple” is Black are classified as Black in the Loose Definition, couples that are “50 percent” white, following the selection criteria, cannot also be classified as white.

In Table 3 (Appendix A) we present the racial distribution of the sample under the different criteria. Alm et al. (2023) also use a definition intermediate between the Strict and Loose definitions, in which the Black classifications requires that the Black couple needs to be at least “75 percent” Black. In our sample, there are so few couples that meet the “75 percent criteria” that such a definition is nearly identical to the “100 percent” definition (e.g., both Black). As such, we disregard this definition. Results for the EITC marriage penalty/bonus estimates under different criteria to determine a couple’s race are not reported, but all results are available upon request.

A slightly different alternative is to allocate children in order to maximize the couple’s combined EITC. While these two approaches are somewhat similar, other child tax credits and other deductions could potentially affect the total tax liabilities. As such, we choose to allocate them to the parent in a way that minimizes the total income tax paid, typically to the parent with the higher individual earnings. Alm & Leguizamón (2015) note that allocating children to the mother tends to decrease the magnitude of average marriage penalty/bonus generated by the overall income tax liabilities, which is consistent with Alm & Whittington (1996) and Eissa & Hoynes (2000). However, Alm & Leguizamón (2015) also suggest that the case for allocating children exclusively to the mother in case of divorce has become a weaker one in recent years, as more children appear to be allocated to fathers. Furthemore, the purpose of analyzing the marriage penalty/bonus in the literature has been to quantify the cost of marriage, rather than to quantify the benefits of divorce. As such, it is customary to assume that couples would file separately only to minimize tax liabilities, implying specific assumptions about deductions.

The EITC age limit for dependent children does not apply if an adult child is permanently and totally disabled. We are only able to observe whether an individual self-reported receiving disability payments.

As mentioned, the tax code is race-blind, so we are not trying to determine any type of direct discrimination in the tax system, even if discrimination in the labor market can create differences that would be reflected in the marriage penalty/bonus. Consequently using the data to create and to analyze Black households that look exactly like white households along those dimensions would yield no racial differences in the EITC marriage penalty/bonus. Our aim here is to highlight that differences in the labor market outcomes, accompanied by differences in family structure, can create racial differences in a progressive system in which the family is the unit of taxation.

Note that we can only observe cohabiting couples in the CPS starting in 1995. From 1996-2006, “unmarried partner” was an answer category to the question of relationship to head of household, which likely undercounted the number of cohabitating couples. In 2007, this was changed so that there is a direct question of whether there are unmarried partners in the household.

The confidence intervals become slightly wider, but the differences remain statistically significant through the majority of the period.

We have also done a similar exercise using the 2019 composition as the base year. Results are qualitatively similar.

Although there is some degree of collinearity between the income ratio and the one-earner dummy, we include the one-earner variable to minimize concerns that the correlation between income ratios and the outcome variables is affected by the high number of couples with income ratios equal to zero (i.e. one-earner couples).

A chi-square test for the difference of coefficients confirms that they are statistically different.

Following this change, those couples without children entered our calculations in 1994, with a small marriage penalty.

In both cases, the differences are still statistically significant.

Another concern is that, even within the restricted sample of EITC-eligible households, the income of Black and white households may be systematically different. We consider this, and a further disaggregation of the distribution of income, in Appendix C.

See BOE-T-1989-4943. Agencia Estatal Boletin Oficial del Estado, Sentence 45/1989. Number 52, 2 March 1989, pp. 44-56, available online at. https://www.boe.es/buscar/doc.php?lang=en&id=BOE-T-1989-4943 (accessed 7 May 2024).

It is important to remember that at any given point we are only including ETIC-eligible families. Prior to 1993, childless couples did not qualify, which explains why the average drops after we start including families without children.

Households experiencing an averaged EITC marriage bonus have more qualifying dependents than those experiencing an averaged penalty. Among those with a penalty, Black households tend to have more children, which may lead to the higher penalties that we observe if this higher average is influenced by a higher proportion of families with more than three dependents.

References

Alm, J., & Whittington, L. A. (1996). The rise and fall and rise…of the marriage tax. National Tax Journal, 49(4), 571–589.

Alm, J., & Leguizamón, J. S. (2015). Whither the marriage tax?. National Tax Journal, 68(2), 251–280.

Alm, J., Leguizamón, J. S., & Leguizamón, S. (2014). Revisiting the income tax consequences of legalizing same-sex marriage. Journal of Policy Analysis and Management, 33(2), 263–289.

Alm, J., Leguizamón, J. S., & Leguizamón, S. (2023). Race, ethnicity, and taxation of the family: The many shades of the marriage penalty/bonus. National Tax Journal, 76(3), 525–560.

Bastian, J. E. (2017). Unintended consequences? More marriage, more children, and the EITC. Proceedings of the Annual Conference on Taxation of the National Tax Association, 110, 1–56.

Bastian, J. E. (2020). The rise of working mothers and the 1975 Earned Income Tax Credit. American Economic Journal: Economic Policy, 12(3), 44–75.

Bastian, J. E., & Jones, M. R. (2021). Do EITC expansions pay for themselves? Effects on tax revenue and government transfers. Journal of Public Economics, 196, 104355.

Bastian, J. E., & Michelmore, K. (2018). The long-term impact of the Earned Income Tax Credit on children’s education and employment outcomes. Journal of Labor Economics, 36(4), 1127–1163.

Braga, B., Blavin, F., & Gangopadhyayam, A. (2020). The long-term effects of childhood exposure to the Earned Income Tax Credit on health outcomes. Journal of Public Economics, 190, 104249.

Brown, D. A. (1997). The marriage bonus/penalty in black and white. University of Cincinnati Law Review, 65, 787–798.

Brown, D. A. (1999). The marriage penalty/bonus debate: Legislative issues in Black and white. New York Law School Journal of Human Rights, 16(1), 287–302.

Brown, D. A. (2007). Race and class matters in tax policy. Columbia Law Review, 107(3), 790–831.

Brown, D. A. (2009). Shades of the American dream. Washington University Law Review, 87, 329–378.

Brown, D. A. (2022). The whiteness of wealth: How the tax system impoverishes Black Americans – and how we can fix it. Crown Publishing Group.

Center on Budget and Policy Priorities (2023). Policy basics: The Earned Income Tax Credit, available online at. https://www.cbpp.org/research/federal-tax/the-earned-income-tax_credit#:~:text=The%20EITC%20and%20Child%20Tax,of%20workers%20paid%20low%20wages.

Congressional Research Service (2022). The Earned Income Tax Credit (EITC): Legislative history. CRS Report R44825. Congressional Research Service

Costello, R., DeFilippes, P., Fisher, R., Klemens, B., & Lin, E. (2024). Marriage penalties and bonuses by race and ethnicity: An application of race and ethnicity imputation. AEA Papers and Proceedings, 114, 644–648.

Dahl, G. B., & Lochner, L. (2012). The impact of family income on child achievement: Evidence from the Earned Income Tax Credit. The American Economic Review, 102(5), 1927–1956.

Derby, E., Dowd, C., & Mortenson, J. (2023). Statistical bias in racial and ethnic disparity estimates using BIFSG. SSRN Working Paper, available online at https://ssrn.com/abstract=4733299.

Dickert-Conlin, S., & Houser, S. (2002). EITC and marriage. National Tax Journal, 55(1), 25–40.

Eissa, N., & Hoynes, H. W. (1999). Good news for low income families? Tax-transfer schemes and marriage, Department of economics working paper. University of California, Berkeley

Eissa, N., & Hoynes, H. W. (2000). Explaining the fall and rise in the tax cost of marriage: The effect of tax laws and demographic trends, 1984–97. National Tax Journal, 53(3, Part 2), 683–711.

Eissa, N., & Hoynes, H. W. (2004). Taxes and the labor market participation of married couples: The Earned Income Tax Credit. Journal of Public Economics, 88(9-10), 1931–1958.

Ellwood, D. T. (2000). The impact of the Earned Income Tax Credit and social policy reforms on work, marriage, and living arrangements. National Tax Journal, 53(4, Part 2), 1073–1106.

Ellwood, D. T., & Sawhill, I. (2000). Fixing the marriage penalty in the EITC. Brookings Report. Available online at http://brookings.edu/wp-content/uploads/2016/06/20000920.pdf.

Flood, S., King, M., Rodgers, R., Ruggles, S., Warren, J. R., Backman, D., Chen, A., Cooper, G., Richards, S., Schouweiler, M., & Westberry, M. (2023). IPUMS CPS: Version 11.0 [dataset]. IPUMS, available online at https://doi.org/10.18128/D030.V11.0.

Feenberg, D. R., & Coutts, E. (1993). An introduction to the TAXSIM model. Journal of Policy Analysis and Management, 12(1), 189–194.

Friedberg, L., & Isaac, E. (2024). Same-sex marriage recognition and taxes: New evidence about the impact of household taxation. The Review of Economics and Statistics, 106(1), 85–101.

Gale, W. G. (2021). Public finance and racism. National Tax Journal, 74(4), 953–974.