Abstract

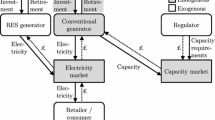

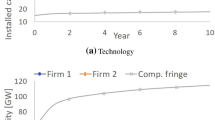

Capacity auctions with reliability options are seen as a promising possibility to reduce the investment risk for electricity generators as well as to set incentives for sufficient investments in generating capacity. However, there has been little attention so far on the interaction between a capacity market and an increasing share of renewable energy. In a first step we formalize the functioning of capacity auctions with reliability options. We improve their incentive regulation to allow effective incentives for sufficient investments. In a second step we study, with comparative statics, how an increasing share of renewable energy, varying carbon emission costs and the existing capacity mix influence the outcome of a capacity auction. For an increasing share of renewable energy, capacity auctions direct investments to more flexible power plants. This opposes the merit order effect of renewable energy which is observed at energy-only markets. A capacity market can therefore prevent missing flexibility feared at energy-only markets as a result of an increasing share of renewable energy.

Similar content being viewed by others

Notes

See Ranci and Cervigni (2013) for a detailed overview of the structure and functioning of electricity markets.

Resource adequacy denotes the system’s ability to satisfy demand at all times in contrast to security of supply which describes the ability to balance sudden changes in demand (Regulatory Commission for Electricity and Gas 2012: 7). Resource adequacy can therefore be defined as long-term security of supply.

Emission costs stem from an emissions trading scheme or carbon taxes.

For an optimal price cap MM vanishes as it is part of the PER. We nevertheless retain the differentiation in PER and MM to illustrate the functioning of a capacity market in the following analysis.

Recall that a penalty only occurs for price bids exceeding PER per capacity unit (see Sect. 3.2.1).

A detailed description of the investment algorithm is given in Bhagwat (2016).

The effect that an increasing share of renewable energy reduces the spot price level in the short run is called merit order effect (Sensfuß et al. 2008).

Recall that Fig. 1 depicts a spot market in equilibrium. Then MM corresponds to the integral over duration time from \(p_{cap}\) to infinity. This relation is no longer valid in a distorted equilibrium. Thus, MM increases for decreasing spot market rents.

Other advantages (risk reduction, reaction on an increasing share of renewable energy sources) may nevertheless justify a capacity market as we will see in the further discussion of the example.

It is also possible that the regulator commits already existing generators to a maximum bid which is equal to the PER per capacity unit.

References

Bajo-Buenestade, R. (2017). Welfare implications of capacity payments in a price-capped electricity sector: A case study of the Texas market (ERCOT). Energy Economics, 64, 272–285.

Bhagwat, P. C. (2016). Security of supply during the energy transition: The role of capacity mechanisms. Delft University of Technology. https://doi.org/10.4233/uuid:9dddbede-5c19-40a9-9024-4dd8cbbe3062. Accessed July 25, 2019.

Bhagwat, P. C., Iychettira, K. K., Richstein, J. C., Chappin, E. J. L., & De Vries, L. J. (2017). The effectiveness of capacity markets in the presence of a high. Utilities Policy, 48, 76–91.

Bhagwat, P. C., Richstein, J. C., Chappin, E. J. L., & De Vries, L. J. (2016). The effectiveness of a strategic reserve in the presence of a high portfolio share of renewable energy sources. Utilities Policy, 39, 13–28.

Bothwell, C., & Hobbs, B. F. (2017). Crediting renewables in electricity capacity markets: The effects of alternative definitions upon market efficiency. The Energy Journal, 38 (KAPSARC Special Issue), 173–188

Caramanis, M. (1982). Investment decisions and long-term planning under electricity spot pricing. IEEE Transactions on Power Apparatus and Systems, 101(12), 4640–4648.

Crampes, C., & Creti, A. (2006). Capacity competition in electricity markets. Economia delle fonti di energia e dell’ambiente, 48(2), 59–82.

Cramton, P., & Ockenfels, A. (2012). Economics and design of capacity markets for the power sector. Zeitschrift für Energiewirtschaft, 36, 113–136.

Cramton, P., Ockenfels, A., & Stoft, S. (2013). Capacity market fundamentals. Economics of Energy & Environmental Policy, 2, 27–46.

Creti, A., & Fabra, N. (2007). Suply security and short-run capacity markets for electricity. Energy Economics, 29(2), 259–276.

De Miera, G. S., del Rio Gonzalez, P., & Vizcaino, I. (2008). Analysing the impact of renewable electricity support schemes on power prices: The case of wind electricity in Spain. Energy Policy, 36(9), 3345–3359.

De Vries, L. J. (2007). Generation adequacy: Helping the market do its job. Utilities Policy, 15, 20–35.

Elberg, C., & Kranz, S. (2014). Capacity mechanisms and effects on market structure. EWI Working Paper No. 14/04.

Energy Industry Act (Energiewirtschaftsgesetz—EnWG). (2017). Energiewirtschaftsgesetz. https://www.gesetze-im-internet.de/enwg_2005/EnWG.pdf. Accessed July 29, 2018.

Federal Network Agency (Bundesnetzagentur). (2018a). Feststellung des Bedarfs an Netzreserve für den Winter 2018/2019 sowie das Jahr 2020/2021. https://www.bundesnetzagentur.de/SharedDocs/Downloads/DE/Sachgebiete/Energie/Unternehmen_Institutionen/Versorgungssicherheit/Berichte_Fallanalysen/Feststellung_Reservekraftwerksbedarf_2018.pdf?_blob=publicationFile&v=2. Accessed July 30, 2018.

Federal Network Agency (Bundesnetzagentur). (2018b). Kraftwerksliste Bundesnetzagentur (bundesweit; alle Netz- und Umspannebenen) Stand 02.02.2018. https://www.bundesnetzagentur.de/DE/Sachgebiete/ElektrizitaetundGas/Unternehmen_Institutionen/Versorgungssicherheit/Erzeugungskapazitaeten/Kraftwerksliste/kraftwerksliste-node.html. Accessed July 30, 2018.

Finon, D., & Pignon, V. (2008). Electricity and long-term capacity adequacy: The quest for regulatory mechanism compatible with electricity market. Utilities Policy, 16, 143–158.

Flinkerbusch, K., & Scheffer, F. (2013). Eine Bewertung verschiedener Kapazitätsmechanismen für den deutschen Strommarkt. Zeitschrift für Energiewirtschaft, 37, 13–25.

Hobbs, B. F., Iñón, J., & Stoft, S. E. (2001). Installed capacity requirements and price caps: Oil on the water, or fuel on the fire? The Electricity Journal, 14, 23–34.

Höschle, H., De Jonghe, C., Le Cadre, H., & Belmans, R. (2017). Electricity markets for energy, flexibility and availability—Impact of capacity mechanisms on the remuneration of generation technologies. Energy Economics, 66, 372–383.

Jaffe, A., & Felder, F. (1996). Should electricity markets have a capacity requirement? If so, how should it be priced? The Electricity Journal, 9, 52–60.

Joskow, P. L. (2008). Capacity payments in imperfect electricity markets: Need and design. Utilities Policy, 16, 159–170.

Joskow, P. L., & Tirole, J. (2007). Reliability and competitive electricity markets. RAND Journal of Economics, 38, 60–84.

Keles, D., Bublitz, A., Zimmermann, F., Genoese, M., & Fichtner, W. (2016). Analysis of design options for the electricity market: The German case. Applied Energy, 183, 884–901.

Mastropietro, P., Herrero, I., Rodilla, P., & Batlle, C. (2016). A model-based analysis on the impact of explicit penalty schemes in capacity mechanisms. Applied Energy, 168, 406–417.

Meyer, R., & Gore, O. (2015). Cross-border effects of capacity mechanisms: Do uncoordinated market design changes contradict the goals of the European market integration? Energy Economics, 51, 9–20.

Neuhoff, K., & De Vries, L. (2004). Insufficient incentives for investment in electricity generations. Utilities Policy, 12, 253–267.

Newbery, D. (2016). Missing money and missing markets: Reliability, capacity auctions and interconnectors. Energy Policy, 94, 401–410.

Nicolosi, M., & Fürsch, M. (2009). The impact of an increasing share of RES-E on the conventional power market—The example of Germany. Zeitschrift für Energiewirtschaft, 3, 246–254.

Ockenfels, A., Inderst, R., Knieps, G., Schmidt, K., & Wambach, A. (2013). Langfristige Steuerung der Versorgung im Stromsektor. https://www.bmwi.de/Redaktion/DE/Publikationen/Ministerium/Veroeffentlichung-Wissenschaftlicher-Beirat/wissenschaftlicher-beirat-langfristige-steuerung-der-versorgungssicherheit-im-stromsektor.pdf?_blob=publicationFile&v=1. Accessed August 2, 2018.

Pfeifenberger, J., Spees, K., & Schumacher, A. (2009). A comparison of PJM’s RPM with alternative energy and capacity market designs. http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.644.9890&rep=rep1&type=pdf. Accessed July 29, 2018.

Ranci, P., & Cervigni, G. (Eds.). (2013). The economics of electricity markets: Theory and policy. Cheltenham: Edward Elgar.

Regulatory Commission for Electricity and Gas. (2012). Study on capacity remuneration mechanisms. http://www.creg.info/pdf/Etudes/F1182EN.pdf. Accessed October 19, 2018.

Schäfer, S., & Schulten, L. (2014). A capacity market for electricity sectors with promotion of renewable energy. MAGKS Joint Discussion Paper Series in Economics No. 39-2014.

Sensfuß, F., Ragwitz, M., & Genoese, M. (2008). The merit-order effect: A detailed analysis of the price effect of renewable electricity generation on spot market prices in Germany. Energy Policy, 36(8), 3086–3094.

Siegmeier, J. (2011). Kapazitätsinstrumente in einem von erneuerbaren Energien geprägten Stromsystem. https://tu-dresden.de/bu/wirtschaft/ee2/ressourcen/dateien/lehrstuhlseiten/ordner_programmes/ordner_projekte/ordner_electricitymarkets/ordner_ge/wp_em_45_Siegmeier_Kapazittsinstrumente.pdf?lang=de. Accessed August 2, 2018.

Stoft, S. (2002). Power system economics—Designing markets for electricity. Hoboken: IEEE Press & Wiley-Interscience.

Vázquez, C., Rivier, M., & Pérez-Arriaga, I. J. (2002). A market approach to long-term security of supply. IEEE Transactions on Power Systems, 17(2), 349–357.

Wissen, R., & Nicolosi, M. (2008). Anmerkungen zur aktuellen Diskussion zum Merit-Order-Effekt der erneuerbaren Energien. Energiewirtschaftliche Tagesfragen, 58, 110–115.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Schäfer, S., Altvater, L. On the functioning of a capacity market with an increasing share of renewable energy. J Regul Econ 56, 59–84 (2019). https://doi.org/10.1007/s11149-019-09389-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-019-09389-6