Abstract

In pricing real estate with indifference pricing approach, market incompleteness is shown to significantly alter the conventional pricing relationships between real estate and financial asset. Specifically, we focus on the pricing implication of market comovement because comovement tends to be stronger in financial crisis when investors are especially sensitive to price declines. We find that real estate price increases with expected financial asset return but only in weak market comovement (i.e., a normal market environment) when investors enjoy diversification benefit. When market comovement is strong, real estate price strictly declines with expected financial asset return. More importantly, contrary to the conventional positive relationship from real option studies, real estate price generally declines with expected financial asset risk. With realistic market parameters, we show that there is a nonlinear relationship between real estate price and financial risk. When the market comovement is strong, real estate price only increases with financial asset risk when the risk is low but eventually declines with the risk when it becomes high. Our cross-country empirical results also show that the relationship between financial market risk and real estate price is non-monotonic, conditional on the degree of market comovement.

Similar content being viewed by others

Notes

For example, Garmaise and Moskowitz (2004) emphasize that real estate is unique asset class because of the high transaction cost and illiquidity while Quigg (1993), Capozza and Li (2001, 2002) and Ambrose (2005) stress the difficulty of hedging real estate with financial asset in the presence of significant nondiversifiable idiosyncratic risk.

These results are consistent with Quan and Titman (1999) and Bond et al. (2003) who show that real estate markets in the Asia-Pacific region are more co-integrated with the financial market and these real estate markets are also more sensitive to country-specific market risk than those in Europe or in North America. Another recent paper by Fei et al. (2008) find that the conditional correlation among REITs, stock and direct real estate returns are time varying. Moreover, they also show that the higher correlation between equity REIT and direct real estate is related to higher future returns of equity REIT.

Hereafter, for simplicity we use the term financial asset return to represent the expected payoff from the risky financial asset and the term financial asset in referring to the risky financial asset.

IPA is a flexible modeling approach and can be easily adapted to developed land or existing real estate as its underlying principle is utility maximization of the different agents’ (e.g., buyer and seller) expected wealth instead of non-arbitrage argument in complete markets.

Our model is developed following the models of Musiela and Zariphopoulou (2004) and Elliott and van der Hoek (2009), who actually have addressed multi-period incomplete market environments. However, as we extend their models specifically to investigate real estate investment issues in this study we did not examine a multi-period market environment as such set-up does not provide additional insights into our model implication for real estate investment behavior except increasing the complexity of numerical results.

A large body of literature has developed binomial or trinomial models to price various contingent claims (e.g., Cox et al. 1979; Boyle 1988; Buttimer et al. 1997; van der Hoek and Elliott 2006). In these models, asset prices are obtained via binomial or trinomial models. For example, Cox et al. (1979) show that the stochastic process of underlying asset in the Black-Scholes model is only a special case of their binomial model and show that their binomial model can be a good approximation of real world circumstances. Thus, following Cox et al. (1979) and others, we use a binomial tree model to develop testable theoretical implications for land development behavior.

The choice of exponential utility function is due on the availability of the closed-form solutions under IPA. As the exponential utility function is one of the mostly widely used utility functions in asset pricing literature, our results can be generally applicable.

In this setting, we assume that there is infinite supply of riskless and risky financial assets. While Heaton and Lucas (1996) discuss how market incompleteness may be the result of finite supply of financial assets, we do not pursue that type of market incompleteness in this paper, but focus on heterogenous risk aversions, nondiversifiable idiosyncratic risk, and nonsynchronous market comovement.

Market completeness can also be represented by the alternative two payoffs, \( \left\{ {Y_T^d,S_T^u} \right\} \)and \( \left\{ {Y_T^u,S_T^d} \right\}, \)two categories of asset markets move inversely. For brevity we focus on only the first two outcomes in the text from now onwards.

See detailed proof in Appendix A.1.

The proof of Proposition 2 is similar to that of in Musiela and Zariphopoulou’s (2004) study.

There is a growing literature in finance that shows that idiosyncratic risk can predict future stock returns (e.g., Ang et al. 2006, 2008; Bali et al. 2005; Bali and Cakici 2008; et al.). These findings imply that there is non-zero relationship between return and idiosyncratic risk. Avramov et al. (2010) also provide some theoretical support for this non-zero relationship.

Proof in Appendix A.2.

See proof in Appendix A.3.

We show comparative statics results in appendix A.3.

We are aware that the literature on market liquidity has defined liquidity and liquidity risk in various forms. Here, we adopt the most conventional measure of liquidity – bid-ask spread.

As it is shown in Eq. (12), the bid and ask price differs in agent’s risk aversion coefficient. Hence, we only show the simulation results for bid price as the ask price is similar in functional forms.

The real estate expected payoff is fixed at 1.8 while the idiosyncratic variance and total variance of the real estate are 1.464 and 1.56 respectively. The (systematic) variance of the risky financial asset is 0.1536 and the correlation coefficient of the payoffs is 0.1961 (comovement proxy). To allow for the change in up payoff of the financial asset and bidder risk aversion, we solve for the down payoff of the financial asset to keep the rest constant.

The bidder’s risk aversion is fixed at 2, the (systematic) variance of the risky financial asset is 0.1536, and the correlation coefficient of the payoffs is 0.1961 (comovement proxy), and the expected payoff of the real estate at 1.8. We solve for down payoff of the financial asset and the real estate to keep other parameters constant, as we allow the up payoff of the financial asset and the real estate to change freely in this simulation.

We fix the expected payoffs of the real estate and the risky financial asset at 1.8 and 1.18, respectively. The idiosyncratic risk of the real estate is fixed at 1.464 while the correlation of the real estate and risky financial asset payoffs is 0.1961 (comovement proxy). To allow for the up payoff of the financial asset and the bidder’s risk aversion to change freely in this simulation, we solve for the down payoff of the financial asset and the up-and-down payoffs of the real estate to keep the expected payoff of the financial asset and the real estate and the idiosyncratic risk fixed.

The bidder’s risk aversion is fixed at 2, the expected payoff of the real estate and the financial asset at 1.8 and 1.18, respectively and the correlation coefficient of the real estate and risky financial asset payoffs is 0.1961 (comovement proxy). We allow the up payoff of the financial asset, the idiosyncratic risk and the total risk of the real estate to change freely in this simulation. The down payoff of the financial asset, the up and down payoffs of the real estate, and the conditional probability\( P\left( {Y_T^u|S_T^u} \right) \) are solved to keep the expected payoff of the financial asset, the expected payoff of the real estate, and the correlation coefficient constant.

We fix the bidder’s risk aversion at 2, the expected payoff of the real estate at 1.8, the idiosyncratic risk of the real estate at 1.464, the (systematic) variance of the risky financial asset at 0.1536. We allow the up and down payoffs of the financial asset, the up and down payoffs of the real estate, and the conditional probability to change in this simulation.

In appendix A.4, we show that the covariance of the two random payoffs is a direct function of the conditional or joint probabilities of the payoffs of the real estate associated with the payoffs of the risky financial asset.

We adopt comovement conditions that are realistic yet different. We find that in normal market condition, the comovement is weak in the United States (with correlation of 0.1 between real estate and financial asset market returns), while in pessimistic market the comovement strengthen (correlation is about 0.5). Our empirical computation based on the correlation between by the quarterly returns of the MIT/CRE transaction based index return and the value-weighted market index in U.S. from 1984 to 2006 ranges from 0.16 in low volatility period and 0.5 in high volatility period. Our simulated result are not sensitive to the choice of these exact correlation numbers.

Equation (17) is an approximation of our model implication, where the real estate price at time t \( {\text{Price}}_t^{{re}} \)is a function \( \Phi \left[ \bullet \right] \)of future financial asset risk and return at time t + 1, specifically \( {\text{Price}}_t^{{re}} = \Phi \left[ {\left( {R_{{t + 1}}^m - R_{{t + 1}}^f} \right),\sigma_{{t + 1}}^m} \right] \) .

To avoid the tautology, we use the return information from time t to time t + 1, but we use the comovement between the real estate index and financial asset measured from time t-1 to t. The assumption is that investors use the last available information on comovement to project the next period comovement in pricing the asset.. We also conduct the robustness checks by using an alternative regression model where the dummy variable Low t-1 equals to 1 when the equity market volatility is in the bottom 30 % percentile, 0 otherwise, which is consistent with empirical finding that market comovement is high when volatility level is high (Andersen et al. 1999).

Given the concern about the stationarity of the real estate index, we first remove all existing time trends from the index return series if there is any. We find that only the United Kingdom index return contains significant time trend. So we conduct the analysis based on the residuals by removing the time trend in the data from the United Kingdom.

References

Aguerrevere, F. L. (2003). Equilibrium investment strategies and output price behavior: a real-options approach. The Review of Financial Studies, 16(4), 1239–1272.

Ambrose, B. W. (2005). Forced development and urban land prices. Journal of Real Estate Finance and Economics, 30(3), 245–265.

Andersen, T. G., Bollerslev, T., Diebold, F. X., & Labys, P. (1999). (Understanding, optimizing, using and forecasting) realized volatility and correlation. Working paper. Published in revised form as “Great realization”, Risk, March 2000, 105–108.

Ang, A., Hodrick, R. J., Xing, Y., & Zhang, X. (2006). The cross-section of volatility and expected returns. Journal of Finance, 51, 259–299.

Ang, A., Hodrick, R. J., Xing, Y., & Zhang, X. (2008). High idiosyncratic volatility and low returns: international and further U.S. evidence. Journal of Financial Economics, 91(1), 1–23.

Avramov, D. E., Cederburg, S., & Hore, S. (2010). Cross-sectional asset pricing puzzles: an equilibrium perspective. Working paper.

Bali, T., Cakici, N., Yan, X., & Zhang, Z. (2005). Does idiosyncratic volatility really matter? Journal of Finance, 60, 905–929.

Bali, T., & Cakici, N. (2008). Idiosyncratic volatility and the cross-section of expected returns? Journal of Financial and Quantitative Analysis, 43, 29–58.

Black, F., & Scholes, J. (1973). The pricing of options and corporate liabilities. Journal of Political Economy, 81, 637–659.

Boyle, P. (1988). A lattice framework for option pricing with two state variables. Journal of Financial and Quantitative Analysis, 23(1), 1–12.

Bond, S. A., Karolyi, G. A., & Sanders, A. B. (2003). International real estate returns: a multifactor, multicountry approach. Real Estate Economics, 31(3), 481–500.

Buraschi, A., Porchia, P., & Trojan, F. (2010). Correlation risk and optimal portfolio choice. Journal of Finance, 65, 393–420.

Buttimer, R. J., Kau, J. B., & Slawon, V. C. (1997). A model for pricing securities dependent upon a real estate index. Journal of Housing Economics, 6, 16–30.

Capozza, D. R., & Li, Y. (2001). Residential investment and interest rates: an Empirical test of land development as a real option. Real Estate Economics, 29(3), 503–519.

Capozza, D. R., & Li, Y. (2002). Optimal land development decisions. Journal of Urban Economics, 51, 123–142.

Cox, J., Ross, S., & Rubinstein, M. (1979). Option pricing: a simplified approach. Journal of Financial Economics, 7(3), 229–263.

Davidoff, T. (2007), Stock prices, housing prices, housing stock prices, and fundamentals. Working paper, University of California, Berkley.

Elliott, R. J., & van der Hoek, J. (2009). Duality methods. In R. Carmona (ed.), Indifference pricing: Theory and applications. Princeton University Press: Princeton, New Jersey.

Fei, Peng, Ding, L., & Deng, Y. (2008). Correlation and volatility dynamics in REIT returns: performance and portfolio considerations. IRES working paper No. 2010–002, National University of Singapore.

Garmaise, M. J., & Moskowitz, T. J. (2004). Confronting information asymmetries: evidence from real estate markets. The Review of Financial Studies, 17(2), 405–437.

Green, R. K. (2002). Stock prices and house prices in California: new evidence of a wealth effect? Regional Science and Urban Economics, 32(6), 775–783.

Heaton, J., & Lucas, D. J. (1996). Evaluating the effects of incomplete markets on risk sharing and asset pricing. Journal of Political Economy, 104(3), 443–487.

Henderson, V. (2007). Valuing the option to invest in an incomplete market. Mathematics and Financial Economics, 1(2), 103–128.

Hodges, S., & Neuberger, A. (1989). Optimal replication of contingent claims under transactions costs. Review of Futures Markets, 8, 222–239.

Hugonnier, J., & Morellec, E. (2007). Corporate control and real investment in incomplete markets. Journal of Economic Dynamics and Control, 31, 1781–1800.

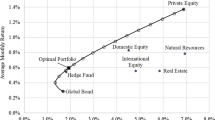

Ibbotson, R. G., & Siegel, L. B. (1984). Real estate returns: a comparison with other investments. AREUEA Journal, 12(3), 219–242.

Ledoit, O., Santa-Clara, P., & Wolf, M. (2003). Flexible multivariate GARCH modeling with an application to international stock markets. Review of Economics and Statistics, 85, 735–747.

Lintner, J. (1965). The valuation of risk assets and selection of risky investments in stock portfolios and capital budgets. Review of Economics and Statistics, 47, 13–37.

Longin, F., & Solnik, B. (1995). Is the correlation in international equity returns constant: 1960–1990? Journal of International Money and Finance, 14(1), 3–26.

Longstaff, F. A. (2001). Optimal portfolio choice and the valuation of illiquid securities. Review of Financial Studies, 14(2), 407–431.

McDonald, R., & Siegel, D. (1986). The value of waiting to invest. Quarterly Journal of Economics, 101(4), 707–727.

Merton, R. (1973). Theory of rational option pricing. Bell Journal of Economics and Management Science, 4, 141–183.

Miao, J., & Wang, N. (2007). Investment, consumption, and hedging under incomplete markets. Journal of Financial Economics, 86, 608–642.

Moskowitz, T. J. (2003). An analysis of covariance risk and pricing anomalies. The Review of Financial Studies, 16(2), 417–457.

Musiela, M., & Zariphopoulou, T. (2004). A valuation algorithm for indifference prices in incomplete markets. Finance and Stochastics, 8(3), 399–414.

Ooi, J. T. L., & Sirmans, C. F. (2004). The wealth effects of land acquisition. Journal of Real Estate Finance and Economics, 29(3), 277–294.

Ooi, J. T. L., Sirmans, C. F., & Turnbull, G. K. (2006). Price formation under small numbers competition: evidence from land auctions in Singapore. Real Estate Economics, 34(1), 51–76.

Petersen, A. M. (2009). Estimating standard errors in finance panel data sets: comparing approaches. Review of Financial Studies, 22(1), 435–480.

Pu, M., Fan, G. Z., & Ong, S. E. (2012). Heterogeneous agents and the indifference pricing of property index linked swaps. Journal of Real Estate Finance and Economics, 44, 543–569.

Quigg, L. (1993). Empirical testing of real option-pricing models. Journal of Finance, 48(2), 621–640.

Quan, D. C. Q., & Titman, S. (1999). Do real estate prices and stock prices move together? An international analysis. Real Estate Economics, 27(2), 183–207.

Titman, S. (1985). Urban land prices under uncertainty. American Economic Review, 75(3), 505–514.

van der Hoek, J., & Elliott, R. J. (2006). Binomial models in Finance. Springer: New York, NY.

Williams, J. T. (1993). Equilibrium and options on real assets. The Review of Financial Studies, 6(4), 825–850.

Williams, J. T. (1998). Agency and brokerage of real estate in competitive equilibrium. The Review of Financial Studies, 11(2), 239–280.

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank our anonymous referee, Yakov Amihud, Tianshu Chu, Yongheng Deng, Philip H. Dybvig, Shihe Fu, Richard C. Green, Allaudeen Hameed, Ravi Jagannathan, Andrew Karolyi, Jun Liu, Deborah Lucas, Seow Eng Ong, Martin Spencer, Suresh Sundaresan, Tien Foo Sing, Takeshi Yamada, and seminar participants at Southwestern University of Finance and Economics for their helpful discussions and comments. We also thank our discussants Wenlan Qian and Sau Kim Lum and the participants at the 2010 Asian Finance Association Meeting and at the 2010 Asian Pacific Real Estate Research Symposium in Hong Kong. Any errors are our own.

Appendix A

Appendix A

A.1. Proof of Proposition 1

Suppose that agent A keeps the land and maximize his utility by choosing the optimal investment strategy β given the optimal construction size q *. Differentiating Eq. (5) with regard to β gives

where R is one plus the risk-less interest rate over the one period, and\( {{{S_T^u}} \left/ {{{{S}_0} > R > }} \right.}{{{S_T^d}} \left/ {{{{S}_0}}} \right.} \) and \( {{{Y_T^u}} \left/ {{{{Y}_0} > R > }} \right.}{{{Y_T^d}} \left/ {{{{Y}_0}}} \right.} \) hold in order to eliminate arbitrage opportunities. Substituting this result back into Eq. (5) yields the following optimal utility level for the investor

Alternatively, agent A can sell the land for kP a , and invest all his wealth w a + kP a into x units of the risk-free asset and β units of the risky asset. Differentiating Eq. (6) with regard to β, we derive

Substituting Eq. (A1c) into Eq. (6) produces the optimal utility level

According to the definition of indifference ask prices, we have

Solving this equation, we can obtain the indifference ask price as follows

On the other hand, agent B is indifferent between foregoing the vacant land at time 0 and paying kP b for the land at time T; and thus similarly, we can obtain the bid price for the land as

Q.E.D.

A.2. Proof of Proposition 3

The mathematical implications for the Proposition 3 are represented in the following comparative statics results. We find that, \( \frac{{\partial {{P}_a}}}{{\partial S_T^u}} = \frac{{\partial {{P}_b}}}{{\partial S_T^u}} < 0 \), \( \frac{{\partial {{P}_a}}}{{\partial S_T^d}} = \frac{{\partial {{P}_b}}}{{\partial S_T^d}} < 0 \), and \( \frac{{\partial {{P}_a}}}{{\partial \eta }} = \frac{{\partial {{P}_b}}}{{\partial \eta }} > 0 \).

Differentiating Eq. (9) produces the following derivatives

We use η to represent the increase of the risk of the risky financial asset. If we increase \( S_T^u \) by η, to keep the expected value of \( {{\tilde{S}}_T} \) the same, we need to reduce the payoff \( S_T^d \) by\( {{p}^u}\eta /{{p}^d} \).

since \( p_s^uS_T^u + p_s^dS_T^d > R{{S}_0} \) by assumption that stock is riskier than riskless asset.

Q.E.D

A.3. Proof of Proposition 4

The prices of the land in the incomplete market setting with a risky hedging financial asset are expressed in the following equations.

The mathematical implications for the Proposition 4 are represented in the following comparative statics results after differentiating the above pricing equations.

In order to change the volatility while keeping the expected mean of the random variable \( {{\tilde{Y}}_T} \) unchanged, we introduce the variable z to represent the increase in \( Y_T^u \), whereas decrease \( Y_T^d \) by \( {{{z\left( {\pi {{p}^{{u\left| u \right.}}} + \left( {1 - \pi } \right){{p}^{{u\left| d \right.}}}} \right)}} \left/ {{\left( {\pi {{p}^{{d\left| u \right.}}} + \left( {1 - \pi } \right){{p}^{{d\left| d \right.}}}} \right)}} \right.} \) at the same time. Hence, z represents the change in the nondiversifiable idiosyncratic risk of the real asset. Substituting these changes into Eq. (12) and then differentiating the resultant equation, we obtain the following results.

Let \( {{h}^u} = \pi {{p}^{{u\left| u \right.}}} + \left( {1 - \pi } \right){{p}^{{u\left| d \right.}}} \) and \( {{h}^d} = \pi {{p}^{{d\left| u \right.}}} + \left( {1 - \pi } \right){{p}^{{d\left| d \right.}}} \). Then the following derivatives can be produced

We use η to represent the increase of the risk of the risky financial asset. If we increase \( S_T^u \) by η, to keep the expected value of \( {{\tilde{S}}_T} \) the same, we need to reduce the payoff \( S_T^d \) by \( {{p}^u}\eta /{{p}^d} \). The derivative is shown as the followings:

We have shown the exact form of \( \frac{{d\pi }}{{d\eta }} \) in appendix A.2.

Q.E.D

A.4. Proof of the Relationship between joint Probabilities and Covariance Structure of Real Estate and Financial Asset

According to the definition of covariance, we have the covariance of \( {{\tilde{Y}}_T} \) and \( {{\tilde{S}}_T} \)as follows

where \( {{p}^{{uu}}},{ }{{p}^{{ud}}},{ }{{p}^{{du}}},{\text{ and }}{{p}^{{dd}}} \)represent the joint probabilities of the outcomes \( \left( {Y_T^u,S_T^u} \right),\left( {Y_T^u,S_T^d} \right),\left( {Y_T^d,S_T^u} \right),{\text{ and }}\left( {Y_T^d,S_T^d} \right). \) If these two variables have a high positive correlation (i.e., strong market comovement) that implies small values of p ud and p du, we can approximate the above equation as

Given that the up and down probabilities of \( {{\tilde{Y}}_T}{\text{ and }}{{\tilde{S}}_T} \) remain unchanged and that their increasing and decreasing proportions are also unchanged, this suggests that an increasing joint up or down probability of these two variables leads to a greater positive correlation between these two variables. If these two variables tend to be negatively correlated so that \( {{p}^{{uu}}} \) and \( {{p}^{{dd}}} \)are very low, this equation can be approximately expressed as follows

Given those conditions remaining unchanged, this suggests that an increase in \( {{p}^{{ud}}} \) and \( {{p}^{{du}}} \)results in a greater absolute-value correlation between these two variables. It is easy to find that our results can be also applied to examine the relationship between the conditional probabilities and conariance structure.

Rights and permissions

About this article

Cite this article

Fan, GZ., Huszár, Z.R. & Zhang, W. The Relationships between Real Estate Price and Expected Financial Asset Risk and Return: Theory and Empirical Evidence. J Real Estate Finan Econ 46, 568–595 (2013). https://doi.org/10.1007/s11146-012-9376-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-012-9376-x