Abstract

This paper investigates the impact of an earthquake on households' perception of the seismic risks associated with residential locations—and, consequently, the impact of this change in perceptions on real estate prices—by performing revealed preference analysis on a unique data set of house prices and damage claims after the 2010/2011 Canterbury earthquake in New Zealand. We show that both informational and heuristic obstacles could have caused households to underestimate location earthquake risk before the quake and overreact to it after the quake. Our findings highlight the importance of quake-related information for seismic risk management and are robust to households’ risk preferences in neighborhood propensity score matching.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Households' perception of residential property location risk is important for urban economics and environmental risk management (Kunreuther & Slovic, 1978). Limitations that prevent fully rational risk perception arise due to bounded rationality (Combs & Slovic, 1979; Ganderton et al., 2000; Guttentag & Herring, 1984, 1986; Kahneman, 2003; Slovic et al., 1978) or, specifically, individuals' cognitive limitations in (i) acquiring information on the probability of a negative event and (ii) processing that information correctly (Howarth, 1988; Kunreuther & Slovic, 1978; Simon, 1978; Tversky & Kahneman, 1974, 1982).Footnote 1 These heuristic and informational limitations are magnified for rare risks like earthquake damage, which means that individuals often ignore or incorrectly assess seismic risk in reality. It is widely accepted, for example, that individuals tend to underinsure against low-probability, high-loss events relative to high-probability, low-loss events (Slovic et al., 1977; Kunreuther & Slovic, 1978; Camerer & Kunreuther, 1989; McClelland et al., 1990; Yin, Chen, Kunreuther & Michel-Kerjan, 2016).

A major issue in seismic risk research is that risk perceptions are difficult to ascertain because they have been deemed subjective. Prior research has mainly measured risk perception using survey techniques (e.g., Bernknopf et al., 1990; Katona, 1975). However, numerous limitations have been identified with survey evidence on risk perceptions of quakes. For example, random sampling error and sample selection bias are generally found (Lindell & Perry, 2000). More importantly, households' willingness to pay to reduce the seismic risk associated with residence locations is hard to acquire through survey or laboratory experiments, since real estate investment is a crucial decision that involves too many factors to be captured by a survey or simulated in a lab environment. Therefore, there is only scant evidence on how individuals perceive rare environmental risks such as earthquakes in their housing purchases and how these characteristics affect their decisions on neighborhood sorting, while factoring in potential seismic risks.

This study offers the first micro-level analysis using ex post quake insurance claims as the direct measure of potential loss due to an earthquake at the finest possible neighborhood level. We assume that seismic damage for a specific location is unchanged before and after the earthquake; this potential loss is an objective cost with certainty. This is in contrast to perception of the probability of this loss, or ‘subjective or perceived risk’. It is this risk that is factored into investment choices. By analyzing the impact of this potential loss on individual house prices before and after the earthquake, we provide rare evidence of the changes in households’ perception of seismic risks and how such changes are factored into real estate prices in seismic risk reduction. We also examine the moderating effect of demographic characteristics on households’ response, in terms of risk perception, to information shocks.

Our empirical findings suggest that seismic risks were not factored into house prices before the quake. We also find that the earthquake rendered households better informed and aware of the seismic risks in their neighborhood—and, consequently, changed their risk perception in the post-quake period. Such changes were revealed by the different magnitudes of house price drop in neighborhoods with different potential loss after the earthquake. More importantly, we found that households were homogeneous in their response to earthquake risk, except for the ethnicity or race factor in the pre-quake period, which suggests that lack of prior quake-related information might have caused Christchurch residents to be unable to distinguish or estimate a location’s seismic risk.

The practical application of this research is in seismic risk management. Unlike flood or bush fire risk, information on location earthquake risk is vague and broad due to the highly unpredictable nature of an earthquake. Current practice in earthquake risk reduction is to identify hazards and build safer structures. Our research shows that insurance policies and premiums can be used as a proxy to improve public awareness of location seismic risk; specifically, due to individuals' cognitive limitations in assessing rare events such as earthquakes. A successful natural disaster insurance program should provide meaningful guidance on location seismic risk and mitigate hazards by spreading the potential loss across the society.

The remainder of the paper is organized as follows. Section 2 introduces the institutional background of seismic insurance policy in New Zealand, Sect. 3 outlines the methodology developed in the paper, and Sect. 4 describes the data. Section 5 presents and interprets our empirical findings and Sect. 6 concludes.

2 Background

2.1 The 2010/2011 Canterbury earthquake

Christchurch is a city of about 370,000 residents in the Canterbury province, which has 550,000 residents. Canterbury was initially struck by a magnitude 7.1 earthquake on 4 September 2010, which was centered about 44 km west of the Christchurch CBD. Remarkably, there were relatively few casualties and no deaths as a direct result of the earthquake. The damage to property was widespread, however, and also produced liquefaction in some city areas.Footnote 2

The quake was followed by a 6.3 aftershock on 22 February 2011. Although the energy from the aftershock was less than the 4 September magnitude of 7.1, the February event occurred much closer to the city (about 6 km southeast of the Christchurch CBD) and was at a shallow depth. As a result, it measured 9.0 on the Modified Mercalli Intensity scale, making it one of the largest ever recorded in an urban area1.Footnote 3 This caused catastrophic destruction in Christchurch and resulted in 185 deaths and damage to almost 100,000 buildings. The earthquakes combined caused widespread liquefaction, cliff collapses, and land subsidence in riverside areas. In June 2011, the New Zealand government decided to condemn houses in several severely impacted (residential red zoned) areas that were uneconomical to rebuild. This led to voluntary buyouts of about 7857 badly damaged residential properties at the official 2007 valuation for demolition. A notable feature of the Canterbury earthquake was the unusually extended sequence of more than 10,000 aftershocks that occurred during the 2 years following the February 2011 event, with extensive repeated damage to residences and infrastructure. To date (mid-2021), the combined 2010/2011 events have cost insurers more than 31 billion New Zealand dollars, and total economic losses are estimated to be more than 40 billion New Zealand dollars (Insurance Council of New Zealand, 2021).

2.2 Public natural disaster insurance schemes in New Zealand

At the time of the quake, the Earthquake Commission (EQC), a government agency that invests in natural disaster research and insurance, provided a uniform public risk insurance program that was invariant with property specific seismic risks, up to NZ$100,000 plus Goods and Services Tax (GST), to all privately insured residential homeowners. Uniquely, both building and land damage were covered, as well as some external elements, such as driveways and retaining walls. Amounts above this level were covered by private insurers, and these were generally full-replacement policies.Footnote 4

EQC coverage is automatically included in private property insurance when homeowners take out general building insurance. These arrangements mean that an unusually high level (95%) of natural disaster insurance coverage existed in Christchurch prior to the earthquake (Nguyen & Noy, 2020b), in contrast to between 10 and 13% in California. In the event of post-quake property damage claims, initial insurance damage assessments were first carried out by EQC; additional private insurer assessments were done only for damage estimated to be more than NZ$100,000. As a result, there is less concern about selection bias within the EQC data set in terms of who is and who is not insured or making claims—or in terms of groups with differing willingness to pay for quake insurance—which generates differing price bids.

EQC premiums are generally at a set rate regardless of property value, while private insurance is based on house value. At the time of the quake, private insurers based premiums on natural disaster risk in three broad regions, with Canterbury in the low-risk zone. However, the difference in premiums between risk regions did not reflect actual risk, with cross-subsidization occurring from low-risk to high-risk regions. This noncorrelation between risk and premiums is common in public natural disaster insurance schemes, but less common for private insurers. Although New Zealand has world-leading earthquake research capability, private insurers were reluctant to translate this into explicit locality-premium differentiation until 2018.

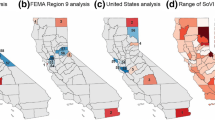

We used the spatial distribution of quake damage-to-value ratios, calculated using EQC claims data against a property’s pre-quake value, which is depicted in Fig. 1. This ratio is widely used by building structural engineers to assess post-quake building damage. The figure shows that damage from the 2010/2011 Canterbury earthquake was mainly in the CBD area and on the eastern side of city.

2.3 Earthquake risk in Christchurch

Although New Zealand is known for its frequent earthquakes, prior to the quake Christchurch itself was officially regarded as a low-risk area because no major fault lines were known to run near the city. People’s perception of the risk of a major earthquake was therefore low.

In contrast, the potential for liquefaction was known, and soil maps were available at some aggregated levels before the earthquake (Brown & Weeber, 1992; Center for Advanced Engineering, 1997; Christensen, 2002, 2004; Clough, 2005; Elder, McCahon & Yetton, 1991). However, this quake-related information was limited in terms of the areas covered and lack of specific details (Brackley, 2012). The 2010/2011 Canterbury earthquake sequence thus served as an information shock, and people updated their perceived earthquake risk accordingly when losses were better revealed.

3 Methodology

3.1 Estimation of loss

We first estimate the direct property loss caused by the earthquake for neighborhoods, which was proxied by meshblocks (MB).Footnote 5 The cost of quake damage for individual residential properties was estimated by a logarithmic functional form against a set of property attributes. The damage analysis model is

where \({C}_{jm}\) is the direct cost of building and land damage estimated by the insurance payment for property j in MB m. \({S}_{jm}\) is a vector of building structure variables that include log floor area, number of stories, building age, garaging, and building materials.Footnote 6\({Land}_{jm}\) is the property’s assessed land value prior to the earthquake, obtained from the government valuation.Footnote 7\({\tau }_{jm}\) is the building vintage effect. \({D}_{m}\) is the MB fixed effect, which measures the earthquake loss with certainty since it is identified with post-quake claims data. \({\mu }_{jm}\) is the error term, which could be correlated within each MB and is heteroskedastic across MBs.Footnote 8 See Panel A of Table 1 for summary statistics of the main variables used in Eq. (1).

\(\ln \left( {Land_{jm} } \right)\) is included as an independent variable in the above equation to account for land attributes and surrounding amenities on claims. Land attributes could include the site size, view, contour, shape, soil type, retaining walls, path/driveway, and street location. Surrounding amenities may include schools, parks, hospitals, valleys, lakes, rivers, hills/mountains, and road/bridge infrastructure. The assumption is that both land attributes and neighborhood amenities are capitalized into a property’s land value. By including land value in the damage claims regression, we control for potential repair/rebuild costs due to damage to amenities and land attributes.

MB fixed effect \({D}_{m}\) captures the average cost of damage to property in neighborhood m caused by the earthquake. A typical MB in our sample has a population of 120 and an area of around 180 m by 420 m. The advantage of using MB fixed effects for location-specific loss is that this substantially reduces measurement errors in estimating earthquake damages. This is because earthquake impacts, such as liquefaction effects, can be highly differentiated even within the same street. Thus, loss measures based on small disaggregated geographic units such as MBs will be more efficient for capturing variation in damages than measures based on large geographically based hazard zones (Naoi et al., 2009). In turn, this will facilitate identification of the impact of perceived risk on house prices. Regarding the use of \({D}_{m}\) as a proxy of a neighborhood’s objective earthquake risk (certain loss), we make the following assumption:

Assumption 1

Potential loss (\({D}_{m}\)) is unchanged before and after the earthquake.

This assumption is valid, in that potential loss is mainly determined by an MB’s geographic features rather than by factors that could be changed by the earthquake, such as amenities, which we control for by using land value.

3.2 Estimation of risk perception

Following the literature (e.g., Beron et al., 1997), the perceived risk (of certain loss) is defined as the perceived probability of certain earthquake loss. Mathematically, perceived risk is defined as follows:

where \({Pr}_{i}(event)\) denotes the perceived probability of an event for household i. For the same event, due to differences in cognitive ability and information availability, households may perceive its probability quite differently.

We will use a revealed preference method to estimate households' perceived risks attached to their location choices. As demonstrated by MacDonald et al. (1987) and Bin and Landry (2013), the marginal implicit hedonic price for a change in a risk factor will reflect the consumer’s assessment of the probability of loss and marginal insurance cost. Thus we can estimate risk perception by examining the effect of certain loss (measured by MB fixed effect \({D}_{m}\) in Sect. 3.1) on house prices. Specifically, we run an Ordinary Least Squares (OLS) regression as follows,

where \({SP}_{jmt}\) is the jth property’s sale price in MB m at time t; \({\widehat{D}}_{m}\) is the estimated certain loss to MB m obtained from the location insurance claims in Eq. (1); and \({EQ}_{t}\) is an earthquake event dummy that equals 1 for sales that occurred after 22 February 2011 and 0 otherwise.\({Land}_{jmt}\) is the property’s pre-quake land value obtained from the government valuation; \({S}_{jmt}\) is a vector of building structural attributes, including log of floor area, number of bedrooms, multi-storey building, log building age, and building materials; \({Dis}_{m}\) is the geographic distance in kilometers of the MB m to the city’s CBD; \({\tau }_{jt}\) is the building vintage effect; \({\theta }_{jt}\) is a calendar quarter dummy to account for time effects; \({Area}_{jt}\) is the area-unit (a statistical unit defined by Statistics New Zealand that is equivalent to a suburb in urban areas) fixed effect to account for additional location effects; and \({\mu }_{jt}\) is the error term.Footnote 9 See Panel B of Table 1 for summary statistics of the main variables used in Eq. (3).

The variable \(\left({\widehat{D}}_{m}\right)\) estimates the property’s earthquake risk at MB level. The coefficient (\({\beta }_{2}\)) indicates how households capitalize the location’s earthquake risk into the property sale price. This coefficient measures two items: risk perception and risk preference. Households with the same risk preference may perceive different probabilities that certain loss will occur, and so house transaction prices will differ. Similarly, differences in risk preference will also result in different prices even if the perceived risks are the same. With the current model specification, we cannot identify perception from preference. The following assumption is necessary for the identification of changes in risk perception.

Assumption 2

Households are consistent in their risk preference before and after the earthquake.

The variable \(\left({Land}_{jmt}\right)\) represents the land component of the property’s sale price. The inclusion of land value is important, given any likely omission of a common factor related to amenities in our model specification (Bin & Landry, 2013; Bin et al., 2008; Singh, 2019). More importantly, the land value can also capture idiosyncratic location values of specific properties. Value from land attributes (such as size, shape, contour, views, soils, etc.) varies across properties, while value from surrounding amenities is invariant across properties in the same MB. For MBs with higher potential losses, land attributes become more important because they may significantly reduce the impact of potential losses to the specific property.

The interaction term \(\left({\widehat{D}}_{m}\times {EQ}_{t}\right)\) measures changes in risk perception in response to the earthquake. Such changes could occur because households update their perceived probability of earthquake and consequent quake damages as a result of the change in quake information and physical conditions attributed to the earthquake (Bin & Landry, 2013).

The interaction term \(\left({\widehat{D}}_{m}\times \mathrm{ln}\left({Land}_{jmt}\right)\right)\) measures the moderation effects of earthquake risk on the dependence of property sale prices on land values. For households in a quake zone, land can be used as a shock absorber to reduce the quake risk, because land itself is physically ‘indestructible’ and its economic value is often preserved in urban development even after being exposed to earthquake. This is particularly true for properties in regions with high quake risk, since the earthquake can easily damage the value of houses but not the land; thus land plays a more important role in determining property prices in a region with high risk of earthquake. Therefore, the variation in land attributes will contribute to significant variation in property price, and this contribution will increase with the risk of earthquake. The coefficient of this interaction term is expected to be positive.

The interaction term \(\left({\widehat{D}}_{m}\times {EQ}_{t}\times \mathrm{ln}\left({Land}_{jmt}\right)\right)\) measures difference in the moderation effect of MB potential losses on the correlation between land values and property price, before and after earthquake. Since potential losses are more perceivable after the earthquake, and land attributes contribute more to property sale price, we expect the coefficients of this triple-interaction term to be positive.

3.3 The impact of neighborhood characteristics on perceived earthquake risk

Although we cannot disentangle risk preference from risk perception in Eq. (3), we can partially parameterize risk preference as a function of its key determinants and then examine the impact of the key determinants of risk preference on changes in risk perception. Kasperson et al. (1988) show that hazards interact with psychological, social, institutional, and cultural processes in ways that may amplify or weaken public responses to the risk. Our study shows that the moderator effects of various preference determinants on changes in risk perception and so suggest how house prices in neighborhoods with different potential damage and demographic characteristics will change in response to earthquakes.

Specifically, we introduced MB demographic characteristics in Eq. (3) and have the following modified OLS equation:

where \({NB}_{jm}\) is a vector of MB characteristics obtained from 2006 census data that potentially determine households’ risk preference: neighborhood population, income, years of education, marriage status, housing tenure choices, and ethnicity. Except for population, all other variables are MB average, reflecting MB features. For example, average marital status reflects the percentage of married households in the MB. See Panel C of Table 1 for summary statistics of the demographic variables used in the above equation. All other variables are the same as in model (3).

The vector of interaction terms \(\left({\widehat{D}}_{m}\times {NB}_{m}\right)\) measures how MB characteristics (e.g., income) moderate how potential losses are factored into house price. Correspondingly, the vector of the triple-interaction term \(\left({\widehat{D}}_{m}\times {EQ}_{t}\times {NB}_{m}\right)\) shows how such characteristics moderate changes in households’ risk perception after the earthquake.

4 Data

Residential property sales data for Christchurch before and after the 2010/2011 Canterbury earthquakes (January 2008–July 2013) were obtained from Quotable Value New Zealand (QVNZ).Footnote 10 This period covers 2 years before and 2 years after the earthquakes of September 2010 and February 2011. The property sales database was tagged with property ID, total sale price, sale date, property valuation, structural characteristics, land attributes, census MB number, and area unit ID. The sample was restricted to single-family homes located within 30 km of the Christchurch CBD, with commercial buildings and farm use excluded. We further excluded outliers: those with a sale price over NZ$2 million or below NZ$20,000 or buildings with a floor area below 30 m2 or over 500 m2. This left a balanced sample of 28,681 home sales.

The home earthquake damage database was obtained from the EQC. Each claim includes a detailed property description and claim assessment information. Property information includes property ID, building floor area, building site area, building wall, roof material, and rated capital value. Claim assessments were split into three types: land only, building only, and land and building. Claims associated with MB number were derived from GISFootnote 11 based on each property’s latitude and longitude coordinates (rounded to approximately 70 m to protect privacy). We further excluded claims for a repair cost less than NZ$100 or building floor area more than 1000 m2. This left a balanced sample of 62,462 insurance claims. The home insurance claims are used to calculate MB earthquake losses in model (1).

The pre-quake MB database of neighborhood demographic characteristics from the 2006 census was obtained from Statistics New Zealand. The census data include variables at MB level, such as median income, population, average years of education, percentage of houses privately owned, percentage of married households, ethnic ratios, and smoking rates. We used neighborhood smoking rates as a proxy for the neighborhood’s risk-seeking attitude; this proxy has been established in prior research (Viscusi, 1990; Viscusi & Hersch, 2001; Anderson & Mellor, 2008; Harrison et al., 2010; Adams, Bose & Rustichini, 2014). We then adopted propensity matching score methodology to test whether risk preference affects neighborhood sorting and in turn leads to changes in the neighborhood’s aggregate risk preference after the earthquake.

These neighborhood data are matched to property sale data using the MB number obtained in the dataset to study the moderating effects of key demographic characteristics such as income and education. In total, we obtain 2271 matched MBs with balanced data in the census, property sales, and earthquake claims databases. Summary statistics of the main variables for property earthquake damage claims, home sales, and MB characteristics are shown in Table 1.

5 Empirical results

5.1 Earthquake damage and neighborhood earthquake risk

Table 2 presents estimation results of damage model (1) based on EQC earthquake claim payments, controlling for the property’s pre-quake land values, building characteristics, and MB fixed effects.Footnote 12 The coefficients for building floor area, number of stories, age of building, and dummy for external or internal garage were positive and statistically significant. For example, a 1% increase in building floor area, number of building stories and building age increased building damage in terms of insurance claims by 0.793, 0.147 and 0.143%, respectively. These findings are in line with our expectation that damage depends on building characteristics. Higher,Footnote 13 larger, and older buildings incur higher losses. Moreover, the coefficient of land was positive (0.026) and statistically significant, suggesting that houses in more expensive land areas incurred greater claims once they had been exposed to earthquake. Since data were not available on soil type or foundation type for individual claims, controlling for pre-quake land features and amenities using land value is important for generating an unbiased earthquake measure in this study.

Figure 2 shows the histogram of estimated MB losses.Footnote 14 MB earthquake damage (\({\widehat{D}}_{m})\) was obtained from estimates of MB fixed effects in Eq. (1). The estimates reflect inherent seismic losses for all houses in the same MB, compared with the benchmark MB loss in the city, which is independent of any losses due to damage to unobservable land features and local amenities by model specification. In total, there are 2737 MBs in the city with mean damage of − 0.111. Figure 2 shows that the estimated losses were right-skewed (skewness = 0.21), which suggests that the distribution of losses was concentrated to the left of the benchmark MB loss.

Frequency distribution of meshblock losses. This figure depicts the distribution of meshblock earthquake damage in the 2010/2011 Canterbury earthquake, compared with the benchmark meshblock in Christchurch. Meshblock earthquake damage (\({\widehat{D}}_{m})\) is obtained from estimates of meshblock fixed effects in Eq. (1). In total, there are 2737 meshblocks with a mean damage of − 0.111

5.2 Perceived earthquake risk in housing purchases

Table 3 presents the results of estimation of model (3). The coefficient of MB losses (D̂m) was positive (0.093) and statistically insignificant, implying that households did not factor in location earthquake risk in house prices. Post-earthquake, the magnitude of the MB coefficient \(\left({\widehat{D}}_{m}\times {EQ}_{t}\right)\) was negative (− 0.366) and statistically significant, implying that the earthquakes serve as information shocks and significantly enhance households' perception of seismic risks. A 1-percentage-point increase in MB earthquake risk decreased property sale price by 0.366% in the post-quake period. Also, other than the indirect effect through enhanced risk perception, earthquakes per se \(({EQ}_{t})\) directly discount property values by 4.1%. Therefore, our findings are in line with previous research, whereby households discount their property value by the assessed subjective risk level when quake-related information is more fully revealed (Schlenker, Haemann & Fisher, 2005; Michael, 2007; Butsic et al., 2011).

Land value was found to be positively and significantly related to property sale prices. For the benchmark MB (with potential loss standardized to zero), our results show that changes in land value will not be fully factored into the property price: A 1% change in land value will lead to a 0.36% change in property price only. The coefficient of the interaction term between land value and potential loss \(\left({\widehat{D}}_{m}\times \mathrm{ln}\left({Land}_{jmt}\right)\right)\) is statistically insignificant, which suggests that households failed to account for location earthquake risk in land value before the quake. In contrast, the coefficient of the triple-interaction term, \(\left({\widehat{D}}_{m}\times {EQ}_{t}\times \mathrm{ln}\left({Land}_{jmt}\right)\right)\) was positive (0.023) and statistically significant, suggesting that households linked the property’s land value to the location’s seismic risk after the quake. In other words, households tended to use the land as a risk absorber in seismic risk reduction. They pay more for houses in MBs with higher potential losses and higher land values when such risks are better perceived. For a 1% increase in land value or potential risk the property sale price increased by 0.023%. These results support the findings of Yu and Shi (2022), who show that the 2010/2011 Christchurch earthquake removed barriers to urban development in Christchurch, especially in inner high-value land areas.

Moreover, we controlled for MB distance to the Christchurch CBD, area-unit (suburb) fixed effects, and calendar year-quarter fixed effects in the regressions to address concern about possible omitted spatial variables and time effects. The results show that distance to CBD is positive (0.028) and significantly correlated with the property’s sale price: A 1% increase in distance to CBD increased the property sale price by 0.028%. These results are not surprising, since the earthquake hit the Christchurch CBD and quake damage (both buildings and infrastructure) was mainly in the central area. Property-specific attributes and building materials are also accounted for, and show that house prices were positively related to building floor area, number of bedrooms, and number of building stories but negatively related to building age.

5.3 Risk perception and neighborhood characteristics

The estimation results for perceived risk and neighborhood characteristics in model (4) are presented in the second column of Table 3. We focus our analysis on estimates in addition to model (3), since the coefficients of common variables in model (3) and model (4) are similar. They show that the household’s income, education, tenure, and marital status did not affect pre-quake house prices in terms of location seismic risk. Meanwhile, we found that households in high-density areas had taken on more seismic risk (the estimated coefficient is 0.012) before the quake. These findings contradict the natural disaster literature, which posits that an individual’s risk-taking behaviors are mostly affected by income, education, and age (Atreya et al., 2015; Guiso et al., 1996; Mulwanda, 1992; Vaughan & Nordenstam, 1991). Our results suggest that lack of prior quake-related information could be one of the main reasons that households failed to factor location seismic risk into their house purchase. There is evidence that pre-quake information on property-specific seismic risk was rather limited in Christchurch, and prior quake hazard maps have also been deemed inadequate in terms of both the areas they covered and the quality of information they provided (Brackley, 2012; Stein et al., 2012).

Interestingly, the results regarding ethnic variables suggest that both Asians and Europeans were either more risk averse or more aware of risks (estimated coefficients are − 0.103 for Asian and − 0.050 for European) before the earthquake; however, they became less sensitive to potential losses after the earthquake (the estimated coefficient is 0.253 for Asian and 0.099 for European), which suggests that they downgraded their risk perception after the earthquake, when damage was more fully revealed. All of these suggest that when quake-related information is limited, personal experience and cultural and cognitive factors can be the major determinants of households’ risk perception (Asgary & Willis, 1997; Wachinger et al., 2013). In this instance, it appears that Asians and Europeans were more alert to seismic risk than other ethnicities.

Overall, our findings suggest that the Canterbury quake sequence served mainly as information shocks. Although the 2010/2011 earthquake increased households’ awareness of earthquake risk, in addition to continuing personal discomfort, mistrust of authorities, and nonmonetary costs, in the aftermath it will take time to manifest in neighborhood sorting. Our results highlight the importance of quake-related information on perceived location seismic risk.

5.4 Robustness checks

5.4.1 Damaged or repaired house sales

Households may choose to sell their damaged or repaired houses after the earthquake. To address the influence of ‘damaged or repaired’ house sales in the post-quake period, we further exclude damaged property sales from the analysis. Damaged property sales were identified by matching the QVNZ sale data set to the EQC claims data set via property ID.Footnote 15 Given a high percentage (95%) of insurance coverage in Christchurch prior to the earthquake (Nguyen & Noy, 2020b), matching would largely remove any quake-damaged or -repaired property sales in our analysis. Note that quake-damaged properties without repairs were difficult to sell, since most insurance policies were not transferrable to new owners, and thus a prudent homeowner would wait for an insurance settlement before listing the property for sale. Due to the lengthy insurance settlement process, we would assume that most of those identified quake-damaged properties in our sale analysis within the first 2 years after the quake were classified as minor damage and then as repaired sales. The results of Table 4 in Appendix 1 show that the coefficients of the price model, excluding damaged or repaired property sales, were very close to the results obtained using all sales. Overall, our results are robust to damaged or repaired sales in the analysis.

5.4.2 Changes in aggregate risk preference

Assumption 2 is crucial in the prior analysis to identify changes in risk perception. We test the robustness of our results given that households’ risk preference may change over time by applying a propensity score matching (PSM) method, as described in Appendix 2. Ideally, we should be able to drop relocated households and repeat our revealed preference analysis with balanced data. However, individual relocation information is unavailable. Therefore, we can only use MB aggregate data to perform PSM, dropping areas with quite different risk preferences. We categorize all MBs into two types, high-potential-loss and low-potential-loss groups,Footnote 16 using the median of the MB potential loss distribution as the cutoff for variable definition. Applying PSM using MB smoking rate as a proxy for households’ risk attitudes, we can select MBs without a significant location sorting endogeneity problem for our revealed preference analysis. The results of PSM analysis are presented in Table 5 of Appendix 2, which shows that the PSM results remain very close to the results obtained in Table 3. Therefore, our results support the second assumption, that individual risk preferences are stable over time (Stigler & Becker, 1977).

5.4.3 Measuring changes in risk perception over time

To measure how new post-quake information (such as disruption to business and social activities, the rising burden of building maintenance and compliance, the loss of memorabilia, death and injury, or loss of historical/environmental assets, insurance claims and settlements, and uncertainty about the government’s relief efforts and plans for rebuilding) affects households’ perceived risk, we replace the interaction of earthquake damage and earthquake dummy (\({\widehat{D}}_{m}\times {EQ}_{t}\)) with an interaction of earthquake damage and calendar quarters (\({\widehat{D}}_{m}\times {\theta }_{jt}\)) in Eq. (3) and graph the dynamic effect of perceived earthquake damage on residential housing prices over time in Fig. 3.Footnote 17 The results show that the price discount on the quake-related risk factor was small and insignificant before the first and second quakes, but increased dramatically after the quakes. A 1-percentage-point increase in MB earthquake losses would decrease house prices by 0.05% in 2011, 0.10% in 2012, and 0.25% in 2013. Thus, the results support our previous findings that households did not consider location seismic risk before the quake due to limited quake-related information. When a big earthquake hits, people assess new quake-related information to update their perceived earthquake risk. A possible explanation is that the unusually extended aftershock sequence reinforced pessimism about the likelihood of future quake damage. There was also increasing awareness of the difficulty of repairs and slow processing of insurance claims. The slow pace of the general Christchurch infrastructure rebuild may thus have increased pessimism over time. These physical and psychological factors may cause interested property buyers to become increasingly hesitant.

Effect of changes in perceived earthquake risk on housing prices. This figure plots the relationship between households’ perceived location seismic risk and housing prices before and after the earthquake. The dotted line represents the price discount for a 1% change in perceived meshblock earthquake damage over the sample period. These values are calculated by replacing the interaction of earthquake damage and earthquake dummy (\({\widehat{D}}_{m}\times {EQ}_{t}\)) with an interaction of earthquake damage and calendar quarters (\({\widehat{D}}_{m}\times {\theta }_{jt}\)) in Eq. (3)

5.4.4 Additional controls for location heterogeneities and time trends

To account for the different time trends across various locations in Christchurch, we further group Christchurch city into two zones (inner and outer areas) based on their geographic distance to the Christchurch CBD. Fu and Shi (2021) show that urban spatial development patterns could differ in central and non-central neighborhoods. Following Fu and Shi (2021), we classified an inner zone as being within 5 km of the CBD and an outer zone as between 5 and 30 km from the CBD. We thus include zone fixed effects, year fixed effects, zone*year fixed effects, and seasonal (quarter) fixed effects in Table 3 to carry out additional robustness checks. The results are consistent with our main findings and are presented in Table 6 of Appendix 3.Footnote 18

6 Conclusion

In this study, we analyze the effect of perceived location earthquake risk on the housing price in Christchurch, New Zealand, paying close attention to how this perceived risk manifested before and after the 2010/2011 Canterbury earthquake. To capture perceived earthquake risk, we employ a measure developed by MacDonald et al. (1987) and Bin and Landry (2013) whereby the marginal implicit hedonic price for a change in potential earthquake loss will reflect the consumer’s assessment of the probability of loss and marginal insurance cost. Using quake-related building insurance claims as a proxy for location seismic risk, we confirm that households didn’t incorporate location seismic risk in their housing purchases before the quake, but readjusted their risk assessment in the post-quake period (Schlenker, Haemann & Fisher, 2005; Michael, 2007; Butsic et al., 2011). Our results are robust to controlling for damaged or repaired property sales, changes in households’ risk perception, location heterogeneities, and time trends.

To investigate the degree to which perceived earthquake risk differs among different neighborhoods, we rely on the hazard interaction theory of Kasperson et al. (1988) to show the moderator effects of household characteristics on perceived location seismic risk. We find strong evidence that Asian and European households are more alert to location seismic risk, which suggests that with limited prior quake information, personal experience, culture, and race can be major determinant factors in perceived earthquake risk (Asgary & Willis, 1997; Wachinger et al., 2013). By using a risk proxy based on smoking rates prior to the quake, we show that individuals’ risk preferences do not change our conclusions.

As discussed, it is well established that people are not good at making decisions that involve rare risks; specifically, given the high level of uncertainty associated with earthquake prediction. Both informational and heuristic obstacles influence people’s risk perceptions and their willingness to participate in environmental risk management. Christchurch was officially regarded as a low-risk area and, as a result, households were insensitive to location seismic risk in the pre-quake period. The 2010/2011 earthquake served as an information shock and households substantially re-evaluated their risk perceptions in the post-quake period when suburb-based earthquake damage information became available.

Our findings have important policy implications for seismic risk management. The New Zealand government-run single (unity-risk) premium insurance program was based on three broad regions at the time of the quake, with Canterbury in the low-risk zone, which may have reduced information clarity. This noncorrelation between risk and premiums is common in public natural disaster insurance schemes, but can potentially bias households' perception of location seismic risk. Nguyen and Noy (2020a) compare the insurance cost of a public unity-risk scheme in New Zealand with varying-risk premium insurance programs in California and Japan. They find that providing a public insurance system was much costlier (about 3.8–8.8 times higher than operating a private varying-risk premium insurance program for a similar-sized disaster), although varying-risk premium insurance may discourage people from purchasing adequate insurance coverage. Timar et al. (2018) found that the locational liquefaction risk discount disappeared in Hutt City, New Zealand, within 4 years of the 2010/2011 Canterbury earthquake. Our empirical findings suggest that a varying-risk insurance premium may serve as a proxy for location seismic risk, which is the key factor in influencing households’ risk perception in seismic risk management.

7 Appendix 1

See Table 4.

8 Appendix 2: Propensity score matching

We use propensity score matching (PSM) following four steps, as follows.

First, we choose the covariates that predict households' locational choices. Since most households made this choice before earthquake, we use meshblock demographic characteristics and smoking rates before the earthquake as matching variables. We categorize all meshblocks into two types: high-potential-loss blocks (HD = 1) and low-potential-loss blocks (HD = 0), using the median of \(\widehat{D}\) as the cut-off value to define this binary variable, i.e., HD = 1 if \(\widehat{D}>{\widehat{D}}_{median}\) and HD = 0 otherwise.

Second, we employ a logistic model to investigate the impact of these covariates on households' locational choices. Logit results show that most coefficients are statistically significant, which suggests that these covariates will affect households’ locational choices.Footnote 19 Then, we calculate the propensity score \(\left( {\log \left( {\frac{p}{1 - p}} \right)} \right)\) using the predicted probability of choosing a high-potential-loss location.

Third, we conduct a nearest-neighbor search. For each meshblock in the high-potential-loss group, we choose a corresponding meshblock in the low-potential-loss group whose propensity score is closest to that of the high-potential-loss meshblock. In this way, we select a group of control meshblocks to serve as the comparison group for our analysis. We undertake the following balance test, as suggested by Garnefeld, Eggert, Husemann-Kopetzky and Böhm (2019) to verify that covariates are balanced across different types in the matched sample: We (1) test whether the difference in matching covariates between different types of meshblocks is still statistically significant after matching and (2) calculate Rosenbaum and Rubin’s (1983) “percentage reduction in bias” statistic for each match variable. The results of the nearest neighbor search show that for most matching variables, except for smoking rate, the difference in matching variables is statistically significant between high-potential-loss meshblocks and unmatched low-potential-loss meshblocks, but it becomes insignificant after matching, which suggests that PSM will generate a comparison group with characteristics similar to those of high-potential-loss meshblocks.Footnote 20 The matching rule for smoking rate is exactly opposite to other variables. The difference in smoking rate is insignificant between the unmatched group (with low potential loss) and the high-potential-loss group, while it is significant between the matched group and the high-potential-loss group. Since the smoking rate is a proxy for risk preference, these unusual results for smoking rates actually suggest that our matching is efficient for selecting groups with similar risk preference. Furthermore, PSM significantly reduces selection bias.

Fourth, we conduct a revealed preference analysis using the matched sample. The number of unmatched meshblocks is 26, which we drop while doing the revealed preference analysis. Finally, we obtain 2173 meshblocks and 23,457 households' sale records. Estimation results based on PSM for our revealed preference analysis are reported in Table 5 below.

9 Appendix 3

See Table 6.

Notes

Two accepted heuristics in behavioural economics are (i) ‘optimism or threshold bias’, whereby people tend to ignore risks that are severe but rare, and (ii) ‘availability bias’, whereby people tend to worry excessively about events that are recent or have been covered by the media, even if they are highly unlikely (Combs and Slovic, 1979).

Liquefaction is the process whereby, during the earthquake process itself, sand and silt grains in wet soil are rearranged and the soil behaves more like a liquid than a solid. Pressurised water is forced up to the ground surface and the remaining land sinks and distorts.

The 2010 quake was measured at about 6.5 on the MMI scale.

Now insurers place a cap on the maximum loss that can be claimed as a result of an earthquake.

Meshblocks are the smallest regional statistical units used in the census by Statistics New Zealand.

Building materials are further classified into brick, concrete, roughcast, stone, and weatherboard for walls and concrete, iron, tile, wood, and mixed material for roofs.

Under New Zealand legislation, local councils are required to value all properties for rating purposes no more than every 3 years. In Christchurch the latest available rating valuations before the quake were carried out in 2007/2008. Although rating valuations were subject to scrutiny by homeowners, assessment results were uniformly assessed and had to meet the statistical compliance requirements in effect at the time of valuation, which is set by the Valuer-General in line with standards of the International Association of Assessing Officers (IAAO). See Shi, Young, and Hargreaves (2009) for more discussion of New Zealand’s rating system and the quality of overall general assessments.

Heteroskedasticity across MBs and correlation within a MB error terms have been taken into account while calculating the standard errors of the estimators.

Property type is excluded in the above equation, since our samples are restricted to single-family homes. Because people do not rely on a normalised home price per square meter in property transactions, in the above equation we use the log of total property sales, controlling for the log of property floor area and number of bedrooms.

QVNZ is a state-owned enterprise established primarily for rating valuations and is the official database for all property transactions in New Zealand.

Geographic Information Systems. Every property’s X and Y coordinates are placed on a GIS map to identify the associated neighborhood’s characteristics.

Payments were classified according to combined land and building claims, building claims, land claims, and just building claims, separately. ‘Building claims’ are claims for buildings either with or without land claims. ‘Just building’ claims are those with no associated land claims. ‘Land claims’ are those claims for land either with or without building claims. There were not enough ‘Land only’ claims (145) for a robust statistical analysis. Since the combined claims would better represent total quake damage, we then used total property repair cost in the regression analysis.

The relationship of quake risk to building height is complex and depends on quake wave amplitude and frequency and how these interact with building characteristics.

MB fixed effects data are available on request from the first author.

Due to privacy reasons, we don’t have property address or information on the seller or buyer in the sales and claims databases.

This dichotomy is artificial because location choices are continuous. We thus have to sacrifice information on continuous variation in location choice for the purpose of correcting selection bias in this study.

Estimation results are available from the corresponding author on request.

Due to the large number of variables and interaction terms, location fixed effects and time trends cannot be estimated at a conventional unit-area (suburb) level.

For brevity, we do not report results from the logit model, but they are available upon request.

For brevity, we do not report results from the nearest neighbor search, but they are available upon request.

References

Adams, S., Bose, N., & Rustichini, A. (2014). How different are smokers? An analysis based on personal finances. Journal of Economic Behavior & Organization, 107, 40–50.

Anderson, L. R., & Mellor, J. M. (2008). Predicting health behaviors with an experimental measure of risk preference. Journal of Health Economics, 27(5), 1260–1274.

Asgary, A., & Willis, K. G. (1997). Household behaviour in response to earthquake risk: An assessment of alternative theories. Disaster, 21(4), 354–365.

Atreya, A., Ferreira, S., & Michel-Kerjan, E. (2015). What drives households to buy flood insurance? New evidence from Georgia. Ecological Economics, 117, 153–161.

Bernknopf, R. L., Brookshire, D. S., & Thayer, M. A. (1990). Earthquake and volcano hazard notices: An economic evaluation of changes in risk perceptions. Journal of Environmental Economics and Management, 18, 35–49.

Beron, K. J., Murdoch, J. C., Thayer, M. A., & Vijverberg, W. P. M. (1997). Analysis of the housing market before and after the 1989 Loma Prieta earthquake. Land Economics, 73(1), 101–113.

Bin, O., Kruse, J. B., & Landry, C. E. (2008). Flood hazards, insurance rates, and amenities: Evidence from the coastal housing market. Journal of Risk and Insurance, 75(1), 63–82.

Bin, O., & Landry, C. E. (2013). Changes in implicit flood risk premiums: Empirical evidence from the housing market. Journal of Environmental Economics and Management, 65, 361–376.

Brackley, H. L. (2012). Review of liquefaction hazard information in eastern Canterbury, including Christchurch city and parts of Selwyn, Waimakariri and Hurunui districts, report prepared for Environment Canterbury report no. R12/83. Institute of Geological and Nuclear Sciences Limited.

Brown, L. J., & Weeber, J. H. (1992). Geology of the Christchurch urban area. Scale 1:25,000. Institute of Geological and Nuclear Sciences.

Butsic, V., Hanak, E., & Valletta, R. G. (2011). Climate change and housing prices: Hedonic estimates for ski resorts in western North America. Land Economics, 87(1), 75–91.

Camerer, C. F., & Kunreuther, H. (1989). Decision processes for low probability events: Policy implications. Journal of Policy Analysis and Management, 8(4), 565–592.

Center for Advanced Engineering. (1997). Risk & realities a multi-disciplinary approach to the vulnerability of lifelines to natural hazards based on the work of the Christchurch engineering lifelines group. University of Canterbury.

Christensen, S. (2002). Christchurch liquefaction study: Stage II, Environment Canterbury report U02/22. Beca, Carter, Hollings and Ferner Ltd.

Christensen, S. (2004). Christchurch liquefaction study: Stage IV, Environment Canterbury report U04/25/1. Beca, Carter, Hollings and Ferner Ltd.

Clough, B. (2005). Christchurch liquefaction study: Stage IV (addendum report), Environment Canterbury report U04/25/2. Beca, Carter, Hollings and Ferner Ltd.

Elder, D. M. G., McCahon, I. F., & Yetton, M. D. (1991). The earthquake hazard in Christchurch: A detailed evaluation. Christchurch: Soils & Foundations Ltd.

Combs, B., & Slovic, P. (1979). Newspaper coverage of causes of death. Journalism Quarterly, 56, 837–843.

Fu, Y., & Shi, S. (2021). Barriers to urban spatial development: Evidence from the 2010–2011 Christchurch earthquakes. Journal of Regional Science, 62(1), 218–245.

Ganderton, P. T., Brookshire, D. S., McKee, M., Stewart, S., & Thurston, H. (2000). Buying insurance for disaster-type risks: Experimental evidence. Journal of Risk & Uncertainty, 20(3), 271–289.

Garnefeld, I., Eggert, A., Husemann-Kopetzky, M., & Böhm, E. (2019). Exploring the link between payment schemes and customer fraud: A mental accounting perspective. Journal of the Academy of Marketing Science, 47, 595–616.

Guiso, L., Jappelli, T., & Terlizzese, D. (1996). Income risk, borrowing constraints, and portfolio choice. American Economic Review, 86(1), 158–172.

Guttentag, J., & Herring, R. (1984). Credit rationing and financial disorder. Journal of Finance, 39, 1359–1382.

Guttentag, J., & Herring, R. (1986). Disaster myopia in international banking. Princeton University Essays in International Finance, No. 164.

Harrison, G. W., Lau, M. I., & Rutstrӧm, E. E. (2010). Individual discount rates and smoking: Evidence from a field experiment in Denmark. Journal of Health Economics, 29(5), 708–717.

Howarth, C. I. (1988). The relationship between objective risk, subjective risk and behaviour. Ergonomics, 31(4), 527–535.

Insurance Council of New Zealand. (2021). Canterbury earthquakes—ICNZ. Accessed at https://www.icnz.org.nz/natural-disasters/canterbury-earthquakes

Kahneman, D. (2003). Maps of bounded rationality: Psychology for behavioral economics. American Economic Review, 93(5), 1449–1475.

Kasperson, R. E., Renn, O., Slovic, P., Brown, H. S., Emel, J., Goble, R., Kasperson, J. X., & Ratick, S. (1988). The social amplification of risk: A conceptual framework. Risk Analysis, 8(2), 177–187.

Katona, G. (1975). Psychological economics. Elsevier Scientific Publishing Company.

Kunreuther, H., & Slovic, P. (1978). Economics, psychology, and protective behavior. American Economic Review, 68(2), 64–69.

Lindell, M. K., & Perry, R. W. (2000). Household adjustment to earthquake hazard. Environment and Behavior, 32(4), 461–501.

MacDonald, D., Murdoch, J., & White, H. (1987). Uncertain hazards, insurance and consumer choice: Evidence from housing markets. Land Economics, 63, 361–371.

McClelland, G. H., Schulze, W. D., & Hurd, B. (1990). The effects of risk beliefs on property values: A case study of a hazardous waste site. Risk Analysis, 10(4), 485–497.

Michael, J. A. (2007). Episodic flooding and the cost of sea-level rise. Ecological Economics, 63(1), 149–159.

Mulwanda, M. P. (1992). Active participants or passive observers. Urban Studies, 29(1), 89–97.

Naoi, M., Seko, M., & Sumita, K. (2009). Earthquake risk and housing prices in Japan: Evidence before and after massive earthquakes. Regional Science and Urban Economics, 39, 658–669.

Nguyen, C. N., & Noy, I. (2020a). Comparing earthquake insurance programmes: How would Japan and California have fared after the 2010–11 earthquakes in New Zealand? Disasters, 44(2), 367–389.

Nguyen, C. N., & Noy, I. (2020b). Measuring the impact of insurance on urban earthquake recovery using nightlights. Journal of Economic Geography, 20(3), 857–877.

Rosenbaum, P. R., & Rubin, D. B. (1983). The central role of the propensity score in observational studies for causal effects. Biometrika, 70(1), 41–55.

Schlenker, W., Haemann, W. M., & Fisher, A. C. (2005). Will U.S. agriculture benefit from global warming? Accounting for irrigation in the hedonic approach. American Economic Review, 95(1), 395–406.

Shi, S., Young, M., & Hargreaves, B. (2009). Issues in measuring a monthly house price index in New Zealand. Journal of Housing Economics, 18(4), 336–350.

Singh, R. (2019). Seismic risk and house prices: Evidence from earthquake fault zoning. Regional Science and Urban Economics, 75, 187–209.

Simon, H. (1978). Rationality as process and as product of thought. American Economic Review, 68(2), 1–16.

Slovic, P., Fischhoff, B., Lichtenstein, S., Corrigan, B., & Combs, B. (1977). Preference for insuring against probable small losses: Insurance implications. Journal of Risk and Insurance, 44(2), 237–258.

Slovic, P., Fischhoff, B., & Lichtenstein, S. (1978). Accident probabilities and seat belt usage: A psychological perspective. Accident Analysis and Prevention, 10(4), 281–285.

Stein, S., Geller, R. J., & Liu, M. (2012). Why earthquake hazard maps often fail and what to do about it. Tectonophysics, 562–563, 1–25.

Stigler, G. J., & Becker, G. S. (1977). De gustibus non est disputandum. American Economic Review, 67(2), 76–90.

Timar, L., Grimes, A., & Fabling, R. (2018). That sinking feeling: The changing price of urban disaster risk following an earthquake. International Journal of Disaster Risk Reduction, 31, 1326–1336.

Tversky, A., & Kahneman, D. (1974). Judgement under uncertainty: Heuristics and biases. Science, 185(4157), 1124–1131.

Tversky, A., & Kahneman, D. (1982). Availability: A heuristic for judging frequency and probability. In D. Kahneman, P. Slovic, & A. Tversky (Eds.), Judgment under uncertainty: Heuristics and biases (pp. 163–178). Cambridge University Press.

Vaughan, E., & Nordenstam, B. (1991). The perception of environmental risks among ethnically diverse groups. Journal of Cross-Cultural Psychology, 22(1), 29–60.

Viscusi, W. K. (1990). Do smokers underestimate risks? Journal of Political Economy, 98(6), 1253–1269.

Viscusi, W. K., & Hersch, J. (2001). Cigarette smokers as job risk takers. Review of Economics and Statistics, 83(2), 269–280.

Wachinger, G., Renn, O., Begg, C., & Kuhlicke, C. (2013). The risk perception paradox—implications for governance and communication of natural hazards. Risk Analysis, 33(6), 1049–1065.

Yin, H., Chen, J., Kunreuther, H., & Michel-Kerjan, E. (2016). Availability heuristic and gambler’s fallacy over time in a natural disaster insurance choice setting. Working paper #2016-08, The Wharton School, University of Pennsylvania.

Yu, F., & Shi, S. (2022). Barriers to urban spatial development: evidence from the 2010-2011 Christchurch earthquakes. Journal of Regional Science, 62(1), 218–245.

Acknowledgements

We gratefully acknowledge the New Zealand Earthquake Commission for providing insurance claims data. We would like to thank Junji Xiao for his valuable comments and work on this research which helped us to improve this paper considerably. For their helpful comments, we thank referees, seminar participants at Massey University, and discussants at the 26th European Real Estate Society conference, and AREUEA 2019 international conference.

Funding

Open Access funding enabled and organized by CAUL and its Member Institutions.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose. The authors have no competing interests to declare that are relevant to the content of this article. All authors certify that they have no affiliations with or involvement in any organization or entity with any financial interest or non-financial interest in the subject matter or materials discussed in this manuscript. The authors have no financial or proprietary interests in any material discussed in this article.

Human or animal rights

The research does not involve human participants and/or animals.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Shi, S., Naylor, M. Perceived earthquake risk in housing purchases. J Hous and the Built Environ 38, 1761–1787 (2023). https://doi.org/10.1007/s10901-023-10012-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10901-023-10012-6