Abstract

This paper evaluates the comparative performance of emission and performance standards in a one-stage game of abatement R&D and Cournot duopoly, in terms of R&D propensity, output and social welfare. For each standard, firms simultaneously select R&D and output levels, given the standard’s exogenous constraint. A performance standard generates higher R&D investments and output, but lower profit, than the pollution-equivalent emissions standard. The same conclusion extends to social welfare only under high demand. We also conduct a similar comparison for each of the two instruments across the one-stage and the two-stage models. The two-stage model leads to higher levels of R&D and industry output for both standards. The same conclusion applies to the social welfare comparison for the emissions standard. However, for the performance standard, the same conclusion requires a damage parameter below a given threshhold. When the standards are chosen to maximize welfare, the performance comparison becomes highly parameter-dependent, except that social welfare is higher for the performance standard. Some policy implications are discussed.

Similar content being viewed by others

Availability of Data and Materials

Not applicable (no data is used).

Notes

See [15,16,17,18,19,20,21]. For a recent survey of studies examining the incentives that policy instruments in various market structures generate for the adoption of abatement technology, see [4]. Other strands of the literature on environmental regulation in strategic settings deal with issues such as green labels (e.g., [22] and [23]), the role of taxes [24], corporate social responsibility [25], or vertical relations in the presence of an eco-industry [26, 27].

The abatement technology that is tacitly referred to in this literature is end-of-pipe. For different variants of modeling R&D in an environmental setting (see, e.g., [7]).

Another study with similar motivation as ours in an international context is [28].

These results underscore the complexity that often arises when questions with otherwise clear-cut conclusions are addressed in settings with strategic behavior, even when restricted to just two command-and-control instruments. Indeed, industrial organization and strategic trade theory are replete with examples of reversals and complex conclusions upon the introduction of strategic behavior.

For analogy purposes, we point out that in the extensive literature on process R&D in industrial organization, both one-stage and two-stage models have been considered. While the latter forms the dominant framework, the one-stage version was adopted in some important early work, such as [5, 10, 35], as well as recent work, [36]. An alternative for possible future work is to consider intermediate levels of observability that would lead to a model in between the one and the two-stage games.

We follow the dominant strand of literature in environmental economics in positing a quadratic damage function. However, this is to a large extent an educated guess, as little scientific basis exists for any general shape and properties of damage functions (see [37] for a survey of this critical issue).

Unlike the other results, which have analogs in industrial organization, this welfare comparison is thus specific to environmental economics in that the specification of the damage function plays a crucial role whenever the compared industry outputs (and thus pollution levels) are not the same.

When environmental R&D serves the purpose of reducing the ratio of emissions per output, the firms will tend to prefer to use cleaner technologies to comply with environmental regulation.

In other words, if \(e\ge q_{e}\), the regulation would not modify the behavior of the firms.

Indeed, recalling that due to the two-dimensional action space here, one needs joint concavity of the objective function, note that, with subscripts denoting partial derivaties, we have \(\Pi _{q_{i}q_{i}}=-2b<0,\) \(\Pi _{x_{i}x_{i}}=-\gamma ,\) \(\Pi _{q_{i}x_{i}}=1,\) and \(\Pi _{q_{i}q_{i}}\Pi _{x_{i}x_{i}}-\Pi _{q_{i}x_{i}}^{2}=2b\gamma -1>0\) by (A1).

Dijkstra and Gil-Moltó [16] consider similar comparative statics effects induced by emission taxation by a social planner in a Cournot market.

Although these well-known studies refer to process R&D (or cost-reducing R&D), we tacitly assume here that many of the classical stylised facts will also be shared by abatement R&D, due to the same (market-failure-inducing) reasons.

In particular, at the extreme case of \(h=0\), or zero tolerance for pollution, (12) clearly holds, and we are back to the usual net-of-damage welfare comparison, with the two-stage game leading in welfare.

\(a\ge 1.59\) and \(a\le 5.69\) are set to satisfy (A3)(i) and (A3)(ii), respectively.

\(\gamma \ge 1.3\) has been chosen consistently with (A3).

\(s\ge 0.68\) is required to satisfy (A3)-(i).

Note that a specific example of s satisfying \(0.68\le s<5.86\) and assuming the same values of other parameters is given by the first two columns of Table 3, where \(s=2.5\).

Here, \(s\ge 0.84\) is required to satisfy \(h^{*}\ge 0\). Notice that 0.84 is greater than the lower bound from (A3)-(i), but the latter is needed to validate the solution under the emission (not the performance) standard.

References

Montero, J. P. (2002). Permits, Standards, and Technology Innovation. Journal of Environmental Economics and Management, 44, 23–44.

Amir, R., Gama, A., & Werner, K. (2018). On environmental regulation of oligopoly markets: emission versus performance standards. Environmental and Resource Economics, 70, 147–167.

Bruneau, J. F. (2004). A note on permits, standards, and technological innovation. Journal of Environmental Economics and Management, 48, 1192–1199.

Requate, T. (2005). Dynamic incentives by environmental policy instruments - survey. Ecological Economics, 54, 175–195.

Brander, J., & Spencer, B. (1983). Strategic commitment with R&D: The symmetric case. Bell Journal of Economics, 14, 225–235.

Jaffe, A. B., & Stavins, R. N. (1995). Dynamic incentives of environmental regulations: the effects of alternative policy instruments on technology diffusion. Journal of Environmental Economics and Management, 29, S43–S63.

Amir, R., Germain, M., & van Steenberghe, V. (2008). On the impact of innovation on the marginal abatement cost curve. Journal of Public Economic Theory, 10, 985–1010.

Pindyck, R. (2013). Climate change policy: what do the models tell us? Journal of Economic Literature, 51, 860–872.

Amir, R. (2000). Modelling imperfectly appropriable R&D via spillovers. International Journal of Industrial Organization, 18, 1013–1032.

Spence, M. (1984). Cost reduction, competition, and industry performance. Econometrica, 52, 101–121.

Griliches, Z. (1995). R&D and productivity: Econometric results and productivity issues. In P. Stoneman (Ed.), Handbook of the Economics of Innovation and Technological Change. Oxford: Blackwell.

Bernstein, J., & Nadiri, I. (1988). Interindustry R&D spillovers, rates of return, and production in high-tech industries. American Economic Review, 78, 429–34.

Topkis, D. M. (1978). Minimizing a submodular function on a lattice. Operations Research, 26, 305–321.

Vives, X. (1999). Oligopoly Pricing: Old Ideas and New Tools. Cambridge, MA: MIT Press.

Bréchet, T., & Meunier, G. (2014). Are clean technology and environmental quality conflicting policy goals? Resource and Energy Economics, 38, 61–83.

Dijkstra, B. R., & Gil-Moltó, M. J. (2018). Is emission intensity or output U-shaped in the strictness of environmental policy? Journal of Public Economic Theory, 20, 177–201.

Downing, P. B., & White, L. W. (1986). Innovation in pollution control. Journal of Environmental Economics and Management, 13, 18–29.

Jung, C., Krutilla, K., & Boyd, R. (1996). Incentives for advanced pollution abatement technology at the industry level: An evaluation of policy alternatives. Journal of Environmental Economics and Management, 30, 95–111.

Malueg, D. (1989). Emission credit trading and the incentive to adopt new pollution abatement technology. Journal of Environmental Economics and Management, 16, 52–57.

Milliman, S. R., & Prince, R. (1989). Firms incentives to promote technological change in pollution control. Journal of Environmental Economics and Management, 17, 247–265.

Perino, G., & Requate, T. (2012). Does more stringent environmental regulation induce or reduce technology adoption? when the rate of technology adoption is inverted U-shaped. Journal of Environmental Economics and Management, 64, 456–467.

Ben Youssef, A., & Lahmandi-Ayed, R. (2008). Eco-labelling, competition and environment: Endogenization of labeling criteria. Environmental and Resource Economics, 41, 133–154.

Podhorsky, A. (2020). Environmental certification programs: How does information provision compare with taxation? Journal of Public Economic Theory, 22, 1772–1800.

Constantatos, C., Pargianas, C., & Sartzetakis, E. (2020). Green consumers and environmental policy. Journal of Public Economic Theory. https://doi.org/10.1111/jpet.12469

Hirose, K., Lee, S. H., & Matsumura, T. (2020). Noncooperative and cooperative environmental corporate social responsibility. Journal of Institutional and Theoretical Economics, 176, 1–23.

Benchekroun, H., & Nimubona, A. D. (2015). Environmental R&D in the presence of an eco-industry. Environmental Modeling & Assessment, 20, 491–507.

Nimubona, A. D., & Sinclair-Desgagné, B. (2011). Polluters and abaters. Annals of Economics and Statistics, 103(104), 9–24.

Endres, A., & Finus, M. (2002). Quotas may beat taxes in a global emission game. International Tax and Public Finance, 9, 687–707.

Viscusi, W. K., Vernon, J. M., Harrington, & J. E. (2000). Economics of regulation and antitrust. MIT Press, Cambridge.

Harrington, W., Morgenstern, R., & Sterner, T. (2004). Choosing environmental policy: comparing instruments and outcomes in the United States and Europe, RFF Press.

Hueth, B., & Melkonyan, T. (2009). Standards and the regulation of environmental risk. Journal of Regulatory Economics, 36, 219–246.

Amir, R., Evstigneev, I., & Wooders, J. (2003). Noncooperative versus cooperative R&D with endogenous spillover rates. Games and Economic Behavior, 42, 183–207.

Buccella, D., Fanti, L., & Gori, L. (2022). A contribution to the theory of R&D investments - EconStor https://www.econstor.eu

Poyago-Theotoky, J. (1999). A note on endogenous spill-overs in a non-tournament R&D duopoly. Review of Industrial Organization, 15, 253–262.

Dasgupta, P., & Stiglitz, J. E. (1980). Industrial structure and the nature of innovative activity. The Economic Journal, 90, 266–293.

López, Á. L., & Vives, X. (2019). Overlapping Ownership, R&D Spillovers and Antitrust Policy. Journal of Political Economy, 127, 2394–2437.

Pindyck, R.S. (2013). Climate change policy: what do the models tell us?, Journal of Economic Literature 51, 860–872.

D’Aspremont, C., & Jacquemin, A. (1988,). Cooperative and noncooperative R&D in duopoly with spillovers, American Economic Review, 78, 1133–1137.

Acknowledgements

The authors are grateful to Joana Resende for helpful conversations about the topic of this paper.

Author information

Authors and Affiliations

Contributions

All authors, Rabah Amir, Adriana Gama, Rim Lahmandi-Ayed and Katarzyna Werner contributed equally to the solution of the model, the writing of the paper and all other parts. All four of them checked the final version of the paper.

Corresponding author

Ethics declarations

Ethical Approval

Not applicable

Conflict of Interest

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A. Proofs

This section provides the proofs for all the results of the paper. Since the proofs are based on simple but sometimes involved computations, only the main lines are presented to allow the interested reader to follow the steps; details are thus mostly left out.

Proof of Proposition 1

-

(i) Provided that \(e=q_{h}h=\frac{\gamma h[a-c(1-h)]}{3b\gamma -(1-h)^{2}}\), we have

$$\begin{aligned} x_{e}=\frac{(a-c)}{3b\gamma -1}-\frac{3b}{3b\gamma -1}\frac{\gamma h[a-c(1-h)]}{3b\gamma -(1-h)^{2}} \end{aligned}$$and

$$\begin{aligned} x_{h}-x_{e}=\frac{h[3bc\gamma -a(1-h)]}{[3b\gamma -1][3b\gamma -(1-h)^{2}]}, \end{aligned}$$which is clearly (strictly) positive by (A1) and the fact that \(0<h<1\).

-

(ii) Similarly,

$$\begin{aligned} q_{h}-q_{e}=\frac{\gamma h[3bc\gamma -a(1-h)]}{[3b\gamma -1][3b\gamma -(1-h)^{2}]}>0. \end{aligned}$$ -

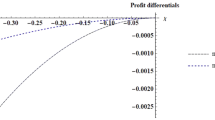

(iii) The profit result follows from the following inequalities:

$$\begin{aligned} \pi _{e} &= {} q_{e}(a-2bq_{e})-(c-x_{e})(q_{e}-e)-\gamma x_{e}^{2}/2 \\ &\ge {} q_{h}(a-b(q_{e}+q_{h}))-(c-x_{h})(q_{h}-e)-\gamma x_{h}^{2}/2 \\ &> {} q_{h}(a-2bq_{h})-(c-x_{h})q_{h}(1-h)-\gamma x_{h}^{2}/2=\pi _{h}. \end{aligned}$$The first inequality follows by the Nash property, the second one, by \(q_{e}<q_{h}\) (part ii) and \(e=q_{h}h\). The equalities are given by definition of the two equilibrium profit levels.

This completes the proof of Proposition 1. \(\square\)

Proof of Proposition 2

Since we fixed \(e=q_{h}h=\frac{\gamma h[a-c(1-h)]}{3b\gamma -(1-h)^{2}}\), we can write \(W_{e}\) in terms of h, and then compute the difference

where

\(A=h(6b\gamma -1)+(6b\gamma -2)>0,\) \(B=(4b\gamma -1)h(1-h)+2b\gamma (3b\gamma -1)>0,\)

\(C=\gamma (3bc\gamma -a(1-h))h>0,\) and \(D=[3b\gamma -1]^{2}[3b\gamma -(1-h)^{2}]^{2}>0\).

Here the first three inequalities follow by (A1) and the last one is obvious. Then, \(W_{h}>W_{e}\) if and only if \(\frac{a}{c}>b\gamma \frac{A}{B}\), which leads to the desired result. \(\square\)

Proof of Proposition 3

Assumption (A2) is required for a well-defined, interior and symmetric subgame-perfect equilibrium in the two-stage games (see details in [2]). To prove the four desired inequalities here, we proceed by direct calculations. As the steps are very simple, we leave the details to the reader.\(\square\)

Proof of Proposition 4

First, observe that Assumption (A2) is imposed here for the same reasons as in the proof of Proposition 3.

-

(i) Using the expressions for \(W_{e}\) and \(\tilde{W}_{e}\) given in the text, we have after simplification that \(\tilde{W}_{e}-W_{e}=\frac{b(e-(a-c)\gamma )^{2}}{(3b\gamma -1)^{2}(9b\gamma -4)}\), which is strictly positive since \(9b\gamma >8\).

-

(ii) Using the expressions for \(W_{h}\) and \(\tilde{W}_{h}\) given in the text, we have after simplification

$$\begin{aligned} \tilde{W}_{h}-W_{h}=\frac{\gamma ^{2}(1-h)^{2}[a-c(1-h)]^{2}[b(9b\gamma -4(1-h)^{2})-h^{2}s(36b\gamma -14(1-h)^{2})]}{[9b\gamma -4(1-h)^{2}]^{2}[3b\gamma -(1-h)^{2}]^{2}}>(<)0 \end{aligned}$$if \(\frac{b}{h^{2}s}>(<)\frac{36b\gamma -14(1-h)^{2}}{9b\gamma -4(1-h)^{2}}\)

Proof of Proposition 5

The reader can easily verify that the FOC for the social welfare maximizing problem (14) is:

which leads to \(e^*=\frac{cb\gamma (9b\gamma -2)-a(4b\gamma -1)}{2\,s(3b\gamma -1)^{2}-b(9b\gamma -2)}\). Substituting this result into equations (2) leads to \(x^{*}_e=\frac{2(a-c)(3b\gamma -1)s-b(c(9b\gamma -2)-a)}{2\,s(3b\gamma -1)^{2}-b(9b\gamma -2)}\) and \(q^{*}_e=\frac{(3b\gamma -1)(2(a-c)\gamma s -a)}{2\,s(3b\gamma -1)^{2}-b(9b\gamma -2)}\).

The SOC of this problem is \(\frac{2b(9b\gamma -2)-4\,s(3b\gamma -1)^{2}}{(3b\gamma -1)^{2}}<0,\) equivalent to \(2\,s(3b\gamma -1)^{2}-b(9b\gamma -2)>0\) or \(s>\frac{b(9b\gamma -2)}{2(3b\gamma -1)^2},\) that is, the denominator of \(e^*\), \(x^*_e\) and \(q^*_e\) must be strictly positive. (A3)(i) and (A3)(ii) imply the last inequality, since \(\frac{b(c(9b\gamma -2)-a)}{2(a-c)(3b\gamma -1)}>\frac{b(9b\gamma -2)}{2(3b\gamma -1)^2}\). Notice that (A1) implies that \(a-c>0\), \(3b\gamma -1>0\) and \(9b\gamma -2>0\). If (A3)(ii) also holds, we have that \(c(9b\gamma -2)-a>0\), otherwise, it must be that \(3b\gamma <1,\) which contradicts (A1).

Clearly, (A3)(i) and (A3)(ii) imply that \(e^*>0\); these two assumptions also imply that \(x^*_e<c\). To see this, observe that \(c-x^*_e=\frac{-a b + 2 ( 3 b \gamma -1) ( 3 b c \gamma -a) s}{ 2\,s(3b\gamma -1)^{2}-b(9b\gamma -2)}>0\) iff \(s>\frac{ab}{2(3b\gamma -1)(3bc\gamma -a)}\); by (A1), \(3b\gamma -1>0\) and \(3bc\gamma -a>0\). (A3)-(ii) implies that \(\frac{b(c(9b\gamma -2)-a)}{2(a-c)(3b\gamma -1)}>\frac{ab}{2(3b\gamma -1)(3bc\gamma -a)}\), and thus, (A3)(i) and (A3)(ii) guarantee that \(x^*_e<c\).

Finally, observe that (A3)(i) implies that both the numerator and the denominator of \(x^*_e\) are strictly positive, hence, \(x^*_e>0\). In addition, \(q^*_e-e^*=\frac{\gamma [2 (a - c) ( 3 b \gamma -1) s-b(c ( 9 b \gamma -2)-a) ]}{ 2\,s(3b\gamma -1)^{2}-b(9b\gamma -2)}>0\) iff \(s>\frac{b(c(9b\gamma -2)-a)}{2(a-c)(3b\gamma -1)}\), corresponding to (A3)(i). \(\square\)

Proof of Proposition 6

The comparative statics results for \(e^{*}\) are straightforward from the (closed-form) expression for \(e^{*}\). Since a closed-form expression for \(h^{*}\) is not tractable, we shall use [13] theorem for monotone comparative statics [13] or Vives, [14].

(i) The idea is to take \(\ln W_{h}(h)\) to turn it into additively separable parts, and then take the cross-partial w.r.t. h and the relevant exogenous variable. In the case of a, we get \(\frac{\partial ^{2}\ln W_{h}(h)}{\partial h\partial a}=\frac{-2c}{[a-c(1-h)]^{2}}<0\). Hence, by Topkis’s theorem, \(h^{*}\) is decreasing in a.

(ii)-(iii) Similarly, it is easy to check that \(\frac{\partial ^{2}\ln W_{h}(h)}{\partial h\partial \gamma }>0\) and \(\frac{\partial ^{2}\ln W_{h}(h)}{\partial h\partial s}<0\), which imply that \(h^{*}\) is increasing in \(\gamma\) and decreasing in s. \(\square\)

Appendix B

This Appendix provides a comparison of the equilibrium variables of interest in the game with endogenous standards, for a given set of parameters. To distinguish the second-best solution from that of the one-stage game, we will add the superscript \(^{*}\) to the variables. Thus, \(e^{*}\)(\(h^{*}\)) denotes the equilibrium level of emission (performance) standard, while \(W_{e}^{*}\) (\(W_{h}^{*}\)) stands for the corresponding welfare. Throughout this section we assume \(b=c=1\), meaning that a accounts exactly for market size, the demand slope is 1, and the initial unit cost of abatement is one.

1.1 Varying Parameter a

We first consider the performance of both policy instruments assuming a variation in the size of the market a. Table 3 provides this comparison as the market size a varies.

As seen in Table 3, as higher output leads to more abatement, firms have a higher incentive to invest in R&D (the second row in Table 3). Since higher output raises the pollution level, the regulator tightens the standards (decrease in the level of standard in the first row in Table 3) in order to reduce the damage to the environment. Overall, social welfare increases.

Further details concerning the impact that the change in parameter a has on the comparison between the equilibrium variables under the emission and performance standards are given next. Here and in the next two subsections, the given parameter values are chosen as representative and in respect of Assumption (A3).

Remark 2

Let \(b=c=1\), \(s=\gamma =2.5\) and \(1.59\le a\le 5.69\).Footnote 19 Then

-

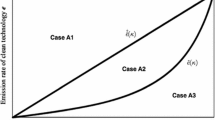

(i) for \(1.59\le a<1.79,\) \(x_{e}^{*}<x_{h}^{*}\), \(q_e^*<q_h^*\), \(e^{*}>q_{h}^{*}h^{*}\), and \(q_e^*-e^*<q_h^*(1-h^*)\);

-

(ii) for \(1.79< a<3.09,\) \(x_{e}^{*}<x_{h}^{*}\), \(q_e^*<q_h^*\), \(e^{*}<q_{h}^{*}h^{*}\), and \(q_e^*-e^*<q_h^*(1-h^*)\);

-

(iii) for \(3.09< a<5.19,\) \(x_{e}^{*}>x_{h}^{*}\), \(q_e^*<q_h^*\), \(e^{*}<q_{h}^{*}h^{*}\), and \(q_e^*-e^*>q_h^*(1-h^*)\);

-

(iv) for \(5.19< a \le 5.69,\) \(x_{e}^{*}>x_{h}^{*}\), \(q_e^*>q_h^*\), \(e^{*}<q_{h}^{*}h^{*}\), and \(q_e^*-e^*>q_h^*(1-h^*)\);

-

(v) \(W_{h}^{*}>W_{e}^{*}\).

Remark 2 shows how R&D investment, output, emissions, abatement and welfare change with market size under the two policy regimes. For small market sizes (parts i-ii), the performance standard generates higher R&D, industry output and abatement, and lower pollution levels. If \(1.79<a<3.09\) (part ii), all the variables are higher under the performance standard. In part (iii), the performance standard leads in terms of output, but lags in R&D and in abatement level. For a large market size (part iv), the emission standard dominates in terms of R&D, output and abatement. One consistent outcome is that the comparison of R&D investment mirrors that of the abatement level.

Overall, considering all relevant values of a, the comparison of the equilibrium levels of R&D and output under the two policy instruments is highly parameter-dependent, but the performance standard is uniformly superior for social welfare (part v).

1.2 Varying Parameter \(\gamma\)

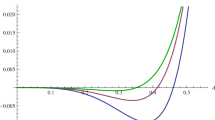

We turn to the impacts that an increase in the cost of R&D, \(\gamma\), has under both policy instruments. Table 4 demonstrates the results of this comparison for different values of \(\gamma\).

As R&D becomes more costly, firms reduce their output (the third row in Table 4) and their R&D efforts (the second row in Table ), in order to lower abatement cost. In an attempt to limit the resulting consumer surplus loss, the regulator weakens the stringency of the pollution constraint under each policy instrument (the amount of pollution allowed increases as shown in the first row in Table 4). It is intuitive that welfare goes down.

Remark 3 summarizes these findings and gives details concerning the comparison between the equilibrium variables under both policy instruments; \(s=2.5\) and \(a=3\) were chosen for illustrative purposes.

Remark 3

Let \(a=3\), \(b=c=1\), \(s=2.5\) and \(\gamma \ge 1.30\).Footnote 20 Then (i) for \(1.3 \le \gamma < 1.39,\) \(x_{e}^{*}>x_{h}^{*},\) \(q_{e}^{*}>q_{h}^{*}\) and \(q^*_e-e^*>q_{h}^{*}(1-h^{*});\) (ii) for \(1.39< \gamma < 2.33,\) \(x_{e}^{*}>x_{h}^{*},\) \(q_{e}^{*}<q_{h}^{*}\) and \(q^*_e-e^*>q_{h}^{*}(1-h^{*});\) (iii) for \(2.33 < \gamma ,\) \(x_{e}^{*}<x_{h}^{*},\) \(q_{e}^{*}<q_{h}^{*}\) and \(q^*_e-e^*<q_{h}^{*}(1-h^{*});\) (iv) \(e^*<q_{h}^{*}h^{*}\); (v) \(W_{h}^{*}>W_{e}^{*}\).

Here, the emission standard delivers more R&D and output at low R&D cost (part i), but less of both at high R&D cost (part iii). This occurs because under the performance standard the fall in output not only has the desired effect of a reduction in abatement cost, but it also leads to a reduction in environmental damage (the term \(2s(hq_{h})^{2}\) in Eq. (15)). This effect is absent under the fixed emission standard, where the reduction in output does not directly affect the level of environmental damage (i.e., the term \(2se^{2}\) in Eq. (13) does not contain \(q_{e}\)). Then, smaller reductions in output are required under the performance standard to mitigate the increased R&D cost. Hence, for a high level of R&D cost, output is higher for the performance standard.

Once more, the performance standard dominates in terms of welfare for all our parameter values, but pollution is lower under the emission standard.

1.3 Varying Parameter s

This part evaluates the comparative performance of the two standards as the damage parameter s varies. The comparison is presented in Table 5, in which, in addition to varying values of parameter s, we also assume different values of \(\gamma\). In this way, we are able to capture the range of possible results (qualitatively).

Segments A and B of Table 5 compare the equilibrium values of R&D, output, emissions, abatement and welfare under both policy instruments for different values of parameters. In Segment A, \(\gamma =2.5\) and \(s=10\) have been chosen for illustrative purposes. Table 5 shows that for these parameter values the performance standard outperforms the emission standard in terms of the incentives to generate higher output and welfare, but not R&D. Remark 4 complements these results by showing how the relationship between R&D, output, emissions, abatement and welfare under the two policy instruments changes with different values of s, while \(\gamma\) is kept constant.

Remark 4

Let \(a=3,\) \(b=c=1\), \(\gamma =2.5\) and \(s\ge 0.68\).Footnote 21 Then

-

(i) for \(s<(>)5.86\), \(x_{h}^{*}>(<)x_{e}^{*}\) and \(q_{h}^{*}(1-h^{*})>(<)q_{e}^{*}-e^{*}\);

-

(ii) \(q_{h}^{*}>q_{e}^{*}\) and \(q_{h}^{*}h^{*}>e^{*}\);

-

(iii) \(W_{h}^{*}>W_{e}^{*}.\)

Remark 4 confirms that the comparison of R&D levels under the two policy instruments depends on the value of s. When environmental damage is not significant (part i), the performance standard generates more R&D incentives; however, high values of s lead to a reversion. This is not the case for output and welfare, which are larger under the performance standard under the present set of parameters.Footnote 22

To see that the performance standard does not generally provide more incentives to produce output, we now consider the effects of varying s under a different value of \(\gamma\). An example is illustrated in part B of Table 5.

Remark 5

Let \(a=3\), \(b=c=1\), \(\gamma =1.3\) and \(s\ge 0.84\).Footnote 23 Then

-

(i) \(x_{h}^{*}<x_{e}^{*}\) and \(q_{h}^{*}(1-h^{*})<q_{e}^{*}-e^{*}\);

-

(ii) \(q_{h}^{*}<q_{e}^{*}\) and \(q_{h}^{*}h^{*}>e^{*}\);

-

(iii) \(W_{h}^{*}>W_{e}^{*}\).

Here, output under the emission standard is larger than under the performance standard, and so is environmental R&D, with the latter reversing the conclusion of Proposition 1. Hence, once more, this confirms that the results of the comparison of R&D and output incentives depends in key ways on whether the two regulatory regimes are exogenously given (on the basis of equal emissions) or endogenous (i.e., set to maximize welfare).

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Amir, R., Gama, A., Lahmandi-Ayed, R. et al. A One-Stage Model of Abatement Innovation in Cournot Duopoly: Emissions vs Performance Standards. Environ Model Assess 28, 875–891 (2023). https://doi.org/10.1007/s10666-023-09891-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10666-023-09891-4

Keywords

- Environmental regulation

- Environmental innovation

- End of pipe abatement

- Emission standard

- Performance standard