Abstract

In this paper, we examine the effects of Czech monetary policy on the economy within the vector auto regression (VAR), structural VAR, Bayesian VAR with sign restrictions, and factor-augmented VAR, frameworks. We document a well-functioning transmission mechanism similar to the euro area countries, especially in terms of persistence of monetary policy shocks. Subject to various sensitivity tests, we find that a contractionary monetary policy shock has a negative effect on the degree of economic activity and the price level, both with a peak response after one year or so. Regarding prices at the sectoral level, tradables adjust faster than non-tradables, which is in line with microeconomic evidence on price stickiness. There is no price puzzle, as our data come from a single monetary policy regime. There is a rationale in using the real-time output gap instead of current GDP growth, as using the former results in much more precise estimates. The results indicate a rather persistent appreciation of the domestic currency after a monetary tightening, with a gradual depreciation afterwards.

Similar content being viewed by others

Notes

We therefore utilize the real-time estimates of the output gap available from the Czech National Bank (CNB). Using the central bank output gap is advantageous for monetary policy shock identification, as the central bank conducts its policy based on its estimate of the degree of economic activity, not the estimates of other institutions or individuals. Note that price indices are not revised ex-post by the Czech Statistical Office. An additional rationale for using the output gap is that in an environment of changing potential growth of the economy, as is the case in our sample, actual GDP growth does not necessarily give an accurate picture about the degree of economic activity.

If a firm has to borrow to finance its production, interest rates enter its cost function. Consequently, a monetary policy tightening increases the firm’s costs, to which the firm may react by increasing the price of the products it sells. In consequence, this argument suggests that the price puzzle does not have to be caused by model misspecification. In general, see Coricelli et al. (2006) for more specific explanations of the price puzzle.

See Coricelli et al. (2006) for a survey of current findings on monetary policy transmission in Central and Eastern Europe, including those undertaken within the VAR framework.

European Forecasting Network (2004).

See Coats et al. (2003; chapter 5) on the construction of the output gap used by the CNB. The output gap is the difference between the log of actual and potential output, where the latter is estimated by a multivariate filter, more specifically by the Kalman filter procedure, where the system of equations is in the state-space representation.

We admit that interpolation introduces information not available at the time of policy-making.

The actual monetary policy instrument of the CNB is the 2W repo rate. Since the repo rate is not changed continuously and is censored, we opt for the 3M PRIBOR, which is very closely linked to the 2W repo rate; its correlation stands at 0.998 in our sample. In addition, the 3M PRIBOR may capture central bank communication. See Horváth (2009) for a discussion related to the use of the monetary policy rate vs. the interbank market rate in the Czech Republic.

The inclusion of foreign variables that are considered exogenous is motivated by the need to control for foreign shocks and thus not to confuse domestic monetary shocks with the central bank’s responses to external developments (Jarocinski 2006).

BVAR procedure starts with OLS estimation of the VAR system—we assume diffuse prior for VAR coefficients and vaiances. We take 1,000 joint draws from the posterior distribution and from the space of rotation matrices. Next, we compare whether the implied impulse responses satisfy prescribed restrictions. We repeat the procedure until we obtain 200 impulse responses satisfying the restrictions. Then we compute median response as well as 16th and 84th percentile error bands. For this exercise, we used the Matlab code based on the code available at web site of Fabio Canova.

Identification approaches based on sign restrictions of impulse responses imposed for longer period of time are introduced in Uhlig (2005).

Several authors have raised the question of the accuracy of monetary policy shocks within VARs. See Boivin and Giannoni (2002) for a related discussion.

In general, the output gap should be a better measure of demand pressures (especially when potential output growth is changing), but one should keep in mind that it is unobservable and thus subject to greater uncertainty.

The output gap and prices fall after a contractionary monetary policy shock, bottoming out after about twelve months. The exchange rate first appreciates, but later depreciates significantly, in line with uncovered interest rate parity (see also Eichenbaum and Evans 1995). The results on the reaction of tradable and non-tradable prices largely comply with the benchmark case, except that non-tradable prices reach their bottom response a bit later (about two years).

The exemption is Jarocinski (2006). His sample starts in June 1997, which is before the adoption of inflation targeting, but after the exchange rate turbulence and the abandonment of the fixed exchange rate regime. As a result, we code his sample in Table 2 as coming from a single monetary policy regime. Another approach to dealing with monetary policy changes is presented by Darvas (2005), who estimates a time-varying coefficient VAR. Indeed, his results suggest that the values of the estimated parameters change rather abruptly around the year 1997 and remain relatively stable afterwards. (This is confirmed in this study by the recursive estimation of the parameters. The results are available upon request.).

However, note that the targeting horizon (i.e., the horizon minimizing the loss function of the monetary authority) and the horizon at which the monetary policy impact is the most profound are not identical concepts. See Strasky (2005) for details.

We followed the algorithm developed by Bernanke et al. (2005) to estimate FAVAR, which is available on the personal website of Jean Boivin: http://www2.gsb.columbia.edu/faculty/JBoivin/Personal/

See Bernanke et al. (2005) for a more detailed discussion of principal component analysis and FAVAR.

References

Alvarez L, Hernando I (2006) Competition and price adjustment in the euro area. Working Paper No. 0629, Bank of Spain

Amisano G, Giannini C (1997) Topics in structural VAR econometrics, 2nd edn. Springer-Verlag, Berlin

Angeloni I, Kashyap A, Mojon B (2003) Monetary policy transmission in the euro area. Cambridge University Press, Cambridge, MA

Anzuini A, Levy A (2007) Monetary policy shocks in the new EU members: a VAR approach. Appl Econ 39:1147–1161

Barro R (1972) A theory of monopolistic price adjustment. Rev Econ Stud 39:17–26

Barth MJ, Ramey VA (2001) The cost channel of monetary transmission, 2001. NBER Macroecon Ann 16:l99–239

Bernanke B, Boivin J, Eliasz P (2005) Measuring the effects of monetary policy: a factor-augmented vector autoregressive (FAVAR) approach. Quart J Econ 120:387–422

Boivin J, Giannoni P (2002) Assessing changes in the monetary transmission mechanism: A VAR Approach. Fed Reserve Bank of San Francisco Econ Policy Rev 8(1):97–111

Boivin J, Ng S (2006) Are more data always better for factor analysis? J Econometrics 132:169–194

Boivin J, Giannoni P, Mihov I (2007) Sticky prices and monetary policy: evidence from disaggregated US data. NBER Working Paper No. 12824

Bouakez H, Cardia E, Ruge-Murcia F (2005) The transmission of monetary policy in a multi-sector economy. University of Montreal Working Paper, Cahier de recherche CIREQ, 20/2005

Brissimis S, Magginas N (2006) Forward-looking information in VAR models and the prize puzzle. J Monetary Econ 53:1225–1234

Christiano L, Eichenbaum M, Evans C (1999) Monetary policy shocks: what have we learned and to what end. In: Taylor J, Woodford M (eds) Handbook of macroeconomics. Elsevier, North Holland, pp 65–148

Coats W, Laxton D, Rose D (2003) The Czech national bank’s forecasting and policy analysis system. Czech National Bank (available at www.cnb.cz)

Coricelli F, Horváth R (2009) Price setting and market structure: an empirical analysis of micro data in slovakia. Manag Decis Econ (Forthcoming)

Coricelli F, Égert B, MacDonald R (2006) Monetary transmission mechanism: gliding on a wind of change. BOFIT Discussion Papers No 8/2006, Bank of Finland

Creel J, Levasseur S (2005) Monetary policy transmission mechanisms in the CEECs: how important are the differences with the euro area?, OFCE Working Paper No. 2

Croushore D, Evans C (2006) Data revision and the identification of monetary policy shocks. J Monetary Econ 53:1135–1160

Darvas Z (2005) Monetary transmission in the new members of the EU: evidence from time-varying coefficient structural VARs, ECOMOD 2005 conference

Dedola L, Lippi F (2005) The monetary transmission mechanism: evidence from the industries of five OECD countries. Eur Econ Rev 49:1543–1569

Dybczak K, Flek V, Hájková D, Hurník J (2006) Supply-side performance and structure in the Czech economy (1995–2005). Czech National Bank Working Paper No. 4/2006

Eichenbaum M, Evans C (1995) Some empirical evidence on the effects of monetary policy shocks on exchange rates. Quart J Econ 110:975–1010

Elbourne A, de Haan J (2006) Financial structure and monetary policy transmission in transition countries. J Comp Econ 34:1–23

Erceg C, Levin A (2006) Optimal monetary policy with durable consumption goods. J Monetary Econ 53:1341–1359

European Forecasting Network (2004) Monetary transmission in acceding countries. Annex 53:97–142

Fry R, Pagan A (2005) Some issues in using VARs for macroeconometric research. CAMA Working Papers Series No 19/2005, The Australian National University

Gali J, Monacelli T (2005) Monetary policy and exchange rate volatility in a small open economy. Rev Econ Stud 72:707–734

Ganev G, Molnár K, Rybinski K, Wozniak P (2002) Transmission mechanism of monetary policy in Central and Eastern Europe. CASE Reports No. 52

Gavin W, Kemme D (2007) Using extraneous information to analyze monetary policy in transition economies. FRB of St. Louis Working Paper No. 2004–034B

Gerlach S, Smets F (1995) The monetary transmission mechanism: evidence From the G-7 countries. CEPR Discussion Paper No. 1219

Giordani P (2004) An alternative explanation of the price puzzle. J Monetary Econ 51:1271–1296

Hall P (1988) On symmetric bootstrap confidence intervals. J Roy Stat Soc B50:35–45

Héricourt J (2005) Monetary policy transmission in the CEECs: revisited results using alternative econometrics. University of Paris 1, Mimeo

Horváth R (2009) Time-varying policy neutral rate in real time: a predictor for future inflation? Econ Model 26(1):71–81

Hurník J, Arnoštová K (2005) The monetary transmission mechanism in the Czech Republic: evidence from VAR analysis. Czech National Bank Working Paper Series No 4/2005

Jarocinski M (2006) Responses to monetary policy shocks in the east and the west of Europe: A comparison. Austrian National Bank Working Paper No. 124

Kim S, Roubini N (2000) Exchange rate anomalies in the industrial countries: a solution with a structural VAR approach. J of Monetary Econ 45:561–586

Kotlán V, Navrátil D (2003) Inflation targeting as a stabilization tool: its design and performance in the Czech Republic. Financ a úvěr–Czech J of Econ Financ 53:220–242

Leeper E, Sims C, Zha T (1998) What does monetary policy do? Brookings Pap Eco Ac 2:1–63

Lütkepohl H (2006) New introduction to multiple time series analysis, 2nd edn. Springer, New York

Martin C (1993) Price adjustment and market structure. Econ Lett 41:139–143

Mojon B, Peersman G (2001) A VAR description of the effects of monetary policy in the individual countries of the euro area. ECB Working Paper No. 92

Peersman G, Smets F (2001) The monetary transmission mechanism in the euro area: more evidence from VAR analysis. ECB Working Paper No. 91

Peersman G, Smets F (2005) The industry effects of monetary policy in the euro area. Econ J 115:319–342

Sims C (1980) Macroeconomics and reality. Econometrica 48:1–48

Strasky J (2005) Optimal forward-looking policy rules in the quarterly projection model of the Czech National Bank. Czech National Bank Research and Policy Note, No. 5/2005

Uhlig H (2005) What are the effects of monetary policy on output? Results from an agnostic identification procedure. J Monetary Econ 52:381–419

Vonnák B (2005) Estimating the effect of Hungarian monetary policy within a structural VAR framework. MNB Working Papers 2005/1

Acknowledgments

We thank Oxana Babetskaia-Kukharchuk, Sophocles Brissimis, Martin Cincibuch, Paolo Giordani, Jan Hanousek, Jaromír Hurník, Marek Jarocinski, Michal Kejak, Evžen Kočenda, Francesco Lippi, Benoit Mojon, Michal Skořepa, Wadim Strielkowski, Petr Zemčík, and seminar participants at the Austrian National Bank, the Czech National Bank, Charles University, and the International Trade and Finance Association Annual Conference for helpful comments and discussions. All remaining errors are entirely our own. The views expressed in this paper are not necessarily those of the Czech National Bank. This paper was supported by Czech National Bank Research Project No. A3/07.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

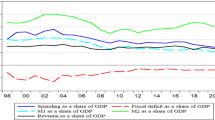

See Fig. 5.

Appendix 2—additional results

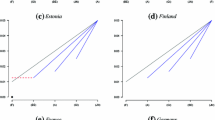

2.1 Impulse responses to a monetary shock

Appendix 3—factor-augmented VAR

In this Appendix, we briefly document our attempt to study monetary policy effects within FAVAR. However, as documented below, we find that the results based on FAVAR are very sensitive and the confidence intervals for the impulse responses are rather large.

We follow an approach developed by Bernanke et al. (2005).Footnote 18 FAVAR can be represented in the following form:

Vector Y t contains observable economic variables, whereas F t represents unobserved factors which provide additional economic information not fully captured by the Y t . We estimate these unobservable factors using a principal components approach, which exploits the assumption that information about the unobservable economic factors can be inferred from a large number of economic time series X t . Specifically, we can think of the unobservable factors in terms of concepts such as “economic activity” or “investment climate.” They can be represented not by a single economic variable, but rather by several time series of economic indicators.

The FAVAR methodology allows us not only to use richer information set in the model specification, but also to analyze the effects of a monetary policy shock on a greater number of economic variables. There are two main approaches to estimating FAVAR: a two-step principal components approach and a one-step approach that estimates (3) and a dynamic factor model jointly. As Bernanke et al. (2005) do not find any particular differences between these two estimators in terms of inference, we opt for the computationally simpler two-step approach.Footnote 19

In our FAVAR specification, X t consists of a balanced panel of 40 series that have been transformed in order to ensure their stationarity. The description of these series and their transformations is included in Table 3. The data is at monthly frequency and spans the period from February 1998 to May 2006. Following Bernanke et al. (2005), we assume that the monetary policy instrument (the 3-month interest rate) is the only observable factor, hence the only variable included in Y t . For identification purposes the monetary policy instrument is ordered last, which implies that latent factors do not respond contemporaneously (within a month) to innovations in monetary policy. As in Bernanke et al. (2005), we distinguish between “slow-moving” and “fast-moving” variables. A “slow-moving” variable is assumed not to react contemporaneously to shocks, while the “fast-moving” variables react instantaneously to changes in monetary policy or economic conditions. The classification of the variables into these two categories is included in Table 2.

In the first step of the two-step estimation, we can distinguish three stages. First, we use principal component analysis to estimate the common factors C t from all the variables in X t . Second, after dividing the series in X t into slow- and fast-moving ones, we estimate the “slow-moving” factors \( \overset{\lower0.5em\hbox{$\smash{\scriptscriptstyle\frown}$}}{F}_{t}^{s} \) as the principal components of the “slow-moving” variables. Finally, we estimate the following regression:

Based on these estimates, \( \overset{\lower0.5em\hbox{$\smash{\scriptscriptstyle\frown}$}}{F}_{t} \)is constructed as \( \overset{\lower0.5em\hbox{$\smash{\scriptscriptstyle\frown}$}}{C}_{t} - \overset{\lower0.5em\hbox{$\smash{\scriptscriptstyle\frown}$}}{b}_{Y} Y_{t} \). In the second step, we estimate the VAR in \( \overset{\lower0.5em\hbox{$\smash{\scriptscriptstyle\frown}$}}{F}_{t} \) and Y t , using a recursive assumption.

One caveat in our analysis is the fact that we have only 40 series available for principal component analysis, as compared to the 120 used in Bernanke et al. (2005). While this may be viewed as a weakness at first sight, it has been argued by Boivin and Ng (2006) that more series do not necessarily ensure better data quality, due to cross-correlation of idiosyncratic errors. In one of their tests, they show that the factors extracted from 40 pre-screened series may in some cases yield better results as compared to using 147 series. Therefore, for the sake of size, 40 series, at least in general, should not pose a problem.

Our main results are given in Fig. 9. Each panel shows the impulse responses of selected macroeconomic variables to a monetary policy shock with 90% confidence intervals. The FAVAR model in Fig. 9 includes three principal factors, but the results were no different when the number of factors was changed. In the benchmark specification we use one lag. The results are highly sensitive to the numbers of lags used, with more lags resulting in highly improbable results.

As a result, the FAVAR model does not appear to properly capture the developments in the Czech economy. Most importantly, the confidence intervals are too large to infer the direction of the impact of the monetary policy change on the macroeconomic variables. The exception is actual GDP growth, lgdp t , which declines after monetary policy shock, as predicted by the theory.

There may be several reasons for the lack of significant results in the FAVAR estimation for the Czech economy. One reason is likely to do with the relatively short span of the available data; another may be data quality, as discussed by Boivin and Ng (2006). As it is at monthly frequency, our dataset lacks variables related to consumption, housing starts and sales as well as real inventories and therefore some important economic information may be missing (Fig. 12).

Rights and permissions

About this article

Cite this article

Borys, M.M., Horváth, R. & Franta, M. The effects of monetary policy in the Czech Republic: an empirical study. Empirica 36, 419–443 (2009). https://doi.org/10.1007/s10663-009-9102-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-009-9102-y