Abstract

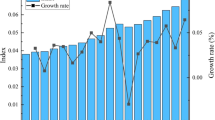

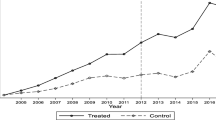

China’s urbanization process has entered a period of rapid development, and cities have become key to driving regional economic development. This paper uses data from 286 cities in China in the period 2005–2018 to construct an urban economic growth quality index system and examine the influence of spatial factors on the convergence trend of China’s urban economic growth quality. It is found that there is a β absolute convergence trend of economic growth quality in Chinese cities across the whole country. After controlling for the initial conditions of individual economies, spatial factors strengthen the spatial convergence trend of urban economic growth quality and significantly increase the corresponding convergence rate. Among the areas studied, the western region has the fastest convergence rate, followed by the central and eastern regions, and the convergence rates of both the central and western regions are higher than the national average. Agglomeration economies and fiscal policy tools are important for the promotion of the urban economic growth quality. The agglomeration of productive service industries significantly improves the spatial convergence rate of urban economic growth quality. This effect is mainly due to the spatial spillover of industrial agglomeration. The expansion of government fiscal expenditure also contributes to the spatial convergence trend of urban economic growth quality. Local economic growth quality is also affected by government fiscal expenditure in neighboring cities.

Similar content being viewed by others

Notes

Relevant statistics for 1949 are from ‘50 Years of New China Cities’, Xinhua Publishing House, December 1999. Data from 1978 onward are obtained from the China Economic Statistics Database. Data in the table are presented in current year prices.

References

Ahmad M, Hall SG (2017) Economic growth and convergence: do institutional proximity and spillovers matter? J Policy Model 39:1065–1085

Baker SR, Bloom N, Davis SJ (2016) Measuring economic policy uncertainty. Q J Econ 131:1593–1636

Barro RJ, Sala-i-Martin X (1992) Convergence. J Polit Econ 100:223–251

Baumol WJ (1986) Productivity growth, convergence, and welfare: what the long-run data show. Am Econ Rev 76:1072–1085

Bian ZC, Zhao L, Ding H (2019) Transformation of China’s monetary policy regulatory framework, nonlinear change of fiscal multipliers and the choice of fiscal instruments in China’s new era. Econ Res J 54:56–72

Bin YJ, Huang XY, Hong GZ et al (2016) The effect of transport accessibility on urban growth convergence in China: a spatial econometric analysis. Acta Geogr Sin 71:1767–1783

Borsi MT, Metiu N (2015) The evolution of economic convergence in the European union. Empir Econ 48:657–681

Caggiano G, Leonida L (2009) International output convergence: evidence from an autocorrelation function approach. J Appl Econom 24:139–162

Caggiano G, Leonida L (2013) Multimodality in the distribution of GDP and the absolute convergence hypothesis. Empir Econ 44:1203–1215

Cartone A, Postiglione P, Hewings GJD (2021) Does economic convergence hold? A spatial quantile analysis on European regions. Econ Model 95:408–417

Chen SY, Chen DK (2018) Air pollution, government regulations and high-quality economic development. Econ Res J 53:20–34

Chen J, Fleisher BM (1996) Regional income inequality and economic growth in China. J Comp Econ 22:141–164

Chen FL, Wang MC, Xu KN (2018) The evolution trend of China’s coordinated regional development: a spatial convergence analysis. Financ Trade Econ 39:128–143

Combes P-P (2000) Economic structure and local growth: France, 1984–1993. J Urban Econ 47:329–355

De Long JB (1988) Productivity growth, convergence, and welfare: comment. Am Econ Rev 78:1138–1154

Démurger S, Sachs JD, Woo WT et al (2002) Geography, economic policy, and regional development in China. Asian Econ Pap 1:146–197

Gu CL, Pang HF (2008) Study on spatial relations of Chinese urban system: gravity model approach. Geogr Res 1:1–12

Guo Y, Fan BN, Long J (2020) Practical evaluation of China’s regional high-quality development and its spatiotemporal evolution characteristics. J Quant Tech Econ 37:118–132

Huang WH, Yuan LS (2014) Has human capital “club convergence” clustered in China? China Popul Environ 24:123–132

Jian T, Sachs JD, Warner AM (1996) Trends in regional inequality in China. China Econ Rev 7:1–21

Jiang Y (2012) An empirical study of openness and convergence in labor productivity in the Chinese provinces. Econ Chang Restruct 45:317–336

Jiang AY, Yang ZL (2020) New urbanization construction and high-quality urban economic growth: an empirical analysis based on the double difference method. Inq Into Econ Issues 3:84–99

Kong QX, Chen AF, Peng D, Wong Z (2021a) Has the belt and road Initiative improved the quality of economic growth in China’s cities? Int Rev Econ Financ 76:870–883

Kong QX, Tong X, Peng D et al (2021c) How do factor market distortions affect OFDI: an explanation based on investment propensity and productivity effects. Int Rev Econ Financ 73:459–472

Kong QX, Peng D, Ni YH et al (2021) Trade openness and economic growth quality of China: empirical analysis using ARDL model. Financ Res Lett 38:101488

Lee L, Yu J (2012) Spatial panels: random components versus fixed effects. Int Econ Rev 53:1369–1412

Lin YF, Liu MX (2003) Growth convergence and income distribution in China. J World Econ 26(8):3–14

Maddison A (1982) Phases of capitalist development. Oxford University Press

Nandan A, Mallick H (2021) Do growth-promoting factors induce income inequality in a transitioning large developing economy? An empirical evidence from Indian states. Econ Chang Restruct 12:1–31

Pan WQ (2010) The economic disparity between different regions of China and its reduction: an analysis from the geographical perspective. Soc Sci China 1:72–84

Sala-i-Martin XX (2002) The classical approach to convergence analysis. Econ J 106:1019–1036

Seya H, Tsutsumi M, Yamagata Y (2012) Income convergence in Japan: a Bayesian spatial Durbin model approach. Econ Model 29:60–71

Shen KR, Ma J (2002) The characteristics of “club convergence” of China’s economic growth and its cause. Econ Res J 1:33–39

Solow RM (1956) A contribution to the theory of economic growth. Q J Econ 70:65–94

Song XJ, Li XN, Yu JH (2020) Estimation of short spatial dynamic panel data models: with application to growth convergence among Chinese cities. China J Econ 7:38–59

Su PL, Guo ZH (2021) Analysis of spatial differences and influencing factors of high-quality economic development. Stat Decis 37:123–125

Summers R, Heston A (1984) Improved international comparisons of real product and its composition: 1950–1980. Rev Income Wealth 30:207–219

Sun XD, Zheng YT, Zhang LL (2015) Chinese city scale based on the agglomeration economy rule. China Popul Environ 25:74–81

Sun XH, Cao Y (2018) Convergence of clubs for urban economic growth—identification methods and convergence mechanisms: an empirical test from 347 administrative regions in China. Mod Econ Sci 40:14–25

Wang LY, Qi TX, Li KP (2013) Geographical environmental differences, modernization process and economic convergence. Econ Sci 2:45–55

Wang QR, Liu JQ, Liu DY (2020) The convergence characteristics of China’s provincial economic growth and the test of spatial spillover effects. World Econ Pap 3:91–106

Weeks M, Yudong Yao J (2003) Provincial conditional income convergence in China, 1953–1997: a panel data approach. Econom Rev 22:59–77

Wong Z, Li RR, Zhang YD et al (2021) Financial services, spatial agglomeration, and the quality of urban economic growth–based on an empirical analysis of 268 cities in China. Financ Res Lett 43:101993

Wong Z, Li R, Peng D, Kong Qi (2021) China-european railway, investment heterogeneity, and the quality of urban economic growth. Int Rev Financ Anal 78:101937. https://doi.org/10.1016/j.irfa.2021.101937

Wu YC (2021) Can smart city construction improve urban resilience? A quasi-natural experiment. J Public Adm 14:25–44

Xu XX, Li X (2004) Convergence in Chinese cities. Econ Res J 5:40–48

Ying LG (2000) Measuring the spillover effects: some Chinese evidence. Pap Reg Sci 79:75–89

Young AT, Higgins MJ, Levy D (2008) Sigma convergence versus beta convergence: evidence from US county-level data. J Money Credit Bank 40:1083–1093

Zhang D (2022) Are firms motivated to greenwash by financial constraints? Evidence from Global Firms’ Data J Int Financ Manag Account. https://doi.org/10.1111/jifm.12153

Zhang P, Yang X (2021) Fiscal policy tools’ optimization choice for the coordinated development of regional economy and Chinese logic. Soft Sci 35:29–34

Zhang J, Wu GY, Zhang JP (2004) The estimation of China’s provincial capital stock:1952–2000. Econ Res J 10:35–44

Zhang D, Kong Q (2022) Do energy policies bring about corporate overinvestment? Empirical evidence from Chinese listed companies. Energy Econ 105:105718

Zhang J, Xu HL, Wang HW (2020) A study on knowledge spillover and convergence of regional economic growth in China. Macroeconomics 4:71–84

Zhang D, Mohsin M, Rasheed AK et al (2021) Public spending and green economic growth in BRI region: mediating role of green finance. Energy Policy 153:112256

Zhang D (2021) Does the green loan policy boost greener production? Evidence from Chinese firms. Emerg Mark Rev. https://doi.org/10.1016/j.ememar.2021.100882

Zhao WJ, Ge CB (2019) Study on the influencing factors of China’s economic growth pattern: empirical analysis based on 248 urban data. Inq into Econ Issues 6:9–19

Acknowledgements

We gratefully acknowledge financial support from the National Natural Science Foundation of China (NO. 71303105), the National Social Science Foundation of China (No. 19FJYB039; 20BJY194), and the Postgraduate Research and Practice Innovation Program of Jiangsu Province (No. KYCX21_1430).

Funding

National Natural Science Foundation of China, 71303105, Qunxi Kong, National Office for Philosophy and Social Sciences, 19FJYB039, Qunxi Kong, Jiangsu Provincial Department of Education, KYCX21_1430, Rongrong Li.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Kong, Q., Li, R., Ni, Y. et al. Does China’s green economic recovery generate a spatial convergence trend: an explanation using agglomeration effects and fiscal instruments. Econ Change Restruct 55, 2499–2526 (2022). https://doi.org/10.1007/s10644-022-09396-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-022-09396-2