Abstract

This paper is an attempt to provide new perspectives on green energy defaults (GED) that promote the purchase of renewable energy electricity (REe) among consumers. We aim to complement existing studies and improve the understanding of GED, particularly when they are less, or unexpectedly, effective. To that end, we run a randomized controlled experiment and take the UK as a case study. We replicate the research design of previous lab experiments for comparative reasons. We also expand the analytical framework, identify key determinants and compare stated versus revealed preferences. Initial results indicate a lack of effectiveness across all treatment groups. This seems to challenge most of the existing lab experimental evidence and questions external validity claims. In addition to the actual treatments, current tariff agreements appear as significant determinants of choices. Nevertheless, when stated and revealed preferences are analysed, statistical tests revealed positive and significant differential effects, suggesting that the sole provision of an explicit, simple decision framework can trigger a greater adoption of REe, even in an opt-in treatment scenario. We thus argue that GED can still influence consumer decision-making in the desired policy direction. However, outcomes are likely to be context-specific so policy generalisations are not advisable. Building upon existing knowledge and our experimental results, we propose various motivational and contextual issues affecting consumer behaviour and thus the effectiveness and suitability of GED. They can offer guidance for future GED studies, particularly in countries in which market and consumer policy conditions for REe may be less advanced or certain.

Similar content being viewed by others

Interest in the application of behavioural economics (BE) to consumer policy has grown in recent years. At the risk of oversimplification, BE looks at rational choice theory and related assumptions about the homo economicus (e.g., unbounded rationality, clearly defined preferences, utility maximisation) from a broader perspective to provide a more realistic understanding of human economic behaviour. BE explores cognitive, motivational and contextual factors (e.g., status quo bias, heuristics, social norms) that affect people’s preferences, decision-making processes and resulting choices (Kahneman, 2003; Thaler, 2015). With a strong focus on consumers (Reisch & Zhao, 2017), it aims to generate policy-relevant information by analysing interventions that address or overcome those factors.

In the domain of energy and climate change, and following the seminal contribution from Pichert and Katsikopoulos (2008), BE applications have focused on the use of green energy defaults (GED) to promote the market uptake of renewable energy electricity (REe) among consumers. In simple terms, GED are understood as a type of ‘nudge’ or choice setting that seeks to determine the outcome if energy users do not actively choose their electricity mix supply (Schubert, 2017; Sunstein & Reisch, 2013). In simple terms, GED experiments (lab, field or natural) aim to analyse the impact of default rules via an opt-out green energy tariff or contract (i.e., intervention group), compared to an opt-in option (i.e., control group). Participants are randomly allocated to one of the two groups; the former is often labelled as the ‘green energy condition’, and the latter the ‘standard/grey energy condition’ (Ebeling & Lotz, 2015; Hedlin & Sunstein, 2016 ; Pichert & Katsikopoulos, 2008). Sometimes, a third condition called ‘active choice’ (or ‘neutral condition’) (Hedlin & Sunstein, 2016; Pichert & Katsikopoulos, 2008) is also analysed. It is claimed that GED can have large effects because of the presence of procrastination, inertia (or ‘status quo bias’), loss aversion and also due to implied endorsement. For detailed conceptual and theoretical aspects, see Schubert (2017) and Sunstein and Reisch (2013).

So far, most GED experimental lab studies have produced results in developed countries, where contextual aspects are comparatively favourable for the adoption of REe, notably in Germany (Ebeling & Lotz, 2015; Momsen & Stoerk, 2014; Pichert & Katsikopoulos, 2008; Vetter & Kutzner, 2016). The results are often positive and significant. For example, Pichert and Katsikopoulos (2008) found a 68% adoption rate when participants were exposed to a green default. This compared favourably with a 41% rate under a standard or conventional ‘grey energy’ default (p = 0.001). Rates were similarly high when participants were exposed to an active choice setting (67%). Comparable results are reported by Ebeling and Lotz (2015): The acceptance rate for the green opt-out option was 69.1%, compared to 7.2% for the opt-in treatment (p < 0.001). In a second (online) experiment, the authors found that 93.8% of participants chose green energy in the opt-out option, compared to 34.1% for the opt-in alternative (p = 0.001). Similarly, Vetter and Kutzner (2016) found that a green default increased the odds of choosing green electricity by a factor of 4.05 (p < 0.001). In a comparison of the effectiveness of different choice settings, Momsen and Stoerk (2014) estimate that a GED generated the highest adoption rate (69.7%), which compared favourably with an active choice scenario (48.2%) (p = 0.028). For further details, see also Kaiser et al. (2020).

Within this experimental context, it is argued, for example, that GED ‘can be used to promote pro-environmental behaviour’ (Pichert & Katsikopoulos, 2008, p. 63), ‘overrule motivational aspects of green energy purchases’ (Ebeling & Lotz, 2015, p. 868) and that studies ‘support confidence in defaults as tools to influence environmental-decision making’ (Vetter & Kutzner, 2016, p. 27). In addition to the contributing factors affecting the effectiveness of GED mentioned above (e.g., procrastination, loss aversion), the literature on consumer policy addressing the adoption of REe also highlights important motivational and contextual aspects that can also contribute to the success of GED. They include, for example, high public acceptance of renewable energy (Bertsch et al., 2016; Zoellner et al., 2008), pro-environmental behaviour (Gerpott & Mahmudova, 2010; Gifford & Nilsson, 2014), a long tradition of certainty about renewable energy policies (Bechberger & Reiche, 2004; Laird & Stefes, 2009; Wüstenhagen & Bilharz, 2006), high willingness to pay for green electricity (Sundt & Rehdanz, 2015) and positive consumer attitudes to renewable energy when supplied by public firms and/ or (local) cooperatives (Kalkbrenner & Roosen, 2016; Mundaca et al., 2018; Rommel et al., 2016). Now, let us now imagine a country in which, for instance, there is a perceived negative corporate reputation (Walsh et al., 2006), lack of trust in or confusion about green (energy) product attributes (Joshi & Rahman, 2015) and ongoing reviews of, and changes to, renewable energy policy (Simpson & Clifton, 2014). What can it be the response from consumers to a GED? What drives their choices? What can the comparison of stated and revealed preferences expose? Which directions can emerge for future consumer policy studies?

This paper seeks to answer these research questions, aiming to provide new perspectives about GED for consumer policy. Our goal is to complement existing studies and gain a better understanding of GED, particularly when they are less, or unexpectedly, effective. We expand the common analytical framework focusing on effectiveness and identify key determinants. In addition, we also compare stated versus revealed preferences (methodological details in the next section). For consistency and comparative reasons, we replicate the experimental lab research design of previous work (Ghesla, 2017; Hedlin & Sunstein, 2016; Pichert & Katsikopoulos, 2008; Vetter & Kutzner, 2016), notably the one from Pichert and Katsikopoulos (N = 225). Using the UK as a case study (details below), we thus run a GED lab experiment and randomly assigned participants to three treatment scenarios: opt-out, opt-in and an active choice for a REe tariff. Building upon existing theoretical and empirical evidence, we aim to identify various motivational and contextual issues (potentially) framing the effectiveness and policy adequacy of GED. These aspects can be relevant for countries in which market and consumer policy conditions for REe are less advanced or certain.

We choose the UK as a case for a variety of institutional and contextual reasons. First, some elements of the UK electricity market deserve attention. For example, the electricity supply industry was privatised in 1989 and full competition was introduced to Britain’s electricity retail market in 1999, including to all residential customers. In the following decade, the market was dominated by six incumbent firms, accounting for almost 100% of the retail market. However, since 2011, the combined electricity market share of the large legacy suppliers has steadily reduced from nearly 100% in 2011 to 70% by the end of 2020 (OFGEM, 2021a), as more new entrants enter the market (by December 2020, there were 54 suppliers active in the domestic electricity market (OFGEM, 2021b)). The increase in suppliers and available tariffs has been coupled with an increase in switching behaviour by consumers, with a record high of 20.4% in April 2019 (OFGEM, 2019). However, despite this rise around 50% of households remain on default electricity tariffs (OFGEM, 2020a), which are often more expensive (OFGEM, 2021c).

Secondly, the share of UK electricity generation from RE sources reached a record high of 37.1% in 2019, increasing from 33.1% in 2018 (BEIS, 2020a). In 2019, REe generation totalled 121 TWh, a 9.5% increase from 2018, a tenfold increase in the share of electricity generation since 2004.Footnote 1 The UK has also experimented with all forms of renewable energy policy mechanisms (e.g., feed-in-tariffs) (Newbery, 2016) and according to BEIS (2020b), the UK’s climate and energy policies have been an important driver for the REe capacity growth, which has increased by more than three times since 2010. The IEA (2019) identifies that the most important policies behind this growth are the Renewable Obligation (introduced in 2002), Feed-in-Tariffs (introduced in 2010) and the Contract for Difference (introduced in 2013).Footnote 2 Whereas these policies are largely devoted to address the production side, much less is known about policies addressing consumers.

Thirdly, in terms of green energy tariffs per se, these were first available to UK domestic customers over 20 years ago (Graham, 2006). Such tariffs remained available until 2014, when in an attempt to ease consumer confusion over complex tariffs, the government regulator for electricity and gas markets, OFGEM, introduced a limit to four simple tariffs per supplier in 2014 (OFGEM, 2014a). This resulted in all the major suppliers withdrawing the green electricity tariffs they offered, which were less popular and made less profit (Littlechild, 2019). Yet, in recent years, there has been a resurgence in the provision of green tariffs from both incumbent firms and new entrants. However, during the periods that green electricity tariffs have been available in the UK domestic market, issues have existed surrounding confusion of the product and lack of trust. For long periods of time, there was no official definition of what was meant by a ‘green’ tariff, which led to many different forms of including carbon offsets and green funds. This resulted in confusion among consumers over what a green tariff was, or that different types of green tariffs even existed (OFGEM, 2014b). In addition, concerns over suppliers double counting has been found to be more prominent in the UK than in other countries (Hast et al., 2015), where suppliers assign the renewable energy they are obligated to source as a green energy tariff. Such concerns over the risk of double counting and confusion of the product have weakened consumer trust in the green tariffs in the UK.

Within the context described above, there are also further, specific reasons to choose the UK as a case study. For example, studies show that consumer trust in the energy sector is low (CarbonBrief, 2014; Which?, 2013). It is claimed that this is the least-trusted industry in the UK, and one of the least-trusted sectors in Europe (Citizens Advice, 2015; Edelmenan Trust, 2014). There is also a loss of political trust among consumers due to Brexit (Marshall & Drieschová, 2018; Newton et al., 2018) that may influence the level of endorsement that a GED implies. Third, the UK has experimented with all forms of renewable energy policy mechanisms, including tradable green certificates, traditional feed-in-tariffs and contract for differences (Newbery, 2016) and the UK market allows customers to switch suppliers. In addition, many of the major UK energy suppliers offered a green tariff in the past (Graham, 2006) are customers are familiar with the concept of green tariffs. However, all of the major companies abandoned the practice by 2015 (Bawden, 2015). This led to confusion among consumers, as few customers understood what a green tariff was, or that different types of green tariffs existed (OFGEM, 2014a). The above has generated a complex renewable energy governance (Kern et al., 2014), creating risks and uncertainties among consumers and producers (Bolton et al., 2016; Cowell et al., 2017; Fudge et al., 2016). Our general hypothesis is that this set of country-specific factors, to be found potentially in many countries around the world, may undermine―at least to some extent―the effectiveness of GED compared to what has been reported in previous online lab experiments.

The paper is organised as follows. The ‘Methods’ section provides methodological details. It describes the experiment, procedure and data collection. The ‘Results’ section summarises our key findings. In ‘Discussion: Avenues for Future Consumer-Oriented GED Studies’ section, and building upon existing knowledge and our findings, we propose and discuss various motivational and contextual that should deserve more attention in future GED studies. Finally, we present concluding remarks in the ‘Conclusion’ section.

Methods

Experiment, Variables and Participants

Following the replication of previous GED studies, our experiment analysed the effectiveness of GED and randomly assigned participants to three treatment scenarios: opt-out, opt-in and an active choice for a REe tariff. In line with the literature (Hedlin & Sunstein, 2016; Horton et al., 2011), the study can be categorised as an online laboratory experiment.

First, a power analysis was conducted to determine the sample size capable of robustly detecting an experimental effect, considering type I and type II errors. Because very few GED studies report an effect sizeFootnote 3, we assumed a relatively conservative, medium effect size (0.5 Cohen’s d), and more strict levels of statistical significance (1%) and power (90%) than previous studies. This resulted in a minimum sample per group of 121 participants who were recruited from an online panel. We enlisted the support of a market research firm (ResearchNow) to collect the data. Taking into account that we were able to recruit 518 participants (150+ under each treatment scenario), our study is capable of detecting even a small effect size (d = 0.2) with 38% power in a two-sided hypothesis test. Note that our sample is more powered than previous GED experiments (Pichert and Katsikopoulos (2008) (N = 225), Ebeling & Lotz, 2015—Experiment 2 (N = 290), Momsen and Stoerk (2014) (N = 118) and Ghesla (2017) (N = 161)). However, it is smaller than two studies with larger samples (Ebeling and Lotz (2015)—Experiment 1 (N = 41,952) and Hedlin and Sunstein (2016) (N = 1,245)). A fundamental consideration for this difference is that we, like all the previous GED studies, focus on the difference between experimental groups (i.e., effect size) but refrain from analysing the prevalence of certain attributes in a larger population (e.g., political preferences, as in Ebeling and Lotz (2015)).

The online lab experiment (see Appendix) was hosted by an open-source survey provider (LimeSurvey).Footnote 4 It began with an initial welcome page that stated the title of the experiment, provided information regarding the anonymization of responses, and thanked participants for taking part. This page was deliberately brief to avoid framing responses in any way. An initial screening question eliminated those who were not responsible for electricity supplier/ tariff decisions in the household. These initial participants were not included in the experiment, as willingness to pay for renewable energy is related to whether the respondent is a bill payer or not (Hite et al., 2008; Zarnikau, 2003). The next part of the survey elicited socio-economic and demographic data (see Table 1).Footnote 5 Variables were chosen based on previous studies of willingness to pay (WTP) for renewable electricity (e.g., Aldy et al., 2012; Bollino, 2009; Hanemann et al., 2011; Kim et al., 2012; Kosenius & Ollikainen, 2013; Longo et al., 2008).

Next, participants were randomly allocated to one of three treatment scenarios using a ‘recruit and deny’ strategy (Gandhi et al., 2016). A hidden, random number generator drew an integer number from 1 to 3, which allocated participants to one of three treatments: (1) a green default scenario (opt-out) (n = 190), (2) a standard default scenario (opt-in) (n = 170) and (3) an active choice scenario (n = 158). Kruskal-Wallis tests showed no evidence of any significant unequal distribution of variable parameters across groups (see Table 2). Importantly, this meant that the randomization of participants was successful, which cancelled out potentially confounding effects of these variables on the likelihood to choose (or not) a green energy tariff.

At the beginning of each treatment, participants were asked to imagine they had just moved to a new town and were informed by the local energy supplier of the available electricity tariffs. The preparation of this text was guided by OFGEM proposals about default renewal notices; notably, that the supplier should not encourage the consumer to choose one particular tariff, and should clearly explain what happens if the consumer does nothing (the default treatment) (OFGEM, 2014a, b, 2021c) (Table 3).

An important element of our study was to replicate a real-world pricing premium for green electricity. However, at the time the experiment was conducted, none of the larger suppliers offered specific green tariffs. Therefore, information was sourced from historical tariff data, personal communications with energy companies and relevant, published studies. This resulted in a price premium of 5%, or around £2.50/ month (€3 approx.) based on average electricity bills in the UK in 2016. This value is significantly lower than those used in most GED studies (Table 4).Footnote 6

The final part of the survey elicited information about current electricity contracts. This was critical to be able to compare stated and revealed choices.

To compare groups, various statistical techniques were used to tests for significance across treatment scenarios. First, a Pearson’s χ2 test was applied to test differences in enrolment rates between the three treatments. We also ran a series of χ2 goodness-of-fit tests to compare our results with the average values we derived from the literature. Next, a series of Chi-square (χ2) goodness-of-fit tests took place to compare the results of our experiment with the ones previously reported in the GED literature. Bonferroni adjustment (α = .017) was applied to control for type error I whenever post-hoc tests were carried out. We also compared whether there were significant differences in the time it took participants to answer the different treatment questions using a one-way analysis of variance (ANOVA) based on an F distribution. Extreme outliers that lied without the intervals were removed (28 in total). We also used a Wilcoxon signed-rank test to assess for the differences between stated and revealed choices for each group across treatment scenarios. Finally, effect size statistics were computed. Phi (Φ) and Pearson’s correlation (r) coefficients were calculated for χ2 and Wilcoxon signed-rank tests respectively; where 0.5 was considered a large, 0.3 a medium and 0.1 a small effect size (Cohen, 1988, 1992).

Model Specification

Unlike most previous studies, we quantitatively explored the extent to which different variables explained respondents’ choices. Logistic regressions assessed the impact of predictors on the probability that respondents would choose either the green energy tariff or the standard energy tariff. The logistic regression model is presented below. Independent and dependent variables are specified in Table 2 and Table 3, respectively.

in which P(Ci) is the probability of C occurring, which is the binary dependent variable indicating the willingness to choose (1) or not (0) the green electricity tariff under i treatment scenario by respondent j. e is the base of natural logarithms, βX represents our vector of explanatory variables and ε is an error term. Explanatory variables include income (Inc), location (Loc), household tenure type (Ten), household size (HHsize) and the current electricity contract (Reality). We also include the time (Time) undertaken by participants to make a choice under each scenario. This was used as a proxy for the cognitive effort (Lenzner et al., 2010) that participants deployed during the experiment. In a second step, we introduced the following control variables to check for the robustness of our results: age (Age), gender (Gend) and education (Educ). Both explanatory and control variables are based on the reviewed literature, notably the socio-economic and demographic factors affecting WTP for renewable electricity and findings from GED studies. Income or financial constraints (and related educational level) are often cited as the most important factors that prevent or promote the adoption of renewable energy (cf. Hobman & Frederiks, 2014; Pichert & Katsikopoulos, 2008; Zarnikau, 2003). Gender and age have also been put forward, although the results are inconclusive (cf. Longo et al., 2008; Sardianou & Genoudi, 2013). Electricity contracts and, thus, price and the corresponding use of renewable energy have been identified as having an impact on an individual’s decision to choose a green or standard energy carrier (Bird et al., 2002; Mozumder et al., 2011), and this observation has been confirmed in experimental studies (cf. Kaenzig et al., 2013; Momsen & Stoerk, 2014; Pichert & Katsikopoulos, 2008). Furthermore, household size and tenure have been identified as having a positive and significant impact on a consumer’s preference for renewable energy (Ameli & Brandt, 2015; Beckman & Xiarchos, 2013; Mozumder et al., 2011). Time was adopted as a proxy of cognitive effort. The time it takes to answer a survey question is generally accepted to be a reflection of the cognitive effort required to arrive at an answer (Lenzner et al., 2010). Such measures are often used in online surveys, including other energy default studies (Dinner et al., 2011). However, it is important to highlight that the use of response time as a measure of cognitive ability is influenced by other factors (Kyllonen & Zu, 2016), notably slow processing or carefulness by the individual concerned.

Each model (with and without control variables; bootstrapped based on 1000 samples) was checked for goodness-of-fit using a Chi-square (χ2) test to give an overall, initial indication of how well models performed. Then, Cox and Snell’s R2 and Nagelkerke’s R2 were used as pseudo R2 measures to indicate the amount of variation in the dependent variable odds ratios (i.e., the constant effect of a predictor X on the likelihood that an outcome will occur) were estimated for all independent variables to assess their contributions to the model. For categorical variables with more than two categories (e.g., income, location), each category was compared with the category last coded being used as a baseline. Surveys with incomplete answers were excluded from the logistic regression analysis (14 in treatment 1, 11 in treatment 2 and 9 in treatment 3). To ensure the robustness of the results, numerous diagnostic tests were performed.Footnote 7

Results

First-Order Impacts of the GED

As hypothesised, findings show a relatively lower level of effectiveness for the green default and active choice treatments, and a relatively higher level under the standard default (see Fig. 1 and Table 5). In the green default scenario, and contrary to indications from the literature, 81 of the 190 participants (42.6%) chose to stay with the green tariff. In the standard default scenario, 81 of 170 participants (47.6%) chose to opt-in and switch to the green tariff. In the scenario requiring an active choice, 37 of 158 participants (23.4%) chose the green tariff. Results show that a large number of individuals were unfavourably inclined to REe, challenging the existing experimental GED evidence.

A 3 × 2 χ2 test found a significant overall effect for all treatment groups (χ2(2, 518) = 22.57, p < .001). We assessed which treatments were statistically significant in three, separate 2×2 post-hoc χ2 tests (α = .017). We found no significant differences between the green and the standard default (χ2(1, 360) = 0.912, p = .340). Interestingly, given that more participants chose the REe tariff in the standard default treatment, tests revealed a significant difference between the standard default and the active choice scenario (χ2(1, 328) = 20.82, p < .001), with a medium effect size (Φ = 0.25). Likewise, the comparison of the green default and the active choice treatment found that significantly more participants chose the REe tariff in the green default condition (χ2(1, 348) = 14.21, p < .001, Φ = 0.20). This is in contrast to Hedlin and Sunstein (2016), who found that active choosing may be more effective than green defaults. Our findings reveal relatively lower levels of enrolment even in an active choice treatment.

A series of χ2 goodness-of-fit tests comparing the choice of REe in our experiment with the ones reported in the literature (see Table 5) revealed the following: we found a significant difference (χ2(1, 190) = 119.5, p = .000) in the proportion of participants that chose REe in our green default scenario (42.6%) as compared with the average value of 76.3% we derived from previous studies. Likewise, we also identified a significant difference (χ2(1, 158) = 163.2, p = .000) when comparing the proportion of individuals that chose REe in our active choice scenario (23.4%) and the average value from the literature (63%). However, we found that the choice of REe in the standard default treatment (47.6%) is consistent with the results reported in the literature (43.2%), as no significant difference was found (χ2(1, 170) = 1.37, p = .242).

Following Pichert and Katsikopoulos (2008), we also examined the motivation of participants who were unwilling to choose the REe tariff across all treatment scenarios (see Table 6). Most participants, 294 out of 319 (92%), provided a reason for their grey tariff choice and price concerns dominated (69%). Our finding supports other studies that state that electricity demand and competition among utilities in the UK is still very price-driven, with cost by far the most important factor in switching choices (Diaz-Rainey & Ashton, 2008; Hast et al., 2015). However, of those unwilling to choose REe, around half also gave at least one other reason. The second most common reason was a lack of information (27%); this percentage is high compared to other studies and could be due to the controversy surrounding green tariffs in the UK. Very few of those who did want a green tariff considered that climate change mitigation was not their responsibility (~ 3%), suggesting a small effect of the GED among people with low environmental concerns.

Cognitive effort was proxied by the latent time it took each participant to answer the treatment choice question (Lenzner et al., 2010). The analysis indicated that there was a statistically significant difference between treatment groups, determined by one-way ANOVA (F(2, 493) = 30.757, p < .001). The data was also analysed to examine whether there was a difference between the time taken by participants who chose the REe tariff and those who chose the standard tariff under each treatment scenario. We found that participants who stuck with the REe tariff took the same time to make in the green and standard default treatments (Table 7). However, in the active choice treatment, those who chose the REe tariff took almost twice as long to answer the question than those who chose the standard tariff.

Key Determinants Behind Choices

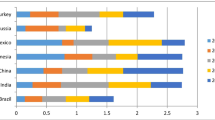

Logistic regression was performed to identify and evaluate the impact of different factors on the likelihood to choose (or not) a green tariff. Two models were estimated (without and with control variables). Overall, results consistently indicate that current (green) electricity contracts, treatments and time were significant predictors. Once control variables were introduced, results remained robust and gender (female) also became significant (see Table 8 for details).

The first model (i.e., without control variables) was statistically significant (χ2 (24, 484) = 105.22, p = .000). The model explained between 19.5% (Cox & Snell R2) and 26.6% (Nagelkerke R2) of the variance of the REe choice, and was able to correctly classified 71.9% of cases. As shown in Table 8, only four variables made a unique statistically significant contribution to the model. The strongest predictor was ‘reality’ (i.e. green electricity tariff contracts). In particular, ceteris paribus, we observe that respondents with a green electricity contract are 6.8 times more likely to choose a green energy tariff than those who do not know which electricity tariff they have. The second strongest predictor is the actual treatment. Consistent with the results shown in the ‘First-Order Impacts of the GED’section, odds ratios show that it is the standard default treatment (odds ratio = 3.65) that has a relatively higher effect than the green default treatment (odds ratio = 2.66) on the likelihood to choose a green tariff. Note that we use ‘active choice’ as a baseline for comparison. This means that participants under the ‘standard’ and ‘green default’ treatments were 3.65 and 2.66 times, respectively, more likely to choose a green energy tariff than those who were under the active choice treatment. The fourth strongest predictor turned out to be time. The odds ratio is positive, indicating that for every additional second devoted under the treatment, respondents were 1.01 times more likely to choose a green tariff; controlling for other factors in the model.

After controlling for age, gender and education, the model remained significant (χ2 (27, 484) = 118.60, p = .000) and its explanatory capability increased (21.7% Cox & Snell R2 and 29.6% Nagelkerke R2). The same determinants indicated above made a statistically significant contribution to the model, namely: the green default treatment, the standard default, a ‘green tariff’ in reality and time. We observe that the effect of current green electricity tariffs was stronger (odds ratio = 8.02) compared to the previous model (odds ratio = 6.81). On the contrary, the effects of treatments remained almost the same. Finally, one can also see that gender made a significant contribution. The odds ratio was positive, indicating that women were 1.85 times more likely than men in choosing a green electricity tariff.

Stated Versus Revealed Preferences

We also explore the effectiveness of each experimental treatment compared to real-life preferences. This analysis focused on cases where information about the actual choices of respondents was possible to obtain (n = 450) (i.e., it excluded all responses for which no information about current electricity contracts was identified). As shown in Fig. 2, revealed preferences were relatively homogenous across all groups: around 10% for the REe tariff, and 90% for a standard ‘grey’ or ‘standard’ electricity tariff. No significant difference was found across all groups (χ2 (2, 405) = .52, p = .771).

Under treatment 1 (n = 166), the REe tariff was chosen by 70 participants (42%). In reality, however, only 18 (11%) had a REe contract; a differential effect of 31%. A Wilcoxon signed rank test revealed a statistically significant impact of the treatment (z = 6.5, p = .000) with a medium effect size (r = 0.36). Under treatment 2 (n = 150), only 15 people (10%) had a REe contract; however, 73 participants (49%) chose a REe tariff with a nearly large effect (z = 7.3, p = .000, r = 0.43). Finally, in treatment 3 (n = 134), although the differential effect was lower (11%) than in the other treatments, it remained significant (z = 2.8, p = .004), with a small effect size (r = 0.18). Overall, and while our initial results show a low impact of a GED, the direction and significance of these effects also suggest that the provision of an explicit, simple decision framework can still have the potential to trigger a greater adoption of REe, even in an opt-in or active choice treatment scenario.

Discussion: Avenues for Future Consumer-Oriented GED Studies

Despite growing attention to GED, research beyond their potential effectiveness is still scarce and our analysis shows a different perspective. From a humble point of view, here we propose and briefly discuss various avenues that have the potential to increase the understanding of context-specific moderators and mediating mechanisms affecting consumer behaviour and thus the effectiveness and suitability of GED from a consumer perspective. By pursuing these avenues, we believe they can strengthen the value of future GED studies and resulting policy recommendations. This may be particularly relevant in countries where market and consumer policy conditions for REe may be less advanced or uncertain.

Endorsement and Policymaking

Validation by, and trust in, the choice architect are important factors that can determine the effectiveness of GED (Halpern, 2015; Sunstein & Reisch, 2013). The main effects reported here suggest some level of scepticism among consumers when the GED originates from a (potentially) untrustworthy choice architect. One can argue that given unfavourable policy and/ or market conditions, the choice architect (e.g., policy maker, energy company) is likely to fail in providing a minimum level of trust for a GED. Note that the identity of the choice architect was not given in our experiment. In addition to research design replication, the main reason for this was to avoid any pre-framing and deception. At the same time, the absence of an explicit choice architect may have led participants to think that a ‘hidden’ company or policymaker was behind the study, leading to an actual increase in REe tariffs, for example. If a participant did make such inferences, this could have motivated him/her to override their cognitive factors and biases (e.g., inertia) that would have otherwise caused him/her to stick with the default. Different levels of trust or endorsement by policymakers among consumers do deserve particular attention in future studies. Furthermore, previous research has assumed that GED interventions can be effective acting alone, neglecting interaction effects and corresponding endorsements effects with other policy instruments (e.g., carbon tax) (Hagmann et al., 2019). This is another area that needs attention. Turbulent political times (such as Brexit) can also affect policymaking and related levels of (implicit) endorsement among consumers. Sensitivity to explicit endorsements may indeed vary in time. Likewise, heterogeneity among consumers and numerous determinants suggest a variety of ‘asymmetries’ among individuals. Thus, additional research can address specific, asymmetric paternalistic approaches (Camerer et al., 2003) to REe enrolment programmes. This would mean, for instance, to identify, target and benefit consumers who are more likely to make ‘irrational’ choices about the purchase of REe contracts, while imposing marginal or no constraints on those who are already making more thoughtful decisions.

Marketplace Metacognition and Experience

One can also speculate that the ‘marketplace metacognition’ (MM) is likely to develop among consumers to cope with perceived attempts at persuasion. According to Wright (2002, p. 667), MM involves ‘everyday individuals’ thinking about market-related thinking. This includes people’s beliefs about their own and others’ mental states and processes and their beliefs about other people’s beliefs on those topics as these beliefs pertain to the specific domain of marketplace cooperation and manipulation.’ In a GED setting, a key implication is that when MM is invoked, consumers may become sceptical and their cognitive effort increases (Brown & Krishna, 2004). When consumers perceive an attempt to persuade them, cognitive effort is enhanced and they are more likely to resist such efforts; particularly if GED are perceived as an imposition. Sunstein (2015) argues that individuals reject nudges if they are perceived to have illicit motivations (e.g., profiteering), even if the nudge supports their preferences. Discrepancies between our study and previous GED research may also be the result of the market experience of participants. The UK has one of the highest switching rates for electricity in Europe (ACER/CEER, 2014), with multiple campaigns and regulations encouraging such behaviour (such as ‘The Big Switch’ or ‘Energy Best Deal’) As mentioned before, we found an increase in switching behaviour by consumers (20.4% in April 2019) (OFGEM, 2019) and studies have shown that the effects of defaults are reduced by individual experience (List, 2003; Löfgren et al., 2012). This observation is supported by Brown and Krishna (2004), who found that previous experience can influence whether individuals stick with a default. Further research should address elements that directly or indirectly cause (dis)comfort among consumers when being targeted with a GED, and the extent to which they relate to switching rates market (in)experience.

Psychological Reactance

The above observations lead us to the issue of psychological reactance, which refers to people’s negative reactions when their freedom is threatened or eliminated (Clee & Wicklund, 1980). While the literature has acknowledged that reactance can make GED less effective (Hedlin & Sunstein, 2016), there is limited empirical evidence about its actual effects. Although our default rule did not restrict individual freedom, as in any GED experiment (i.e., each individual could opt in or out), a perception of constraint could exist. If consumers perceive that a GED goal is illegitimate and do not fit their values or interests, they are unlikely to support it (Reisch & Sunstein, 2016). In our case, note for example that the standard default had a higher REe enrolment rate and one could argue that this was, at least partly, because individuals felt less sceptical or ‘reactant’ about the choice format and the hidden choice architect. In turn, the standard default may have appeared less paternalistic than the other two treatments. Combined with issues concerning endorsement, trust and MM, our results are an indication that reactance is a mediating mechanism that deserves far more attention in upcoming studies. After all, consumers ‘do not decide in a vacuum, but always in a choice context’ (Reisch & Zhao, 2017, p. 201) and psychological reactance may always affect or be part of the consumer choice context.

Pricing and Loss Aversion

The literature argues that when a good or service with social welfare features is offered, extra costs can create a boomerang effect due to psychological reactance (Clee & Wicklund, 1980; Hedlin & Sunstein, 2016). The experimental evidence with GED consistently shows the application of using a premium tariff (in the range of €0.75–€23 per month) and our study is not the exception. However, our premium (~ €3/month) is at the lower end of the spectrum. As current electricity contracts were a consistent predictor across all treatment scenarios, one can infer that consumers are very likely to be price-sensitive. In addition, price concerns were the top reason for the non-adoption of REe contract (see R1 = 69% in Table 2). Our results support Hedlin and Sunstein (2016), that speculate about greater reactance about GED when REe is more expensive than the grey or standard energy. This is also supported by Ghesla (2017), who shows much lower REe enrolment rates (2% in active choice, 4% in standard default and 20% in green default) when high REe prices are used. Thus, participants may not perceive that a GED triggers a loss of autonomy; they may object to it simply because REe costs more. In other words, loss aversion (Kahneman et al., 1991; Tversky & Kahneman, 1991) could initially arise as individuals place a higher value on (financial) losses than (potential environmental) gains relative to their current tariff agreement (i.e., reference point). Furthermore, and contrary to what the literature indicates (Schubert, 2017), respondents may not stick to the GED because of loss aversion, they may opt-out because the kind of ‘endowment’ established by the GED is already perceived as undesirable. In our case, consumers may have also felt that they were already paying the full social cost of electricity. Considering our results, one can argue that the GED approval rate estimated for the UK (64.9%) (Reisch & Sunstein, 2016, p. 318) may be much lower and more consistent with our findings, if the extra costs are made explicit to energy users in such studies. Combined with the issues of trust, price sensitivity via the use of different premiums and saliency levels can shed more light on economic concerns and the extent (or not) to which extra costs trigger, for example, reactance and/or loss aversion among consumers. Again, interactions with other policy instruments matter (e.g., energy pricing).

Institutional Aspects

The above-mentioned aspects relate to some or to a large extent with various institutional consumer issues that can help explaining or contextualising our results. For example, as mentioned early on, a lack of trust in energy suppliers is relatively high and can probably drive or increase high levels of inertia among consumers (cf. OFGEM, 2020b). Consumer confidence to engage in the UK’s electricity market has remained unchanged since 2017 (OFGEM, 2020b). Thus, institutional efforts should be devoted to increasing trust in the electricity supply industry. In addition, as the UK has introduced but also ended various REe policy support schemes, one can also speculate that the uncertainty about the future of RE growth that project developers have experienced (IEA, 2019) has also been perceived by (some) consumers in terms of REe supply, and thus prompted some unwillingness to adopt a RE tariff in our experiment. The regulatory framework in the UK also allows consumers to switch energy suppliers; however, negative perceptions of the switching process remain relatively high, including perceived risks (e.g., ‘REe supplier might go bust’) (OFGEM, 2020b). Consumer research shows that those who tend to switch are prompted by (i) end of fixed-term notices, (ii) get an electricity bill and (iii) move to a new house (OFGEM, 2020b). In our case, we hypothesise that none or most of our participants felt or experienced some of these events at the time we ran the experiment. Certainly, we also need to acknowledge that our messaging on ‘assume you have moved to a new town’ did not work properly. Whatever the case might be, the three aspects indicated above that prompt engagement to switch tariffs among consumers should be closely considered by choice architects. Pricing (and related cost savings) is still the dominant reason among consumers to switch supplier (OFGEM, 2020b). This is very consistent with both the design of our experiment and the given reasons to be unwilling to choose a REe tariff. Importantly, this means that the cost-effectiveness of REe policy measures remains critical to increase and/or maintain consumer engagement in REe tariffs in the future. According to Newbery (2016), capacity auctions combined with power purchasing agreements can provide the most cost-effective form of support to keep REe competitive in the long-term.

The Stated vs. Revealed Preference Gap

The comparison of stated and revealed choices suggests numerous aspects. For example, one could initially claim that this reveals a paradox or that differential effects simply imply a ‘value-action’ gap among energy users. The latter means that individuals simply overstated their behavioural reaction or willingness to adopt REe; a critical aspect already found in stated preference (lab) experiments (Loewenstein et al., 2014), but not yet fully understood in GED experimental lab studies. This highlights that much further analytical attention needs to be paid to what people say and actually do. This, in turn, underscores (even more) the value of revealed preferences and field and natural experiments to support consumer policy in the future. We also take note that 27% of the sample mentioned ‘not enough information on green tariffs’ as a reason for non-adoption. At the same time, differential effects suggest that the provision of an explicit, simple decision framework (or better information presentation) may trigger greater adoption of REe, even in an opt-in or active choice scenario. After all, interest in REe, as shown by stated preferences, is higher (by a factor of 2 to 5) than revealed rates. With due limitations, this suggests that a GED may still be an effective instrument, provided an explicit, simple ‘salient’ decision framework is implemented. This poses the question of whether a GED, even if less effective than previous research shows, is still capable of supporting a simple heuristic model to effectively promote the adoption of REe. Clear preferences also matter. Johnson and Goldstein (2003, p. 1339) state that ‘if preferences [….] are strong, we would expect defaults to have little or no effect’. Sunstein and Reisch (2014) argue that default effects might be limited by entrenched, pre-existing attitudes. Our first order effects seem to support this; however, differential effects also suggest less established or inconsistent preferences. In line with Vetter and Kutzner (2016), the difference between stated and revealed preferences show that potentially strong, pre-existing attitudes (e.g., towards the choice architect) might not necessarily limit the effectiveness of a GED. Carlsson (2010) highlights that unstable preferences throughout an experiment do not imply irrational behaviour; instead, a learning process could be unfolding. Thus, some respondents may not have fully developed their preferences during our experiment and they formed or even changed their preferences (e.g., preference reversal) (Tversky et al., 1990). In future GED studies, values, beliefs, attitudes and risk attributes (e.g., financial loss, credibility of electricity supplier) could be varied independently from one another and allow the estimation of their effect on the choice of REe under different treatments. The identification of specific motivational and psychological factors (e.g., self-deception) in explaining unconstructed or dynamic preferences regarding REe tariffs can also provide a better understanding of differences between stated and revealed choices.

Conclusion

This paper has been a humble attempt to provide new analytical and empirical perspectives about green energy defaults (GED) for consumer policy. Above all, it has aimed to complement the existing scientific and policy knowledge that can be derived from randomized controlled lab experiments. Compare to previous research, we have expanded the analytical framework going beyond first-order effects. On the one hand, our study has shown a different view on the potential effectiveness of GED. First-order results showed a relative lack of effectiveness of GED and lower market uptake of REe across all treatment groups. Results also showed that current green electricity contracts are a significant driver for REe choices. However, on the other hand, the comparison between stated and revealed preferences also revealed a positive and significant differential effect of GED. Our results suggest that GED can still frame decision-making in the desired policy direction, and we hypothesise that the provision of a simple and salient decision framework via a GED can trigger greater adoption of REe; even in an opt-in or active choice default rule. By no means have we claimed to provide a definitive answer. Modestly, and by replicating research design from previous lab experiments, our results underscore the need to carefully consider the heterogeneity of energy users, markets and policy environments. Importantly, our results suggest that extrapolating experimental results from one context/country to another needs to be taken with caution. Building upon existing knowledge, we postulate various motivational and contextual factors that underline the complexities to predict consumer behaviour in a GED setting. A larger critical mass of country-specific studies and representative samples are needed to continue unpacking the context-dependence of consumer preferences and provide better evidence-based policy advice. Removing barriers for REe is critical, and this is often a function of the existing consumer behaviours, policy portfolios and context. In sum, our argument is that a better understanding of context-specific moderators and mediating mechanisms will more effectively support consumer policy addressing the adequacy and effectiveness of GED in the future.

Notes

In 2019, REe generation by fuel source was (BEIS, 2020b): hydro 5%, onshore wind 27%, offshore wind 27%, solar PV 11%, landfill gas 3%, bioenergy 28%.

See Newbery (2016) for a historical perspective on electricity market reforms and review of policies addressing REe.

Our sample is representative of the UK population for gender only (χ2 (1, 518) = .41, p = .51). For all the other variables, tests show statistical differences. To some extent, this was expected. For example when it comes to age, the sample is different from the UK distribution (χ2 (5, 518) = 79.57, p = .000) for the adult population and there are a relatively low number of young adults under 25 years old (3.3% vs. 8.9%); however, as many young people either live with their parents or at university/college accommodation, they are less likely to be responsible for the energy tariff decision. This would also be expected as a large number of elderly people may either be living in retirement homes or with family, and as a result no longer make energy decisions. That said, the sample has a relatively lower share of participants in the higher income categories than the UK average. The sample also has fewer participants who live in urban areas and more who live in rural locations. Our sample also has more participants with a degree level qualification (40.7% vs. 27%), as well as more homeowners (71.8% vs. 64%) than the average in the UK. Finally, our sample is underrepresented by people who live on their own in the (20.5% vs. 30.6%).

Although green tariffs offered by smaller specialist suppliers were available, this data was not used. The principal reason was that our study focused on the potential reintroduction of green tariffs by incumbent suppliers as the default; these rates were, in most cases, significantly lower than those proposed by specialist suppliers (Graham, 2006).

For both models this included: (a) testing for multicollinearity, with all estimated tolerance values above 0.1 and variation inflation factors (VIF) below 5, (b) testing for influential cases, with all estimated Cook’s distance values below 1, except in one case (#277 = 1.08 in the model with control variables) that when inspected in detail showed a DFBeta value for the constant below 1 (= − .01026) so we saw no reason to exclude it from the analysis and (c) testing for bias, with less than 5% of the standardised residuals lying outside ± 1.96 and 1% lying outside ± 2.58. Only two cases (#369 in the model with no control variables; #434 in the model with control variables) had standardised residuals greater than 3, but estimated Cook’s distance values were well below 1. We thus did not remove these observations from the analysis. Finally, (d) the Hosmer-Lemeshow test was also applied to both logistic models and estimated p-values were larger than .05 (.73 in the model with no control variables, .22 in the model with control variables). This was done to check how well calibrated the models were and thus complement estimated pseudo R2.

References

ACER/CEER. (2014). Annual report on the results of monitoring the internal electricity and natural gas markets (p. 279). Agency for the Cooperation of Energy Regulators, Council of European Energy Regulators. https://www.europarl.europa.eu/meetdocs/2014_2019/documents/itre/dv/acer_market_monitoring_report_2014_/acer_market_monitoring_report_2014_en.pdf. Accessed 29 Jul 2021.

Aldy, J. E., Kotchen, M. J., & Leiserowitz, A. A. (2012). Willingness to pay and political support for a US national clean energy standard. Nature Climate Change, 2(8), 596–599.

Ameli, N., & Brandt, N. (2015). Determinants of households’ investment in energy efficiency and renewables: Evidence from the OECD survey on household environmental behaviour and attitudes. Environmental Research Letters, 10(4), 044015. https://doi.org/10.1088/1748-9326/10/4/044015.

Bawden, T. (2015, September 2). Big Six energy companies have “quietly abandoned their green electricity tariffs.” The Independent. https://www.independent.co.uk/environment/climate-change/big-six-energy-companies-have-quietly-abandoned-their-green-electricity-tariffs-10481787.html. Accessed 29 Jul 2021.

Bechberger, M., & Reiche, D. (2004). Renewable energy policy in Germany: Pioneering and exemplary regulations. Energy for Sustainable Development, 8(1), 47–57.

Beckman, J., & Xiarchos, I. (2013). Why are Californian farmers adopting more (and larger) renewable energy operations? Renewable Energy, 55, 322–330.

BEIS. (2020a). Collection: Renewables statistics. Department for Business, Energy & Industrial Strategy. https://www.gov.uk/government/collections/renewables-statistics#methodology. Accessed 29 Jul 2021.

BEIS. (2020b). Digest of UK energy statistics: Renewable sources of energy. Chapter 6. Department for Business, Energy & Industrial Strategy. https://www.gov.uk/government/statistics/renewable-sources-of-energy-chapter-6-digest-of-united-kingdom-energy-statistics-dukes. Accessed 29 Jul 2021.

Bertsch, V., Hall, M., Weinhardt, C., & Fichtner, W. (2016). Public acceptance and preferences related to renewable energy and grid expansion policy: Empirical insights for Germany. Energy, 114, 465–477.

Bird, L., Wüstenhagen, R., & Aabakken, J. (2002). A review of international green power markets: Recent experience, trends, and market drivers. Renewable and Sustainable Energy Reviews, 6(6), 513–536.

Bollino, C. A. (2009). The willingness to pay for renewable energy sources: The case of Italy with socio-demographic determinants. The Energy Journal, 30(2), 81–96.

Bolton, R., Foxon, T., & Hall, S. (2016). Energy transitions and uncertainty: Creating low carbon investment opportunities in the UK electricity sector. Environment and Planning C: Government and Policy, 34(8), 1387–1403.

Brown, C., & Krishna, A. (2004). The Skeptical Shopper: A Metacognitive Account for the Effects of Default Options on Choice. Journal of Consumer Research, 31(3), 529–539.

Camerer, C., Issacharoff, S., Loewenstein, G., O’Donoghue, T., & Rabin, M. (2003). Regulation for conservatives: Behavioral economics and the case for “Asymmetric Paternalism.” University of Pennsylvania Law Review, 151(3), 1211–1254.

CarbonBrief. (2014). Trust in energy companies has fallen to near-rock bottom. Why?https://www.carbonbrief.org/trust-in-energy-companies-has-fallen-to-near-rock-bottom-why. Accessed 29 Jul 2021.

Carlsson, F. (2010). Design of stated preference surveys: Is there more to learn from behavioral economics? Environmental and Resource Economics, 46, 167–177.

Citizens Advice. (2015). Trust in the energy sector and billing. Citizens Advice. https://www.citizensadvice.org.uk/global/migrated_documents/corporate/attachment-2%2D%2D-summary-of-energy-trust-polling.pdf. Accessed 29 Jul 2021.

Clee, M., & Wicklund, R. (1980). Consumer behavior and psychological reactance. Journal of Consumer Research, 6(4), 389–405.

Cohen, J. (1988). Statistical power analysis for the behavioral sciences (2nd ed.). Lawrence Erlbaum Associates.

Cohen, J. (1992). A power primer. Psychological Bulletin, 112(1), 155–159.

Cowell, R., Ellis, G., Sherry-Brennan, F., Strachan, P., & Toke, D. (2017). Rescaling the governance of renewable energy: Lessons from the UK devolution experience. Journal of Environmental Policy & Planning, 19(5), 480–502.

Dale, L., Milborrow, D., Slark, R., & Strbac, G. (2004). Total cost estimates for large-scale wind scenarios in UK. Energy Policy, 32(17), 1949–1956.

Diaz-Rainey, I., & Ashton, J. K. (2008). Stuck between a ROC and a hard place? Barriers to the take up of green energy in the UK. Energy Policy, 36(8), 3053–3061.

Dinner, I., Johnson, E. J., Goldstein, D. G., & Liu, K. (2011). Partitioning default effects: Why people choose not to choose. Journal of Experimental Psychology: Applied, 17(4), 332-341.

Ebeling, F., & Lotz, S. (2015). Domestic uptake of green energy promoted by opt-out tariffs. Nature Climate Change, 5(9), 868–871.

Edelmenan Trust. (2014). Energy—Edelman Trust Barometer. https://www.slideshare.net/Edelman_UK/energy-trust-barometer-2014?related=4. Accessed 29 Jul 2021.

Fudge, S., Peters, M., & Woodman, B. (2016). Local authorities as niche actors: The case of energy governance in the UK. Environmental Innovation and Societal Transitions, 18, 1–17.

Gandhi, R., Knittel, C., Pedro, P., & Wolfram, C. (2016). Running randomized field experiments for energy efficiency programs: A practitioner’s guide. Economics of Energy & Environmental Policy, 5(2), 7–26.

Gerpott, T., & Mahmudova, I. (2010). Determinants of green electricity adoption among residential customers in Germany. International Journal of Consumer Studies, 34(4), 464–473.

Ghesla, C. (2017). Behavioral economics and public policy: The case of green electricity defaults (Doctoral Thesis, ETH Zurich).

Gifford, R., & Nilsson, A. (2014). Personal and social factors that influence pro-environmental concern and behaviour: A review. International Journal of Psychology, 49(3), 141–157.

Graham, V. (2006). Reality or rhetoric? Green tariffs for domestic consumers. National Consumer Council. http://www.vision21.org.uk/userfiles/green-tariffs.pdf. Accessed 29 Jul 2021.

Hagmann, D., Ho, E., & Loewenstein, G. (2019). Nudging out support for a carbon tax. Nature Climate Change, 9(6), 484–489.

Halpern, D. (2015). Inside the Nudge Unit: How small changes can make a big difference. WH Allen.

Hanemann, M., Labandeira, X., & Loureiro, M. L. (2011). Climate change, energy and social preferences on policies: Exploratory evidence for Spain. Climate Research, 48(2–3), 343–348.

Hast, A., Syri, S., Jokiniemi, J., Huuskonen, M., & Cross, S. (2015). Review of green electricity products in the United Kingdom, Germany and Finland. Renewable and Sustainable Energy Reviews, 42, 1370–1384.

Hedlin, S., & Sunstein, C. R. (2016). Does active choosing promote green energy use? Experimental evidence. Ecology Law Quarterly, 43(1), 107–141.

Hite, D., Duffy, P. A., Slaton, C., & Bransby, D. (2008). Consumer willingness-to-pay for biopower: Results from focus groups. Biomass and Bioenergy, 32(1), 11-17.

Hobman, E. V., & Frederiks, E. R. (2014). Barriers to green electricity subscription in Australia: “Love the environment, love renewable energy … but why should I pay more?”. Energy Research & Social Science, 3, 78–88.

Horton, J., Rand, D., & Zeckhauser, R. (2011). The online laboratory: Conducting experiments in a real labor market. Experimental Economics, 14(3), 399–425.

IEA. (2019). Energy policies of IEA countries. United Kingdom 2019 review. https://www.iea.org/reports/energy-policies-of-iea-countries-united-kingdom-2019-review. Accessed 29 Jul 2021.

Johnson, E., & Goldstein, D. (2003). Do defaults save lives? Science, 302(5649), 1338–1339.

Joshi, Y., & Rahman, Z. (2015). Factors affecting green purchase behaviour and future research directions. International Strategic Management Review, 3(1), 128–143.

Kaenzig, J., Heinzle, S., & Wüstenhagen, R. (2013). Whatever the customer wants, the customer gets? Exploring the gap between consumer preferences and default electricity products in Germany. Energy Policy, 53, 311–322.

Kahneman, D. (2003). Maps of bounded rationality: Psychology for behavioral economics. American Economic Review, 93(5), 1449–1475.

Kahneman, D., Knetsch, J., & Thaler, R. (1991). Anomalies: The endowment effect, loss aversion, and status quo bias. The Journal of Economic Perspectives, 5(1), 193–206.

Kaiser, M., Bernauer, M., Sunstein, C. R., & Reisch, L. A. (2020). The power of green defaults: The impact of regional variation of opt-out tariffs on green energy demand in Germany. Ecological Economics, 174, 106685. https://doi.org/10.1016/j.ecolecon.2020.106685.

Kalkbrenner, B., & Roosen, J. (2016). Citizens’ willingness to participate in local renewable energy projects: The role of community and trust in Germany. Energy Research & Social Science, 13, 60–70.

Kern, F., Kuzemko, C., & Mitchell, C. (2014). Measuring and explaining policy paradigm change: The case of UK energy policy. Policy & Politics, 42(4), 513–530.

Kim, J., Park, J., Kim, H., & Heo, E. (2012). Assessment of Korean customers’ willingness to pay with RPS. Renewable and Sustainable Energy Reviews, 16(1), 695–703.

Kosenius, A.-K., & Ollikainen, M. (2013). Valuation of environmental and societal trade-offs of renewable energy sources. Energy Policy, 62, 1148–1156.

Kyllonen, P. C., & Zu, J. (2016). Use of response time for measuring cognitive ability. Journal of Intelligence, 4(4), 1-29. https://doi.org/10.3390/jintelligence4040014.

Laird, F., & Stefes, C. (2009). The diverging paths of German and United States policies for renewable energy: Sources of difference. Energy Policy, 37(7), 2619–2629.

Lenzner, T., Kaczmirek, L., & Lenzner, A. (2010). Cognitive burden of survey questions and response times: A psycholinguistic experiment. Applied Cognitive Psychology, 24(7), 1003–1020.

List, J. (2003). Does market experience eliminate market anomalies? The Quarterly Journal of Economics, 118(1), 41–71.

Littlechild, S. (2019). Promoting competition and protecting customers? Regulation of the GB retail energy market 2008–2016. Journal of Regulatory Economics, 55, 107–139.

Loewenstein, G., Sunstein, C., & Golman, R. (2014). Disclosure: Psychology changes everything. Annual Review of Economics, 6(1), 391–419.

Löfgren, Å., Martinsson, P., Hennlock, M., & Sterner, T. (2012). Are experienced people affected by a pre-set default option—Results from a field experiment. Journal of Environmental Economics and Management, 63(1), 66–72.

Longo, A., Markandya, A., & Petrucci, M. (2008). The internalization of externalities in the production of electricity: Willingness to pay for the attributes of a policy for renewable energy. Ecological Economics, 67(1), 140–152.

Marshall, H., & Drieschová, A. (2018). Post-truth politics in the UK’s Brexit referendum. New Perspectives. Interdisciplinary Journal of Central & East European Politics and International Relations, 26(3), 89–105.

Momsen, K., & Stoerk, T. (2014). From intention to action: Can nudges help consumers to choose renewable energy? Energy Policy, 74, 376–382.

Mozumder, P., Vásquez, W., & Marathe, A. (2011). Consumers’ preference for renewable energy in the southwest USA. Energy Economics, 33(6), 1119–1126.

Mundaca, L., Busch, H., & Schwer, S. (2018). ‘Successful’ low-carbon energy transitions at the community level? An energy justice perspective. Applied Energy, 218, 292–303.

Newbery, D. M. (2016). Towards a green energy economy? The EU Energy Union’s transition to a low-carbon zero subsidy electricity system—Lessons from the UK’s Electricity Market Reform. Applied Energy, 179, 1321–1330.

Newton, K., Stolle, D., & Zmerli, S. (2018). Social and political trust. In E. M. Uslaner (Ed.), The Oxford Handbook of Social and Political Trust (pp. 37–56). Oxford University Press.

OFGEM. (2014a) Simpler energy tariffs. Office of Gas and Electricity Markets. https://www.ofgem.gov.uk/publications-and-updates/simpler-energy-tariffs. Accessed 29 Jul 2021.

OFGEM. (2014b). Green tariffs: Additionality and messaging. Office of Gas and Electricity Markets. https://www.ofgem.gov.uk/ofgem-publications/88451/gtmessagingsummaryfinal-pdf. Accessed 29 Jul 2021.

OFGEM. (2019). State of the energy market. Office of Gas and Electricity Markets. https://www.ofgem.gov.uk/system/files/docs/2019/11/20191030_state_of_energy_market_revised.pdf. Accessed 29 Jul 2021.

OFGEM. (2020a). Outcome of review into whether conditions are in place for effective competition in domestic supply contracts. Office of Gas and Electricity Markets. https://www.ofgem.gov.uk/system/files/docs/2020/08/cfec_review_final_publication_1.pdf. Accessed 29 Jul 2021.

OFGEM. (2020b). OFGEM consumer survey 2019. Office of Gas and Electricity Markets. https://www.ofgem.gov.uk/system/files/docs/2020/02/2019_consumer_survey_report_0.pdf. Accessed 29 Jul 2021.

OFGEM. (2021a). Electricity supply market shares by company: Domestic (GB). Office of Gas and Electricity Markets. https://www.ofgem.gov.uk/data-portal/electricity-supply-market-shares-company-domestic-gb. Accessed 29 Jul 2021.

OFGEM. (2021b). Number of active domestic suppliers by fuel type (GB). Office of Gas and Electricity Markets. https://www.ofgem.gov.uk/data-portal/number-active-domestic-suppliers-fuel-type-gb. Accessed 29 Jul 2021.

OFGEM. (2021c). Default tariff. Office of Gas and Electricity Markets. https://www.ofgem.gov.uk/key-term-explained/default-tariff. Accessed 29 Jul 2021.

ONS. (2013). 2011 Census statistics. Office for National Statistics. https://www.ons.gov.uk/census/2011census. Accessed 29 Jul 2021.

ONS. (2018). Household disposable income and inequality in the UK: Financial year ending 2017. Office for National Statistics. https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances. Accessed 29 Jul 2021.

Pichert, D., & Katsikopoulos, K. (2008). Green defaults: Information presentation and pro-environmental behaviour. Journal of Environmental Psychology, 28(1), 63–73.

Reisch, L., & Sunstein, C. (2016). Do Europeans like nudges? Judgment and Decision making, 11(4), 310–325.

Reisch, L., & Zhao, M. (2017). Behavioural economics, consumer behaviour and consumer policy: State of the art. Behavioural Public Policy, 1(2), 190–206.

Rommel, J., Sagebiel, J., & Müller, J. R. (2016). Quality uncertainty and the market for renewable energy: Evidence from German consumers. Renewable Energy, 94, 106–113.

Sardianou, E., & Genoudi, P. (2013). Which factors affect the willingness of consumers to adopt renewable energies? Renewable Energy, 57, 1–4.

Schubert, C. (2017). Green nudges: Do they work? Are they ethical? Ecological Economics, 132, 329–342.

Simpson, G., & Clifton, J. (2014). Picking winners and policy uncertainty: Stakeholder perceptions of Australia’s Renewable Energy Target. Renewable Energy, 67, 128–135.

Sundt, S., & Rehdanz, K. (2015). Consumers’ willingness to pay for green electricity: A meta-analysis of the literature. Energy Economics, 51, 1–58.

Sunstein, C. (2015). Nudging and choice architecture: Ethical considerations. Yale Journal on Regulation, 32, 413-450.

Sunstein, C., & Reisch, L. (2013). Green by default. Kyklos, 66(3), 398–402.

Sunstein, C., & Reisch, L. (2014). Automatically green: Behavioral economics and environmental protection. Harvard Environmental Law Review, 38(1), 127–158.

Thaler, R. (2015). Misbehaving: The making of behavioral economics. Norton.

Tversky, A., & Kahneman, D. (1991). Loss aversion in riskless choice: A reference-dependent model. The Quarterly Journal of Economics, 106(4), 1039–1061.

Tversky, A., Slovic, P., & Kahneman, D. (1990). The causes of preference reversal. The American Economic Review, 80(1), 204–217.

Vetter, M., & Kutzner, F. (2016). Nudge me if you can—How defaults and attitude strength interact to change behavior. Comprehensive Results in Social Psychology, 1(1–3), 8–34.

Walsh, G., Dinnie, K., & Wiedmann, K.-P. (2006). How do corporate reputation and customer satisfaction impact customer defection? A study of private energy customers in Germany. The Journal of Services Marketing, 20(6), 412-420. https://doi.org/10.1108/08876040610691301.

Which? (2013). Consumer trust in the energy industry hits new low. https://press.which.co.uk/whichpressreleases/consumer-trust-in-the-energy-industry-hits-new-low/. Accessed 29 Jul 2021.

Wright, P. (2002). Marketplace metacognition and social intelligence. Journal of Consumer Research, 28(4), 677–682.

Wüstenhagen, R., & Bilharz, M. (2006). Green energy market development in Germany: Effective public policy and emerging customer demand. Energy Policy, 34(13), 1681–1696.

Zarnikau, J. (2003). Consumer demand for ‘green power’ and energy efficiency. Energy Policy, 31(15), 1661–1672.

Zoellner, J., Schweizer-Ries, P., & Wemheuer, C. (2008). Public acceptance of renewable energies: Results from case studies in Germany. Energy Policy, 36(11), 4136–4141.

Acknowledgements

The authors gratefully acknowledge research funding from the Swedish Energy Agency (grant 38263-1). The authors also want to thank the reviewers and the editor for providing very constructive comments.

Funding

Open access funding provided by Lund University.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Online lab experiment

Electricity tariffs and purchase preferences in the UK

This survey aims to collect data on consumer behaviour and electricity tariff choices in the UK. All responses are anonymous.

Thank you for your participation!

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Mundaca, L., Moncreiff, H. New Perspectives on Green Energy Defaults. J Consum Policy 44, 357–383 (2021). https://doi.org/10.1007/s10603-021-09492-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10603-021-09492-2