Abstract

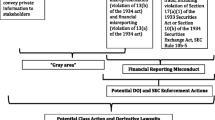

The rising tide of corporate scandals and audit failures has shocked the public, and the integrity of auditors is being increasingly questioned. It is crucial for auditors and regulators to understand the main causes of audit failure and devise preventive measures accordingly. This study analyzes enforcement actions issued by the China Securities Regulatory Commission against auditors in respect of fraudulent financial reporting committed by listed companies in China. We find that auditors are more likely to be sanctioned by the regulators for failing to detect and report material misstatement frauds rather than disclosure frauds. Further analysis of the material misstatements indicates that auditors are more likely to be sanctioned for failing to detect and report revenue-related frauds rather than assets-related frauds. In sum, our results suggest that regulators believe auditors have the responsibility to detect and report frauds that are egregious, transaction-based, and related to accounting earnings. The results contribute to our knowledge of auditors’ responsibilities for detecting frauds as perceived by regulators.

Similar content being viewed by others

References

J. Aharony C. W. Lee T. J. Wong (2000) ArticleTitle‘Financial Packaging of IPO Firms in China’ Journal of Accounting Research 38 103–426

American Institute of Certified Public Accountants (AICPA): 2005, ‘Consideration of Fraud in a Financial Statement Audit’, SAS (Statement on Auditing Standards) 82, AICPA, Codification of Statements on Auditing Standards, AU sec. 316.

M. D. Beneish (1999) ArticleTitleThe Detection of Earnings Manipulation Financial Analysts Journal 55 IssueID5 24–36

S. E. Bonner Z. Palmrose S. M. Young (1998) ArticleTitleFraud Type and Auditor Litigation: An Analysis of SEC Accounting and Auditing Enforcement Releases The Accounting Review 73 IssueID4 503–532

M. Brewster (2003) Unaccountable: How the Accounting Profession Forfeited a Public Trust John Wiley & Sons Hoboken, NJ

J. V. Carcello Z. Palmrose (1994) ArticleTitleAuditor Litigation and Modified Reporting on Bankrupt Clients Journal of Accounting Research 32 IssueIDSupplement 1–30

K. H. Chan P. Mo (1998) ArticleTitleOwnership effects on Audit-Detected Error Characteristics: An Empirical Study in An Emerging Economy The International Journal of Accounting 33 IssueID2 235–261

K. C. W. Chen H. Yuan (2004) ArticleTitleEarnings Management and Capital Resource Allocation: Evidence from China’s Accounting-Based Regulation of Right Issues The Accounting Review 79 IssueID3 645–665

J. P. Chen S. Chen X. Su (2001) ArticleTitleProfitability Regulation, Earnings Management, and Modified Audit Opinions: Evidence from China Auditing: A Journal of Practice & Theory 20 IssueID2 9–30 Occurrence Handle10.2308/aud.2001.20.2.9

L. E. DeAngelo (1981) ArticleTitleAuditor Size and Audit Quality Journal of Accounting and Economics 3 IssueID3 183–199 Occurrence Handle10.1016/0165-4101(81)90002-1

P. M. DeChow R. G. Sloan A. P. Sweeney (1996) ArticleTitleCauses and Consequences of Earnings Manipulation: An Analysis of Firms Subject to Enforcement Actions by the SEC Contemporary Accounting Research 13 IssueID1 1–36 Occurrence Handle10.1111/j.1911-3846.1996.tb00489.x

M. L. DeFond T. J. Wong S. Li (2000) ArticleTitleThe Impact of Improved Auditor Independence on Audit Market Concentration in China Journal of Accounting and Economics 28 IssueID3 269–305

J. P. H. Fan T. J. Wong (2005) ArticleTitleDo External Auditors Perform a Corporate Governance Role in Emerging Markets? Evidence from East Asia Journal of Accounting Research 43 35–72 Occurrence Handle10.1111/j.1475-679x.2004.00162.x

E. H. Feroz M. K. Taek V. S. Pastena K. Park (2000) ArticleTitleThe Efficacy of Red Flags in Predicting the SEC’s Targets: An Artificial Neural Networks Approach International Journal of Intelligent Systems in Accounting, Finance, and Management 9 IssueID3 145–157

E. H. Feroz K. Park V. S. Pastena (1991) ArticleTitleThe Financial and Market Effects of the SEC’s Accounting and Auditing Enforcement Releases Journal of Accounting Research 29 IssueIDSupplement 107–142

A. Gaeremynck M. Willekens (2003) ArticleTitleThe Endogenous Relationship between Audit-report Type and Business Termination: Evidence on Private Firms in a Non-litigious Environment Accounting and Business Research 33 IssueID1 65–79

InstitutionalAuthorNameInternational Monetary Fund (IMF) (2005) World Economic Outlook IMF Washington D.C.

W. R. Kinney R. D. Martin (1994) ArticleTitleDoes Auditing Reduce Bias in Financial Reporting? A Review of Audit-Related Adjustment Studies Auditing: A Journal of Practice & Theory 13 IssueID1 149–155

L. Kren (2005) ArticleTitleShould US. Manufacturers Fear China? Machine Design 77 IssueID10 110

N. Li (2002) ArticleTitleIndependent Audit is an External Protection of Fictitious Accounting The SICPA Journal 1 28–30

R. Li H. He (2000) ArticleTitleAn Analysis of the Development and Current Situation of the Civil Legal Liabilities of CPAs in China China Accounting and Finance Review 2 IssueID1 104–120

K. Z. Lin K. H. Chan (2000) ArticleTitleAuditing Standards in China: A Comparative Analysis with Relevant International Standards and Guidelines The International Journal of Accounting 35 IssueID4 559–577 Occurrence Handle10.1016/S0020-7063(00)00079-0

J. K. Loebbecke M. M. Eining J. J. Willingham (1989) ArticleTitle`Auditors' experience with Material Irregularities: Frequency, Nature, and Detectability Auditing: A Journal of Practice & Theory 9 IssueID1 1–28

InstitutionalAuthorNameNational Accounting Institute (NAI) United Research Program (2003) ArticleTitleNo Fictitious Records and Accounting Integrity The Accounting Research 1 31–38

Z. Palmrose S. Scholz (2004) ArticleTitleThe Circumstances and Legal Consequences of Non-GAAP Reporting: Evidence from Restatements Contemporary Accounting Research 21 IssueID1 139–180

T. P. Rollins W. G. Bremser (1997) ArticleTitleThe SEC’s Enforcement Actions against Auditors: An Auditor Reputation and Institutional Theory Perspective Critical Perspectives on Accounting 8 IssueID3 191–206 Occurrence Handle10.1006/cpac.1996.0106

R. L. Rosner (2003) ArticleTitleEarnings Manipulation in Failing Firms Contemporary Accounting Research 20 IssueID2 361–408 Occurrence Handle10.1506/8EVN-9KRB-3AE4-EE81

R. Sack A. Barr J. C. Burton C. Sampson (1988) ArticleTitleA Journal Roundtable Discussion: Frank Talk from Former SEC Chief Accountants Journal of Accountancy 166 IssueID6 76–84

G. J. Stabus (2005) ArticleTitleEthics Failures in Corporate Financial Reporting Journal of Business Ethics 57 5–15

Q. Tang C. W. Chow A. Lau (1999) ArticleTitleAuditing of State-Owed Enterprises in China: Historic Development, Current Practice and Emerging Issues The International Journal of Accounting 34 IssueID2 173–187 Occurrence Handle10.1016/S0020-7063(99)00008-4

Y. Wu (2002) ArticleTitleThe Falsification Method of Enterprise' Accounting Reports and Corresponding Audit Approach The CICPA Journal 6 46–47

J. Z. Xiao Y. Zhang Z. Xie (2000) ArticleTitleThe Making of Independent Auditing Standards in China Accounting Horizons 14 IssueID1 69–89

Y. Xuan (2002) ArticleTitleWhy Did CPAs Involve in Listed Companies Falsification Whirlpool The CICPA Journal 2 24–26

L. Yang Q. Tang A. Kilgore Y. H. Jiang (2001) ArticleTitleAuditor-Government Associations and Auditor Independence in China British Accounting Review 33 IssueID2 175–189 Occurrence Handle10.1006/bare.2001.0162

X. Yang (2002) ArticleTitleThe Rational Thinking of Integrity of Accounting The Accounting Research 3 6–12

L. Zhang Z. Wang (2003) ArticleTitleArrangement Changes in U.S. Auditing Standards on Fraud and Enlightenment The Accounting Research 4 61–64

Q. Zhou Y. Lin (2003) ArticleTitleAnalysis of Accounting Issues in the Annual Reports 2002 of Listed Companies Traded on the Shanghai Stock Exchange The Accounting Research 8 14–18

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Firth, M., Mo, P.L.L. & Wong, R.M.K. Financial Statement Frauds and Auditor Sanctions: An Analysis of Enforcement Actions in China. J Bus Ethics 62, 367–381 (2005). https://doi.org/10.1007/s10551-005-0542-4

Issue Date:

DOI: https://doi.org/10.1007/s10551-005-0542-4