Abstract

Family firms and business groups play an important role in many emerging economies. In this paper we study how different aspects of family involvement influence technological innovation in a firm. Arguments drawn from agency theory and particularly the principal-principal agency hypothesize a negative influence of family involvement with respect to technological innovation. In contrast, stewardship theory predicts a positive influence of family involvement on technological innovation. Drawing on these theoretical lenses with contrasting directionalities with regard to the impact of family involvement on technological innovation, we study how family involvement in ownership, management and board of directors, and business group affiliation influence R&D investments and patents obtained by the firm. The hypotheses are empirically tested on a seven-year panel of 172 firms from the pharmaceutical industry in India. Our results indicate that family shareholding and family control over both CEO and chairperson positions have a positive and significant influence on the firm’s R&D investments, broadly lending support to stewardship theory. We also find a positive influence of business group affiliation on R&D investments and patents applied by the firm. Our conjecture is that the high technology opportunity environment in the Indian pharmaceutical industry facilitates stewardship behavior which in turn promotes innovation in these firms.

Similar content being viewed by others

Notes

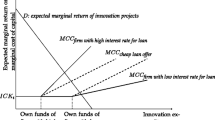

David et al. (2008) classified debt contracts into two types: transactional debt that has simple performance attributes and a fixed time period, whereas relational debt tends to have an extended duration and more complex performance attributes.

http://www.pharmaceutical-drug-manufacturers.com/pharmaceutical-industry/ (accessed Dec. 11, 2011).

www.nstmis-dst.org/PDF/FINALRnDStatisticsataGlance2011121.pdf (accessed Dec. 26, 2013).

http://www.ipindia.nic.in/ipirs1/patentsearch.htm (accessed Dec. 26, 2013).

http://www.bseindia.com/ (accessed Sep. 9, 2014).

PCT makes it easier for companies to file patents in many countries simultaneously. Under this treaty, patent applications are first filed in a national contracting office, where search for prior art is performed and results are reported. However, patents cannot be given through PCT; hence companies have to subsequently file for patents individually at different national and regional offices. International patent application through PCT reduces considerable cost and time in repetitive search and preliminary examination at different national and regional patent offices (http://www.wipo.int/pct/en/treaty/about.html, accessed Sep. 9, 2014).

“Failures and doubting investors have not dissuaded Glenmark Pharma’s Glenn Saldanha” http://articles.economictimes.indiatimes.com/2011-05-22/news/29571304_1_biologics-research-targets-poker (accessed Sep. 9, 2014).

According to Cappelli et al. (2010), “The India Way” of management had its foundations in the 1991 economic reforms in India. The authors noted some of the following behavior common among many of the Indian firms. Indian firms built a culture of family among the workforce; taking care of the employees and their families, and providing empowerment and resources to carry out their responsibilities (Cappelli et al., 2010: 50). This was reciprocated by employees, through higher level of commitment and trust in the organization. The executives offered employees a long term vision—like that of reaching customers with new products or services, or lifting large sections out of poverty—rather than focusing on higher financial growth that is seen in some Western firms (Cappelli et al., 2010: 96). Indian firms were also found to be much more open to failures. Managers focused on developing creativity and entrepreneur behavior in organizations and were comfortable with failure of projects and provided some leeway for errors and learning in decision making (Cappelli et al., 2010: 125).

We thank an anonymous reviewer for these inputs.

References

Acemoglu, D., & Robinson, J. 2012. Why nations fail: The origins of power, prosperity, and poverty. New York: Crown Business.

Aghion, P., & Howitt, P. 1992. A model of growth through creative destruction. Econometrica, 60(2): 323–351.

Ahlstrom, D. 2010. Innovation and growth: How business contributes to society. Academy of Management Perspectives, 24(3): 10–23.

Ahlstrom, D., & Ding, Z. 2014. Entrepreneurship in China: An overview. International Small Business Journal, 32(6): 610–618.

Ahuja, G., Lampert, C. M., & Tandon, V. 2008. Chapter 1: Moving beyond Schumpeter: Management research on the determinants of technological innovation. Academy of Management Annals, 2(1): 1–98.

Anderson, R. C., & Reeb, D. M. 2003. Founding-family ownership and firm performance: Evidence from the S&P 500. Journal of Finance, 58(3): 1301–1328.

Anderson, R. C., & Reeb, D. M. 2004. Board composition: Balancing family influence in S&P 500 firms. Administrative Science Quarterly, 49(2): 209–237.

Arora, A., Branstetter, L., & Chatterjee, C. 2008. Strong medicine: Patent reform and the emergence of a research-driven pharmaceutical industry in India. Presented at the NBER Conference on Location of Biopharmaceutical Activity, Boston (pp. 7–8).

Balasubramanian, N., & Lee, J. 2008. Firm age and innovation. Industrial and Corporate Change, 17(5): 1019.

Baliga, B. R., Moyer, R. C., & Rao, R. S. 1996. CEO duality and firm performance: What’s the fuss?. Strategic Management Journal, 17(1): 41–53.

Barsade, S. G. 2002. The ripple effect: Emotional contagion and its influence on group behavior. Administrative Science Quarterly, 47(4): 644–675.

Baysinger, B. D., Kosnik, R. D., & Turk, T. A. 1991. Effects of board and ownership structure on corporate R&D strategy. Academy of Management Journal, 34(1): 205–214.

Blomqvist, K., KylaKheiko, K., & Virolainen, V.-M. 2002. Filling a gap in traditional transaction cost economics: Towards transaction benefits-based analysis. International Journal of Production Economics, 79(Sept.): 1–14.

Bushee, B. J. 1998. The influence of institutional investors on myopic R&D investment behavior. Accounting Review, 73(3): 305–333.

Cameron, K. S., Whetten, D. A., & Kim, M. U. 1987. Organizational dysfunctions of decline. Academy of Management Journal, 30(1): 126–138.

Cappelli, P., Singh, H., Singh, J., & Useem, M. 2010. The India way: How India’s top business leaders are revolutionizing management. Boston: Harvard Business Press.

Chang, S. J., & Hong, J. 2000. Economic performance of group-affiliated companies in Korea: Intragroup resource sharing and internal business transactions. Academy of Management Journal, 43(3): 429–448.

Chari, M. D., & Banalieva, E. R. 2015. How do pro-market reforms impact firm profitability? The case of India under reform. Journal of World Business, 50(2): 357–367.

Chaudhuri, S. 2005. The WTO and India’s pharmaceuticals industry: Patent protection, TRIPS, and developing countries. New York: Oxford University Press.

Chaudhuri, P., & Khanna, T. 2014. Toward resource independence—Why state-owned entities become multinationals: An empirical study of India’s public R&D laboratories. Journal of International Business Studies, 45(8): 943–960.

Chen, H. L., & Hsu, W. T. 2009. Family ownership, board independence, and R&D investment. Family Business Review, 22(4): 347–362.

Chen, V. Z., Li, J., & Shapiro, D. M. 2011. Are OECD-prescribed “good corporate governance practices” really good in an emerging economy?. Asia Pacific Journal of Management, 28(1): 115–138.

Chen, Y. Y., & Young, M. N. 2010. Cross-border mergers and acquisitions by Chinese listed companies: A principal–principal perspective. Asia Pacific Journal of Management, 27(3): 523–539.

Chittoor, R., Ray, S., Aulakh, P. S., & Sarkar, M. 2008. Strategic responses to institutional changes: Indigenous growth model of the Indian pharmaceutical industry. Journal of International Management, 14(3): 252–269.

Choi, S. B., Lee, S. H., & Williams, C. 2011. Ownership and firm innovation in a transition economy: Evidence from China. Research Policy, 40(3): 441–452.

Cohen, W. M., & Levin, R. C. 1989. Empirical studies of innovation and market structure. In R. Schmalensee & R. Willig (Eds.). Handbook of industrial organization, Vol. 2: 1059–1107. Amsterdam: Elsevier.

Connelly, B. L., Hoskisson, R. E., Tihanyi, L., & Certo, S. T. 2010. Ownership as a form of corporate governance. Journal of Management Studies, 47(8): 1561–1589.

Corbetta, G., & Salvato, C. 2004. Self serving or self actualizing? Models of man and agency costs in different types of family firms: A commentary on “Comparing the agency costs of family and non family firms: Conceptual issues and exploratory evidence”. Entrepreneurship: Theory and Practice, 28(4): 355–362.

Dalton, D. R., Daily, C. M., Certo, S. T., & Roengpitya, R. 2003. Meta-analyses of financial performance and equity: Fusion or confusion?. Academy of Management Journal, 46(1): 13–26.

Dalton, D. R., Daily, C. M., Ellstrand, A. E., & Johnson, J. L. 1998. Meta analytic reviews of board composition, leadership structure, and financial performance. Strategic Management Journal, 19(3): 269–290.

Dalton, D. R., Hitt, M., Certo, S., & Dalton, C. 2007. The fundamental agency problem and its mitigation: Independence, equity, and the market for corporate control. Academy of Management Annals, 1: 1–64.

David, P., Hitt, M. A., & Gimeno, J. 2001. The influence of activism by institutional investors on R&D. Academy of Management Journal, 44(1): 144–157.

David, P., O’Brien, J. P., & Yoshikawa, T. 2008. The implications of debt heterogeneity for R&D investment and firm performance. Academy of Management Journal, 51(1): 165–181.

David, P., O’Brien, J. P., Yoshikawa, T., & Delios, A. 2010. Do shareholders or stakeholders appropriate the rents from corporate diversification? The influence of ownership structure. Academy of Management Journal, 53(3): 636–654.

Davis, J. H., Schoorman, F. D., & Donaldson, L. 1997. Toward a stewardship theory of management. Academy of Management Review, 22(1): 20–47.

De Massis, A., Frattini, F., & Lichtenthaler, U. 2012. Research on technological innovation in family firms: Present debates and future directions. Family Business Review, 26(1): 10–31.

Demsetz, H., & Lehn, K. 1985. The structure of corporate ownership: Causes and consequences. Journal of Political Economy, 93(6): 1155–1177.

Dharwadkar, R., George, G., & Brandes, P. 2000. Privatization in emerging economies: An agency theory perspective. Academy of Management Review, 25(3): 650–669.

Donaldson, L., & Davis, J. H. 1991. Stewardship theory or agency theory: CEO governance and shareholder returns. Australian Journal of Management, 16(1): 49–64.

Eddleston, K. A., Kellermanns, F. W., & Sarathy, R. 2008. Resource configuration in family firms: Linking resources, strategic planning and technological opportunities to performance. Journal of Management Studies, 45(1): 26–50.

Fama, E. F., & Jensen, M. C. 1983. Separation of ownership and control. Journal of Law and Economics, 26: 301.

Gedajlovic, E., Carney, M., Chrisman, J. J., & Kellermanns, F. W. 2012. The adolescence of family firm research taking stock and planning for the future. Journal of Management, 38(4): 1010–1037.

Gomez-Mejia, L. R., Cruz, C., Berrone, P., & De Castro, J. 2011. The bind that ties: Socioemotional wealth preservation in family firms. Academy of Management Annals, 5: 653–707.

Greene, W. H. 2003. Econometric analysis. Upper Saddle River: Prentice Hall.

Greene, W. 2007. The emergence of India’s pharmaceutical industry and implications for the US generic drug market. Working paper, US International Trade Commission, Office of Economics, Washington, DC.

Gulati, R. 1995. Does familiarity breed trust? The implications of repeated ties for contractual choice in alliances. Academy of Management Journal, 38(1): 85–112.

Habbershon, T. G., & Williams, M. L. 1999. A resource-based framework for assessing the strategic advantages of family firms. Family Business Review, 12(1): 1–25.

Hijdraa, A., Woltjer, J., & Ars, J. 2014. Value creation in capital waterway projects: Application of a transaction cost and transaction benefit framework for the Miami River and the New Orleans Inner Harbour Navigation Canal. Land Use Policy, 38: 91–103.

Hoskisson, R. E., Eden, L., Lau, C. M., & Wright, M. 2000. Strategy in emerging economies. Academy of Management Journal, 43(3): 249–267.

Hoskisson, R. E., Hitt, M. A., Johnson, R. A., & Grossman, W. 2002. Conflicting voices: The effects of institutional ownership heterogeneity and internal governance on corporate innovation strategies. Academy of Management Journal, 45(4): 697–716.

Iyengar, R. J., & Zampelli, E. M. 2009. Self selection, endogeneity, and the relationship between CEO duality and firm performance. Strategic Management Journal, 30(10): 1092–1112.

Jain, S., & Sharma, D. 2013. Institutional logic migration and industry evolution in emerging economies: The case of telephony in India. Strategic Entrepreneurship Journal, 7(3): 252–271.

Jensen, M. C., & Meckling, W. H. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4): 305–360.

Jiang, Y., & Peng, M. W. 2011. Are family ownership and control in large firms good, bad, or irrelevant?. Asia Pacific Journal of Management, 28(1): 15–39.

Johnson, S., La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. 2000. Tunneling. American Economic Review, 90(2): 22–27.

Kennedy, P. 1998. A guide to econometrics. Cambridge: MIT Press.

Khanna, T., & Palepu, K. 1997. Why focused strategies may be wrong for emerging markets. Harvard Business Review, 75(4): 41–51.

Khanna, T., & Palepu, K. 2000. Is group affiliation profitable in emerging markets? An analysis of diversified Indian business groups. Journal of Finance, 55(2): 867–891.

Kochhar, R., & David, P. 1996. Institutional investors and firm innovation: A test of competing hypotheses. Strategic Management Journal, 17(1): 73–84.

Kor, Y. Y. 2006. Direct and interaction effects of top management team and board compositions on R&D investment strategy. Strategic Management Journal, 27(11): 1081–1099.

Krishnan, R. T. 2003. The evolution of a developing country innovation system during economic liberalization: The case of India. Paper presented at the Globelics Conference, Rio de Janeiro.

Krishnan, R. T. 2010. From jugaad to systematic innovation: The challenge for India. Bangalore: Utpreraka Foundation.

Krug, B., & Hendrischke, H. 2012. Market design in Chinese market places. Asia Pacific Journal of Management, 29(3): 525–546.

Kumar, N., & Aggarwal, A. 2005. Liberalization, outward orientation and in-house R&D activity of multinational and local firms: A quantitative exploration for Indian manufacturing. Research Policy, 34(4): 441–460.

La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. 1999. Corporate ownership around the world. Journal of Finance, 54(2): 471–517.

Laverty, K. J. 1996. Economic “short-termism”: The debate, the unresolved issues, and the implications for management practice and research. Academy of Management Review, 21(3): 825–860.

Le Breton-Miller, I., & Miller, D. 2009. Agency vs. stewardship in public family firms: A social embeddedness reconciliation. Entrepreneurship: Theory and Practice, 33(6): 1169–1191.

Le Breton-Miller, I., Miller, D., & Lester, R. H. 2011. Stewardship or agency? A social embeddedness reconciliation of conduct and performance in public family businesses. Organization Science, 22(3): 704–721.

Li, Y., Chen, H., Liu, Y., & Peng, M. W. 2014. Managerial ties, organizational learning, and opportunity capture: A social capital perspective. Asia Pacific Journal of Management, 31(1): 271–291.

Liu, Y., Ahlstrom, D., & Yeh, K. S. 2006. The separation of ownership and management in Taiwan’s public companies: An empirical study. International Business Review, 15(4): 415–435.

Liu, Y., Wang, L. C., Zhao, L., & Ahlstrom, D. 2013. Board turnover In Taiwan’s public firms: An empirical study. Asia Pacific Journal of Management, 30(4): 1059–1086.

Lu, Y., Au, K., Peng, M. W., & Xu, E. 2013. Strategic management in private and family business. Asia Pacific Journal of Management, 30(3): 633–639.

Mahmood, I. P., & Mitchell, W. 2004. Two faces: Effects of business groups on innovation in emerging economies. Management Science, 50(10): 1348–1365.

Maury, B. 2006. Family ownership and firm performance: Empirical evidence from Western European corporations. Journal of Corporate Finance, 12(2): 321–341.

McCloskey, D. N. 2010. Bourgeois dignity: Why economics can’t explain the modern world. Chicago: University of Chicago Press.

Meyer, K. E., Estrin, S., Bhaumik, S. K., & Peng, M. W. 2009. Institutions, resources, and entry strategies in emerging economies. Strategic Management Journal, 30(1): 61–80.

Miller, D., Le Breton-Miller, I., & Scholnick, B. 2008. Stewardship vs. stagnation: An empirical comparison of small family and non family businesses. Journal of Management Studies, 45(1): 51–78.

Morck, R., & Yeung, B. 2003. Agency problems in large family business groups. Entrepreneurship: Theory and Practice, 27(4): 367–382.

Munari, F., Oriani, R., & Sobrero, M. 2010. The effects of owner identity and external governance systems on R&D investments: A study of Western European firms. Research Policy, 39(8): 1093–1104.

Nair, A., Ahlstrom, D., & Filer, L. 2007. Localized advantage in a global economy: The case of Bangalore. Thunderbird International Business Review, 49(5): 591–618.

Peng, M. W., & Jiang, Y. 2010. Institutions behind family ownership and control in large firms. Journal of Management Studies, 47(2): 253–273.

Ramachandran, J., & Sud, M. 2005. Dr. Reddy’s Laboratories Limited: A road less travelled. IIMB Case Study Series.

Rechner, P. L., & Dalton, D. R. 1991. CEO duality and organizational performance: A longitudinal analysis. Strategic Management Journal, 12(2): 155–160.

Rodrik, D., & Subramanian, A. 2003. The primacy of institutions (and what this does and does not mean). Finance & Development, 40(2): 31–34.

Romer, P. M. 1990. Endogenous technological change. Journal of Political Economy, 98(5): S71–S102.

Sarkar, J., & Sarkar, S. 2000. Large shareholder activism in corporate governance in developing countries: Evidence from India. International Review of Finance, 1(3): 161–194.

Sharma, R. 2012. Breakout nations: In pursuit of the next economic miracles. New York: W.W. Norton.

Shivdasani, A. 1993. Board composition, ownership structure, and hostile takeovers. Journal of Accounting and Economics, 16(1–3): 167–198.

Shleifer, A., & Vishny, R. W. 1997. A survey of corporate governance. Journal of Finance, 52(2): 737–783.

Sirmon, D. G., & Hitt, M. A. 2003. Managing resources: Linking unique resources, management, and wealth creation in family firms. Entrepreneurship: Theory and Practice, 27(4): 339–358.

Smith, K. 2005. Measuring innovation. In J. Fagerberg, D. Mowery, & R. Nelson (Eds.). The Oxford handbook of innovation. Oxford: Oxford University Press.

Su, E., & Carney, M. 2011. Can China’s family firms create intellectual capital?. Asia Pacific Journal of Management, 30(3): 1–19.

Sujit, K. S., & Padhan, P. C. 2012. Business house affiliation and other factors determining R&D intensity in selected Indian firms. Elixir Financial Management, 48: 9446–9456.

Teece, D. J. 1986. Profiting from technological innovation: Implications for integration, collaboration, licensing and public policy. Research Policy, 15(6): 285–305.

Thomsen, S., & Pedersen, T. 2000. Ownership structure and economic performance in the largest European companies. Strategic Management Journal, 21(6): 689–705.

Tihanyi, L., Johnson, R. A., Hoskisson, R. E., & Hitt, M. A. 2003. Institutional ownership differences and international diversification: The effects of boards of directors and technological opportunity. Academy of Management Journal, 46(2): 195–211.

Van den Berghe, L. 2003. Redefining the role and content of corporate governance from the perspective of business in society and corporate social responsibility. In P. K. Cornelius & B. Kogut (Eds.). Corporate governance and capital flows in a global economy: 481–490. Oxford: Oxford University Press.

Villalonga, B., & Amit, R. 2006. How do family ownership, control and management affect firm value?. Journal of Financial Economics, 80(2): 385–417.

Wang, L. C., Ahlstrom, D., Nair, A., & Hang, R. Z. 2008. Creating globally competitive and innovative products: China’s next Olympic challenge. SAM Advanced Management Journal, 73(3): 4–15.

Wang, L., & Judge, W. Q. 2012. Managerial ownership and the role of privatization in transition economies: The case of China. Asia Pacific Journal of Management, 29(2): 479–498.

Young, M. N., Peng, M. W., Ahlstrom, D., Bruton, G. D., & Jiang, Y. 2008. Corporate governance in emerging economies: A review of the principal–principal perspective. Journal of Management Studies, 45(1): 196–220.

Zahra, S. A. 1996. Goverance, ownership, and corporate entrepreneurship: The moderating impact of industry technological opportunities. Academy of Management Journal, 39(6): 1713–1735.

Zahra, S. A. 2010. Harvesting family firms’ organizational social capital: A relational perspective. Journal of Management Studies, 47(2): 345–366.

Zahra, S. A., Hayton, J. C., Neubaum, D. O., Dibrell, C., & Craig, J. 2008. Culture of family commitment and strategic flexibility: The moderating effect of stewardship. Entrepreneurship: Theory and Practice, 32(6): 1035–1054.

Zeng, M., & Williamson, P. 2007. Dragons at your door: How Chinese cost innovation is disrupting global competition. Boston: Harvard Business School Press.

Acknowledgments

A prior version of this paper was presented at the 2012 Academy of Management Conference in Boston. We thank the reviewers and the participants of the conference for their helpful comments and suggestions. We also thank the facilitators of the Paper Development Workshop organized by the BPS division during the 2012 Academy of Management Conference, in particular Naga Lakshmi Damaraju for her comments and suggestions on the paper. We also thank Deepak K. Sinha for his valuable comments. Finally, we thank the anonymous reviewers and the editors of the Asia Pacific Journal of Management for their several useful suggestions and comments which have greatly helped in the development of this paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ashwin, A.S., Krishnan, R.T. & George, R. Family firms in India: family involvement, innovation and agency and stewardship behaviors. Asia Pac J Manag 32, 869–900 (2015). https://doi.org/10.1007/s10490-015-9440-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10490-015-9440-1