Abstract

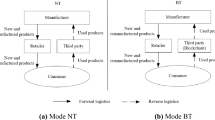

Information asymmetry is particularly common in the supply chain framework. As we know, the downstream retailer usually knows more about the market demand information than the upstream manufacturer because of her proximity to consumers. This paper considers a supply chain that a manufacturer sells products to consumers via a retailer in a local market. Besides, the manufacturer has an option to establish a direct online channel in the overseas market, in which the retailer can sell products as a gray marketer to earn an extra profit. Both markets’ demand information is transparent to the retailer but asymmetric to the manufacturer. There are two side an opposite effects of information sharing on the retailer. The positive effect is that when she withholds demand information she can possess an information advantage. However, the negative effect is that when the retailer shares her private demand information, especially when the manufacturer enters the overseas market, the retailer’s profit may be negatively affected because of the competition. Therefore, whether the retailer has motivation to share her private demand information with the manufacturer is an intriguing yet unanswered question. We first characterize the tradeoff in three supply chain structures, Local Market, Dual Market and Gray Market. Then, we obtain the equilibrium results of each case and find that a co-opetition strategy may arise because of competition when considering gray market and dual-channel. Finally, we uncover the underlying reasons and develop valuable insights.

Similar content being viewed by others

Notes

In our paper, the retailer is authorized to sell in the local market but not authorized in the overseas market. Meanwhile, the premium-brand manufacturer is aware of the gray market action of the retailer. Hence, the role of the retailer in paralleling products to the overseas market is a gray marketer.

Note that this paper focuses on gray market in which the products are mostly luxury goods. Therefore, the uncertain demand may be correlated to some extent which can be explained in several aspects. Firstly, as for population structure, according to a research report about share of middle-class adults in 2015, the share of middle class adults accounts for 39% of the population in North America, 33% in Europe, 15% in Asia-Pacific, 11% in China and Latin America. The rise of the middle class in emerging countries is polarizing the competitive arena, becoming a “new baby-boom sized generation” for luxury brands to target (Stierli 2015). Therefore, the share of middle-class reflects the market size but also the correlation. Secondly, for consumption culture, luxury consumers in China or Japan do not differ from those in the United States, Russia or Australia usually. They use the same brands, have the same discretionary incomes, and wish to fulfil the same needs with luxury products (Husic and Cicic 2009). Hence, the same consumption habit can also reflect demand correlation. Thirdly, for historical sales data, as revealed in the luxury industry research report, the sales growth of luxury goods is 12% in Brazil and Mexico, 7% in China and 20% in Southeast Asia (D’Arpizio 2013). Thus, the demand has a linear correlation to some extent. In general, as demonstrated above, the demand of luxury goods is different from ordinary goods, and the uncertain demand in different markets has certain correlation.

Actually, the manufacturer’s entry decision depends on both the entry cost C and the uncertain demand \(\delta \), where \(\delta \sim U[0,2d]\). Specifically, when the retailer shares demand information, if \(C \le \varphi (0)\), the manufacturer must enter the overseas market no matter what value the uncertain demand \(\delta \) takes. If \(C>\varphi (2d)\), the manufacturer never enters the overseas market no matter what value the uncertain demand \(\delta \) finally takes. While when the entry cost is at a middle level, i.e. \(\varphi (0)<C\le \varphi (2d)\), the manufacturer’s entry decision mainly depends on the uncertain demand \(\delta \). Therefore, the manufacturer may or may not enter the overseas market which we call partial entry. Notably, because the uncertain demand \(\delta \) is a random variable, we then obtain the retailer’s profit by integrating over \(\delta \) when the manufacturer’s entry strategy is partial entry.

It is shown that \(\phi (\theta )=\pi _{R}^{S}(\xi (d))-\pi _{R}^{N}(\xi (d))\) when \(C=\xi (d)\). Therefore, \({\hat{\theta }}\) is related to a, \(\rho \) and d. For the sake of brevity, we set \(a=1\). Then, when the parameter \(\rho \) and d take a high and low value respectively, we find that the threshold \({\hat{\theta }}\) is increasing in \(\rho \) and d respectively as is shown in Fig. 9. Thus, given the uncertain demand correlation coefficient \(\rho \) and the expected uncertain demand d, there is a unique solution to \(\phi (\theta )=0\) and other parameters have no effect on this result.

References

Ahmadi, R., Iravani, F., & Mamani, H. (2015). Coping with gray markets: The impact of market conditions and product characteristics. Production and Operations Management, 24(5), 762–777.

Ahmadi, R., Iravani, F., & Mamani, H. (2017). Supply chain coordination in the presence of gray markets and strategic consumers. Production and Operations Management, 26(2), 252–272.

Ahmadi, R., & Yang, B. R. (2000). Parallel imports: Challenges from unauthorized distribution channels. Marketing Science, 19(3), 279–294.

Amrouche, N., & Yan, R. (2016). A manufacturer distribution issue: How to manage an online and a traditional retailer. Annals of Operations Research, 244(2), 257–294.

Arya, A., & Mittendorf, B. (2013). Discretionary disclosure in the presence of dual distribution channels. Journal of Accounting and Economics, 55(2–3), 168–182.

Autrey, R. L., Bova, F., & Soberman, D. A. (2015). When gray is good: Gray markets and market-creating investments. Production and Operations Management, 24(4), 547–559.

Beckett, J. (2012). A CG manufacturer’s guide to retail data goldmines. https://www.retailvelocity.com/whitepapers/Guide_Goldmines_Demand_Signal_Repository_Impleme ntations.pdf. Retrieved April 15, 2020.

Cai, G., Zhang, Z., & Zhang, M. (2009). Game theoretical perspectives on dual-channel supply chain competition with price discounts and pricing schemes. International Journal of Production Economics, 117(1), 80–06.

Cheng, T. (2005). The impact of information sharing in a two-level supply chain with multiple retailers. Journal of the Operational Research Society, 56(10), 1159–1165.

Chen, Y., Fang, S., & Wen, U. (2013). Pricing policies for substitutable products in a supply chain with Internet and traditional channels. European Journal of Operational Research, 224(3), 542–551.

Chiang, W. K., Chhajed, D., & Hess, J. D. (2003). Direct marketing, indirect profits: A strategic analysis of dual-channel supply-chain design. Marketing Science, 49(1), 1–20.

D’Arpizio, C. (2013). Luxury goods worldwide market study spring 2013. https://www.bain.com/insights/Luxury-goods-worldwide-market-study-2013. Retrieved April 13, 2020.

Delaney, L. (2019). The complexities of parallel importing. https://www.bain.com/insights/whats-powering-chinas-market-for-luxury-goods. Retrieved April 23, 2020.

Gal-Or, E., Geylani, T., & Dukes, A. J. (2008). Information sharing in a channel with partially informed retailers. Marketing Science, 27(4), 642–658.

Ha, A. Y., Tian, Q., & Tong, S. (2017). Information sharing in competing supply chains with production cost reduction. Manufacturing & Service Operations Management, 19(2), 246–262.

Ha, A. Y., & Tong, S. (2008). Contracting and information sharing under supply chain competition. Management Science, 49(4), 701–715.

Huang, H., He, Y., & Chen, J. (2019). Competitive strategies and quality to counter parallel importation in global market. Omega, 86(5), 173–197.

Huang, S., Guan, X., & Chen, Y.-J. (2018). Retailer information sharing with supplier encroachment. Production and Operations Management, 27(6), 1133–1147.

Husic, M., & Cicic, M. (2009). Luxury consumption factors. Journal of Fashion Marketing and Management, 13(2), 231–245.

Iravani, F., Dasu, S., & Ahmadi, R. (2016). Beyond price mechanisms: How much can service help manage the competition from gray markets? European Journal of Operational Research, 252(3), 789–800.

Jain, A., Seshadri, S., & Sohoni, M. (2015). Differential pricing for information sharing under competition. Production and Operations Management, 20(2), 235–252.

Jiang, B., Tian, L., Xu, Y., & Zhang, F. (2016). To share or not to share: Demand forecast sharing in a distribution channel. Marketing Science, 35(5), 800–809.

Kim, B., & Park, K. S. (2016). Organizational structure of a global supply chain in the presence of a gray market: Information asymmetry and valuation difference. International Journal of Production Economics, 175(5), 71–80.

Lannes, B. (2019). What’s powering China’s market for luxury goods?https://www.bain.com/insights/whats-powering-chinas-market-for-luxury-goods. Retrieved January 14, 2020.

Lannes, B., Yu, W., Ding, J., Kou, M., & Yu, J. (2016). China retail’s two-speed channel challenge. https://www.bain.com/insights/china-retails-two-speed-channel-challenge. Retrieved April 15, 2020.

Lee, H. L., So, K. C., & Tang, C. S. (2000). The value of information sharing in a two-level supply chain. Management Science, 46(5), 626–643.

Lei, H., Wang, J., Yang, H., & Wan, H. (2020). The impact of ex-post information sharing on a two-echelon supply chain with horizontal competition and capacity constraint. Annals of Operations Research,. https://doi.org/10.1007/s10479-020-03598-5.

Li, L. (2002). Information sharing in supply chain with horizontal competition. Management Science, 48(9), 1196–1212.

Li, G., Zheng, H., Sethi, S. P., & Guan, X. (2018). Inducing downstream information sharing via manufacturer information acquisition and retailer subsidy. Decision Sciences,. https://doi.org/10.1111/deci.12340.

Li, Q., Li, B., Chen, P., & Hou, P. (2017). Dual-channel supply chain decisions under asymmetric information with a risk-averse retailer. Annals of Operations Research, 257, 423–447.

Li, Z., Gilbert, S. M., & Lai, G. (2015). Supplier encroachment as enhancement or a hindrance to nonlinear pricing. Production and Operations Management, 24(1), 89–109.

Mendelsohn, F. A., & Stanton, A. H. (2010). Combating gray market goods in an economic downturn with the Lanham Act. Computer and Internet Lawyer, 27(8), 6–13.

Mittendorf, B., Shin, J., & Yoon, D.-H. (2013). Manufacturer marketing initiatives and retailer information sharing. Quantitative Marketing and Economics, 11(2), 263–287.

Netease Automobile. (2019). Shanghai free trade zone to explore a new mode of parallel import automobile trade. https://auto.163.com/19/0320/08/EAMR4AC I000884MM.html. Retrieved April 23, 2020.

Ren, Z. J., Cohen, M. A., Ho, T. H., & Terwiesch, C. (2010). Information sharing in a long-term supply chain relationship: The role customer review strategy. Operations Research, 58(1), 81–93.

Ru, J., Shi, R., & Zhang, J. (2015). Does a store brand always hurt the manufacturer of a competing na-tional brand? Production and Operations Management, 24(2), 272–86.

Shannon, S. (2017). The billion-dollar grey market in watches upsets big brands. Financial Times. https://www.cnbc.com/amp/2017/09/15/the-billion-dollar-grey-market-in-watches-upsets-big-brands.html. Retrieved April 15, 2020.

Shao, J., Krishnan, H., & McCormick, S. T. (2016). Gray markets and supply chain incentives. Production and Operations Management, 25(11), 1807–1819.

Shulman, J. D. (2013). Product diversion to a direct competitor. Market Science, 33(3), 422–436.

Stierli, M. (2015). Global wealth databook 2015. https://www.credit-suisse.com/about-us/en/reports-research/global-wealth-report.html. Retrieved April 10, 2020.

Swanson, A. (2014). China’s growing gray market for all that’s foreign. http://foreignpolicy.com/2014/08/20/chinas-growing-gray-market-for-all-thats-foreign. Retrieved January 14, 2020.

The Free Dictionary. (2020). https://encyclopedia.thefreedictionary.com/gray+market. Retrieved April 15, 2020.

Xiao, T., & Shi, J. (2016). Pricing and supply priority in a dual-channel supply chain. European Journal of Operational Research, 254(3), 813–823.

Xiao, Yang, Palekar, U., & Liu, Y. (2011). Shades of gray-the impact of gray markets on authorized distribution channels. Quantitative Marketing and Economics, 9(2), 155–178.

Yi, Z. L., Li, F., & Ma, L. J. (2019). The impact of distribution channels on trial-version provision with a positive network effect. OMEGA: The International Journal of Management Science, 85, 115–133.

Yoo, W. S., & Lee, E. (2011). Internet channel entry: A strategic analysis of mixed channel structures. Marketing Science, 30(1), 29–41.

Zhang, H. (2009). Vertical information exchange in a supply chain with duopoly retailers. Production and Operations Management, 11(4), 531–546.

Zhao, D., & Li, Z. (2018). The impact of manufacturer’s encroachment and nonlinear production cost on retailer’s information sharing decisions. Annals of Operations Research, 264, 499–539.

Acknowledgements

This work was partially supported by the National Natural Science Foundation of China (71801155, 71971052, 71671033, 71801155), the Natural Science Foundation of Guangdong Province (No. 2018A030313938), the Fundamental Research Funds for the Central Universities (N2006006), the Fund for Innovative Research Groups of the National Natural Science Foundation of China (71621061), the Major 691 International Joint Research Project of the National Natural Science Foundation of China (71520107004) and the 111 Project (B16009).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Lemma 5

In the case that the retailer does not share demand information, we derive the manufacturer’s payoff difference between entry and no entry by calculating Eqs. (19) and (21) as follows: \(\pi _{M}^{NE}-\pi _{M}^{NN}=\frac{57{{a}^{2}}+38(\rho +2)ad+(9{{\rho }^{2}}+20\rho +28){{d}^{2}}}{152}-C-\frac{{{(2a+d+\rho d)}^{2}}}{16} =\frac{38{{a}^{2}}+76ad+(-{{\rho }^{2}}+2\rho +37){{d}^{2}}}{304}-C\). We define \(\gamma (d)=\frac{38{{a}^{2}}+76ad+(-{{\rho }^{2}}+2\rho +37){{d}^{2}}}{304}\). Because \(\frac{\partial \gamma (d)}{\partial d}=\frac{38a+(-{{\rho }^{2}}+2\rho +37)d}{152}>0\), the manufacturer will enter only when the entry cost C lower than \(\gamma (d)\). \(\square \)

Proof of Lemma 6

In the case that the retailer shares demand information, we derive the manufacturer’s payoff differences between entry and no entry by calculating Eqs. (24) and (27) as follows: \(\pi _{M}^{SE}-\pi _{M}^{SN}=\frac{57{{a}^{2}}+38(\rho +2)a\delta +(9{{\rho }^{2}}+20\rho +28){{\delta }^{2}}}{152}-C-\frac{{{(2a+3\delta -\rho \delta )}^{2}}+{{(2a+3\rho \delta -\delta )}^{2}}}{64} =\gamma (\delta )-C\). Noting that \(\delta \in [0,\ 2d]\) and \(\gamma (\delta )\) is increasing in \(\delta \), we have when \(C\le \gamma (0)\), the manufacturer will always enter; when \(C>\gamma (2d)\), the manufacturer will never enter; when C is between \(\gamma (0)\) and \(\gamma (2d)\), the manufacturer will enter only if \(\delta >{\hat{\delta }}(C)\). \(\square \)

Proof of Lemma 7

In order to examine the retailer’s information sharing strategy, we derive the retailer’s payoff differences between information sharing and non-information sharing by calculating Eqs. (29) and (30) as follows: When \(C\le \gamma (0)\), \(\pi _{R}^{S}(C)-\pi _{R}^{N}(C)=\frac{{{(19a+29\rho d-10d)}^{2}}+144{{d}^{2}}{{(1-\rho )}^{2}}}{5776}+\frac{144{{(1-\rho )}^{2}}+{{(29\rho -10)}^{2}}}{17328}{{d}^{2}}-\frac{{{(19a+29\rho d-10d)}^{2}}+144{{d}^{2}}{{(1-\rho )}^{2}}}{5776}-\frac{(1+{{\rho }^{2}}){{d}^{2}}}{12}=\frac{-459{{\rho }^{2}}-3756\rho -1200}{17328}{{d}^{2}}<0\). When \(C>\gamma (2d)\), \(\pi _{R}^{S}(C)-\pi _{R}^{N}(C)= \frac{{{(2a+3d-\rho d)}^{2}}+{{(2a+3\rho d-d)}^{2}}}{64}+\frac{5-6\rho +5{{\rho }^{2}}}{96}{{d}^{2}}-\frac{{{(2a+3d-\rho d)}^{2}}+{{(2a+3\rho d-d)}^{2}}}{64}-\frac{(1+{{\rho }^{2}}){{d}^{2}}}{12}=-\frac{{{(1+\rho )}^{2}}{{d}^{2}}}{32}<0\). Thus, the retailer will not share demand information with the manufacturer when the entry cost C is very low or especially high. \(\square \)

Proof of Proposition 1

When the retailer withholds her private demand information, the entry strategy of the manufacturer is that he will enter only when the entry cost C is lower than \(\gamma (d)\). We derive the retailer’s profit difference between entry and no entry by calculating Eqs. (29) and (30) as follows: \(\pi _{R}^{N}(C){{|}_{C\le \gamma (d)}}-\pi _{R}^{N}(C){{|}_{C>\gamma (d)}}=\frac{{{(19a+29\rho d-10d)}^{2}}+144{{d}^{2}}{{(1-\rho )}^{2}}}{5776}+\frac{(1+{{\rho }^{2}}){{d}^{2}}}{12} -\frac{{{(2a+3d-\rho d)}^{2}}+{{(2a+3\rho d-d)}^{2}}}{64}-\frac{(1+{{\rho }^{2}}){{d}^{2}}}{12}= \frac{-722{{a}^{2}}+(760\rho -2204)ad+(165{{\rho }^{2}}+430\rho -1317){{d}^{2}}}{11552}<0\). When the retailer shares her private demand information and the entry cost C is between \(\gamma (0)\) and \(\gamma (2d)\), then the manufacturer will enter only when the potential market demand is higher than the threshold \({\hat{\delta }}\). \(\frac{\partial \pi _{R}^{S}}{\partial {\hat{\delta }}}=\frac{722{{a}^{2}}+(2204-760\rho )a{\hat{\delta }}+(1317-430\rho -165{{\rho }^{2}}){{{{\hat{\delta }}}}^{2}}}{11552}>0\). Recall that \({\hat{\delta }}(C)=\frac{\sqrt{38[{{a}^{2}}{{(1-\rho )}^{2}}-8C({{\rho }^{2}}-2\rho -37)]}-38a}{-{{\rho }^{2}}+2\rho +37}\) which is increasing in entry cost C. Hence, \(\pi _{R}^{N}(C)\) and \(\pi _{R}^{S}(C)\) are both increasing in C. Notably, there is a sudden upward increase for the retailer’s expected payoff in the non-sharing condition when \(C=\gamma (d)\). To derive the retailer’s optimal information sharing strategy when \(C\in (\gamma (0),\ \gamma (d)]\), it is necessary to compare the retailer’s payoff difference under sharing and non-sharing conditions when \(C=\gamma (d)\).

Note that when \(C=\gamma (d)\), \({\hat{\delta }}(C)=d\), \(\phi (\rho )=\pi _{R}^{S}(\gamma (d))-\pi _{R}^{N}(\gamma (d))= \frac{2166{{a}^{2}}+(-1140\rho +3306)ad+(-2001{{\rho }^{2}}-3938\rho -3483){{d}^{2}}}{69312}\), \(\phi '(\rho )=\frac{2166{{a}^{2}}+(-1140\rho +3306)ad+(-2001{{\rho }^{2}}-3938\rho -3483){{d}^{2}}}{69312} =\frac{-1140ad-4002\rho {{d}^{2}}-3938{{d}^{2}}}{69312}<0\), thus \(\phi (\rho )\) is decreasing in \(\rho \). Because \(\rho \in [0,1]\), when \(\rho =0\), \(\phi (0)=\frac{2166{{a}^{2}}+3306ad-3483{{d}^{2}}}{69312}\) is a quadratic function of d. To ease calculation, we define \(f(d)=2166{{a}^{2}}+3306ad-3483{{d}^{2}}\). By \(f(0)>0\) and \(f(1)>0\), we have \(\phi (0)>0\) always holds when the expected random demand satisfies \(\frac{d}{a}\in [0,\ \frac{1}{2}]\). When \(\rho =1\), \(\phi (1)=\frac{2166{{a}^{2}}+2166ad-9422{{d}^{2}}}{69312}\) is also a quadratic function of d. To ease calculation, we define \(g(d)=2166{{a}^{2}}+2166ad-9422{{d}^{2}}\). Similarly, we can prove that \(\phi (1)>0\) always holds when the expected random demand satisfies \(\frac{d}{a}\in [0,\ \frac{1}{2}]\). Hence, \(\phi (\rho )>0\) always holds when the expected random demand and the entry cost satisfy \(\frac{d}{a}\in [0,\ \frac{1}{2}]\), \(C\in ({{C}^{*}},\ \gamma (d))\) where \({{C}^{*}}\) is the unique solution to \(\pi _{R}^{S}({{C}^{*}})=\pi _{R}^{N}({{C}^{*}})\), and \(C\in (\gamma (0),\ \gamma (d))\). \(\square \)

Proof of Lemma 8

When the retailer does not share demand information, we have the manufacturer’s payoff difference between entry and no entry by calculating equation (32) as follows: \(\pi _{M}^{NE}-\pi _{M}^{NN}= \frac{{{a}^{2}}(9{{\theta }^{3}}-52{{\theta }^{2}}+68\theta +32)+2ad[\theta \rho ({{\theta }^{2}}-14\theta +32)+2(4{{\theta }^{3}}-19{{\theta }^{2}}+18\theta +16)]+{{d}^{2}}[\theta {{\rho }^{2}}{{(4-\theta )}^{2}}+4\theta \rho (8-3\theta )+4(2{{\theta }^{3}}-8{{\theta }^{2}}+5\theta +8)]}{8({{\theta }^{3}}-8{{\theta }^{2}}+10\theta +16)} -C-\frac{\theta {{(2a+d+\rho d)}^{2}}}{8(1+\theta )}=\xi (d)-C\). Because \(\frac{\partial \xi (d)}{\partial d}= \frac{(2-\theta )[2a({{\theta }^{3}}\rho -{{\theta }^{2}}\rho -6{{\theta }^{3}}+2{{\theta }^{2}}+26\theta +16)+2d(-{{\theta }^{2}}{{\rho }^{2}}+2{{\theta }^{3}}\rho -7{{\theta }^{3}}+2{{\theta }^{2}}+26\theta +16)]}{8(1+\theta )({{\theta }^{3}}-8{{\theta }^{2}}+10\theta +16)}>0\), we have the manufacturer will enter only when the entry cost C is lower than \(\xi (d)\). \(\square \)

Proof of Lemma 9

When the retailer shares demand information, we have the manufacturer’s payoff difference between entry and no entry by calculating equation (34) as follows: \(\pi _{M}^{SE}-\pi _{M}^{SN}= \frac{{{a}^{2}}(9{{\theta }^{3}}-52{{\theta }^{2}}+68\theta +32)+2a\delta [\theta \rho ({{\theta }^{2}}-14\theta +32)+2(4{{\theta }^{3}}-19{{\theta }^{2}}+18\theta +16)]+{{\delta }^{2}}[\theta {{\rho }^{2}}{{(4-\theta )}^{2}}+4\theta \rho (8-3\theta )+4(2{{\theta }^{3}}-8{{\theta }^{2}}+5\theta +8)]}{8({{\theta }^{3}}-8{{\theta }^{2}}+10\theta +16)} -C-\frac{\theta {{(2a+\delta +\rho \delta )}^{2}}}{8(1+\theta )}=\xi (\delta )-C\). By noting that \(\delta \in [0,2d]\) and \(\xi (\delta )\) is increasing in \(\delta \), we have when \(C\le \xi (0)\), the manufacturer will always enter; when \(C>\xi (2d)\), the manufacturer will never enter; when C is between \(\xi (0)\) and \(\xi (2d)\), the manufacturer will enter only if \(\delta >{\hat{\delta }}(C)\). \(\square \)

Proof of Lemma 10

In order to examine the retailers information sharing strategy, we derive the retailers payoff differences between information sharing and non-information sharing by calculating Eqs. (38) and (39) as follows: When \(C\le \gamma (0)\), \(\pi _{R}^{S}(C)-\pi _{R}^{N}(C)= \frac{{{(32a-12\theta a-2{{\theta }^{2}}a+{{\theta }^{3}}a+32\rho d-16\theta d+6{{\theta }^{2}}d-8{{\theta }^{2}}\rho d+{{\theta }^{3}}\rho d+4\theta \rho d)}^{2}}+16\theta {{(-4a+5\theta a-{{\theta }^{2}}a+4\theta d-{{\theta }^{2}}d-4\rho d+\theta \rho d)}^{2}}}{16{{({{\theta }^{3}}-8{{\theta }^{2}}+10\theta +16)}^{2}}}\) \(+\frac{16\theta {{(4-\theta )}^{2}}{{(\theta -\rho )}^{2}}+{{(32\rho -16\theta +6{{\theta }^{2}}+4\theta \rho -8{{\theta }^{2}}\rho +\rho {{\theta }^{3}})}^{2}}}{48{{({{\theta }^{3}}-8{{\theta }^{2}}+10\theta +16)}^{2}}}{{d}^{2}}- \frac{{{(32a-12\theta a-2{{\theta }^{2}}a+{{\theta }^{3}}a+32\rho d-16\theta d+6{{\theta }^{2}}d-8{{\theta }^{2}}\rho d+{{\theta }^{3}}\rho d+4\theta \rho d)}^{2}}+16\theta {{(-4a+5\theta a-{{\theta }^{2}}a+4\theta d-{{\theta }^{2}}d-4\rho d+\theta \rho d)}^{2}}}{16{{({{\theta }^{3}}-8{{\theta }^{2}}+10\theta +16)}^{2}}}-\frac{(\theta +{{\rho }^{2}}){{d}^{2}}}{12}=\) \(\frac{\theta [\rho ^2(-3\theta ^5+48\theta ^4-264\theta ^3+528\theta ^2-768) +\rho (12\theta ^4-160\theta ^3+560\theta ^2-256\theta -1024)-4\theta ^6+64\theta ^5 -320\theta ^4+420\theta ^3+688\theta ^2-1024\theta -1024]}{48*(\theta ^3-8*\theta ^2 +10*\theta +16)^2}\) \(<0.\) When \(C>\gamma (2d)\), \(\pi _{R}^{S}(C)-\pi _{R}^{N}(C)=\frac{\theta {{(2\theta a+2\theta d+d-\rho d)}^{2}}+{{(2a+2\rho d+\theta \rho d-\theta d)}^{2}}}{16{{(1+\theta )}^{2}}}+\frac{\theta +4{{\theta }^{2}}-6\theta \rho +4{{\rho }^{2}}+\theta {{\rho }^{2}}}{48}{{d}^{2}} -\frac{\theta {{(2\theta a+2\theta d+d-\rho d)}^{2}}+{{(2a+2\rho d+\theta \rho d-\theta d)}^{2}}}{16{{(1+\theta )}^{2}}}-\frac{(\theta +{{\rho }^{2}}){{d}^{2}}}{12}=\frac{3\theta (\theta -1)+\theta (\rho ^2-6\rho +\theta )}{48}\). \(\pi _{R}^{S}(C)-\pi _{R}^{N}(C)<0\) holds when \(\theta <6\rho -\rho ^2\). Thus, the retailer will not share demand information with the manufacturer when the entry cost C is very low or especially high. \(\square \)

Rights and permissions

About this article

Cite this article

Jiang, ZZ., Zhao, J., Yi, Z. et al. Inducing information transparency: The roles of gray market and dual-channel. Ann Oper Res 329, 277–306 (2023). https://doi.org/10.1007/s10479-020-03719-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-020-03719-0