Abstract

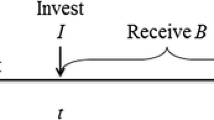

We model R&D efforts to enhance the value of a product or technology before final development. Such efforts may be directed towards improving quality, adding new features, or adopting technological innovations. They are implemented as optional, costly and interacting control actions expected to enhance value but with uncertain outcome. We examine the interesting issues of the optimal timing of R&D, the impact of lags in the realization of the R&D outcome, and the choice between accelerated versus staged (sequential) R&D. These issues are also especially interesting since the history of decisions affects future decisions and the distributions of asset prices and induces path-dependency. We show that the existence of optional R&D efforts enhances the investment option value significantly. The impact of a dividend-like payout rate or of project volatility on optimal R&D decisions may be different with R&D timing flexibility than without. The attractiveness of sequential strategies is enhanced in the presence of learning-by-doing and decreasing marginal reversibility of capital effects.

Similar content being viewed by others

References

Abel, A.B., A.K. Dixit, J.C. Eberly, and R.S. Pindyck. (1996). “Options, the Value of Capital, and Investment.” The Quarterly Journal of Economics, 111, 753–777.

Abel, A.B. and J.C. Eberly. (1997). “An Exact Solution for the Investment and Value of a Firm Facing Uncertainty, Adjustment Costs, and Irreversibility.” Journal of Economic Dynamics and Control, 21, 831–852.

Amir, E., Y. Guan, and G. Livne. (2004). “The Association between the Uncertainty of Future Economic Benefits and Current R&D and Capital Expenditures: An Industry Analysis.” Working Paper, London Business School. Forthcoming, Journal of Business, Finance & Accounting

Bar-Ilan, A. and W.C. Strange. (1998). “A Model of Sequential Investment.” Journal of Economic Dynamics & Control, 22, 437–463.

Bar-Illan, A., A. Sulem, and A. Zanello. (2002). “Time-to-Build and Capacity Choice.” Journal of Economic Dynamics & Control, 26, 69–98.

Black, F. and M. Scholes. (1973). “The Pricing of Options and Corporate Liabilities.” Journal of Political Economy, 81, 637–659.

Brynjolfsson, E. and L.M. Hitt. (2000). “Beyond Computation: Information Technology, Organizational Transformation and Business Performance.” Journal of Economic Perspectives, 14, 23–48.

Chan, S.H., J.D. Martin, and J.W. Kensinger. (1990). “Corporate Research and Development Expenditures and Share Value.” Journal of Financial Economics, 26, 255–276.

Childs, P.D. and A.J. Triantis. (1999). “Dynamic R&D Investment Policies.” Management Science, 45, 1359–1377.

Constantinides, G. (1978). “Market Risk Adjustment in Project Valuation.” Journal of Finance, 33, 603–616.

Cox, J., J.E. Ingersoll Jr, and S. Ross. (1985). “An Intertemporal General Equilibrium Model of Asset Prices.” Econometrica, 53, 363–384.

Dixit, A. and R. Pindyck. (1994). Investment Under Uncertainty. Princeton, New Jersey: Princeton University Press.

Geske, R. (1979). “The Valuation of Compound Options.” Journal of Financial Economics, 7, 63–81.

Grabowski, H. and J. Vernon. (1990). “A New Look at the Returns and Risks to Pharmaceutical R&D.” Management Science, 36, 804–821.

Grenadier, S.R. and A.M. Weiss. (1997). “Investment in Technological Innovations: An Option Pricing Approach.” Journal of Financial Economics, 44, 397–416.

Harrison, J.M. and S. Pliska. (1981). “Martingales and Stochastic Integrals in the Theory of Continuous Trading.” Stochastic Processes and Their Applications, 11, 313–316.

Hartman, R. and M. Hendrickson. (2002). “Optimal Partially Reversible Investment.” Journal of Economic Dynamics & Control, 26, 483–508.

Hull, J. and A. White. (1993). “Efficient Procedures for Valuing European and American Path-Dependent Options.” Journal of Derivatives, 1, 21–31.

Korn, R. (1997). “Optimal Impulse Control when Control Actions Have Random Consequences.” Mathematics of Operations Research, 22, 639–667.

Kothari, S.P., T.E. Laguerre, and A.J. Leone. (2002). “Capitalization versus Expensing: Evidence on the Uncertainty of Future Earnings from Capital Expenditures versus R&D Outlays.” Review of Accounting Studies, 7, 355–382.

Kulatilaka, N. (1988). “Valuing the Flexibility of Flexible Manufacturing Systems.” IEEE Transactions in Engineering Management, 35, 250–257.

Majd, S. and R. Pindyck. (1987). “Time to Build, Option Value, and Investment Decisions.” Journal of Financial Economics, 18, 7–27.

Majd, S. and R. Pindyck. (1989). “The Learning Curve and Optimal Production under Uncertainty.” RAND Journal of Economics, 20, 331–343.

Martzoukos, S.H. (2000). “Real Options with Random Controls and the Value of Learning.” Annals of Operations Research, 99, 305–323.

Martzoukos, S.H. (2003). “Real R&D Options with Endogenous and Exogenous Learning.” In D.A. Paxson (ed.), Real R&D Options. Butterworth-Heinemann Quantitative Finance Series.

McDonald, R. and D. Siegel. (1984). “Option Pricing When the Underlying Asset Earns a Below-Equilibrium Rate of Return: A Note.” Journal of Finance, 39, 261–265.

Merton, R.C. (1973). “An Intertemporal Capital Asset Pricing Model.” Econometrica, 41, 867–887.

Myers, S.C. and S. Majd. (1990). “Abandonment Value and Project Life.” Advances in Futures and Options Research, 4, 1–21.

Pennings, E. and O. Lint. (1997). “The Option Value of Advanced R&D.” European Journal of Operational Research, 103, 83–94.

Pindyck, R.S. (1993). “Investments of Uncertain Cost.” Journal of Financial Economics, 34, 53–76.

Ritchken, P. and B. Kamrad. (1991). “A Binomial Contingent Claims Model for Valuing Risky Ventures.” European Journal of Operational Research, 53, 106–118.

Roberts, K. and M. Weitzman. (1981). “Funding Criteria for Research, Development, and Exploration Projects.” Econometrica, 49, 1261–1288.

Schwartz, E.S. and C. Zozaya-Gorostiza. (2003). “Investment Under Uncertainty in Information Technology: Acquisition and Development Projects.” Management Science, 49, 57–70.

Schwartz, E.S. and C. Zozaya-Gorostiza. (2000b). “Evaluating Investments in Disruptive Technologies.” UCLA Working Paper.

Schwartz E.S. and M. Moon. (2000). “Evaluating Research and Development Investments.” In M.J. Brennan and L. Trigeorgis (eds.), Project Flexibility, Agency and Competition. New Developments in the Theory and Applications of Real Options. Oxford University Press.

Thompson, A.C. (1995). “Valuation of Path-dependent Contingent Claims with Multiple Exercise Decisions over Time: The Case of Take-or-Pay.” Journal of Financial and Quantitative Analysis, 30, 271–293.

Trigeorgis, L. (1991). “Anticipated Competitive Entry and Early Preemptive Investment in Deferrable Projects.” Journal of Economics and Business, 43, 143–156.

Trigeorgis, L. (1996). Real Options: Managerial Flexibility and Strategy in Resource Allocation. Cambridge: The MIT Press.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Koussis, N., Martzoukos, S.H. & Trigeorgis, L. Real R&D options with time-to-learn and learning-by-doing. Ann Oper Res 151, 29–55 (2007). https://doi.org/10.1007/s10479-006-0127-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-006-0127-3