Abstract

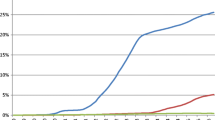

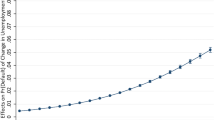

This paper examines the relationship between mortgage default decisions and relevant observable variables in Colombia between 1997 and 2004. We estimate a discrete choice model of default using a panel of individual mortgage characteristics and payment information. We show that home prices and debt balances are the main determinants of mortgage default. We account for the presence of unobserved heterogeneity using Survey data and simulation techniques. Including controls for the distribution of income shows that income was not important but helps clarifying the relevance of mortgage leverage in the determination of the observed default rates.

Similar content being viewed by others

References

Aspachs O., Goodhart C.A.E., Tsomocos D., Zicchino L.: Towards a measure of financial fragility. Ann Financ 3(1), 37–74 (2007)

Aspachs, O., Goodhart, C.A.E., Segoviano, M., Tsomocos, D.P., Zicchino, L.: Searching for a metric for financial stability. In: Goodhart, C.A.E., Tsomocos, D.P. (eds.) Financial Stability, vol. 1. Edward Elgar Publishing, (forthcoming) (2012)

Bajari P., Kahn M.E.: Estimating housing demand with an application to explaining racial segregation in cities. J Business Econ Stat 23(1), 20–33 (2005)

Bayer P., Ferreira F., McMillan R.: A united framework for measuring preferences for schools and neighborhoods. J Polit Econ 115(4), 558–638 (2007)

Deng Y., Quigley J., Van Order R.: Mortgage terminations, heterogeneity and the exercise of mortgage options. Econometrica 68(2), 275–307 (2002)

Escobar, J., Huertas, C.A., Mora, D.A., Romero, J.V.: Indice de precios de la vivienda usada en Colombia—IPVU—Metodo de ventas repetidas. Borradores Semanales de Economia 368, Banco de la Republica, Bogota (2006)

Epple D., Romer T., Sieg H.: Interjurisdictional sorting and majority rule: an empirical analysis. Econometrica 69(6), 1437–1465 (2001)

Geanakoplos, J.: The Leverage Cycle. In: Acemoglu, D., Rogoff, K., Woodford, M. (eds.), NBER Macroeconomic Annual 2009, vol. 24, pp. 1–65. University of Chicago Press [plus erratum] [CFP 1304] (2009)

Goodhart C., Osorio C., Tsomocos D.: The Optimal Monetary Policy Instrument, Inflation Versus Asset Price Targeting, and Financial Stability. Cambridge University Press, Cambridge (2010)

Goodhart C., Tsomocos D., Vardoulakis A.: Modelling a Housing and Mortgage Crisis. In: Alfaro, R.A. Financial Stability, Monetary Policy and Central Banking. Series in Central Banking, Analysis and Economic Policies, Central Bank of Chile, Chile (2010)

Train K.: Discrete Choice Methods with Simulation. Cambridge University Press, Cambridge (2006)

Author information

Authors and Affiliations

Corresponding author

Additional information

We are grateful to Oscar Leiva at Titularizadora Colombiana for providing the primary data set and to staff at Banco de la República in Cali and Bogotá for additional data support. We also thank Julio Escobar, Jean-Francois Houde, Salvador Navarro, Javier Gutiŕrez Rueda and seminar participants at the University of Wisconsin for their comments and insights.

Rights and permissions

About this article

Cite this article

Carranza, J.E., Estrada, D. Identifying the determinants of mortgage default in Colombia between 1997 and 2004. Ann Finance 9, 501–518 (2013). https://doi.org/10.1007/s10436-012-0196-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10436-012-0196-z