Abstract

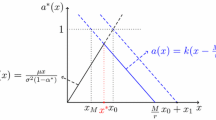

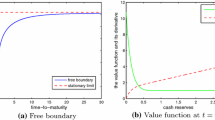

In this paper, we consider a company whose surplus follows a rather general diffusion process and whose objective is to maximize expected discounted dividend payments. With each dividend payment, there are transaction costs and taxes, and it is shown in Paulsen (Adv. Appl. Probab. 39:669–689, 2007) that under some reasonable assumptions, optimality is achieved by using a lump sum dividend barrier strategy, i.e., there is an upper barrier \(\bar{u}^{*}\) and a lower barrier \(\underline{u}^{*}\) so that whenever the surplus reaches \(\bar{u}^{*}\), it is reduced to \(\underline{u}^{*}\) through a dividend payment. However, these optimal barriers may be unacceptably low from a solvency point of view. It is argued that, in that case, one should still look for a barrier strategy, but with barriers that satisfy a given constraint. We propose a solvency constraint similar to that in Paulsen (Finance Stoch. 4:457–474, 2003); whenever dividends are paid out, the probability of ruin within a fixed time T and with the same strategy in the future should not exceed a predetermined level ε. It is shown how optimality can be achieved under this constraint, and numerical examples are given.

Similar content being viewed by others

References

Ames, W.F.: Numerical Methods for Partial Differential Equations, 2nd edn. Academic Press, New York (1977)

Harrison, J.T., Sellke, T.M., Taylor, A.J.: Impulse control of Brownian motion. Math. Oper. Res. 8, 454–466 (1983)

Karatzas, I., Shreve, S.E.: Brownian Motion and Stochastic Calculus. Springer, New York (1988)

Karlin, S., Taylor, H.M.: A Second Course in Stochastic Processes. Academic Press, New York (1981)

Krylov, N.V.: Lectures on Elliptic and Parabolic Equations in Hölder Spaces. Graduate Studies in Mathematics. American Mathematical Society, Providence (1996)

Paulsen, J.: Optimal dividend payouts for diffusions with solvency constraints. Finance Stoch. 4, 457–474 (2003)

Paulsen, J.: Optimal dividend payments until ruin of diffusion processes when payments are subject to both fixed and proportional costs. Adv. Appl. Probab. 39, 669–689 (2007)

Paulsen, J.: Optimal dividend payments and reinvestments of diffusion processes when payments are subject to both fixed and proportional costs. SIAM J. Control Optim. 47, 2201–2226 (2008)

Paulsen, J., Gjessing, H.K.: Ruin theory with stochastic return on investments. Adv. Appl. Probab. 29, 965–985 (1997)

Protter, P.: Stochastic Integration and Differential Equations, 2nd edn. Springer, New York (2004)

Shreve, S.E., Lehoczky, J.P., Gaver, D.P.: Optimal consumption for general diffusions with absorbing and reflecting barriers. SIAM J. Control Optim. 22, 55–75 (1984)

Stroock, D.W.: Partial Differential Equations for Probabilists. Cambridge Studies in Advanced Mathematics, vol. 112. Cambridge University Press, Cambridge (2008)

Yosida, K.: Lectures on Differential and Integral Equations. Dover, New York (1990)

Acknowledgements

The research of Lihua Bai was supported by the National Natural Science Foundation of China (10871102) and (11001136) and the Fundamental Research Funds for the Central Universities (65010771). Also, financial support from the Department of Mathematics, University of Bergen, is appreciated. We should also like to thank the referees for some useful suggestions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bai, L., Hunting, M. & Paulsen, J. Optimal dividend policies for a class of growth-restricted diffusion processes under transaction costs and solvency constraints. Finance Stoch 16, 477–511 (2012). https://doi.org/10.1007/s00780-011-0169-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00780-011-0169-5

Keywords

- Optimal dividends

- General diffusion

- Solvency constraint

- Quasi-variational inequalities

- Lump sum dividend barrier strategy