Abstract

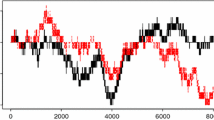

Given a time series of intra-day tick-by-tick price data, how can realized variance be estimated? The obvious estimator—the sum of squared returns between trades—is biased by microstructure effects such as bid–ask bounce and so in the past, practitioners were advised to drop most of the data and sample at most every five minutes or so. Recently, however, numerous alternative estimators have been developed that make more efficient use of the available data and improve substantially over those based on sparsely sampled returns. Yet, from a practical viewpoint, the choice of which particular estimator to use is not a trivial one because the study of their relative merits has primarily focused on the speed of convergence to their asymptotic distributions, which in itself is not necessarily a reliable guide to finite sample performance (especially when the assumptions on the price or noise process are violated). In this paper we compare a comprehensive set of nineteen realized variance estimators using simulated data from an artificial “zero-intelligence” market that has been shown to mimic some key properties of actual markets. In evaluating the competing estimators, we concentrate on efficiency but also pay attention to implementation, practicality, and robustness. One of our key findings is that for scenarios frequently encountered in practice, the best variance estimator is not always the one suggested by theory. In fact, an ad hoc implementation of a subsampling estimator, realized kernel, or maximum likelihood realized variance, delivers the best overall result. We make firm practical recommendations on choosing and implementing a realized variance estimator, as well as data sampling.

Similar content being viewed by others

References

Aït-Sahalia, Y., Mancini, L.: Out of sample forecasts of quadratic variation. J. Econom. 147, 17–33 (2008)

Aït-Sahalia, Y., Mykland, P., Zhang, L.: How often to sample a continuous-time process in the presence of market microstructure noise. Rev. Financ. Stud. 18, 351–416 (2005)

Aït-Sahalia, Y., Mykland, P., Zhang, L.: Ultra-high frequency volatility estimation with dependent microstructure noise. J. Econom. (2006, forthcoming). Available at http://www.princeton.edu/~yacine/

Andersen, T.G., Bollerslev, T.: Answering the skeptics: Yes, standard volatility models do provide accurate forecasts. Int. Econ. Rev. 39, 885–905 (1998)

Andersen, T.G., Bollerslev, T., Diebold, F.X., Ebens, H.: The distribution of stock return volatility. J. Financ. Econ. 61, 43–76 (2001)

Andersen, T.G., Bollerslev, T., Meddahi, N.: Market microstructure noise and realized volatility forecasting. J. Econom. (2006, forthcoming). Available at http://gremaq.univ-tlse1.fr/perso/meddahi/

Bandi, F.M., Russell, J.R.: Comment on JBES 2005 invited address by Peter R. Hansen and Asger Lunde. J. Bus. Econ. Stat. 24(2), 167–173 (2006)

Bandi, F.M., Russell, J.R.: Separating microstructure noise from volatility. J. Financ. Econ. 79, 655–692 (2006)

Bandi, F.M., Russell, J.R., Yang, C.: Realized volatility forecasting and option pricing. J. Econom. 147, 34–46 (2008)

Barndorff-Nielsen, O.E., Hansen, P.R., Lunde, A., Shephard, N.: Designing realised kernels to measure the ex post variation of equity prices in the presence of noise. Econometrica 76, 1481–1536 (2008)

Barndorff-Nielsen, O.E., Hansen, P.R., Lunde, A., Shephard, N.: Subsampling realised kernels. J. Econom. (2009, forthcoming)

Bollerslev, T., Domowitz, I., Wang, J.: Order flow and the bid–ask spread: An empirical probability model of screen-based trading. J. Econ. Dyn. Control 21, 1471–1491 (1997)

Bouchaud, J.-P., Gefen, Y., Potters, M., Wyart, M.: Fluctuations and response in financial markets: The subtle nature of ‘random’ price changes. Quant. Finance 4, 176–190 (2004)

Domowitz, I., Wang, J.: Auctions as algorithms: Computerized trade execution and price discovery. J. Econ. Dyn. Control 18, 29–60 (1994)

Farmer, J.D., Patelli, P., Zovko, I.I.: The predictive power of zero intelligence in financial markets. Proc. Natl. Acad. Sci. USA 102, 2254–2259 (2005)

Ghysels, E., Sinko, A.: Volatility forecasting and microstructure noise. J. Econom. (2006, forthcoming). Available at http://www.unc.edu/~eghysels/working_papers.html

Griffin, J.E., Oomen, R.C.: Sampling returns for realized variance calculations: Tick time or transaction time? Econom. Rev. 27(1–3), 230–253 (2008)

Hansen, P., Large, J., Lunde, A.: Moving average-based estimators of integrated variance. Econom. Rev. 27(1–3), 79–111 (2008)

Large, J.: Estimating quadratic variation when quoted prices jump by a constant increment. J. Econom. (2005, forthcoming)

Malliavin, P., Mancino, M.E.: Fourier series method for measurement of multivariate volatilities. Finance Stoch. 6, 49–61 (2002)

Malliavin, P., Mancino, M.E.: A Fourier transform method for nonparametric estimation of multivariate volatility. Ann. Stat. 37, 1983–2010 (2009)

Mancino, M.E., Sanfelici, S.: Robustness of Fourier estimator of integrated volatility in the presence of microstructure noise. Comput. Stat. Data Anal. 52, 2966–2989 (2008)

Niederhoffer, V., Osborne, M.F.M.: Market making and reversal on the stock exchange. J. Am. Stat. Assoc. 61(316), 897–916 (1966)

Oomen, R.C.: Properties of realized variance under alternative sampling schemes. J. Bus. Econ. Stat. 24, 219–237 (2006)

Smith, E., Farmer, J.D., Gillemot, L., Krishnamurthy, S.: Statistical theory of the continuous double auction. Quant. Finance 3, 481–514 (2003)

Zhang, L.: Efficient estimation of stochastic volatility using noisy observations: A multi-scale approach. Bernoulli 12, 1019–1043 (2006)

Zhang, L., Mykland, P.A., Aït-Sahalia, Y.: A tale of two timescales: Determining integrated volatility with noisy high frequency data. J. Am. Stat. Assoc. 100, 1394–1411 (2005)

Zhou, B.: High frequency data and volatility in foreign-exchange rates. J. Bus. Econ. Stat. 14, 45–52 (1996)

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors wish to thank an anonymous referee and the associate editor, Yacine Aït-Sahalia, Mavira Mancino, Andrew Patton, Simona Sanfelici, Kevin Sheppard, and the participants of the workshop on high-frequency data at Imperial College London for helpful comments and suggestions.

Rights and permissions

About this article

Cite this article

Gatheral, J., Oomen, R.C.A. Zero-intelligence realized variance estimation. Finance Stoch 14, 249–283 (2010). https://doi.org/10.1007/s00780-009-0120-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00780-009-0120-1