Abstract

It is often claimed that negative events carry a larger weight than positive events. Loss aversion is the manifestation of this argument in monetary outcomes. In this review, we examine early studies of the utility function of gains and losses, and in particular the original evidence for loss aversion reported by Kahneman and Tversky (Econometrica 47:263–291, 1979). We suggest that loss aversion proponents have over-interpreted these findings. Specifically, the early studies of utility functions have shown that while very large losses are overweighted, smaller losses are often not. In addition, the findings of some of these studies have been systematically misrepresented to reflect loss aversion, though they did not find it. These findings shed light both on the inability of modern studies to reproduce loss aversion as well as a second literature arguing strongly for it.

Similar content being viewed by others

Notes

For instance, when selecting between a 50:50 bet for $10 or −$10 and a similar bet for $20 or −$20, people presumably pick the former option.

As evidenced in a Google Scholar search from July 2017. From 105 available full texts who cited the sentence in whole only four cited the reference.

In addition, it is extremely difficult to directly investigate the effect of large losses in an ethical fashion using actual incentives.

The tenth data point is a repeated questioning of a participant (Bill Beard) and is not included; it shows a pattern similar to that of the top left pane.

By contrast, in portfolio theory (Markowitz, 1952), this would be captured by symmetric weights to gains and losses and a risk premium—an additional cost for taking risk which increases as a function of the distance from the preferred risk level.

The subsample presented in Swalm (1966) was also somewhat biased. Participants were initially collected from two populations: a single company referred to as “Company A” and a cross-industry population. All but one of the presented participants was from Company A.

Given equal distances between objective values in a gain and loss domain a and b for alternatives 1 and 2 (e.g., a1 = 1, a2 = 10; b1 = − 1, and b2 = − 10) if one is more sensitive to the loss domain (e.g., the correlation between choices and a is higher than the respective correlation with b), then assuming a negative linear effect of losses, this implies a stronger pull effect of large losses than large gains in terms of changes in standard deviations of choices, but a symmetric weaker effect for small losses. This can change if the references point is zero (a1 = 0, b1 = 0).

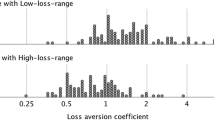

In a similar vein, Harinck, Van Dijk, Van Beest, and Mersmann (2007) examined the pleasantness level associated with gains and losses, and people’s willingness to pay for lotteries involving gains and losses of different sizes. They only found increased unpleasantness compared pleasantness ratings in outcomes above 50 Euros, and similarly report loss aversion in willingness to pay for large outcomes only.

While the preferred risk level account is apparently not consistent with the findings showing risk seeking for losses and risk aversion for gains (i.e., the reflection effect; Kahnman & Tversky, 1979), these regularities are explained by other factors besides the sensitivity to variance (e.g., diminishing sensitivity to zero) which could affect choice behavior in addition to a one’s preferred risk level. Supporting this view is findings of positive association between individuals’ risk taking levels in a gain domain and a mixed domain with symmetric gains and losses demonstrating consistency in individuals’ risk preferences independently of the losses involved (e.g., Yechiam & Ert, 2011).

References

Abdellaoui, M., Bleichrodt, H., & Paraschiv, C. (2007). Loss aversion under prospect theory: A parameter-free measurement. Management Science, 53, 1659–1674.

Anbarci, N., Arin, K. P., Okten, C., & Zenker, C. (2017). Is Roger Federer more loss averse than Serena Williams? Applied Economics, 49, 3546–3559.

Andreoni, J., Harbaugh, W., & Vesterlund, L. (2003). The carrot or the stick: Rewards, punishments, and cooperation. American Economic Review, 93, 893–902.

Barnes, J. D., & Reinmuth, J. E. (1976). Comparing imputed and actual utility functions in a competitive bidding setting. Decision Sciences, 7, 801–812.

Baumeister, R. F., Bratslavsky, E., Finkenauer, C., & Vohs, K. D. (2001). Bad is stronger than good. Review of General Psychology, 5, 323–370.

Benartzi, S., & Thaler, R. H. (1995). Myopic loss-aversion and the equity premium puzzle. Quarterly Journal of Economics, 110, 73–92.

Bereby-Meyer, Y., & Erev, I. (1998). On learning to become a successful loser: A comparison of alternative abstractions of learning processes in the loss domain. Journal of Mathematical Psychology, 42, 266–286.

Bernoulli, D. (1738 [1954]). Exposition of a new theory on the measurement of risk. Econometrica, 22, 22–36.

Butler (1822). The Poems of Samuel Butler, vol 2. Chiswick: C. Whittingham.

Camerer, C. E. (1989). An experimental test of several generalized utility theories. Journal of Risk and Uncertainty, 2, 61–104.

Camerer, C. F. (2005). Three cheers—Psychological, theoretical, empirical—For loss aversion. Journal of Marketing Research, 42, 129–133.

Campbell, J. Y., & Cochrane, J. H. (1999). By force of habit: A consumption—Based explanation of aggregate stock market behavior. Journal of Political Economy, 107, 205–251.

Cason, H. (1930). Pleasant and unpleasant feelings. Psychological Review, 37, 227–240.

Coombs, C. H. (1964). A Theory of Data. New York: Wiley.

Costantini, A. F., & Hoving, K. L. (1973). The effectiveness of reward and punishment contingencies on response inhibition. Journal of Experimental Child Psychology, 16, 484–494.

Davidson, D., Siegel, S., & Suppes, P. (1955). Some experiments and related theory on the measurement of utility and subjective probability. Stanford Value Theory Report No. 4, August, 1955.

Dickinson, D. L. (2001). The carrot vs. the stick in work team motivation. Experimental Economics, 4, 107–124.

Dodson, J. D. (1932). The relative values of satisfying and annoying situations as motives in the learning process. Journal of Comparative Psychology, 14, 147–164.

Edgeworth, F. Y. (1877). New and old methods of ethics: Or “Physical Ethics” and“Methods of Ethics”. Oxford: James Parker.

Edwards, W. (1954). The theory of decision making. Psychological Bulletin, 51, 380–417.

Ert, E., & Erev, I. (2013). On the descriptive value of loss aversion in decisions under risk: Five clarifications. Judgment and Decision Making, 8, 214–235.

Fennema, H., & Van Assen, M. (1999). Measuring the utility of losses by means of the tradeoff method. Journal of Risk and Uncertainty, 17, 277–295.

Fishburn, P. C., & Kochenberger, G. A. (1979). Two piece Von Neumann-Morgenstern utility functions. Decision Sciences, 10, 503–518.

Friedman, M., & Savage, L. J. (1948). The utility analysis of choices involving risk. Journal of political Economy, 56, 279–304.

Gal, D., & Rucker, D. (2018). The loss of loss aversion: Will it loom larger than its gain? Journal of Consumer Psychology. (in press). https://ssrn.com/abstract=3049660.

Galenter, E., & Pliner, P. (1974). Cross-modality matching of money against other continua. In H. R. Moskowitz et al. (Eds.), Sensation and Measurement (pp. 65–76). Dordrecht: Reidel Publishing.

Ganzach, Y., & Karsahi, N. (1995). Message framing and buyer behaviour: A field experiment. Journal of Business Research, 32, 11–17.

Gehring, W. J., & Willoughby, A. R. (2002). The medial frontal cortex and the rapid processing of monetary gains and losses. Science, 295, 2279–2282.

Grayson, C. J. (1960). Decisions under uncertainty: drilling decisions by oil and gas operators. Cambridge: Graduate School of Business, Harvard University.

Green, P. B. (1963). Risk attitudes and chemical investment decisions. Chemical Engineering Progress, 59, 35–40.

Grossman, S. J., & Shiller, R. J. (1981). The determinants of the variability of stock market prices. American Economic Review, 71, 222–227.

Halter, A. N., & Dean, G. W. (1971). Decisions under uncertainty. Cincinnati: South-Western Publishing.

Harinck, F., Van Dijk, E., Van Beest, I., & Mersmann, P. (2007). When gains loom larger than losses: Reversed loss aversion for small amounts of money. Psychological Science, 18, 1099–1105.

Hochman, G., & Yechiam, E. (2011). Loss aversion in the eye and in the heart: The Autonomic Nervous System’s responses to losses. Journal of Behavioral Decision Making, 24, 140–156.

Hossain, T., & List, J. A. (2012). The behavioralist visits the factory: Increasing productivity using simple framing manipulations. Management Science, 58, 2151–2167.

Kacelnik, A., & Bateson, M. (1997). Risk-sensitivity: crossroads for theories of decision making. Trends in Cognitive Science, 1, 304–309.

Kachelmeier, S. J., & Shehata, M. (1992). Examining risk preferences under high monetary incentives: Experimental evidence from the People’s Republic of China. American Economic Review, 82, 1120–1141.

Kahneman, D. (2011). Thinking, fast and slow. New York: Farrar, Straus and Giroux.

Kahneman, D., Knetsch, J. L., & Thaler, R. (1990). Experimental tests of the endowment effect and the Coase Theorem. Journal of Political Economy, 98, 1325–1348.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47, 263–291.

Katz, L. (1963). The effect of differential gain and loss on sequential two-choice behavior. Doctoral Dissertations 1896-February 2014. 1642. Retrieved June 2017 from http://scholarworks.umass.edu/dissertations_1/1642.

Katz, L. (1964). Effects of differential monetary gain and loss on sequential two-choice behavior. Journal of Experimental Psychology, 68, 245–249.

Lejarraga, T., & Hertwig, R. (2017). How the threat of losses makes people explore more than the promise of gains. Psychonomic Bulletin & Review, 24, 708–720.

Lejarraga, T., Hertwig, R., & Gonzalez, C. (2012). How choice ecology influences search in decisions from experience. Cognition, 124, 334–342.

Lichtenstein, S. (1965). Bases for preferences among three-outcome bets. Journal of Experimental Psychology, 69, 162–169.

Markowitz, H. M. (1952). Portfolio selection. Journal of Finance, 7, 77–91.

Meyer, W. J., & Offenbach, S. (1962). Effectiveness of reward and punishment as a function of task complexity. Journal of Comparative and Physiological Psychology, 55, 532–534.

Morewedge, C. K., & Giblin, C. E. (2015). Explanations of the endowment effect: An integrative review. Trends in Cognitive Sciences, 19, 339–348.

Mosteller, F., & Nogee, P. (1951). An experimental measurement of utility. Journal of Political Economy, 59, 371–404.

Myers, J. L., & Suydam, M. M. (1964). Gain, cost, and event probability as determiners of choice behavior. Psychological Science, 1, 39–40.

Penney, R. K., & Lupton, A. A. (1961). Children’s discrimination learning as a function of reward and punishment. Journal of Comparative and Physiological Psychology, 54, 449–451.

Pope, D. G., & Schweitzer, M. E. (2011). Is Tiger Woods loss averse? Persistent bias in the face of experience, competition, and high stakes. American Economic Review, 101, 129–157.

Pratt, J. W. (1964). Risk aversion in the small and in the large. Econometrica, 32, 122–136.

Pruitt, D. G. (1962). Pattern and level of risk in gambling decisions. Psychological Review, 69, 187–201.

Rabin, M., & Weizsäcker, G. (2009). Narrow bracketing and dominated choices. American Economic Review, 99, 1508–1543.

Raiffa, H. (1982). The art and science of negotiation. Cambridge: Belknap.

Redelmeier, D. A., & Tversky, A. (1992). On the framing of multiple prospects. Psychological Science, 3, 191–193.

Rozin, P., & Royzman, E. B. (2001). Negativity bias, negativity dominance, and contagion. Personality and Social Psychology Review, 5, 269–320.

Samuelson, W., & Zeckhauser, R. (1988). Status quo bias in decision making. Journal of Risk and Uncertainty, 1, 7–59.

Schopenhauer, A. (1859 [1969]). The world as Will and Representation (3rd ed, vol. 1). New York: Dover.

Sharpe, W. F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. Journal of Finance, 19, 425–442.

Shefrin, H., & Statman, M. (1985). The disposition to sell winners too early and ride losers too long: Theory and evidence. Journal of Finance, 40, 777–790.

Slovic, P. (1969). Differential effects of real versus hypothetical payoffs on choices among gambles. Journal of Experimental Psychology, 80, 434–437.

Slovic, P., & Lichtenstein, S. (1968). The importance of variance preferences in gambling decisions. Journal of Experimental Psychology, 78, 646–654.

Smith, A. (1776 [1981]). An inquiry into the nature and causes of the wealth of nations, volumes I and II. Indianapolis: Liberty Fund.

Stevens, J. C., & Marks, L. E. (1965). Cross-modality matching of brightness and loudness. Proceedings of the National Academy of Sciences, 54, 407–411.

Swalm, R. O. (1966). Utility theory—Insights into risk taking. Harvard Business Review, 47, 123–136.

Thaler, R. (1980). Toward a positive theory of consumer choice. Journal of Economic Behavior and Organization, 1, 39–60.

Tversky, A. (1972). Elimination by aspects: A theory of choice. Psychological Review, 79, 281–299.

Tversky, A., & Kahneman, D. (1991). Loss aversion in riskless choice: A reference-dependent model. Quarterly Journal of Economics, 106, 1039–1061.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5, 297–323.

von Neumann, J., & Morgenstern, O. (1944). Theory of games and economic behavior. Princeton: Princeton University Press.

Vul, E., Harris, C., Winkielman, P., & Pashler, H. (2009). Puzzlingly high correlations in FMRI studies of emotion, personality, and social cognition. Perspectives on Psychological Science, 4, 274–290.

Walasek, L., & Stewart, N. (2015). How to make loss aversion disappear and reverse: Tests of the decision by sampling origin of loss aversion. Journal of Experimental Psychology: General, 144, 7–11.

Walster, B., Walster, G. W., & Berscheid, E. (1978). Equity: theory and research. Boston: Allyn and Bacon.

Wang, X. T., & Johnson, J. G. (2012). A tri-reference point theory of decision making under risk. Journal of Experimental Psychology: General, 141, 743–756.

Weaver, R., & Frederick, S. (2012). A reference price theory of the endowment effect. Journal of Marketing Research, 49, 696–707.

Williams, J. M. (1922). Principles of social psychology, as developed in a study of economic and social conflict. New York: Alfred A. Knope.

Xue, G., Lu, Z., Levin, I. P., Weller, J. A., Li, X., & Bechara, A. (2009). Functional dissociations of risk and reward processing in the medial prefrontal cortex. Cerebral Cortex, 19, 1019–1027.

Yechiam, E., & Ert, E. (2011). Risk attitude in decision making: In search of trait-like constructs. Topics in Cognitive Science, 3, 166–186.

Yechiam, E., & Hochman, G. (2013a). Losses as modulators of attention: Review and analysis of the unique effects of losses over gains. Psychological Bulletin, 139, 497–518.

Yechiam, E., & Hochman, G. (2013b). Loss-aversion or loss-attention: The impact of losses on cognitive performance. Cognitive Psychology, 66, 212–231.

Yechiam, E., Retzer, M., Telpaz, A., & Hochman, G. (2015). Losses as ecological guides: Minor losses lead to maximization and not to avoidance. Cognition, 139, 10–17.

Yeung, N., & Sanfey, A. G. (2004). Independent coding of reward magnitude and valence in the human brain. Journal of Neuroscience, 24, 6258–6264.

Acknowledgements

The author would like to thank Nathaniel J.S. Ashby, Elias Khalil, and Liat Levontin for their helpful comments.

Funding

This work was supported by the I-CORE program of the Planning and Budgeting Committee and the Israel Science Foundation (1821/12).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author (EY) declares that he has no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Rights and permissions

About this article

Cite this article

Yechiam, E. Acceptable losses: the debatable origins of loss aversion. Psychological Research 83, 1327–1339 (2019). https://doi.org/10.1007/s00426-018-1013-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00426-018-1013-8