Abstract

The paper shows how the standard two-period CAPM with exogenous wealth and exogenous returns can be extended inter-temporally by including the evolution of wealth from the Evolutionary Finance model of Evstigneev et al., J Math Finance 12:329–339, (2011). The missing link between the two models is the CAPM with heterogeneous behavior derived by Hens and Naebi, J Appl Econ Lett 28:501–507, (2020). The paper delivers theoretical and empirical results for behavioral heterogeneity in the CAPM with evolutionary dynamics. The market selection process results in a beta based on fundamentals to which the standard beta tends to converge asymptotically. The results of our model are confirmed by data from the DJIA.

Similar content being viewed by others

1 Introduction

The capital asset pricing model (CAPM) is one of the cornerstones of finance because it is ‘... a rich source of intuition and also the basis for many practical financial decisions’ (cf. Duffie (1988, p.93)). It is built on the earlier work of Harry Markowitz (1952) who developed the mean–variance model for portfolio selection. Sharpe (1964), Mossin (1966) and Lintner (1965) derived the equilibrium consequences of Markowitz` (1952) model under the assumptions: 1) Unlimited borrowing and lending at a risk free rate, 2) Absence of background risk and 3) All investors have homogenous expectations.

Since the introduction of the CAPM many studies attempted to test it empirically and because of its poor evidence, they criticized the assumptions of the theory. As a result, many other versions of the CAPM have been developed to overcome those problems. For instance, Lintner (1969) extended the CAPM to heterogeneous expectations and Mayers (1972) to background risk. Black (1972) relaxed the assumptions that investors can do unlimited borrowing at the risk free rate. And further empirical evidence has led to the incorporation of both heterogeneity in expectations and bounded rationality into asset pricing.Footnote 1 For example, in a dynamic setting, Chiarella et al. (2013) demonstrate the stochastic behavior of time-varying betas and show that there can be inconsistency between ex-ante and ex-post estimates of asset betas when agents are heterogeneous and boundedly rational.

All these extensions maintained the central assumption that all investors choose their portfolios based on mean–variance analysis (cf. Markowitz (1952)). However, DeMiguel et al. (2009) showed that the mean–variance analysis may not be a clever way of forming portfolios and a new literature called behavioral finance has amassed evidence that many investors indeed deviate from this assumption (cf. Barberis and Thaler (2003)).

Inspired by these contributions, the general idea of our paper is to extend the single-period static model of CAPM to a dynamic equilibrium asset pricing model with more realistic assumptions, in which a subset of investors is allowed to grow their portfolio over time in a different way from the mean–variance analysis.

The single-period model of the CAPM, allowing for non-mean–variance behavior, has already been developed by Hens and Naebi (2020). Motivated by Evstigneev et al. (2011), for short EHSH (2011), the principal objective of this paper is to apply evolutionary dynamics—mutation and selection— to a new modeling of the CAPM with heterogeneous behavior.

In the evolutionary finance framework, the market is understood as a heterogeneous population of frequently interacting investment strategies in competition for market capital. The main point considered here is to check the asymptotic market wealth of those who behave as described by the CAPM. Namely, the paper aims at detecting the asymptotic wealth share of mean–variance and non-mean–variance strategies to see which group survives in the market, i.e. which groups wealth share is asymptotically bounded away from zero, and therefore, affects the market identity. In a much simpler setting with short-lived Arrow-securities, Sciubba (2006) figured out that neither the mean–variance nor the CAPM investment rule can survive in competition with an investor who maximizes a logarithmic expected utility function. Our results apply for long-lived assets and for a much richer ecology of investment strategies.

1.1 Relationship to CAPM-models with intertemporal dynamics

Merton (1973) developed the Intertemporal Capital Asset Pricing Model (ICAPM) that uses utility maximization to get exact multifactor predictions of expected security returns. The CAPM assumes that investors choose portfolios that produce returns in the future while in the ICAPM investors are concerned not only with their end-of-period payoff, but also with the opportunities they will have to consume or invest the payoff. Thus, when choosing a portfolio at time t-1, the ICAPM investors consider how their wealth at time t might vary with future variables including labor income, the prices of consumption goods and the nature of portfolio opportunities at t. Breeden (1979) and Lucas (1978) developed the Consumption Capital Asset Pricing Model (CCAPM) which links between consumption and stock returns, thus, it relies on the aggregate consumption in order to understand and predict future asset prices instead of the market portfolio's return in the CAPM. Breeden et al. (1989) examined the empirical implications of the consumption-based capital asset pricing model (CCAPM), and compared its performance with a model based on the market portfolio. Moreover, many theoretical models on conditional CAPM were developed that like Lucas (1978) are based on the representative agent economy by assuming perfect rationality and homogeneous expectations.

The approach taken in this paper eliminates the shortcomings of the dynamic CAPMs (ICAMP and CCAPM) which rely on agents’ perfect foresight to establish equilibrium. In particular, in our model the investors do not have to agree on the future prices for each of the possible future realizations of the states of the world without knowing which particular state will be realized. The CCAPM differs radically from our model that is based on the evolutionary model of EHSH (2011). In this paper, only historical observations and the current state of the world influence current behavior; neither agreement on the future market structure is required, nor are coordinated actions of the agents assumed. Another important distinction between the current approach and the conventional dynamic CAPM lies in the primitives of the model. We avoid using unobservable agents’ characteristics such as individual utilities or subjective expectations. This makes the theory closer to reality, where typically quantitative information about individuals’ utilities is lacking. Moreover, investors’ strategic behavior often is not fully expressible in terms of the maximization of one quantitative criterion or another. Rather, it may involve satisfying simple rules of thumb based on experience and other behavioral notions (e.g., winning in competition, dominating a market segment, etc.).

1.2 Relationship to fundamental beta literature

In the CAPM, the beta coefficient is used as a measure of the systematic risk associated with financial assets. The basic measure of beta is the covariance of an asset return with the market return divided by the variance of the market return.

In contrast, a fundamental beta is based not only on price data but also on other market-related and financial data. Betas derived this way reveal that although all companies experience systematic risk, they differ in their sensitivity to macroeconomic conditions due to their underlying accounting characteristics. As a result, fundamental betas suggest that systematic risk is a function of various accounting variables such as liquidity, leverage, and the dividend payout ratio (cf. Dyl and Hoffmeister (1986)). Since the fundamental beta needs accounting data, it is usually recalculated monthly, quarterly and yearly. Thereby, taking into account any changes in the company’s underlying risk structure during that time.

In this regard, many studies have demonstrated that fundamental betas have important advantages and significantly outperform return-based betas as predictors of asset's behavior, such as the work of Rosenberg and McKibben (1973), Fama and MacBeth (1973); Fama and French (2004), Chance (1982), Dyl and Hoffmeister (1986), and Gahlon and Gentry (1982). They argue that this is because fundamental betas provide better indications of the sources of systematic risk experienced by firms.

However, fundamental beta prediction models developed by previous research are a product of statistical models and do not provide a clear theory. Here, by employing the evolutionary finance model of Evstigneev, Hens and Schenk-Hoppe, EHSH, (2011), we come up with a formula for fundamental beta based on dividend yields.

The paper is structured as follows: Section 2 presents the evolutionary capital asset pricing model. This section briefly reviews the evolutionary finance model of EHSH (2011) with a risk-free asset and it endogenizes the wealth distribution and the returns in the CAPM with heterogeneous strategies. In Section 3, which is the theoretical part of the article, the evolutionary fundamental beta is introduced and derived. Section 4 deals with the empirical work and the numerical simulation of the evolutionary finance model with a risk free asset of EHSH (2011) using nine strategies, including the equally weighted strategy, the expected relative dividend strategy, the adaptive historical relative dividend strategy, the relative dividend yield strategy, the momentum strategy, noise traders, the buy and hold strategy, the maximum Sharpe ratio strategy and the mean–variance strategy. The result shows that starting from any initial distribution of wealth, the market selection process converges to the situation in which the most market wealth concentrates on the expected relative dividend strategy. Then the empirical result on the convergence of the standard beta to the evolutionary fundamental beta is presented. Section 5 concludes.

2 Evolutionary capital asset pricing model

The general idea of the Evolutionary CAPM is to extend the single-period static model of CAPM to a dynamic equilibrium asset pricing model with more realistic assumptions, in which a subset of investors is allowed to grow their portfolio over time in a different way from the mean–variance analysis.

In a first step, the single-period model of CAPM allowing for non-mean–variance behavior has already been developed by Hens and Naebi (2020). In this model there are i = 1, …, I-1 investors doing mean–variance analysis while investor I might not be a mean–variance optimizer. Allowing for non-mean–variance behavior the market identityFootnote 2\({\sum }_{i=1}^{I}{\lambda }_{k}^{i}{r}^{i}={\lambda }_{k}^{M}\) can be re-written so that \({\sum }_{i=1}^{I-1}{\lambda }_{k}^{i}{r}^{i}={\lambda }_{k}^{M}-{\lambda }_{k}^{I}{r}^{I}\). Here \({r}^{i}\) is the relative wealth of investor i and \({\lambda }_{k}^{i}\) is the fraction of wealth invested in asset k by investor i and \({\lambda }_{k}^{M}\) is the relative market capitalization of asset k. As Hens and Naebi (2020) have shown, in this setting the Security Market Line (SML) is given by:

\({\upmu }_{k}\) is asset k’s expected return, i.e. the expected value of \({R}_{k}\). \({R}^{M}={\sum }_{k}{R}_{k}{\lambda }_{k}^{M}\) is the return of the market portfolio and \({R}^{I}={\sum }_{k}{R}_{k}{\lambda }_{k}^{I}\) is the return of the portfolio held by the non-mean–variance investors I. Thus, the SML accounts for the presence of non-mean–variance behavior in the market by adjusting assets’ betas.

Here, we do the next and much bigger step: endogeneizing the wealth distribution and the returns in the CAPM with heterogeneous behavior which we will discuss in the following sections. The CAPM of Sharpe, Mossin and Lintner is static in this respect but in real financial markets, the buying and selling behavior of heterogeneous strategies determines both the asset returns and the wealth of the strategies. Hence, to understand the dynamics of the CAPM, one needs to study models in which a heterogeneous set of strategies compete over time. The evolutionary finance model of EHSH (2011) does exactly this. The second step is thus to employ the EHSH-model to endogenize the wealth distribution and the returns and model a really dynamic CAPM with heterogeneous behavior.

2.1 Dynamics of relative wealth in the EHSH-model with a risk-free asset

Consider a financial market operating over discrete points in time t = 0, 1, …. In this market, there are K + 1 assets, k = 0, 1,..., K where k = 0 denotes the risk-free asset and its holdings is referred as balances in a bank account with the interest rate of \({R}_{f}\). Other assets, k = 1,..., K are risky and pay a dividend \({D}_{t+1}^{k}\). For simplicity, it is assumed that risky assets are in a unit supply and the risk-free asset is in unlimited supply. The market is influenced by random factors modeled in terms of an exogenous stochastic process \({z}_{1}, \dots , {z}_{t}\) where \({z}_{t}\) is a random element of some measurable space. We use the notation \({z}^{t}=({z}_{0},\dots ,{z}_{t})\) to denote the path of states up to period t. Let T denote the last time period considered, i.e. time runs from \(t=0\) to t =T. There are finitely many investment strategies indexed by i = 1, …, I with I ≥ 2, each is pursued by an investor. The investment strategy of investor i at date t is characterized by a vector of investment proportions \({{\lambda }_{t}^{i}=({\lambda }_{t}^{i, o} , {\lambda }_{t}^{i,1} , \dots , {\lambda }_{t}^{i,K})}^{\mathrm{^{\prime}}}\) with \({\sum }_{k=0}^{K}{\lambda }_{t}^{i,k}=1\). In the comparison of the strategies, it is assumed that all investors have the same allocation to the risk-free asset for all periods \({\lambda }_{t}^{i, 0}={\lambda }^{0}\). The wealth of each investor is denoted as \({w}_{t}^{i}\) and \({\alpha }_{t}^{i}{w}_{t}^{i}\) is the wealth reinvested for the next period. Here \({\alpha }_{t}^{i}\) is the reinvestment rate and \(0<{\alpha }_{t}^{i}<1\). Since we seek for the best long-term trading strategy, regardless of the amount they withdraw from their portfolio, it is also assumed that all investors have the same reinvestment rate over time \({\alpha }_{t}^{i}\)=\(\alpha\).

A portfolio of investor i at date t = 0, 1, … is specified by a vector \({x}_{t}^{i}={({x}_{t}^{i,0}, {x}_{t}^{i,1}, \dots , {x}_{t}^{i, K})}^{^{\prime}}\) where \({x}_{t}^{i,0}\) is the amount in the investor's bank account and \({x}_{t}^{i,k}\) (k = 1,…, K) is the number of units of asset k held by the investor i at time t. To express the units of each asset held by investor i one computes:

where \({p}_{t}^{k }\) is the price of asset k at time t. It is assumed that the market is always in equilibrium and the equality of asset demand and asset supply makes it possible to determine the equilibrium prices \({p}_{t}^{k}\) of each asset k = 1, …, K. As we assumed the total supply of each risky asset is normalized to 1, in equilibrium we have \({\sum }_{i=1}^{I}{x}_{t}^{i, k}=1\) , k = 1, 2, …, K. Therefore, equilibrium prices are given by:

In other words, the price of asset k is the wealth average of the strategies' portfolio share for asset k. The price of the risk-free asset is exogenous and set to \({p}_{t}^{0 }=1\). There is no market clearing condition for this asset.

Note that wealth, dividends and prices may all be subject to some growth rate. To analyze them one can restrict attention to relative wealth, relative dividends and relative prices getting rid of the absolute growth rates.

To derive the dynamics of investors' relative wealth, as in the traditional model, we start from the fundamental equation of wealth dynamics:

where \({R}_{t+1}^{k}\) is the return on asset k = 0, 1, …, K at time t + 1. In the evolutionary setting, the return is exogenous for the risk-free asset, k = 0, which is denoted here by \({R}_{f}\) and endogenous for the risky assets, k = 1, 2, …, K, the fundamental equation of which is as follows:

By expanding the expression (4) using Eq. (5) and \({R}_{f}\), we get:

We model dividends as \({D}_{t+1}^{k }= {d}_{t+1}^{k }{ W}_{t}\) where \({W}_{t}=\sum_{i=1}^Iw^i_t\) is the aggregate wealth of all investors and \({d}_{t+1}^{k}\) is exogenously determined by a stochastic process \({d}_{t+1}^{k }= {d}_{t+1}^{k }({z}^{t+1})\). Consequently, all endogenous variables are stochastic.

By inserting \({p}^{k}\) and \({D}^{k}\) into Eq. (6) and dividing both sides by aggregate wealth at t+1, \({W}_{t+1}\), one can find a system of equations determining the relative wealth of investor i denoted by \({r}_{t+1}^{i}\) as below:

As shown in Appendix 2, the growth rate of aggregated wealth of all investors can be obtained as follows:

Finally, the resulting system of equations can be written in more compact vector notation as:

where \(Id\) is a K*K identity matrix, \({\Lambda }_{t+1}\) is a K*I matrix of the period t + 1 investment strategies and \({X}_{\mathrm{t}}\) is an I*K matrix of all investors period-t portfolio holdings of all risky assets.

Equation (9) governs the evolution of wealth shares for given investment strategies. The first term captures the capital gains while the second term describes the change in relative wealth as resulting from the exogenous dividends and the return on the risk-free asset. Our interpretation of the dynamics (Eq. (9)) is that of a market selection process on a set of investment strategies. The underlying stochastic process and the equations above result in a random dynamical system on the simplex \(\Delta =\{r\in {\mathbb{R}}^{I}, {r}^{i}\ge 0, {\sum }_{i=1}^{I}{r}^{i}=1\}\) as in EHSH (2011).

2.2 The structure of asset returns under the evolutionary finance model of EHSH (2011)

The standard formulation of the CAPM is only based on asset returns, and asset prices are not mentioned explicitly. Therefore, before introducing the evolutionary fundamental beta, we express the return of any risky asset k in our framework.

As shown in Eq. (5), the return of any risky asset k at time t is given by \({R}_{t}^{k} = \frac{{D}_{t}^{k }+ {p}_{t}^{k}}{{p}_{t-1}^{k}}\)

By substituting the equations of \({D}_{t}^{k }\) and \({p}_{t}^{k}\), we get:

To get rid of the absolute growth rate of wealth, one can find the following equation for the evolutionary return on risky assets in terms of relative dividends and of market prices relative to aggregate wealth:

where, as mentioned before, \({\gamma }_{t}= \frac{{\overline{d} }_{t} + \alpha {R}_{f}{ \lambda }^{0}}{1-\alpha \left(1-{ \lambda }^{0}\right)}\) is the growth rate of the aggregate wealth of all investors, \({d}_{t}^{k}\) is the factor in \({D}_{t}^{k }= {d}_{t}^{k }{ W}_{t-1}\) and \({q}_{t}^{k}\) is the relative price of asset k and is given by \({q}_{t}^{k }=\frac{{p}_{t}^{k}}{{\sum }_{i=1}^{I}{ w}_{t}^{i}}=\alpha {\sum }_{i=1}^{I}{\lambda }_{t}^{i, k}{r}_{t}^{i}\). Written in relative terms, the price equation keeps its form and simply is the convex combination of the strategies in the market.

3 Evolutionary fundamental beta

So far, we have depicted a market in which there is a heterogeneous set of investment strategies competing for the market capital over time, and their frequent interactions determine the equilibrium prices and subsequently the return on risky assets and relative wealth of the strategies. Now, using Hens and Naebi (2020), we embed this ecology of investment strategies into the CAPM.

Based on the evolutionary concepts mutation and selection, all other strategies in the market are asymptotically driven to extinction by the survival strategies. Supposing there is only a single survival strategy \({\lambda }_{t}^{I,k}\) in the market, this strategy determines the equilibrium market prices and the market identity. To account for the possibility, we introduce the evolutionary fundamental beta as belowFootnote 3:

3.1 Theorem 1- Evolutionary fundamental beta

Suppose the evolution of wealth converges to a single strategy \({\lambda }_{t}^{I,k}\), k = 1, …, K, then in the limit \({{\lambda }_{t}^{M,k}\text{=}\lambda }_{t}^{I,k}\) and the beta of asset k is:

and \({\lambda }_{t}^{M,k}\) denotes the relative market capitalization of the asset k.

3.2 Proof

Suppose that the evolution of wealth converges to a single strategy \({\lambda }_{t}^{I,k}\), which dominates all other strategies. Hence, in the limit \({r}_{t}^{I}=1\). On the other hand, the relative price of asset k is given by \({q}_{t}^{k}=\alpha {\sum }_{i=1}^{I}{\lambda }_{t}^{i, k}{ r}_{t}^{i}\). Since in the limit \({r}_{t}^{I}=1\), the relative price of asset k, \({q}_{t}^{k}\), is asymptotically determined by the strategy \({\lambda }_{t}^{I,k}\) and is constant \({q}_{t}^{k}={q}^{k}\).

Recalling the formula for returns on risky assets from Eq. (11) and given that as a result of our assumption the relative asset price k in the limit is constant, we obtain:

Moreover, recall the definition of the market return \({R}_{t}^{M}\):

By entering the formula obtained for \({R}_{t}^{k}\) (Eq. (12)) in \({R}_{t}^{M}\), we get the following formula for the market return:

Hens and Naebi (2020) have already shown that the beta in the CAPM, which allows for non-mean–variance strategies, is given by \({\widehat{\beta }}_{k}=\frac{cov[{R}_{k} , \left({R}^{M}-{R}^{I}{r}^{I}\right)] }{cov[{R}^{M}, \left({R}^{M}-{R}^{I}{r}^{I}\right)]}\) where i = 1, …, I-1 investors use mean–variance analysis while investor I might not be a mean–variance optimizer. However, to get the beta in the CAPM with heterogeneous strategies, we need to assume that a subset of these heterogeneous investors definitely follow the mean–variance strategy. Now to get the beta in the CAPM given by\({\beta }_{t}^{ k}=\frac{Cov ({R}_{t}^{k},{ R}_{t}^{M})}{Var ({R}_{t}^{M})}\), the covariance of \({R}_{t}^{k}\) and \({R}_{t}^{M}\) as well as the variance of \({R}_{t}^{M}\) are required, which are obtained as follows:

Finally, we get the following formula for the beta:

Note that \(Var \left({\overline{d} }_{t}\right)>0\) in any data set, which completes the proof.

Hence, we have derived a beta in terms of fundamentals by considering the existence of heterogeneous strategies interacting in an evolutionary setting. As we show in the next section, simulations yield that indeed the dynamical system converges to the strategy \({\lambda }^{*,k}=\left(1-{\lambda }^{0}\right)E\left({d}^{k}\right)\), a strategy well-known from the EHSH (2011) model.

4 Simulation analysis and empirical results

In this section we first simulate the financial market with the presence of heterogeneous strategies in the evolutionary finance model of EHSH (2011). This helps us to understand the concept of market selection process by recognizing the winning strategies that capture the wealth of the market. Using this property, we then propose Hypothesis 1, which states that the deviation of the standard beta from the evolutionary fundamental beta must be systematically reduced over time; even when, in contrast to the two-fund separation theorem, investors not all invest in the market portfolio. Finally, we test the hypothesis of convergence towards the evolutionary fundamental beta by the Wald coefficient test.

For the purpose of simulation and empirical analysis, we used annual Dow Jones Industrial Average (DJIA) data from 1981 to 2019. The data used consists of the dividends and the market capitalization of 40 companies that are currently in the DJIA index or that have been in it for at least two subsequent years.

4.1 Simulation analysis

In the simulation programFootnote 4, written by (Fischer, Julian 2021. Evolutionary Finance Model in Python. Bachelor Thesis at the Department of Physics, University of Zurich), several investment strategies are implemented. In this paper we compare the evolution of wealth of the following strategies: A strategy generated from mean–variance analysis, the naive diversification rule fixing equal weights in the portfolio, the max Sharpe ratio strategy, the buy and hold strategy, the momentum strategy, noise traders, the expected relative dividend strategy \({\uplambda }^{*}\), the adaptive relative dividend strategy and the relative dividend yield strategy, each of which are describe below. In order to initialize the program, the equally weighted strategy was chosen. It serves as a base, whereas all the others can be enabled separately.

The financial market considered originates from the evolutionary finance model of EHSH (2011). In the simulation there is no transaction cost imposed and provided that short selling is enabled, a short position of up to 10% in each asset is allowed. There are two stochastic processes considered for dividends: 'Historical DJIA data' dividend process and 'i.i.d.Footnote 5 DJIA data' dividend process.

In the first stochastic process, the historical dividend payouts in DJIA were re-scaled and used as payouts for the assets. This gives 40 assets followed over 39 years. A second approach to model dividend payouts was realized as follows and denoted as 'i.i.d. DJIA data' dividend process. The state of the world \({z}_{t}\) determines which of the 39 years is selected randomly with equal probability. Note that in the i.i.d. process, the payouts were not chosen in historical order but randomly by a uniformly distributed random variable. Moreover, the i.i.d. process allows to generate more than 39 time periods and in our i.i.d. simulations we have chosen T = 200. Finally, note that this latter approach adds more randomness to the system since even after rescaling two consecutive historical dividends are more similar to each other than rescaled dividends from two randomly selected years.

4.2 The equally weighted strategy

This is also known as naive diversification or the \(\frac{1}{N}\) strategy. As the name suggests, the same fraction of wealth is invested into each asset k. The weight of each asset is given by the following expression:

As before \({\lambda }^{0}\) is the part allocated to the risk-free asset. As DeMiguel et al. (2009) have shown, on many data sets this strategy achieves out-of-sample Sharpe-ratios that cannot be beaten by mean–variance optimization.

4.3 Expected relative dividend strategy \({\lambda }^{*}\)

The next strategy used in the simulation is the expected relative dividend strategy. It is locally stable (also globally stable in many settings) against any other investment strategy, as shown in Theorem 1 in EHSH (2011). The result suggests that it should be the most successful one also in our setting. This investment strategy allocates wealth across all of the available assets in proportions corresponding to the expected (relative) dividend payouts. Therefore, the higher the expected (relative) dividend payouts of a certain asset, the higher the weight \({\lambda }^{*}\) allocates to this asset.

where, as before, \({d}_{t}^{k}\) is the relative dividend of the asset k. Note that in the simulations including \({\lambda }^{*}\) this strategy is allowed to know the expected relative dividends. This is of course not realistic in practice. Therefore, we replace it by an adaptive version based on the previous averages of relative dividends. Nevertheless, to link our simulations to the theoretical results of EHSH (2011) we found it worthwhile to include this rational benchmark.

4.4 Adaptive historical relative dividend strategy \({\lambda }^{*ad}\)

The adaptive historical relative dividend strategy \({\uplambda }^{*\mathrm{ad}}\) adapts the weights according to past relative dividends of asset k, as the name suggests. Technically, it is very similar to the \({\uplambda }^{*}\) strategy; however it does not rely on the expectation and this makes it easier to implement in reality. The weight that the \({\lambda }^{*ad}\) assigns to each asset is given by:

Here \({\overline{d} }^{k}\) is the mean of historical relative dividends and lr denotes the look-back period which is the period where \({\lambda }^{*ad}\) does not yet fully rely on past dividends.

In the initializing phase where t is less than lr, (t < lr), the adaptive historical relative dividend strategy weights are chosen as a weighted average between the \(\frac{1}{N}\) and \({\lambda }^{*ad}\) strategies.Footnote 6

4.5 Relative dividend yield strategy (RDY)

The relative dividend yield strategy compares a certain asset’s dividend yield to the dividend yield of the broader market. In this strategy, wealth is allocated between assets in terms of their relative dividend yields; therefore, the higher the relative dividend yield of a certain asset, the higher the weight this strategy allocates to the asset.

Given that the dividend yield of asset k based on the definition is \({DY}_{t-1}^{k }=\frac{{D}_{t-1}^{k }}{{P}_{t-1}^{k}}\), the relative dividend yield of this asset is calculated by:

Accordingly, Eq. (22) defines the proportions allocated to asset k based on the relative dividend yield strategy:

4.6 Buy & hold strategy

In the equilibrium where no companies are introduced nor removed, the “Buy & Hold” strategy plays a passive role and its relative wealth remains constant. It initially buys a share of the market portfolio and keeps its relative wealth over all periods.

4.7 Noise traders

The strategy “Noise Traders” aims to replicate an investor who trades assets randomly. The allocation of wealth across the assets is conducted by using i.i.d. random variables. The proportion of wealth invested in asset k is given by:

where \({\kappa}_{t}^{k}\) denotes the realization of the underlying random variable and \({\overline{\kappa} }_{t}= \sum_{k=1}^{K}{\kappa}_{t}^{k}\) denotes the sum of all realizations. The underlying random variables can technically follow any distribution. Unjustifiably, the distribution was chosen to be uniform.

4.8 Momentum strategy

Strategies based on momentum root in the belief that 'past winners stay winners and will outperform past losers'. The assets which performed well over a certain period will be chosen over the ones which performed poorly. The momentum strategy is widely applied and supported by empirical evidence. Jegadeesh and Titman (2011) and Chan et al. (1996) find empirical evidence for the existence of momentum in stocks, however it can be found across various asset classes, as Asness et al. (2017) show.

In order to identify these winners, a look-back period mr for the momentum strategy was defined and the change of prices was translated into an input signal \({s}_{t}^{k}=\frac{{p}_{t}^{k}}{ {p}_{t-mr}^{k}}-1\). The weights of the momentum strategy for each asset were then computed as given below:

where \({\overline{s} }_{t}= \sum_{k=1}^{K}{s}_{t}^{k}\) is the sum of all input signals. As the method above does not allow any short-selling, all signals were bounded from below by 0. However, if one enables short selling, then the signal can result in extreme portfolio weights, since the only further restriction on the weights is \(\sum_{k=1}^{K}{\lambda }_{t}^{k}= 1-{\lambda }^{0}\).

In order to tame any extreme positions, the input signal \({s}_{t}^{k}\) was smoothed with a sigmoid function,Footnote 7 similarly as in Hens et al. (2020). Equation (25) gives the weights for the momentum strategy with enabled short selling:

where \({\widehat{s}}_{t}= \frac{1 }{K}\sum_{k=1}^{K}{s}_{t}^{k}\) is the mean of all input signals and \(\beta \in R\) is a constant.

4.9 Maximum sharpe ratio strategy

Maximizing the Sharpe ratio results in the steepest Capital Allocation Line (CAL), on which the Market Portfolio can be found. To find this portfolio, one faces the following maximizing problem:

This maximizing problem can be solved and consequently, the proportions of \({\lambda }_{t}^{Max S}\) can be determined. In the expression above, \(Co{v}_{t-1}\) denotes the covariance matrix of returns and \({\mu }_{t-1}\) the expected return based on the previous periods. \({r}_{f}\) is the risk-free rate. The steepest CAL is obtained by maximizing the Sharpe ratio and is called the Capital Market Line (CML), which is tangential to the efficient frontier. The slope depends on the risk-free rate.

4.10 Mean–variance strategy

Mean–variance analysis is the process of weighing risk, expressed as variance, against expected return and focuses on creating a portfolio that optimizes the expected return according to a specific level of risk or vice versa. In the simulation, the Minimum Volatility Strategy is implemented. This strategy finds the portfolio which minimizes the variance of returns (as a measure of risk). Here, the weights attributed to asset k are determined by minimizing the variance of the portfolio, as in Eq. (27):

where again \(Co{v}_{t-1}\) denotes the covariance matrix of returns. In the setting of portfolio theory, the Min Volatility’ strategy would be the chosen one, as long as one cannot estimate any expected returns, but only estimates the covariances.

We numerically investigate by simulation the evolution of wealth in each of the strategies presented above with two dividend processes, the i.i.d. dividend process and historical DJIA data. In the simulation reported below, we first endowed each strategy with the same initial wealth of 1,000. Then, in the second run without changing the other parameters, we simply changed the initial wealth for the winning strategy in the first simulation to see if the market selection process still remains the same as before.

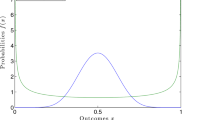

A typical run of a simulation with the 7 strategies with the given parameters is shown in Fig. (1). It depicts the wealth shares of the investment strategies during 39 years simulated with historical DJIA data and 200 years simulated with i.i.d. dividend process.

In Fig. (1), all strategies are endowed with the same initial wealth. However, after a few periods the expected relative dividend strategy \({\lambda }^{*}\) dominates other strategies and gains approximately 80% of the market wealth with both relative dividend processes. Note that the remaining market wealth is hold by the Buy&Hold strategy. Since this strategy follows the market, ultimately its investment proportions are equal to the winning strategy.Footnote 8 Thus, effectively 100% of the wealth is eventually governed by the strategy \({\lambda }^{*}\).

Similar results are obtained when in the Relative Dividend Strategy, the expectation is formed by taking averages of realized relative dividends, which in the simulation program is denoted by \({\lambda }^{*,\mathrm{ ad}}\). The results of using the \({\lambda }^{*,\mathrm{ ad}}\) strategy instead of the \({\lambda }^{*}\) strategy in the simulation (with the same values given to the parameters as before) are shown in Fig. (2).

Moreover, one can also replace the \({\lambda }^{*}\) strategy by a Relative Dividend Yield (RDY) Strategy which would then gain all market wealth in the simulations as shown in Fig. (3).

Since, so far there are no theoretical results why the Adaptive Historical Relative Dividend Strategy and Relative Dividend Yield Strategy work equally well, we base our arguments in this paper on the expected relative dividends strategy \({\uplambda }^{*}\) found to perform best in the models of EHSH.

Figure (4) shows the wealth shares of the strategies used in Fig. (1), in which the initial wealth of the expected relative dividend strategy \({\lambda }^{*}\) is decreased from 1,000 to 500, and the other parameters of the model remain the same as before. As can be seen, despite the decline in initial wealth, this strategy again dominates other strategies in the market, gaining more than half of the market wealth.

The fact that we observe, starting from any initial distribution of wealth in this setting, the market selection process converges to the situation in which the most market wealth concentrates at the expected relative dividend strategy \({\lambda }^{*}\). Moreover, since the relative price of asset k is the relative wealth average of the strategies' portfolio share for asset k, \({q}_{t}^{k }=\alpha {\sum }_{i=1}^{I}{\lambda }_{t}^{i, k}{ r}_{t}^{i}\), these relative wealth dynamics are reflected in the asset prices, that is, the price of asset k initially reflects all the investment strategies, but converges to the \({\lambda }^{*}\) strategy. In other words, the mean–variance strategy is asymptotically defeated by the \({\lambda }^{*}\) and asset prices are determined by the expected relative dividend strategy \({\lambda }^{*}\).

Therefore, we adjust the CAPM which assumes that all market investors follow the mean–variance strategy, by considering different investment strategies in the market in which the beta is obtained as a result of price convergence to the winning strategy.

4.11 Empirical results

In the empirical work, aiming to prevent a survival bias in calculating the evolutionary fundamental beta, we directly used the dividends and the market capitalization from the Dow Jones Industrial Average (DJIA) data in the following formulaFootnote 9:

where \({MC}_{t-1}^{k }\) denotes the market capitalization of the asset k at time t-1, \({TMC}_{t-1}\) is the total market capitalization at time t-1 and \({\overline{D} }_{t}\) denotes the total dividends paid at time t.

Given that the definition of dividend yield of asset k is \({DY}_{t}^{k }=\frac{{D}_{t}^{k }}{{P}_{t-1}^{k}}\) and in the equilibrium in our setting \({MC}_{t-1}^{k}= {p}_{t-1}^{k}\),Footnote 10 we can also rewrite the above formula for beta as follows:

It is therefore clear that the evolutionary fundamental beta derived is actually in terms of dividend yields.

In this setting, the deviation of the standard beta from the evolutionary fundamental beta must be systematically reduced over time; even when, in contrast to the two-fund separation theorem, not all investors do invest in the market portfolio. This is because market wealth converges towards the winning strategy(s). Thus, we present our Hypothesis 1 as follows:

-

Hypothesis 1- There is a tendency for the standard beta to converge to the evolutionary fundamental beta.

In order to test Hypothesis 1 on the convergence of the standard beta towards the evolutionary fundamental beta, we estimate the following regression equation using annual Dow Jones Industrial Average (DJIA) data from 1981 to 2019.

where \({b}_{t}\) and \({a}_{t}\) denote the estimated values and \({\varepsilon }_{t}\) is the error term. The coefficient \({b}_{t}<1\) implies the convergence of two betas. The null hypothesis for testing with the Wald test of coefficient restriction is \({H}_{0}: {b}_{t}\ge 1\) for t = 1981, …, 2019.

We estimated the regression using the OLS method with White-corrected covariance matrix to adjust for heteroscedastic errors and used the Wald test to test the coefficient restrictions. The results are presented in Table1.

Based on the estimation output in Table (1), the coefficient \({a}_{t}\) in the regression is not significantly different from zero (\(\left|t\right|\)< 2) and the coefficient \({b}_{t}\) in the regression is significantly different from zero (\(\left|t\right|\)> 2), and is less than 1 which is in line with our hypothesis on the tendency of \(\beta\) to converge to \({\beta }^{*}\). Moreover, the null hypothesis that \({b}_{t}\ge 1\) is rejected with the Wald F-statistic at any level of significance (P-value = 0.000), confirming our hypothesis on the tendency of \(\beta\) to converge to \({\beta }^{*}\).

5 Conclusion

In this paper, we extended the single-period static model of CAPM to a dynamic equilibrium asset pricing model with more realistic assumptions, in which a subset of investors is allowed to form their portfolio over time in a different way from the mean–variance analysis. Motivated by the EHSH-Model (2011), we applied evolutionary dynamics to a new modeling of CAPM with heterogeneous behavior that resulted in endogenous wealth distribution and returns of the risky assets in the model.

It is shown by numerical simulations that investors who are endowed with the mean–variance strategy as described by the CAPM are asymptotically driven to extinction when the evolutionary strategy proposed by Evstigneev et al. (2002) enters the market. Indeed, in this setting the evolutionary strategy dominates all other strategies and asymptotically determines the market identity as well as relative prices of risky assets. Hence, using this property, we derived a beta based on fundamentals to which the standard beta tends to converge asymptotically. The convergence is also confirmed by data from the DJIA.

Data availability

All data is publicly available.

Change history

30 August 2022

A Correction to this paper has been published: https://doi.org/10.1007/s00191-022-00791-6

Notes

See the survey papers in the handbook of Hens and Schenk-Hoppe (2009) for developments in this literature.

For each asset, the market identity is the equality of demand and supply written in terms of asset allocations and relative wealth.

This assumption is well justified according to the Evolutionary Finance models of EHSH in which for many settings investing proportional to expected relative dividends dominates all other strategies in the market and asymptotically gains all the market wealth (cf. Evstigneev et al. (2016)).

The simulation is available online on http://anywhere3.pythonanywhere.com/login_ba, Pwd: FinEco21. The description of the strategies is taken from the Bachelor thesis of Julian Fischer.

Independent and identically distributed.

In the initializing phase,\({\lambda }_{t}^{*ad, k}=\left(1-{\lambda }^{0}\right).\frac{({\mathrm{n}}_{\frac{1}{N} }. {\uplambda }_{\mathrm{K }}^\frac{1}{N} + {\mathrm{n}}_{{ \lambda }^{\mathrm{tm}}} . {\widehat{d}}^{ad} )}{{\mathrm{n}}_\frac{1}{N}+ {\mathrm{n}}_{{ \lambda }^{\mathrm{tm}}}},k=1, \dots , K\). Where \({\mathrm{n}}_\frac{1}{N}=\mathrm{max}\left(lr-t,0\right)\) and \({\mathrm{n}}_{{ \lambda }^{\mathrm{tm}}}= lr-{\mathrm{n}}_\frac{1}{N}\) are weights for the weighted average during the defined look-back period. The variable \({\widehat{d}}^{ad}\) is the mean of the previous relative dividend payouts, within the look-back period lr.

sig(x) = \(\frac{1}{1-{e}^{-x}}\)

For a formal argument see footnote 12 below.

Proven in Appendix 3.

By the definition, market capitalization of asset k is \({MC}_{t}^{k}= {\sum }_{i=1}^{I}{p}_{t}^{k}{ \mathrm{x}}_{t}^{i, k}\) which can be rearranged as \({{MC}_{t}^{k}= p}_{t}^{k}{\sum }_{i=1}^{I}{ \mathrm{x}}_{t}^{i, k}\). Since it is assumed that risky assets are in a unit supply, in the equilibrium \({\sum }_{i=1}^{I}{ \mathrm{x}}_{t}^{i, k}=1\). Therefore, \({MC}_{t}^{k}= {p}_{t}^{k}\).

References

Asness CS, Moskowitz TJ, Pedersen LH (2017) Value and Momentum Everywhere. J Finance 68(3):929–985

Barberis N, Thaler R (2003) A Survey of Behavioral Finance. In: Constantinides GM, Harris M, Stulz RM (eds) Handbook of the Economics of Finance, 1 Vol 1 Chapter 18. Elsevier, Amsterdam, pp 1053–1128

Black F (1972) Capital market equilibrium with restricted borrowing. J Bus 45(3):444–455

Breeden DT (1979) An Intertemporal Asset Pricing Model with Stochastic Consumption and Investment Opportunities. J Financ Econ 7:265–296. https://doi.org/10.1016/0304-405X(79)90016-3

Breeden D, Gibbons M, Litzenberger R (1989) Empirical Test of the Consumption-Oriented CAPM. J Finance 44(2):231–262. https://doi.org/10.2307/2328589

Chan J, Jegadeesh N, Lakonishok J (1996) Momentum Strategies. J Finance 51(5):1681–1713

Chance Don M (1982) Evidence on a Simplified Model of Systematic Risk. Financial Manag 11(3):53–63

Chiarella C, Dieci R, He X (2013) Time-varying beta: A boundedly rational equilibrium Approach. J Evol Econ 23:609–639. https://doi.org/10.1007/s00191-011-0233-5

DeMiguel V, Garlappi L, Uppal R (2009) Optimal versus Naive Diversification: How Inefficient Is the 1/N Portfolio Strategy? J Rev Financial Stud 22(5):1915–1953. https://doi.org/10.1093/rfs/hhm075

Duffie JD (1988) Security Markets: Stochastic Models. Academic Press, San Diego

Dyl EA, Hoffmeister JR (1986) A Note on Dividend Policy and Beta. J Bus Financ Acc 13(1):107–115

Evstigneev IV, Hens T, Schenk-Hoppé KR (2002) Market Selection of Financial Trading Strategies: Global Stability. J Math Finance 12(4):329–339

Evstigneev IV, Hens T, Schenk-Hoppé KR (2011) Local stability analysis of a stochastic evolutionary financial market model with a risk-free asset. J Math Financial Econ 5:185–202. https://doi.org/10.1007/s11579-011-0056-zir

Evstigneev IV, Hens T, Schenk-Hoppé KR (2016) Evolutionary Behavioral Finance, Chapter 9. In: Haven E, Molyneux P, Wilson JOS, Fedotov S, Duygun M, (eds) The Handbook of Post Crisis Financial Modelling. Palgrave MacMillan, pp 214–234

Fama EF, MacBeth JD (1973) Risk, Return, and Equilibrium: Empirical Tests. J Polit Econ 81(3):607–636

Fama EF, French KR (2004) The Capital Asset Pricing Model: Theory and Evidence. J Econ Perspect 18(3):25–46

Gahlon JM, Gentry JA (1982) On the Relationship Between Systematic Risk and the Degrees of Operating and Financial Leverage. J Financial Manag 11(2):15–23

Hens T, Naebi F (2020) Behavioural Heterogeneity in the Capital Asset Pricing Model with an Application to the Low-Beta Anomaly. J Appl Econ Lett 28(6):501–507. https://doi.org/10.1080/13504851.2020.1761529vx

Hens T, Schenk-Hoppé KR (2009) Handbook of Financial Markets: Dynamics and Evolution. North Holland

Hens T, Schenk-Hoppé KR, Woesthoff MH (2020) Escaping the Backtesting Illusion. J Portf Manag 46(4):81–93

Jegadeesh N, Titman S (2011) Momentum. Annu Rev Financ Econ 3:493–509

Lintner J (1965) Security Prices, Risk, and Maximal Gains from Diversification. J Finance 20(4):587–615

Lintner J (1969) The Aggregation of Investor’s Diverse Judgments and Preferences in Purely Competitive Security Markets. J Financial Quant Anal 4(4):347–400. https://doi.org/10.2307/2330056

Lucas R (1978) Asset Prices in an Exchange Economy. Econometrica 46(6):1429–1445. https://doi.org/10.2307/1913837

Markowitz H (1952) Portfolio selection. J Finance 7(1):77–99

Mayers D (1972) Nonmarketable Assets and Capital Market Equilibrium under Uncertainty. In: Jensen MC (ed) Studies in the Theory of Capital Markets. Praeger, New York, pp 223–248

Merton R (1973) An Intertemporal Capital Asset Pricing Model. Econometrica 41(5):867–887. https://doi.org/10.2307/1913811

Mossin J (1966) Equilibrium in a Capital Asset Market. Econometrica 34(4):768–783. https://doi.org/10.2307/1910098

Rosenberg B, McKibben W (1973) The Prediction of Systematic and Specific Risk in Common Stock. J Financial Quant Anal 8(2):317–333

Sciubba E (2006) The evolution of portfolio rules and the capital asset pricing model. J Econ Theory 29:123–150

Sharpe WF (1964) Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk. J Finance 19(3):425–442

Acknowledgements

We like to thank an anonymous referee of this journal and participants of the financial economics seminar at the University of Zurich for helpful comments. Moreover, we are grateful to Julian Fischer for having provided the program with which we did the simulations in part 4 of this paper.

Funding

Open access funding provided by University of Zurich

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Ethical standards

Yes – we comply with all ethical standards of the Journal of Evolutionary Economics.

Conflict of interest

None.

Ethical conduct

The paper was conducted in line with the ethical standards of Journal of Evolutionary Economics.

The authors have no relevant financial or non-financial interests to disclose.

The authors have no competing interests to declare that are relevant to the content of this article.

All authors certify that they have no affiliations with or involvement in any organization or entity with any financial interest or non-financial interest in the subject matter or materials discussed in this manuscript.

The authors have no financial or proprietary interests in any material discussed in this article.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The original version of this article was revised. In this section: 4.1 Simulation analysis. The description of these strategies is taken from Fischer (2021).

Appendices

Appendix 1 Dynamics of relative wealth

To prove the relation (9) we proceed as follows:

Finally, the resulting system of equations can be written in a compact vector notation as:

Appendix 2 The growth rate of aggregated wealth (gamma)

To prove growth rate of aggregated wealth, we proceed as follows:

By summing the relation above over i and recalling our assumptions \({\lambda }_{t}^{i,0}\)=\({\lambda }^{0}\), \({\alpha }_{t}^{i}\)=\(\alpha\), \({D}_{t+1}^{k}={d}_{t+1}^{k} {W}_{t}\) and \({\overline{d} }_{t+1}=\sum_{k=1}^{K}{d}_{t+1}^{k}\) we have:

Appendix 3 Evolutionary fundamental beta in practice

To prove Evolutionary Fundamental Beta in practice, we proceed as follows:

The fundamental equation of return on any risky asset k at time t is given by \({R}_{t}^{k} = \frac{{D}_{t}^{k }+ {MC}_{t}^{k}}{{MC}_{t-1}^{k}}\).

By writing it in relative terms, we have:

Given that as a result of our assumption the relative market capitalization of asset k in the limit is a constant,\(\frac{{MC}_{t-1}^{k}}{{TMC}_{t-1}}=\frac{{MC}_{t}^{k}}{{TMC}_{t}}={RMC}^{k}\), we obtain:

Recalling the definition of the market return \({R}_{t}^{M}={\sum }_{k=1}^{K}{\lambda }_{t}^{M,k}{R}_{t}^{k}\) and entering the formula obtained for \({R}_{t}^{k}\) in \({R}_{t}^{M}\), we get the following formula for the market return:

Now to get the beta in the CAPM given by\({\beta }_{t}^{ k}=\frac{Cov ({R}_{t}^{k},{ R}_{t}^{M})}{Var ({R}_{t}^{M})}\), the covariance of \({R}_{t}^{k}\) and \(,{ R}_{t}^{M}\) as well as the variance of \({R}_{t}^{M}\) are required, which are obtained as follows:

We get the following formula for the beta:

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Hens, T., Naebi, F. Behavioral heterogeneity in the CAPM with evolutionary dynamics. J Evol Econ 32, 1499–1521 (2022). https://doi.org/10.1007/s00191-022-00786-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-022-00786-3