Abstract

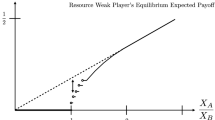

We study independent private-value all-pay auctions with risk-averse players. We show that: (1) Players with low values bid lower and players with high values bid higher than they would bid in the risk neutral case. (2) Players with low values bid lower and players with high values bid higher than they would bid in a first-price auction. (3) Players’ expected utilities in an all-pay auction are lower than in a first-price auction. We also use perturbation analysis to calculate explicit approximations of the equilibrium strategies of risk-averse players and the seller’s expected revenue. In particular, we show that in all-pay auctions the seller’s expected payoff in the risk-averse case may be either higher or lower than in the risk neutral case.

Similar content being viewed by others

References

Barut Y, Kovenock D, Noussair C (2002) A comparison of multiple-unit all-pay and winner-pay auctions under incomplete information. Int Econ Rev 43(3):675–708

Baye M, Kovenock D, de Vries C (1993) Rigging the lobbying process. Am Econ Rev 83:289–294

Baye M, Kovenock D, de Vries C (1996) The all-pay auction with complete information. Econ Theory 8:291–305

Bender CM, Orszag S (1978) Advanced mathematical methods for scientists and engineers. McGraw-Hill, New York

Dasgupta P (1986) The theory of technological competition. In: Stiglitz J, Mathewson G (eds) New developments in the analysis of market structure. MIT, Cambridge Press

Dixit A (1987) Strategic behavior in contests. Am Econ Rev 77(5):891–898

Eso P, White L (2004) Precautionary Bidding in auctions. Econometrica 72:77–92

Fibich G, Gavious A (2003) Asymmetric first-price auctions – a perturbation approach. Math Oper Res 28:836–852

Fibich G, Gavious A, Sela A (2004) Revenue equivalence in asymmetric auctions. J Econ Theory 115:309–321

Hilman A, Riley JG (1989) Politically contestable rents and transfers 1. Econ Polit 1:17–39

Kaplan T, Luski I, Sela A, Wettstein D (2002) All-pay auctions with variable rewards. J Ind Econ L(4):417–430

Krishna V, Morgan J (1997) An analysis of the war of attrition and the all-pay auction. J Econ Theory 72:343–362

Maskin E, Riley JG (1984) Optimal auctions with risk averse buyers. Econometrica 6:1473–1518

Matthews S (1987) Comparing auctions for risk averse players: a player’s point of view. Econometrica 55:636–646

Milgrom P, Weber R (1982) A theory of auctions and competitive bidding. Econometrica 50: 1089–1122

Monderer D, Tennenholtz M (2000) K-price auctions. Games Econ Behav 31:220–244

Myerson RB (1981) Optimal auction design. Math Oper Res 6:58–73

Noussair C, Silver J (2005) Behavior in all-pay auctions with incomplete information. Games Econ Behav (Forthcoming)

Riley JG, Samuelson WF (1981) Optimal auctions. Am Econ Rev 71:381–392

Tullock G (1980) Efficient rent-seeking. In: Buchanan J. et al (ed) Towards a theory of the rent-seeking. A&M University Press, College station

Vickrey W (1961) Counterspeculation, auctions, and competitive sealed tenders. J Finan 16:8–37

Weber R (1985) Auctions and competitive bidding. In: Young HP (ed) Fair Allocation. American Mathematical Society, Providence

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Fibich, G., Gavious, A. & Sela, A. All-pay auctions with risk-averse players. Int J Game Theory 34, 583–599 (2006). https://doi.org/10.1007/s00182-006-0034-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00182-006-0034-5