Abstract

By providing affordable health insurance untied from employer provision, the Massachusetts Health Reform Program could increase self-employment. Previous studies have estimated both positive and negative effects of the reform on aggregate self-employment using difference-in-differences designs. In this study, I use the synthetic control methodology to confirm the absence of a statistically significant effect of the reform on aggregate self-employment. However, I do detect positive and significant short-run effects of the reform on the probability that individuals become incorporated self-employed. This effect is restricted to individuals 40 years old or younger. I also find that for employees in this age range the reform caused a significant wage reduction. This finding highlights that the higher reform-mandated health insurance coverage was at least in part financed by employees.

Similar content being viewed by others

1 Introduction

As of 2005, 46.6 million people—about 16% of the US population—lacked health insurance. Among those who were covered, about 60% had employer-sponsored health insurance (ESI), while only 9% had coverage plans from the private individual market. The rest had some kind of public coverage like Medicare, Medicaid, or Military Health Insurance (DeNavas-Walt 2010; Fairlie and London 2008). The private individual market was subject to medical underwritings, that is, individuals being charged premiums on the basis of their health statuses and being denied coverage due to preexisting conditions. Due to the difficulties of acquiring health insurance from the private individual market, many scholars (Buchmueller and Valletta 1996; Niu 2014) have studied whether ESI can lead to a “job lock” phenomenon, that is, hinder individuals from switching to jobs that do not provide health insurance. Difficulties in acquiring health insurance privately outside one’s employment can also act as a barrier to new business creation. This is because people who receive employer-provided health insurance would risk being without health insurance coverage when they leave their salaried jobs to become self-employed. Thus, there is a strong link between health insurance availability and self-employment in the USA.

As of 2015, 15 million—10.1% of US workers—were self-employed.Footnote 1 Nation-wide surveys conducted in 2005 and 2008 by the National Association of the Self-employed (NASE) highlighted that access to health insurance is a major problem for micro-businesses (businesses with 10 or fewer employees). Only about 67% of entrepreneurs had personal health insurance coverage through their businesses or from the individual market, and the percentage of entrepreneurs with health coverage through their spouses was close to 20%. In addition, only 46.8% of micro-business firms offered health insurance through their businesses (NASE, 2005, 2008) https://www.nase.org/sf-docs/default-source/research-results/health_coverage_perspective.

While there is extensive research regarding the job lock phenomenon and the effects of health insurance on labor market decisions,Footnote 2 few studies have probed the effects of the provision of affordable health insurance that can be easily acquired through the individual market without being turned away due to medical underwriting on micro-business creation. Self-employment, although often a last resort for unemployed individuals, is an important driver of economic growth. Several studies have shown that increased levels of self-employment lead to increased salaried job creation, growth in per capita income, and reduced poverty rates (Henderson and Weiler 2010; Rupasingha and Goetz 2013). The few existing studies that investigate whether ESI is a barrier to self-employment generation have provided contradictory results (Fairlie et al. 2011; Holtz-Eakin et al. 1996). Moreover, when it comes to measuring self-employment, the previous literature on this topic has hardly made any distinction between entrepreneurship and other types of self-employment. This distinction is crucial, as within the self-employed, it is the “entrepreneurs” that drive economic growth through innovation, business creation and undertaking risky ventures to produce new goods and services. Instead, the self-employed who are not entrepreneurs do not generally undertake risky ventures and concentrate mostly on occupations that do not require strong business acumen. Levine and Rubinstein (2017) argued that the incorporated self-employed are a good proxy for productivity-enhancing entrepreneurs, as their daily jobs require them to perform activities demanding in non-routine cognitive skills, such as creativity, analytical problem solving, and inter-personal communication skills needed for persuading and managing.Footnote 3 Unincorporated individuals, on the other hand, engage in more manual labor tasks such as carpentry, plumbing, truck driving, etc. To differentiate between entrepreneurs and all other types of self-employed individuals, I divide the self-employed into the incorporated and unincorporated self-employed. The legal features of having an incorporated business, like limited liability and a separate legal identity, are valuable to entrepreneurs looking to undertake risky business investments. These features are less attractive to unincorporated individuals. The Current Population Survey (CPS) data used for the main analysis of this study indicate that about 81.5% of incorporated business owners employ themselves in managerial, professional, sales and administrative occupations, while only about 57% for the unincorporated self-employed do the same. About 43% of unincorporated self-employed engage in service- and operations-related occupations compared to a mere 18.5% of their incorporated counterparts.

This paper examines whether ESI acts as a barrier to self-employment by focusing on the case of the Massachusetts Health Care Reform (MHCR). The program was initiated in 2006 and mandated that every Massachusetts (MA) resident (with some exemptions, mainly on the basis of affordability) received health insurance coverage. It aimed to provide universal health insurance coverage to the people of MA by expanding Medicaid, providing state subsidized health insurance through a portal called the “Connector” and introducing private health insurance market reforms to make health insurance more affordable and acquirable in the individual market (see Sect. 3). This had the potential to weaken job lock and lead to a higher rate of self-employment by enticing aspiring entrepreneurs tied to their salaried jobs. At the same time, the cost of self-employment had increased because of the employer mandate, which required employers with more than 10 full-time employees to sponsor their health insurance. Also, because of this employer mandate, current employees who were acquiring health insurance may not have wanted to switch over to self-employment. Thus, the effect of the reform on self-employment is theoretically ambiguous. It is important to note here that, although the CPS does not provide information on the number of people employed by these self-employed individuals, according to the relatively new Annual Survey of Entrepreneurs, as of 2014, about 22% of businesses with employees on their payroll have 10 or more full-time employees.

In this paper, I use the Basic Monthly files and the Annual Social and Economic Component (ASEC) of the CPS for the years 1996–2011 to investigate whether the MHCR led to an increase in health insurance coverage and self-employment. I use the synthetic control methodology popularized by Abadie and coauthors (Abadie and Gardeazabal 2003; Abadie et al. 2010, 2015) to analyze the effects of the reform. The synthetic control model (SCM) creates a control state that mimics the treatment state of MA in terms of the outcome variable (health insurance coverage or self-employment). The final coefficient estimate is deduced by averaging the difference in the outcome variable between MA and the synthetic control state over the post-reform period. The SCM has been growing in popularity over the past decade and has important advantages over the difference-in-difference (DID) methodology used in previous studies to analyze the effect of this reform on self-employment (Heim and Lurie 2014; Niu 2014). In detail, the selection of the control state in the SCM for comparison with MA is not ad hoc (as in the DID methodology). Instead of using one or more of the 49 other US states as the control unit, which may or may not have properties similar to MA, the synthetic control methodology optimally weights some of these 49 other US states to ensure that the evolution of synthetic control over time closely resembles that of MA. This sort of weighting to create an optimal control state would also be advantageous to deal with the shocks of the Great Recession that affected some of the years used in this analysis as the SCM creates a control state that would be affected similar to MA due to the recession. This is in contrast to the DID, where the control units of the “Rest of the U.S” or the “Northeastern states” as used in previous studies like Niu (2014) would presumably be affected differently to MA due to differences in industrial compositions, socio-demographic factors, and labor market conditions.

The preferred method of carrying out statistical inference in the SCM is randomization inference (RI) (Abadie and Gardeazabal 2003; Abadie et al. 2010, 2015; Peri and Yasenov 2019; Pichler and Ziebarth 2020). RI is essentially a permutation test done under the assumption that the null hypothesis is true. If the null hypothesis of no effect holds true for all units, the treatment effect estimate is independent of whether or not a unit is assigned a treatment or a control status. Thus, the effect of the treatment can be obtained for each unit individually, and a distribution of these treatment effects can be obtained. The inference test can then be done by checking whether the treatment effect of the actual treated unit is “surprising” in this distribution or not (Chetty et al. 2009; Fisher 1922; Kaestner 2016). RI has the desirable property of not making any parametric assumptions about the functional form of the variance–covariance matrix and so does not suffer from the problem of over-rejecting the null hypothesis (Chetty et al. 2009).Footnote 4 An important advantage of RI over other kinds of permutation tests is its logical simplicity. RI p values are simply functions of the rank of the true treatment effect on the treated unit to placebo treatment effects of the treatment on the control units. Although other permutation test alternatives exist (see Chernozhukov et al. 2021), I use RI due to its simplistic nature and its widespread use with synthetic control analyses. Recent studies have also shown it dramatically outperforming conventional methods of inference in a classical DID framework with a small number of treatment clusters (Paz and West 2019).

I find the effect of the reform on aggregate self-employment to be small and insignificant. On further examination of the effect of the reform on the two different types of self-employment, incorporated and unincorporated, I find evidence of a significant increase in self-employment among those in the incorporated sector. The effect is large in percentage terms and is as high as 38.6% in the months immediately following the reform. After the full implementation of the reform, however, the effect dies down and is not significant. At the same time, the effect of the reform on the unincorporated self-employed is insignificant. Since the demand for health insurance and preferences for labor supply for females can be different from that of males for reasons related to childbirth, among other things, I check for heterogeneous effects between males and females within each type of self-employment but find no evidence for it using the SCM.

When it comes to age, I investigate the effect of the reform separately on those who are presumably more susceptible to having higher health care needs, which I define as those above 40 years old, versus those who are less susceptible, that is, individuals 40 years old or younger. I find that incorporated self-employment increased significantly only for individuals 40 or below and not for the older subgroup. To explore a mechanism that might explain why the effect was concentrated only among those 40 or below, I examine the effect of the reform on income levels of salaried workers a few months after the reform was passed compared to before the reform. I exploit the rotation pattern of the CPS to form a panel dataset by linking individuals observed in the ASEC data of the CPS in the periods just before and a few months after the reform. Using a fixed-effect DID panel data model, I infer that the reform led to a large average decline of $6,176, which is significant by RI for salaried workers 40 or below. Instead, I find a smaller and insignificant decline in income for those above 40. This shows that employers had shifted the burden of financing the mandated health insurance to be provided to workers disproportionately more toward younger workers who were more incentivized to leave their wage/salaried jobs and start their own businesses in the incorporated sector. Salaried workers are skilled workers with high education levels, so they transitioned into the incorporated self-employment sector, which requires high skills, innovation, and cognitive abilities, rather than into the unincorporated sector, which primarily represents menial labor. Thus, the MHCR indeed had an impact on young, self-employed, incorporated individuals, who are a good proxy of entrepreneurs engaging in productivity-enhancing tasks. The incorporated self-employed, however, represent only about a third of the total self-employed population, and those 40 or below, in turn, represent only about 30.5% of the incorporated self-employed prior to the reform. This conclusion is different from previous studies, such as Niu (2014), which concluded that self-employment on a whole increased due to the reform, and Heim and Lurie (2014), which found a decrease in self-employed individuals.

The results of the paper can help gather insights not just about the effects on MA, but more generally on the USA as a result of the implementation of the federal Affordable Care Act (ACA) later, which was very similar to the MHCR in terms of the individual mandate to acquire health insurance, the selling of health insurance through exchanges, the expansion of healthcare coverage through Medicaid, and the private health insurance market reforms, such as the elimination of medical underwritings and subsidization through tax credits to make health insurance more affordable.

2 Literature review

Several studies have estimated the effects of the Tax Reform Act of 1986 (TRA86), which enabled self-employed individuals to deduct health insurance costs from their taxable incomes (Gumus and Regan 2013; Gurley-Calvez 2011; Selden 2009; Velamuri 2012). The general consensus among these studies is that TRA86 significantly reduced the probability of individuals from exiting self-employment, while the effect on the probability of entering has been insignificant. Holtz-Eakin et al. (1996), using DID models on Survey of Income and Program Participation (SIPP) and Panel Study of Income Dynamics (PSID) data, could not find statistically significant estimates of lesser likelihoods to transition into self-employment for insured salaried workers without spousal health insurance and insured workers with families in poor health than those with spousal health insurance and without family members in poor health. Fairlie et al. (2011) use matched CPS data from 1996 to 2006 and used DID models to conclude that employer-insured individuals with higher demands for health insurance are less likely to transition into self-employment than individuals without ESI.

Some have studied the impact of the MHCR itself on self-employment, and so far, the results have been mixed. Jackson (2010) found that new firm creation decreased after the reform. Heim and Lurie (2014) found that the reform led to a decline in the rate of taxpayers who earned a majority of their income from self-employment. The analysis most closely related to this study is that of Niu (2014), who used DID models to find that, from the 1995–2011 files of the CPS, the reform led to a large and significant increase in health insurance coverage and increased the likelihood of self-employment by 0.71% points—an 8.4% increase from the pre-reform average in MA compared to the rest of the USA or other north-eastern states. However, the study used robust standard errors clustered at the state level with only one treatment state: MA. The use of clustered robust standard errors (CRSE) with a small number of treatment clusters in a DID framework has been shown to lead to small standard errors and a consequent over-rejection of the null hypothesis (Conley and Taber 2011). In Appendix, I replicate this study and show how the significance of the coefficients disappear when using RI instead of CRSE. A working paper by Becker and Tuzemen (2014) also explores the effect of the MA reform on self-employment. However, like Niu (2014), their analyses suffer from the same issues of using CRSE and bootstrap for inference in a DID setting with just one treatment cluster of the state of MA. They also do a synthetic control analysis, but without carrying out any statistical inference for it. Furthermore, their characterization of the incorporated self-employed as salaried workers is highly debatable and in stark contrast to the literature on entrepreneurship (see Levine and Rubinstein 2017). Also, the analyses of Niu (2014) and Becker and Tuzemen (2014) do not include placebo tests for the crucial assumption of parallel trends on which the DID framework operates. In my study, I make transparent the constitution of self-employed individuals which include both the incorporated and unincorporated self-employed, and I use the SCM to overcome the parallel trends violation issue of the DID method. I overcome the challenge of carrying out statistical inference with one treatment state by using the randomization inference strategy for statistical significance. I also explore a new mechanism which explains why there has been a transition from wage/salaried work to incorporated self-employment through a negative income effect of the reform on younger workers in wage/salaried jobs.

This paper is also one of several studies that assess the internal and statistical validity of several research designs commonly used in applied microeconometric research. Peri and Yasenov (2019) revisited the labor market effects of the Mariel Boatlift, first studied by Card (1990). With an SCM, they reaffirmed the previous conclusion of no significant effect of the Mariel Boatlift on the wages of low-educated workers in Miami. Stephens and Yang (2014) revisited the issue of compulsory education laws in the USA, finding that the effect of these laws became insignificant on a variety of outcomes, such as wages, mortality, incarceration, and social returns to schooling, when they added region-specific year-of-birth effects to previously used specifications. Wolfers (2006) replicated Friedberg (1998) and showed that her widely accepted view, that is, that no-fault divorce laws accounted for one-sixth of the rise in divorce rates since the 1960s, was misleading and that there had been no persistent effect of the laws after about a decade of their adoption. Sommers et al. (2014) concluded that the MHCR decreased all-cause mortality. Kaestner (2016) replicated their study and showed that the significance of the estimates disappear with the use of RI.

This paper makes several contributions. First, it informs the debate on the broader literature of the relationship between health insurance and self-employment and whether ESI is indeed a barrier to individuals who want to be self-employed. Second, it adds to the conflicting literature about whether the MHCR significantly impacted self-employment generation. Third, it shows the importance of distinguishing between types of self-employed individuals based on incorporated and unincorporated self-employment, or between “entrepreneurship” and other types of self-employment, which has often been neglected in the prior job lock literature. Fourth, it brings new evidence to light about a reduction in wages of younger wage/salaried workers in MA due to the reform as a result of the employer mandate which serves as a mechanism for explaining the main results. Fifth, it shows how using CRSE in a DID framework with only one treatment cluster can lead to erroneously obtaining significant estimates by replicating the work of Niu (2014) and overcomes this issue by using the SCM with RI. Sixth, it further explains whether the ACA, which expanded health insurance coverage at a federal level in similar ways as the MHCR, had any significant causal effect on self-employment. If a reform toward achieving universal health insurance coverage indeed generates self-employment, then a decline in self-employment will be another of the various harmful impacts of a repeal-and-replace policy, which former US President Barack Obama has cautioned against (Obama 2017).

3 The Massachusetts Health Care Reform (MHCR)

The Massachusetts Health Care Reform law was passed in Massachusetts on April 12, 2006. Its long form title is “An Act Providing Access to Affordable, Quality, Accountable Health Care.” Since the governor of Massachusetts at the time was Mitt Romney, the reform is often colloquially termed as “Romneycare”. The reform has several key features.

First, the expansion of “MassHealth”, the state’s Medicaid program, expanded eligibility for children, removed caseload caps for children and adults with disabilities, long-term unemployed and people with HIV.

Second, the introduction of programs like “Commonwealth Care”, “Commonwealth Choice” and “Young Adult Plans” which subsidizes private insurance for people below 300% of the Federal Poverty Line (FPL)Footnote 5 who do not have access to MassHealth or employer provided health insurance.

Third, it substantially restructured the private insurance market by merging the state’s non-group and small group insurance markets. The merging of the pool of about 50,000 MA residents in the non-group market without access to ESI to the small group market consisting of over 700,000 residents insured through small group plans under employers with up to 50 employees led to the creation of a large pool so that the participants of the non-group market could benefit from higher product choice availability.

Fourth, it established the Commonwealth Health Insurance Connector Authority or the “Connector”, which serves as an exchange or portal for people to purchase health insurance plans like Commonwealth Care, Commonwealth Choice, and Young Adult Plans. The Connector also sets premium subsidy levels for Commonwealth Care and defines “affordability” for the individual mandate.

Fifth, it mandated that every individual obtain health insurance unless they are exempt on the basis of “affordability” as defined by the Connector.

Sixth, it required employers with more than 10 full-time employees to have at least 25% of their full-time employees on their health plans or pay 33% of the employees’ insurance premiums or pay a penalty of up to $295 per uninsured employee per year into the Commonwealth Care Trust Fund. Both the individual and employer mandates were implemented in July 2007.

Finally, the plan was funded by redirecting federal funds previously earmarked for safety net hospitals and from “the uncompensated care pool”, which was set up in MA in the late 1980s as part of previous reforms to reimburse hospitals for treating low-income people. This pool had risen to over $500 million by 2005.Footnote 6

It should be noted that this form of implementation of the health care reform was also adopted by the ACA to expand health insurance coverage on a nation-wide level. In ways similar to the MHCR, the ACA also expanded Medicaid eligibility to below 138% of the FPL, subsidized private insurance through premium tax credits and cost-sharing subsidies, introduced federal and state exchanges to enable people to access a wide variety of insurance plans and eliminate tedious application processes, imposed the individual mandate, the “employer mandate” that penalizes employers who do not pay their fair shares of their employees? health care plans, banned medical underwriting, and guaranteed the issue of insurance regardless of preexisting conditions (a law that already existed in MA as a result of previous health care reforms). Thus, the results of this paper may lend insight into the effects of ACA (also called Obamacare) on self-employment generation as well. Caution should be exercised in using these results to make inferences about Obamacare expansions, however, as the experiences of the MA reform differ from those of the ACA in certain regards as well. First, it was relatively easy for MA to fund the expansion, as it already had a low uninsurance rate of about 9% for the non-elderly compared to 18% nationally. At the same time, it had the aforementioned uncompensated care pool to finance the expansion. Second, it had the largest number of physicians per capita of any state, which gave the state an advantage in providing health care to the influx of newly insured individuals (Mazumder and Miller 2016). Third, under the ACA, states have the option to not expand their Medicaid,Footnote 7 unlike MA, which expanded its Medicaid program, MassHealth. As of May 2019, 37 states (including the District of Columbia) have expanded Medicaid and 14 states have not. Fourth, from a demographic point of view, even before the reform in 2006, MA had the third-highest per capita incomeFootnote 8 and consistently ranks in the top 10 states in terms of educational attainment. Thus, one should be careful about generalizing the results observed in the case of MA to each of the 37 states that expanded Medicaid under the ACA.

4 Data

The source of the data used in this analysis is the Basic Monthly files and the ASEC (also known as the March files) of the CPS. The CPS is one of the oldest, largest US surveys, interviewing approximately 50,000 households a month, and is representative of the civilian household-based population of the USA. In this analysis, the sample has been restricted to adults between 21 and 64 years old. When individuals turn 65, they become eligible for Medicare, which is a single-payer, federally funded medical insurance program. Individuals 65 and older have thus been dropped from this analysis, as they already have access to affordable health insurance outside their work and do not suffer from job lock. Veterans and the disabled have also been dropped from the analysis for similar reasons. Farm and agricultural workers have also been dropped because the problem of a potential barrier to self-employment due to ESI is not relevant for this population subgroup.Footnote 9 This analysis uses the years 1996–2011 of the CPS. The ASEC of the CPS records individual health insurance responses that were true for the previous calendar year. For this reason, the time for the health insurance variable in the graphs demonstrating health insurance coverage trends has been adjusted one year backward for true correspondence to the years (i.e., 1995 onward). The ASEC files are the only files that contain information on individual health insurance coverage. This information cannot be found in the Basic Monthly files. Thus, the ASEC provides the only data that could be used to resolve whether the reform increased health insurance coverage. The analysis period has been stopped at 2011 to facilitate comparison with Niu (2014). Hawaii has been dropped from the analysis, just as in Niu (2014), because the state implemented an ESI mandate in the 1970s.

The primary variables of interest are “whether an individual has any health insurance coverage” and “whether the individual is a self-employed person”. The health insurance coverage may be public or private. Public coverage can be Medicare, Medicaid, State Children’s Health Insurance Program (SCHIP), or any other state-sponsored program. Private coverage can be employer-sponsored or individually purchased from the private market. For the regressions, for which the outcome of interest is whether the person is covered by any health insurance, health insurance weights created by the State Health Access Data Assistance Center at the University of Minnesota have been used. For self-employment, the individual can be self-employed in an incorporated or an unincorporated business. For regressions with this outcome of interest, the person-level supplemental weights have been used.

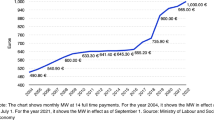

Table 1 provides the summary statistics for salaried and self-employed workers in the entire USA for the years 1995–2011. It also provides summary statistics for the self-employed individuals in MA and the Rest of the United States “before” and “after” the reform. Since the MHCR was implemented over a span of time rather than on a specific day, the time period has been divided into “before” the reform, “during” the implementation period, and “after” the reform implementation, just like Niu (2014). The “before” period is defined as the months prior to May 2006, the “during” period as the months between May 2006 and June 2007 (inclusive), and the “after” period as the months after June 2007. As is apparent from Table 1, self-employed individuals tend to be male, white, married, and older when compared to salaried individuals. Figure 1 shows how the rate of health insurance coverage and self-employment evolved over time for MA and the rest of the USA. For health insurance coverage, there is a clear spike in the period immediately following the reform, and this level change seems to be sustained over the course of the next few years. For self-employment, there seems to have been a spike in the years prior to the reform and a decline in the years after.

5 Empirical analysis

I use the SCM which is an econometric method for evaluating case studies for evaluating the effect of the MHCR on health insurance coverage and self-employment.

The SCM, first used by Abadie and Gardeazabal (2003), creates a “synthetic” control state as a combination of all the available control states. This combination is achieved by optimally choosing the weights \(W^{*}=(W_{1},W_{2},.\, .\, ., W_{J})\) to be assigned to each of J available control states that will minimize the following function:

where \(X_{1}\) is a \((K\times 1)\) vector of pre-treatment values of the predictors of the outcome variable for the treatment state, \(X_{0}\) is a \((K\times J)\) matrix of values of the same predictors for the J control states and V is a diagonal matrix of non-negative components where the values of the diagonal elements reflect the relative importance of the different predictors (Abadie and Gardeazabal 2003).

Evolution of Health Insurance Coverage and Self-Employment Rates in MA versus the Rest of the United States. Notes: Yearly health insurance coverage and self-employment rates have been plotted in the left- and right-hand-side panels, respectively. Health insurance coverage data are available only on a yearly basis in the March Current Population Survey (CPS) files, the responses indicating whether individuals had some sort of health insurance coverage in the previous calendar year. Thus, the year variable has been adjusted one year backward to show true one-to-one correspondence between time and health insurance coverage. Self-employment data are available in both the Basic Monthly and March files, so the figure on yearly self-employment rates is based on many more observations. The red vertical line indicates the year 2006 when the reform was passed

The SCM is generally better-suited than the DID method in case of violations of the assumption of parallel trends. In DID, there is usually a treatment state and one or more ad hoc control states, the treatment effect of the treated state being derived under the assumptions that the pre-trends of the treatment and control states are parallel and that the contemporaneous shocks after the treatment affected them similarly. The SCM can circumvent this problem by attaching optimal weights to the available control and creating a new control state which closely mimics the trend of the treated state. The SCM not only has some distinct advantages over the DID method, but also over other regression-based estimation strategies that impose parametric restrictions on the nature of the relationship between the outcome and the predictors. First, synthetic control weights sum to 1, i.e., the SCM does not extrapolate out of sample while attaching weights to the available control units. Regression techniques, however, do extrapolate out of sample and their weights can be negative. While regression uses extrapolation to generate a good fit even when the available control units are completely dissimilar, the SCM makes the discrepancy between the trend of the treated state and the convex combination of the available control units that make up the missing counterfactual. Second, as opposed to regression, the SCM does not require the availability of post-treatment outcomes for the generation of the missing counterfactual. That is, the identification of units to be included in the “donor pool” of the synthetic control or the predictors to be included for the generation of the optimal synthetic control can be done without knowing how they affect the conclusion of the study. Third, synthetic control weights assigned to the available control units are sparse which allows for simple interpretation of the generated control unit (see Abadie 2021).

The variables used in the SCM for the generation of the synthetic control state are state-level GDP growth, sex, nonwhite, Hispanic, urban, age, proportions of population in each of the four education, four occupation, seven industry, and six marital status categoriesFootnote 10 as well as the outcome variable itself,Footnote 11. For generating the synthetic control unit for health insurance coverage as seen in Fig. 2, the SCM attached weights to the six control states of Minnesota (0.615), District of Columbia (0.176), New York (0.141), Rhode Island (0.064), Pennsylvania (0.003), and California (0.002). The SCM attached weights to Pennsylvania (0.398), D.C. (0.218), Connecticut (0.169), Colorado (0.134), Vermont (0.056), and Maryland (0.026) and discarded all the other states for the construction of the synthetic control state for analyzing self-employment effects in MA, as seen in Fig. 4. Appendix Table 7 compares the pre-reform averages of the variables included in the SCM for MA with the top two states receiving the highest weights from the synthetic control analysis. We see that these states are comparable to MA in the pre-reform period in terms of the specified socio-economic and demographic variables as well as the respective outcome variables for which they received the highest weights. Additionally, Appendix Figs. 8 and 9 show the trends of shares of health insurance coverage and self-employment of MA with these states. As we can see, the pre-reform trends of MA and these states are fairly similar. These explain, at least in part, why the synthetic control assigns the highest weights to these states for the respective outcomes.

Trends in Health Insurance Coverage: MA versus Synthetic MA. Notes: The share of individuals covered by some form of health insurance has been shown on a yearly basis. Since the responses of individuals reflect whether or not they had health insurance in the previous year, the “Year” variable has been adjusted one year backward to show true one-to-one correspondence between time and health insurance coverage. The solid line represents Massachusetts, and the dashed line represents the synthetic control unit. The variables used to construct the synthetic control are health insurance coverage share, GDP growth, sex, nonwhite, Hispanic, Metropolitan Statistical Area (MSA), age, and the categories of education, occupation, and marital status

The present study uses RI for statistical inference, the idea behind which is that, if the null hypothesis of no effect is true, then the estimation of the treatment effect does not depend on whether the unit has been given the label of “treatment status” or “control status”. The label “treatment status” can be given to each available unit, and a treatment effect can be calculated for each of these units. Doing this for all the available units produces a distribution of treatment effects under the null of “no effect”. The effect of the actual treatment unit (in this case, MA) can then be compared to the distribution obtained from all the other units to see if the effect is “surprising” or not Kaestner (2016). In practice, in this case, since there is one treatment unit and 49 control units, I assign treatment status to each of these 50 units individually and calculate the treatment effect for each of them. Then, the one-sided p value relevant for the inference of whether the treatment effect in MA is significant or not can be calculated as the rank of the treatment effect of MA as a proportion of the total number of available units. However, two-sided p values are required for two-tailed inference testing. In case of a symmetric distribution of these obtained treatment effects, two-sided p values for the parameters of interest could have been calculated as the ratio of the rank of the absolute values of the coefficient estimates (treatment effects) to the total number of available units. However, the distribution of the state-wise treatment effects of the reform is not symmetric. Hence, in this case, the two-sided p values have been obtained by simply multiplying the one-sided p values by 2.

Appendix provides a full replication of Niu (2014) in Table 10 and shows how the significance of the estimates obtained in that study disappear when using RI in Table 11, which suggests a lack of statistical validity in using CRSE with one treatment cluster in DID. The result of a significant 0.71% points or an 8.4% sustained increase in the aggregate self-employment level in MA, as found in Niu (2014), is not supported by the SCM with randomization inference, as shown in the following sections.

5.1 Effect of the MA reform on health insurance coverage

Since information on health insurance coverage is available only in the ASEC of CPS, the analysis of the effect of the reform on health insurance coverage has been done using yearly data. As can be seen in Fig. 4, the synthetic control unit closely follows the health insurance coverage curve of MA.Footnote 12 The coefficient estimate of the effect of the reform on health insurance coverage in MA by the SCM can be deduced as the average of the differences in the share of individuals covered by health insurance between MA and the synthetic control state over the post-reform period. Mathematically,

Effect of Romneycare on Health Insurance Coverage in Each U.S. State by Synthetic Control Method. Notes: The effects of the reform according to the synthetic control method have been plotted on a yearly basis for each US state. The black line represents the effect on Massachusetts, while the gray lines represent the placebo effects on every other US state (except Hawaii) and D.C. The effects on the states in each month are the differences between the actual share and the synthetic control share of individuals covered by health insurance

\({\textrm{Effect}}_{{\textrm{MA}}}=\frac{1}{N}\sum _{i=1}^{N}({\textrm{HI}}\;{\textrm{cov}}.\;{\textrm{share}}\;{\textrm{of}}\;{\textrm{MA}}\;{\textrm{in}}\;{\textrm{year}}\;i- {\textrm{HI}}\;{\mathrm{cov.}}\;{\textrm{share}}.\;{\textrm{of}}\;{\textrm{synthetic}}\)\({\textrm{MA}}\;{\textrm{in}}\;{\textrm{year}}\;i)\) where N is the number of post-reform years, which is 5 in this case. For obtaining the RI p values, the synthetic control method has to be applied separately to each of the 49 other US states under the supposition that the MA reform took place in each of these states. That is, 49 other state-specific synthetic controls have to be generated and the corresponding placebo effects of the reform for each state have to be calculated in a way similar to that described above. Once all 50 estimates of the effects of each state have been obtained, the two-sided RI p value for the effect in MA can be calculated as twice the ratio of the rank of the effect of MA divided by total number of available treatment and control units. In other words, two-sided RI p value =\(2\times \frac{{\textrm{Rank}}\;{\textrm{of}}\;{\textrm{effect}}\;{\textrm{in}}\;{\textrm{MA}}}{50}\). Figure 3 plots the yearly effects of the reform on health insurance coverage for each state in the USA. The black line refers to the effect on MA. When I average up the effects for all years after its implementation, I find that there has been an observably large effect of the reform on health insurance coverage in MA compared to the other US states. The effect of the reform in MA is 5.19% points which ranks 1 compared to all the other states. This implies an RI 2-sided p value of \(2\times \frac{1}{50}=0.04\). In the pre-reform years, 84.61% of individuals in MA were covered by health insurance. Thus, a 5.19% point increase reflects a 6.1% increase in health insurance coverage in MA, that is significant at 5%. One thing worth noting here is the conservative nature of the RI procedure which results due to a relatively small number of control units. Since there are only 50 total units, the two-sided RI p value cannot get any smaller than 0.04, which happens when MA ranks 1 on its effect compared to the placebo effects on the other control units. Thus, the coefficients of interest in this study cannot be significant at a 1% level of significance. In other words, the effect of the reform on MA can be concluded to be statistically significant only if MA ranks 1 or 2. However, a closer look at the results tables would show that the coefficient estimates of MA that have been concluded to be statistically insignificant generally have quite high RI p values. This means that the rank of MA among the (placebo) effects of the 50 states has been quite low for these cases, and this alleviates worries about potential Type II errors.

Trends in self-employment: MA versus synthetic MA. Notes: The share of self-employed individuals, which includes both the incorporated and unincorporated self-employed, has been shown on a monthly basis. The solid line represents Massachusetts, and the dashed line represents the synthetic control unit. The variables used for constructing the synthetic control are share of self-employed, GDP growth, sex, nonwhite, Hispanic, MSA, age, and the categories of education, occupation, and marital status

5.2 Effect of the MA reform on self-employment

Figure 4 plots the monthly share of entrepreneurs in MA. It also presents the monthly share of entrepreneurs of the synthetic control state as generated by the SCM.Footnote 13 On the x-axis, the origin represents the month when the implementation of the reform started, that is, May 2006. The figure suggests that, in the months immediately following the reform, there was a jump in self-employment in MA as opposed to synthetic MA. That, however, seems to have died down. Whether the apparent increase in self-employment in the months immediately following the reform is statistically significant needs to be evaluated. To this aim, I apply the same methodology used to assess the effect of the reform on health insurance coverage, with the only difference that in this case I can use monthly data and compute separate effects for the “during” and “after” period, as described in Sect. 4.

Effect of Romneycare on Self-Employment in Each US State by Synthetic Control Method. Notes: The effects of the reform according to the synthetic control method have been plotted on a monthly basis for each US state. The black line represents the effect on Massachusetts, while the gray lines represent the placebo effects on every other US state (except Hawaii) and D.C. The effects on the states in each month are the differences between the actual share and the synthetic control share of the self-employed

Figure 5 plots the monthly effects of each and every US state and D.C.Footnote 14 The monthly effects of MA have been marked by the black line. The effect on MA immediately following the reform in the “during” period, although higher than most other states, with a rank of four is still not high enough for the RI to declare it as statistically significant. The effect of MA in the “after” period is highly insignificant with a rank of 23 as is evident from the SCM estimates provided in Table 2. The main analyses of this study have been done using monthly data to facilitate comparison with Niu (2014). However, in appendix, I also show that the estimates remain quantitatively unchanged when the analyses are done using yearly data.Footnote 15

5.2.1 Effects on incorporated and unincorporated self-employment

Due to the important nature of the distinction between “entrepreneurs” and all other self-employed individuals, as discussed before, I investigate whether the MHCR affected the incorporated self-employed differently from the unincorporated. In the pre-reform period, 10.4% of the population was self-employed. Among these self-employed, a third were in incorporated and the other two-thirds in unincorporated self-employment. The rate of health insurance coverage also differed substantially between these two groups. While 89.1% of the incorporated self-employed had health insurance coverage in the pre-reform period, only 73.4% of the unincorporated self-employed had the same. On both of these groups, the MA health reform program had large effects in terms of health insurance coverage. SCM estimates show that the reform led to an 8.05% point (9.03%) increase in health insurance coverage rates for the incorporated self-employed with an RI p value of 0.08. For the unincorporated self-employed, the increase was even higher at 12.02% points (16.38%) with an RI p value of 0.04 (see Fig. 6). Table 2 presents the coefficients of the effect of the MHCR on self-employment among MA residents as obtained by the SCM (Panel A). It also details the effects of the reform separately for individuals in incorporated and unincorporated companies (Panels B and C, respectively). The reform led to a significant, positive increase in the share of incorporated self-employed individuals during the months of the implementation of the reform. The effect of the reform on the share of incorporated self-employed is 0.0143% points, which translates to a 38.6% increase during the implementation period; however, this does not seem to be a persistent effect, as it was no longer significant after the full implementation of the reform. On the other hand, the unincorporated self-employed did not see any significant effects due to the reform (see Fig. 7). At the same time, there is no evidence of heterogeneous effects between the male and female self-employed individuals within each type of self-employment, as shown in Table 3. The result that the reform affected only the incorporated self-employed but not the unincorporated can be explained by the argument that it is the incorporated self-employed that are more prone to be “job locked” by ESI. They are the more highly educated individuals with higher income and previously employed in wage/salaried jobs that most likely provided ESI and hence would be more sensitive to the reform than the group of individuals characterized by lower income and education levels who mostly specialize in manual labor-intensive jobs where they often lack health insurance in the workplace. The fact that health insurance coverage rates increased among the incorporated self-employed and there has been a significant increase in incorporated self-employment in the months immediately following the reform is clear evidence that the MA health reform managed to weaken the “job lock” effect of ESI for this group. Thus, one can conclude that the MHCR did not affect aggregate self-employment generation in MA to the extent suggested by Niu (2014). It did not decrease self-employment either, as suggested in Jackson (2010) and Heim and Lurie (2014). It did, however, increase the share of incorporated self-employed individuals, that is, the entrepreneurs who generally engage in productivity-enhancing activities, create jobs by employing other workers, and drive economic growth by undertaking risky ventures that lead to the creation of new goods, services, and production processes (Levine and Rubinstein 2017). This was, however, only a short-term effect and did not persist in the long term.

One explanation for the short-run effect of the reform which does not sustain in the long run comes from the opposing forces of the reform. As Niu (2014) pointed out, the expansion of health insurance coverage occurred mainly through increased uptake of ESI, Medicaid and the Connector’s subsidized insurance plans with private market coverage increase being insignificant. An increase in Medicaid and Connector’s health insurance expansion is expected to increase the likelihood of self-employment, while both the individual and employer mandates are expected to have negative effects. An increase in ESI coverage rates implies that, due to the individual mandate, more individuals were taking up health insurance through their employers, while the employer mandate made starting up new businesses with more than 10 employees more costly. The negative components outweighing the positive component of state expansion of Medicaid and other subsidized health insurance plans after the initial few months of the reform makes even more sense when we take into account the fact that the MA health reform program was implemented in phases. At the initial phase of the reform, the state subsidization of Medicaid and Connector’s plans was implemented which is expected to increase self-employment. The individual and employer mandates, which are expected to decrease self-employment, were implemented later on in July 2007. These negative effects outweighed the positive effect of the reform starting July 2007 from which time we see the effect of the reform become insignificant. However, it is also noteworthy that businesses with more than 10 employees consist of a very small proportion of the total. According to a more recently launched survey by the US Census Bureau, the Annual Survey of Entrepreneurs, only about 22% of businesses with paid employees in their payrolls have 10 or more employees. Another explanation comes from the potential immigration that could have taken place into MA from neighboring states. It could be the case that, during the initial months of the reform, residents from nearby states were attracted to move to MA due to the opportunity created by the reform to start new businesses. Over time, this immigration of people wanting to open up new businesses slowed down, especially with the implementation of the individual and employer mandates in July 2007. These explanations are, however, speculative in nature and are difficult to test.

Effect of Romneycare on Health Insurance Coverage Rates of Incorporated and Unincorporated Individuals by Synthetic Control Analysis. Notes: The top (bottom)-left panel plots the evolution of health insurance coverage rates for the incorporated (unincorporated) self-employed in MA and the synthetic control unit. On the top (bottom)-right panel, the black line represents the effect on Massachusetts, while the gray lines represent the placebo effects on every other US state (except Hawaii) and D.C for incorporated (unincorporated) self-employed individuals. The effects on the states in each year are the differences between the actual share and the synthetic control share of the self-employed

Monthly effect of Romneycare on Incorporated and Unincorporated Self-Employment by Synthetic Control Analysis. Notes: The top (bottom)-left panel plots the evolution of the share of the incorporated (unincorporated) self-employed in MA and the synthetic control unit. On the top (bottom)-right panel, the black line represents the effect on Massachusetts, while the gray lines represent the placebo effects on every other US state (except Hawaii) and D.C for incorporated (unincorporated) self-employed individuals. The effects on the states in each month are the differences between the actual share and the synthetic control share of the self-employed

The importance of investigating heterogeneity in the effects of the reform on younger and older age groups has been emphasized previously (see Sect. 1). There is no clear definition to what constitutes old and young working people, and my characterization of individuals aged 40 and above as the older group may seem ad hoc. However, the analysis can be done by changing this cut-off in either direction in small increments without the results changing qualitatively. Table 4 shows synthetic control estimates of the effect of the MA reform on aggregate, incorporated, and unincorporated self-employment separately for individuals aged 21–40 and 41–64. The results suggest that the reform had a significant, positive effect of 1.8% points on individuals aged 21–40 during the implementation period but had no significant effect on the 41–64 age group. Although the coefficient estimate of incorporated self-employment for the 21–40 group is insignificant, it is important to notice that it is very marginally insignificant. An RI two-sided p value of 0.12 implies that the rank of the effect of MA was third-highest among the placebo effects of all 50 states. A rank of 2 would have rendered the coefficient significant. Overall, highly insignificant RI 2-sided p values of unincorporated self-employment and the previous synthetic control analyses revealing that the reform increased only incorporated self-employment indicate that the significant effect of the reform among the 21–40 age group was due to incorporated self-employment. This raises the question why the effect of the reform was concentrated only among the younger working individuals in the incorporated self-employment sector. One possible explanation—investigated in the next subsection—lies in the way employers had shifted the cost burden of the newly mandated health insurance for its employees.

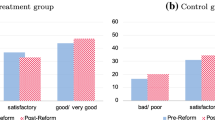

5.2.2 Heterogeneous income effects of the reform among the 21–40 and the 41–64 age groups using matched current population survey (CPS) data

The MHCR mandated that employers with more than 10 full-time employees provide at least partial health insurance coverage to their employees or pay penalties of up to $295 per employee each year. One might expect that this increased cost to employers of providing the newly mandated health insurance was probably transferred to its workers in the form of lowered wages or salary cuts. Since the previous sections indicated that only younger individuals aged 21–40 saw a statistically significant increase in incorporated self-employment, in this section, I investigate whether the burden of financing the newly mandated health insurance was shifted more to the younger age group than to the older one. Toward this end, I form matched CPS panel data that range from just before to one year after the start of the reform with individuals that remained in salaried jobs. The CPS follows a 4–8–4 rotation pattern that implies that individuals are interviewed for four months, left alone for eight months, and then interviewed for another four months. It is thus possible to track cohorts of individuals who were interviewed just before and some months after the reform had started to take effect. However, one caveat is that this panel component is fairly limited because the same individuals are not followed once the 4-8-4 rotation pattern ends. Also, only the ASEC of the CPS provides data on income of the surveyed individuals. This ASEC is also called the “March component” of the CPS, as it takes place in the month of March each year. Therefore, the ASEC provides only yearly data for the month of March. The total personal income in the ASEC reflects the personal income of an individual over the past 12 months. Due to this nature of the data, I can observe the same individuals only one time before and one time after the reform. However, using a panel of individuals interviewed in March 2006 and March 2007, I can examine whether there had been a significant decrease in income among these individuals for the financing of the health insurance mandated by the MA reform and whether this decrease was significantly larger for the younger age group (21–40). The individuals in this matched dataset consist of those who were employed in salaried jobs before the reform and remained in salaried jobs as of March 2007. Utilizing a panel-data approach to a dataset with a fixed pool of relevant individuals allows me to mitigate self-selection into job types (employees vs. self-employed). Table 5 reports some summary statistics for this matched dataset for the 21–40 and 41–64 age groups separately for the treatment group of MA and the control group of the rest of the USA. The table suggests that there was a decrease in the mean income of individuals in the 21–40 age group in MA. It is also notable that the salaried workers are primarily workers with high levels of education, about 73% of the 21–40 age group in MA having some college education as of March 2007. Also, a big fraction (76%) of these workers are engaged in managerial, professional, sales, and administrative positions, which are more cognitively demanding than services and operations sector occupations.

For this exercise, I use the following fixed-effect DID model:

Here, \(y_{\textrm{it}}\) represents personal income. \(\textrm{MASS}_{\textrm{it}}\) is a dummy variable that takes a value of 1 if the state is MA, Post is another dummy that takes the value 1 for March 2007 and \(c_{i}\) represents the individual effect, which does not vary with time. The covariates included in the X vector are age, age squared, marital status, married gender interaction, urban, education, occupation, and industry. The fixed-effect regression model estimates are reported in Table 6. The coefficient of interest, \(\tau '\) to be a significant -$6176 with an RI 2-sided p value of 0.08 for the 21–40 age group. The decline in income of the 41–64 group was an insignificant -$1333 with an RI 2-sided p value of 0.72, and the aggregate decline in income among the salaried workers in MA was an insignificant -$3078 with a 2-sided p value of 0.32 by RI. This explains why the reform affected self-employment primarily among the lower age group individuals. The employers in MA seem to have transferred the burden for financing the new health insurance coverage disproportionately more towards the younger salaried workers as compared to the older ones and consequently we see them leaving their salaried jobs to open up their own businesses in the incorporated sector. The wage/salaried jobs constitute mostly of individuals with relatively high levels of education working in primarily managerial, professional, sales and administrative fields as evident from Table 5. So it does not come as a surprise that they became self-employed in the incorporated sector, which is the true form of entrepreneurship, requiring cognitively demanding tasks on a day-to-day basis as opposed to being self-employed in the unincorporated sector which represents more subsistence level employment which individuals often engage in for lack of better options.

6 Robustness checks

Following Abadie et al. (2010), I also study whether the significance of the effect of the reform on self-employment in MA is affected by dropping control states that the SCM could not fit well as measured by the MSPE in the pre-reform periods. Abadie et al. (2010) redid the SCM by eliminating control states with a pre-reform MSPE of more than 20 times, then 5 times, and then 2 times that of the treatment state. I repeat the same exercise here but without the case of 20 times, as it is too lenient. In the pre-reform periods, MA had an MSPE of 0.0000794. It also had a rank of 4 in the “during” period and 23 in the “after” period among the 49 other states and D.C. Considering states with pre-MSPEs of no more than five times that of MA leads to the dropping of only two states: California and Montana. California had a higher placebo treatment effect in both the “during” and “after” periods, whereas Montana had a lower effect in both periods. Therefore, the two-sided RI p values of the effect of the reform in MA now become 0.125 and 0.917 in the “before” and “after” periods, respectively, which are still insignificant at the 10% level. Considering states with no more than twice the pre-MSPE of MA leads to dropping 19 states. MA now ranks number 2 in the “during” period and number 14 in the “after” period. Since there are only 31 states left, however, the p values for the coefficients of MA in the “during” and “after” periods are \(2\times (2/31)=0.129\) and \(2\times (14/31)=0.903\), respectively. These are, again, still insignificant at the 10% level.

These exercises can be repeated for the incorporated and unincorporated sectors as well. However, as one can see from Table 2, the two-sided RI p values for the insignificant coefficients are very large. This implies that MA is so far down the ranking of the state-wise effect of the reform (or fake reform) that even dropping the high pre-MSPE states would not lead to insignificant coefficients becoming significant for MA. The same exercises have not been repeated for the sake of brevity.

I also perform “in-time placebos” following Abadie et al. (2015) to check whether the positive and significant effects of the reform on incorporated self-employment and self-employment of 21–40-year-olds differ largely from a fictitious case where the reform is assumed to have taken place sometime before the actual reform date. This follows from the intuition that if these placebo effects are large and very similar to the actual reform coefficients, then our confidence on the true effects of the reform will dissipate. Just like Abadie et al. (2015), I consider the pre-reform period of January 1996 to April 2006 and set the fake reform time at about the mid-point i.e., May, 2001. Appendix Fig. 11 shows that the trend of the incorporated self-employed in MA in the post placebo reform period runs somewhat lower than the synthetic control. This difference, however, is small at an average of – 0.0036 in the post placebo reform period which much lower than the true coefficient of 0.0143 in the “during” period of the reform (see Table 2). Similarly, the trend of the 21–40 year old self-employed individuals in MA in the post placebo reform period runs visually somewhat lower than the synthetic control. This average placebo effect is – 0.0079, much smaller than the true coefficient of 0.0180 in the “during” period of the reform (see Table 4).

7 Conclusions

This study uses the synthetic control approach as opposed to the frequently used difference-in-difference approach to answer the research question of whether the MHCR indeed increased self-employment. The synthetic control approach gives a distinct advantage over the difference in difference approach which relies on the parallel trends assumption and the appropriate selection of “similar” control units. The synthetic control method overcomes these challenges by generating an appropriate control state which is a weighted average of all available control units. If we consider the entire population of self-employed individuals in MA, the MHCR had no significant causal effect in increasing (or decreasing) self-employment. There is, however, strong evidence that the reform did have a significant, positive effect on entrepreneurs in the incorporated sector. According to the SCM, the effect was restricted only to individuals aged 40 years or below, and the increase was short-lived, becoming insignificant months after the full implementation of the reform. Thus, the evidence from the MHCR suggests that ESI is indeed a barrier to self-employment for entrepreneurs. In this regard, this study emphasizes the need to segregate entrepreneurs from other types of self-employed persons, which previous papers analyzing the job lock effect of ESI on self-employment have rarely done. The study also explores a mechanism on why the MA reform only affected the younger workers to be self-employed by examining the income effect of the reform on wage/salaried workers. It shows that due to the employer mandate which required employers to expand health insurance coverage in the work place, employers started significantly reducing the wages of the younger workers to sponsor this health insurance.

The study, however, is not free from limitations. First, the use of the randomization inference with the synthetic control method is a conservative approach. Due to the small number of treatment and control units available, the effect of the reform on outcomes in MA is deemed to be statistically significant only if MA ranks 1 or 2 among the placebo effects of the reform on the control units. Second, the analysis of the income effect of the reform on wage/salaried workers is constrained to a fairly small sample as a result of the limited panel that can be constructed due to the 4-8-4 rotation pattern of the CPS.

This study disagrees with the results of Heim and Lurie (2014) and Jackson (2010), who argued that the MHCR led to a decrease in entrepreneurship. This paper also provides probable explanations of why some previous papers found significant effects of the MHCR on self-employment by providing evidence that previous estimates were probably the results of over-rejecting the null hypothesis of no effect due to the usage of CRSE, which was often clustered at the state level. Since the ACA is structured very similarly as the MHCR, this paper suggests that the ACA has probably also not managed to stimulate an increase in all kinds of self-employment in the country after its implementation, although it might have had potentially large effects in incorporated self-employment, especially among those below 40. However, caution should be exercised in generalizing the results of this paper to every other US state, as MA already had a low uninsurance level with high levels of income and educational attainments relative to the rest of the USA and is thus fundamentally different from many other states.

Notes

See also Faggio and Silva (2014).

Chetty et al. (2009) used RI in their DID regressions to tackle the problem of over-rejection of the null hypothesis of no effect due to serial correlation leading to biased standard errors.

In the ACA, subsidies for insurance extend to people below 400% of the FPL.

The ACA enacted Medicaid expansions to people with incomes below 138% of the FPL. However, in 2012, the Supreme Court ruled that states have the option to not expand their Medicaid program (Frean et al. 2017).

The six marital status categories are married with spouse present, married with spouse absent, separated, divorced, widowed, and never married/single.

Ferman et al. (2020) discuss how the lack of guidance in picking controls in SC analysis can lead to specification search opportunities. The controls included in my analysis have been chosen ex-ante in comparison with Niu (2014). In addition, they show that false rejections are more likely for short pre-intervention periods and when using mean pre-treatment outcome values as predictors. My analysis uses a rather long time series (\(N=124\)) and does not include mean pre-treatment outcome values as predictors.

The mean-square-predicted error (MSPE) in the pre-reform period, which is used as a measure for goodness of fit, is 0.000128.

The synthetic control state is fitted to the treatment state of MA with an MSPE of 0.0000794.

See appendix for the figures on fit and placebos of all the other SCM samples and subsamples.

Appendix Tables 8 and 9 provide synthetic control estimates, and Appendix Fig. 10 shows the effects of the reform using yearly data. For the incorporated self-employed, the two-sided p value of the coefficient estimate for the “during” period changes slightly, from .08 (MA ranked second) to .12 (MA ranked third).

References

Abadie A (2021) Using synthetic controls: feasibility, data requirements, and methodological aspects. J Econ Lit 59(2):391–425

Abadie A, Gardeazabal J (2003) The economic costs of conflict: a case study of the Basque country. Ame Econ Rev 93(1):113–132

Abadie A, Diamond A, Hainmueller J (2010) Synthetic control methods for comparative case studies: estimating the effect of California’s tobacco control program. J Am Stat Assoc 105(490):493–505

Abadie A, Diamond A, Hainmueller J (2015) Comparative politics and the synthetic control method. Am J Polit Sci 59(2):495–510

Becker T, Tuzemen D (2014) Self-employment and health care reform: evidence from massachusetts. Federal Reserve Bank of Kansas City Working Paper (14–16)

Buchmueller TC, Valletta RG (1996) The effects of employer-provided health insurance on worker mobility. ILR Rev 49(3):439–455

Chernozhukov V, Wüthrich K, Zhu Y (2021) An exact and robust conformal inference method for counterfactual and synthetic controls. J Am Stat Assoc 116(536):1849–1864

Chetty R, Looney A, Kroft K (2009) Salience and taxation: theory and evidence. Am Econ Rev 99(4):1145–77

Conley TG, Taber CR (2011) Inference with “difference in differences’’ with a small number of policy changes. Rev Econ Stat 93(1):113–125

Currie J, Madrian BC (1999) Health, health insurance and the labor market. Handb Labor Econ 3:3309–3416

DeNavas-Walt C(2010) tIncome, poverty, and health insurance coverage in the United States (2005). Diane Publishing

Faggio G, Silva O (2014) Self-employment and entrepreneurship in urban and rural labour markets. J Urban Econ 84:67–85

Fairlie RW, London RA (2008) The dynamics of health insurance coverage: identifying trigger events for insurance loss and gain. Health Serv Outcomes Res Method 8(3):159–185

Fairlie RW, Kapur K, Gates S (2011) Is employer-based health insurance a barrier to entrepreneurship? J Health Econ 30(1):146–162

Ferman B, Pinto C, Possebom V (2020) Cherry picking with synthetic controls. J Policy Anal Manag 39(2):510–532

Fisher RA (1922) On the interpretation of \(\chi \) 2 from contingency tables, and the calculation of p. J Roy Stat Soc 85(1):87–94

Frean M, Gruber J, Sommers BD (2017) Premium subsidies, the mandate, and medicaid expansion: coverage effects of the affordable care act. J Health Econ 53:72–86

Friedberg L (1998) Did unilateral divorce raise divorce rates? evidence from panel data

Gruber J (2008) Massachusetts health care reform: the view from one year out. Risk Manag Insur Rev 11(1):51–63

Gruber J, Madrian BC (2004) Supply, and job mobility. Health Policy Uninsured 97

Gumus G, Regan TL (2013) Tax incentives as a solution to the uninsured: evidence from the self-employed. INQUIRY J Health Care Organ Provis Financ 50(4):275–295

Gurley-Calvez T (2011) Will tax-based health insurance reforms help the self-employed stay in business? Contemp Econ Policy 29(3):441–460

Heim BT, Lurie IZ (2014) Does health reform affect self-employment? evidence from Massachusetts. Small Bus Econ 43(4):917–930

Henderson J, Weiler S (2010) Entrepreneurs and job growth: probing the boundaries of time and space. Econ Dev Q 24(1):23–32

Holtz-Eakin D, Penrod JR, Rosen HS (1996) Health insurance and the supply of entrepreneurs. J Public Econ 62(1–2):209–235

Jackson S (2010) Mulling over Massachusetts: health insurance mandates and entrepreneurs. Entrep Theory Pract 34(5):909–932

Kaestner R (2016) Did Massachusetts health care reform lower mortality? No according to randomization inference. Stat Public Policy 3(1):1–6

Levine R, Rubinstein Y (2017) Smart and illicit: who becomes an entrepreneur and do they earn more? Q J Econ 132(2):963–1018

Mazumder B, Miller S (2016) The effects of the Massachusetts health reform on household financial distress. Am Econ J Econ Pol 8(3):284–313

Niu X (2014) Health insurance and self-employment: evidence from Massachusetts. ILR Rev 67(4):1235–1273

Obama BH (2017) Repealing the aca without a replacement-the risks to American health care. Obstetr Gynecol Surv 72(5):263–264

Paz LS, West JE (2019) Should we trust clustered standard errors? A comparison with randomization-based methods. Technical report. National Bureau of Economic Research

Peri G, Yasenov V (2019) The labor market effects of a refugee wave synthetic control method meets the mariel boatlift. J Human Resour 54(2):267–309

Pichler S, Ziebarth NR (2020) Labor market effects of us sick pay mandates. J Hum Resour 55(2):611–659

Raymond AG (2007) The 2006 Massachusetts health care reform law: progress and challenges after one year of implementation. In: Massachusetts health policy forum

Rupasingha A, Goetz SJ (2013) Self-employment and local economic performance: evidence from US counties. Pap Reg Sci 92(1):141–161

Selden TM (2009) The impact of increased tax subsidies on the insurance coverage of self-employed families evidence from the 1996–2004 medical expenditure panel survey. J Hum Resour 44(1):115–139

Sommers BD, Long SK, Baicker K (2014) Changes in mortality after Massachusetts health care reform: a quasi-experimental study. Ann Intern Med 160(9):585–593

Stephens M Jr, Yang DY (2014) Compulsory education and the benefits of schooling. Am Econc Rev 104(6):1777–1792

Velamuri M (2012) Taxes, health insurance, and women’s self-employment. Contemp Econ Policy 30(2):162–177

Wolfers J (2006) Did unilateral divorce laws raise divorce rates? A reconciliation and new results. Am Econ Rev 96(5):1802–1820

Funding

Open access funding provided by Università degli Studi di Padova within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

There is no conflict of interest for this research paper to the best of my knowledge.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

I thank my advisor, Marco Bertoni, for his invaluable guidance and support. I also thank Lorenzo Rocco, Cheti Nicoletti, Jan Marcus, Ingo Isphording, and seminar participants at the University of Padova, the University of Modena and the University of Duisberg-Essen for their helpful comments. I also acknowledge the Cassa di Risparmio di Padova e Rovigo (CARIPARO) Foundation for the financial support that made this project possible.

Appendices

Appendices

Replication of Niu (2014)

The following table presents a replication exercise of Niu (2014). Column (1) shows the actual estimates from Niu (2014), while column (2) shows the replication results. Column (3) shows the replication results with the sample used in this study, which is a preferable sample.

The following table shows that the significance of the coefficients obtained in Niu (2014) become insignificant when the inference test is done by randomization as opposed to robust standard errors clustered at the state level.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Chattopadhyay, D. Did the Massachusetts Health Reform Program increase self-employment?. Empir Econ 65, 1309–1344 (2023). https://doi.org/10.1007/s00181-023-02369-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-023-02369-y

Keywords

- Health insurance

- Self-employment

- Synthetic control

- Randomization inference

- Massachusetts Health Care Reform