Abstract

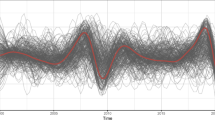

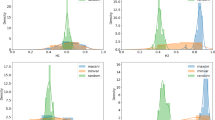

The aim of this article is the study of complex structures which are behind the short-term predictability of stock returns series. In this regard, we employ a seasonal version of the Mackey–Glass–GARCH(p,q) model, initially proposed by Kyrtsou and Terraza (Computat Econ 21:257–276, 2003) and generalized by Kyrtsou (Int J Bifurcat Chaos 15(10):3391–3394, 2005). To unveil short or long memory components and non-linear structures in the French Stock Exchange (CAC40) returns series, we apply the test of Geweke and Porter-Hudak (J Time Ser Anal 4:221–238, 1983), the Brock et al. (Econom Rev 15:197–235, 1996) and Dechert (An application of chaos theory to stochastic and deterministic observations. Working paper, University of Houston, 1995) tests, the correlation-dimension method of Grassberger and Procaccia (Phys 9D:189–208, 1983), the Lyapunov exponents method of Gençay and Dechert (Phys D 59:142–157, 1992), and the Recurrence quantification analysis introduced by Webber and Zbilut (J Appl Physiol 76:965–973, 1994). As a confirmation procedure of the dynamics generating future movements in CAC40, we perform forecast with the use of a seasonal Mackey–Glass–GARCH(1,1) model. The interest of the forecasting exercise is found in the inclusion of high-dimensional non-linearities in the mean equation of returns.

Similar content being viewed by others

References

Ashley R (2008) On the origins of conditional heteroskedasticity in time series. Working paper, Department of Economics, Virginia Tech. http://ashleymac.econ.vt.edu/working_papers/origins_of_conditional_heteroscedasticity.pdf

Baumol JW, Quandt RE (1995) Chaos models and their implications for forecasting. In: Trippi RT (ed) Chaos and nonlinear dynamics in the financial markets: theory, evidence and applications. Irwin, US

Bask M, Gençay R (1998) Testing chaotic dynamics via Lyapunov exponents. Phys D 114: 1–2

Beller K, Nofsinger JR (1998) On stock return seasonality and conditional heteroskedasticity. J Financ Res XXI(2): 229–246

Belaire-Franch J (2004) Testing for non-linearity in an artificial financial market: a recurrence quantification approach. J Econ Behav Organ 54: 483–494

Belaire-Franch J, Contreras D, Tordera-Lledo L (2002) Assessing nonlinear structures in real exchange rates using recurrence plot strategies. Phys D 171: 249–264

Bollerslev T (1987) A conditionally heteroskedastic time series model for speculative prices and rates of return. Rev Econ Stat 69: 542–547

Bourbonnais R, Terraza M (1998) Analyse des séries temporelles en économie. PUF, Paris

Brock WA, Dechert WD, Scheinkman JA, LeBaron B (1996) A test for independence based on the correlation dimension. Econom Rev 15: 197–235

Brock WA, Hommes CH (1998) Heterogeneous beliefs and routes to chaos in a simple asset pricing model. J Econ Dyn Control 22: 1235–1274

Brock WA, Hsieh DA, LeBaron B (1992) Nonlinear dynamics, chaos and instability, 2nd edn. MIT Press, Cambridge

Chen S-H, Lux T, Marchesi M (2001) Testing for non-linear structure in an artificial financial market. J Econ Behav Organ 46: 327–342

Chiarella C, Dieci R, Gardini L (2002) Speculative behaviour and complex asset price dynamics. J Econ Behav Organ 49(1): 173–197

Dechert WD (1995) An application of chaos theory to stochastic and deterministic observations. Working paper, University of Houston

Dechert WD, Gençay R (1996) The topological invariance of Lyapunov exponents in embedded dynamics. Phys D 90: 40–55

Dechert WD, Gençay R (2000) Is the largest Lyapunov exponent preserved in embedded dynamics?. Phys Lett A 276: 59–64

Donoho DL (1995) De-noising by soft-thresholding. IEEE Trans Inform Theory 41(3): 613–627

Donoho DL, Johnstone IM (1994) Ideal spatial adaptation via wavelet shrinkage. Biometrika 81: 425–455

Donoho DL, Johnstone IM (1995) Adapting to unknown smoothing via wavelet shrinkage. J Am Stat Assoc 90: 1200–1224

Eckmann JP, Kamphorst SO, Ruelle D (1987) Recurrence plots of dynamical systems. Europhys Lett 4(9): 973–977

Engle RF (1982) Autoregressive conditional heteroskedasticity with estimates of the variance of United Kingdom inflation. Econometrica 50(4): 987–1007

Fama E (1965) The behaviour of stock market prices. J Bus 38: 34–105

Farmer DJ, Sidorowith JJ (1987) Predicting chaotic time series. Phys Rev Lett 59: 845–848

Freedman D, Pisani R, Purves R (1978) Statistics. W.W. Norton, New York

Gallant RA, White H (1992) On learning the derivatives of an unknown mapping with multilayer feedforward networks. Artificial Neural Networks, Blackwell, Cambridge, pp. 206–223

Gaunersdorfer A (2000) Endogenous fluctuations in a simple asset pricing model with heterogeneous agents. J Econ Dyn Control 24: 799–831

Gaunersdorfer A (2001) Adaptive beliefs and the volatility of asset prices. Cent Eur J Oper Res 9: 5–30

Gençay R, Dechert WD (1992) An algorithm for the n Lyapunov exponents of an n-dimensional unknown dynamical system. Phys D 59: 142–157

Gençay R, Liu T (1997) Nonlinear modelling and prediction with feedforward and recurrent networks. Phys D 108: 119–134

Geweke J (1993) Inference and forecasting for deterministic non-linear time series observed with measurement error. In: Day RH, Chen P(eds) Nonlinear dynamics and evolutionary dynamics. Oxford University Press, Oxford

Geweke J, Porter-Hudak S (1983) The estimation and application of long memory time series models. J Time Ser Anal 4: 221–238

Goffe WL, Ferrier GD, Rogers J (1994) Global optimization of statistical functions with simulated annealing. J Econom 60: 65–99

Grassberger P, Procaccia I (1983) Measuring the strangeness of strange attractors. Phys 9D 189–208

Hommes C (2006) Heterogeneous agent models in economics and finance. In: Tesfatsion L, Judd K(eds) Handbook of computational economics. North-Holland, Amsterdam

Hommes C, Manzan S (2006) Comments on testing for nonlinear structure and chaos in economic time series. J Macroecon 28(1): 169–174

Hristu-Varsakelis D, Kyrtsou C (2008) Evidence for nonlinear asymmetric causality in US inflation, metal and stock returns. Dis Dyn Nature Soc, 2008 138547: 7. doi:10.1155/2008/138547

Kantz H, Schreiber T (1997) Nonlinear time series analysis, Cambridge nonlinear science series, vol 7. Cambridge University Press, Cambridge

Kaplan D, Glass L (1995) Understanding nonlinear dynamics. Springer, New York

Kyrtsou C (2005) Evidence for neglected linearity in noisy chaotic models. Int J Bifurcat Chaos 15(10): 3391–3394

Kyrtsou C (2008) Re-examining the sources of heteroskedasticity: the paradigm of noisy chaotic models. Phys A 387: 6785–6789

Kyrtsou C, Karanasos M (2008) Analyzing the link between stock volatility and volume by a Mackey–Glass GARCH-type model: the case of Korea. Int J Financ Mark Inst (accepted subject to revisions)

Kyrtsou C, Labys W (2006) Evidence for chaotic dependence between US inflation and commodity prices. J Macroecon 28(1): 256–266

Kyrtsou C, Labys W (2007) Detecting positive feedback in multivariate time series: the case of metal prices and US inflation. Phys A 377(1): 227–229

Kyrtsou C, Labys W, Terraza M (2004) Noisy chaotic dynamics in commodity markets. Emp Econ 29(3): 489–502

Kyrtsou C, Malliaris A (2009) The impact of information signals on market prices, when agents have non-linear trading rules. Econ Modell 26(1): 167–176

Kyrtsou C, Terraza M (2002) Stochastic chaos or ARCH effects in stock series? A comparative study. Int Rev Financ Anal 11: 407–431

Kyrtsou C, Terraza M (2003) Is it possible to study chaotic and ARCH behaviour jointly? Application of a noisy Mackey–Glass equation with heteroskedastic errors to the Paris Stock Exchange returns series. Comput Econ 21: 257–276

Kyrtsou C, Vorlow C (2005) Complex dynamics in macroeconomics: A novel approach. In: Diebolt C, Kyrtsou C(eds) New trends in macroeconomics. Springer, Heidelberg

Kyrtsou C, Vorlow C (2009) Modelling nonlinear comovements between time series. J Macroecon 31(1): 200–211

Lux T (1995) Herd behaviour, bubbles and crashes. Econ J 105: 881–896

Lux T (1998) The socio-economic dynamics of speculative markets: interacting agents, chaos, and the fat tails of returns distributions. J Econ Behav Organ 33: 143–165

Mackey M, Glass L (1977) Oscillation and chaos in physiological control systems. Science 50: 287–289

Malliaris AG, Stein JL (1999) Methodological issues in asset pricing: random walk or chaotic dynamics. J Banking Financ 23: 1605–1635

Mizrach (2009) Learning and conditional heteroskedasticity in assets returns. In: Kyrtsou C, Vorlow C (eds) Progress in financial markets research. NOVA Publishers, New York (forthcoming)

Strozzi F, Zaldivar J-M, Zbilut JP (2002) Application of nonlinear time series analysis techniques to high-frequency currency exchange data. Phys A 312: 520–538

Takens F (1981) Detecting strange attractors in turbulence. In: Rand D, Young LS (eds) Dynamical systems and turbulence. Lecture notes in mathematics, vol 89, Springer, Berlin

Trulla LL, Giuliani A, Zbilut JP, Webber CL (1996) Recurrence quantification analysis of the logistic equation with transients. Phys Lett A 223: 225–260

Tsay RS (1986) Nonlinearity tests for time series. Biometrica 73: 461–466

White H (1989) Some asymptotic results for learning in single hidden layer feedforward networks models. J Am Stat Assoc 84: 1003–1013

Wolf A, Swift JB, Swinney HL, Vastano JA (1985) Determining Lyapunov exponents from a time series. Phys 16D 285–317

Webber CL, Zbilut JP (1994) Dynamical assessment of physiological systems and states using recurrence plot strategies. J Appl Physiol 76: 965–973

Zbilut JP, Giuliani A, Webber CL (2000) Recurrence quantification analysis as an empirical test to distinguish relatively short deterministic versus random number series. Phys Lett A 267: 174–178

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kyrtsou, C., Terraza, M. Seasonal Mackey–Glass–GARCH process and short-term dynamics. Empir Econ 38, 325–345 (2010). https://doi.org/10.1007/s00181-009-0268-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-009-0268-8

Keywords

- Noisy chaos

- Short-term dynamics

- Correlation dimension

- Lyapunov exponents

- Recurrence quantifications

- Forecasting