Abstract

Within the framework of banking efficiency analysis, we propose a methodology for computing unobservable shadow prices for nonperforming loans (NPL). Our approach is to include NPL as an undesirable output variable in a distance function stochastic frontier analysis. We conduct a panel study of US and European banks during the most recent financial crisis by adopting a semi-nonparametric Fourier specification, which ensures convergence to the true values of both the estimated function and the related efficiency. Computing NPL prices has several advantages, such as identifying approaching crises, quantifying the responsibilities of governments and banks for credit risk and determining appropriate regulatory interventions.

Similar content being viewed by others

1 Introduction

In this research, our main concern is computing unobservable shadow prices for nonperforming loans (NPL, henceforth) within the banking efficiency framework.

Because they refer to an undesirable output, shadow prices are negative and represent the opportunity cost (i.e., the marginal cost) of the bank’s foregone revenue of an incremental decrease in NPL. Shadow prices are evaluated at the production function. They generally differ from observable market prices which depends also on speculative actions.

Until relatively recently, most contributions of the literature regarding banking efficiency have neglected the question of problem loans. In the wake of the 2007–2008 financial crisis, this question started receiving growing importance and now there is a general consensus that nonperforming loans have a strong connection with bank crises as well as economic recessions (see Beck et al. 2013; Ari et al. 2019). Hence, the necessity of calculating shadow price of nonperforming loans, being a measure of the resources required to avoid such painful effects.

The natural environment for the analysis of costs and shadow prices is that of banking efficiency. Hughes and Mester (1993) considered problem loans inside the cost function frontier, and Berger and DeYoung (1997) pioneered this field by attempting to study the relations between problem loans and banking efficiency employing the Granger causality method. However, both attempts are vulnerable to criticism. In fact, the former disregards the simultaneity bias between inefficiency and problem loans. The latter, instead, uses a statistical tool based on the VAR methodology and consequently is deprived of an economic interpretation of causality. With the work of Pastor and Serrano (2005), the question under consideration is addressed properly. Their approach focuses on the consistent estimation, for seemingly unrelated equations, of the covariance matrix between the residuals of NPL and cost or profit inefficiency. Maggi and Guida (2011) elaborate an alternative way to properly tackle this problem. It consists of the estimation of an indirect function linking NPL with a cost function stochastic frontier that allows to compute the impact of NPL on operational costs. However, cost and profit function approaches, as those used in the afore mentioned literature, imply market power arguments (see Cuesta and Orea 2002) for the evaluation of the shadow prices which may be avoided with a distance function approach. Hence, in the present work we propose a methodology for the computation of unobservable shadow prices where NPL is included as an undesirable output variable in a distance function stochastic frontier.

There are many pieces of research in the efficiency analysis that regards the shadow prices of negative–or bad–outputs, alike NPL, mostly focused on the effects of pollution (see Mekaroonreung and Johnson 2012; Rezek and Campbell 2007; Lee et al. 2002). An exception is in Li et al. (2013) who conduct a study for Taiwanese commercial banks. However, they use a traditional functional form which may be improved upon to avoid potential bias issues in estimating and computing NPL shadow prices.

We conduct a panel study of US and European banks during the most recent financial crisis. Then, we assess both the quality of problem loans and the related responsibilities of banks and governments. The pattern of NPL shadow prices (or simply NPL prices) provides an understanding of the evolution of banking crises as well as the regulatory prescriptions to adjust balance sheet records for the credit risk. Importantly, the methodology adopted may be generalized to the computation of any unobservable price in the management of efficiency problems.

From an econometric point of view, we adopt the Fourier semi-nonparametric specification within the distance function framework. Despite its greater complexity, this functional specification ensures convergence to the true values of both the estimated function and the related efficiency (Gallant 1981; Berger et al. 1997).

Our major contributions consist of (1) modeling and computing unobservable NPL prices as a measure of credit risk; (2) providing a rigorous, unbiased method to calculate efficiency in the presence of undesired outputs for US and European banks during the period of the most recent financial crisis; (3) quantifying the responsibilities of governments and banks for credit risk; (4) finding a regulatory mechanism to compensate for the credit risk.

The paper is organized as follows. In Sect. 2, we define the theory underlying our empirical model and the behavior of banks in charging prices, including NPL prices. In Sect. 3, we describe our dataset and variables. In Sect. 4, we specify the functional form used in the empirical analysis and the computational aspects related to the evaluation of NPL prices and efficiency. In Sect. 5, we estimate the distance stochastic frontier. In Sect. 6, we compute the pattern of NPL prices and bank efficiency. Section 7 draws the regulatory implications from the main results. Section 8 concludes.

2 Theoretical model

In this section, we lay out the theoretical setup that will be used in the empirical analysis to derive banking efficiency and output prices. More specifically, we are interested in obtaining a measure of the default risk of NPL. This price is generally not observable and pertains to an undesirable output. Consequently, it represents an opportunity cost and has a negative sign. This methodology may be generalized for the computation of any unobservable price in management efficiency problems.

The representative commercial bank uses a positive vector of N inputs, denoted by \(\mathbf {x}=(x_{1},\ldots ,x_{N})\), \(\mathbf {x}\in \mathbb {R}_+^N\), to produce a positive vector of M outputs, denoted by \(\mathbf {u}=(u_{1},\ldots ,u_{M})\), \(\mathbf {u}\in \mathbb {R}_+^M\). The production technology of the bank can be defined by the output set, \(P(\mathbf {x})\), that can be produced by means of the input vector \(\mathbf {x}\), i.e., \(P(\mathbf {x})=\left\{ \mathbf {u} \in \mathbb {R}_+^M : \mathbf {x} \ can \ produce \ \mathbf {u} \right\} \). It is also assumed that technology satisfies the usual axioms initially proposed by Shephard (1970) for the expansion of a given output vector. Therefore, the resulting output vector remains within \(P(\mathbf {x})\), allowing us to define the output distance function, \(\theta \), as the reciprocal of the maximum radial attainable using available resources and technology.

The output distance of the bank output set to the frontier can be formally defined as:Footnote 1

where \(\mathbf {u}\in P(\mathbf {x})\) if and only if \(D_{o}(\mathbf {x},\mathbf {u}) \le 1\) (see Färe et al. 1993). Additionally, we assume weak disposability of outputs, defined as \(\theta \in [0,1]\). As a consequence, we allow for the presence of NPL assets generated by banks that are not freely eliminated because doing so would either require a greater use of inputs or need resources to be diverted from marketable production.Footnote 2

The output distance function seeks the largest proportional increase in the observed output vector, \(\mathbf {u}\), provided that the expanded vector, \(\left( \frac{\mathbf {u}}{\theta } \right) \), is still an element of the original output set (Färe and Primont 1995).

The consideration of NPL as an output of the production process, besides allowing to derive the corresponding price, eliminates the empirical complications that would occur using a cost function approach. In fact, in this case, a simultaneity problem would arise between inefficiency, i.e., costs, and NPL considered as an explanatory variable.

Our approach is based on the equality between the definitions of efficiency and distance function. Hence, according to equation (1) and in view of our statistical analysis, we may model efficiency as a function of inputs and outputs, including NPL.Footnote 3

Once we have estimated efficiency, we exploit the duality of the maximum revenue problem for the distance function to derive the shadow prices for NPL.

Now, we set the primal and dual problems to find the vector of the shadow price levels, among which is the unobservable price for NPL we are looking for. Denoting \(\mathbf {r}=(r_{1},\ldots ,r_{M})\) as the vector of the output shadow price levels and assuming that \(r_{m} \ne 0\), the distance function may be expressed as:

If the parent technology has convex output sets \(P(\mathbf {x})\), for all \(\mathbf {x}\in \mathbb {R}_+^N\), it can be proven (see Shephard 1970 or Färe 1988) that the following duality holds:

Equation (2) (primal problem) means that, given the level of prices, the revenue function may be obtained by maximizing revenue with respect to outputs compatibly with the output distance function. Conversely, equation (3) (dual problem) means that, given the level of outputs, the output distance function may be obtained by maximizing revenue with respect to output prices under the constraint that \(R(\mathbf {x},\mathbf {r})\le 1\).

Then, assuming that the revenue and distance functions are both differentiable,Footnote 4 a Lagrange problem can be set up to maximize revenue:

Following Färe et al. (1993), by combining the first-order conditions with respect to outputs and the fact that the negative of the Lagrange multiplier equals the revenue function, i.e., \(-\lambda =R(\mathbf {x},\mathbf {r})\) (see Jacobsen 1972), we obtain the gradient of the distance function as equal to the revenue-normalized shadow prices:

Now, we know that by means of the second part of the duality theorem the distance is equal to the normalized revenue. Hence, we may obtain the non-normalized revenue, R, by assuming that the observed price of the m-th output, \(r^{o}_{m}\), equals its shadow price, \(r_{m}\), and calculating the ratio between the non-normalized price and the normalized one:

Then, we may use the maximum revenue, obtained as in (6), to calculate the shadow price levels for the remaining outputs. Finally, denoting with \(r_{m'}\) any other shadow output price, i.e., \(m'\ne m\)—we get the solution for the unobservable price for NPL:

Of course, the first derivative of the distance function with respect to NPL is expected to be negative (a hypothesis that will be checked empirically) because efficiency decreases after an increase in bad loans.

3 Variables and data

We draw data from BankScope 517 commercial banks in Europe and 2404 in the US over 2000-2010. Europe includes the Euro-system member countries plus UK, Sweden, Norway and Turkey. The large database allows for a detailed analysis of the behavior of countries and banks during the last financial crisis.

The model adopted for the distance function is that of the production approach with three outputs and two inputs. We consider deposits (\(u_1\)), loans (\(u_2\)) and services (\(u_3\)), as the desirable outputs, whereas NPL (\(u_4\)) as the undesirable output. Inputs are capital (\(x_1\)) and labor (\(x_2\)). Deposits and loans are balance sheet stock values. The services variable is the total value of services from the profit and loss account. Fixed assets have been computed at current cost after transforming the historical balance sheet values (International Accounting Standards 16). All nominal variables are expressed in dollars at constant prices (year 2000). The labor price is calculated as total personnel cost divided by number of employees.

To determine the price of capital per k-th bank we model the capital cost as an indirect function, of total assets and liabilities as \(\left( \frac{TA_{kt} + TLiab_{kt}}{2} \right) ^{\beta _1}\). This allows to bypass issues in measuring total capital and produces the best results in terms of consistency with the market data compared to other specifications that we tried,Footnote 5

with \(k=1,\ldots ,K , t=2000,\ldots ,2010\).

\(TA_{kt}\) and \(TLiab_{kt}\) stand for total assets and total liabilities, respectively, and \(pc_{k}\) is the price of the bank capital to be estimated as the coefficient of the bank specific dummy variable \(d_{pc_k}\).

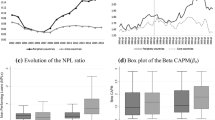

Regarding our core variable, it is worth noting that in Europe, the current definition of NPL is very different from the typical US. In particular, the US definition refers only to defaulted credits, while in European countries the more prudent category of uncertain loans is also considered. To provide a deeper understanding of this aspect, in Fig. 1, we report our first indicator of bank credit risk, consisting of the empirical probability of loan failure averaged across banks measured as the ratio of the monetary stocks of NPL over total loans L.

Consistent with the broader definition of NPL in Europe, Fig. 1 shows that the NPL/L ratio in Europe is on average \(2.88\%\), which is always higher than the average level recorded in the US, that is, \(1.5\%\). After a period of negligible (modest) growth, the ratio surprisingly decreases for both countries until just before 2007. Such evidence underlines that, whatever definition is used for NPL, the empirical probability of loan failure, NPL/L, may not be considered, on its own, a reliable predictor of crisis. Noticeably, during the crisis, the indicator follows its downward trajectory for Europe till 2008 and then stabilizes with the reformed regulation, while it starts increasing for the US, from \(1.36\%\) to \(1.57\%\) and stabilizes thereafter. This is not surprising if it is considered that the regulatory changes for the US credit markets occurred after 2007 and were relatively more severe.

Therefore, we question whether the increase in loans in the face of a less than proportional increase in NPL that occurred in this period is due to the bank behavior towards the maximization of efficiency neglecting risk. Consequently, in the following section, we estimate efficiency by including NPL among the explanatory variables of the distance function, and obtain an efficiency score net of the risk effect of NPL.

4 Empirical methodology

In this section, we present the empirical model used to estimate the distance function and compute the shadow prices for NPL, corresponding to the shadow price equation analysis (Eq. (7)) of Sect. 2.

The specification adopted to represent distance is the Fourier flexible form (FFF). Such a function, developed by Gallant (1981), differs from the more traditional translog (TL), in that it is based on a global approximation. Therefore, it allows to obtain asymptotically correct nominal sizes of the rejection region to be used for statistical tests, and enables to estimate the underlying true function with an average prediction bias that becomes progressively smaller as the number of terms in the Fourier expansion increases. The FFF combines the standard quadratic TL with the nonparametric trigonometric Fourier form approximation (FF), where the arguments of the trigonometric terms, \(z_i, z_j, z_l\) (see Eq. (9)), refer to the sequence of inputs and outputs (\(N+M\)) as commented on below. Following the rule of thumb expounded in Eastwood and Gallant (1991), the number of trigonometric terms in the FFF has been chosen to consider a total number of parameters equal to the number of observations raised to the power of two-thirds. However, as suggested by Gallant (1981), the effective number of coefficients may be corrected by reducing the trigonometric terms to avoid possible multicollinearity.Footnote 6

The advantage of estimating the FFF, despite being computationally more complicated than the TL is that it delivers unbiased coefficients. In fact, it is shown in the literature cited above that the global approximation allows for the convergence between the true parameters and those of the FFF. Interestingly, such a property is also valid for an FFF expressed not entirely in trigonometric terms but in a nested form like the one used here.

The FFF-from which, for simplicity’s sake, we omit the fixed and time effects- can be expressed as follows:

Accordingly, the logarithm of the distance function is given by:

As usual, we impose the standard properties of the distance function to model the nonlinearity of the FFF, i.e., the symmetry and homogeneity of degree 1:Footnote 7

Symmetry

-

(i)

\(\beta _{nn'}=\beta _{n'n},\alpha _{mm'}=\alpha _{m'm}, \gamma _{nm}=\gamma _{mn},\delta _{ij}=\delta _{ji},\lambda _{ij}=\lambda _{ji}\) ,

all the combinations among i, j, l provide the same \(\delta _{ijl}\) and \(\lambda _{ijl}\),

\(m=1,\ldots ,M,n=1,\ldots ,N,i,j,l=1,\ldots ,N+M. \)

\({{Homogeneity\,of\,degree\,1\,of\,the\,TL\,part}}\)

-

(ii)

\(\sum _{m=1}^{M}\alpha _m =1\) , \(\sum _{m=1}^{M}\alpha _{mm'}= \sum _{m=1}^{M}\gamma _{nm}=0\).

Following Lovell et al. (1994), we impose condition (ii) in equation (10), by normalizing the distance function with respect to one of the outputs, the M-th in our case:

Substituting \(\frac{u_{m}}{u_{M}}=u_{m}^*\) in (10), for \(m=1,\ldots ,M-1\), we obtain a regression of the general form:

Equation (12) can be rewritten as:

Importantly, since the distance function coincides with the efficiency, the negative term \(- ln(D_{o})\) in equation (13) can be interpreted as an error term that captures the technical inefficiency.Footnote 8

As usual, outputs and inputs are all normalized by their sample means to consider the TL part as a second-order Taylor approximation. Hence, by defining \(\bar{x}_{n}\) and \(\bar{u}_{m}\) as the sample means of the inputs and outputs, respectively, and having posited that \(\tilde{x}_{n}=\frac{x_{n}}{\bar{x}_{n}}\), \(\tilde{u}_{M}=\frac{u_{M}}{\bar{u}_{M}}\), \(\tilde{u}_{m}=\frac{u_{m}}{\bar{u}_{m}}\), \(\tilde{u}_{m}^*=\frac{\tilde{u}_{m}}{\bar{\tilde{u}}_{m}}\), the estimated FFF becomes:

For coherency, we have also transformed the independent variables into radiants to be used in the trigonometric part (FF) of the flexible function as in Berger et al. (1997): \(z_i =0.2 \cdot \pi - \mu \cdot a + \mu \cdot ln(y_i)\), where \(ln(y_i)\) represents loans, services, NPL, capital and labor (all modified as described above), \(i=1,\ldots ,5\), \(\mu \equiv \frac{0.9 \cdot 2\pi -0.1 \cdot 2 \pi }{(b-a)}\) and [a, b] is the range of \(ln(y_i)\).

Following Gallant (1981), we make an inference by performing a feasible generalized least squares (FGLS) regression with country dummies. In this way we account for both fixed effects—which we reckon are determined by the countries where the banks operate- and the heterogeneity of the banks dimension consisting in heteroscedasticity or, more generally, in random effects uncorrelated with regressors. The presence of fixed effects ensure asymptotically consistent estimates in the case of our large sample, while FGLS ensures efficient estimates. We also consider a time trend in order to capture the dynamic part of efficiency.

Once the distance function is estimated, we calculate the efficiency by adopting the free efficiency method (see Berger 1993):

where \(\widehat{\epsilon _{.k}} = \sum _{t} \epsilon _{tk}\)/T.

The NPL shadow price may be calculated according to the procedure expounded in Sect. 2. In particular, after estimating \(D_{0}(\mathbf {x}, \mathbf {u})\) we compute (i) the normalized shadow prices, \(\mathbf {r}^{*}(\mathbf {x},\mathbf {u})\), of undesirable outputs for each bank, by first deriving the distance function; (ii) the shadow revenue, R, as in equation (6), assuming that the market price of a loan is equal to its shadow price (non-normalized by R); and (iii) the (non-normalized) shadow prices for NPL from equation (7), for a given shadow revenue.

5 Estimation

In this section we report the results of our estimations. As stated above, all variables have been normalized by their sample mean; therefore, the first-order coefficients can be interpreted as distance elasticities evaluated at that point. The linear homogeneity of outputs is imposed by using deposits as the numeraire.Footnote 9 We consider the Fourier approximation until the third term and, due to multicollinearity, drop some of the regressors. The notation used is that of Sect. 3.Footnote 10

5.1 Europe

We obtain estimates (Table 1) that are significant and consistent with the literature (see among others Cuesta and Orea 2002).

In particular, looking at the elasticities of the first-order terms, we find positive coefficients for desirable outputs, loans, deposits and services,Footnote 11 and a negative coefficient for undesirable output (NPL). The negative sign represents the cost that banks would incur, in terms of the loss of desirable outputs, if some resources had to be diverted to manage bad loans. Hence, the price associated with NPL, being a measure of credit default risk, may be interpreted as the cost to be paid to comply with a regulation that aims to compensate for the effects of bad loans. In general, the proposed methodology may be applied when market regulation becomes necessary in the presence of undesirable outputs; the case of pollution, treated by Färe et al. (1993) is a notable example of such an application.

Regarding the management of inputs, the labor factor has an impact (0.77) greater than capital (0.46) on production efficiency.Footnote 12 As expected, such a result means that a large stock of capital, combined with technological progress, may be better exploited with an increase in the labor factor.

The dummies are all negative suggesting that the baseline, Turkey, presents a level of efficiency above the other countries. This is in line with several studies (see Bader et al. 2008; Hassan 2006) that point to the greater efficiency of Islamic banks with respect to conventional banks, even though such a result might be influenced by the small number of banks.

The time variable, t, has a null coefficient, suggesting that the efficiency decrease per year is statistically negligible.

5.2 The US

Additionally, for the US estimation (Table 2), the coefficients of inputs and outputs are significant and with the correct signs.

Comparing with Europe, we find that the labor factor has a greater impact on the efficiency (0.86 vs 0.77), and the opposite is true for capital (0.21 vs 0.47), meaning that the labor (capital) factor in the US performs better (worse) than in Europe. This result is expected, in that it is consistent with both the larger stock of capital employed (with respect to labor) and the lower level of labor protection in the US compared to Europe.

Looking at the dummies, almost all US states are characterized by significant fixed effects that are different from that of the baseline state (Wyoming), while the time variable, as opposed to Europe, presents a positive coefficient, pointing to an efficiency increase of 0.01 throughout the period.

Hence, even if the performed estimations account expressly for the NPL variable, a further deepening is necessary to explain why a dramatic crisis occurred in the US, notwithstanding the increasing efficiency net of risk, and why—in the presence of a constant efficiency—a much less pronounced crisis occurred for the European banks.

6 Inefficiencies or responsibilities?

In this section, we deal with the efficiency scores computed with formula (15) and the prices for NPL derived by formula (7), to evaluate to what extent the outbreak of the recent financial crisis is the result of bank inefficiencies or of the failure to control the NPL risk. The latter reflects inadequate government policies or specific-bank strategies for profits.

On average, the efficiency scores for Europe and the US are respectively 0.81 and 0.84. The scores are both high and with small differences across European and US states, ranging from 0.80 to 0.82 and from 0.83 to 0.85, respectively. Hence, the characterization of efficiency is across banks rather than states and is consistent with the small increasing trend for the US.

Therefore, despite accounting for NPL in the estimation of efficiency, it does not seem reasonable to use such an argument to explain the crisis. Rather, it appears more logical to think in terms of responsibilities in the management and regulation of credit risk.

To discriminate between responsibilities of banks and governments, we state that the responsibility for the crisis lies with bank when the assets (NPL) are managed differently in different countries by the same commercial bank; conversely it rests on the governments when they let banks allocate different amounts for bad loans.

We have learned from Fig. 1 that the statistical definitions of NPL may differ across countries, so the empirical probability of default, NPL/L, should be used with caution in evaluating the credit risk. For this reason, we will focus mainly on the prices of NPL, that represent a measure of NPL riskiness, which can be interpreted as the costs that banks should bear to recover bad loans.

Tables 3 and 4 show the non-normalized shadow prices for NPL in Europe and the US, respectively. Consistent with the theoretical results, all values are negative. For convenience of exposition, they are presented as positive costs.

We observe high prices of NPL for both Europe and the US, particularly for the US, suggesting that the more binding monitoring process of credit activity in Europe is effective. More specifically, on average, the cost of bad loans—in terms of capital recovery and related expenses—amounts to approximately 23% in the US and 16% in Europe.Footnote 13

Figure 2 shows that in both cases, the riskiness of the bad loans grew until the explosion of the crisis in 2007. In particular, due to the expansive monetary policy of the Federal Reserve, subprime trading in real estate grew incredibly since 2002, and the same occurred for the price of NPL, until reaching a peak between 2006 and 2007.Footnote 14 Then, it fell during 2008 in response to the regulatory actions undertaken. With transmission of the crisis to the financial system in 2008, the two prices exhibit no differences and then progressively separate out again.

The relevance of our analysis is twofold. First, the calculation of shadow prices provides a means for regulating the market for NPL by charging banks the cost associated with a given level of NPL assets. Second, as a measure of credit default risk, the shadow price is useful to evaluate the conditions of the banking market, with an increasing trend anticipating the emergence of a crisis, as happened with the peak in 2007, shown in Fig. 2.

6.1 Evaluating responsibilities for the crisis

The indicator we use for evaluating the responsibility of banks is the between variance of the prices for NPL and the default empirical probability, NPL/L, calculated as the deviation of bank means over countries from the overall mean, representing the standard for commercial banks. In an analogous way, to measure country responsibilities, we compute the deviation of country means over banks from the overall mean. In the former case, the prices for NPL or the NPL/L ratios are listed per bank by country, in the latter case, the same variables are listed per country by bank.

The larger the between variance of banks (\(\sigma ^2_{B_{banks}}\)), the lower the capacity of commercial banks to apply the same policy of risk management in different countries, and the greater the responsibility of banks. The greater the between variance of countries (\(\sigma ^2_{B_{countries}}\)), the less effective country regulations are in controlling the credit risk. In the following Tables, 5 and 6, we consider the ratio between these two indicators, where 1 is the term of reference for comparison.Footnote 15 We stress that the higher the \(\sigma ^2_{B_{countries}}\)/\(\sigma ^2_{B_{banks}}\) ratio, the less attention countries will give to controlling the NPL risk, and consequently the greater the responsibility of countries compared to banks.

Tables 5 and 6 show that in Europe, governments are the main actors in determining the NPL/L ratio, given that \(\sigma ^2_{B_{countries}}(NPL/L)>\sigma ^2_{B_{banks}}(NPL/L)\). In contrast, the riskiness of NPL is determined principally by banks, since \(\sigma ^2_{B_{countries}}(P_{NPL})<\sigma ^2_{B_{banks}}(P_{NPL})\). This means that, notwithstanding the stricter rules, European banks circumvent the regulatory provision in order to increase their loan market share.Footnote 16

Regarding the US states, we obtain opposite evidence. In particular, they are less penalized than European countries in terms of credit default when considering the NPL/L indicator, while the contrary occurs for the NPL price. These different results are a consequence of the US having a default probability ratio that is relatively smaller, though riskier, than is the case in Europe. In fact, as stated above, in the US case, NPL include only loans which are declared officially non-reimbursable, while for Europe, they also encompass loans where full repayment is uncertain.

Actually, for the US, under the Generally Accepted Accounting Principles (GAAP), the Statement of Financial Accounting Standard (SFAS) defined broad criteria to detect NPL based on probable and reasonably estimated loss. Hence, the NPL/L ratio was managed in a strategic way by banks so that the loan loss provision was dealt as well. In accordance with these rules, there is a greater responsibility of the country in the determination of NPL prices, which is pointed out in Table 6 by the values of the index \(\sigma ^2_{B_{countries}}(P_{NPL})/\sigma ^2_{B_{banks}}(P_{NPL})>1\) until 2007 and \(<1\) starting from 2008 with a stabilizing pattern, when governments started undertaking the necessary reforms of financial markets.

Such evidence is also pictured consistently in Fig. 1, with a low NPL/L probability for the US till the increase in 2007, followed by a stabilized—if not decreasing—pattern thereafter.

In contrast, in Europe, Basel Accords II and III established stringent conditions for the definition of both the NPL and the loan loss provision, which engendered an indicator constantly lower than 1 (Table 6).Footnote 17

Noticeably, the values of Table 6 after the crisis are very similar for the two countries. Such result confirms the evidence shown in Fig. 2 that the reforms adopted in the US brought the US credit risk at the European level, and indicates that also the uncertainty on that risk has been reduced accordingly.

7 Regulatory implications

In the previous sections, we have studied the nonperforming loan prices by focusing on bank efficiency as well as on the responsibilities of countries and banks for the surge in credit risk. Now, we make a comparison between the prices of NPL and loans to asses the amount of the charge against bad loans to compensate for the risk assumed by each bank. This cost can be in the form of a reduction in the interest rate that banks receive on their loans. It would be a way to regulate the credit market by saving that part of revenue necessary to offset the credit risk.

To make such a comparison, it is necessary to conform the values reported in Fig. 2 to the interest rate on loans (\(r_{L}\)). We calculate:

where \(r(NPL)_{L}\) is that part of the interest rate, \(r_{L}\), that should be subtracted to compensate for the risk of NPL. In the following Fig. 3 the difference between \(r_{L}\) and \(r(NPL)_{L}\) is pictured for both the US and Europe. This difference has the meaning of an interest rate on loans net of credit risk (IRNCR).

In this figure the initial descending path until 2004 is due, for the US, to the expansive monetary policy—adopted to come out of the new-economy speculative bubble of 2000—and the ascending path to the inversion of such a policy until slightly before 2007, in place to control inflation after a steady phase of growth. For Europe, we detect a tenuous descending path from 2000 until 2004, and then after, a slightly more marked decline until the minimum, reached in correspondence of the maximum for the US. This evolution is due to the European monetary policy directed to the stability of interest rates. Then, the descending path, until the minimum in 2007, and the subsequent increasing phase are determined by the increasing trend in the NPL price—and so of \(r(NPL)_{L}\)—up to the outbreak of the crisis and the following downturn. However, the minimum of the IRNCR indicator approaches the values \(7.50\%\) and \(9.50\%\) for the US and Europe, respectively, thus remaining well above zero.

Consistent with Figs. 1 and 2 the difference of IRNCR for the two countries becomes stable after 2008, once the new stricter rules have been put into practice.

A relevant result of this analysis is the wedge between the shadow price of nonperforming loans and market price of loans, that indicates the need for regulation in the loan market to prevent a credit crisis.

8 Conclusions

In this research, we propose a methodology for the computation of the NPL shadow prices in the banking efficiency framework. The results from our econometric estimation, based on the Fourier expansion, point to high levels of efficiency both in Europe and the US, though at different levels of the NPL prices. In particular, shadow prices are higher in the US, in accordance with the more permissive definition of NPL. We find that the risk of bad loans is principally due to a low level of market regulation in the US, and consequently is mainly referable to the government action, while in the EU, it is mostly imputable to banks. We also show that the more recent financial crisis might have been anticipated by monitoring the pattern of the NPL shadow prices. Finally, the application of estimated NPL shadow prices as penalties may be useful as a mechanism for regulating the credit market in the presence of the risk of problem loans.

Notes

In other words, this source of inefficiency (formally amounting to \(D_{o}(\mathbf {x},\mathbf {u}) < 1\)) implies that valuable output could be obtained for less costly input.

This assumption is necessary to compute shadow prices for NPL and will be put in practice with the empirical model.

We also employed direct functions, both linear and logarithmic, as well as different specifications for indirect functions.

We also test the robustness of our results by estimating the more widely used translog flexible functional form and obtain similar results (available upon request).

These properties are also termed as Cobb-Douglas hypotheses, which characterize the nested function of the FFF.

We checked empirically the existence of both monotonicity and concavity, well as output convexity. Furthermore, concavity exists in the TL part since the coefficients of the variables of interest are between 0 and 1. In fact, this is true for the homogeneity condition of degree 1 we imposed for outputs, having used the output oriented approach to evaluate distance.

The choice of the output is arbitrary and the resulting estimates are invariant to such a choice (see Cuesta and Orea 2002).

All estimations and calculations were performed with Stata 14 software.

By virtue of the homogeneity of degree 1 in outputs the coefficient of deposits is given by \(1-\sum _{m=1}^{M-1}\alpha _m\).

The negative sign of inputs shows the effect of an increase in labor and capital under parity conditions, i.e., without changing outputs.

Note that NPL prices may well be different among banks even if their efficiencies are similar. In fact, as shown in the theoretical section, the NPL price (normalized by the shadow revenue) is the first derivative of the considered efficiency, and thus it may behave in a different way.

The subsequent restrictive monetary policy, undertaken by the Fed to control inflation starting from 2004, exacerbated the NPL price escalation concurring to the collapse of the subprime payment system and engendering the crisis in 2007.

Interestingly, we also find that the between variances of banks and countries bring about the major contribution to total variance compared with the contribution from the within variances. This means that what mainly matters for explaining the variance of the risk connected to NPL is the role of the banks or countries considered as a system (i.e., represented by the means of the groups) rather than individually.

See Slovik (2012), who finds that European banks try to bypass the regulatory framework based on the risk-weighted asset to total asset ratio to increase the assets dimension and profits.

There is a lower bound of \(1.25\%\) for risk-weighted assets and an upper bound of \(50\%\) for the regulatory capital requirement.

References

Ari A, Chen S, Ratnovski L (2019) The dynamics of non-performing loans during banking crises: a new database. IMF Working Papers 272, International Monetary Found

Bader MK, Mohamad S, Ariff M, Shah TH (2008) Cost, revenue and profit efficiency of Islamic versus conventional banks: International evidence using data envelopment analysis. Islamic Econ Stud 15(2):23–76

Beck R, Jakubik P, Piloiu A (2013) Non-performing loans, what matters in addition to the economic cycle? Working Paper Sries 1515, European Central Bank

Berger AN (1993) Distribution free” estimates of efficiency of the US banking industry and tests of the standard distributional assumptions. Finance and Economics Discussion Series 188, Board of Governors of the Federal Reserve System (US)

Berger AN, DeYoung R (1997) Problem loans and cost efficiency in commercial banks. Finance and Economics Discussion Series 1997-8, Board of Governors of the Federal Reserve System (US)

Berger AN, Leusner J, Mingo J (1997) The efficiency of bank branches. J Monetary Econ 40(1):141–162

Crouzeix JP (1977) Conjugacy in quasiconvex analysis. In: Auslender A (ed) Convex analysis and its applications. Springer, Berlin, pp 66–99

Cuesta RA, Orea L (2002) Mergers and technical efficiency in Spanish savings banks: a stochastic distance function approach. J Bank Finance 26(12):2231–2247

Eastwood BJ, Gallant AR (1991) Adaptive rules for seminonparametric estimators that achieve asymptotic normality. Econ Theory 7(03):307–340

Färe R (1988) Fundamentals of production theory. Lecture notes in economics and mathematical systems. Springer

Färe R, Lovell CAK (1978) Measuring the technical efficiency of production. J Econ Theory 19(1):150–162

Färe R, Primont D (1995) Multi-output production and duality: theory and applications. Kluwer Academic Publishers, Boston

Färe R, Grosskopf S, Lovell CAK, Yaisawarng S (1993) Derivation of shadow prices for undesirable outputs: a distance function approach. Rev Econ Stat 75(2):374–380

Farrell MJ (1957) The measurement of productive efficiency. J R Stat Soc Ser A Gen 120(3):253–290

Gallant AR (1981) On the bias in flexible functional forms and an essentially unbiased form: the Fourier flexible form. J Econ 15(2):211–245

Hassan MK et al (2006) The x-efficiency in Islamic banks. Islamic Econ Stud 13(2):49–78

Hughes JP, Mester LJ (1993) A quality and risk-adjusted cost function for banks: evidence on the ‘too-big-to-fail’ doctrine. J Prod Anal 4:293–315

Jacobsen SE (1972) On Shephard’s duality theorem. J Econ Theory 4(3):458–464

Lee JD, Park JB, Kim TY (2002) Estimation of the shadow prices of pollutants with production/environment inefficiency taken into account: a nonparametric directional distance function approach. J Environ Manag 64(4):365–375

Li Y, Hu JL, Liu HW (2013) Non-performing loans and bank efficiencies: an application of the input distance function approach. J Stat Manag Syst 12(3):435–450

Lovell CAK, Travers P, Richardson S, Wood L (1994) Resources and functionings: a new view of inequality in Australia, pp 787–807. Springer, Berlin (1994)

Maggi B, Guida M (2011) Modelling non-performing loans probability in the commercial banking system: efficiency and effectiveness related to credit risk in Italy. Empir Econ 41:269–291

Mekaroonreung M, Johnson A (2012) Estimating the shadow prices of SO2 and NOX for US coal power plants: a convex nonparametric least squares approach. Energy Econ 34(3):723–732

Pastor J, Serrano L (2005) Efficiency, endogenous and exogenous credit risk in the banking systems of the euro area. Appl Financial Econ 15(9):631–649

Penot JP, Volle M (1990) On quasiconvex duality. Math Oper Res 15:597–625

Rezek JP, Campbell RC (2007) Cost estimates for multiple pollutants: a maximum entropy approach. Energy Econ 29(3):503–519

Shephard R (1970) Theory of cost and production functions. Princeton studies in mathematical economics. Princeton University Press

Slovik P (2012) Systematically important banks and capital regulations challenges. Department Working Papers, OECD Publishing 916

Acknowledgements

The authors wish to thank Eleonora Cavallaro, Daniela Palatta, Stefano Fachin and Ronald Gallant for helpful comments and suggestions. Additionally, we particularly thank three anonymous referees and the Editor for precious and valuable advice. Financial support is from University of Rome La Sapienza.

Funding

Open access funding provided by Università degli Studi di Roma La Sapienza within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Disclaimer The views and opinions expressed in this article are those of the authors and do not reflect the official policy or position of SOGEI S.p.A.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Fusco, E., Maggi, B. Computing nonperforming loan prices in banking efficiency analysis. Comput Manag Sci 19, 1–23 (2022). https://doi.org/10.1007/s10287-021-00406-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10287-021-00406-8