Abstract

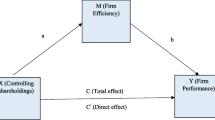

In this paper we extend the corporate governance literature by combining stakeholder and strategic contingency theories to provide an explanation of how owners influence the financial performance of firms. We hypothesize that ownership influences financial performance through three other variables: strategic orientation, organizational structure, and management style. Using LISREL analysis, we find this indirect influence to be significant. We also discuss implications for future research.

Similar content being viewed by others

References

Aghion, Philippe, Oliver J. Blanchard, and Robin Burgess (1994), The behavior of State firms in Eastern Europe, pre-privatization, European Economic Review 38, 1327–1349.

Andrews, William A. and Michael J. Dowling (1998), Explaining performance changes in newly privatized firms, Journal of Management Studies 35, 601–617.

Barringer, Bruce R. and Allen C. Bluedorn (1999), The relationship between corporate entrepreneurship and strategic management, Strategic Management Journal 20, 421–444.

Berman, Shawn L., Andrew C. Wicks, Suresh Kotha, and Thomas M. Jones (1999), Does stakeholder orientation matter? The relationship between stakeholder management models and firm financial performance, Academy of Management Journal 42, 488–505.

Bollen, Kenneth and Richard Lennox (1991), Conventional wisdom on measurement: A structural equation perspective, Psychological Bulletin 110, 305–314.

Brouthers, Keith D. and Gary J. Bamossy (1997), The role of key stakeholder in international joint venture negotiations: Case studies from eastern Europe, Journal of International Business Studies 28, 285–308.

Burns, Tom and George M. Stalker (1961), The Management of Innovation, London: Tavistock.

Campbell, Donald T. and Julian Stanley (1963), Experimental and Quasi-experimental Research, Chicago: Rand Mc-Nally.

Carlin, Wendy and Michael Landesmann (1997), From theory into practice? Restructuring and dynamism in transition economies, Oxford Review of Economic Policy 13, 77–105.

Cohen, Jacob (1968), Weighted kappa: Nominal scale agreement with provision for scaled disagreement or partial credit, Psychological Bulletin 70, 213–220.

Covin, Jeffrey G. and Dennis P. Slevin (1988), The influence of organization structure on the utility of an entrepreneurial top management style, Journal of Management Studies 25, 217–234.

Cuervo, Alvaro and Belen Villalonga (2000), Explaining the variance in the performance effects of privatization, Academy of Management Review 25, 581–590.

De Castro, Julio O., G. Dale Meyer, Kelly C. Strong, and Nikolaus Uhlenbruck (1996), Government objectives and organizational characteristics: A stakeholder view of privatization effectiveness, The International Journal of Organizational Analysis 4, 373–392.

Dharwadkar, Ravi, Gerard George, and Pamela Brandes (2000), Privatization in emerging economies: An agency theory perspective, Academy of Management Review 25, 650–669.

EBRD (1996), Transition Report 1996, London: European Bank for Reconstruction and Development.

Estrin, Saul (1994), Economic transition and privatization: The issues, in: Saul Estrin (ed.), Privatization in Central and Eastern Europe, London: Longman Press.

Frooman, Jeff (1999), Stakeholder influence strategies, Academy of Management Review 24, 191–205.

Gatian, Amy W. and Kenneth C. Gilbert (1996), The central European need for management training and advisory services, Multinational Business Review (spring), 69–76.

George, Jennifer M. (1990), Personality, affect, and behavior in groups, Journal of Applied Psychology 75, 107–116.

Gerbing, David W. and James C. Anderson (1993), Monte Carlo evaluations of goodness-of-fit indices for structural equation models, in: Kenneth A. Bollen and J. Scott Long (eds), Testing Structural Equation Models, Sage publications, 40–65.

James, Lawrence R., Robert G. Demaree, and Gerrit Wolf (1984), Estimating within-group interrater reliability with and without response bias, Journal of Applied Psychology 69, 84–98.

Jennings, Daniel F. and Samuel L. Seaman (1994), High and low levels of organizational adaption: An empirical analysis of strategy, structure and performance, Strategic Management Journal 15, 459–475.

Jöreskog, Karl G. and Dag Sörbom (1989), LISREL7: A Guide to the Program and Applications, 2nd edition, SPSS Inc.

Jöreskog, Karl G. and Dag Sörbom (1996), PRELIS2: User’s reference guide. Scientific Software International.

Kozlowski, Steve and Keith Hattrup (1992), A disagreement about within-group agreement: Disentangling issues of consistency versus consensus, Journal of Applied Psychology 77, 161–167.

Lane, Peter J., Albert A. Cannella, and Michael H. Lubatkin (1998), Agency problems as antecedents to unrelated mergers and diversification: Amihud and Lev reconsidered, Strategic Management Journal 19, 555–578.

Lioukas, Spyros and Athanassios Kouremenos (1989), In search of typical state enterprise models, in Tai’eb Hafsi (Ed), Strategic Issues in State-Controlled Enterprises, London, JAI Press.

Lioukas, Spyros, Dimitris Bourantas, and Vassilis Papadakis (1993), Managerial autonomy of State-owned enterprises: Determining factors, Organization Science 4, 645–666.

Lumpkin, G.T. and Gregory G. Dess (1996), Clarifying the entrepreneurial orientation construct and linking it to performance, Academy of Management Review 21, 135–172.

Luo, Yadong and J. Justin Tan (1998), A comparison of multinational and domestic firms in an emerging market: A strategic choice perspective, Journal of International Management 4, 21–40.

Martin, Roderick (1999), Transforming Management in Central and Eastern Europe, Oxford University Press: Oxford.

Martin, Stephen and David Parker (1997), The Impact of Privatisation, Routledge, London.

Megginson, William L., Robert C. Nash, and Mathias van Randenborgh (1994), The financial and operating performance of newly privatized firms: An international empirical analysis, The Journal of Finance 49, 403–452.

Miller, Danny and Peter H. Friesen (1983), Strategy-making and environment: The third link, Strategic Management Journal 4, 221–235.

Murtha, Thomas P. and Stefanie A. Lenway (1994), Country capabilities and the strategic state: How national political institutions affect multinational corporations’ strategies, Strategic Management Journal 15, 113–129.

Naman, John L. and Dennis P. Slevin (1993), Entrepreneurship and the concept of fit: A model and empirical test, Strategic Management Journal 14, 137–153.

OECD (1992), Reforming the Economies of Central and Eastern Europe, Paris: OECD.

Parker, David (1995), Privatization and agency status: Identifying the critical factors for performance improvement, British Journal of Management 6, 29–43.

Prescott, John E. (1986), Environments as moderators of the relationship between strategy and performance, Academy of Management Journal 29, 329–346.

Slevin, Dennis P. and Jeffery G. Covin (1997), Strategy formation patterns, performance, and the significance of context, Journal of Management 23, 189–209.

Tan, J. Justin and Robert J. Litschert (1994), Environment-strategy relationship and its performance implications: An empirical study of the Chinese electronics industry, Strategic Management Journal 15, 1–20.

Whitley, Richard and Laszlo Czaban (1998), Institutional transformation and enterprise change in an emergent capitalist economy: The case of Hungary, Organization Studies 19, 259–280.

Wright, Peter, Stephen P. Ferris, Atulya Sarin, and Vidya Awasthi (1996), Impact of corporate insider, blockholder, and institutional equity ownership on firm risk taking, Academy of Management Journal 39, 441–463.

Zahra, Shaker A., R. Duane Ireland, Isabel Guitierrez, and Michael Hitt (2000), Privatization and entrepreneurial transformation: Emerging issues and a future research agenda, Academy of Management Review 25, 509–524.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Brouthers, K.D., Gelderman, M. & Arens, P. The Influence of Ownership on Performance: Stakeholder and Strategic Contingency Perspectives. Schmalenbach Bus Rev 59, 225–242 (2007). https://doi.org/10.1007/BF03396749

Published:

Issue Date:

DOI: https://doi.org/10.1007/BF03396749