Abstract

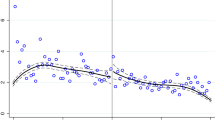

This paper presents an econometric analysis of taxpayer compliance, exploring its relationship with audit rates, penalties if detected, tax rate schedule, income level, and sources of self-employment income. Using data drawn from theAnnual Report of the Commissioner of Internal Revenue Service [IRS, various] and theData Book [IRS, various] for 1980 to 1995, the audit rate and penalty rate are both effective deterrents to noncompliance. The effectiveness of these two policy instruments depends upon the individual's level of income. It seems the higher the income level, the more effective these instruments are. In general, compliance increases with the level of income but at a decreasing rate. It is also found that individuals tend to comply less as the marginal tax rate rises. Again, such tendency is more pronounced for high-income taxpayers than for low-income taxpayers.

Similar content being viewed by others

References

Allingham, M.; Sandmo, A. "Income Tax Evasion: A Theoretical Analysis,"Journal of Public Economics, 1, 3/4, 1972, pp. 323–38.

Alm, J.; Bahl, R.; Murray, M. N. "Tax Structure and Tax Compliance,"The Review of Economics and Statistics, 72, 4, 1990, pp. 603–13.

__. "Audit Selection and Income Tax Underreporting in the Tax Compliance Game,"Journal of Development Economics, 42, 1993, pp. 1–33.

Alm, J.; Cronshaw, M.; McKee, M. "Tax Compliance with Endogenous Audit Selection Rules,"Kyklos, 46, 1, 1993, pp. 27–45.

Anderson, P. "Tax Evasion and Labor Supply,"Scandinavian Journal of Economics, 79, 1977, pp. 375–83.

Beck, P.; Jung, W. "Taxpayer Compliance Under Uncertainty,"Journal of Accounting and Public Policy, 8, Spring 1989, pp. 1–27.

Becker, G. "Crime and Punishment: An Economic Approach,"Journal of Political Economy, 76, 1968, pp. 169–217.

Beron, K.; Tauchen, H.; Witte, A. "A Structural Equation Model for Tax Compliance and Auditing," working paper, 2556, National Bureau of Economic Research, 1988.

Clotfelter, C. "Tax Evasion and Tax Rates: An Analysis of Individual Returns,"The Review of Economics and Statistics, 65, 3, 1983, pp. 363–73.

Crane, S.; Nourzad, F. "Time Value of Money and Income Tax Evasion Under Risk Averse Behavior: Theoretical Analysis and Empirical Evidence,"Public Finance, 40, 3, 1985, pp. 381–94.

__. "Inflation and Tax Evation: An Empirical Analysis,"The Review of Economics and Statistics, 68, 2, 1986, pp. 217–23.

__. "On the Treatment of Income Tax Rates in Empirical Analysis of Tax Evasion,"Kyklos, 40, 3, 1987, pp. 338–48.

__. "Tax Rates and Tax Evasion: Evidence from California Amnesty Data,"National Tax Journal, 43, 2, 1990, pp. 189–99.

Dubin, J.; Graetz, M.; Wilde, L. L. "Are We a Nation of Tax Chesters?: New Econometric Evidence on Tax Compliance,"The American Economic Review, 77, 2, 1987, pp. 240–5.

__ "The Effects of Audit Rates on the Federal Individual Income Tax: 1977–86,"National Tax Journal, 43, 4, 1990, pp. 395–407.

Dubin, J.; Wilde, L. L. "An Empirical Analysis of Federal Income Tax Auditing and Compliance,"National Tax Journal, 41, 1, 1988, pp. 61–74.

Erard, B. "The Influence of Tax Auditing on Reporting Behavior," in Joel Slemrod, ed.,Why People Pay Taxes, Ann Arbor, MI: University of Michigan Press, 1992.

Erard, B.; Feinstein, J. S. "Honesty and Evasion in the Tax Compliance Game,"RAND Journal of Economics, 25, 1, 1994, pp. 1–19.

Feinstein, J. S. "An Econometric Analysis of Income Tax Evasion and its Detection,"RAND Journal of Economics, 22, 1991, pp. 14–35.

Graetz, M.; Reinganum, J.; Wilde, L. L. "The Tax Compliance Game: Toward an Interactive Theory of Law Enforcement,"Journal of Law, Economics, and Organization, 2, Spring 1986, pp. 1–32.

Graetz, M.; Wilde, L. L. "The Economics of Tax Compliance: Fact and Fantasy,"National Tax Journal, 38, September 1985, pp. 355–63.

Greenberg, J. "Avoiding Tax Avoidance: A (Repeated) Game Theoretic Approach,"Journal of Economic Theory, 32, 1, 1984, pp. 1–13.

Internal Revenue Service.Federal Tax Compliance Research: Individual Income Tax Gap Estimates for 1985, 1988, and 1992, 1415, April 1996.

__.Annual Report of the Commissioner of the Internal Revenue Service, 55, various.

__.Data Book, 55B, various.

Joulfaian, D.; Rider, M. "Tax Evasion in the Presence of Negative Income Tax Rates,"National Tax Journal, 49, 4, 1996, pp. 553–70.

__. "Differential Taxation and Tax Evasion by Small Business,"National Tax Journal, 51, 4, 1998, pp. 675–87.

Kamdar, N. "Information Reporting and Tax Compliance: An Investigation Using Individual TCMP Data,"Atlantic Economic Journal, 23, 4, 1995, pp. 278–92.

__. "Corporate Income Tax Compliance: A Time Series Analysis,"Atlantic Economic Journal, 25, 1, 1997, pp. 37–49.

Klepper, S.; Nagin, D. "The Anatomy of Tax Evasion,"Journal of Law, Economics, and Organization, 5, 1, 1989, pp. 1–24.

Koskella, E. "A Note on Progression, Penalty Schemes, and Tax Evasion,"Journal of Public Economics, 22, 1, 1983a, pp. 127–33.

__. "On the Shape of the Tax Schedule, the Probability of Detection, and the Penalty Schemes as Deterrents to Tax Evasion,"Public Finance, 38, 1983b, pp. 70–80.

Lee, K. "Risk Taking and Business Income Tax Evasion,"Public Finance/Finances Publiques, 50, 1, 1995, pp. 106–20.

Pencavel, J. "A Note on Income Tax Evasion, Labor Supply, and Nonlinear Tax Schedules,"Journal of Public Economics, 12, 1, 1979, pp. 115–24.

Pommerehne, W. W.; Weck-Hannemann, H. "Tax Rates, Tax Administration and Income Tax Evasion in Switzerland,"Public Choice, 88, 1–2, 1996, pp. 161–70.

Poterba, J. "Tax Evasion and Capital Gains Taxation,"American Economic Review, 77, 2, 1987, pp. 234–9.

Reinganum, J.; Wilde, L. L. "Income Tax Compliance in a Principal-Agent Framework,"Journal of Public Economics, 26, 1, 1985, pp. 1–18.

__. "Equilibrium Verification and Reporting Policies in a Model of Tax Compliance,"International Economic Review, 27, 3, 1986, pp. 739–60.

__. "A Note on Enforcement Uncertainty and Taxpayer Compliance,"Quarterly Journal of Economics, CIII, 4, 1988, pp. 793–8.

Sandmo, A. "Income Tax Evasion, Labor Supply, and the Equity-Efficiency Trade-Off,"Journal of Public Economics, 16, 1981, pp. 265–88.

Sherman, W. R. "Another Year, Another Penalty: The Ever-Changing State of Civil Penalties,"National Public Accountant, 35, 11, 1990, pp. 24–31.

Srinivasan, T. "Tax Evasion: A Model,"Journal of Public Economics, 2, 1973, pp. 339–46.

Witte, A.; Woodbury, D. "The Effect of Tax Laws and Tax Administration on Tax Compliance: The Case of the U.S. Individual Income Tax,"National Tax Journal, 38, 1, 1985, pp. 1–13.

Yaniv, G. "Tax Evasion and the Tax Rate: A Theoretical Reexamination,"Public Finance/Finances Publiques, 49, 1, 1994, pp. 107–12.

Yitzhaki, S. "A Note on Income Tax Evasion: A Theoretical Analysis,"Journal of Public Economics, 3, 1974, pp. 201–2.

U.S. Department of Commerce.Statistical Abstract of the United States: 1996, Washington, DC: USDC, 1996.

U.S. General Accounting Office. "Tax Administration: Negligence and Substantial Understatement Penalties Poorly Administered," report, GAO/GGD-91-91, 1991.

__. "Tax Administration: IRS Can Better Pursue Noncompliant Sole Proprietors," report GAO/GGD-94-175, 1994.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Ali, M.M., Cecil, H.W. & Knoblett, J.A. The effects of tax rates and enforcement policies on taxpayer compliance: A study of self-employed taxpayers. Atlantic Economic Journal 29, 186–202 (2001). https://doi.org/10.1007/BF02299137

Issue Date:

DOI: https://doi.org/10.1007/BF02299137