Abstract

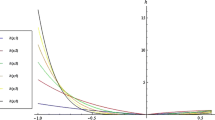

This paper concerns the valuation of average options of European type where an investor has the right to buy the average of an asset price process over some time interval, as the terminal price, at a prespecified exercise price. A discrete model is first constructed and a recurrence formula is derived for the exact price of the discrete average call option. For the continuous average call option price, we derive some approximations and theoretical upper and lower bounds. These approximations are shown to be very accurate for at-the-money and in-the-money cases compared to the simulation results. The theoretical bounds can be used to provide useful information in pricing average options.

Similar content being viewed by others

References

F. Black and M. Scholes, The pricing of options and corporate liabilities, J. Political Econ. 81 (1973) 637–659.

A.P. Carverhill and L.J. Clewlow, Valuing average rate (“Asian”) options, Risk 3 (1990) 25–29.

J.C. Cox, S. Ross and M. Rubinstein, Option pricing: A simplified approach, J. Fin. Econ. 7 (1979) 229–263.

H. Geman and M. Yor, Bessel processes, Asian options and other applications, Working paper (1992).

J. Hull,Options, Futures, and Other Derivative Securities (Prentice-Hall, 1989).

J. Hull and A. White, The use of the control variate technique in option pricing, J. Fin. Quan. Anal. 23 (1988) 237–251.

A.G.Z. Kemna and A.C.F. Vorst, A pricing method for options based on average asset values, J. Banking Fin. 14 (1990) 113–129.

E. Lévy, Pricing European average rate currency options, J. Int. Money Fin. (1991), to appear.

A.C.F. Vorst, Average rate exchange options, Erasmus University working paper (1990).

D. Stoyan,Comparison Methods for Queues and Other Stochastic Models (Wiley, 1983).

M. Yor, On some exponential functions of Brownian motion, Adv. Appl. Prob. 24 (1992) 509–531.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Iwaki, H., Kijima, M. & Yoshida, T. Approximate valuation of average options. Ann Oper Res 45, 131–145 (1993). https://doi.org/10.1007/BF02282045

Issue Date:

DOI: https://doi.org/10.1007/BF02282045