Abstract

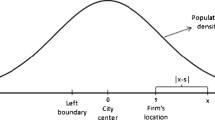

In this paper, we show that the impact of an ad valorem tax on demand prices is the same for all interrelated spatial regions regardless of sizes of their price elasticities. In the case of a degenerate spatial equilibrium model in which several independent submarkets develop, the tax incidence is identical within a submarket; but varies between different submarkets. In the case of non-linear and/or non-separable demand and supply functions, the same results hold as long as (i) the tax does not affect unit transportation costs and (ii) a unique equilibrium commodity flow solution exists.

Similar content being viewed by others

References

Batten DF (1983) Spatial analysis of interacting economics. Boston, Kumer Nijhoff

Burness SH (1976) On the taxation of nonreplenishable resources. J Environ Econ Manag 3

Campbell TC, Huang MJ, Shahrokh S (1982) Market delineation in the coal industry. Rev Reg Stud 9:6–17

Chao GS, Friesz TL (1984) Spatial price equilibrium sensitivity analysis. Trans Res 18B:423–440

Church AM (1981) Taxation of nonrenewable resources. Lexington, MA, Lexington

Cutler L, Pass DS (1971) A computer program for quadratic mathematical models to be used for aircraft design and other application involving linear constraints. Rand Corporation

Dafermos S (1983) An iterative scheme for variational inequalities. Math Program 26:40–47

Dafermos S, Nagurney A (1984) Sensitivity analysis for the general spatial economic equilibrium problem. Oper Res 32:1069–1086

Diamond P (1978) Tax incidence in a two-good model. J Publ Econ

Enke S (1951) Equilibrium among spatially separated markets: solution to electric analog. Econometrica 19:40–47

Florian M, Los M (1982) A new look at static spatial price equilibrium models. Reg Sci Urban Econ 12:579–597

Friesz TL, Tobin RL, Smith T, Harker PT (1983) A nonlinear complementarity formulation and solution procedure for the general derived demand network equilibrium problem. J Reg Sci 23:337–359

Gass SI (1985) Linear programming models and applications, 5th edn. New York, McGraw-Hill

Gordon RL (1975) US coal and the electric power industry. Baltimore, John Hopkins University Press

Harberger A (1962) The incidence of the corporation income tax. J Polit Econ 70:215–240

Harker PT (1984A) A variational inequality approach for the determination of oligopolistic market equilibrium. Math Program 105–111

Harker PT (ed) (1984a) Spatial price equilibrium: advances in theory, computation and application. New York, Springer

Harker PT (1988) Dispersed spatial price equilibrium. Environ Plan A 20:353–368

Hyman DN (1987) Public finance: a contemporary application of theory to policy, 2nd edn. Chicago IL: The Dryden Press

Irwin CL, Yang CW (1982) Iteration and sensitivity for a spatial equilibrium problem with linear supply and demand equations. Oper Res 30:319–335

Irwin DN, Yang CW (1983) Iteration and sensitivity for a nonlinear spatial equilibrium problem. In: Fiacco JA (ed) (Lect Notes Pure and Appl Math) Vol 85. New York, Marcel Dekker, pp 91–107

Kahn A (1970) The economics of regulation: principles and institutions. New York, Wiley

Kolstad ChD, Frank AW (1978) Optimal coal severance tax rates in the Western US. A report for the US Department of Energy under Contract W-7405-Eng 36

Kolstad CD, Frank AW (1983) Competition in interregional taxation: the case of Western Coal. J Polit Econ 91:443–460

Labys WC, Yang CW (1980) A quadratic programming model of the appalachian steam coal markets. Energy Econ 2:86–95

Labys WC, Yang CW (1991) Advances in the spatial equilibrium modeling of mineral and energy issues. Int Reg Sci Rev 14:61–94

Musgrave R (1959) The theory of public finance. New York, McGraw-Hill

Nagurney A (1986) An algorithm for the single commodity spatial price equilibrium problem. Reg Sci Urban Econ 16:573–588

Nagurney A (1987) Computational comparison of spatial price equilibrium methods. J Reg Sci pp 55–76

Newcomb RT, Fan J (1980) Coal market analysis issues. EPRI Report, EA-1575, Electric Power Research Institute (Palo Alto, CA)

Newcomb RT, Reynolds SS, Masbruch TA (1989) Changing patterns of investment decision making in world aluminum. Resourc Energy 1:261–297

Olson DO (1984) The interregional incidence of energy-production tax. Int Reg Sci Rev 9:109–124

Page WP (1980) Horizontal divestiture of energy companies: regional market evidence on coal production and reserve ownership concentration. Energy 5:1245–1257

Page WP, Yang CW (1984) Severance taxes and spatial characteristics of energy markets: the care of appalachian coal, paper delivered at the Sixth Annual North American Meeting of Energy Economists. San Francisco

Pang JS (1984) Solution of the general multicommodity spatial equilibrium problem by variational and complementarity methods. J Reg Sci 24:403–414

Pang JS, Chan D (1982) Iterative methods for variational and complementarity problems. Math Program 24:284–313

Peeters L (1990) A spatial equilibrium model of the EC feed grain sector. Eur Rev Agric Econ 17:365–386

Rosen HS (1992) Public finance 3rd edn. Homewood, IL: Richard Irwin

Samuelson PA (1952) Spatial price equilibrium and linear programming. Am Econ Rev 42:283–303

Sheppard E, Haining RP, Plummer P (1992) Spatial pricing in interdependent market. J Reg Sci 32:55–75

Silberberg E (1970) A theory of spatially separated markets Int. Econ Rev 343–348

Smith TE (1984) A solution condition for complementarity problems: with an application to spatial price equilibrium. Comp Oper Res pp 61–69

Smith TE, Friesz TL (1985) Spatial market equilibrium with flow dependent supply and demand: the single commodity case. Reg Sci Urban Econ 15:181–218

Sussman J, Taylor G (1982) Severance taxation in theory and practice: some findings from Colorado. Paper delivered at the International Association of Energy Economists Meeting, Denver, Colorado

Takayama T, Judge GG (1964) Equilibrium among spatially separated markets: a reformulation. Econometrica 32:510–524

Takayama T, Uri N (1983) A note on spatial and temporal price and allocation modeling. Reg Sci Urban Econ pp 455–470

Takayama T, MacAulay TG (1988) Recent developments in spatial (temporal) equilibrium models: non-linearity, existence and other issues. Paper presented at 1988 International Meeting of Econometric Modeling, Washington, DC

Thompson RL (1989) Spatial and temporal price equilibrium agricultural models. In: Labys WC, Takayama T, Uri N (eds) Quantitative methods for market-oriented economic analysis over space and time. Brookfield, VT, Gower

Thore S (1982) The Takayama-judge model of spatial equilibrium extended to convex production sets. J Reg Sci 22:203–212

Thore S (1982) The Takayama-judge spatial equilibrium model with endogenous income. Reg Sci Urban Econ 12:351–364

Tobin RL, Friesz TL (1986) Sensitivity analysis for variational inequalities. J Opt Theory Appl 48:191–204

Tobin RL, Friesz TL (1987) Sensitivity analysis for general spatial price equilibrium. J Reg Sci pp 77–102

Tomlin JA (1976) A programming guide to LCPL: a program for solving linear complementarity problems by Lemke's method. Stanford University, Stanford, CA

Tresch RW (1981) Public finance: a normative theory. Plano, TX, Business Publications

Yang CW (1983) An impact analysis of a quadratic programming model: a case of appalachian coal market with the pollution tax. In: Wang Y, Grayson L, Sanford R (eds) Use of computers in the coal industry. New York, American Institute of Mining Metallurgical and Petroleum engineers. pp 665–669

Yang CW (1989) A note on the musgravian transformation. East Econ J 15:229–234

Yang CW (1990) An evaluation of the Maxwell-Boltzmann entropy model of the appalachian steam coal market. Rev Reg Stud 20:21–29

Yang CW, Labys WC (1981) Stability of appalachian coal shipments under policy variations. Energy J 2

Yang CW, Labys WC (1982) A sensitive analysis of the stability property of the QP commodity model. J Emp Econ 7:93–107

Yang CW, Labys WC (1985) A sensitivity analysis of the linear complementarity programming model: appalachian coal and natural gas markets. Energy Econ 7:145–152

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Yang, C.W., Page, W.P. Sensitivity analysis of tax incidence in a spatial equilibrium model. Ann Reg Sci 27, 241–257 (1993). https://doi.org/10.1007/BF01581661

Received:

Accepted:

Issue Date:

DOI: https://doi.org/10.1007/BF01581661