Abstract

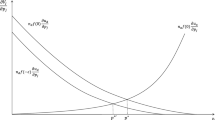

In order to maximize votes, incumbent politicians design and implement redistributional programs. These programs benefit some voters at the expense of others. In the simple two group (or tax payers and beneficiaries) case we identify the nature of vote maximizing transfer policies. This model's basic approach is shown to hold for multiple group models as well. Strategic implications for the organizers of sub groups of the population (or group leaders) are developed. Other extensions of the model are discussed.

qu]Where the budget is clever is in its detail. Each little measure is designed to hurt (but not too much) people who are not politically important, while tossing a bone to people who are. You can see this in a host of different ways.

Similar content being viewed by others

References

Black, D. (1958). The theory of committees and elections. Cambridge: Cambridge University Press.

Downs, A. (1957). An economic theory of democracy. New York: Harper and Row.

Enelow, J. and Hinich, M. (1984). The spatial theory of voting. Cambridge: Cambridge University Press.

Frohlich, N. and Oppenheimer, J.A. (1974). The carrot and the stick. Public Choice 29 (Fall): 43–61.

Frohlich, N. and Oppenheimer, J.A. (1984). Postelection redistributive strategies of representatives: Part of a theory of the politics of redistribution. Public Choice 42 (2): 113–133.

Hettich, W. and Winer, S.L. (1986). Economic and political foundations of tax structure. Mimeo.

Hettich, W. and Winer, S.L. (1987). Federalism, special interests and the exchange of policies for political resources. The European Journal of Political Economy 3: 33–54.

Hochman, H.M. and Rodgers, J.D. (1974). The simple politics of distributional preference. Mimeo.

Hotelling, H. (1929). Stability in competition. The Economic Journal 39: 41–57.

Luce, D. and Raiffa, H. (1957). Games and decisions. New York: Wiley.

McKelvey, R. and Richelson, J. (1974). Cycles of risk. Public Choice 18: 41–66.

McRae, H. (1986). Bones aimed at the Tory faithful. The Guardian (Wednesday, 19 March): 3.

Meltzer, A.H. and Wellrath, M. (1975). The effects of economic policies on votes for the presidency: Some evidence from recent elections. The Journal of Law and Economics 18: 781–798.

Miller, G. (1977). Bureaucratic compliance as a game on the unit square. Public Choice 29 (Spring): 39–52.

Shepsle, K. (1972). The strategy of ambiguity, uncertainty and competition. American Political Science Review 66: 551–568.

Smithies, A. (1941). Optimum location in spatial competition. Journal of Political Economy 49: 423–439.

Thurow, L. (1971). The income distribution as a pure public good. Quarterly Journal of Economics 85 (May): 327–336.

Tversky, A. and Kahneman, D. (1981). The framing of decisions and the psychology of choice. Science 221: 453–458.

Author information

Authors and Affiliations

Additional information

We are indebted to the Social Sciences and Humanities Research Council of Canada and the US National Science Foundation for their generous support of this project. We would also like to thank Nuffield College, Oxford University for making its facilities available to us and offering a wonderfully supportive environment for our initial work on this project. Thank also are owed to Giacomo Bonnano and David Austen-Smith who offered us a number of useful suggestions.

Rights and permissions

About this article

Cite this article

Frohlich, N., Oppenheimer, J. Redistributive politics: A theory of taxation for an incumbent in a democracy. Public Choice 64, 135–153 (1990). https://doi.org/10.1007/BF00153160

Issue Date:

DOI: https://doi.org/10.1007/BF00153160