Abstract

To meet their commitments to Paris climate accord, governments around the world have begun to introduce emission pricing schemes such as carbon taxes with the intention of curbing the greenhouse gas (GHG) emissions and at the same time promoting the development of low-carbon technologies. However, adoption of such taxes has prompted major concerns among the industries, especially for large emitters such as petrochemical manufacturing plants, since it will substantially increase their operating costs and hence directly affect their competitiveness in the global market. This paper proposes a bottom-up framework for modeling the potential impacts of a carbon tax introduction on petrochemical selling prices. The framework has been developed using a set of mathematical equations that links the amount of GHG emissions with the carbon tax rates. The required increases in the petrochemical product prices are then projected for compensating the incurred emission costs. The goal is to retain the same production revenues prior to carbon tax imposition—this is known as tax passing strategy. To illustrate the approach, a case study involving productions and supply chains of four petrochemical products—acetic acid, bisphenol-A, nylon-6,6, and polypropylene—is considered.

Similar content being viewed by others

1 Introduction

One main characteristic of our society today is mass consumption of fossil fuels to meet our growing demand for energy and petrochemical products. Indeed, petrochemical products have become an indispensable part of our life—from the food we eat, the water we drink, the clothes we wear, and the appliances we use for our convenience—that their use has become synonymous with modern living. The increasing importance of petrochemical products for our daily use has led to tremendous growth of the industry over the past decades. With a global market value of about U$515 billion, petrochemical industry currently serves as the building blocks of virtually all other high-end industries such as agriculture, electronics, automotive, and pharmaceuticals [33]. However, despite its contribution to the world economy, recent years have seen many challenges that threaten the future sustainability of the industry. And, these come on two fronts: raw material availability and environmental degradation.

As petrochemicals production is heavily reliant on non-renewable fossil fuel supplies (oil, coal, and natural gas), the industry is highly vulnerable to future disruptions caused by the depletion of these non-renewable resources. A recent study by British Petroleum in 2016 has highlighted that proven reserves for oil, gas, and coal would only last for another 51, 53, and 114 years, respectively [4]. While new reserves are still being discovered, along with new technologies (e.g., hydraulic fracturing technique) enabling access to fossil fuel deposits in unconventional places being advanced, our consumption of fossil fuels has also been increasing even sharply over the past few years. Ultimately, this will still drive a fuel price increase and hence will significantly affect the sustainability of the petrochemical industry in the coming future.

Another main concern of the petrochemical industry is the environmental implications of its manufacturing processes. Petrochemicals production emits large quantities of greenhouse gases (GHGs) that trap heat that comes from the sun. As more GHGs are released, more heat is trapped in the atmosphere causing an increase in the earth surface temperatures. Such phenomenon will have a range of catastrophic impacts on the earth’s climate in the long run from the melting of polar ice caps to rising sea levels and extreme weather events. In an effort to tackle the climate change impact, governments around the world have pledged their commitment—under the Paris agreement—to reduce their countries’ GHG emissions. Such commitment from the government in keeping with the country’s reduction targets will pose significant challenges to petrochemical companies in managing their emissions as regulations will be made more stringent in the coming years.

One economic instrument that has been adopted by governments of many developed countries to reduce their countries’ GHG emissions is carbon tax, which is a form of emission pricing mechanism. When implemented, such initiative, which involves putting a monetary value or penalty on the GHG emissions, can be expected to incentivize businesses, companies, and publics to reduce their emission footprint in various ways such as investing in clean technologies, improving the operational efficiency, or simply changing the consumption behaviors. Such a pivotal role of carbon pricing strategy for reducing the GHG emissions has been reflected with about 40 countries that are signatories of the Paris climate agreement already implementing it and another 100 countries planning to adopt it [37].

Overall, there are potentially two economic outcomes that may result from the carbon tax introduction to businesses. Companies may absorb the tax if the incurred extra cost is considered to be small or have no significant impact on their revenues or profits. On the other hand, the more common practice is that companies decide to pass on parts or even all of their emission costs to the buyers of their products in the form of higher selling prices. This is equivalent to Goods and Services Tax (GST) that is charged by businesses to their customers [29]. Such a tax passing strategy could lead to undesired outcome to the companies that impose it. As the adoption of carbon tax scheme has yet to take place at a global level, there is a high chance that companies that operate in countries that enforce the scheme will lose their profits or market shares to their competitors in other jurisdictions that are not covered by such scheme [9]. In the long run, this may lead to carbon leakage—a situation whereby companies just shift their operations to lower cost countries with more relaxed emission policies and continue to emit, thereby resulting in an increase in the total GHG emissions instead [21]. Such leakage will not only inflict damage to the environment, but also lead to job losses and reduced economic activity in the end.

Therefore, it is extremely important for governments (i.e., the policy makers) to take into account the potential economic consequences carefully prior to designing and implementing an effective carbon tax scheme. The availability of modeling tools that can assist the policy makers in providing insights into a range of issues that are relevant for getting the right carbon tax rate then becomes critical [38]. In this paper, we propose a unique approach for evaluating the economic implications caused by the introduction of carbon taxes to petrochemical industry. Here, we focus on the potential impact in the form of petrochemical selling prices. The rest of the paper proceeds as follows. In the next section, we present our literature reviews and highlight the current research gaps. Section 3 shows our mathematical equations for assessing the potential economic impact of a carbon tax. Subsequently, to illustrate our approach, we apply our model to a case study involving a hypothetical petrochemical manufacturing supply chain in Sect. 4. In Sect. 5, we discuss our results and end with concluding remarks in Sect. 6.

2 Modeling of carbon tax impacts

Recent years have witnessed several attempts on modeling the economic and environmental implications of carbon tax implementation. Traditionally, all these modeling approaches can grouped into top-down and bottom-up frameworks [38]. The former is generally preferred by the economists and involves estimating the market behavior in response to carbon tax imposition. A typical problem to address includes evaluation of the effects of different carbon tax rates on the country’s Gross Domestic Product (GDP) and employment rate. On the other hand, the latter approach is more commonly used by the engineers to identify the impacts of applying new technologies or practices that are potential for reducing the emissions. For instance, a bottom-up approach has been successfully applied to predict the likelihood of energy consumption profile in the commercial buildings sector in response to carbon tax imposition [6].

Different types of mathematical models have been proposed in the literature to support decision making with regard to carbon tax implementation. For example, [34] applied an input–output model to show the efficacy of carbon taxes for reducing the GHG emissions at the national level. Meanwhile, the use of computable general equilibrium (CGE) models has been proposed to investigate the impacts of carbon taxes on the GDP of various countries including Norway [7], Malaysia [2], Australia [32], and China [17]. All these studies concluded that imposition of carbon taxes while effective in reducing the countries’ GHG emissions can have a dire consequence on the economic activities—however, this is highly dependent on the imposed tax rates.

Several modeling tools have also been proposed to evaluate the potential loss of competitiveness due to carbon taxation. For example, [39] applied a gravity model to measure the impacts of carbon tax to energy-intensive industries such as oil, chemical, fertilizer, paper, cement, and steel in 21 OECD countries. His results showed negative impacts of carbon tax on the international competitiveness of those industries. Similarly, a simulation model was applied to assess the potential effects of carbon tax policies on the competitiveness of the mining and metals industry in countries that are members of the International Council on Mining and Metals [19]. The results highlighted the importance of electricity sector in ensuring the overall competitiveness of the power-intensive mining sector such as aluminum smelting and copper refining. An input–output analysis was also performed to evaluate the impacts of carbon taxes on the competitiveness of 106 industries across the UK [16]. The results showed that at a carbon tax rate of £20 per tonne, 94 industries would have their operating costs increase by less than one percent and 4 industries would see their costs increase by more than 5%.

Despite the important contribution of petrochemical industry to the country’s economy, our review on this subject revealed a limited work in examining the impacts of carbon taxes on this particular industry. To name a few, [25] applied a fuzzy programming approach and integrated it with gray prediction and input–output model to find an optimal carbon tax scenario for Taiwan’s petrochemical industry. Their results showed an improvement in the GHG emissions in the upstream petrochemical industries, while the downstream parts failed to achieve the desired reduction targets. In a separate study, using a fuzzy goal programming model, [26] evaluated the effects of combining a carbon tax policy with a cap-and-trade scheme. They concluded the benefits of such hybrid policy for maintaining the competitiveness of Taiwan’s petrochemical industry.

This paper aims to study the impending financial implications due to carbon tax imposition on the petrochemical industry. We propose a unique approach which differs from other methodologies in the existing literature in that we consider the economic impacts along the petrochemical value chain (supply chain). For this, we apply a bottom-up approach to establish a relationship between the amount of GHG emissions and the incurred emission taxes. Then, we estimate the required product price increase in order to retain the same production revenues; this will be done for each petrochemical company along the supply chain. We describe our approach in detail next.

3 Proposed model

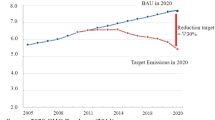

Carbon tax scheme offers a simple and yet cost-effective means of reducing the GHG emissions. Such scheme, which involves setting a fixed emission tax rate, has been claimed to be successful in not only lowering the emissions but also spurring the growth of clean technology developments in countries such as Sweden and Denmark [1]. A key determining success of the outcome of this scheme is the imposed tax rate [35]. When set too low, companies will be more likely to opt for paying the “penalty” and continue emitting their GHGs. On the other hand, too high, the company’s profit margin will be impaired and this will consequently affect its competitiveness in the global market. The latest data by [37] showed a range of carbon tax rates imposed by various countries. Today, Sweden has the highest carbon tax in the world at U$131 per tonne of GHG emissions. However, this rate does not apply to its energy-intensive industries such as petrochemicals, which are currently covered by European Union’s Emissions Trading System (EU ETS) [38]. Among the lowest carbon tax rate countries are Poland and Mexico with less than U$ 1 per tonne.

Consider Fig. 1, which shows a manufacturing supply chain of a petrochemical product Z. There are three plants (Plant X, Plant Y, and Plant Z) involved in the production chain of product Z. As each of the plants emits certain amount of GHGs, the carbon tax (CT) incurred by each plant P can be calculated as follows:

where G is the total number of GHG types emitted from the plant; \(\varPhi_{i}\). is the total amount of emissions of GHG type i; \({\text{GWP}}_{i}\) is the global warming potential value of that GHG type i; and \(T^{P}\) is the carbon tax rate applied to the GHG emissions from that plant. We have used GWP in the above equation to benchmark the global warming impacts of a unit of GHG type i to the same unit of carbon dioxide gas over a period of time (usually 100 years) [36]. In this case, the larger the GWP value of a given GHG, the more that gas will cause the warming impact on the earth surface. Table 1 highlights the GWP values of several important GHGs [22]. We have sourced the GHG emission data of each petrochemical plant of our case study and the environmental impact data for the GWP calculation from Ecoinvent database [12]. We have also utilized SCEnAT (Supply Chain Environmental Analysis Tool) developed by the University of Sheffield [24] to calculate the total GHG emissions from each petrochemical plant along the supply chain of our case study.

Let us consider a scenario where Plant X decides to increase the selling price of its product to compensate for the carbon tax cost. Consequently, the increased price of product x in combination with the carbon tax incurred by the downstream Plant Y may cause it to also increase the selling price of its product y to the next customer (Plant Z) and so on. Hence, as illustrated through this scenario, due to carbon tax imposition, we can expect a price increase that will reverberate throughout the petrochemical supply chain starting from the downstream refinery outputs all the way to the upstream petrochemical products until terminate at the end products. In this case, we envisage that the maximum price increase will be borne by the plants that produce the utmost end products along the production chain.

Let R be the revenue of a plant P, which can be defined as follows:

where L and M are total number of products and raw materials froe plant; \(f_{j}\) and \(f_{k}\) are the corresponding flows of product j and raw material k of the plant; and \(c_{j}\) and \(c_{k}\) are the selling price of product j and the cost of raw material k, respectively. With the introduction of carbon tax CT, a drop in the revenue of plant P per unit of product j can be calculated as follows:

Let \(c_{j}^{\text{New}}\) be the new selling price of product j that is required to maintain the same revenue from plant P prior to carbon tax implementation. Hence, the relationship between the new and old selling prices of product j can be described as:

Overall, Eqs. (1) to (4) form a basis over which a tandem increase of petrochemical prices can be estimated throughout the supply chain.

4 Case study: petrochemicals production supply chain

To validate our methodology, we applied it to a case study involving a petrochemical industry cluster that is modeled after the Jurong Island petrochemical complex in Singapore. As shown in Fig. 2, there are thirteen facilities (plants) belonging to thirteen companies that are involved in the manufacturing of the following products: acetic acid, bisphenol-A, nylon-6,6, and polypropylene. They are the building blocks for different high-end products including synthetic fibers and rubbers, solvents and paints, and plastics. Table 2 shows the production capacity of each of the production plants. A brief description of each product is given below.

4.1 Acetic acid

Acetic acid is an important industrial chemical that is used in the manufacture of plastic soft drink bottles, photographic films, and synthetic fibers and fabrics. It has also found application as an acidity regulator in the food industry [13]. The global market for acetic acid is expected to reach U$16 billion by 2024 [14]. On the whole, China currently accounts for more than 35% of the world’s total consumption of acetic acid and is expected to maintain its significance till 2024. The most commonly used technology for manufacturing acetic acid is based on a reaction between carbon monoxide (CO) and methanol [30]. This is the assumed technology in our case study where CO is supplied from the upstream syngas plant and methanol is imported from outside the petrochemical complex.

4.2 Bisphenol-A

Bisphenol-A (BPA) has been used since the 1950s in the manufacture of plastics and resins. BPA has been employed for toughening of plastic water bottles, and lining of water pipes and food and beverage cans [11]. However, the potential health impact due to overexposure to BPA in these applications has led to its ban in many countries. Nonetheless, the increasing use of BPA in the construction and automobile industries especially in the Asia Pacific region is expected to compensate for its growing demand in the coming years, reaching up to U$20 billion by 2020 [15]. Our petrochemical case study considers the production of BPA from acetone and phenol. Both of the chemicals are supplied by their respective upstream plants.

4.3 Nylon-6,6

Nylon-6,6 is a thermoplastic polymer that is commonly used in textile, carpet, and apparel production due to its excellent mechanical properties such as resistance to crushing, heat, and friction, as well as stain penetration [20]. The global market for nylon 6,6 (together with nylon 6) was estimated to be U$ 24.44 billion in 2016 and is expected to grow by about 6% over the next 10 years [10]. The conventional synthesis route to nylon 6,6 involves a reaction between adipic acid and hexamethylenediamine (HMD) by condensation polymerization [23]. This is the scenario considered in this case study, where adipic acid is supplied by a neighboring plant and HMD is delivered from outside the complex.

4.4 Polypropylene

Polypropylene (PP) is a thermoplastic polymer that can be easily manufactured through polymerization of propylene. Polypropylene’s characteristics—tough and resistant to many chemical solvents, bases and acids—has made it suitable for replacing traditional materials such as glass, wood, and metal that are used in a wide variety of applications including consumer products container, food packaging, wire insulation, construction materials, automotive components, and many others [3]. The global production of PP was reported to be 56 million tons (U$105 billion in market value) in 2016 and is expected to rise to 76 million tons (U$151 billion) by 2022 [8]. This case study considers the production of PP using propylene that is derived from the thermal cracking of naphtha feedstock supplied from a nearby refinery. We consider that both the cracker and polymerization plants are operated by different company.

Data pertaining to the input–output materials and GHG emissions for the thirteen manufacturing plants are set as given in Table 3. This information has been retrieved from [5, 12, 27]. Table 4 shows the price information for each petrochemical in this case study. Such information has been collected and, in some cases, approximated from various sources in the Internet.

5 Results and discussion

Table 5 displays the total direct GHG emissions from each petrochemical plant—such emissions constitute manufacturing process emissions and fuel combustion emissions from utilities generation. As can be observed from the table, the highest GHG emissions per unit of product belong to adipic acid production plant followed by nylon plant. On the other hand, cyclohexanol plant exhibits the lowest emissions per unit of product.

Table 6 compares the economic consequences from implementing two different carbon tax rates: U$10 and U$20 per tonne of GHGs. These are the commonly applied rates in many countries. For example, in Singapore, while the carbon tax is currently set at U$3.6 per tonne, it will be increased to more than U$10 by 2030 [28]. We applied this projected carbon tax rate in our case study. As shown in the table, higher carbon taxes indeed result in greater revenue losses for the plant. In this case, the percentage of losses for nylon, polypropylene, and adipic acid plants is found to be significantly higher than the rest. Table 7 highlights the effects of different carbon tax rates on the prices of petrochemicals—this is the new selling prices needed to retain the same revenues prior to carbon tax implementation in each plant. As can be seen in the table, a small increase in the price of acetic acid at a rate of U$0.3 per tonne of product is necessary in order to compensate for each dollar of incurred carbon tax rate. On the other hand, larger price increment is needed for PP, BPA, and nylon-6,6 at rates of U$6, U$7, and U$21/tonne per dollar of carbon tax, respectively. To put these numbers into perspective, let us consider the PP product of raffia granule specification. The spot prices for this type of PP in the European market have been reported to range between €1280 and €1290/tonne in January 2017 [18]. In this case, a four percent product price increase of U$60/tonne (€56/tonne based on the January 2017 currency exchange rate) for each U$10 per tonne of GHG emissions is considered quite high and may put the producer of this product out of the European market.

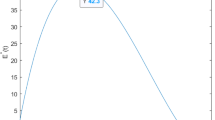

Figure 3 plots the linear correlation between the carbon tax rates and the product selling prices. The figure implies that as the carbon tax rate increases, the product selling prices need to increase in tandem to compensate for the loss of revenues. Such a negative economic effect of carbon taxes is consistent with the findings reported in the literature such as those of [16]. This information, as depicted in the figure, is certainly valuable for the policy makers since it can be used as a point of reference for setting the base tax rate and also adjusting the future rate so as to minimize the negative economic impacts on the petrochemical industry [38].

As can be seen in Fig. 3, the plots also imply that the effects of carbon taxes are product-specific. This is due to the fact that the GHG emissions from petrochemical plants are indeed product-specific—they are highly dependent upon the chemistry of the manufacturing process. Such a strong relationship between the process manufacturing chemistry and the GHG emissions thus highlights one relevant question for the policy makers to consider when designing a carbon tax scheme: is a flat carbon tax rate that is chargeable to all petrochemical facilities (plants) that operate within the same jurisdiction a fair scheme to implement? This is an important question that requires an in-depth analysis by the policy makers. For some plants, in order to reduce the carbon emissions, various environmental measures including improved manufacturing process and energy efficiency through technology upgradation such as electrification in utilities (e.g., electric boilers that run on renewable energy) can be considered. However, such option may require substantial capital investment that needs to be traded off with the amount of tax savings that can be gained. Such study is beyond the scope of this paper.

For other plants, due to the use of mature technologies on their sites, there may not be many options that can be taken to minimize the negative economic implications of carbon tax. For such plants, the only available alternative for reducing their emissions is through carbon capture—a technology that has been frequently cited as the most cost-effective solution to reduce the GHG emissions. However, the cost of carbon capture—without the storage option—by the most leading technologies today has been reported to be around U$60 per tonne of carbon [31]. This is still way above the carbon tax rate that is currently put in place even in many developed countries. This situation thus points out the important role of government supports in the form of subsidies or tax breaks to incentivize companies to invest in clean and cost-effective technologies to reduce the GHG emissions. Such supports can be provided through the collected carbon tax revenue, which can be used to fund the broad R&D effort that focuses on emissions mitigation and also development of low-carbon technologies such as renewable energy and bio-based resources and products.

6 Conclusions

The need to tackle the climate change impact has pressurized governments around the world to seek new approaches to reduce their countries’ GHG emissions. This includes implementing a carbon tax scheme as part of the strategies to cut the emissions and at the same time promote investments and developments of low-carbon technologies. However, adoption of such taxes has caused major concerns to many emissions-intensive industries such as petrochemical manufacturing plants since it can substantially increase their overhead costs. One potential scenario that can arise as a result of carbon tax imposition is that companies may decide to pass on partial or even all of their emission costs to the buyers of their products in the form of increased price. Such a tax passing strategy can lead to negative consequence on the product competitiveness in the global market. This paper proposes a bottom-up modeling framework to study the impending economic impacts and implications caused by the adoption of such tax passing strategy. First, we outline the structure of the petrochemical product value chain of our interest. Next, we estimate the amount of GHG emissions along this manufacturing chain, from the refinery outputs and downstream to the end petrochemical products. Then, we examine the effects of applying different carbon tax rates on the production revenues and assess these impacts by projecting the required price increase for retaining the same production revenues prior to carbon tax imposition.

To validate the approach, we applied our framework to a case study involving four petrochemical products: acetic acid, bisphenol-A, nylon-6,6, and polypropylene. Our results show that an increase in the carbon tax rates will have negative repercussions on the revenues. In this case, a substantial increase in the petrochemical products, ranging from U$0.3 to U$21 per tonne of product, is needed to compensate for each dollar of carbon tax.

Overall, we recognize the limitations of our modeling approach. First, our model could not account for market factors such as fluctuations in the product supply and demand and other external factors such as the global rise and fall of oil prices that could render big corrections in the product prices. Further, our model could not consider the effects of carbon border adjustments for imported products from the carbon tax-free regions. They could be instrumental for averting the issues of loss of product competitiveness though. All these factors are truly challenging to account for using our bottom-up approach; it requires a new approach that integrates our bottom-up model with an economic-based top-down framework. However, despite the limitation of our model, our findings do confirm the potential economic consequences that can arise due to carbon tax adoption. Such a negative economic implication needs to be factored in by the policy makers when designing a carbon tax scheme to meet the desired environmental objectives. Hence, our future work could extend the current framework by considering the abovementioned factors including the impact of global energy prices and the roles of government subsidies and tax cuts in the model so as to capture the interactions between the carbon taxes and the price increase in a more comprehensive manner.

References

Aden N (2016) The roads to decoupling: 21 countries are reducing carbon emissions while growing GDP. http://www.wri.org/blog/2016/04/roads-decoupling-21-countries-are-reducing-carbon-emissions-while-growing-gdp. Accessed 31 May 2019

Al-Amin SC, Hamid A (2009) Computable general equilibrium techniques for carbon tax modeling. Am J Environ Sci 5(3):330–340

Brennan E (2017) PVC, polypropylene and polyethylene: how plastics are used in the home. https://turbofuture.com/industrial/PVC-Polypropylene-and-Polyethylene-How-Plastics-are-Used-in-the-Home. Accessed 31 May 2019

British Petroleum (2016) BP statistical review of world energy 2016. http://oilproduction.net/files/especial-BP/bp-statistical-review-of-world-energy-2016-full-report.pdf. Accessed 31 May 2019

Brown HL, Hamel BB, Hedman BA (1996) Energy analysis of 108 industrial processes. Prentice-Hall, Lilburn

Brown MA, Cox M, Sun X (2012) Modeling the impact of a carbon tax on the commercial buildings sector. In: Proceedings of the American Council for an energy efficient economy (ACEEE) summer study on energy efficiency in building 8.27-8.39

Bruvoll A, Larsen BM (2004) Greenhouse gas emissions in Norway: do carbon taxes work? Energy Policy 32(4):493–505

Business Wire (2017) Global polypropylene (PP) market to reach $151 billion by 2022: growth in automotive and construction sectors in emerging countries to drive growth—research and markets. http://www.businesswire.com/news/home/20170411005588/en/. Accessed 31 May 2019

Carbon Pricing Leadership Coalition (2016) What is the impact of carbon pricing on competitiveness? http://pubdocs.worldbank.org/en/759561467228928508/CPLC-Competitiveness-print2.pdf. Accessed 31 May 2019

CCFGroup (2017) Nylon 66 chip market still with large downward space. http://www.ccfgroup.com/newscenter/newsview.php?Class_ID=D00000&Info_ID=20170629092. Accessed 31 May 2019

Cooper JE, Kendig EL, Belcher SM (2011) Assessment of bisphenol A released from reusable plastic, aluminum and stainless steel water bottles. Chemosphere 85(6):943–947

Ecoinvent (2017) The Ecoinvent database. Ecoinvent, Zurich

European Food Information Council (2004) Acidity regulators: the multi-task players. http://www.eufic.org/en/whats-in-food/article/acidity-regulators-the-multi-task-players. Accessed 31 May 2019

Global Market Insights (2017) Acetic acid market to surpass $16bn by 2024. https://www.gminsights.com/pressrelease/acetic-acid-market. Accessed 31 May 2019

Grand View Research (2015) Global bisphenol A (BPA) market by application (appliances, automotive, consumer, construction, electrical & electronics) expected to reach USD 20.03 billion by 2020. http://www.grandviewresearch.com/press-release/global-bisphenol-a-bpa-market. Accessed 31 May 2019

Grover D, Shreedhar G, Zenghelis D (2016) The competitiveness impact of a UK carbon price: What do the data say? http://eprints.lse.ac.uk/65622/1/Grover-et al-policy-paper-January-2016.pdf. Accessed 31 May 2019

Guo Z, Zhang X, Zheng Y, Rao R (2014) Exploring the impacts of a carbon tax on the Chinese economy using a CGE model with a detailed disaggregation of energy sectors. Energy Econ 45:455–462

ICIS (2017) Polypropylene Europe. https://www.icis.com/chemicals/polypropylene/. Accessed 31 May 2019

ICMM (2013) The cost of carbon pricing: competitiveness implications for the mining and metals industry. https://www.icmm.com/en-gb/publications/climate-change/the-cost-of-carbon-pricing-competitiveness-implications-for-the-mining-and-metals-industry. Accessed 31 May 2019

Invista (2014) The difference between type 6,6 and type 6 nylon. https://www.antron.jp/wp/wp-content/themes/antron/pdf/en/K02957_Technical_Bulletin_Difference_btw_N6_and_N66.pdf. Accessed 31 May 2019

IPCC (2007) Climate change 2007: mitigation of climate change. Cambridge University Press, Cambridge

IPCC (2007) Climate change 2007: the physical science basis. Cambridge University Press, Cambridge

Jacobson DW (2017) An industrial process for the production of nylon 66 through the step-growth reaction of adipic acid and hexamethylenediamine. http://scholarworks.uark.edu/cgi/viewcontent.cgi?article=1107&context=cheguht. Accessed 31 May 2019

Koh SL, Genovese A, Acquaye AA, Barratt P, Rana N, Kuylenstierna J, Gibbs D (2013) Decarbonising product supply chains: design and development of an integrated evidence-based decision support system–the supply chain environmental analysis tool (SCEnAT). Int J Prod Res 51(7):2092–2109

Lee CF, Lin SJ, Lewis C, Chang YF (2007) Effects of carbon taxes on different industries by fuzzy goal programming: a case study of the petrochemical-related industries, Taiwan. Energy Policy 35(8):4051–4058

Lee CF, Lin SJ, Lewis C (2008) Analysis of the impacts of combining carbon taxation and emission trading on different industry sectors. Energy Policy 36(2):722–729

Meyers RA (2005) Handbook of petrochemicals production processes. McGraw-Hill, New York

National Environment Agency (2019) Carbon tax. https://www.nea.gov.sg/our-services/climate-change-energy-efficiency/climate-change/carbon-tax. Accessed 08 Sept 2019

NSW Business Chamber (2011) Carbon pricing key issues for industry. http://www.businesschamber.com.au/NSWBC/media/Misc/Lobbying/Analysis/Carbon-pricing-Jun-2011.pdf. Accessed 31 May 2019

Qian Q, Zhang J, Cui M, Han B (2016) Synthesis of acetic acid via methanol carboxylation with CO2 and H2. Nat Commun 7(11481):1–7

Quartz (2017) Two Indian engineers have solved one of the biggest hurdles in the fight to make lower carbon-emissions targets a reality. https://qz.com/878674/two-indian-engineers-have-drastically-reduced-the-cost-of-capturing-carbon-dioxide-emissions/. Accessed 31 May 2019

Siriwardana M, Meng S, McNeill J (2011) The impact of a carbon tax on the Australian economy: results from a CGE model. https://pdfs.semanticscholar.org/f28a/6cf13d12614440040c5b6897e66c78332b6f.pdf. Accessed 31 May 2019

Statista (2018) Market value of petrochemicals worldwide in 2014 and 2022 (in billion U.S. dollars). https://www.statista.com/statistics/696921/petrochemical-market-value-worldwide/. Accessed 31 May 2019

Tamura H, Abe M, Tomiyama S, Hatono I (1998) Evaluating the effectiveness of carbon tax for total emission control of carbon dioxide: systems analysis of a dynamic environmental-economic model. IFAC Proc 31(20):581–586

Tascini L, Dietz S, Hicks N (2013) Carbon tax v cap-and-trade: Which is better? https://www.theguardian.com/environment/2013/jan/31/carbon-tax-cap-and-trade. Accessed 31 May 2019

US Environmental Protection Agency (2017) Understanding global warming potentials. https://www.epa.gov/ghgemissions/understanding-global-warming-potentials. Accessed 31 May 2019

World Bank (2016) State and trends of carbon pricing. http://documents.worldbank.org/curated/en/598811476464765822/State-and-trends-of-carbon-pricing. Accessed 31 May 2019

World Bank (2017) Carbon tax guide: a handbook for policy makers. Synthesis: carbon tax in brief. https://openknowledge.worldbank.org/bitstream/handle/10986/26300/Carbon%20Tax%20Guide%20-%20Appendix%20web%20FINAL.pdf?sequence=7&isAllowed=y. Accessed 31 May 2019

Zhao YH (2011) The study of effect of carbon tax on the international competitiveness of energy-intensive industries: an empirical analysis of OECD 21 countries, 1992–2008. Energy Procedia 5:1291–1302

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that there is no conflict of interest regarding the publication of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Halim, I., Miah, J.H., Khoo, H.H. et al. Evaluating the potential impacts of carbon tax cost passing strategy on petrochemical selling prices. SN Appl. Sci. 1, 1490 (2019). https://doi.org/10.1007/s42452-019-1553-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s42452-019-1553-6