Abstract

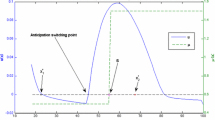

Statistical properties of order-driven double-auction markets with Bid–Ask spread are investigated through the dynamical quantities such as response function. We first attempt to utilize the so-called Madhavan–Richardson–Roomans model (MRR for short) to simulate the stochastic process of the price-change in empirical data sets (say, EUR/JPY or USD/JPY exchange rates) in which the Bid–Ask spread fluctuates in time. We find that the MRR theory apparently fails to simulate so much as the qualitative behaviour (‘non-monotonic’ behaviour) of the response function R(l) (l denotes the difference of times at which the response function is evaluated) calculated from the data. Especially, we confirm that the stochastic nature of the Bid–Ask spread causes apparent deviations from a linear relationship between the R(l) and the auto-correlation function C(l), namely, \({R(l) \propto -C(l)}\). To make the microscopic model of double-auction markets having stochastic Bid–Ask spread, we use the minority game with a finite market history length and find numerically that appropriate extension of the game shows quite similar behaviour of the response function to the empirical evidence. We also reveal that the minority game modeling with the adaptive (‘annealed’) look-up table reproduces the non-linear relationship \({R(l) \propto -f(C(l))}\) (f(x) stands for a non-linear function leading to ‘λ-shapes’) more effectively than the fixed (‘quenched’) look-up table does.

Similar content being viewed by others

References

Arthur WB (1994) Inductive reasoning and bounded rationarity (The El Farol problem). Am Econ Rev 84: 488–500

Bouchaud J-P, Potters M (2000) Theory of financial risk and derivative pricing. Cambridge University Press, Cambridge

Bouchaud J-P, Kockelkoren J, Potters M (2006) Relation between bid–ask spread, impact and volatility in order-driven markets. Quant Finance 6: 115–123

Challet D, Zhang Y-C (1997) Emergence of cooperation and organization in an evolutionary game. Physica A 246: 407–418

Challet D, Marsili M, Zhang Y-C (2005) Minority games. Oxford University Press, Oxford

Coolen ACC (2005) The mathematical theory of minority games: statistical mechanics of interacting agents. Oxford University Press, Oxford

Elliott RJ, Ekkehard K (2004) Mathematics of financial markets. Springer, New York

Inoue J, Sazuka N (2007) Crossover between Levy and Gaussian regimes in first-passage processes. Phys Rev E 76: 021111

Inoue J, Sazuka N (2010) Queueing theoretical analysis of foreign currency exchange rates. Quant Finance 10: 121–130

Inoue J, Sazuka N, Scalas E (2010) On-line trading as a renewal process: waiting time and inspection paradox. Sci Cult 76(9–10): 466–470

Inoue J, Hino H, Sazuka N, Scalas E (in preparation)

Madhavan A, Richerdson M, Roomans M (1997) Why do security prices change? A transaction-level analysis of NYSE stocks. Rev Finan Stud 10(4): 1035–1064

Mezard M, Parisi G, Virasoro MA (1987) Spin glass theory and beyond. World Scientific, Singapore

Montero M, Masoliver J (2007) Mean exit time and survival probability within the CTRW formalism. Eur J Phys B 57: 181

O’hara M (1995) Market microstructure theory. Blackwell, Cambridge

Ponzi A, Lillo F, Mantegna RN (2009) Market reaction to a bid–ask spread change: a power-law relaxation dynamics. Phys Rev E 80: 016112

Redner S (2001) A guide to first-passage processes. Cambridge University Press, Cambridge

Sazuka N (2007) On the gap between an empirical distribution and an exponential distribution of waiting times for price changes in a financial market. Physica A 376: 500–506

Sazuka N, Inoue J (2007a) Fluctuations in time intervals of financial data from the view point of the Gini index. Physica A 383: 49–53

Sazuka N, Inoue J (2007b) In: Fogel D (ed) Proceedings of the IEEE symposium series on computational intelligence (FOCI2007), pp 416–423

Sazuka N, Inoue J, Scalas E (2009) The distribution of first-passage times and durations in FOREX and future markets. Physica A 388: 2839–2853

Scalas E (2007) Mixture of compound Poisson processes as models of tick-by-tick financial data. Chaos Soliton Fractals 34: 33

Scalas E, Gorenflo R, Luckock H, Mainardi F, Mantelli M, Raberto M (2004) Anomalous waiting time in high-frequency financial data. Quant Finance 4: 695

Scalas E, Kaizoji T, Kirchler M, Huber J, Tedeschi A (2006) Waiting times between orders and trades in double-auction markets. Physica A 366: 463

van Kappen NG (1992) Stochastic processes in physics and chemistry. North Holland, Amsterdam

Vikram SV, Sinha S (2010) Emergence of universal scaling in financial markets from mean-field dynamics. Phys Rev E 83: 016101

Wyart M, Bouchaud J-P, Kockelkoren J, Potters M, Vettorazzo M (2008) Relation between bid–ask spread, impact and volatility in double auction markets. Quant Finance 8: 41–57

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ibuki, T., Inoue, Ji. Response of double-auction markets to instantaneous Selling–Buying signals with stochastic Bid–Ask spread. J Econ Interact Coord 6, 93–120 (2011). https://doi.org/10.1007/s11403-011-0078-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11403-011-0078-x