Abstract

While supply elasticity can explain why housing prices appreciate by different amounts across cities, it may play a lesser role in smaller geographic units, such as neighbourhoods within a city. This is because of location substitution: a city cannot be easily substituted by another city, but neighbourhoods of the same city can be close substitutes. This paper revisits the question of whether supply elasticity can differentiate housing price appreciation rates within a city by carefully accounting for substitution effects at the neighbourhood level. From a Hong Kong housing boom (2003—2018), we have found that the impact of supply elasticity on another neighbourhood on average is about one-tenth of the impact on its own neighbourhood. It rejects the notion of perfect substitution, under which this magnitude difference should not have been identified. The contribution of this paper is threefold: 1) It clarifies the theoretical relationship between supply elasticity and substitution in shaping housing price movements. 2) It proposes two novel ways to account for neighbourhoods’ substitution using the spatial spillover of land availability and price co-movement. 3) It delivers a clear answer that supply elasticity can shape the housing price movements within a city.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Real estate prices go up and down in cycles. For markets sharing similar economic fundamentals, their prices tend to move in the same direction, but not necessarily by the same amount. It is known as the heterogeneity of price movements. Such heterogeneity is widely documented not only across cities but also within a city (Bogin et al., 2019; Genesove & Han, 2013; Guerrieri et al., 2013; Landvoigt et al., 2015; Liu et al., 2016; Monkkonen et al., 2012; Ohnishi et al., 2020; Waltl, 2019; Zhu et al., 2019).

Why do housing prices within a city move differently? The classical answer lies in the Alonso–Mills–Muth models (Alonso, 1964; Mills, 1967; Muth, 1969), in which the spatial equilibrium of prices adjusts for changes in transportation costs and technologies. Other theoretical explanations include endogenous gentrification (Guerrieri et al., 2013) and cheap credit for low-income households (Landvoigt et al., 2015). These studies assume that supply elasticity is either perfect or the same across neighbourhoods. However, if this assumption is valid, Liu et al. (2016) suggest that developers would continue to build in locations with higher price appreciation until the appreciation is equalised within the city. This contradiction raises the question of whether variations in supply elasticity are needed to explain the within-city heterogeneous housing price movements.

One issue with the study at the within-city level is the substitutability among alternative locations. From basic economics, we know that the prices of substitutes are positively correlated. If the price of A increases, the demand for A will be displaced by its substitute B, which will then push up the price of B. In contrast to supply elasticity, which drives heterogeneity of price movements, substitution among locations leads to price co-movement. Although cities cannot be easily substituted by each other, neighbourhoods of the same city are highly substitutable, especially within commuting distances. Thus, given the strong neighbourhood substitution, it is unclear in the literature whether supply elasticity can vary the price movements across neighbourhoods of the same city.

Without any rigorous tests, the literature has only casually related the outcomes of supply elasticity to how similar or unique the locations are within the study region. For example, supply elasticity is found to shape price patterns in England and the Bay Area, where geographical and economic profiles are well-diversified (Hilber & Vermeulen, 2016; Kok et al., 2014); however, it is claimed to be irrelevant to the price heterogeneity in the Greater Boston Area because jurisdictions there are many and similar (Glaeser & Ward, 2009). This paper argues that the price effect of supply elasticity and substitution is not just an empirical matter. Three theoretical predictions are clarified in this paper: 1) The negative effect of supply elasticity on housing price appreciation in the self-neighbourhood (the direct effect) does not depend on substitution conditions. 2) The effect of supply elasticity on housing prices of neighbouring locations (the spillover effect) is non-positive, and it grows with locations’ substitutability. 3) More importantly, this paper points out for the first time in the literature that the magnitude difference between the direct and spillover effects of supply elasticity contributes to the heterogeneous price movements within the city.

After the theory clarification, we have overcome two empirical challenges. If the substitution among neighbourhoods has made the impact of supply elasticity controversial, controlling the neighbourhoods’ substitution in empirical models is crucial. The first empirical challenge is how to measure and control substitution—existing studies control substitution by including multiple property attributes and neighbourhood characteristics in the regressions (Bogin et al., 2019; Glaeser & Ward, 2009; Kok et al., 2014). If more demand-side factors are included, similarities across locations are better controlled. In addition to this tradition, this paper proposes two novel methods using the spatial spillover of land availability and price co-movement. Intuitively, the land availability spillover exists only if substitution exists (no such spillover if neighbourhoods are not substitutable at all), and higher substitutability should lead to stronger price co-movement. Hong Kong was chosen for this study because of its compact city scale and developed facilities for within-city commuting, which make its neighbourhood substitution even stronger (more interesting to be studied) than other cities.

Apart from controlling substitution, another empirical challenge is a lack of quantification of supply elasticity determinants at the neighbourhood level (Baum-Snow & Han, 2020; Gyourko, 2009). In this paper, we used neighbourhoods’ initial share of government land reserves for future residential developments (Government Land Share, “GovLS” thereafter) as the neighbourhood supply elasticity proxy to study the heterogeneous price appreciation within Hong Kong. It is a proxy of supply elasticity because the GovLS can depict the developable land availability of neighbourhoods, the higher of which can foster new housing construction easier during the market boom. We don’t aim to find a general proxy for neighbourhood supply elasticity in this paper, but GovLS fits the institutions of Hong Kong and possibly a few Asian cities where the governments have dominant power in land supply.

Using data from 56 neighbourhoods of Hong Kong, we have found that supply elasticity has lowered the price appreciation of the self-neighbourhoods (the direct effect), and the magnitude is about tenfold its impact in a substitutable neighbourhood on average (the adjusted indirect effect). If neighbourhoods were perfect substitutes, supply elasticity would have lowered the housing price appreciation of all locations by the same amount (equally negative impacts in self-neighbourhoods and other locations). As supply elasticity has been found to lower the price appreciation in a self-neighbourhood deeper than in another neighbourhood on average, we conclude that supply elasticity has shaped the heterogeneous housing price movements in Hong Kong, and perfect neighbourhood substitution should be rejected.

The rest of the paper is organised as follows: Sect. 2 deduces the three hypotheses of supply elasticity under the coexistence of substitution; Sect. 3 introduces the three approaches to controlling the location substitution; Sect. 4 shows how the neighbourhoods and variables are defined and measured; Sect. 5 provides empirical results for discussion; Sect. 6 concludes.

Theories and Implications

Supply elasticity and substitution are competing to shape housing price movements. While supply elasticity suggests that locations of elastic supply shall have less price appreciation during a housing boom (Saiz, 2010), substitution can counteract and eliminate the difference in price appreciation. As the substitution effect is marginal across MSAs or cities, the negative effect of supply elasticity on housing price appreciation is apparent (Glaeser et al., 2008; Saiz, 2010). However, when substitution becomes nontrivial, such as across locations within one city, it is unclear about the impacts of supply elasticity on housing prices. This section clarifies the predictions of supply elasticity on housing prices using three scenarios of neighbourhoods’ substitution: perfect substitution, perfect segregation (no substitution), and the reality in between. Hypotheses are introduced at the end of this section.

Perfect Substitution

The intercity urban models consider substitution as a tradeoff between rent, amenities, and wages (Roback, 1982; Rosen, 1979). Very often, this tradeoff has been reduced to two dimensions for within-city studies: given homogenous households, the advantage of living in a better location in a city is always compensated by a higher rent in the spatial equilibrium (Glaeser, 2008). We have noted that intraurban wages may not be constant, as shown by the literature that commuting costs have been capitalised into both rent and wages, and that central jobs are likely to offer wage premiums to compensate for longer commuting distance (Eberts, 1981; McMillen & Singell, 1992; Timothy & Wheaton, 2001). However, for simplicity, this paper assumes wages are not related to the location choices of firms and households but are identical in the same city (Glaeser, 2008).

Without loss of generality, it can be illustrated with the simplest version of the monocentric city model. Given the homogenous households, the utility obtained from locations is only related to locations, not to households. Assume the net utility of living d units of distance to the city’s CBD is \(U\left(d\right)=A\left(d\right)-r\left(d\right)\), where the \(A\left(d\right)\) and \(r\left(d\right)\) are the amenities enjoyable and rent payable for living in the location. At the spatial equilibrium, living closer to or farther away from the city centre gives the same net utility to all households, which implies \({U}^{^{\prime}}\left(d\right)\)=0. Households cannot be better or worse off by changing where to live. This indifference implies perfect substitution. It is easy to see that the marginal enjoyment of living anywhere equals the marginal cost, \({r}^{^{\prime}}\left(d\right)={A}^{^{\prime}}(d)\). Thus, the relative rent changes equal the relative amenity changes, and it is true for all locations in the city.Footnote 1

When neighbourhoods are perfectly substitutable, the housing prices of all neighbourhoods will rise by the same amount in a city-wide market boom, regardless of locations’ variations in supply elasticity. As shown in the next paragraph, this perfect price co-movement does not require the impact of supply elasticity to be null/zero under the perfect substitution, but the direct and spillover impacts of supply elasticity should be equally negative on housing price changes.

Without loss of generality, let's assume location A is elastic in housing supply with plenty of developable land, whereas location B is inelastic in housing supply with no developable land. A city-wide shock boosts the demand for housing in both locations. If the spillover effect of supply elasticity were not in the picture, location A would have lower price appreciation than location B; however, it is impossible because they are perfect substitutions and should have perfect price co-movement. We argue that the spillover effect of supply elasticity can be one channel to eliminate this heterogeneity in the price appreciation if the developable land in location A affects the housing price rises in locations A and B by the same amount. In other words, if the direct effect and the spillover effect of developable land availability are equally negative to housing price appreciation, locations of perfect substitution can have perfect price co-movement, regardless of their difference in supply elasticity.

Perfect Segregation

When households are no longer homogeneous but have heterogeneous preferences towards locations, perfect substitution becomes unlikely (Hilber & Vermeulen, 2016). Given heterogeneous households, the net utility gained from living in any location becomes personal and needs to be indexed by households i: \({U}_{id}= \mathrm{A}\left(\mathrm{d}\right)-\mathrm{r}(\mathrm{d}) +\upvarepsilon (\mathrm{id})\), where the location preference is household-specific and is denoted as \(\upvarepsilon (\mathrm{id})\). Like in the last section, \(\mathrm{A}\left(\mathrm{d}\right)\mathrm{ and r}(\mathrm{d})\) represent the amenities and the market rent for any location at d units of distance away from the city centre. Households can maximise their \({U}_{id}\) by moving to locations with their highest \(\upvarepsilon (\mathrm{id})\) value. If two locations have the same \(\upvarepsilon (\mathrm{id})\), namely \(\upvarepsilon \left({\mathrm{id}}_{1}\right)=\upvarepsilon ({\mathrm{id}}_{2})\), they are perfect substitutions for household i but not for all households. If households can be better off living at certain locations and worse off elsewhere, locations are not perfect substitutions.Footnote 2

When substitution is not perfect, a city is then segmented into a few submarkets. In general, submarkets are both interrelated and segregated to some extent. When the segregation is extreme, submarkets can be nearly unrelated to each other but have their independent demand and supply equilibrium. Under this perfect segregation, the substitution among submarkets can be neglectable, and the supply elasticity can only determine the local price appreciation but will have no impact on other submarkets. In other words, given a market boom, how much the housing price appreciation will be determined only by their local supply elasticity, not by others.

Using the example of locations A and B in the last section, we can see how the impacts are different under the opposite scenario of substitution. After a city-wide boom, the developable land in location A shall lower the price appreciations in location A. In other words, the direct effect of supply elasticity is negative. However, as the two locations are perfectly segregated with no interrelation, the spillover effect of location A's developable land is zero towards location B's housing prices, and location B will have higher housing price appreciations than A due to a lack of developable land in location B. It is in analogy to the impact of supply elasticity across MSAs when the direct effect of supply elasticity on housing prices is negative, but the spillover effect of supply elasticity is marginal.

The Reality

The above discussion has shown: 1) Under perfect substitution, supply elasticity lowers the price appreciation in the self-neighbourhood and other neighbourhoods by the same amount. In other words, the direct and spillover effects of supply elasticity are equally negative. 2) Under perfect segregation, supply elasticity only lowers the price appreciation in the self-neighbourhood but has no impact on other neighbourhoods. Equivalently speaking, the direct effect of supply elasticity is negative, but the spillover effect is zero. However, in reality, neighbourhoods in the same city are neither perfectly substitutable nor perfectly segregated but are all substitutable to some extent. Then, how should the predictions of supply elasticity vary according to the degree of substitution?

Bounded by the two extreme scenarios, the predictions under the realistic scenario should fall between (but not include) the predictions of perfect substitution and perfect segregation: supply elasticity’s direct effect on housing prices should be negative in the self-neighbourhood, and its spillover effect should fall somewhere between zero (the prediction under perfect segregation) and as negative as in self-neighbourhood (the prediction under perfect substitution). Within this range, the magnitude of the spillover effect depends on the substitution level: 1) When the substitutability decreases, supply elasticity’s spillover effect will approach zero. 2) Given increases in the substitutability, the spillover effect will increase but cannot match with the direct effect in the self-neighbourhood. As shown later in empirical models, we take advantage of this positive correlation to control the level of substitution by the strength of the spillover effect of supply elasticity. The predictions under the three scenarios are summarised in Table 1.

Hypotheses

Based on the discussion of the three scenarios, hypotheses are proposed to include all possibilities. As shown in Table 1, the direct effect of supply elasticity (column 2) on housing prices is negative for all scenarios. As our prediction about the direct effect of supply elasticity is unconditional negative (not subject to substitution conditions), we challenge previous studies’ conclusions of perfect substitutions after they failed to identify the negative direct effect of supply elasticity on housing prices (Bogin et al., 2019; Glaeser & Ward, 2009). Here, we want to emphasise that the direct effect of supply elasticity on housing prices is unconditionally negative, even when locations are perfect substitutes.

-

Hypothesis 1: During a city-wide market boom, the supply elasticity (e.g., developable land availability) of a neighbourhood will lower the housing price appreciation of the self-neighbourhood (the direct effect is negative), regardless of the substitution conditions, ceteris paribus.

On one hand, the direct effect of supply elasticity does not change according to substitution conditions; on the other hand, as our earlier discussion has shown, the spillover effect of supply elasticity does depend on substitution conditions. For example, it is zero under perfect segregation and is equally negative to the direct effect of supply elasticity under perfect substitution. In a real-life city, supply elasticity’s spillover effect on housing prices should be negative but smaller in magnitude (less negative) than the direct effect. Thus, here we have two more hypotheses. One is about the spillover effect of supply elasticity, and the other predicts the magnitude difference between supply elasticity’s direct effect in the self-neighbourhood and the spillover effect in another neighbourhood.

-

Hypothesis 2: During a city-wide market boom, the supply elasticity (e.g., developable land availability) of one location should have non-positive effects on the housing price appreciation in another neighbourhood on average (the spillover effect is non-positive), ceteris paribus.

-

Hypothesis 3: During a city-wide market boom, the direct effect of supply elasticity on housing price appreciation should be more negative (larger in magnitude) or at least equally negative compared to its spillover effect to another neighbourhood on average, ceteris paribus.

We want to emphasise that Hypothesis 3 is the key to answering the research question. If this magnitude gap between supply elasticity’s direct effect on the self-neighbourhood and spillover effect on another neighbourhood is significant, then we can reject the notion of perfect substitution and conclude that neighbourhood supply elasticity can vary housing price appreciation within the city given a city-wide market boom. It should be clear by now that we need to test this magnitude gap (Hypothesis 3) rather than the direct effect alone to answer the research question. Meanwhile, it should also be emphasised that identifying the negative direct effect (Hypothesis 1) and the non-positive spillover effect of supply elasticity (Hypothesis 2) are also important because their results justify our empirical methods, which lead to the conclusion.

Empirical Models

Since the debate on the within-city effect of supply elasticity on housing price changes stems from neighbourhoods’ substitution, it is essential to control the substitution in empirical models. Here, we have designed three tests which are distinguished by how the substitution is controlled: 1) the traditional way of adding multiple control variables from the demand side, 2) using the land availability spillover in the spatially lagged independent variable model (SLX), and 3) using the price co-movement in the Spatial Durbin Model (SDM).

Test 1

The aim is to test whether the cross-sectional differences in housing price appreciation can be explained by the cross-sectional differences in supply elasticity. The traditional method relies on cross-sectional regressions, where the supply elasticity is captured by its determinants, and where substitution is modelled by adding multiple control variables (Glaeser et al., 2008; Huang & Tang, 2012). Given our sample of a 15-year boom and the five-year frequency of the census data (control variables), it is possible to construct a panel dataset with three periods and five years per period. This non-spatial panel model Eq. (1) is in the same spirit as the traditional cross-sectional models.

The dependent variable is the accumulated price appreciation every five years across the 56 neighbourhoods. Neighbourhood supply elasticity is captured by the time-invariant proxy GovLS (the initial government land share). Neighbourhoods’ substitution is controlled by multiple variables in X, such as the lagged median household income in the natural log, lagged population density in the natural log, lagged population share with a bachelor’s degree in percentage points, and lagged share of non-Chinese population in percentage points. We have adopted a two-year time lag in these control variables: the 5-year price appreciation (the outcome variable) begins in mid-2003, mid-2008, and mid-2013, while the demographic variables (control variables) are from census surveys in the year 2001, 2006, and 2011.

Test 2

As shown in the theory discussion, the spillover of supply elasticity increases with locations’ substitutability: there is no such spillover under perfect segregation; this spillover can grow to be as negative as the direct effect of supply elasticity under perfect substitution. Motivated by this, we have used the land availability spillover to partly control the substitution among neighbourhoods. It is “partly” because the substitution will be additionally controlled by the housing price co-movement in our Test 3. The spatially lagged independent variable model (SLX) is suitable for this purpose and is also suggested to be the first model for examining spatial spillovers (Halleck Vega & Elhorst, 2015).

The SLX model, as shown in Eq. (2), adds the \(WGovLS\) into the baseline model of Test 1. Other control variables in X are the same as in Test 1. The \(WGovLS\) is constructed by multiplying the GovLS with a matrix W. The W is a square matrix with zero elements on the principal diagonal (\({w}_{ii})\) and non-negative otherwise (\({w}_{ij}, where i\ne j\)). The element \({w}_{ij}\) records the normalised strength of substitution between any pair of locations of i and j. The \(WGovLS\) is the weighted average of GovLS of substitutable locations. Higher weights (\({w}_{ij}\)) are assigned for close substitutes to reflect the stronger spillover of GovLS. For an illustration, assuming there are three neighbourhoods, the \(WGovLS\) in Eq. (3) is the developable land availability of the other two locations weighted by their level of substitutability \({w}_{ij}\).

In general, locations nearby share more amenities and demographics and are more likely to be more substitutable than locations far away. Thus, spatial matrices can be the approximation of the substitution matrix. Multiple matrices are used for the robustness of the regression results, including two global matrices of inverse squared distance matrix (W1) and negative exponential matrix (W2) and two local matrices of the nearest four neighbours matrix (W3) and the nearest eight neighbours matrix (W4).

In the global matrices W1 and W2, any two locations in the city are substitutable, and their substitutability decreases according to distance functions. On the contrary, the local matrices W3 and W4 regard substitution only among a few closest neighbours. Using global or local matrices in SLX allows us to see the contrast between the spillovers within a small sub-region (using W3 and W4) and the spillovers across the whole city (W1 and W2). We use spectral normalisation for all matrices as it keeps the matrix symmetric: how substitutable is the location i to j should be the same as the substitutability between j and i.

Test 3

Another way to control substitution is to add price co-movement into empirical models. It is very intuitive as stronger substitution leads to stronger price co-movement. The price co-movement is captured by spatially lagged price movements (WY), which are other locations’ price movements weighted by their level of substitutability. More weights are assigned to the pairs of close substitutes. As shown by a simple illustration of three neighbourhoods in Eq. (4), the price co-movement driven by substitution level wij (not coincidently by noises) is amplified in the WY by the assigned weights, which are normalised substitution strength between any two locations i and j.

Although the Spatial Durbin Model (SDM) is not the only model to include the price co-movements WY, it is preferred due to its generality (LeSage & Pace, 2009). For example, any independent variable's direct-to-indirect effect ratio can be estimated explicitly in SDM. In contrast, Spatial Autoregressive Model (SAR) forces the ratio equal for all variables (Elhorst, 2010). The SDM model can capture the spatial autocorrelation in the error term to some extent, which is not the case in the SAR model (LeSage & Pace, 2009). Even if the coefficient of the WY can be identified in SAR, it is unclear whether it is caused by WY or by the omission of any variables in WX (Halleck Vega & Elhorst, 2015). Last but not least, we want to include both the price co-movement (WY) and land availability spillover (\(WGovLS\)) to be comprehensive in Test 3.

As shown in Eq. (5), the SDM panel model includes the spatial lags of the dependent and all independent variables, including \(WGovLS\) and \(WX\). The price appreciation (Y) is then explained by the price co-movement (WY), supply elasticity proxy (GovLS), the weighted average of GovLS of substitutable neighbourhoods (WGovLS), control variables (X), and weighted average of control variables from substitutes (WX). The ρ is expected to be positive as the housing prices of substitutable neighbourhoods should move in the same direction.

We suggest that the SDM model can be a natural fit to study the “heterogeneity” of housing price movements. If the price movements can be decomposed into components of homogeneity and heterogeneity, once the homogeneity part (price co-movement) is controlled, then the heterogeneity of the movements (the research focus) can be tested by explanatory variables, such as GovLS. As illustrated in Eq. (6) and Eq. (7) with three locations, after the co-movement (WY) is moved from the right to the left of the equation, the heterogeneity in price movements is isolated on the left-hand side of Eq. (7) and can be tested by variables on the right-hand side.

Like in Test 2, we have used multiple spatial matrices for robustness checks. However, the spillover of housing prices is more likely to ripple to the whole city. Thus, global matrices, namely the inverse squared distance matrix (W1) and the negative exponential matrix (W2), are more appropriate for constructing the housing price spillovers (WY). Since the SDM allows different matrices for the spatially lagged dependent variable (WY) and spatially lagged independent variables (WX), we used both global and local matrices in \(WGovLS\) and WX. In the end, there are six models corresponding to the six columns in Table 6: Models 1–3 have had W1 in the WY and used W1, W3, and W4 in \(WGovLS\) and WX; similarly, Models 4–6 have applied W2 for the global price co-movement and W2, W3, and W4 for capturing explanatory variables’ spillovers, such as the land availability spillover.

Data and Measurement

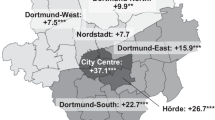

We tested the hypotheses using housing transaction data from Hong Kong between mid-2003 and mid-2018, a 15-year housing market boom (Fig. 1). In the following sections, we will give details about data and variable measurements, including the proxy for neighbourhood supply elasticity.

Neighbourhoods and Price Appreciation

First of all, how should we decide which neighbourhood boundaries to use? In the housing literature, pre-defined administrative zones like census tracts or ZIP codes are common (Bogin et al., 2019; Peng & Thibodeau, 2013, 2017). Alternatively, various statistical techniques are available based on the clustering patterns of housing attributes, implied values of housing attributes, or implied location values (Bhattacharjee et al., 2016; Clapp & Wang, 2006; Goodman & Thibodeau, 1998, 2007; Tu et al., 2007).

In this paper, we used the pre-defined neighbourhood boundaries of ERPC.Footnote 3 Being the primary housing data provider in Hong Kong, EPRC classified residential buildings into 60 neighbourhoods in the 1990s. The number of neighbourhoods is appropriate for this study. If the number is too large, it can be impossible to conduct repeat sales price indices for each location; if it is too small, the sample size may not be sufficient for regression analysis. Another reason for choosing the pre-defined boundaries is to avoid manipulating boundaries which may affect the empirical results and conclusion.

Quarterly repeat sales price indices were constructed using the EPRC transaction records from 1995Q1 to 2018Q2. It is longer than the study period due to the well-known instability of the repeat sale coefficients of early periods. After some neighbourhoods with few transactions were merged with their adjacency, 56 (out of 60) neighbourhoods remain. While the overall housing price rose by 436% in Hong Kong during the 15 years, the range was from 339 to 774% among the 56 neighbourhoods. This within-city heterogeneous housing price appreciation is not unique in Hong Kong but has been documented worldwide (Bogin et al., 2019; Guerrieri et al., 2012, 2013; Landvoigt et al., 2015; Waltl, 2019; Zhu et al., 2019).

Supply Elasticity of Neighbourhoods

As this study is at the within-city level, we need the variations in supply elasticity at the neighbourhood level, which has been an empirical challenge in the housing literature (Baum-Snow & Han, 2020; Gyourko, 2009). As Saiz (2010) has shown that the developable land share is the determinant of supply elasticity, this paper has used the initial government land share (GovLS) as the proxy for neighbourhood supply elasticity in Hong Kong. GovLS is the percentage of the initial government land reserves for future residential developments out of the total land areas of the neighbourhoods. Below, we provide background information on why government land reserves can represent developable land in Hong Kong.

Although the land supply in Hong Kong is dominated by government land sales, acquisition from the private market is also common. However, we argue that the land supplied from the government's land reserves can be converted into new housing supplies much more easily than land supplied by private owners due to the development control in Hong Kong. Hong Kong has adopted a dual development control system: one is the zoning control by Statutory Town Plan, and the other is through the terms and conditions specified in the land lease (Lai et al., 2017).

A land lease is a contract that grants land from the government (the lessor) to the land purchaser (the lessee), specifying the development restrictions, such as land uses, maximum floor areas, height restrictions, etc. When land is granted by the government via land auction or tender, the development restrictions on the lease are in line with the zoning plan at the time of the land sale. Thus, the land can be developed quickly because there is no conflict between the land lease and the Statutory Town Plan. On the contrary, if the land is currently held by private owners, the land was usually granted by the government decades ago; thus, the development restrictions on the lease are usually out of date and may have discrepancies with the current Statutory Town Plan. Before the land can be redeveloped into housing, lease modification or land exchange is inevitable.

Lease modification happens if the old lease needs to change or remove certain clauses; when a major modification is necessary, such as merging a few adjacent lots, it is called land exchange. Both lease modification and land exchange involve two steps: 1) issue the “basic terms” of a new lease, and 2) issue the land premium payable (land value gained due to the modification/exchange, which is the assessed land value difference before and after the modification/exchange). The applicants can negotiate and appeal in both stages for better terms and premiums payable, but it can prolong the development by a few years (Nissim, 2011). Everything equal, land supplied through the private market is more difficult (or takes longer) to respond to the market boom than the land supplied from the government land reserves. Thus, locations with higher GovLS initially are more supply elastic in response to the housing demand shocks later.

The government land reserves, the numerator of the GovLS ratio, were consolidated from three datasets. The first is a land survey of the government-owned land with residential zoning in mid-2012.Footnote 4 The second is a list of government reserves with intentions of residential zoning (currently without residential zoning).Footnote 5 The last one is the reduction in the reserves between mid-2000 and mid-2012.Footnote 6 Figure 2 shows that these reserves lie along the edge of the developed areas of Hong Kong to utilise the established infrastructure. It is good to see that the reserves are spread out across the city with no apparent geographical clustering in any region. Regarding social clustering, as shown in Table 2, GovLS has a low and insignificant correlation with household income level, population density, and the distance to the city’s CBD. These characteristics of GovLS are important to test whether GovLS as the proxy of neighbourhood supply elasticity (not as an indicator for demand-side factors) can explain the heterogeneous housing price appreciation across neighbourhoods.

The Distribution of the Government Land Reserves for Residential Developments in the year 2000. Note: Author’s presentation. Data are from the Development Bureau of HKSAR, the Planning Department of HKSAR, and the Lands Department of HKSAR. It visualises the government land reserves where the land areas are explicitly known (e.g., published in the annual reports). As the reserves from the land survey were digitalised from a pdf map by image classification techniques (accounting for less than 20% of the total government land reserves), they cannot be visualized proportionally with the reserves from other data sources. Thus, they are not shown in the figure above

Apart from the evidence from geographical (Fig. 2) and social (Table 2) distributions, the endogeneity of GovLS is less of a concern because GovLS measured the government reserves in the year 2000 has at least three years of time lag to the outcome variables of housing price changes between the year 2003 and 2018. Moreover, the government should have the least incentive to know which parts of the city would have higher price appreciation in the later market boom to accumulate more reserves in advance. Given the above reasons, the GovLS is reasonably exogenous in our empirical models. We don’t claim this GovLS as the best or a general proxy for neighbourhood supply elasticity of all cities, but it works for the empirical context of Hong Kong and possibly a few Asian cities sharing similar institutions. The focus of this paper is not on the perfection of the proxy of neighbourhood supply elasticity but on answering the research question using a reasonably valid proxy.

Other Controls

Following the literature, we have included neighbourhood income level, population density, education level, and ethnic composition as the control variables with time lags (Ferreira & Gyourko, 2012; Glaeser & Ward, 2009; Guerrieri et al., 2012). Data are from census surveys in the years 2001, 2006, and 2011 and have been aggregated into our 56 neighbourhoods.Footnote 7 We also include a dummy variable for new MTR (subways) stations. It is one if new stations were announced by the government gazette and zero otherwise. During the study period, there were five new MTR lines gazetted, and these new stations were geocoded to neighbourhoods.Footnote 8 The neighbourhood’s distance to the city’s CBD is also included as it may impact the relative differences in housing price appreciation across neighbourhoods (Baum-Snow & Han, 2020).

Summary of Statistics

As we have a long study period, it can be cut into a few sub-periods to construct a panel dataset (Elhorst et al., 2010; Islam, 1995). We have adopted a five-year window (3 periods × 5 years per period) because the census data were available every five years. The outcome variable is housing price appreciation in every five years: 2003–2008, 2008–2013, and 2013–2018. Apart from the MTR dummy, other explanatory variables all have time lags with the outcome variable. For example, GovLS was measured in the year 2000, and demographic control variables were taken from the census surveys two years before each period of housing price changes.

Table 3 summarises the data. The GovLS is the neighbourhood supply elasticity proxy. It is the initial government land reserves for future residential developments divided by the total area of the neighbourhoods. In line with the literature, GovLS is a time-invariant proxy representing the general cross-sectional difference in the supply conditions across locations (Cohen & Zabel, 2020). Likewise, the substitution matrix approximated by spatial matrices is also time-invariant as a general substitutable relationship among neighbourhoods. The CBDdist is the Euclidean distance between the neighbourhoods’ centroids to the city’s CBD in kilometres. PriceReturn, the outcome variable, is the accumulated housing price appreciation (derived from repeat sales price indices) every five years in percentage points. The Medincome is the households’ monthly median income in thousands of HK dollars. PopDensity represents thousands of heads per hectare. In the empirical test, both are in the natural log. Bachelor and NonChineses are the population percentages with a bachelor’s degree or of non-Chinese, respectively. The MTR is the dummy variable of new MTR stations.

Empirical Results

Before we turn to the results of the three tests, we would like to provide additional justification for our neighbourhood supply elasticity proxy. If GovLS is measuring supply elasticity (not some latent demand-side factors), it shall have a negative correlation with price appreciation and a positive correlation with the new construction (Glaeser & Ward, 2009; Glaeser et al., 2008). Therefore, we have run preliminary regressions with cross-sectional data, and the results are shown in Table 4.

The first two columns show that the housing price appreciation is lowered by 13.92 to 15.54 percentage points in the 15 years given one percentage point more of GovLS. The last two columns show that the permitted housing construction is 64.6% to 80.5% higher in the 15 years where locations have one percentage point more of GovLS. Having obtained the expected results of GovLS on housing prices (significantly negative) and new construction (significantly positive), we are ready to move on.

The following sections correspond to the three tests using three different approaches to control substitution effects: firstly, by adding multiple demand-side variables; secondly, by adding land availability spillover; and thirdly, by adding price co-movement. As a preview, the results support our hypotheses.

Result 1

The results of Test 1 are reported in columns 1–2 of Table 5. Our variable of interest, the proxy of supply elasticity (GovLS), has significant and negative signs in both models. As discussed in the theory section, the direct effect of supply elasticity on housing price appreciation is unconditionally negative, no matter how strong the substitution among neighbourhoods is. Even under perfect substitution, negative direct effects of supply elasticity should be identified (Table 1, row 1). For the multivariate model (column 2), although the control variables are not significant individually, they are jointly significant at a level of 10%. The results of joint hypotheses tests are shown in the last two rows of Table 5.

The significant and negative coefficients of GovLS challenge the conclusions of earlier studies using similar models, which argued for perfect substitution after they had failed to obtain significant and negative coefficients from their supply elasticity proxies (Bogin et al., 2019; Glaeser & Ward, 2009). The insignificance of the direct effect of supply elasticity found in the two earlier studies may be caused by the limitation of their supply elasticity proxies. While Bogin et al.(2019) applied the MSA and city-level proxies of supply elasticity to their neighbourhood price pattern study, Glaeser and Ward (2009) used the building regulations of municipalities (without using instruments), which can be endogenous with the housing prices. Next, we turn to the results of Tests 2 and 3 which allow additional methods of controlling substitution in the models.

Result 2

Recall that neighbourhoods’ substitution can be controlled by the land availability spillover, which should be substantial among locations of close substitutes and marginal otherwise. It is achieved by the WGovLS term in the SLX model. The direct effect and the indirect effect of land availability are the estimated coefficients of GovLS and WGovLS in Table 5 (columns 3–6). Similar to our results in Test 1, supply elasticity’s direct effects are all significantly negative (columns 3–6), as suggested in Hypothesis 1. The indirect effects are all negative but are significant only when local matrices are adopted (columns 3–4) and insignificant in global spillovers (columns 5–6). It is not surprising because the spillover should be easier to identify within a few closest neighbours (columns 3–4) than across the whole city on average (columns 5–6). Nevertheless, the spillovers of supply elasticity are found to be non-positive, as suggested in Hypothesis 2. Control variables are jointly significant at 5% (last two rows).

It is noted that the indirect effects of supply elasticity (coefficients of WGovLS) have greater magnitudes than the direct effects (coefficients of GovLS). It is because the indirect effects defined by LeSage and Pace (2009) and calculated by statistical packages are the cumulative values (the sum of indirect effects from all neighbouring locations). “The indirect effect is cumulated from the perspective of society-at-large, these could in fact be larger than the direct effect” (LeSage & Dominguez, 2012, p. 540). Thus, the magnitude of indirect effects cannot be simply compared with direct effects. However, to test Hypothesis 3, we need to compare the magnitude of the impact of supply elasticity in a self-neighbourhood and in another neighbourhood on average. Thus, we have introduced the “adjusted indirect effect”, which has the same one-to-one interpretation as the direct effect. The adjusted indirect effect is one innovation of this paper. Please refer to Appendix 1 for details.

The WGovLS/Neighbours in Table 5 is the adjusted indirect effect of supply elasticity. It is the indirect effect (coefficients of WGovLS) divided by the number of neighbours in the models, which is four in Model 3 using the matrix of the nearest four neighbours (W3), eight in Model 4 using the nearest eight neighbours matrix (W4), and 55 in Models 5 and 6 with global matrices W1 and W2 (the total 56 neighbourhoods in the sample minus one representing the self-neighbourhood). Since the rescaling affects the coefficients and standard errors in the same way, the adjusted indirect effect inherits the significance from the indirect effect.

The Difference is the magnitude gap between the direct effect (coefficients of GovLS) and the adjusted indirect effect (coefficients of WGovLS/Neighbours) in Table 5 and is tested by Wald tests. The Difference is negative for all models but is insignificant when the spillovers are averaged among the nearest four or eight neighbours (columns 3–4). It is reasonable because supply elasticity may not significantly differentiate the housing price movements of the closest neighbours, which may be (nearly) perfect substitutes. The Difference is significant and negative in columns 5–6, where the spillovers are averaged from all other neighbourhoods in the city. As our research question is about the impact of supply elasticity within a city, not within a city's subarea, the results from global spillovers (columns 5–6) are more relevant. As the direct effects of supply elasticity have shown greater impacts on prices in a self-neighbourhood than in another neighbourhood of the same city on average (negative and significant coefficients of the Difference in columns 5–6), Hypothesis 3 is supported. In other words, the perfect substitution among neighbourhoods in Hong Kong is rejected on average. Next, we will discuss the results when the substitution effect is additionally controlled by the price co-movement in Test 3.

Result 3

This section continues the discussion by adding the price co-movement as an additional control for the substitution. The \(\rho\) in Eq. (5), the coefficient of WY in the SDM model, is a scalar parameter for this price co-movement. As expected, the \(\rho\) is significantly positive in all models in Table 6. Unlike the SLX model, it is well known that the coefficients of SDM cannot be interpreted as marginal effects. Following the spatial econometrics literature, we reported the post-estimation effects of GovLS (not the coefficients) in Table 6 using the MCMC method of LeSage and Pace (2009).

As suggested by Hypothesis 1, supply elasticity should have negative effects on price appreciation in self-neighbourhoods, regardless of substitution conditions. In Table 6, the Direct Effects of supply elasticity are all significantly negative. One percentage point increase in the GovLS will lower the same neighbourhood’s housing price appreciation by 3.39 to 5.07 percentage points every five years. It should be emphasised again that the negative direct effect alone cannot answer whether supply elasticity has lowered the relative price appreciation across neighbourhoods if its magnitude is not compared with the magnitude of the adjusted indirect effect.

The Indirect Effects in Table 6 are significantly negative in all models, as suggested by Hypotheses 2. Like in the SLX model, the Indirect Effects here are also accumulated spillovers from all neighbouring locations, and their magnitude can be greater than Direct Effects. Given the global spillover domain of SDM, all locations are connected as neighbours, and the number of neighbouring locations is 55 in our sample model (for details, please refer to Appendix 2). Thus, the Adjusted Indirect Effects here are obtained by dividing the Indirect Effects by 55. Using the one-to-one interpretation of the adjusted indirect effects, we can say that one percentage point more in GovLS will lower the price appreciation of another location on average by 0.19 and 0.46 percentage points every five years. Comparing the estimates of the Adjusted Indirect and the Direct Effects in Table 6, we find that the magnitude of the former is about one-tenth of the latter.

Hypothesis 3 relates to the research question most closely: whether supply elasticity can lower the housing price appreciation in a self-neighbourhood more than in another neighbourhood on average, which may explain the heterogeneity in housing price movements in a city-wide boom. In Table 6, the Difference (the magnitude gap between the Direct Effect and the Adjusted Indirect Effect) serves this purpose and is found to be significantly negative for all models. As we have discussed, such gaps should not be identified if the spillover domain includes only a few nearest neighbourhoods where (nearly) perfect substitutes are possible (columns 3–4 in Table 5). However, as the SDM studies the average spillover across all neighbourhoods of the city, perfect substitution becomes unlikely, and such gaps have been identified (the significantly negative Difference) as expected. The Difference suggests that, given one more percentage point of GovLS in one neighbourhood, the neighbourhood’s housing price appreciation shall be lowered deeper than another neighbourhood on average by 3.05 to 4.6 percentage points every five years. As real estate often accounts for the largest portion of households’ assets, this difference is not trivial, not to mention the compounding effect over the years.

Identifying the negative Difference (Hypothesis 3), the more substantial impacts of supply elasticity on housing price appreciation in a self-neighbourhood than in another neighbourhood on average, is the evidence to reject the notion of perfect substitution within a city. Therefore, we conclude that supply elasticity can explain the within-city heterogeneity of housing price movements, and perfect substitution is unlikely across neighbourhoods in a city on average. Nevertheless, it shall be emphasised that the expected results of direct and indirect effects of supply elasticity (Hypotheses 1–2) are also important. They justify our empirical methods, although they alone are insufficient to answer the research question.

Conclusion

The topic of within-city housing price movements has become increasingly popular in recent years (Bogin et al., 2019; Cohen & Zabel, 2020; Fischer et al., 2021; Waltl, 2019; Zhu et al., 2019). While supply elasticity has been found as the main driver for intercity differences in housing price appreciation, the conclusion should not be generalised automatically to neighbourhoods without empirical evidence (Gyourko, 2009). Indeed, mixed results have been documented in the literature (Bogin et al., 2019; Genesove & Han, 2013). This paper has revisited the question of whether supply elasticity can explain the differences in housing price appreciation across a city’s neighbourhoods in a city-wide boom by paying special attention to controlling the substitution effect.

First of all, this paper has theoretically clarified supply elasticity’s impacts on housing price appreciation given different conditions of neighbourhood substitution: 1) The direct effect of supply elasticity on housing prices should be negative, regardless of the substitution conditions. 2) The spillover effect of supply elasticity should be non-positive, and the magnitude increases with the degree of substitutability among locations. 3) Except for the case of (nearly) perfect substitution, the direct effect of supply elasticity should be more negative than its spillover effect on another neighbourhood on average. The three hypotheses together provide a comprehensive understanding of how supply elasticity, substitution, and their interaction affect the housing price co-movement and heterogeneous price appreciation in a city.

Secondly, this paper proposes two novel ways of controlling neighbourhood substitution empirically: one uses the land availability spillover, and the other adopts price co-movement to quantify the level of substitution among neighbourhoods. It is achieved by calibrating the spatially lagged supply elasticity (WGovLS) and spatially lagged price movements (WY) into empirical models. Additionally, we have shown that the SDM might be the appropriate model to study topics relating to heterogeneous movements of prices: after the price co-movement is controlled by the WY in the SDM, the price heterogeneity can be explicitly tested by other explanatory variables. Our results are robust with various spatial matrices.

Last but not least, this paper has provided a clear answer to the debate in the literature. The variations in neighbourhood supply elasticity can explain the within-city heterogeneity of price movements in a city-wide housing market boom, and perfect substitution across neighbourhoods in a city is unlikely on average. It is evidenced by the significant magnitude gap between the supply elasticity’s impact on a self-neighbourhood and another neighbourhood on average (Hypothesis 3). Meanwhile, all other expected results from the direct and spillover effects of supply elasticity (Hypotheses 1–2) and the strong price co-movement among neighbourhoods have justified our empirical methods, including the model selections and variable measurements, which are essential for a convicting conclusion.

Data Availability

Licensed and public data were used; no new data were created in this study.

Notes

Even if location preference is allowed, as long as households are homogeneous with the same preference, substitution can still be perfect. The net utility can be written as \(U\left(d\right)=A\left(d\right)-r\left(d\right)+\varepsilon (d)\), where the \(\varepsilon (d)\) represents all households’ agreed preference value for locations with d units of distance to the city centre. In equilibrium, the marginal rent is explained by the marginal amenity and marginal preference living in a certain location: \(r\mathrm{^{\prime}}\left(d\right)=A\mathrm{^{\prime}}\left(d\right)+\varepsilon \mathrm{^{\prime}}(d)\). In this case, the marginal preference is like an intangible amenity.

Besides preference, households’ heterogeneity in affordability can also make perfect substitution unlikely. Households with financial constraints cannot gain utility from unaffordable locations. In this case, the \(U_{id}\) does not exist because the rent is beyond the households’ affordability. Clearly, for any household, affordable and unaffordable locations are not substitutable.

EPRC district boundaries can be viewed at their website http://www.eprc.com.hk/DistrictBoundary/. As the original boundaries of EPRC contain some ocean areas, which should be eliminated, they are intersected with the land boundary of Hong Kong using ArcGIS. The overlapping areas are kept as refined boundaries.

This one-time survey was published as map “Unleased and Unallocated Government Land Zoned' Residential' or 'Commercial/Residential' (after deducting the types of land which are considered not suitable for development, not yet available for development or with low development potential)” by the Development Bureau of Hong Kong.

This type of land has been identified and published by the Planning Department of Hong Kong.

This step is to date back the government land reserves to initial value (the value before the study period from mid-2003). Data for this timing adjustment are the land granted by the Lands Department of Hong Kong and MTR Corporation (MTRC). As the MTRC’s annual reports are not available before the year 2000, we ended up with the GovLS measurement in mid-2000. To the best of the authors’ knowledge, there was few (if any) reclamation projects to increase the government land reserves for residential land between mid-2000 and mid-2012.

Census surveys were conducted in around 200 Tertiary Planning Units (TPU), the census tracks of Hong Kong. The TPU data were aggregated into the 56 neighbourhoods by weighted average using the overlapping areas of the two boundaries as the weight. Because the size of each TPU is geographically small (around 1/200 of the size of Hong Kong), it is reasonable to assume that demographical features are uniformly distributed within each TPU.

Director of Government Logistics of HKSAR, 2000, 2007, 2009, and 2010.

As the spillovers are zero for non-substitutable pairs in equation (A1), the number of non-substitutable pairs should be excluded from the denominator for the average calculation.

References

Alonso, W. (1964). Location and Land use: Toward a general Theory of Land Rent. Cambridge University Press.

Baum-Snow, N., & Han, L. (2020). The microgeography of housing supply. University of Toronto.

Bhattacharjee, A., Castro, E., Maiti, T., & Marques, J. (2016). Endogenous Spatial Regression and Delineation of Submarkets: A New Framework with Application to Housing Markets. Journal of Applied Econometrics, 31(1), 32–57. https://doi.org/10.1002/jae.2478

Bogin, A., Doerner, W., & Larson, W. (2019). Local House Price Dynamics: New Indices and Stylized Facts. Real Estate Economics, 47(2), 365–398. https://doi.org/10.1111/1540-6229.12233

Clapp, J. M., & Wang, Y. (2006). Defining neighborhood boundaries: Are census tracts obsolete? Journal of Urban Economics, 59(2), 259–284.

Cohen, J. P., & Zabel, J. (2020). Local House Price Diffusion. Real Estate Economics, 48(3), 710–734. https://doi.org/10.1111/1540-6229.12241

Eberts, R. W. (1981). An empirical investigation of intraurban wage gradients. Journal of Urban Economics, 10(1), 50–60. https://doi.org/10.1016/0094-1190(81)90022-X

Elhorst, J. P. (2010). Applied Spatial Econometrics: Raising the Bar. Spatial Economic Analysis, 5(1), 9–28. https://doi.org/10.1080/17421770903541772

Elhorst, J. P., Piras, G., & Arbia, G. (2010). Growth and Convergence in a Multiregional Model with Space-Time Dynamics. Geographical Analysis, 42(3), 338–355. https://doi.org/10.1111/j.1538-4632.2010.00796.x

Ferreira, F., & Gyourko, J. (2012). Heterogeneity in neighborhood-level price growth in the united states, 1993–2009. American Economic Review, 102(3), 134–140.

Fischer, M., Fuss, R., & Stehle, S. (2021). Local house price comovements. Real Estate Economics, 49, 169–198. https://doi.org/10.1111/1540-6229.12331

Genesove, D., & Han, L. (2013). A spatial look at housing boom and bust cycles In E. Glaeser & T. Sinai (Eds.), Housing and The Financial Crisis. University of Chicago Press.

Glaeser, E. (2008). Cities, agglomeration, and spatial equilibrium. Oxford University Press.

Glaeser, E., Gyourko, J., & Saiz, A. (2008). Housing supply and housing bubbles. Journal of Urban Economics, 64(2), 198–217. https://doi.org/10.1016/j.jue.2008.07.007

Glaeser, E., & Ward, B. A. (2009). The causes and consequences of land use regulation: Evidence from Greater Boston. Journal of Urban Economics, 65(3), 265–278. https://doi.org/10.1016/j.jue.2008.06.003

Golgher, A. B., & Voss, P. R. (2016). How to Interpret the Coefficients of Spatial Models: Spillovers. Direct and Indirect Effects. Spatial Demography, 4(3), 175–205. https://doi.org/10.1007/s40980-015-0016-y

Goodman, A. C., & Thibodeau, T. G. (1998). Housing market segmentation. Journal of Housing Economics, 7(2), 121–143.

Goodman, A. C., & Thibodeau, T. G. (2007). The spatial proximity of metropolitan area housing submarkets. Real Estate Economics, 35(2), 209–232.

Guerrieri, V., Hartley, D., & Hurst, E. (2012). Within-City Variation in Urban Decline: The Case of Detroit. American Economic Review, 102(3), 120–126. https://doi.org/10.1257/aer.102.3.120

Guerrieri, V., Hartley, D., & Hurst, E. (2013). Endogenous gentrification and housing price dynamics. Journal of Public Economics, 100, 45–60. https://doi.org/10.1016/j.jpubeco.2013.02.001

Gyourko, J. (2009). Housing Supply. Annual Review of Economics, 1(1), 295–318. https://doi.org/10.1146/annurev.economics.050708.142907

Halleck Vega, S., & Elhorst, J. P. (2015). THE SLX MODEL. Journal of Regional Science, 55(3), 339–363. https://doi.org/10.1111/jors.12188

Hilber, C. A. L., & Vermeulen, W. (2016). The Impact of Supply Constraints on House Prices in England. The Economic Journal, 126(591), 358–405. https://doi.org/10.1111/ecoj.12213

Huang, H., & Tang, Y. (2012). Residential land use regulation and the US housing price cycle between 2000 and 2009. Journal of Urban Economics, 71(1), 93–99. https://doi.org/10.1016/j.jue.2011.08.001

Islam, N. (1995). Growth Empirics: A Panel Data Approach. The Quarterly Journal of Economics, 110(4), 1127–1170. https://doi.org/10.2307/2946651

Kok, N., Monkkonen, P., & Quigley, J. M. (2014). Land use regulations and the value of land and housing: An intra-metropolitan analysis. Journal of Urban Economics, 81, 136–148.

Lai, L. W.-c., Ho, D. C.-w., & Leung, H.-f. (2017). Change in use of land : a practical guide to development in Hong Kong (Third edition. ed.). Hong Kong University Press.

Landvoigt, T., Piazzesi, M., & Schneider, M. (2015). The Housing Market(s) of San Diego. American Economic Review, 105(4), 1371–1407. https://doi.org/10.1257/aer.20111662

LeSage, J., & Dominguez, M. (2012). The importance of modeling spatial spillovers in public choice analysis. Public Choice, 150(3–4), 525–545. https://doi.org/10.1007/s11127-010-9714-6

LeSage, J., & Pace, R. K. (2009). Introduction to Spatial Econometrics. CRC Press.

Liu, C. H., Nowak, A., & Rosenthal, S. S. (2016). Housing price bubbles, new supply, and within-city dynamics. Journal of Urban Economics, 96, 55–72.

McMillen, D. P., & Singell, L. D. (1992). Work location, residence location, and the intraurban wage gradient. Journal of Urban Economics, 32(2), 195–213. https://doi.org/10.1016/0094-1190(92)90005-6

Mills, E. S. (1967). An aggregative model of resource allocation in a metropolitan area. The American Economic Review, 57(2), 197–210.

Monkkonen, P., Wong, K., & Begley, J. (2012). Economic restructuring, urban growth, and short-term trading: The spatial dynamics of the Hong Kong housing market, 1992–2008. Regional Science and Urban Economics, 42(3), 396–406. https://doi.org/10.1016/j.regsciurbeco.2011.11.004

Muth, R. F. (1969). Cities and Housing. University of Chicago Press.

Nissim, R. (2011). Land Administration and Practice in Hong Kong (3rd ed.). Hong Kong University Press.

Ohnishi, T., Mizuno, T., & Watanabe, T. (2020). House price dispersion in boom-bust cycles: Evidence from Tokyo. Japanese Economic Review, 71(4), 511–539. https://doi.org/10.1007/s42973-019-00019-6

Peng, L., & Thibodeau, T. (2013). Risk segmentation of american homes: Evidence from denver. Real Estate Economics, 41(3), 569–599.

Peng, L., & Thibodeau, T. G. (2017). Idiosyncratic risk of house prices: Evidence from 26 million home sales. Real Estate Economics, 45(2), 340–375.

Roback, J. (1982). Wages, rents, and the quality of life. Journal of Political Economy, 90(6), 1257–1278.

Rosen, S. (1979). Wage-based indexes of urban quality of life. Current issues in urban economics, 74–104.

Saiz, A. (2010). The geographic determinants of housing supply [Article]. The Quarterly Journal of Economics, 125(3), 1253–1296. https://doi.org/10.1162/qjec.2010.125.3.1253

Timothy, D., & Wheaton, W. C. (2001). Intra-Urban Wage Variation, Employment Location, and Commuting Times. Journal of Urban Economics, 50(2), 338–366. https://doi.org/10.1006/juec.2001.2220

Tu, Y., Sun, H., & Yu, S.-M. (2007). Spatial autocorrelations and urban housing market segmentation. The Journal of Real Estate Finance and Economics, 34(3), 385–406.

Waltl, S. R. (2019). Variation Across Price Segments and Locations: A Comprehensive Quantile Regression Analysis of the Sydney Housing Market. Real Estate Economics, 47(3), 723–756. https://doi.org/10.1111/1540-6229.12177

Zhu, E., Wu, J., Liu, H., & Li, X. (2019). Within-City Spatial Distribution, Heterogeneity and Diffusion of House Price: Evidence from a Spatiotemporal Index for Beijing. Real Estate Economics, 50(3), 621–655. https://doi.org/10.1111/1540-6229.12293

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

The authors did not receive support from any organization for the submitted work.

Conflict of interests

The authors have no relevant financial or non-financial interests to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: The Adjusted Indirect Effect

For the SLX model, the marginal effects of GovLS on housing price appreciation y can be written in a partial derivative matrix as in eq (A1) (Golgher & Voss, 2016; LeSage & Pace, 2009). It is an N × N matrix (N is the number of locations), and the elements on the principal diagonal represent the direct effect, while the elements off the principal diagonal are spillover effects. In the SLX model, the direct effect is γ for all locations, but the spillover effect is \({w}_{ij}\theta\), being specific for each pair of locations according to their substitution level \({w}_{ij}\).

For example, \(\frac{\partial {y}_{n}}{\partial {GovLS}_{1}}\) may not necessarily equal \(\frac{\partial {y}_{n}}{\partial {GovLS}_{2}}\) but depend on the substitution level \({w}_{n1}\) and \({w}_{n2}\) as \(\frac{\partial {y}_{n}}{\partial {GovLS}_{1}}\) = \({w}_{n1}\theta\) and \(\frac{\partial {y}_{n}}{\partial {GovLS}_{2}}={w}_{n2}\theta\). Although equation (A1) is very informative, it is not convenient to present the N × N matrix for discussion. Thus, in the spatial econometric literature, the direct effect, indirect effect, and total effect defined by LeSage and Pace (2009) have been prevalently used as a set of numeric summaries of the partial derivative matrix. Their definition and calculation are briefly introduced before we can turn to the “adjusted” indirect effect.

For a city with N locations, the direct effect of LeSage and Pace (2009) is (\(\frac{1}{N}\sum \frac{\partial {y}_{i}}{\partial {GovLS}_{i}}, \forall i)\) the sum of the N principal diagonal elements of equation (A1) divided by N. Thus, the direct effect has a one-to-one interpretation. In our context, it means how GovLS in one location affects the housing price appreciation in the same location on average. On the other hand, their indirect effect \((\frac{1}{N}\sum \sum \frac{\partial {y}_{i}}{\partial {GovLS}_{jk}},i\ne j)\) is the average of column sum or row sum of all elements off the principal diagonal in eq (A1). Thus, the indirect effect is the cumulative spillovers (either the averaged column sum or the averaged row sum) and can have two interpretations: 1) given one more unit of GovLS in one location, what is the sum of its spillover effects on all neighbours on average? Alternatively, 2) if all neighbours have one unit more GovLS, what is the sum of their spillovers to one particular location on average (Golgher & Voss, 2016; LeSage & Pace, 2009)?

As we are interested in comparing the magnitude of the direct effect and the spillover effect of GovLS, we need to translate the “cumulative” indirect effect of LeSage and Pace (2009) into an “adjusted indirect effect” which has a one-to-one interpretation as the direct effect. It is achieved by dividing the indirect effect by the number of neighbours involved in the spillovers. For a model with a global spillover, where every location has N-1 neighbours, the indirect effect of LeSage and Pace (2009) needs to be divided by (N-1); if the spillover is restricted within a sub-area of the city (a local spillover), the indirect effect needs to be divided by the number of neighbours specified in the model.Footnote 9 For example, if the spillovers are restricted among the four (eight) nearest neighbours, then the adjusted indirect effect equals the indirect effect divided by four (eight). The adjusted indirect effect is one innovation of this paper and is shown in eq (A2).

Hypotheses 1–2 can be tested straightforwardly using statistical packages following the definition of LeSage and Pace (2009). The adjusted indirect effect is for testing Hypothesis 3, which requires comparing the magnitude of the impact of supply elasticity in a self-neighbourhood and in another neighbourhood on average. Thus, Hypothesis 3 tests the difference between the direct and the adjusted indirect effect. As shown in eq (A3) and eq (A2), the difference is a linear expression of the direct and indirect effects of LeSage and Pace (2009) and can be tested against zero by Wald tests.

Appendix 2: Global Spillovers in SDM

Like the SLX model in Test 2, the marginal effect of GovLS in SDM can also be written in a partial derivative matrix (Golgher & Voss, 2016; LeSage & Pace, 2009). However, as shown in equation (A4), the marginal effect of GovLS in SDM is not simply the estimated coefficients due to the global term \({\left[I-\rho W\right]}^{-1}\). Thus, we reported the post-estimation effects of GovLS (not the coefficients) in Table 6, following the spatial econometrics literature.

As we have discussed in Appendix 1, statistical packages deliver the direct effect (\(\frac{1}{N}\sum \frac{\partial {y}_{i}}{\partial {x}_{ik}}, \forall i)\) and the indirect effect \((\frac{1}{N}\sum \sum \frac{\partial {y}_{i}}{\partial {x}_{jk}},i\ne j)\) according to the definition of LeSage and Pace (2009). However, the former has a one-to-one interpretation, and the latter has a cumulative interpretation. To test Hypothesis 3, we need to compare the magnitude of the impact of GovLS in a self-neighbourhood with its impact on another neighbourhood on average. Like in Test 2, we need to get the adjusted indirect effect (\(\frac{1}{N(N-1)}\sum \sum \frac{\partial {y}_{i}}{\partial {x}_{jk}},i\ne j)\) for SDM here. In SDM models, every location is connected by the global term \({\left[I-\rho W\right]}^{-1}\) in equation (A4), regardless of the selection of matrices. Thus, the number of neighbours in the SDM is N-1 for all models. Given our sample of 56 neighbourhoods, the adjusted indirect effect is then the indirect effect obtained from standard statistical packages divided by 55.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ren, R., Wong, S.K. & Chau, K.W. A Revisit of Supply Elasticity and Within-city Heterogeneity of Housing Price Movements. J Real Estate Finan Econ (2023). https://doi.org/10.1007/s11146-023-09952-1

Accepted:

Published:

DOI: https://doi.org/10.1007/s11146-023-09952-1